Last Updated on January 8, 2026 by Ewen Finser

Most founders can relate to the feeling of excitement and optimism that comes with starting a business. But once you’re in the weeds with messy day-to-day operations, it’s not all sunshine and rainbows — especially the finances.

If you’re looking to secure funding from investors, you’ll need proper financial management, including compliance with tax laws and industry-specific standards. This is one of the main factors investors will consider before taking a chance on your business.

Given the growth that you’re hoping for and the ever-present need to generate comprehensive financial reports, it’s critical that your accounting software can keep up. With that in mind, here are some of the top AI accounting software solutions that can help startups with their bookkeeping.

Accounting Software Must-Haves for Startups

Here are some of the main things to look for when choosing an accounting solution for your startup:

- AI Accounting: Most early-stage startups don’t have the resources to keep bookkeeping streamlined and accurate. Several accounting solutions integrate AI and automation, saving you valuable time that you can instead dedicate to more strategic tasks.

- Easy Setup: You shouldn’t have to be a CPA to confidently keep your books, and you need to be able to get started right away without having to go through a lengthy onboarding process. That’s why the best solutions are self-guided and easy to learn.

- Integrations: Chances are, you’re relying on other solutions like payment processors, POS systems, payroll software, ERP systems, etc. So look for an accounting software that lets you seamlessly integrate with these existing platforms.

- KPI Tracking: As a startup, it’s vital to keep a close eye on your metrics to see how close you are to reaching your goals. Choose an accounting software that helps you track important financial KPIs so you can catch problems before they wreak havoc on your business.

- Financial Reports: You need to be able to create robust financial statements that help you secure funding and keep your investors happy. At the bare minimum, accounting software should help you generate an income statement, balance sheet, and cash flow statement.

Best AI Accounting Software for Startups: At a Glance

AI Features | Best For | Plans and Pricing | |

Puzzle | – Categorization – Variance analysis – Accrual automation – Accuracy reviews | Startups that are looking to use AI as much as possible to save time and improve accuracy in bookkeeping. | Accounting Basics ($0, $25/month after $20,000 in transactions)Accounting plus Insights ($50/month)Accounting plus Advanced Automation ($100/month)Accounting plus Scale ($300+/month) |

Zeni | – Financial insights – Receipt management – Audit bot | Mid-stage startups that want access to both AI accounting and human financial advice. | Starter ($549/month)Growth ($799/month)Enterprise (Custom pricing) |

Truewind | – Month-end close – AR reconciliation – Anomaly detection | Mid-stage startups that want a customized AI accounting solution. | Essential ($300–$650/month)Core ($650–$1,250/month)Growth ($1,250–$2,000/month) |

Zoho Books | Zia AI Assistant | Startups that want some AI features but prefer a more traditional approach to bookkeeping. | Free ($0/month)Standard ($20/month)Professional ($50/month)Premium ($70/month)Elite ($150/month)Ultimate ($275/month) |

QuickBooks | – Agentic Intuit Assist – Accounting – Payments – Sales tax – Finance Project management | Startups that want an established platform that combines AI with traditional bookkeeping. | Simple Start ($38/month)Essentials ($75/month)Plus ($115/month)Advanced ($275/month) |

Digits | – Categorization – Variance analysis – Accrual automation – Accuracy review | Startups that need real-time financial visibility and want continual updates instead of waiting for monthly reports | – Bill Pay & Basic (~$35/month) – AI Accounting ($100/month) |

