Last Updated on February 20, 2026 by Ewen Finser

In today’s economy, it’s pretty common for all businesses, even small businesses, to have global connections. This is particularly true when it comes to vendors. You want only the best for your business, so you’ll form relationships with the top suppliers, even if they’re outside the U.S. border.

Despite the freedom that comes with working with vendors worldwide, it can also create a layer of confusion on the payments side. Many small business owners are intimidated by international payments, some to the point that they’ll try to avoid them outright. However, this approach is limiting and hinders growth. Global payments are unavoidable in today’s market, and they’re nothing to be afraid of.

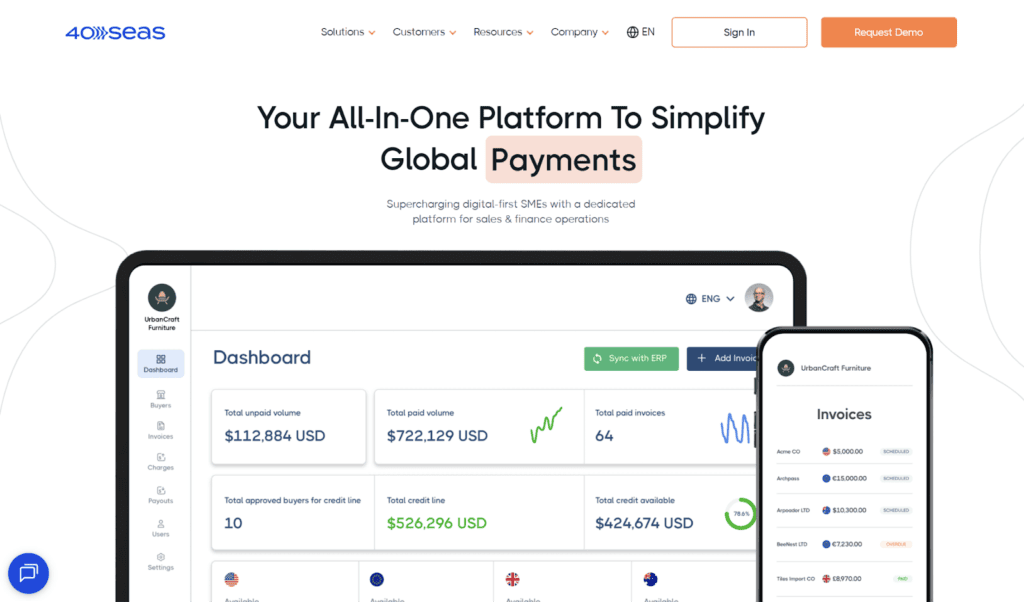

There are several platforms out there that can help you transfer funds internationally. In this article, I’ll be talking specifically about 40Seas vs Melio. While they both get the job done as far as global payments are concerned, they have very different use cases. This guide breaks down the features of each of these platforms to help you determine which one is best suited to your business’s needs.

40Seas vs Melio: At a Glance

40Seas | Melio | |

Best for | Global wholesale, distribution, logistics | SMBs needing an AP solution for both domestic and global payments |

International Payment Features | Payment Methods: ACH, credit card (not American Express), wire Real-time FX | Payment Methods: Global ACH, credit card (Mastercard or Visa) Pay in USD or local currency |

International Transaction Fees | Custom pricing, contact 40Seas for quote | Global ACH: USD: $20Fast USD: 1% ($30 min, $95 max)Local Currency: Conversion rates Global Credit Card: USD: $20 + 2.9%Fast USD: $30 + 2.9%Local Currency: Conversion rates + 2.9% |

Plans/Subscription Costs | Custom pricing, contact 40Seas for quote | Go: $0/mo Core: $25/mo Boost: $55/mo Unlimited: $80/mo |

