- The Bottom Line Up Front

- 1) Homebase: The Best “Clock-to-Paycheck” Automation for Hourly Teams

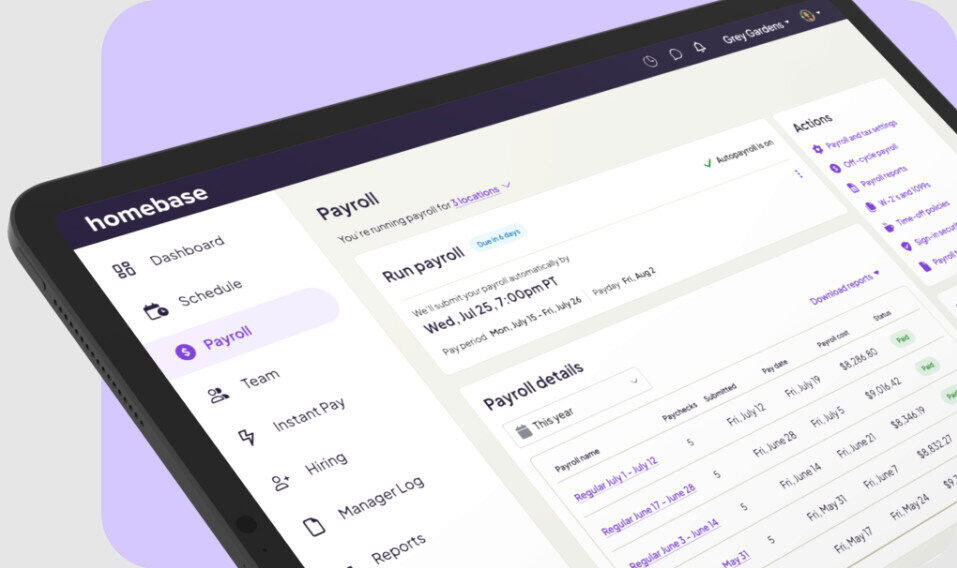

- 2) ADP RUN: Best for Compliance Depth and Scale-Ready Migrations

- 3) Square Payroll: Best for Businesses Already on Square POS

- 4) Paychex Flex: Best for Configurability and Services Backstop

- 5) Gusto: Best UX and Accountant-Friendly Automation

- 6) Rippling: Best Automation Canvas for HR + IT + Finance

- Head-to-Head: Where the Automation Actually Happens

- Pricing Snapshot (2025)

- Implementation Experiences From Someone Who’s Been There

- Recommendations by Use Case

- Final Verdict

Last Updated on November 7, 2025 by Ewen Finser

If you’ve ever run payroll at 1:00 a.m. from a Wi-Fi hotspot after working 10 hours, you know there are only two types of softwares: tools that get out of your way, and everything else. Payroll automation lives or dies on what happens between “clock in” and “tax filed,” not how pretty the landing page looks. I’m a CPA that does everything from timesheets to job costing to garnishments, and on my eternal hunt to put as much time back in my pocket as possible, I’ve found some really excellent tools. Below is my current short list of payroll automation platforms that actually reduce keystrokes and prevent cleanup work later.

My methodology is simple: I follow the data from time capture to payroll calc to tax filing to accounting sync, and I dock points for any manual work (CSV exports, dual entry, missing audit trails). For 2025, six platforms bubble to the top for different reasons: Homebase, ADP RUN, Square Payroll, Paychex Flex, Gusto, and Rippling. Each can run payroll reliably. The differences are in where they automate before payroll (time & scheduling), during payroll (gross-to-net rules), and after payroll (filings, GL posting, analytics).

The Bottom Line Up Front

If your workforce is hourly and schedule-driven, Homebase is the smoothest soup-to-nuts workflow right now (time → scheduling → payroll → filings) without Frankenstein’ing add-ons. ADP and Paychex win on breadth and compliance depth. Gusto nails usability and accountant tooling. Square is the no-brainer for Square POS shops. Rippling is the automation powerhouse for companies that want HR + IT + spend on one chassis.

1) Homebase: The Best “Clock-to-Paycheck” Automation for Hourly Teams

What it is: Homebase started on the front of the payroll funnel; scheduling, time clocks, and team messaging. They then added full-service payroll that converts approved timesheets into tax-compliant paychecks in one pass. This is important because most payroll errors originate upstream in time capture. Homebase keeps it all in one app, and because of this, there is no jumping between systems, no downloads, and no chances for errors.

Where It Automates

- Integrated time direct to payroll: Approved timesheets become gross pay automatically, with overtime rules and multiple pay rates handled at the timecard level. The approved data flows into payroll without CSVs.

