- At a Glance

- 1. Digits: The AI-Native Ledger That Feels the Closest to Puzzle

- 2. Pilot: Full-Service Bookkeeping with a Startup Accent

- 3. Finta: Lightweight Accounting and Taxes for Delaware C Corps

- 4. QuickBooks Online: The Default You’ll Always Have to Explain

- 5. Xero: Global Small-Business Accounting with a Clean UX

- 6. Zeni: AI Bookkeeping Plus a Dedicated Finance Team

- Why Digits Edges Ahead as a Leading Puzzle Alternative

Last Updated on November 22, 2025 by Ewen Finser

If you’re reading this, odds are you already know that Puzzle.io is not just “Excel with a bank feed.” It’s a modern, AI-leaning general ledger that does a great job on revenue recognition, variance analysis, and real financials without the month-end circus.

But no tool is perfect for every stack.

Maybe your firm wants an AI-native ledger that plays nicer with multiple clients. Maybe your startup outgrew “DIY with help” and needs a full-fledged finance team. Maybe you just need something cheap that your tax preparer won’t curse about.

As a CPA, I’ve found myself exposed to more than my fair share of Puzzle accounting alternatives. So let’s jump in and explore what may make the most sense for your company.

At a Glance

Platform | Positioning | Key Features | Automation Level |

Digits | AI-native general ledger | Autonomous GL, continuous agents, real-time dashboards, dimensional reporting, partner mode | Very High AI-first workflows with human review on exceptions |

Pilot | Outsourced bookkeeping + tax | Monthly closes, tax prep, CFO services, startup reporting | Medium Internal tooling + some AI; humans still drive the process |

Finta | Books + tax for Delaware C corps | Bank feeds, automated categorizations, C corp and state filings, 1099 handling | Medium Decent automation around a narrow “startup tax” lane |

QuickBooks Online | Legacy small-business ledger | Invoices, bills, inventory, projects, app marketplace, basic rules, bank feeds | Low–Medium Rules-based automation; lots of manual cleanup |

Xero | Global cloud accounting suite | Bank rec, invoicing, bills, multicurrency, projects, strong app ecosystem | Low–Medium Good bank feeds and rules, but not AI-native |

Zeni | AI-assisted finance team for startups | AI bookkeeping engine, real-time dashboard, bill pay, reimbursements, CFO services | High Strong AI layer, but wrapped in a services model |

Short version? Digits is the closest thing to Puzzle’s AI-first accounting brain, but with a wider, more flexible ledger you can build an actual finance function around. You keep real-time automation, rich dimensional reporting, and a partner-friendly environment for your controllers and firms. Pilot, Finta, and Zeni act more like outsourced finance teams, while QuickBooks Online and Xero sit in the legacy GL camp with broad adoption but less intelligence.

