- The Bottom Line Up Front

- First and Foremost, What Is “Close Software”?

- The Best Financial Close Softwares

- Platform #1: QuickBooks Online (QBO)

- Platform #2: Xero

- Platform #3: Pilot

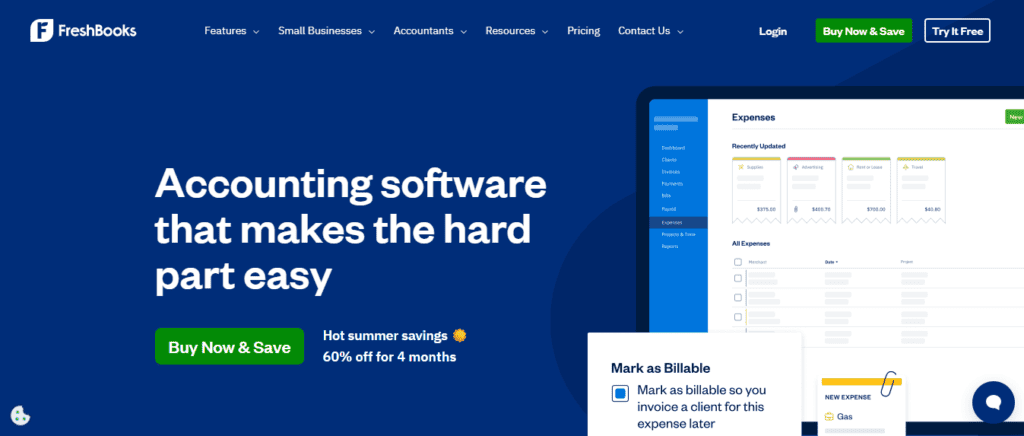

- Platform #4: FreshBooks

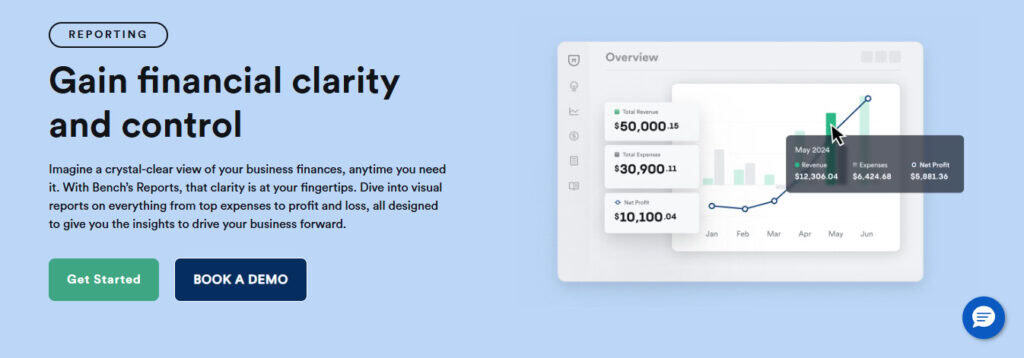

- Platform #5: Bench

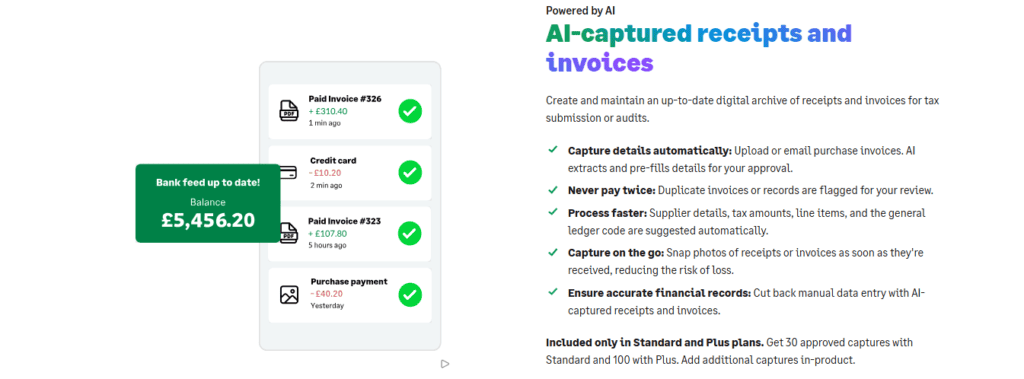

- Platform #6: Sage

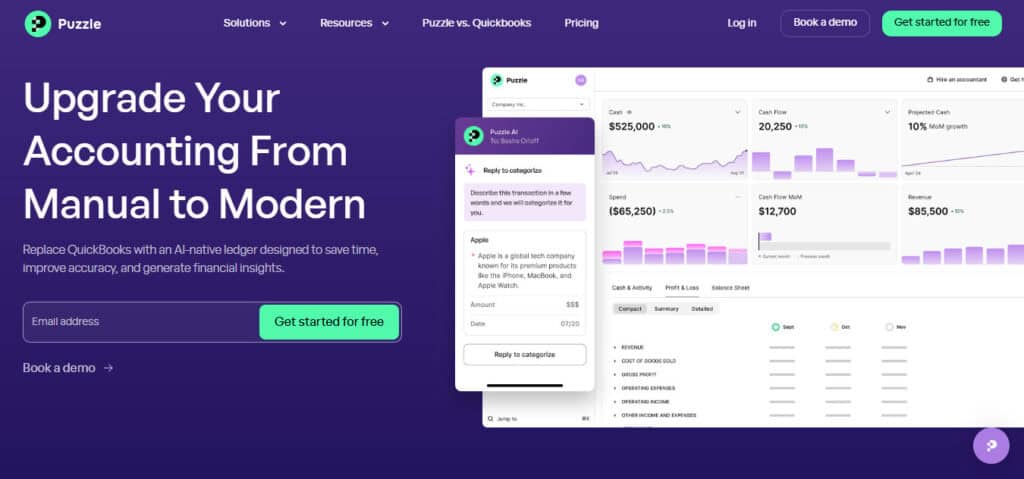

- Platform #7: Puzzle

- How to Choose the Right Close Software for Your Business

- Common Mistakes When Choosing Accounting Software

- My Personal Take

- Final Thoughts

Last Updated on October 10, 2025 by Ewen Finser

Closing the books every month isn’t glamorous, but it’s one of the most important things a business can do. A clean close tells you where the money went, what’s working, and what isn’t. For management and finance leads, it’s the difference between making informed decisions or running your business into the ground.

Over the years, I’ve helped everyone from scrappy startups to established businesses tighten their close process. The common thread? Most of them start with a patchwork of spreadsheets and whatever accounting tool someone set up in the early days. That works for a while. Then the business grows, and those duct-tape workflows start to show their cracks. Numbers don’t tie out. Reconciliations lag. Audits get messy. And everyone starts to dread the end of the month.

That’s where good software comes in – ones that have closing as a core part of their functionality. The best platforms don’t just help you enter transactions; they help you close the books with confidence, speed, and accuracy.

The Bottom Line Up Front

I’ve spent years trying every platform to find what works and what doesn’t. If you’re a startup or small-to-mid-sized business that wants to close the books faster and cleaner, here are seven platforms worth looking at:

- QuickBooks Online (QBO) is reliable and widely used, but lacks modern close features.

- Xero has a nice interface and automation for bank feeds, but it struggles with audit trails.

- Pilot is hands-off bookkeeping for startups, but doesn’t offer much flexibility.

- FreshBooks works well for freelancers but isn’t ideal for month-end close.

- Bench is budget-friendly and comes with a team, but it’s outsourced.

- Puzzle is modern, developer-friendly, and built for automated, GAAP-compliant closes.

- Sage is solid for teams that already have accounting systems but need close collaboration layers.

Each tool has strengths. But if I had to pick one for speed, accuracy, and audit-readiness, Puzzle has edged ahead, especially for tech-forward teams.

First and Foremost, What Is “Close Software”?

Let’s clear up a common question: What is close software, exactly?

