Last Updated on February 27, 2026 by Ewen Finser

Some people work to live, while others live to work, but almost nobody enjoys managing accounts payable transactions.

The good news? Today’s accounts payable solutions can take much of that work off your plate. The right AP software can automate invoice processing, streamline approvals, reduce costly errors, and give you clearer visibility into your cash flow.

Of course, having dozens of options to choose from can create a new kind of headache. Each platform offers different features, which makes it hard to know which accounts payable software truly delivers the best value for your business.

That’s where I come in.

Below, I look at some of the best AP solutions on the market today, highlighting who they’re best suited for and what you can realistically expect in terms of cost, functionality, and scalability.

My Quick Take

I think Melio offers the best bang-for-buck for most businesses, especially in the small-to-medium bracket. It’s simple but relatively feature-rich; it offers pricing tiers that accommodate smaller operations as well as bigger ones, and it has a really robust accounts payable solution.

If you have more niche requirements, though (a large volume of foreign currency transactions, for example), you may be better off looking elsewhere. I’ll get into all that in more detail below.

For the majority of businesses though, Melio strikes the best balance between ease-of-use, affordability, and useful features for most businesses.

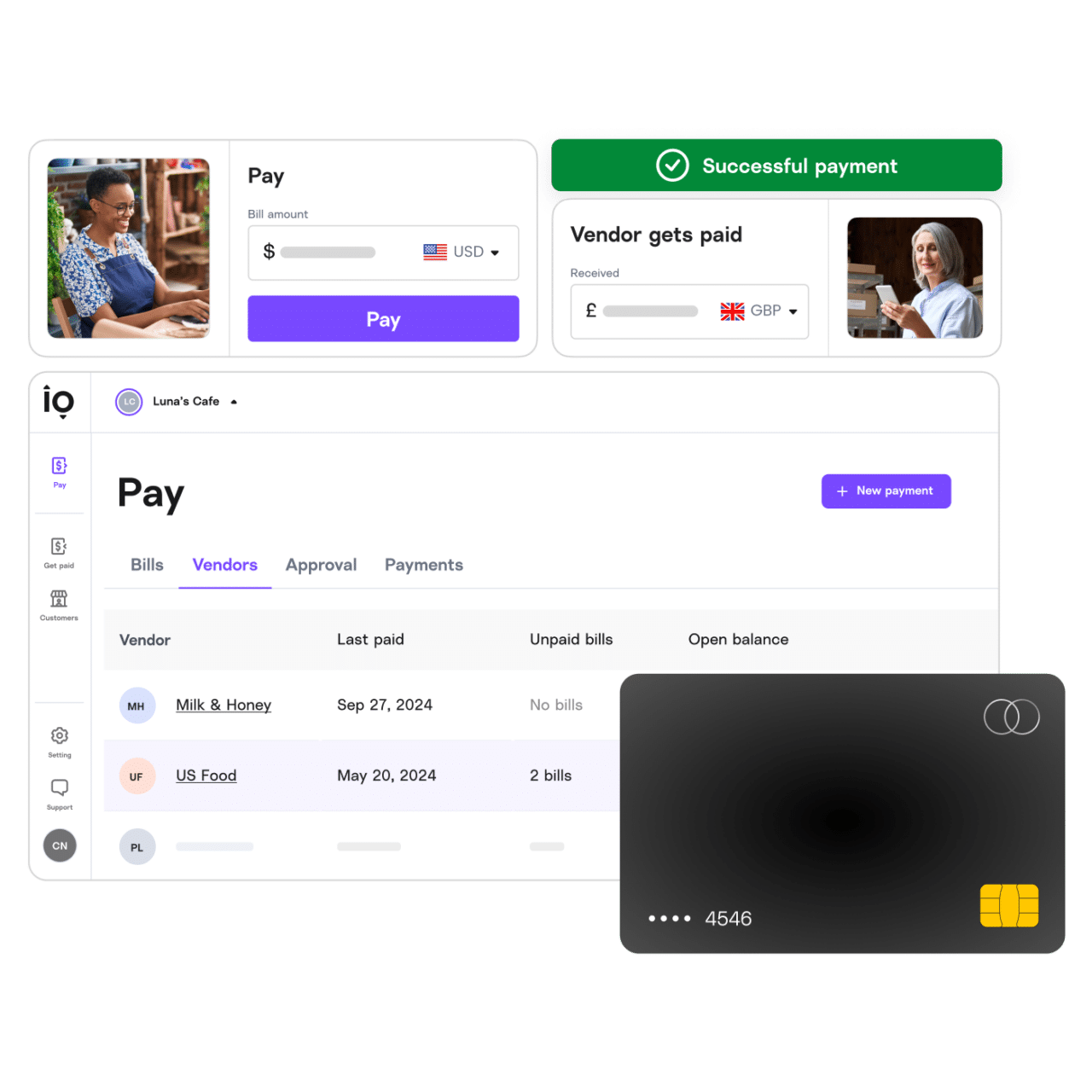

Melio

Melio is easily the best option for small businesses seeking a low-cost, user-friendly AP solution. It’s especially great if your main priority is to schedule or pay bills by ACH or credit card without fees.

Pros