Customer Support | Live chat Phone | Live chat Phone Priority support |

40Seas: AI-Powered Platform for Wholesale, Distribution, and Logistics

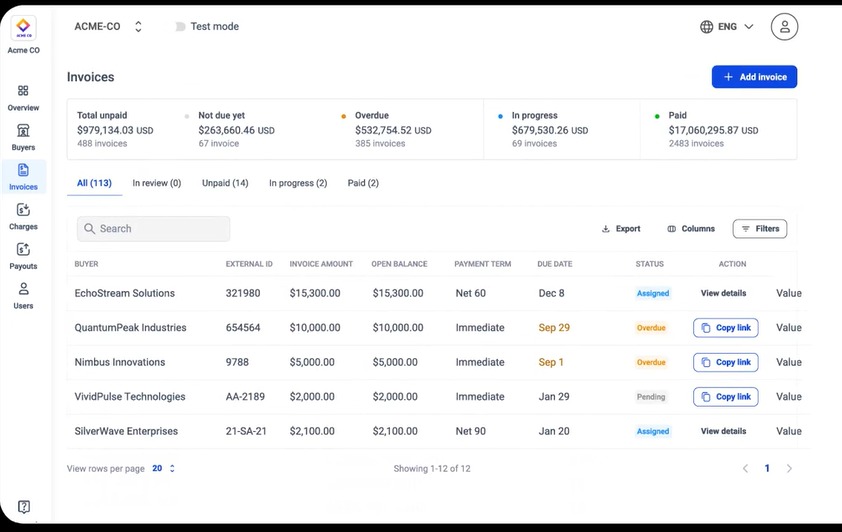

40Seas is an AI-driven finance and sales platform that covers three main areas: automated accounts receivable and collections, buyer intelligence, and global payments. However, I’ll mainly be focusing on global payments here.

International Payment Features

40Seas supports multiple payment methods and real-time FX. You can choose to pay the supplier in the optimal currency for your business’s needs. The flexibility to pay in the currency of your choosing is important because it can simplify accounting and reconciliation, optimize cash flow, and help you avoid paying high FX conversion costs during volatile times.

No matter which currency you pay with, the supplier can withdraw the money in the currency of their choosing. So, let’s say your business is in the U.S., while your supplier is based in the U.K. You can pay in your local currency (USD), while the supplier can withdraw funds in their local currency (GBP).

40Seas supports conversions between the following currencies: GBP, USD, CAD, AUD, and the Euro. However, keep in mind that only for invoices without payment terms can you pay in the currency of your choice. If there are terms (like net 30, net 60, etc.), this feature isn’t available.

Aside from the various currency options, you can use 40Seas to transfer funds to vendors using the payment method of your choice. It supports several payment methods, including common ones like:

- ACH transfer

- Credit card (except American Express)

- Wire transfer

40Seas Credit Options

You can apply for credit through 40Seas with their Order Now, Pay Later feature, which lets you extend payment terms. A 40Seas credit line can be a solid option for improving cash flow when you deal with frequent international transactions.

To apply for a credit line, you’ll have to provide basic information about your business, your requested credit amount, and your recent financial statements. At the very least, you should upload an audited profit and loss statement and an audited balance sheet. You’ll also need to connect a bank account.

Plans and Pricing

40Seas doesn’t have set plans or subscription costs for customers. It also doesn’t make its transaction fees public. Instead, you’ll get a custom price depending on your business’s characteristics, such as your country, industry, and annual trade volume. 40Seas’s site has an online form you can fill out to request a demo before purchasing.

Customer Support

40Seas provides several ways for you to get in touch with someone. Customer service options include:

- Live chat

- Phone

40Seas’s official customer service hours are Monday-Friday, 5AM to 5PM EST. However, the company prioritizes answering all customer service inquiries ASAP, so it’s possible that you could hear back from someone outside this timeframe.

Who Should Use 40Seas?

While 40Seas is tailored to small and medium-sized enterprises, it’s especially geared toward specific industries. Namely, wholesale, distribution, and logistics. If your business happens to be in any of these niches, 40Seas could be a reliable choice for you. But for SMBs in other industries, even though you can still use it, it’s likely not the best fit.