Closing the books means finalizing your accounting records for a set period (usually monthly). It comes with a set of common steps that differ for every business and is the reason why most accountants look kind of haggard by like the 6th or 7th of any given month – they’ve been working to close the books nonstop. Typically, the month-end close has most of the following:

- Reconciling bank and credit card accounts

- Reviewing and categorizing expenses

- Accruals and deferred revenue entries

- Verifying payroll entries and any outstanding liabilities that need to be accrued for

- Matching transactions against documentation

- Locking down the period to prevent changes

Close software helps you do all of that with structure, automation, and collaboration. It’s the difference between your accountant saying, “I think we’re done,” versus confidently signing off and locking the period.

Some tools specialize in the close itself (like Sage). Others integrate close workflows directly into the accounting platform (like Puzzle). The key is streamlining what normally takes a week or more into something you can wrap up in days, with an audit trail to back it all up.

The Best Financial Close Softwares

Platform #1: QuickBooks Online (QBO)

QuickBooks is the old standby. Everyone has used it, or at least tried to.

What it does well:

- Ubiquitous, with tons of support and integrations

- Simple to learn, especially for small teams

- Decent for basic bookkeeping and reporting

Where it falls short:

- No built-in close checklist or true period lock (frustrating!)

- Bank feeds can be glitchy, with limited audit control

- Customization is limited unless you use third-party tools

QBO can be made to work with close processes, but it takes workarounds and often external help to collaborate with different team members (think Excel and email threads). For startups growing fast, the cracks show quickly, so it’s best to have a close checklist within the platform.

Platform #2: Xero

Xero is QuickBooks’ biggest rival. It’s sleek and user-friendly, especially for non-accountants.

What it does well:

- Clean interface and intuitive workflows

- Strong multi-currency and bank feed support

- Good app marketplace for add-ons

Where it falls short:

- No structured month-end close listing

- Weak audit controls and limited approval flows

- Financial reporting lacks depth without third-party tools

It’s great for small businesses who want something a little more modern than QBO, but when it’s time to get serious about a controlled close process, Xero often needs reinforcement.

Platform #3: Pilot

Pilot is more of a bookkeeping service than software. You hand over access, and their team does the books. It’s perfect for people who don’t even want to hear the word “close” from their office.

What it does well:

- Hands-off for founders who don’t want to be involved

- Includes controller-level review (depending on plan purchased)

- Built with startups in mind

Where it falls short:

- Limited visibility into the process

- Customizations can be hard to implement

- No true software ownership. Pilot owns the workflow

- Pilot is great if your priority is outsourcing, but it’s not ideal if you want tight control over your close or need detailed insight as you scale. Also, the cost is high since you’re buying the platform and the labor to run your books, which is fine if you’ve got the money in the bank.

Platform #4: FreshBooks

FreshBooks started as an invoicing tool and still leans that way. It’s meant for small businesses who value simplicity and billing over all else.

What it does well:

- Easy invoicing and time tracking

- Clean UX for solo business owners

- Affordable entry pricing

Where it falls short:

- Not built for accrual accounting or true closing

- Lacks automated reconciliations, audit trail, and approval flow

- Limited integration with other tools

If you’re a freelancer or one-person shop, FreshBooks gets the job done. But for any business doing true accounting, it hits its limits fast.

Platform #5: Bench

Bench is a hybrid like Pilot…they give you a team and platform bundled together. That’s excellent if you want to focus on running your business without thinking about anything related to accounting. But if you want transparency, it leaves a bit to be desired.

What it does well:

- Bookkeeping included, monthly reports delivered

- Friendly, easy-to-use dashboard

- Affordable for early-stage companies

Where it falls short:

- No real-time access to data

- Close process is mostly invisible to clients

- Not built for accrual accounting or highly complex clients

Bench is great for simplicity. But when you’re ready to bring accounting in-house or grow beyond basic financials, you’ll likely outgrow it.

Platform #6: Sage

Sage Intacct has been around for as long as there has been accounting softwares, and it was one of the first to do cloud-based computing. It’s been around long enough to have most of its features tied down tight and available.

What it does well:

- Built for teams who need structure and accountability

- Close checklists, task assignments, and review steps are contained in a module

- Strong audit documentation and version control

Where it falls short:

- Requires a skilled team of true accountants to take full advantage of its power

- Price point geared more toward larger teams

- Not ideal for startups without dedicated finance staff

Sage shines for accounting departments that want to get serious about workflow. But for lean teams or early-stage companies, it may be more than you need.

