- 1) Puzzle.io: The AI-first General Ledger for Operators Who Hate Busywork

- 2) QuickBooks Online: The Ubiquitous SMB Suite That Everyone Knows

- 3) Sage Intacct: Mid-Market Controls, Multi-Entity, and Audit-First Structure

- 4) Digits: Autonomous Finance Layer for Teams Who Want Agents, Not Menus

- 5) FreshBooks: The Client-Friendly Invoicing Suite That Grew Up

- 6) Zoho Books: Modular SMB Accounting Inside a Bigger Business Suite

- 7) Kashoo: Straight-Shooting Books for Freelancers and Micro-Teams

- 8) Patriot Accounting: No-Frills, Practical, Payroll-Friendly

- Notable Sticky Points (and Which Tools Counter Them)

- My Personal Pick

Last Updated on November 7, 2025 by Ewen Finser

ZipBooks is a clean, lightweight ledger. It’s free to start with, has friendly invoicing, easily connects to banks, and creates basic reports. For a lean service shop or solopreneur, it’s hard to argue with the value.

But as your volume or headcount start to increase (or if you need to easily defend yourself against an audit), you’ll want deeper automations, better source-of-truth controls, richer analytics, and more flexible workflows.

With that in mind, here’s a CPA’s guide to the best ZipBooks alternatives, deep diving into the details that actually affect your month-end close: bank feeds, rule engines, approvals, multi-entity handling, document capture, etc.