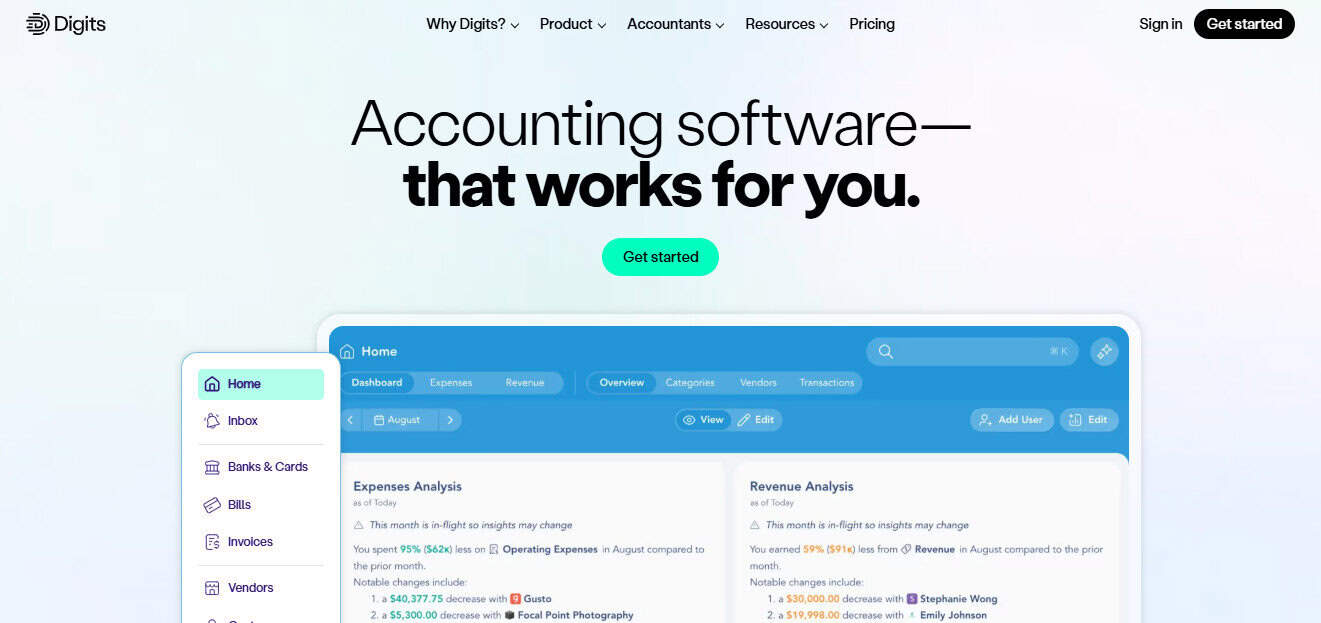

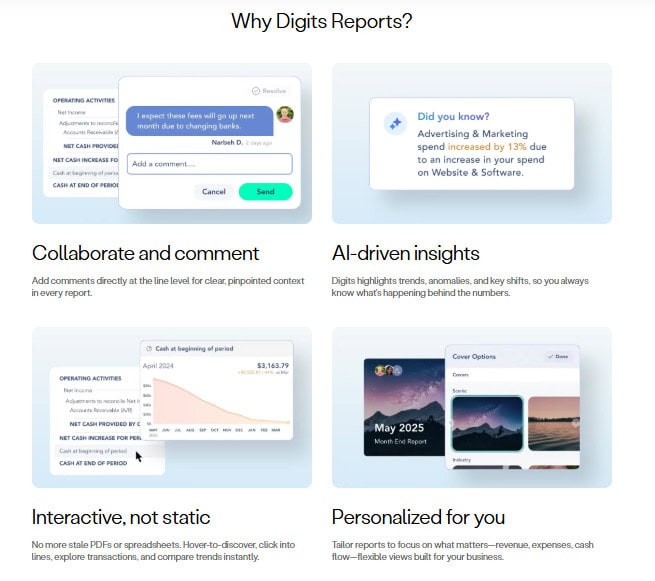

1. Digits: The AI-Native Ledger That Feels the Closest to Puzzle

Digits sits in the same bucket as Puzzle: a truly AI-native general ledger, not just a GL with AI sprinkled on top. It pulls in banks, cards, payroll, bills, and invoices, then uses machine learning to classify, match, and flag exceptions while you control the policies.

Where Puzzle leans into accuracy-first revenue recognition and anomaly checks, Digits leans into the idea of an Autonomous General Ledger: continuous agents that run bookkeeping, bill pay, reporting, and more in the background, then surface what needs review.

Pros

- AI-first ledger, not just AI helpers: Digits runs a fast double-entry ledger built for automation. That means fewer brittle rules and less mess to keep basic bookkeeping upright.

- Deep, dimensional reporting: You can slice by department, location, project, or whatever dimensions you track. Dashboards update in close to real time, so the “what happened last month?” call becomes a login — not a treasure hunt in your inbox.

- Partner-friendly for firms and controllers: Digits sells software first. That gives outside accountants and in-house finance teams room to own the relationship instead of fighting the finance vendor for control.

- Modern stack and API: You get the usual suspects (banks, cards, payroll, bill pay) plus a design built for live data and not batch exports.

Cons

- Still a newer GL vs. legacy giants: If your board insists on “QuickBooks or nothing,” you may have an uphill battle on your hands.

- Best fit for U.S. businesses today: Digits can field multi-entity operations and multi-currency businesses, but that’s under their costly custom plans.

