Last Updated on November 12, 2025 by Ewen Finser

If you’re new to the game of buying or selling businesses, you may not appreciate just how much work goes into it. Valuation, marketing, closing – if you don’t have experience with all of these, you could be facing an uphill battle.

Luckily for you, business brokers exist for exactly this reason. They connect buyers and sellers and help get deals over the line.

Quiet Light and FE International are two of the leaders in this space. I’ve looked at both of them in detail and can recommend a few alternatives as well.

Quiet Light Brokerage: Overview

Quiet Light is a boutique M&A brokerage founded in 2007 by Mark Daoust, an entrepreneur who started the firm after selling his own online business. This type of practical experience is at the very core of the brokerage; all of Quiet Light’s advisors have either bought or sold their own businesses in the past.

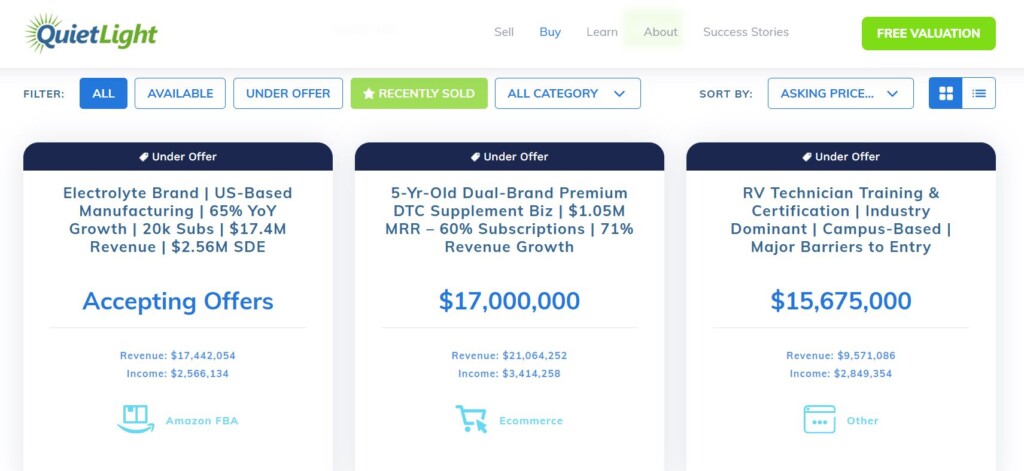

Quiet Light primarily works in the small to mid-market range, typically handling businesses valued from around $250,000 up to $25 million in sale price. This covers everything from six-figure content and affiliate websites to multi-million dollar SaaS and e-commerce brands.

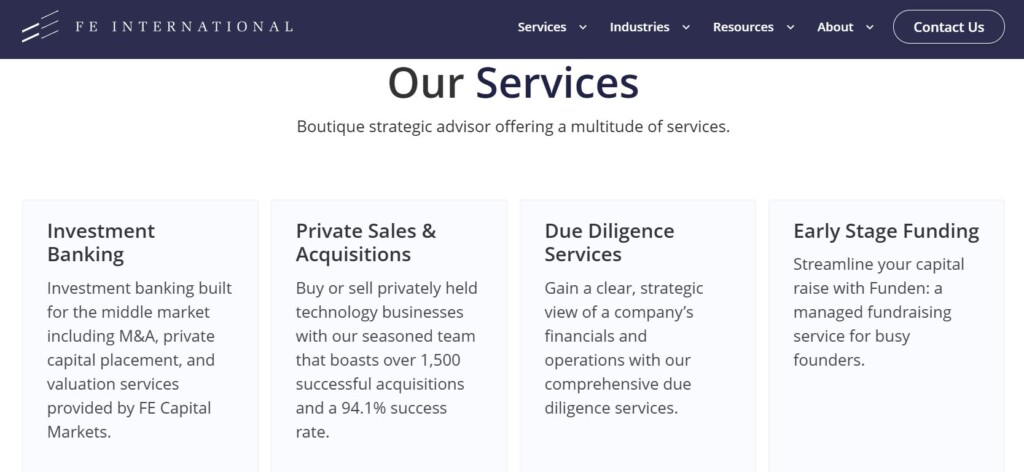

FE International: Overview

Founded by Thomas Smale in 2010, FE International (originally “Flipping Enterprises”) started by brokering smaller websites; however, it has very much left the small-cap market behind now. It’s grown into a full-fledged technology M&A advisory firm and a major player in the online business brokerage space, with a reputation for focusing on higher-end deals and a more investment banking-like approach to sales.