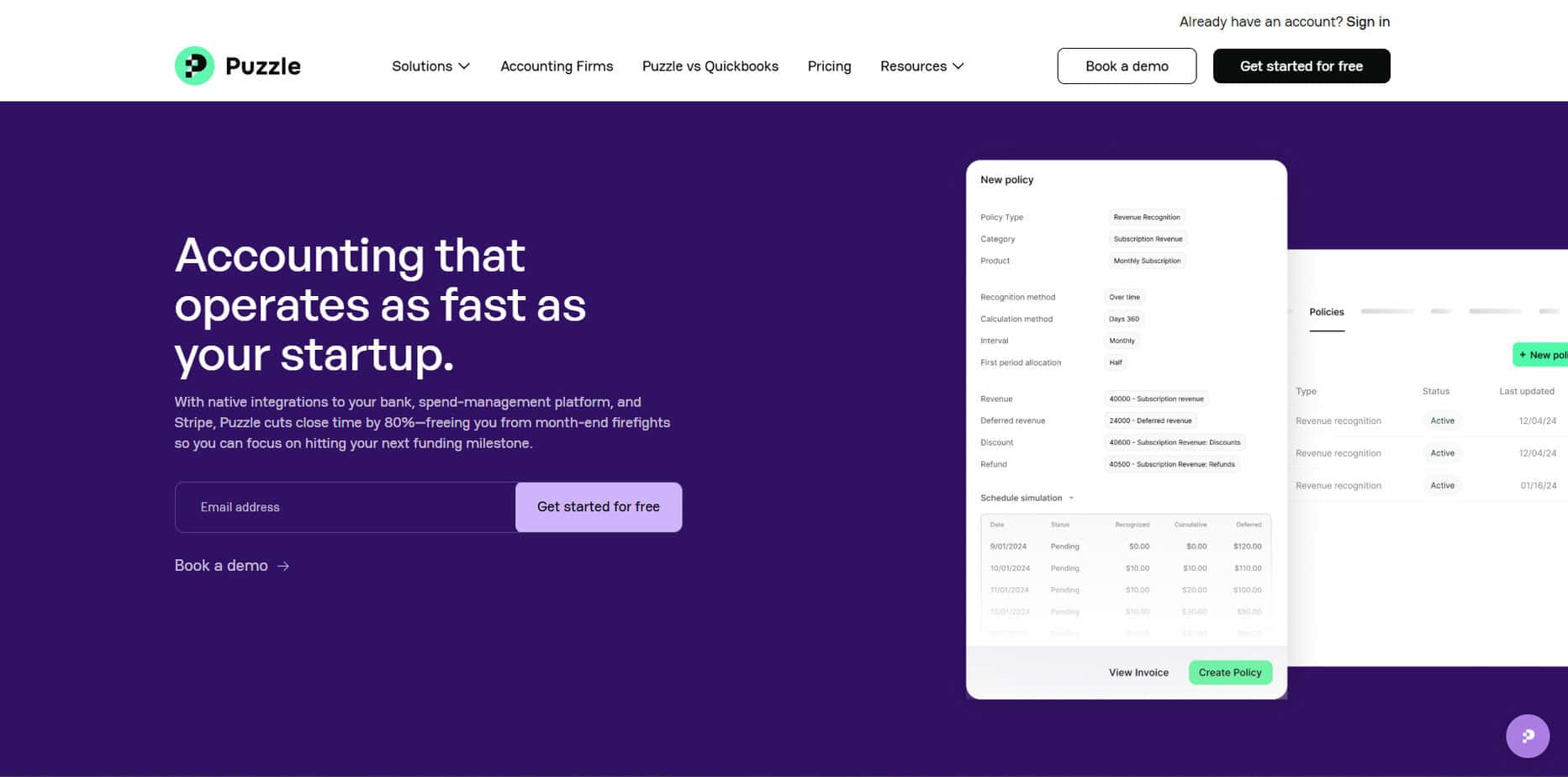

1) Puzzle.io: The AI-first General Ledger for Operators Who Hate Busywork

Best for: VC-backed startups, SaaS, agencies, e-commerce, and owner-operators who want a living ledger that does the job instead of waiting for you to click five more times.

What it does well:

- Bank and card streaming: Including near-real-time classification and de-dupe. You get a clear audit trail rather than mystery journal entries.

- SaaS-friendly revenue: Clean separation of cash vs. revenue, with support for common patterns (deferred revenue, proration, refunds) so that MRR/ARR and GAAP actually agree.

- Source-of-truth docs: Receipt and invoice extraction ties documents to transactions without the infamous file graveyard.

- Variance surfacing: The system nudges you on outliers, missing docs, and uncategorized items so you don’t have to do detective work to figure out what came from where.

Where it can fall short:

- Puzzle is not a massive, customizable ERP. If you need heavy fixed-asset subledgers across multiple legal entities, complex intercompany eliminations, and a ton of custom dimensions, Puzzle will feel a little too streamlined.

- Niche vertical modules like manufacturing routings and job costs for megaprojects aren’t Puzzle’s forte.

Who should choose it: Companies that live in programs like Stripe, Ramp/Brex, Gusto, Bill, and Shopify and want the GL to keep up without heroic effort — especially those that are reconciling daily or weekly and hate waiting on rules to run.