Platform #7: Puzzle

Puzzle is a bit newer, but it’s built by accountants who know the grind. It has a wonderful breadth of technical options, including a close platform built right into the software.

What it does well:

- Real-time bank syncing with strong error detection

- Automated GAAP logic for accruals, deferred revenue, and close

- Every adjustment tracked with full audit trail

- Collaborative system for management, finance leads, and accountants

Where it falls short:

- Still maturing in certain advanced enterprise features

- Less well-known, so fewer third-party integrations (for now)

Puzzle feels like it was built for how modern accounting should work, especially if you’re tired of spreadsheets and want something you can build processes around.

How to Choose the Right Close Software for Your Business

The right close software depends on your size, complexity, and how involved you want to be. Over the years, I’ve seen many teams fall into the trap of choosing a platform because it’s “what everyone uses.” But accounting isn’t one-size-fits-all. You need a system that matches your workflow and not the other way around. When people ask me how to get past pain points similar to what closing at EOM may bring, I ask them to consider the following:

1. Who’s doing the accounting?

- Solo founder managing finances: You’ll want simplicity and automation. Puzzle or Xero could work well here.

- Outsourced bookkeeper: Look for platforms that offer transparency and collaboration, similar to what Pilot and Bench bring to the table. Avoid tools where everything happens in a black box.

- In-house accountant or controller: You’ll need audit trails, reconciliation tools, and structured close checklists. QBO, Sage (for larger companies), and Puzzle are good fits.

2. Do you need accrual accounting?

Cash basis works when you’re tiny. But once you start dealing with revenue recognition, prepaid expenses, or complex liabilities, you’ll need accrual features.

- Has strong accrual logic: Puzzle, Sage

- Works but needs manual support: QBO, Xero

- Not built for it: FreshBooks, and some outsourced platforms

3. How fast do you want your books closed?

In my experience, companies that rely on monthly spreadsheets often close 15–20 days after month-end. Teams using structured close platforms can cut that to 3–5 days if everyone is all hands on deck. That’s a massive difference when you’re making real-time decisions.

Many platforms help here with automated bank reconciliation, real-time data pulls, and rule-based categorization that mirrors how accountants think – not just how software wants you to think.

4. Do you need audit support?

Audit readiness isn’t just for big companies. Investors, lenders, or even IRS scrutiny can turn up at any time. You’ll want:

- Lockable periods

- Audit trails on all changes

- Role-based permissions

- Documentation retention tied to each transaction

Most platforms fall short here. QBO, Xero, and Pilot can be made audit-ready, but not without external tools or effort. Puzzle builds this in by default. Every change is logged. Every entry is traceable.

Common Mistakes When Choosing Accounting Software

I’ve had more than one client come to me after the fact, asking, “Can you fix this mess?” Here are a few of the most common missteps I’ve seen:

- Choosing based on price only.

The cheapest platform can cost you more in time and cleanup down the road. - Assuming a bookkeeper will “just handle it.”

Bookkeepers are great, but they need tools that support the process. You also need a competent bookkeeper who isn’t afraid to ask questions if they don’t understand something. - Ignoring audit requirements.

Whether it’s due diligence, tax audits, or grant compliance, a clean close process is your first line of defense. - Waiting too long to upgrade.

If you’re already behind every month, switching systems won’t be more painful than staying put.

My Personal Take

I’ve used or evaluated every tool on this list. If you’re looking to just invoice and track expenses, FreshBooks or Bench might do the trick. If you need a hybrid solution where a team does the books for you, Pilot is appealing. For teams managing their own books but wanting structure, QBO and Xero are the default.

Puzzle stands out because it’s built around all these facets, including close. It gives you automation, transparency, and audit support without needing a spreadsheet army. The platform’s real-time sync and GAAP-based logic mean fewer manual entries and cleaner books, month after month.

Final Thoughts

There’s no perfect accounting tool. The right choice depends on your business, your team, and how seriously you take your financial close. But if you want to shorten your close window, reduce errors, and make your numbers audit-ready without killing your weekends, look beyond the big names.

Choose a platform that fits how you work today, but can grow with you tomorrow. For many of the startups and SMBs I work with, that ends up being Puzzle.