- The Bottom Line Up Front:

- How I Judge Automation within SMB Softwares

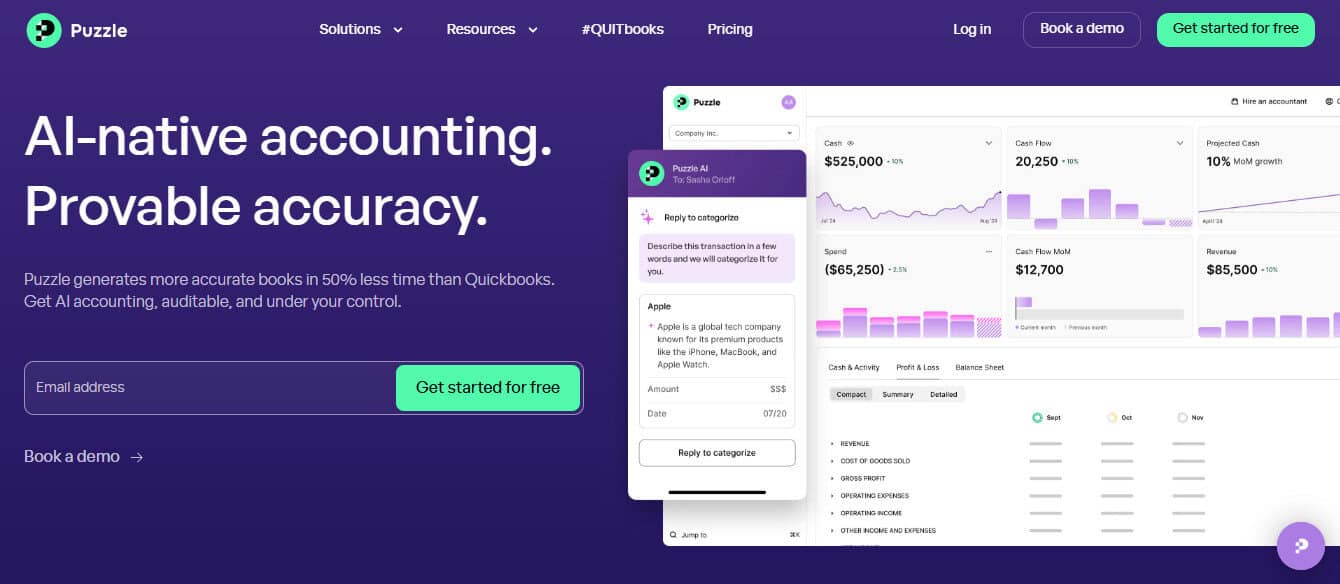

- 1) Puzzle.io: Real-Time Ledger With AI Assistance

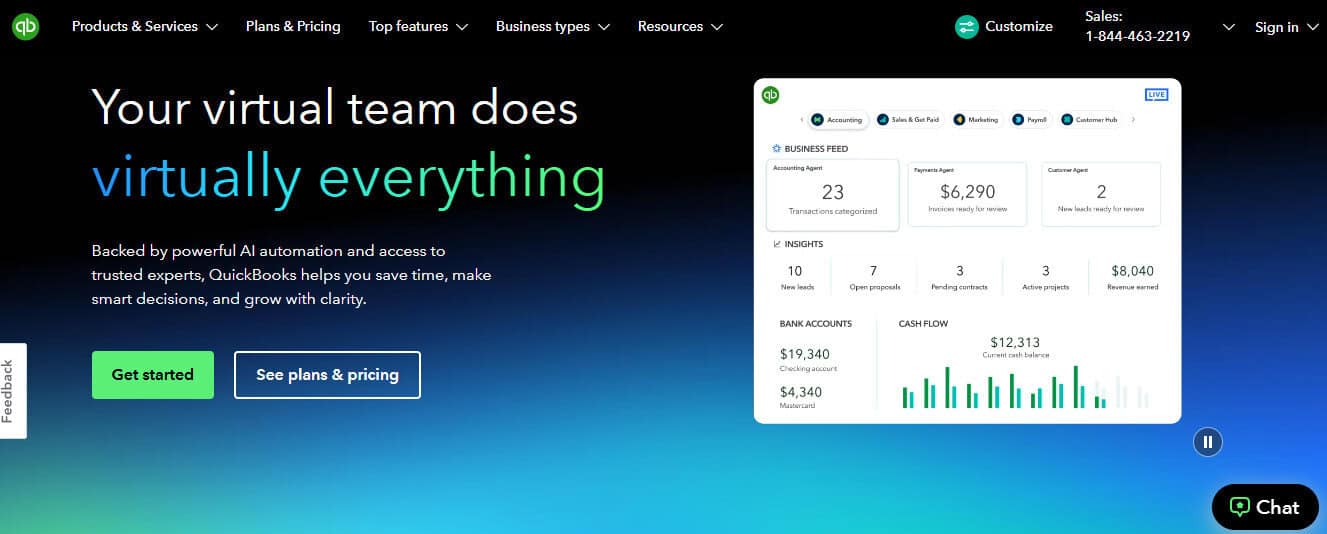

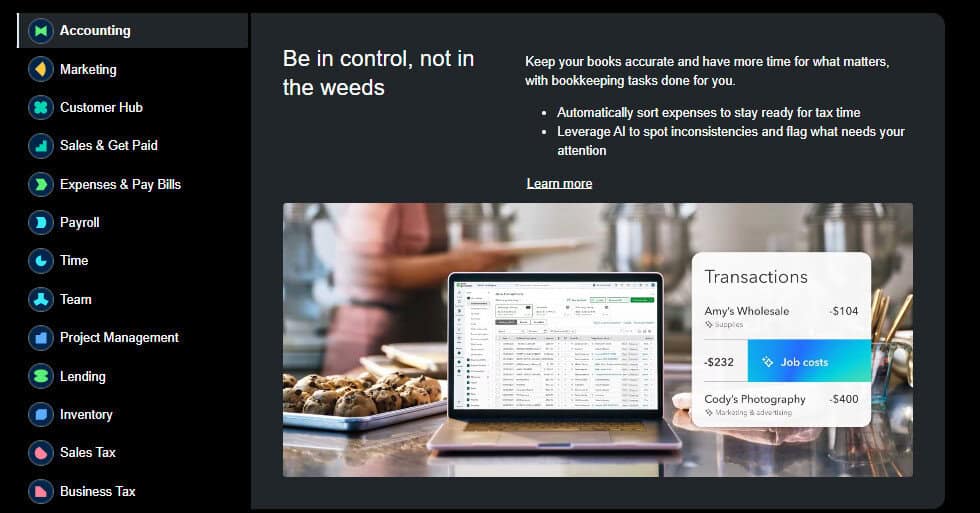

- 2) QuickBooks Online Advanced: Familiar Ledger, Strong Native Workflows

- 3) Xero: Fast Bank Recs and Bulk Fixes

- Where it Fits

- 4) Zoho Books: Flexible Workflows at a Friendly Price

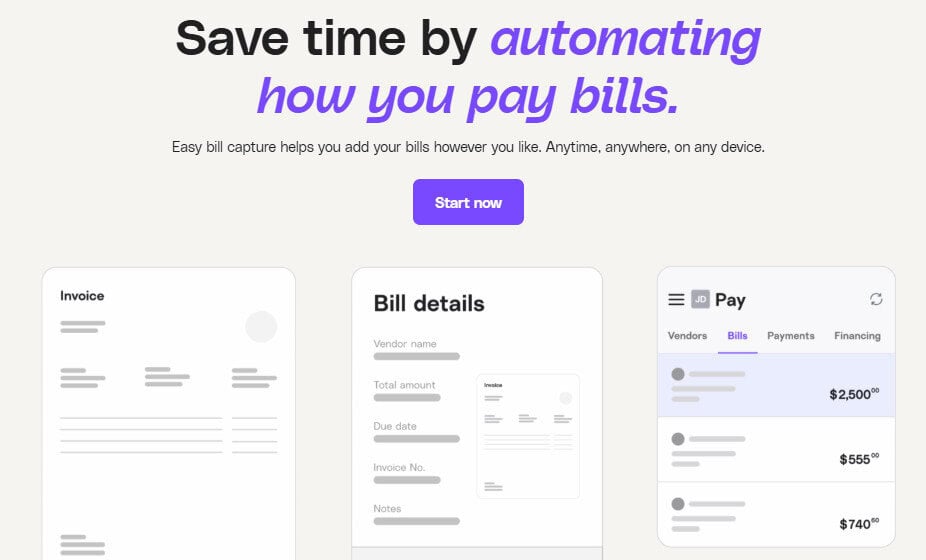

- 5) Melio: Lightweight AP Automation That Plays Nice With Your Ledger

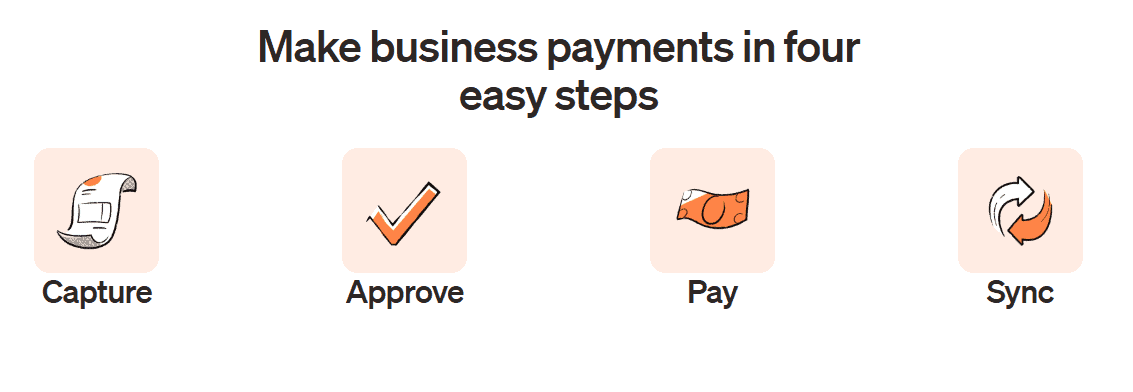

- 6) BILL — Deeper AP/AR Automation and Approvals

- How to Roll Out Automation Without Breaking Your Books

- Final Thoughts

Last Updated on October 3, 2025 by Ewen Finser

As a CPA who has cleaned up more ledgers than I dare admit, I judge automation by one thing: does it cut typing without hiding risk or just