- Change management: Moving from a tax-preparer-driven QBO file to an AI-native GL always means policy work and cleanup.

Who Should Use It

- You’re a VC-backed startup that wants real-time runway, burn, and unit economics, but you still care about GAAP.

- You’re an accounting firm or fractional CFO that wants to run many clients through one modern stack without handing your book of business to a services competitor.

- You’re a controller tired of being the human between Stripe, Brex, Gusto, and legacy accounting.

Pricing

Digits’ AI Accounting plan runs around $100/month for the core platform, with a $35/month option coming soon. Their full package requires custom pricing and a sales call, but it also offers much more niche and deeper options.

It’s cheaper than a full outsourced firm but more capable than a DIY app — a sweet spot that edges it past its competitors if you want Puzzle-level brains with a broader AI-ledger roadmap.

2. Pilot: Full-Service Bookkeeping with a Startup Accent

Pilot is not trying to be a pure software replacement for Puzzle; it wants to be your outsourced finance team, with humans on top of its own internal tooling. With Pilot, you get bookkeeping, tax, and optional CFO services under one roof.

It’s basically a finance department as a subscription, built for startups that want to keep their hands off the GL as much as possible.

Pros

- Hands-off for founders: You offload categorization, closes, and tax prep to Pilot’s team. That is a big win if your CEO would rather chew glass than open a GL.

- Tight link between books and tax: Bookkeeping and corporate tax stay with the same provider, which reduces “who messed this up?” finger-pointing in March and April.

- Startup focus: Pilot has built a big roster of tech startups and Delaware C corps. They know SAFE rounds, R&D credits, and messy Stripe cash flows.

Cons

- You are on their timeline: Real-time answers are still mediated by a service team. If you want instant, self-serve drill-downs and modeling, you may feel boxed in.

- Less control over the stack: Pilot runs its own internal tooling and workflows; you get reports rather than a platform you design around.

- Costs rise with complexity: As expenses and headcount spike, so does pricing.

Who Should Use It

- You’re a seed to a Series B startup that wants “just handle it” bookkeeping and tax.

- You don’t have an in-house controller yet.

- Your main need is compliance and basic investor reporting, not deep operational accounting or a firm-wide AI ledger.

Pricing

Pilot’s bookkeeping runs from about $199/month (Essentials) to $1,299/month and beyond (Core). Custom plans cost more, and tax and CFO options are priced as an add-on. You’re paying more for people here than you are for the accounting stack itself.