- Automatic filings and payments: Federal, state, and local payroll taxes are then calculated, filed, and paid for you, so there’s no end-of-month scramble. W-2/1099 year-end is included.

- Scheduling intelligence: Schedules tie directly to labor cost controls and time clocks, so you see the payroll impact before the week runs away from you. POS integrations (restaurants/retail) keep hours and tips aligned.

Pricing: Clear and flat: $39 base + $6 per employee paid per month as a payroll add-on to any Homebase plan. No “call for quote” just to get started, which I adore!

Where It May Fall a Bit Short

- Advanced HR stack: You’ll get core HR/compliance tools, but if you want enterprise-grade HCM modules (learning, comp planning, advanced org structures), ADP/Paychex/Rippling have a deeper bench. Those tools can also be a bit more complex and overwhelming for a one-stop shop, though.

- White-glove configurability: Complex, unionized, or heavily multi-jurisdictional setups may still want ADP/Paychex depth or Rippling’s granular policy engine.

CPA take: If 80–90% of your headaches are in wrangling hourly schedules, late punches, and OT calculations, Homebase is the “fewest moving parts to a filed paycheck” option. For small to mid-size shops, the all-in-one is the winner.

2) ADP RUN: Best for Compliance Depth and Scale-Ready Migrations

What it is: ADP RUN is ADP’s small-business suite (generally 1–49 employees) with the same DNA as its enterprise systems. It can flex its compliance muscles, offers multi-state experience, and possesses dense network of integrations. ADP is the brand many CPA firms default to when risk management trumps UX preferences.

Where It Automates

- Compliance workflows: Automated tax filing across jurisdictions, new-hire reporting, garnishment handling, and a ladder to larger ADP products as you scale.

- Ecosystem integrations: Accounting, POS, and HR add-ons typically connect without cobbled exports, which matters when you already have a stack you like.

Pricing: Quote-driven (you’ll need to talk to sales – that’s a big strike in my opinion). Packages (Essential/Enhanced/etc) bundle features, but once again, exact pricing isn’t listed publicly.

Where It Falls Short

- Upfront friction: Implementation and plan selection can feel heavy if you just want to run a simple payroll tomorrow morning.

- Hourly tooling: RUN leans on integrations for time/scheduling; if your pain is punch-to-pay automation, an all-in-one like Homebase or Square will feel lighter.

CPA take: If you’re in a high-risk, multi-state situation or foresee headcount growth that will require enterprise policy controls, ADP is a safe long runway.

3) Square Payroll: Best for Businesses Already on Square POS

What it is: Square Payroll is full-service payroll stitched tightly into Square’s POS ecosystem. If you’re already on Square for payments, tip pooling, and timecards, there’s a lot to like because the data is already where payroll needs it.

Where It Automates Well

- POS to payroll continuity: Tips, timecards, and job codes come through without manual reconciliation. For hospitality/retail, that removes most Friday-afternoon busywork.

- Automated filings: Federal, state, local taxes are filed and paid. Contractor-only payroll is available for 1099 shops or seasonal needs.

Pricing: $35 base + $6 per person for full-service; $6 per contractor if you’re running contractor-only payroll. Transparent and simple.

Where It Falls Short

- Reports & exports: Some timecard/shift reporting is desktop-only, and admin UX can feel basic if you’re coming from a bigger suite.

- Beyond the Square world: If you don’t live in Square POS, the advantage narrows; broader HR needs will push you toward Gusto/ADP/Paychex/Rippling.

CPA take: If your front of house runs on Square, don’t overthink it. Square Payroll will reliably convert what your register already knows into filed paychecks.

4) Paychex Flex: Best for Configurability and Services Backstop

What it is: Paychex Flex wraps payroll, HR, and benefits with the option of substantial human support (HR advisors, implementation help). It’s a “we’ll meet you where you are” platform with deep features and guided setup for complex configurations. P

Where It Automates Well

- Speed to run & filings: Paychex touts “run payroll in as little as 30 seconds” and automates tax administration end-to-end. While this is a serious claim to fame, I’ve never actually seen it unfold this way, so keep that in mind.

- Advanced reporting & HR depth: High report counts, configurable policies, and service-assisted implementations reduce custom spreadsheet drift. Paychex also has strong W-2/1099 support, benefits tie-ins, and job costing.

Pricing: Public list pricing has largely moved to custom quotes (Flex Essentials historically started around $39 + $5/employee, but Paychex now steers you to talk to sales). Expect pricing to vary by size and modules.