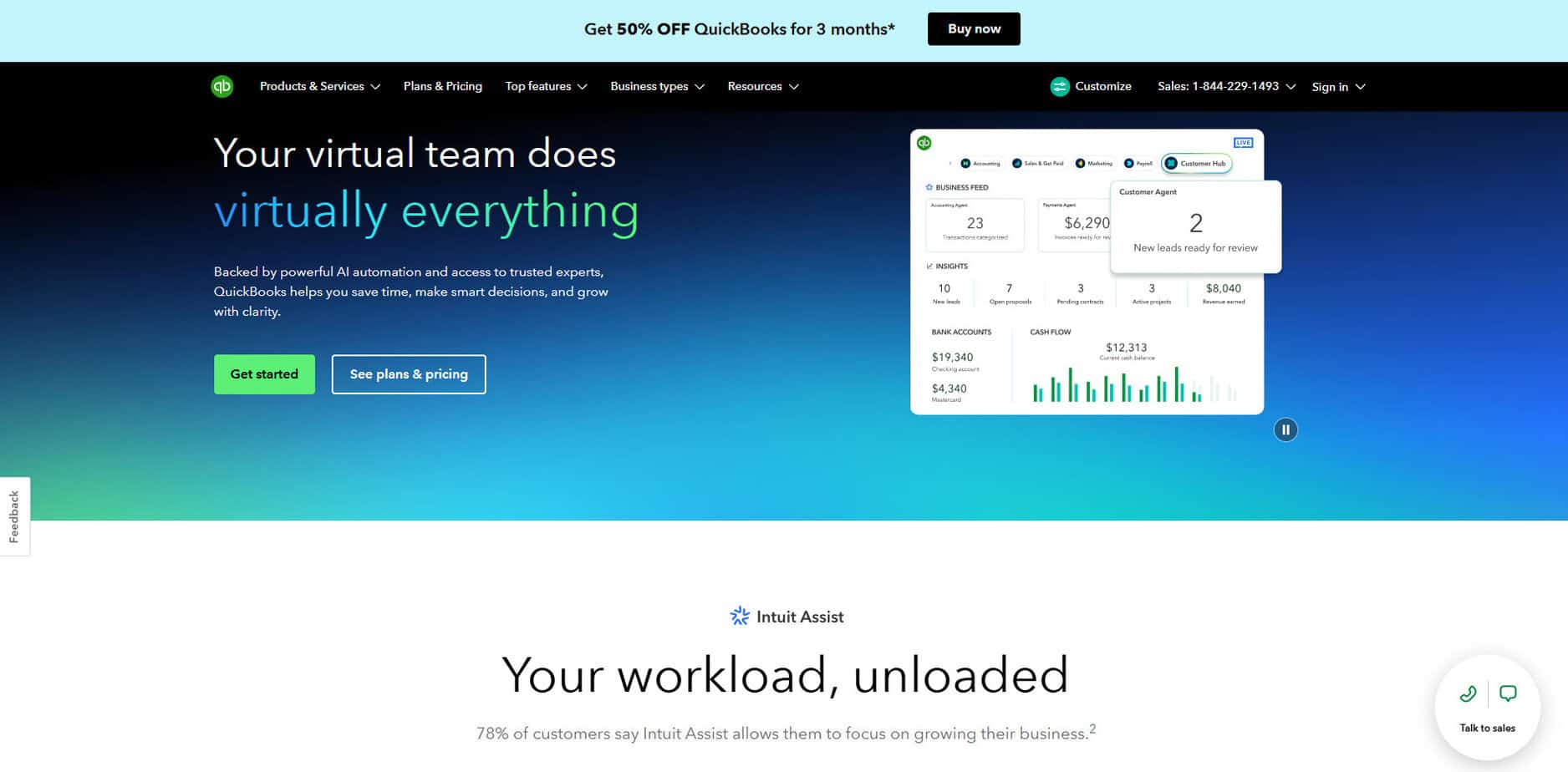

2) QuickBooks Online: The Ubiquitous SMB Suite That Everyone Knows

Best for: General SMBs who want a broad app ecosystem and have access to accountants who already speak QBO.

What it does well:

- Bank rec muscle memory: QBO’s bank feed workflow is still the standard for many firms. Its rules, payee normalization, and familiar screens keep teams moving.

- Huge app marketplace: From inventory to time tracking to niche vertical add-ons, QBO plugs into almost everything.

- Multi-user collaboration: It’s easy to loop in bookkeepers, tax pros, and managers with granular permissions.

Where it can wobble:

- Rule sprawl creates unintended classifications if you grow sloppy. It can get all the way to Q4 before you realize that a rule was mistakenly pushing fuel purchases to vehicle maintenance expenses because someone wasn’t paying attention when setting the rule up.

- Complex revenue recognition and multi-element arrangements require third-party helpers or manual workarounds.

- Reports are broad, but they can get click-intensive when you’re drilling into edge cases or month-end variance analysis.

Who should choose it: Organizations whose CPA lives inside QBO and whose use case is mainstream SMB (basic inventory, projects, invoicing, payables).

3) Sage Intacct: Mid-Market Controls, Multi-Entity, and Audit-First Structure

Best for: Finance teams that need strong GAAP control, multi-entity consolidations, dimensions, and approval hierarchies without going full megacorp ERP.

What it does well:

- Dimensions and approvals: Policies, workflows, and segregation of duties are first-class citizens here.

- Multi-entity and intercompany flows: Streamlined workflows that don’t turn close into a choose-your-own-adventure story.

- Contract revenue management modules: For subscription businesses and services with complex revenue recognition.

Where it can wobble:

- Implementation overhead and cost are its biggest drawbacks, so you’ll want a thoughtful rollout partner and a clear chart-of-accounts and dimension design upfront. Costs are also higher than typical, as Sage is targeted to larger businesses.

- The UI/UX is getting better, but it’s still very “accountant forward.” Training helps.

Who should choose it: Companies that are outgrowing small-biz tools and want discipline, approvals, and consolidation without the heft of something like NetSuite.