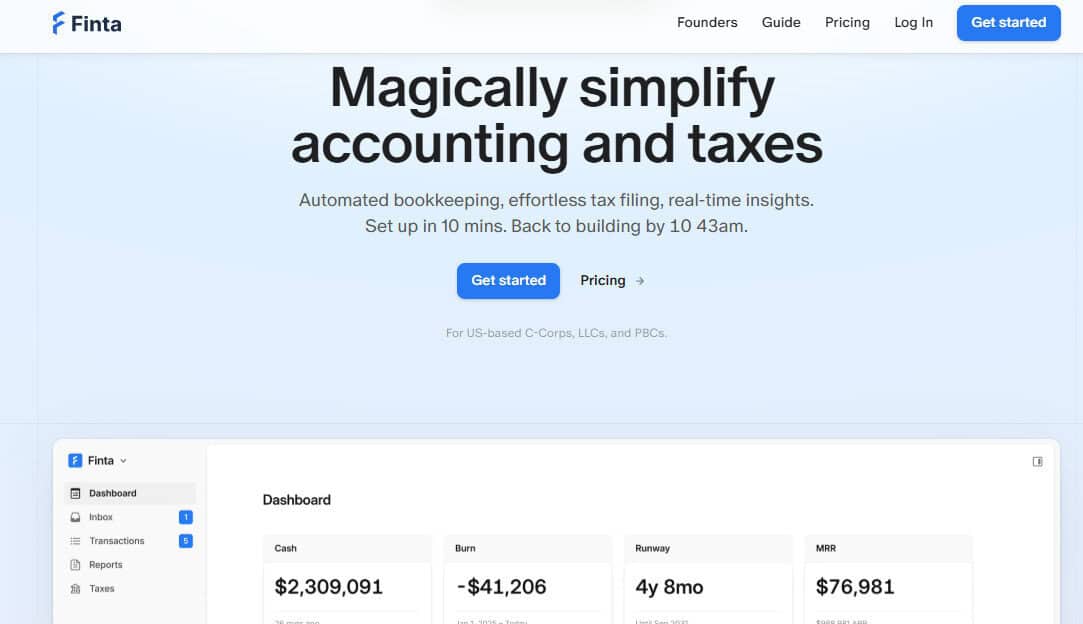

3. Finta: Lightweight Accounting and Taxes for Delaware C Corps

Finta targets U.S. startups (especially Delaware C corps), with a bundle of automated bookkeeping, simple dashboards, and tax filing. Instead of trying to be the GL for every industry, it focuses on getting early-stage founders from “shoebox and Mercury statements” to “books and taxes done.”

Pros

- Fast setup: Finta pitches a 10-minute onboarding to connect banks and get basic automation running.

- Tax and accounting in one lane: They wrap bookkeeping and federal filing together and can handle Delaware franchise tax, state returns, and 1099s — all from the same app.

- Good fit for “one entity, one cap table”: If you’re a single-company startup, the structure maps cleanly.

Cons

- Niche focus: Once you get into multiple entities, advanced rev rec, or complex accruals, you’ll start to feel the edges.

- Less sophisticated reporting: Compared with Puzzle or Digits, you get fewer options for dimensional analysis and custom KPIs. As someone who loves reports and the depth/customizability that comes with platforms like Digits and Puzzle, this is a serious thorn in my side.

- Not built as a partner platform: It’s more like a service and companion app than it is a modern ledger that a firm can run many clients on.

Who Should Use It

- You’re a Delaware C corp or simple LLC that just raised a small round.

- Your main pain is filing federal and state returns on time without learning debits and credits.

- You want to move off spreadsheets into something more structured, but you don’t care about deep GL control yet.

Pricing

Finta’s model is a bit different:

- A federal corporate tax filing runs about $500, with add-ons for state returns, foreign founders, foreign subsidiaries, and 1099s.

- You’re automatically set up on a free Accounting plan when you onboard for taxes, and bookkeeping is included to the extent needed to support the tax work.

If your top priority is to file clean C corp taxes without hiring a full firm, Finta can do that. If you need a robust ledger that can grow with a complex business, you’ll need to look elsewhere.

4. QuickBooks Online: The Default You’ll Always Have to Explain

QuickBooks Online (QBO) is still the default small-business ledger. Every bank, every tax pro, and half the world’s “sample chart of accounts” templates assume you live here. For better or worse, it’s the accounting version of Windows 8: It works, it’s everywhere, and the UI shows its age.

Pros

- Ubiquity: Every CPA and bookkeeper speaks QBO, so hiring help is easy.

- Broad feature set: Invoicing, bills, inventory, basic job costing, budgets, project tracking, and a huge app ecosystem.

- Banking and payroll tie-ins: Intuit stacks banking and TurboTax-powered tax services, which can simplify life for some small shops.

Cons

- Old architecture: QBO was not built for AI-native, real-time accounting. Many “automations” are still rules that break when vendors change patterns. However, in mid-2025, Intuit did push a modest update trying to up QBO’s AI game when it comes to the bank ledger and anomalies.

- Nickel-and-diming: Everything costs extra, and add-ons, extra seats, and app integrations add up fast. It’s death by a thousand cuts with this one.

Who Should Use It

- You’re a local service business (trades, retail, small agencies).

- You rely heavily on local accountants who default to QBO.

- You don’t need live dashboards or AI-driven workflows — just a standard GL that your CPA already knows.

Pricing

- Simple Start: About $38/month for one user.

- Essentials: About $75/month for three users.

- Plus: About $115/month for five users.

- Advanced: About $275/month for up to 25 users.

But if you want AI-powered categorizations, real-time variance checks, and a ledger that talks nicely to modern fintech APIs, QBO will feel more like a legacy anchor than a launchpad.