FE International’s bread-and-butter is SaaS, e-commerce, and content-based businesses, generally in the mid to high six-figure and above range. In recent years, it has moved further up-market, zeroing in on multi-million dollar sales and courting more institutional buyers.

Quiet Light vs FE International

Pricing and Fees

Quiet Light offers notably better bang for your buck than pretty much all of its competitors.

It operates on a pure success-fee basis (no upfront listing fee, you only pay when your business sells). The maximum commission Quiet Light charges is 10% of the sale price, and that’s only for sales up to $1 million. Beyond that, the success fee drops by 1% for each additional $1 million in sale value, with a floor of 3%.

FE International also works on a success-fee model with no listing fees, but its commission generally ends up being higher. FE does not publicly post a standard commission on their site, but third-party analyses indicate it charges around 15% on most sales, with the rate dropping for very large deals.

In practice, FE likely negotiates the commission case-by-case, especially for multi-million dollar businesses. Unlike Quiet Light, which plainly advertises its fee tiers, FE is a bit opaque on pricing – you’ll only really find out what you’re paying when you agree to sign on the dotted line. (This is a turn-off for me, personally; I value transparency in pricing, as it makes budgeting easier and ensures you’re not left to haggle over numbers.)

Winner: Quiet Light’s commission is going to be significantly lower for the majority of deals.

Reach and Buyer Network

Quiet Light has built up a large database of vetted buyers (many of whom are repeat investors or folks referred by past clients). The company doesn’t publicly tout a specific number of buyers, but anecdotal evidence suggests it’s substantial.

A huge chunk of Quiet Light’s sales come from referrals and past clients. This indicates that the company has succeeded in maintaining high satisfaction rates and building a community of buyers and sellers around itself. All good things.

However, FE International has a larger, more widespread reach. The firm claims to have a network of tens of thousands of registered buyers. It also has a large email newsletter, and has succeeded in marketing itself as the “go-to” for high-end online business acquisitions; a lot of bigger buyers work exclusively with FE. It also has a broader international reach than Quiet Light.

Winner: FE International has the edge here.

Level of Service

Quiet Light is built around high-touch, personalized service. From day one, you work directly with an advisor who serves as your partner throughout the entire journey.

This high-quality service continues post-sale; Quiet Light will coordinate all the logistics of escrow and funds transfer, and may even recommend an attorney for reviewing the sales agreement. Your agent will remain responsive throughout this phase of the process.

The feel is slightly different with FE International. It manages client interactions on a team basis; you likely won’t have access to a dedicated broker. You might have an analyst for initial valuation, then a different person advising on the main deal, and a separate team handling due diligence and legal coordination.

There’s an argument in favor of this type of specialization; personally, though, I’d prefer a single point of contact.

Winner: It’s close, but I prefer Quiet Light’s approach.

Vetting and Due Diligence

Quiet Light takes vetting seriously when it comes to both buyers and sellers. Before listing, the team will comb through your financials, Google Analytics, merchant accounts, etc., to verify that your revenue and profit numbers are legit and sustainable. This massively boosts buyer confidence, and makes Quiet Light a more effective platform overall.

It might feel like an audit while you’re undergoing it, but it’s worth it in the long run.

FE International’s vetting process is also extremely rigorous; the company has a reputation for only bringing forward solid businesses that are solid. In fact, FE is known to reject a large percentage of potential sellers.

Winner: This one is close, as both Quiet Light and FE International excel at vetting listings and buyers. You’ll be in good hands with either one.

Overall

For me, Quiet Light is the clear winner here, especially for companies in the mid-market ($100k – $5mn) valuation range. The hands-on experience of its brokers is unmatched in the market, and I’m also a big fan of how transparently it handles sales.

FE International has more experience in the large-cap market, so it might be worth looking there if your company is likely to sell for well above $5mn.

Alternatives

If neither Quiet Light nor FE International tickles your fancy, don’t worry; there are plenty of other providers to choose from in this space.

Empire Flippers

Empire Flippers is one of the biggest names in the online business sales industry. Having started out with a focus on content and affiliate websites, it has since grown into a large curated marketplace for all kinds of online businesses.

Empire won’t offer as much hands-on assistance as Quiet Light or FE International. It’s more of an online marketplace than a full-service brokerage. However, it does offer a higher level of service than most other buy-and-sell platforms.