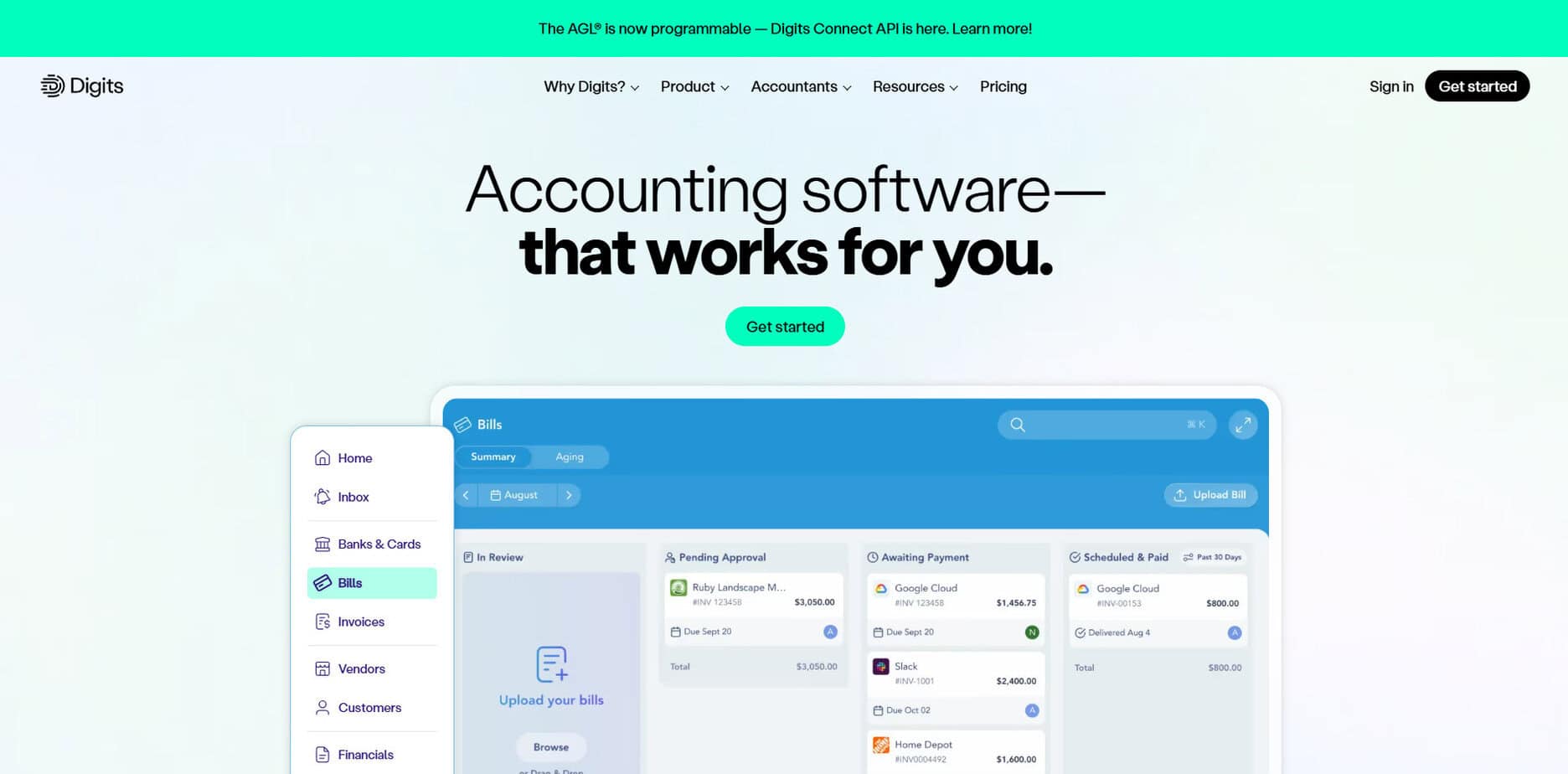

4) Digits: Autonomous Finance Layer for Teams Who Want Agents, Not Menus

Best for: Teams who want AI agents to classify, summarize, and alert across the finance stack — while still exporting clean, accountant-tested data downstream.

What it does well:

- Continuous classification: With a focus on explainability and reviewer workflows.

- Narrative-style reporting: This gives operators useful English, not just twelve subledgers and a ton of spreadsheets.

- Transaction-document sync: For tightening the audit chain and reducing month-end foot chases.

Where it can wobble:

- It’s not a legacy ERP — think automation fabric across your financial data, with the GL experience in focus.

- If your world is in something like industrial job costing with WIP schedules, you’ll likely need to go outside of Digits’ native functions.

Who should choose it: Founders and controllers who want software to do the grunt work and bubble up exceptions. If your close is slow because of categorization and missing docs, this is a somewhat autonomous platform that will help.

5) FreshBooks: The Client-Friendly Invoicing Suite That Grew Up

Best for: Service businesses and solo practices that want polished invoicing, recurring billing, time tracking, and expense capture with minimal onboarding.

What it does well:

- Invoicing UX: Polished estimates, proposals, and recurring invoices that clients actually pay on time.

- Time and expenses: Freelancer-friendly features make it easy to get billable work from timesheet to invoice.

- Project-level views: Light project accounting that’s approachable for non-finance folks.

Where it can wobble:

- FreshBooks is built for SMBs that need surface-level reports without diving in exceptionally deep, so deeper accrual accounting and GAAP nuances will stress the system.

- Report depth is improving but still not mid-market.

Who should choose it: Agencies, consultants, and creative shops that live in invoices, hours, and expenses, and don’t need robust consolidations or complex rev rec.