Where It Falls Short

- Opacity and cost: The quote-only model can slow procurement and makes apples-to-apples comparisons tougher; it’s often pricier than Gusto for similar small-business needs.

- Hourly simplicity: If you need a punch-to-pay closed loop without heavy config, Homebase’s native loop or Square’s POS tie-in can be faster to value. Paychex can also feel a bit clunky and bloated when running checks, with lag time between punching in numbers and total calculations being updated.

CPA take: When the payroll brief reads “complicated, multi-state, benefits-heavy, and we want human help,” Paychex is a credible candidate.

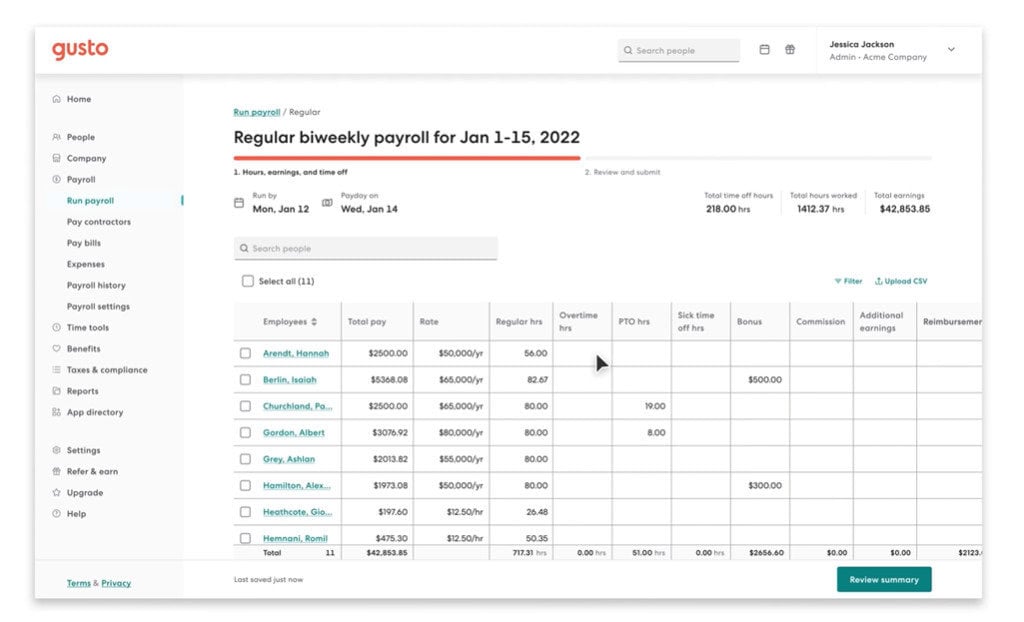

5) Gusto: Best UX and Accountant-Friendly Automation

What it is: Gusto popularized “payroll that runs itself” for SMBs and remains a top choice for straightforward W-2/1099 needs with clean onboarding and benefits options. In my opinion, Gusto continues to double down on automating things to save users time with consistent updates.

Where It Automates Well

- Autopilot payroll & tax filings: Each run calculates, files, and pays federal/state/local payroll taxes. It’s a set-it-and-forget type of system, but always be sure to check exceptions where needed.

- Accountant tooling: Payroll Transfer Automation moves employee data between clients faster, which is useful in transitions and cleanups. Custom reporting is also exceptional.

Pricing: Gusto’s packaging changes enough that I won’t lock a number here; the value prop is consistent for full-service filings plus friendly UX.

Where It Falls Short

- Time & scheduling depth: Gusto has time tracking, but if your team lives by the schedule board (restaurants, retail, crews), you’ll likely want deeper scheduling/time controls either via integration or a platform like Homebase.

- Complexity ceiling: For intricate policy engines or cross-functional IT workflows, Rippling/ADP/Paychex can be a better final home.

CPA take: For clean, recurring payroll with accountant-friendly guardrails, Gusto remains a layup, especially for firms standardizing across many small business clients.