plain, flat out getting things wrong. In my experience, the best tools connect bank and card feeds, apply exceptionally clear rules, route bills for approval, and surface exceptions fast. For small teams, I focus on modern ledger keeping software with lean bill pay stacks. Puzzle.io, QuickBooks Online Advanced, Xero, Zoho Books, Melio, and BILL all come to mind because they shorten the path from raw data to reliable financial statements.

The Bottom Line Up Front:

If you want the fewest clicks between raw bank data and clean books, Puzzle edges out the pack for small teams that value a real-time ledger and AI-assisted cleanup. That’s why it’s one of my go-to recommendations for folks who want hands-off financials (within reason). If you’re already deep in the Intuit ecosystem, QuickBooks Online and a lean bill-pay stack can be effective. Xero stands out for speed at bank recs and bulk edits, Zoho Books for flexible, low-cost workflows, and Melio or BILL for payables automation that bolts onto whichever ledger you use. None of these tools eliminates judgment; they just move your attention from typing to reviewing.

How I Judge Automation within SMB Softwares

Every time I meet with a sales representative for any SMB financial software, all they want to talk about is how easy their software is to use because AI this or Rules Based that. According to the sales rep, closing the books shouldn’t take more than 12 seconds per month, so long as you use their software. Let me tell you, I’ve been fooled a handful of times, and at this point I know what I’m looking for. It’s pretty simple. Can the software do the following:

- Pulls data in reliably (bank feeds, card feeds, invoice OCR).

- Applies consistent logic (rules, workflows, approvals).

- Showcase exceptions quickly so you spend time reviewing, not searching.

