Last Updated on January 22, 2026 by Ewen Finser

Not every successful business owner has a successful exit. I’ve seen many entrepreneurs leave huge sums of money on the table because they sold too early or too late, because they failed to shop their company around properly, or because of mistakes during due diligence.

These are all easy missteps to make, especially if you’re not familiar with the language of business sales. The best way to avoid them is to hire the right sale partner, be it a brokerage or listing platform.

In this article, I break down all the different options and explain which might be the best way to sell a small business based on your individual needs.

Using a Business Broker for Your Exit (The Premium Route)

This is what I regard as the default route, especially if your business is likely to fetch at least six figures. If you’re in this bracket and you’re not using a broker, you’d better have a good reason.

Hiring a professional business broker is the best way to maximize value and simplify your sale. A broker handles all the heavy lifting on your behalf; they’ll help you value the business, find qualified buyers, manage negotiations, and guide the deal to closing. This full-service approach is invaluable, especially if you’ve never been involved in the sale of a business before.

Quiet Light

There are plenty of top-class brokerages out there, but Quiet Light is the one I generally recommend to business owners (especially those with a likely valuation between $500k-$25mn, as this is the firm’s sweet spot).

Founded in 2007, Quiet Light has a team of advisors who have all bought or sold businesses themselves. In other words, they’ve been in your shoes, which helps them provide high-quality, personalized service. When you work with Quiet Light, you get a dedicated advisor who partners with you from day one through closing. This high-touch service means less stress and a smoother process for you as a seller.

Another big advantage of Quiet Light is its fee structure. It operates on a pure success fee basis (there are no upfront listing fees, and you only pay a commission if and when your business sells).

Significantly, the firm caps commission at 10%; for a platform providing Quiet Light’s level of service, this is as good a deal as you’ll get. Marginal commission rates also start sliding once your sale prices passes $1mn.

Quiet Light has built a large network of buyers over the last 15+ years. Many contacts on its list are repeat investors or referrals from past clients. This all means that Quiet Light can offer you a pool of eager, pre-vetted buyers who trust the platform’s listings. This translates to an impressive success rate; 85% of the companies that list on Quiet Light get sold within 90 days.

Other brokers that deserve an honorable mention here include:

FE International

FE International is known for focusing on larger, high-end deals (often mid- to high-seven-figures and above). It boasts a vast network of tens of thousands of buyers, including institutional investors. FE International excels with SaaS, e-commerce, and content businesses, and many bigger buyers work exclusively with them.

However, its services may come at a higher price (often ~15% commission, although rates are not publicly listed). It also offers a less personal touch than what you’ll get from Quiet Light; you’ll be interacting with a team of analysts rather than one dedicated broker.

If your business is very large or you’re targeting an institutional buyer base, FE is a strong option; otherwise, though, I’d opt for a higher-touch service.

Website Closers

In operation since 1998, Website Closers is another major brokerage, known for handling a lot of deals in the $1mn to $50mn+ range. The company has a huge team with franchise offices across the U.S., and its full-service brokerage service is similar to others (free valuations, comprehensive marketing packages, negotiation on your behalf, and coordination of due diligence and closing).

Unfortunately, it doesn’t list its commission structure publicly, which means you’ll need to negotiate with the sales team for your rate. I’d also note that, because Website Closers regularly works on eight- and nine-figure deals, it may not be the most suitable venue for a smaller listing; your company might not get the attention it needs if it’s alongside much bigger sales.

Selling via Online Marketplaces

Full-service brokers tend not to take on smaller sales (<$500k), so if you’re in this category, you might be better off looking at an online buy-and-sell marketplace.

These platforms let you list your business for sale to a wide audience of potential buyers. Typically, you’ll create a listing (with details about your business’s finances, traffic, etc.), and interested buyers will contact you or bid for the purchase. This is more of a “do-it-yourself” method compared to using a broker (though some marketplaces do provide value-added services).

The best choice for you here will depend on various factors, but particularly the size and value of your company. Empire Flippers and Flippa are the two leading platforms in this space, in my view.