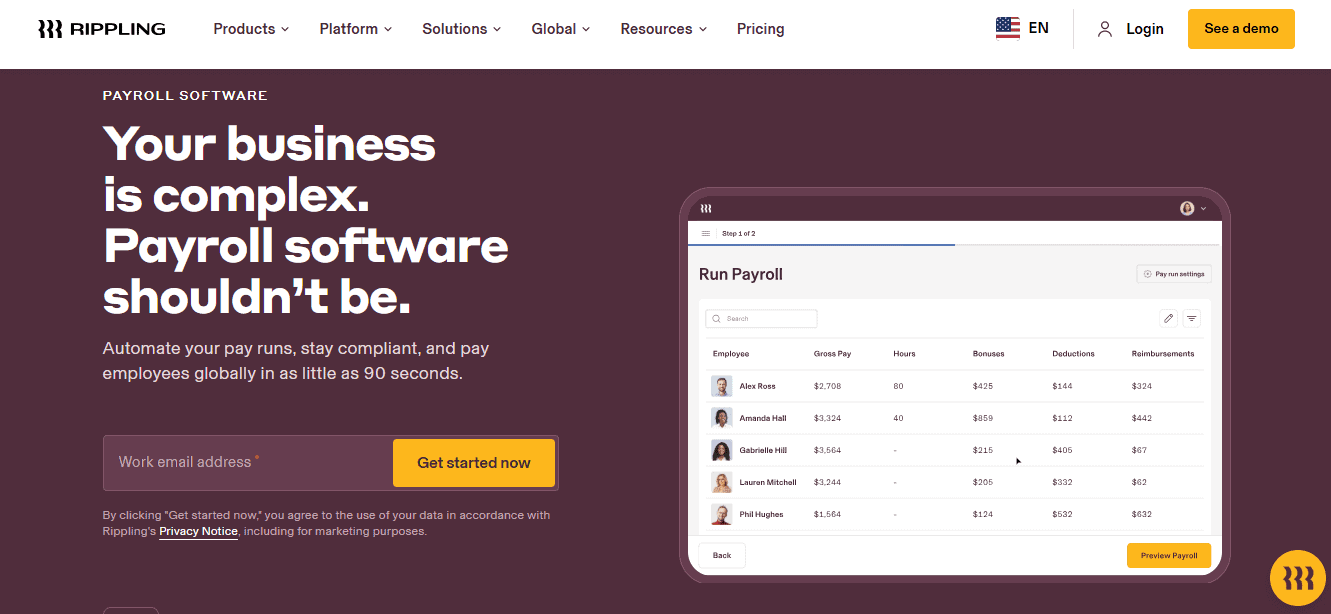

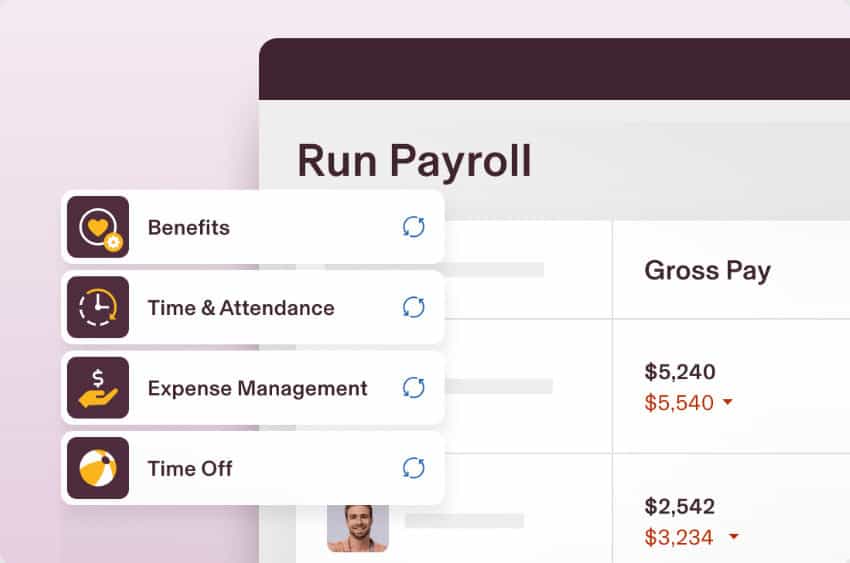

6) Rippling: Best Automation Canvas for HR + IT + Finance

What it is: Rippling is less “a payroll app” and more a policy engine that spans HR, IT, and spend. You can hire someone at 9:00 a.m., push them a laptop, auto-provision apps, enroll benefits, and run payroll rules from one source of truth. That’s serious leverage if you want everything programmable.

Where It Automates Well

- Unified data model: Employee attributes drive payroll, app access, and device policies, so job changes ripple (sorry, couldn’t help myself) through everything without manual updates.

- Scalable controls: Advanced security/compliance (SSO, MFA, RBAC), audit trails, and configurable automations exceed typical SMB payroll systems.

Pricing: Public pricing is limited; credible third-party guides peg HCM from ~$8/user/month with add-ons quoted separately. Expect to talk to sales for a full-stack price.