Also, 40Seas’s main focus is on international, rather than domestic, transactions. While this can be helpful if global transactions represent a significant portion of your business’s AP, if only a minority of your payments are cross-border, you’ll want to look elsewhere.

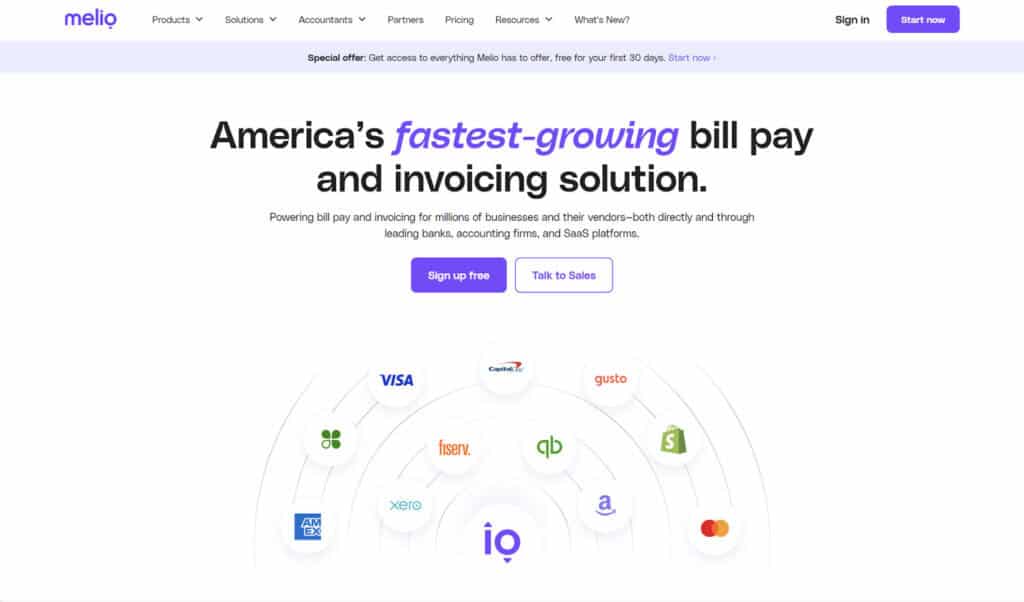

Melio: Bill Pay and Invoicing Platform for SMBs

Melio is a bill pay and invoicing solution for SMBs, though you can also use it for accounts receivable. It’s a well-rounded platform for SMBs in all industries, spanning from the food industry to healthcare to professional services. Melio is an increasingly popular choice for businesses to manage AP and pay vendors both within the U.S. and globally.

International Payment Features

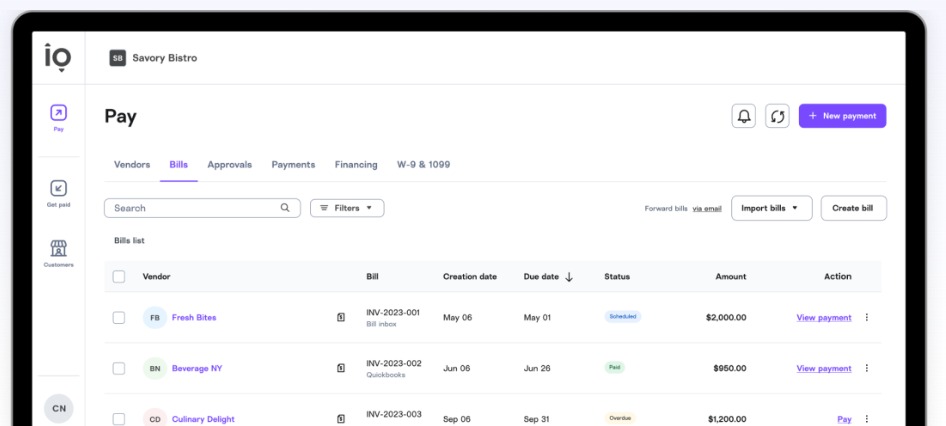

Melio’s site provides a comprehensive look at how the platform handles international payments. You can choose to pay global vendors either in USD or in a foreign currency. Melio currently supports payments in 15 currencies, including common currencies like the AUD, CAD, GBP, and Euro. You can make payments to vendors in 80 countries worldwide. Melio provides SMBs with options to schedule payments in advance and batch multiple payments together.