- Pricing for everyone: Melio has a free tier with genuinely useful features, including auto-pay and the ability to pay bills by card. Many solopreneurs and freelancers can comfortably operate on this plan alone. Melio also offers four paid tiers, including a custom enterprise users, and all offer strong value for money. The tiers also mean that as your business grows, Melio’s service can grow with it; you won’t need to switch providers after reaching a certain level.

- Free ACH payments & scheduling: Melio lets you schedule payments in advance and send a certain number of ACH transfers for free, depending on your subscription level. For a lot of small businesses, these features alone make the investment worthwhile; over months and years, they’ll save you a significant amount of time and money.

- Pay by credit card: You can pay vendors by credit card through Melio (for a 2.9% fee) even if they don’t accept cards directly. Melio will send payment via check or ACH. Granted, vendors who only accept checks are getting rarer, but they are still around (take it from a veteran freelancer). This is extremely handy when you need it.

- Easy to use: The platform is very intuitive. If you’re a small business owner without a lot of tech experience, you’ll find Melio a lot easier to navigate than most of the other platforms here.

Cons

- Limited automation features: Melio’s straightforwardness does come at a (nonfinancial) cost. While it covers the basics well, including bill input, approvals, and payments, it lacks the advanced AP automation capabilities you’ll find on bigger systems, such as OCR invoice capture or complex approval workflows.

- Vendor onboarding friction: Your vendors may need to input details via a Melio link for ACH, which can be confusing. However, this is a one-time setup, so it’s not a massive deal.