Where It Falls Short

- You’ll configure: Enormous power means a learning curve; it can be overkill if you just want “timecards in, taxes out.”

- Cost transparency: Like ADP/Paychex, real pricing clarity comes at quote time.

CPA take: If you want payroll to be just one outcome of a tightly automated people-ops, IT, and finance system, Rippling’s the modern platform to beat.

Head-to-Head: Where the Automation Actually Happens

Time Capture, Scheduling, to Payroll

- Homebase: Native scheduling, time clocks, PTO, and OT rules flow directly into payroll; minimal import/export gymnastics. Best for frontline hourly teams.

- Square Payroll: Strongest if you already run Square POS. Tips and timecards sync automatically.

- Gusto / ADP / Paychex / Rippling: All support time tracking and integrations, but the tightest “built-in” loop for hourly teams tends to be Homebase (or Square for Square POS shops).

Gross to Net Rules and Compliance

- ADP / Paychex / Rippling: Deepest benches for multi-state, garnishments, fringe benefits, and edge cases. These are who you’ll want to turn to if you’re big, complicated, and need support, in my experience.

- Homebase / Gusto / Square: Full-service filings and standard compliance for SMBs; fewer knobs to turn, which is perfect if you’re running a couple of local SMBs with the same name out front

Tax Filings

- All six of the platforms I’ve mentioned automatically calculate, file, and pay taxes (federal/state/local) on supported plans and handle W-2/1099. Paychex/ADP lean into support layers; Gusto/Homebase/Square focus on hands-off simplicity; Rippling folds filings into a broader policy platform.

Accounting Syncs

- ADP/Paychex/Rippling: Broad ecosystems; expect prebuilt connectors and robust exports.

- Homebase/Gusto/Square: Solid QuickBooks/Xero connections; Homebase emphasizes fewer handoffs by eliminating time/scheduling exports altogether.

Pricing Snapshot (2025)

- Homebase Payroll: $39/mo base + $6/employee; add-on to any Homebase plan. Straightforward, no hidden fees called out.

- Square Payroll: $35/mo base + $6/person (full-service) or $6/contractor for contractor-only.

- Gusto: Tiered pricing; autopay + filings included. (Confirm current tier pricing at checkout.)

- ADP RUN: Quote-based; pick a package.

- Paychex Flex: Quote-based; historical entry tier cited around $39 + $5/employee, but Paychex now emphasizes custom quotes.

- Rippling: HCM from ~$8/user/month with add-ons quoted separately.

(Note: Taxes, add-ons, and state registrations can change total cost. Always model your specific headcount, pay cadence, and states.)

Implementation Experiences From Someone Who’s Been There

- State registrations – No software can file taxes where you aren’t registered. Budget time for state unemployment (SUTA) and withholding accounts before “first payroll.”

- Pay rules audit – Overtime, shift differentials, and PTO accrual math belong in the time system, not the GL. Set them once; test with real prior periods.

- Multi-location labor splits – If you job cost, confirm how platform X tracks labor against locations/projects and how that maps to your accounting system.

- Year-end cleanup – Confirm who owns W-2/1099 e-filing, corrections (W-2c/1099-NEC corrections), and the cut-off for final payroll runs.

- Data portability – For quote-driven platforms (ADP/Paychex/Rippling), clarify export formats and how quickly you can move if you outgrow a module.

Recommendations by Use Case

- Restaurants, retail, service with hourly shifts:

Choose Homebase if you want one app from schedule to filed taxes. Choose Square Payroll if you already run Square POS and want native tip/time sync. - Growing, multi-state with compliance complexity:

ADP RUN or Paychex Flex for depth, service options, and future-proofing. - Accountant-led small business portfolios:

Gusto for clean autopilot and improved accountant tooling (Payroll Transfer Automation). - Tech-forward companies consolidating HR, IT, and Finance:

Rippling to centralize automations beyond payroll (SSO/MFA, device/app provisioning, spend).

Final Verdict

All six platforms can get your team paid and your taxes filed. The differentiator is where the automation starts. If your reality is weekly schedules, variable shifts, and overtime rules that drastically swing labor cost, the platform that unifies scheduling, time, and payroll will always feel “faster” and cause fewer GL bruises. To me, that edge belongs to Homebase for hourly teams: the fewest handoffs, clear pricing, and filings handled without needing a middleware tour. ADP and Paychex remain the compliance comfort food for complex orgs; Gusto is the consistent UX workhorse; Square is the quickest win inside the Square stack; Rippling is the automation canvas for companies that want payroll to be just one (automated) step in a larger machine.