I also look for:

- Two-way sync with the GL.

- Audit trails you can trust.

- Clear responsibilities between owners, managers, and bookkeepers.

- Simple roll-forward from cash to accrual when you need it.

With that lens, here are my favorite SMB automation tools:

1) Puzzle.io: Real-Time Ledger With AI Assistance

Where it Fits

Puzzle.io is for owners and finance teams that want a modern ledger with real-time views of cash and accrual, out of the box. You connect accounts, and the system builds your statements and schedules while you focus on exceptions. It’s a strong choice for startups and growing small businesses that need current numbers every day, not just at month-end.

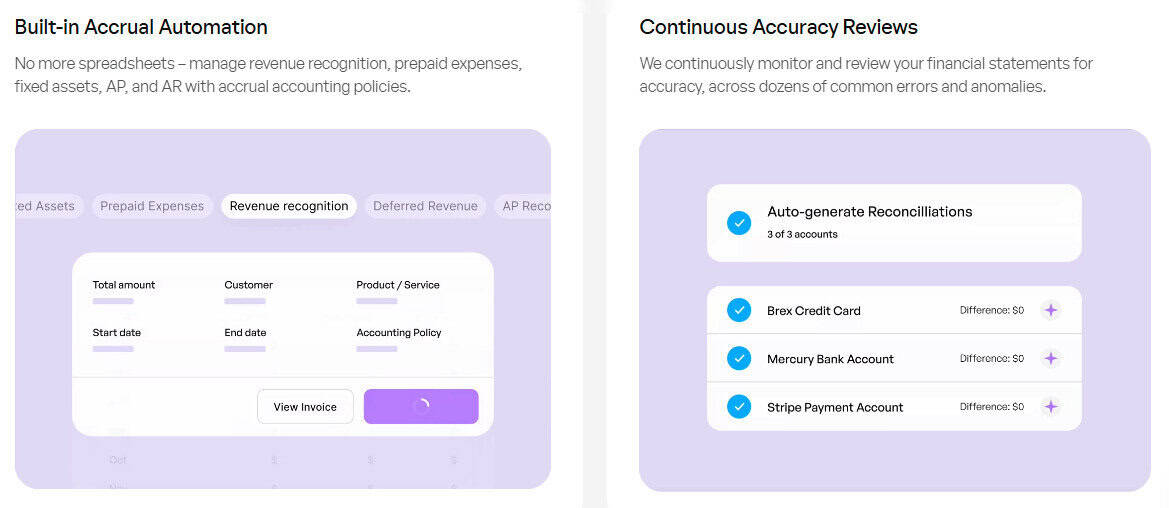

Standout Automations

- Auto-generated financials and reconciliations. Puzzle produces financial statements, accrual schedules, and account recs automatically, then invites you to review anomalies rather than enter every line. That’s the right direction for automation: review first, edit only when needed. It’s for this reason that I’ve really enjoyed the new kid on the block and find it easy to recommend to my clients.

- Simultaneous cash and accrual views. You don’t have to rebuild the same period twice to explain results to an owner vs. a lender; both views live in one system.

- Direct integrations with modern spend tools. A recent example is a one-click setup from Brex into Puzzle’s ledger, which cuts setup time and reduces mapping errors during onboarding. You can also connect most banks via Plaid and Gusto for Payroll relatively easily.

Tradeoffs to Note

- You’ll get the most value if your team buys into a “review exceptions” workflow. If you prefer to hand-key and control every step, Puzzle will feel opinionated.

- Bank connectivity and modern card stacks are the core path; odd workflows or legacy systems may take more lift.

Who it’s Best for

Owners who want a near-live read on cash, burn, and runway, and firms that coach clients on metrics as much as bookkeeping.

My CPA Take

If I were standing up a finance stack today for a 5- to 40-person business, I’d start here when I want the least manual work inside the GL and the most help spotting issues. It’s the one that most often frees me to review, explain, and decide, which is where my time adds value.