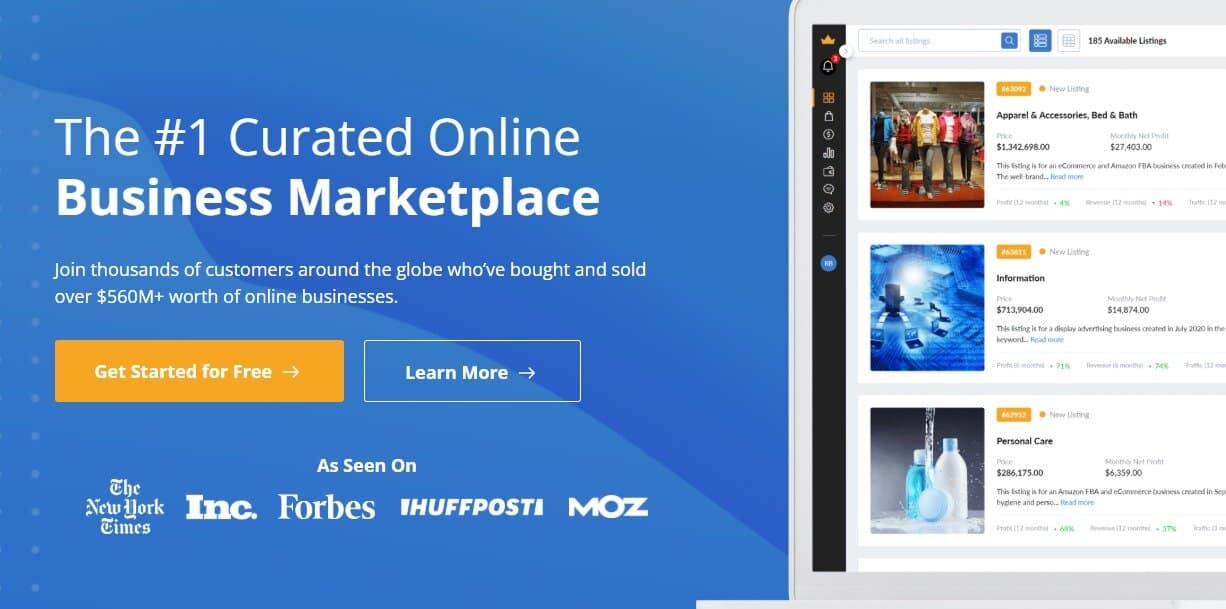

Empire Flippers

Empire Flippers is often described as a “curated marketplace.” Though it stops short of providing the white-glove service you’d expect from the likes of Quiet Light, it does more than the basic listing platform; it will, for example, vet businesses before listing them, and require buyers to complete a registration process and sign an NDA before viewing full listings.

If your company meets its criteria, Empire Flippers can be a fantastic option, particularly for businesses in the mid-six to mid-seven figure range. It has a huge audience of buyers, which will help you to get a large volume of offers and, potentially, a quick sale. If you’re looking to get your exit over the line as soon as possible, this is a big selling point.

However, the platform’s high standards for listing are both a blessing and a curse. EF reportedly rejects about 91% of submitted businesses; it requires that a business has solid financials, verifiable earnings, and usually around 12+ months of operating history. Unless your company meets these standards, you’re probably out of luck.

The upside of this strict vetting is that buyers trust Empire Flippers listings – if you make it onto the marketplace, everyone will know your company is legit. Of course, that’s no good to you if you don’t make it on in the first place.

In terms of support, Empire Flippers lands somewhere between a self-serve marketplace and a full-service broker. You’ll have some assistance from the Empire team, but you’ll still need to answer buyer queries directly and take an active role in negotiation.

Empire Flippers charges a success fee commission similar to a broker (which is annoying, as it’s not a broker). The standard commission is 15% on sales under $700,000, with a tiered reduction for larger deals. So, it’s probably costing you more than the likes of Quiet Light, despite the fact that it’s offering a much more limited service.

Flippa

At the other end of the spectrum is Flippa, the world’s largest open marketplace for buying and selling online businesses. Flippa has been around since 2009 and boasts having facilitated over 100,000 deals in that time.

On Flippa, anyone can list pretty much any business for sale, whether it’s a $500 blog or a $5 million e-commerce brand. The platform covers everything from content sites and Amazon stores to apps, SaaS, domains, and YouTube channels.

Flippa’s big advantage is its massive reach. Your listing could be seen by thousands of people around the world, which is practically guaranteed to lead to a quick sale if your business is fairly priced.

The platform’s other main selling point is its accessibility for sellers. As noted above, Flippa will accept pretty much any listing; you won’t see anything like Empire Flippers’ 91% rejection rate here. So, if you’re struggling to get your company listed for sale, Flippa could be worth considering.

Now, for the trade-offs.

Because Flippa is so open, it’s a classic case of “buyer beware.” The platform’s vetting of listings is very minimal. Scammers are common on Flippa, and the responsibility for dealing with them falls squarely on you as a seller.

The other big drawback of Flippa is its cost. Like Empire Flippers, it’s simply too expensive for the level of service it offers. It charges about 10% for businesses under $50k, 7.5% for $50k–$100k, and 5% for anything over $100k. There’s also a small listing fee (around $29) to put up your listing.

These rates can be a good deal for smaller sales. For larger deals, though, Flippa’s fees approach those of full-service brokers.

Direct Sale

The last route to consider is a direct sale without any platform or broker at all – essentially a private, for-sale-by-owner (FSBO) transaction.

This is almost always the wrong move. Managing the sale of a company can be a full-time job; just finding a buyer can take weeks. If you’re still working in your company full-time, this likely won’t be a viable path for you to walk. Accurately valuing a company is also a difficult task that should be left to a specialist.

However, there are some scenarios in which it can make sense, such as if:

- You already have a buyer lined up: This might be a competitor, supplier, or even a family member has expressed interest in buying your business. You’ll still want a lawyer to formalize things, but you could save a hefty broker fee since the hard part (finding the buyer) is done.

- Your business is very easy to sell: If you own, say, a small content website earning $500/month on autopilot, the transaction might be simple enough for you to safely do by yourself.

- You’re experienced with business sales: If it’s not your first rodeo, you might be in a position to broker your own deal. However, prior experience of offloading a business won’t necessarily help you to find a buyer, especially if you’re trying to sell a niche company.

Walking the Path That Best Suits You

For most owners of established, profitable businesses, the broker route is the best way to maximize sale value and ensure a smooth process. If you’ve decided a broker is the way to go, I think Quiet Light is probably the pick of the bunch, especially if your business is worth between $500k-$25mn. If you’re well outside this range (on either end), you might need to look at either a different broker or a buy-and-sell platform.