The delivery timeline for global payments differs depending on whether you pay in USD or in the vendor’s local currency. International payments in USD generally arrive within 4-6 business days, while international payments in local currencies can arrive as fast as the same business day or in up to three business days.

The delivery time for payments in local currency will depend on the specific currency you’re using for the transaction. Fast payment options are also available. Fast USD payments will arrive in between 1 and 3 business days.

You can pay vendors internationally using the payment method of your choice. The main global payment methods that Melio offers are global ACH and credit card. For international credit card payments, only Mastercard and Visa are currently supported.

Melio Credit Options

In partnership with Credit Key, you can apply for credit through Melio. This offering is called Pay Over Time. You’ll have to apply, but if approved, you can choose a repayment option, with terms ranging from net 30 to 12 monthly installments. Using credit gives you the flexibility to optimize your cash flow management while still ensuring that your global vendors get paid.

Plans and Pricing

With Melio, there are two main types of costs you’ll face: a monthly subscription fee and transaction fees. The company offers four main plans:

- Go ($0/month)

- Core ($25/month)

- Boost ($55/month)

- Unlimited ($80/month)

There is also a custom plan available for larger enterprises.

All of these plans, including the free plan, let you make international payments either in USD or local currency. The plans differ when it comes to other features like the number of free standard ACH payments you get per month, the number of users that can be on your account, online syncs with QuickBooks and Xero, and priority customer support.

For example, the Go plan is limited to one user only. The Core and Boost plans charge $10/month for each additional user added to your account. With the Unlimited plan, the number of users you can have on your account is unlimited, and you also get unlimited free ACH. For the other plans, the number of monthly free ACH payments included is capped.

Here are the transaction fees you’ll be looking at for global payments:

- Global ACH

- USD: $20 flat fee

- Fast USD: 1% ($30 minimum fee, $95 max)

- Local currency: Conversion rates

- Credit card

- USD: $20 + 2.9%

- Fast USD: $30 + 2.9%

- Local currency: Conversion rates + 2.9%

If you make high volumes of international payments, you could be eligible for discounts. Exclusive rates on FX transactions, as well as faster settlement times, are available if you make over $100,000 in international payments each quarter.

Customer Support

The customer support options available to you differ depending on which plan you have. Customer service is available via:

- Live chat

- Phone

Some plans get priority support, while the Unlimited plan also comes with a dedicated account manager.

Who Should Use Melio?

Melio is a solid option for most SMBs. It’s not industry-specific, so businesses of all types can benefit from using the platform. The platform is intuitive and syncs with QuickBooks (Online and Desktop), Xero, and Amazon Business, so you can import your transaction data and keep track of spending.

Another plus of Melio is that it’s not only for AP — you can also use it to accept payments from customers. This allows you to keep both AP and AR streamlined within one platform.

Melio is a good choice for SMBs that deal with both domestic and international payments. The typical U.S. small business will mostly pay vendors within the country, but from time to time, you’ll have to make international payments. Melio can easily facilitate both domestic and international transactions.

Which is Better for International B2B: 40Seas or Melio?

40Seas and Melio may look the same at first glance — you can use either software to make global payments. However, they’re drastically different overall. What it comes down to is the type of business you’re operating. For most SMBs looking to manage global AP, Melio is the way to go. You can use it for both global and domestic payments, and you can also keep track of AR, not just AP.

However, if you happen to be in wholesale, distribution, or logistics, you might prefer 40Seas, as it’s well-established in these niches. But for business in other industries, Melio will be the best fit.