2) QuickBooks Online Advanced: Familiar Ledger, Strong Native Workflows

Where it Fits

Alright, folks, if you’ve read any of my other articles, you know I never pass up on the opportunity to dunk on Intuit. Unfortunately, that’s just not the case here. QBO remains the default ledger for many small businesses, and they just released a slew of AI updates, and dare I say that they’ve actually done a good job with its implementation of automation tools. If you’re already on QBO, their Advanced plan offers a host of decent features (just get comfortable paying a high price for the platform every month, that’s where they get ya).

Standout Automations

- Workflow automation. You can build invoice approval flows, due-date reminders, and customer notifications, all from the Workflow automation center. This moves a lot of email nudging into the background.

- Bank rules and suggested categorization. You can create rules that auto-categorize transactions as they import, and QBO’s suggestions “learn” from past choices. Used well, this shortens bank rec time. This was something I’ve seen QBO historically struggle with.

- Newer approval features. Recent updates include multi-condition approvals for bills/POs, which help when you need sequential sign-off across departments.

Tradeoffs to Note

- Rules stack quickly and can get complicated. If you also set recurring transactions for the same vendors, you can create duplicates. Keep one source of truth for each inflow/outflow type.

- Suggested categories help, but you still need a review step. I never run a bank feed on autopilot to “add all.” That’s how you make a month’s worth of errors that will take an entire day to clean up.

Who it’s Best for

Teams already on QBO who want to turn on more native automation before adding extra apps.

My CPA Take

QBO Advanced gets you 80% of the way with bank rules and workflows alone. Pair it with a simple AP add-on, and you can close fast without drowning in tools.

3) Xero: Fast Bank Recs and Bulk Fixes

Where it Fits

Xero has long focused on efficient bank reconciliations. For high-volume transaction businesses like retail, restaurants, services with many small payments, its cash coding view flies. It also gives advisors tools to correct errors in bulk.

Standout Automations

- Cash coding. You can mass-code bank lines in a spreadsheet-style screen. That speed matters when you have long lists of small, similar transactions.

- Find & Recode. If a staffer mapped a month of transactions to the wrong account or tax setting, you can fix many lines at once. That’s real automation in my opinion: fewer clicks to unwind human error.

Tradeoffs to Note

- Xero’s automation shines at rec and cleanup. For some U.S. teams, approvals and inventory depth may still need add-ons.

- If you migrate from another system, give yourself time to rebuild bank rules and tracking categories. I’ve spent over a month setting rules for over 52 bank accounts.

Who it’s Best for

Firms and owners who value speed in bank rec and clean correction tools over all-in-one workflow.

My CPA Take

When I need to clear a backlog of bank lines or fix a mis-coded quarter, Xero feels like power tools in a tidy toolbox.

4) Zoho Books: Flexible Workflows at a Friendly Price

Where it Fits

Zoho Books brings workflow automation you can tailor, like email alerts, in-app notifications, field updates, webhooks, even custom functions without heavy cost. For budget-sensitive teams that still want rules and approvals, it’s a practical choice.

Standout Automations

- Workflow rules with conditions. You can trigger actions based on criteria across records, schedule them, and log outcomes, which is handy for approvals, follow-ups, and escalations.

- Recent enhancements. 2025 updates added field-to-field comparisons in workflow criteria and other admin improvements, which means you can enforce smarter rules (e.g., when Discount > Tax, flag for review).

Tradeoffs to Note

- The breadth of options can tempt teams into over-engineering. In my experience, it’s best to keep rules simple: route approvals, send reminders, and flag exceptions. Really think about if you need anything more.

- Some third-party ecosystem pieces are not as deep in the U.S. as the Intuit and Xero marketplaces.

Who it’s Best for

Cost-conscious owners who still want structured approvals and repeatable processes.

My CPA Take

Zoho Books punches above its weight on automation knobs. It rewards teams that document their process once and then let the system run it.

5) Melio: Lightweight AP Automation That Plays Nice With Your Ledger

Where it Fits

First, this one is different from the others in the list so far. Melio is an accounts payable tool designed for small businesses and accountants, and not a standalone accounting platform. It syncs vendors, bills, and payments with major ledgers and gives owners a simple way to approve and pay without touching the GL.