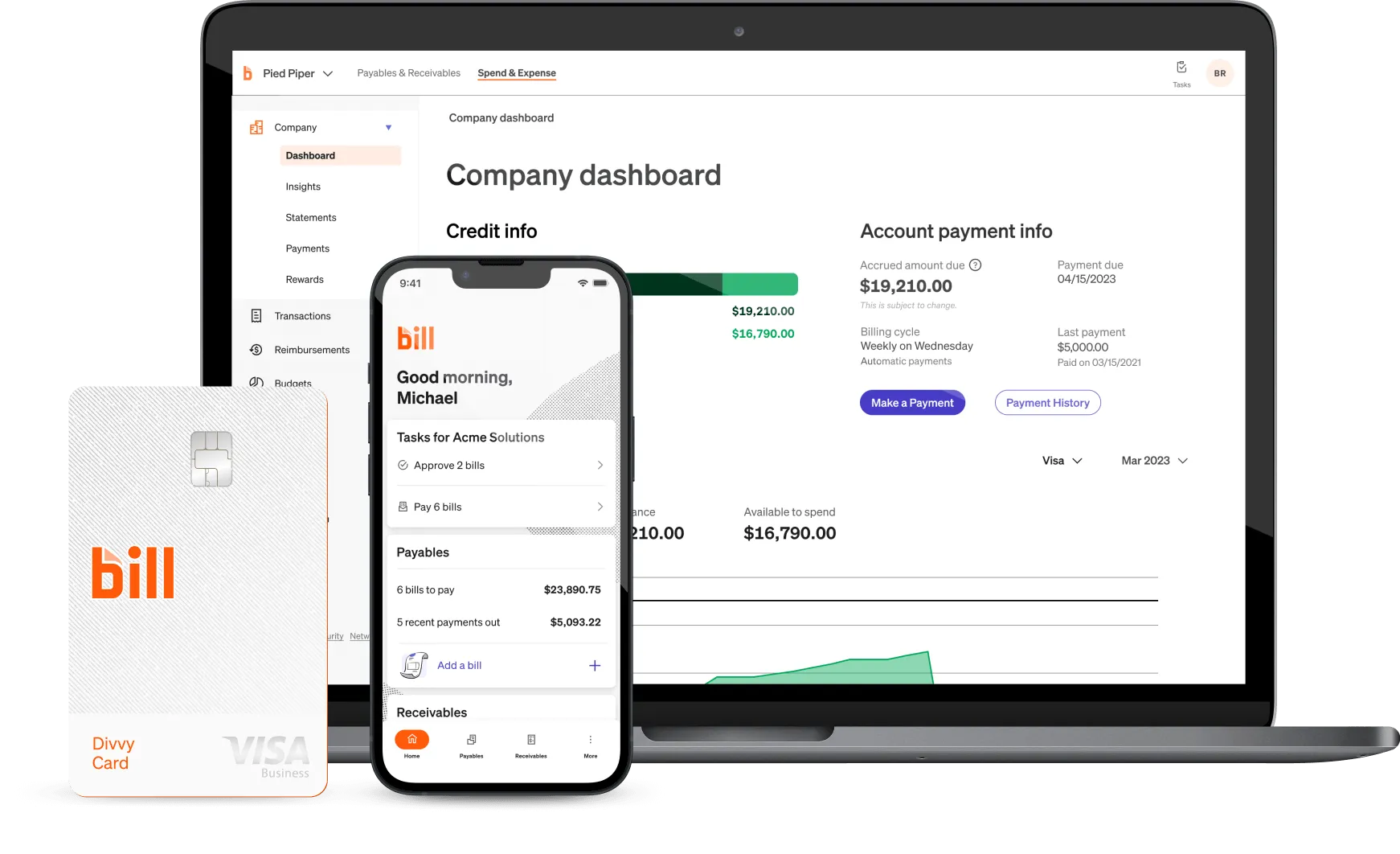

Bill.com (BILL)

BILL (formerly Bill.com) is one of the most established AP automation platforms for mid-sized businesses. It digitizes the entire bill payment workflow and takes a lot of the stress out of multi-step approval.

However, if multi-step approval isn’t a priority, you might be better off looking elsewhere, as this is really one of BILL’s main selling points. Additionally, platform glitches and lackluster customer support knock BILL down a couple of pegs in comparison to its competitors.

Pros

- Automation & efficiency: BILL significantly cuts down manual AP work (which is the name of the game in the AP space, really). Vendors can email invoices to a Bill.com address, the system can auto-capture data, and bills route to the right approvers digitally. It’s all pretty seamless.

- Strong approval controls: BILL is ideal for companies with multiple approvers or departments. You can set up multi-level approval workflows so that, for example, managers approve departmental bills before finance finalizes payment.

- Centralized documentation: BILL acts as a centralized hub for all your vendor bills and payment records. This will be particularly useful for you if you currently store all your invoices and receipts in your Downloads folder with random names full of special characters, making them impossible to find when you need them. I’ve been there more times than I care to count.

Cons

- Costs and fees: This is going to be a recurring theme in this article; accounts payable solutions ain’t cheap. BILL isn’t the worst offender, but with plans starting around $45/user, it’s a little pricey for a lot of small businesses. There are also per-transaction fees in some cases. This may or may not represent value for money for you, depending on the size of your company and your use cases.

- Customer support issues: A consistent complaint in user reviews is poor customer service from BILL. There are numerous reports of slow response times and difficulty getting issues resolved.

- Occasional payment/sync glitches: Compounding BILL’s customer support issues are the semi-regular glitches on its platform. You’re likely to face hiccups like duplicate payments, syncing errors with your accounting software, and delays or holds on certain payments.