5. Xero: Global Small-Business Accounting with a Clean UX

If QBO is the U.S. default, Xero is the cloud accounting darling for the international market. It brings a cleaner interface, strong multi-currency support, and an app marketplace that behaves like an actual ecosystem.

Xero is still a traditional GL, but with better UX and global DNA than most incumbents.

Pros

- Modern, consistent UI: Xero feels less like a 2005 web app and more like a modern SaaS dashboard. Bank recs are clean, and core workflows are smoother than in many QBO files.

- Global focus: Multi-currency, VAT/GST support, and localization options are much stronger than most U.S.-centric tools.

- Unlimited users per plan: You don’t pay per user here, which is a gift for accountants, internal finance teams, and multi-stakeholder access. I especially like this because if you’re growing your team, you’re not getting burdened with additional costs per user license!

Cons

- Still rules-based, not AI-native: Xero has automation, but it’s not an AI-first ledger. You’ll still depend on rules and manual cleanup.

- Ecosystem sprawl: You may need several add-ons (expense, bill pay, reporting) to get truly live visibility.

Who Should Use It

- You’re a global or non-U.S. business with multi-currency needs.

- Your accounting firm already lives in Xero.

- You want a cleaner, cloud-native feel than QBO, but you don’t need AI-heavy features.

Pricing

In the U.S., after current promotions, Xero’s main plans sit roughly around:

- Early: About $25/month

- Growing: About $55/month

- Established: About $80–90/month, depending on final pricing updates.

However, new customers often see a significant discount (for example, 90% off for three months), plus a 30-day free trial.

Short term, it feels cheap. Long term, it lands in the same ballpark as QBO Plus, but less nickel-and-diming.

6. Zeni: AI Bookkeeping Plus a Dedicated Finance Team

Zeni is another AI-plus-humans play, but with a stronger platform angle than some older firms. Their pitch: one dashboard, an AI bookkeeping engine, and a dedicated finance team that handles the messy parts.

Think of it like Pilot, but with a louder AI story and more bundled cash-management tools.

Pros

- Real-time financials: Zeni leans hard on “live” books. The AI engine categorizes and reconciles in near real time, then humans review.

- Bundled finance stack: They offer bill pay, reimbursements, and a host of other services, so you don’t have to think about anything accounting-related.

- Fractional CFO services: You can add FP&A, board reporting, and modeling through the same provider.

Cons

- Pricey for smaller businesses: Zeni is tuned for funded startups with some scale, not the local lawn care shop. It’s also priced higher than entry-level software-only tools because you’re paying for both the AI and the finance team.

- Less control over the ledger: Like with Pilot, you’re buying a service here. You do not own a standalone GL.

Who Should Use It

- You’re a startup that wants to outsource bookkeeping, bill pay, and some FP&A — but still have AI-driven dashboards.

- You have multiple stakeholders (founders, board, investors) who want consistent reporting without building a full internal team.

- You’re comfortable with a provider that blends software and services under one brand (not great for control freaks like me).

Pricing

- Starter: Around $494/month.

- Growth: Around $719/month.

- Enterprise: Custom pricing based on complexity and volume.

Zeni also sells tax and CFO packages as separate line items. And once you stack everything, you’re in “fractional finance team” territory, not “cheap app” territory.

Why Digits Edges Ahead as a Leading Puzzle Alternative

If you like Puzzle’s AI-first, accuracy-first view of accounting, you’ll feel at home in Digits.

Both are modern ledgers, both care about automation that doesn’t wreck GAAP, and both assume that accounting should run closer to real time rather than 30 days behind.

The main differences that nudge Digits slightly ahead in this lineup:

- Ledger as a product, not as an upsell to services: Pilot and Zeni make money when you outsource more. Digits makes money when more work runs through the platform that you and your firm control.

- Dimensional reporting and dashboards out of the box: With Digits, you can answer real operator questions without stitching together tools or requesting information from an outside source.

- Clear, software-first pricing: You know what you pay for with Digit. There’s no death by a thousand cuts, unlike QBO and some outsourced services.

Puzzle is still a strong choice, especially for Stripe-heavy SaaS that needs tight revenue recognition and error checks. But if you want something that feels like a broader AI operating system for accounting, Digits deserves the first demo slot on your list.