Standout Automations

- Two-way sync with QuickBooks. Create a bill, pay it in Melio, and the payment syncs back to QB. This keeps your subledger and bank in lockstep without duplicate entry and the risk of human mistakes.

- Accountant features. Melio has continued to expand firm-friendly views and tools that centralize client payables. For me and my firm, this matters when one team supports many small businesses.

- Workflow for approvals and scheduling. You can route bills for sign-off and schedule ACH or card payments, then let the sync mark things paid within QB.

Tradeoffs to Note

- Melio focuses on AP. If you need AR automation or PO-to-bill matching, you’ll either keep that in the ledger or look at a broader suite.

- For more complex controls, you may outgrow it and need to move to a heavier platform. But for most SMBs, it’s more than adequate.

Who it’s Best for

Owners who want clean AP with minimal training and firms that want a consistent way to run payables across clients.

My CPA Take

When people ask me for “something simple for bill pay that syncs,” this is often my first and last stop.

6) BILL — Deeper AP/AR Automation and Approvals

Where it Fits

BILL (formerly Bill.com) is a financial operations platform that goes beyond basic bill pay. It handles AP approvals, payments, and also offers AR tools, with strong two-way sync to major ledgers. For small businesses that need more controls and roles, it’s a proven option.

Standout Automations

- Approval workflows with business rules. You can route bills by amount, department, or vendor, and approve from anywhere. That cuts email chains and speeds up payment cycles.

- Two-way sync and vendor network. Automatic sync with QuickBooks and Xero keeps ledgers updated, and the BILL network helps pay vendors electronically at scale.

Tradeoffs to Note

- More power means more setup. If you’re a five-person shop, you may not need all the knobs. Bill is also typically more expense than Melio, for instance.

- Owners should still review cash timing; speed at paying is great until it collides with working-capital needs.

Who it’s Best for

Teams that want stronger approval gates and plan to centralize AP (and possibly AR) in one app connected to the GL.

My CPA Take

When a client needs controls that auditors won’t frown at without blowing a small-business budget, BILL makes sense.

How to Roll Out Automation Without Breaking Your Books

I’ve been given financials that I can look at and immediately tell that someone set up automation rules and then never looked at them again until they realized something was terribly incorrect (all expenses hitting the same three accounts, negative liability accounts, etc.). After years of fixing “automated” messes, this is the rollout plan I use:

- Map sources of truth.

One tool should create each transaction. If QBO bank rules create the expense, don’t also create a recurring expense for the same vendor. That’s how duplicates happen. - Start with bank feeds and rules.

Pull in data. Write simple, named rules. For example, “Exxon – under $200” book to Fuel Expense. Review for a week before turning on auto-add in any system. - Add AP last.

Once you trust your inflows/outflows mapping, move approvals and payments into Melio or BILL and let the two-way sync post back to the ledger. This is where you really can start to see massive time savings from automation. - Keep a weekly exceptions ritual.

Block 30–60 minutes to look at unmatched bank lines, stale approvals, and rules that fired wrong. In my experience, this small habit saves hours at month-end because you can look at things while they’re still fresh on your mind, not 35 days later when you’re rushing to close financials. - Document your rules.

A one-page list of “what creates what” helps every new hire and protects you when you forget what you set up six months ago.

Final Thoughts

You don’t need “everything” (despite what the aforementioned sales representative may tell you). You need a ledger you trust and a few automations that remove drudgery without hiding risk. Here’s my short list:

- As a CPA, Puzzle.io is the most review-first experience on the market today, and it keeps you close to real-time numbers with less manual work. That’s why it tops my list.

- QBO Advanced gets you broad automation in a familiar home, especially with bank rules and the newer workflow center.

- Xero feels fastest when you’re neck-deep in bank lines or fixing mis-codings.

- Zoho Books gives you approvals and rules at a fair cost.

- Melio and BILL round out AP needs from simple to robust, both with clean ledger sync.

Pick one to start. Turn on one rule at a time. Keep the review step sacred. Automation is supposed to give you back attention, not take away oversight, and when you implement it with intent, it does exactly that.