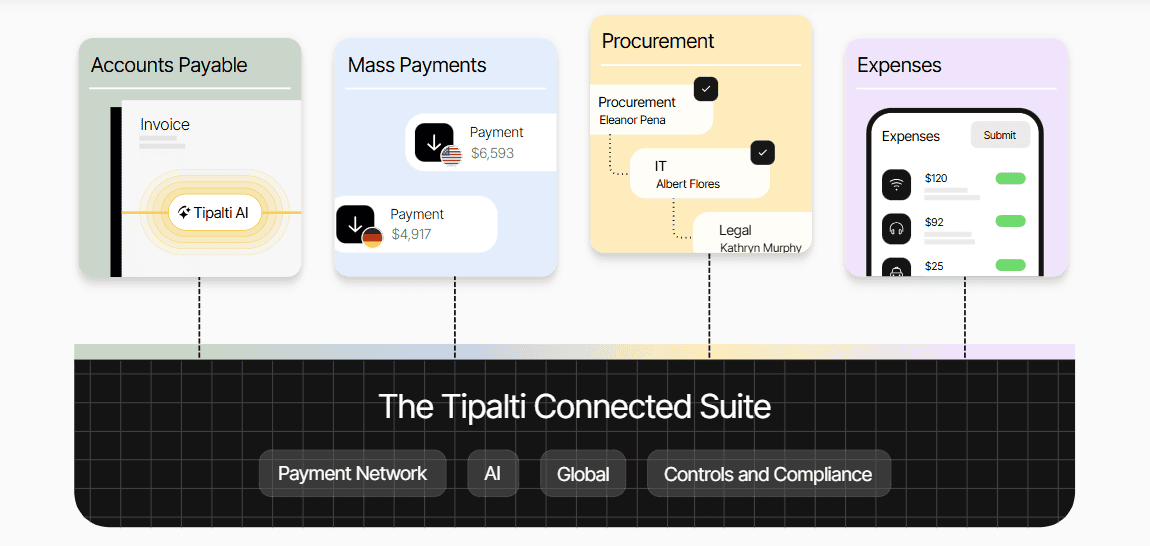

Tipalti

If you regularly pay international vendors in foreign currencies, there’s a lot to like about Tipalti. As well as simplifying currency exchange, it also automates compliance forms (sales tax, VAT, 1099s, etc.) and approvals. However, unless you really need these features, you may struggle to justify investing in Tipalti.

Pros

- Excellent for international AP: Tipalti supports payments to vendors in 190+ countries and 120+ currencies, handling currency conversion, local payment methods, and tax compliance. It’s best-in-class when it comes to international payments.

- Scalability & efficiency: If you have a high volume of payables, Tipalti shines. It can bulk-process thousands of invoices and payments with ease. The system automates everything from invoice capture to approvals to payment scheduling, which streamlines operations for AP teams.

- Compliance and controls: Tipalti can automate the collection of W-8/W-9 tax forms from vendors and the validation of tax IDs to simplify 1099 year-end work. It also checks against sanctions lists to avoid paying prohibited parties. Additionally, it integrates well with ERPs.

Cons

- Clunky user interface: Tipalti’s interface is less intuitive than it could be. Certain functions require a lot of clicks, and certain screens (such as for purchase order matching) can be slow to load.

- Customer support speed: Many users have reported slow support response from Tipalti’s team. This is a particularly big issue for a solution as powerful as Tipalti; the more bells and whistles a product has, the more scope there is for things to go wrong.

- High implementation and price: Tipalti’s price tag will probably be overkill for most smaller businesses. Its basic plan starts at $99/month, and there are more expensive custom plans after this. The onboarding process is demanding, too.