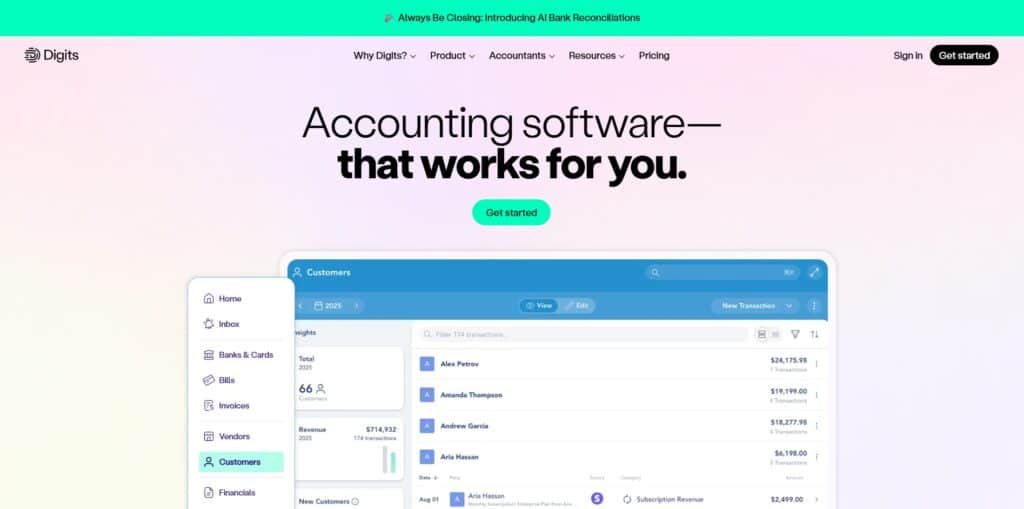

Digits

Digits is a powerful financial platform for businesses of all sizes, but it’s built with the specific goal of replacing static, monthly reports with real-time financial data. The platform uses a proprietary AI model to automate the heavy lifting of bookkeeping and financial analysis, recognizing that modern founders need immediate visibility into their finances.

It also integrates seamlessly with the modern fintech stack, including major banks, credit cards, and payroll providers like Gusto. Of special note is a deep integration with corporate card and spend management platforms like Ramp and Brex, as well as direct connections to payment processors like Stripe — allowing for rich data ingestion that goes beyond simple bank feeds.

AI Features

Some of Digits’ AI features include:

- Categorization: Rather than waiting for month-end, Digits’ AI uses a proprietary “Living Model” to automatically sort expenses and revenue as they happen.

- Variance Analysis: Digits’ automated flux analysis works around the clock, alerting you to unexpected spikes or dips immediately and empowering you to investigate variances before they become costly trends.

- Accrual Automation: Digits’ AI handles prepaid expenses, liability tracking, and accrued expenses, ensuring your financial statements adhere to proper accounting standards without manual journal entries.

- Accuracy Reviews: The “Ask Digits” AI assistant identifies duplicate transactions, missing vendors, or misclassified items, flagging them for easy review.

On top of routine bookkeeping, Digits specializes in investor-ready reporting. It automatically generates live, interactive financial statements that include critical startup metrics like burn rate, runway, and cash flow forecasts — ensuring that you’re always prepared for board meetings or fundraising diligence.