When you list with Empire Flippers, it will vet your business and then post an anonymized listing on its platform. The listing is visible to the public (with your business name and identifying details hidden) and attracts a large number of potential buyers, since Empire Flippers has a huge audience of registered users.

Pros of Empire Flippers

- Huge buyer pool: Listings get a lot of eyeballs quickly due to Empire’s popularity. This is obviously great if you’re prioritizing a quick sale.

- High vetting standards: Empire has a 91% rejection rate, which says a lot about the quality of the companies it lists. Your company’s very presence on the Empire platform will assure interested parties that it represents a solid potential investment.

- Thorough buyer verification: Unlike Flippa, Empire requires buyers to verify their identities and provide proof of funds, reducing the number of tire-kickers getting in the way of smooth sales.

- Privacy: Interested buyers must sign an NDA before viewing all the details of your listing.

Cons of Empire Flippers

- Lack of personal service. You’ll need to answer buyer questions yourself and navigate offers more directly. You’ll encounter much more of this type of legwork with Empire than you would with FE International or Quiet Light.

- High minimum criteria: Empire’s high standards are a positive and a negative. If yours is a smaller or younger company, you might struggle to get it listed.

- Lower final multiples on quick sales: Empire Flippers is great for quick exits, but if maximizing price is your only goal, a longer brokerage process could sometimes yield more.

- Communication volume: Expect a flood of inquiries once listed. It can be time-consuming to deal with multiple prospective buyers at once, even with EF filtering out unverified ones.

Flippa

Flippa is the largest open marketplace for buying and selling online businesses. On Flippa, pretty much anyone can list an online business for sale by paying a listing fee, and the marketplace is open for anyone to browse and bid. Flippa has been around since 2009 and has facilitated over 100,000 deals.

Pros of Flippa

- Huge reach: If you’re after broad market access, Flippa is the place for you. Your company will find unparalleled visibility here, and this could translate into a very quick sale.

- Broad net: If you have a small-cap asset that brokers aren’t interested in helping you with, Flippa could allow you to find a buyer. There are no strict minimums here in terms of earnings or sale prices.

- Control and flexibility: You can auction your company off or set your own price, and you won’t be locked into a long exclusivity period.

- Optional upgrades and services: Selling on Flippa doesn’t have to be a bare-bones experience; the platform offers a broker service, due diligence reports, and in-house escrow as optional extras.

Cons of Flippa

- Minimal vetting: “Buyer beware” is very much a theme of the Flippa experience. Platform vetting is very basic; sellers can provide verified Google Analytics or revenue screenshots, but there’s still a much higher risk of inflated claims here than elsewhere. This reduces buyer confidence, which has knock-on effects for you as a seller.

- Cost: Flippa’s fees on larger deals are similar to those charged by full-service brokers. Unless your company is valued in the four- or five-figure range, Flippa doesn’t really represent value for money.

- Hands-off approach: Unless you hire a Flippa broker, you’ll be handling all the back-and-forth with potential buyers by yourself. This can be stressful if you’re not familiar with deal making.

Website Closers

Website Closers has been around since 1998, making it one of the oldest online business brokers. It focuses on slightly larger deals on average; it’s very active in the $1M – $50M+ range and has a network that includes strategic and financial buyers.

Website Closers has a huge team of brokers and franchisee offices across the US, so your experience might depend on the specific broker you get. The company will help you to prepare marketing packages, confidentially shop your business to its buyer network, conduct the negotiation process on your behalf, and coordinate closing.

Pros of Website Closers

- Extensive track record: Website Closers has seen every type of deal and boasts a long track record of successful sales, particularly of larger companies.

- Strong industry reputation: There are plenty of solid testimonials about Website Closers, from both buyers and sellers.

- Full-service brokerage. Like others in this category, Website Closers takes good care of its sellers; the company offers free valuations, creates comprehensive prospectuses, negotiates on your behalf, assists with due diligence, and coordinates closing.

Cons of Website Closers

- Opaque commission structure: A lack of publicly listed fees is a major red flag for me. You’ll need to negotiate your success fee with Website Closers, which adds friction to the process and makes it more difficult to plan ahead.

- Big-client bias: If your business is worth less than $5mn, your account may not get as much attention as others.

- Communication issues: Website Closers has a reputation for being less responsive than other brokers in this space. If communication is important to you, this is worth keeping in mind.

Picking the Broker That Best Fits Your Business

Finding the best broker for your business will require you to consider all the possibilities in light of your own needs. Generally, though, Quiet Light is my recommendation in this area, especially for mid-market sales.