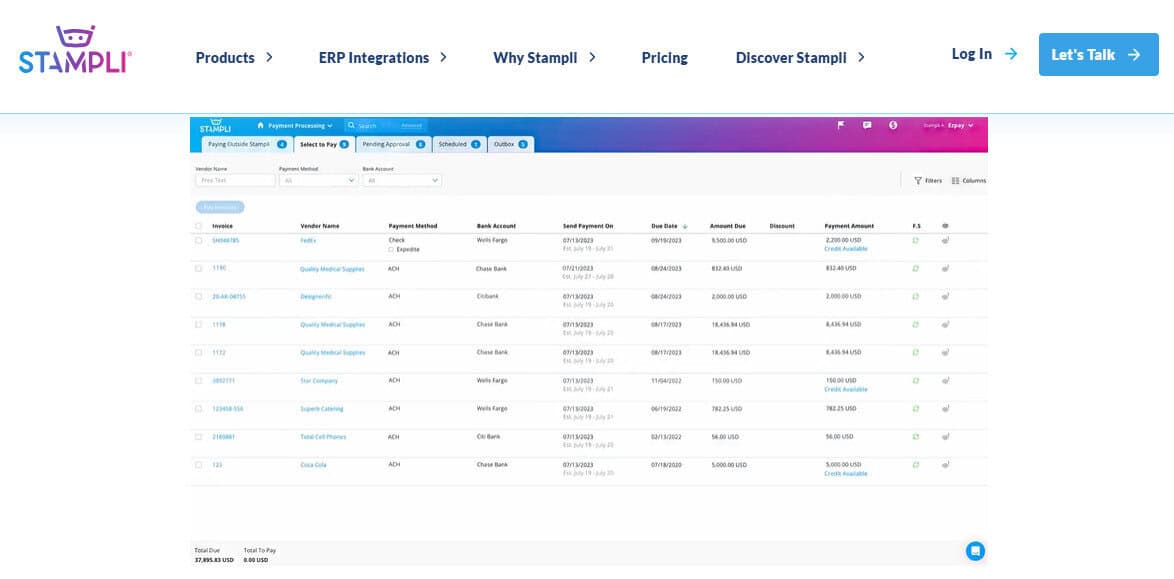

Stampli

User-friendly design is a major problem in the accounts payable market. Though modern UX/UI design has a strong focus on accessibility, many payment platforms still struggle to make products that the average person can use. Not so with Stampli.

Its automations make life a lot simpler, and it facilitates collaboration very effectively as well. AI assistant “Billy the Bot” is one of the better automation features you’ll see in the AP space.

So, it’s a great tool; just be prepared to pay a premium for it.

Pros

- Extremely easy to use: Stampli gets rave reviews for its intuitive interface. Controllers and AP managers often note how quickly approvers (even those outside finance departments) adopt it. The screens are clean and simple, and the mobile app is handy for approving on the go.

- Fast, smart invoice processing: Awful name aside, Billy the Bot really adds a lot to this app when it comes to invoice processing. The AI-powered system can get simple invoices ready for approval in as little as a minute. It also remembers coding patterns – e.g. if you always allocate Vendor X to Department Y, it will start to suggest that path automatically.

- Great collaboration & transparency: Stampli’s invoice discussion thread feature is among the most useful innovations I’ve seen in this space. Questions and approvals happen in context, which cuts out the endless email threads that are often necessary otherwise.

Cons

- Higher cost: Stampli is one of the pricier AP solutions. Pricing varies widely depending on volume and features, but it will likely set you back a lot more than its competitors. Realistically, it only makes sense if you’re working with a high volume of accounts payable transactions; it’s not built with small business in mind.

- Focused scope (AP only): Stampli is highly specialized for AP and does not offer broader expense management features (like employee expense reimbursement or travel cost modules). If you’re looking for an all-in-one spend management solution, Stampli’s not it. Not only will you have to pay through the nose for Stampli, you’ll probably need to invest in another expense management tool as well.

Airbase

If you’re looking for a platform that does more than accounts payable, Airbase may be for you. Unlike many of the other providers on this list, it offers a corporate card system; if this is something you need, you could do a lot worse than Airbase.

Pros

- All-in-one convenience: Because Airbase handles AP bills, employee reimbursements, and card spending, it gives finance teams a unified view of company spend. All purchases, whether via invoice or credit card, flow through one platform with consistent approval workflows.

- User-friendly interface: Airbase is straightforward and easy to learn. Both the desktop and mobile versions should be accessible to the average employee.

- Powerful card and spend controls: Airbase’s roots in corporate cards mean it offers great control over card spending. You can instantly issue virtual credit cards for vendors or subscriptions, set specific limits or expiration dates, and require approvals for card transactions over certain amounts. If you’re sick of the limitations of a single corporate card, there’s a lot to like about this.

Cons

- Reporting and analytics limitations: Airbase’s reporting features are pretty lightweight compared to those of other AP platforms. This doesn’t really affect its core expense management functions, but automated reporting can come in handy, so this is worth bearing in mind.

- Pre-funding requirement for cards: Because Airbase offers a credit line, its setup and approval processes are more demanding than those of other AP solutions. It might require you to pre-fund a deposit account, which will tie up a significant amount of cash.

What’s the Verdict?

If you need a general-purpose AP tool that will grow with your business and represent great value for money at every level, I don’t think there’s any reason to look further than Melio. If you have more specialized requirements, though, you should look for a tool that caters to them; all of the tools I’ve discussed here deliver solid results for users.