6) Zoho Books: Modular SMB Accounting Inside a Bigger Business Suite

Best for: Small businesses already using the Zoho ecosystem (like Zoho CRM or Zoho Projects).

What it does well:

- Tight suite integration: Leads in CRM convert to customers, projects flow into invoices, and the finance data stays in the family. This is an excellent feature if you have multiple teams working out of a singular ERP where everything is shared.

- Automation rules: Its ability to set rules across approvals, reminders, and workflows is huge.

- International support: Multi-currency, localized taxes, and compliance for global SMBs.

Where it can wobble:

- If you’re not on any of Zoho’s other tools, quite a bit of the value fades.

- Advanced GAAP reporting, consolidations, and granular analytics still require add-ons or exports.

Who should choose it: Teams already committed to Zoho’s ecosystem who want accounting that plugs into the rest of their operational software without glue code.

7) Kashoo: Straight-Shooting Books for Freelancers and Micro-Teams

Best for: Solo owners and very small shops that want clean income/expense tracking, simple invoicing, and bank-feed automation (without getting lost in menus).

What it does well:

- No-nonsense setup: Including a chart that doesn’t fight you and an interface non-accountants can actually live in. This is great if you’re uncomfortable running your own books, and it helps ease into the pain of getting acquainted with an SMB system.

- Bank feeds with auto-categorization: This keeps the day-to-day tidy, plus receipt capture so that transactions aren’t naked at month-end.

- Invoicing and payments: These look professional, and they include sales-tax tracking that’s easy to reconcile.

Where it can wobble:

- It’s light on mid-market depth, so no serious multi-entity, consolidations, or advanced approvals.

- With fewer native integrations than the big suites, you may lean on CSVs or a couple of third-party bridges.

- Kashoo lacks in GAAP nuance, so deferred revenue, project WIP, and complex accruals will require manual journals and discipline.

Who should choose it: Freelancers, consultants, and boutique agencies that value speed and clarity over knobs and dials. If you anticipate scaling into multi-subsidiary, contract revenue, or heavier analytics, pick something that grows further before you outpace it.

8) Patriot Accounting: No-Frills, Practical, Payroll-Friendly

Best for: Small employers who want simple bookkeeping tied to approachable payroll.

What it does well:

- Tight payroll pairing: If you’re already on Patriot Payroll, the accounting side keeps things tidy.

- Simplicity and price discipline: Fewer bells and less confusion for owner-operators.

- Core reports: Covering the essentials without labyrinthine menus.

Where it can wobble:

- There’s limited depth for accrual complexities, multi-entity, and advanced analytics.

- The app ecosystem is smaller, so integrations may require manual bridges.

Who should choose it: Small employers who value straightforwardness and don’t need a sprawling marketplace.

Notable Sticky Points (and Which Tools Counter Them)

Revenue Recognition

Puzzle.io focuses on keeping cash events, revenue schedules, and documentation aligned so that all variances can quickly be explained and cash vs. accrual reporting doesn’t become an opinion. Intacct and NetSuite both have heavier rev-rec modules for complex contracts, but they demand careful configuration and governance. QBO can do the job with add-ons or spreadsheets; just be honest with yourself about the manual time required.

Bank Feeds and Classification

If your bank feeds are noisy, your close is slow. Puzzle and Digits treat classification as a background service, with exceptions surfaced to humans. QBO is fine with rules, but rules rot without maintenance. Zoho Books and FreshBooks are improving here and are good enough for simpler charts and lighter transaction volume.

Documents and Audit Trail

The audit is in March when the engaging firm asks for evidence. You’ve long forgotten what last year’s transactions were for. Lucky for you, Puzzle and Digits link documents tightly so that reviewers aren’t spelunking through folders. Intacct and NetSuite also do great with approvals and role controls; you’ll just spend more time in setup. QBO works if your team actually attaches the docs and follows naming conventions.

Multi-Entity and Consolidations

Intacct and NetSuite lead the pack here. QBO can get there with separate files and consolidation work, but it isn’t elegant. Typically, consolidations and multi-entity items are going to require specialized and robust software.

My Personal Pick

There are plenty of capable ZipBooks alternatives, but most misses in SMB finance aren’t about which brand you choose… they’re about workflow design. That’s why the right pick should make your month-end quieter, your documents obvious, and your exceptions smaller.

If your day-to-day looks like Stripe payouts, card spend on Ramp/Brex, payroll in Gusto, and bills through an AP tool, Puzzle.io threads those systems into a ledger that behaves like a teammate. It’s not trying to be a megaton ERP — it’s trying to keep the close boring, the variance list short, and the audit trail airtight. That’s why, for my money, it edges out the rest.