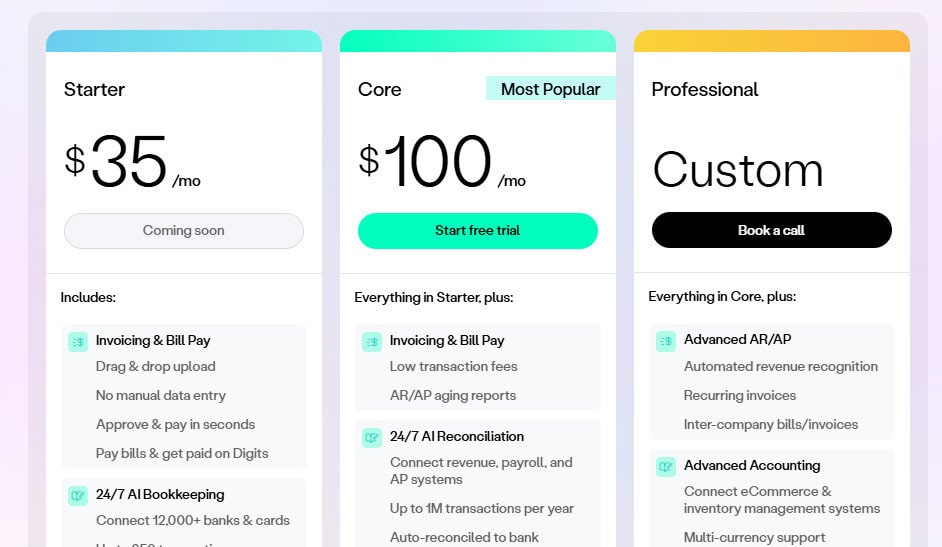

Pricing

Digits Bill Pay & Basic (starts at ~$35/month):

- Works for simplified cash management

- Access to AI-powered bill pay, invoicing, and basic transaction search capabilities

Digits AI Accounting ($100/month):

- Full AI-driven bookkeeping and automated reconciliation

- Real-time financial reports (P&L, balance sheet, cash flow) with living dashboards and deep-dive transaction views

Key Takeaway

Digits is all about speed and visibility, transforming accounting from a monthly chore into a real-time advantage. It’s a premium, tech-forward option that eliminates the lag time of traditional bookkeeping, so if you want instant answers to financial questions and reports that update the moment a transaction occurs, Digits is an excellent choice.

Puzzle

While Puzzle is a great choice for any SMB, it’s specifically designed with startups in mind. The company understands that early-stage founders have a lot on their plates, which is why the platform has really leaned into AI to make things easier.

AI Features

Some of Puzzle’s AI features include:

- Categorization: Puzzle’s AI can categorize transactions with up to 95% accuracy. For example, if you have categories like revenue, payroll, utilities, and office supplies, Puzzle will automatically sort your transactions and assign them to the correct category, making your general ledger easier to read through.

- Variance Analysis: Based on your predefined thresholds, Puzzle can immediately spot major increases in expenses. So if you set a threshold for changes greater than 15% and $500, Puzzle will flag any instances that occur between accounting periods — helping you detect unusual spending and proactively adjust your budget.

- Accrual Automation: Since most businesses use accrual rather than cash accounting, it’s important that your accounting software can automate your bookkeeping in accordance with accrual principles. Puzzle’s AI can help you manage items like revenue recognition, prepaid expenses, fixed assets, AP, and AR.

- Accuracy Reviews: Puzzle uses AI to continually check your financial records for accuracy and flag critical errors.

Puzzle also integrates with several popular programs, including payroll providers, invoicing and payment processors, banking and credit card solutions, and FP&A software. Of special note is Puzzle’s integration with Stripe, which is a direct API connection that doesn’t require any third-party connectors.

On top of routine bookkeeping, Puzzle also helps with tax compliance, using AI to ensure you’re compliant with tax/reporting laws and keep you prepared for upcoming audits. It also provides quick access to critical metrics for fundraising, including burn rate, runway, and ARR/MRR.

Pricing

- Accounting Basics (free; $25/month after $20,000 in transactions):

- Works for either cash or accrual accounting

- Access to basic automation features for your profit and loss statement, your balance sheet, transaction categorization, accrual policies, and revenue recognition

- Accounting plus Insights ($50/month):

- Real-time financial insights into significant changes, spending, and revenue

- Real-time financial insights into significant changes, spending, and revenue

- Accounting plus Advanced Automation ($100/month):

- Advanced automation tools such as continuous accuracy monitoring, AI month-end close review, AI flux analysis, and AI business insights

- Advanced automation tools such as continuous accuracy monitoring, AI month-end close review, AI flux analysis, and AI business insights

- Accounting plus Scale (starts at $300/month):

- Customization of subledgers, reports, automations, and AI prompts, among other features

Key Takeaway

Puzzle is all about streamlining your bookkeeping process and reducing manual entry. It’s also fairly low-cost, so even if you’re an early-stage startup, it could be a realistic option. If you’re ready to fully embrace AI in the accounting process, Puzzle is a solid choice.

Zeni

Zeni is a popular AI-powered bookkeeping platform that claims you can save 70 hours per month by using its automated accounting solutions. Zeni has startups in mind — its website provides a free startup financial model template, as well as a startup company valuation calculator.

AI Features

Here are some of Zeni’s AI capabilities.

- AI-Powered Financial Insights: Zeni gives you real-time insights into your business’s financial health, detecting trends and potential issues. It also conducts financial analysis and can provide you with informed recommendations for your business.

- AI-Powered Receipt Management: This feature automatically categorizes and tracks expenses, in addition to aiding with invoice processing.

- AI GPT: This tool can categorize your vendors, merge data from duplicate vendors, and automate bookkeeping tasks like journal entries.

- AI Audit Bot: Zeni’s audit bot checks your transactions for accuracy, detects errors, and helps your startup maintain compliance with GAAP.

Despite its heavy emphasis on AI, Zeni also focuses on the human side of financial management. All plans come with a built-in finance team, giving you access to the input of a controller, bookkeeping manager, and bookkeeping analyst. Zeni can also integrate with QuickBooks Online, Avalara, Plaid, Stripe, PayPal, and Square.

Pricing

Here are the plans Zeni offers (note that its website does not disclose which features are available under which plans):

- Starter ($549/month):

- For pre-revenue companies that need basic AI bookkeeping

- Growth ($799/month):

- For companies that are generating revenue and need advanced AI bookkeeping capabilities

- For companies that are generating revenue and need advanced AI bookkeeping capabilities

- Enterprise (custom pricing):

- For companies with complex needs

- Customized AI bookkeeping

Key Takeaway

While Zeni has many of the same AI features as Puzzle, it’s a more expensive option that may be a better choice for mid-stage startups. However, regardless of which plan you have, Zeni comes with access to a human finance team, making it a good pick for startups that want to combine AI accounting with human expertise.

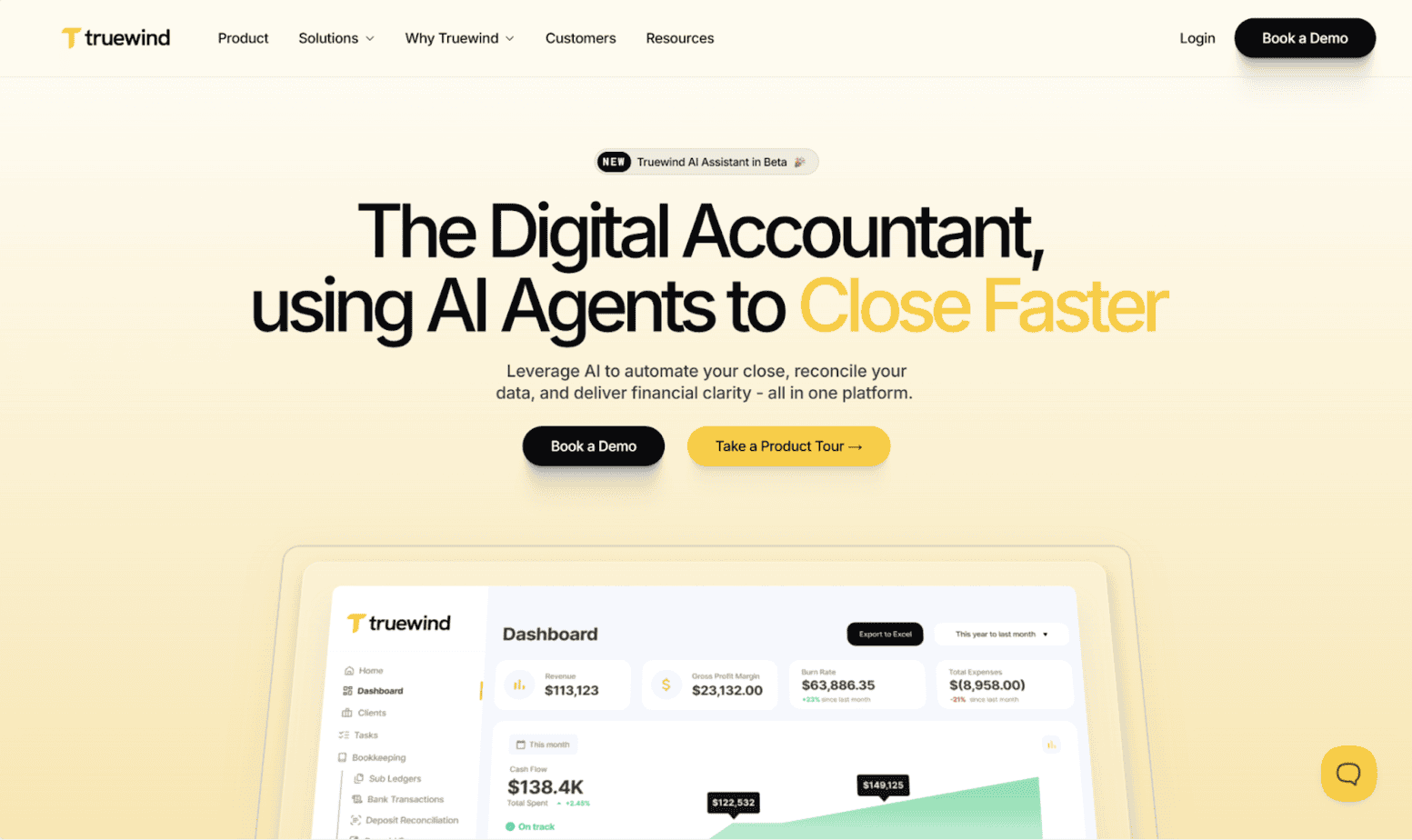

Truewind

Truewind is a great accounting solution for companies in a wide range of industries, from entertainment to nonprofits, but it’s also a common choice for startups — the company claims that over 500 startups use their software.

Truewind can integrate with both QuickBooks Online and Sage, and it helps you conduct AP and AR matching, bank reconciliations, payroll reconciliations, and GAAP reports.

AI Features

Truewind’s AI capabilities include:

- Month-End Close: You can set deadlines and assign tasks for AI agents to follow when closing your books.

- AR Reconciliation: Truewind’s AI can match statements from platforms like Stripe, Amazon, and Shopify to your bank deposits.

- Anomaly Detection: Truewind reviews your books, highlights any potential issues that could be impacting accuracy, and offers suggestions.

Pricing

Truewind’s pricing is customized to your business, so there isn’t a set monthly fee for each plan. However, the company does provide a range of what the fee could be:

- Essential ($300–$650/month):

- Transaction categorization

- Bank reconciliation

- Payroll reconciliation

- Prepaid amortization

- Fixed asset schedule

- Core ($650–$1,250/month):

- Intercompany reporting

- Revenue recognition

- Class and department tracking

- Accounts payable

- Accounts receivable

- Customized reporting

- Growth ($1,250–$2,000/month):

- Tools for inventory management

- Other vital features for businesses in complex industries

Key Takeaway

Truewind offers a wealth of customizable AI features across multiple flexible plans. It’s fairly expensive, but it may be the right choice for mid-stage startups that want a more bespoke approach to AI accounting.

Zoho Books

Zoho Books caters to startups, small businesses, and nonprofits, and it’s an attractive choice for startups specifically due to its easy setup, intuitive UI, and access to customer support. It integrates with other apps in the Zoho ecosystem, as well as online payment platforms like Stripe and apps like Microsoft, Google Workspace, and Slack. And in addition to standard bookkeeping, the platform has compliance features for sales tax and document management.

AI Features

Zoho Books has its own AI assistant, Zia, which can answer questions about various areas of your business, analyze your financial data, and provide key insights — it can even generate visualizations.

Aside from Zia, Zoho Books doesn’t have many AI features that are specific to accounting. However, you can use automation to set recurring expenses and invoices, auto-charge invoices, send emails, and perform periodic tasks at set intervals.

Pricing

The platform has six different plans to choose from, with features including:

- Free:

- Invoice creation

- Journal entries

- Sales receipts

- Online payments

- Bank reconciliation

- Financial reports (profit and loss, balance sheet, etc.)

- Standard ($20/month):

- Sales and use tax

- Bank feed connection

- Custom reports

- Custom journal templates

- Professional ($50/month):

- Bill management

- Sales and purchase order tracking

- Multi-currency transaction

- Inventory tracking

- Premium ($70/month):

- Basic revenue recognition

- Fixed asset management

- Budgeting

- Cash flow forecasting

- Elite ($150/month):

- Advanced revenue recognition

- Dashboard customization

- Advanced inventory control

- Ultimate ($275/month):

- Data visualization

- KPI tracking

- Advanced analytics

Key Takeaway

Zoho Books is a popular choice for startups due to its relatively low cost and its strong accounting capabilities. While it has its own smart assistant, its AI features are otherwise fairly limited. This could be a good choice for startups that want some AI insights but are not fully on board with automating the majority of bookkeeping tasks.

QuickBooks

QuickBooks is one of the most well-known accounting solutions for SMBs simply due to its longevity and wide usage. It can help you manage bookkeeping, payments, invoicing, multi-currency transactions, budgeting, and forecasting, just to name a few of its common applications.

One of the benefits of its popularity is that it can integrate with over 800 apps, such as Amazon Business, PayPal, Square, Shopify, and Gusto. Since Intuit not only owns QuickBooks but also TurboTax, you can easily get live assistance from tax professionals if needed (though this may come with its own charge).

AI Features

Built into QuickBooks is Intuit Assist, an AI financial assistant that comes with:

- Smart Expense Organization: Automatically categorizes transactions

- Accounting Agent: Performs day-to-day bookkeeping tasks

- Payments Agent: Automates invoices and tracks late payments

- Sales Tax Agent: Finds discrepancies between P&L and sales tax liability reports

- Customer Agent: Manages leads, follow-ups, and proposals

- Finance Agent: Analyzes KPIs and performs scenario planning

- Project Management Agent: Aids with project cost allocation

Pricing

The AI features you can access through Intuit Assist depend on which plan you have:

- Simple Start ($38/month):

- Smart expense organization

- Essentials ($75/month):

- Smart expense organization

- Accounting agent

- Payments agent

- Plus ($115/month):

- Sales tax agent

- Customer agent

- Advanced ($275/month):

- Finance agent

- Project management agent

Key Takeaway

For SMBs, QuickBooks dominates in the bookkeeping software market, and it’s a great choice for startups that want something that has withstood the test of time and can combine traditional bookkeeping with AI assistance. It’s also a suitable option for startups that require integrations with business apps, since it can sync with several hundred.

So, What Is the Best AI Accounting Software for Startups?

There are plenty of solid AI accounting platforms out there — so many that it can be overwhelming to try to pick the best one for your business.

Zoho Books is a common choice for many startups, but its AI features are limited and overpowered by its competitors. And while the ever-popular QuickBooks now has Intuit Assist, it’s still a far cry from the constant AI accuracy checks and real-time financial insights that you get with other platforms.

So for a relatively low-cost solution with robust AI capabilities, I’d recommend Puzzle. Even though platforms like Zeni and Truewind have similar AI features, they are much more costly. Puzzle is also more startup-specific than incumbents like QuickBooks, and the company’s research suggests that it can save you 20 hours monthly compared to QuickBooks.

Ultimately, I’d still recommend doing your research to see which AI accounting software best fits your needs, but it’s hard to go wrong with Puzzle.