Last Updated on January 9, 2026 by Ewen Finser

You may be asking yourself what’s a Digit and a Pilot? And why are we comparing them? Well, they’re not phalanges or ocean-faring vessel drivers, nope, you’re wrong there. They’re something way less engaging; yup, you guessed it, they’re accounting softwares! After all, why else would a CPA who’s certified in all things nerd ever even consider talking about something else?

But today’s comparison is less run-of-the-mill in terms of the usual subject matter. These platforms are so very different from one another that I’m looking forward to showcasing how each platform approaches the standard accounting workflow. One is basically a “do it for me” approach, where you’re totally hands off, and the other is a “let the AI do as much as possible” to save my time where I can. Neither is wrong; they’re just different, so let’s jump into the ins and outs and see what makes the most sense for most small businesses.

The Bottom Line Up Front

Digits is product-first accounting software built on an AI-native ledger and autonomous agents; Pilot is a people-plus-software bookkeeping/tax/CFO service layered atop mainstream ledgers. If you want to run the books in-house (or as a firm) with automation and keep the stack modular, Digits wins. If you want to outsource the back office to a service team and stay within a familiar QuickBooks-centric workflow, Pilot is the safer pick. For speed, data visibility, and future automation runway, I give an edge to Digits.

What Each Platform Is and Isn’t

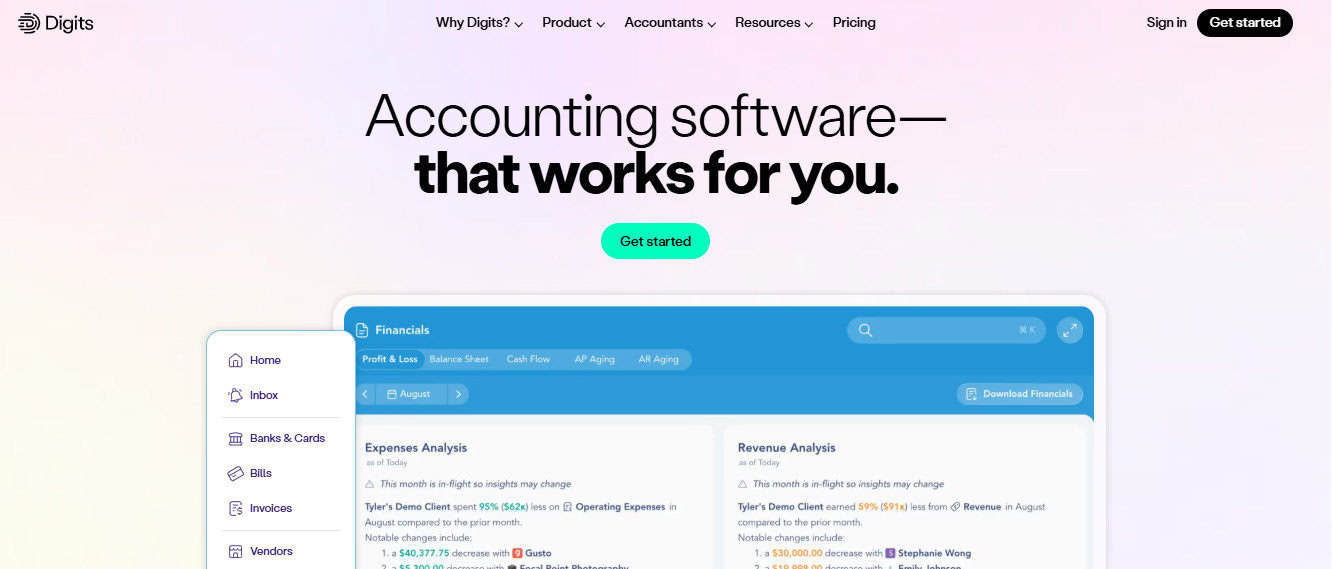

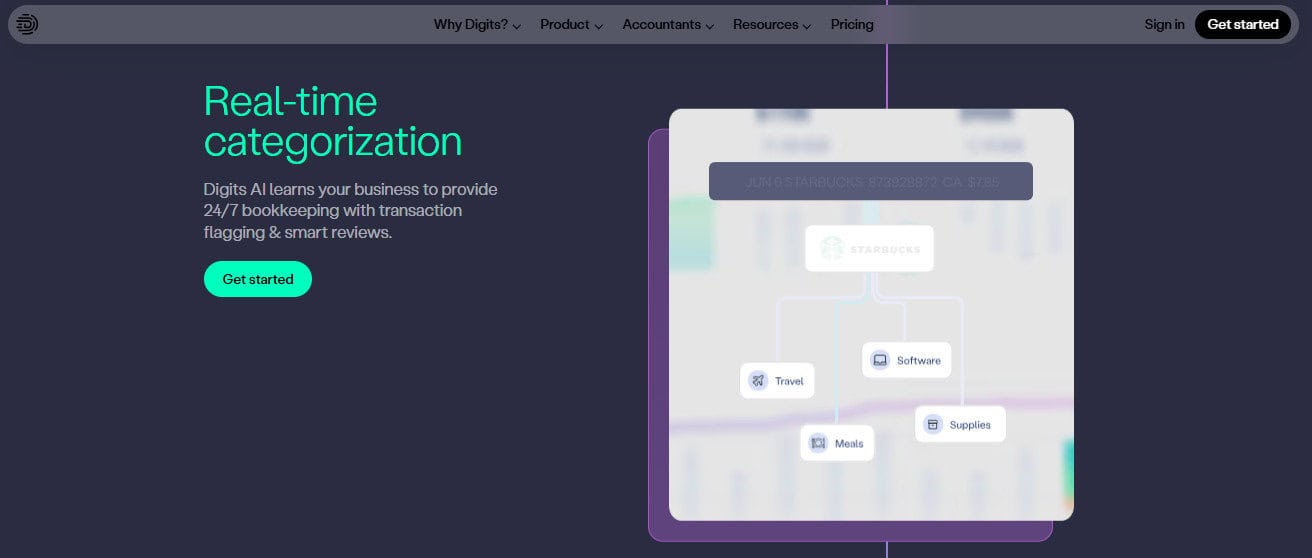

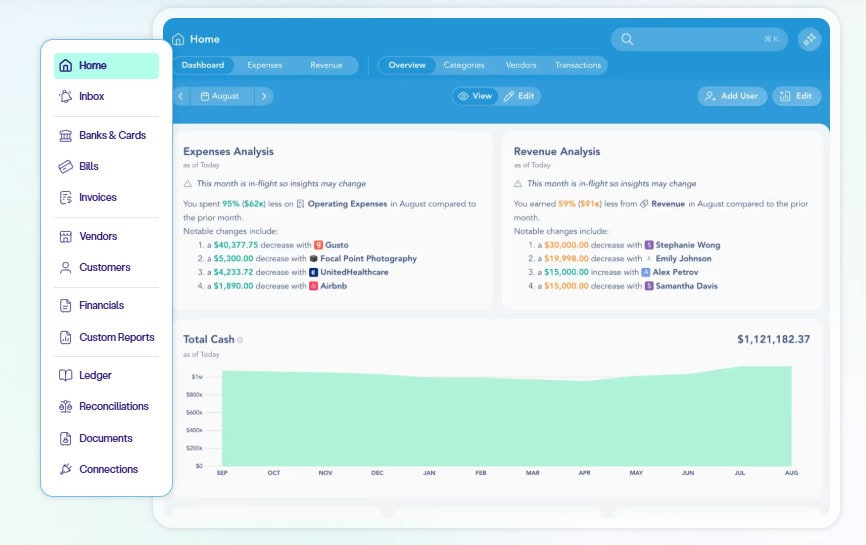

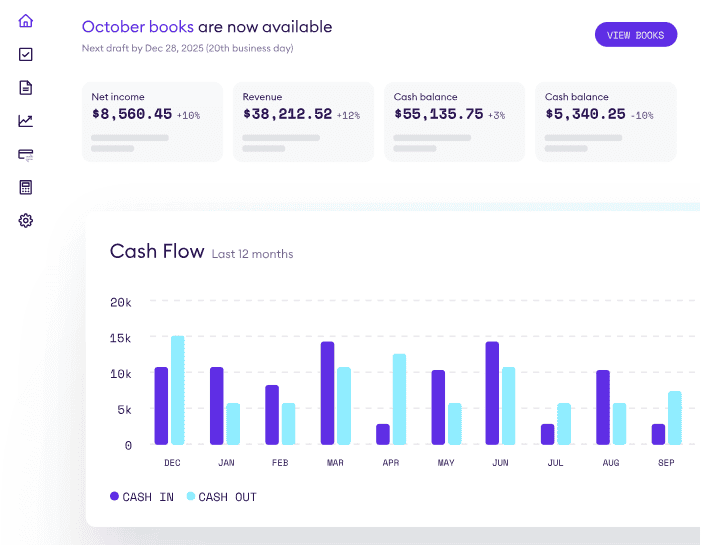

Digits is an AI-native accounting platform that includes an autonomous general ledger, automated bookkeeping, bill pay, invoicing, reporting, and real-time dashboards all under one umbrella. Under the hood, it leans on proprietary models trained on a very large transaction database and uses “Accounting Agents” to run workflows end-to-end, pausing for human review on exceptions. That architecture matters because it changes what “close” and “monthly catch-up” can look like for a team or an accounting firm serving many clients.

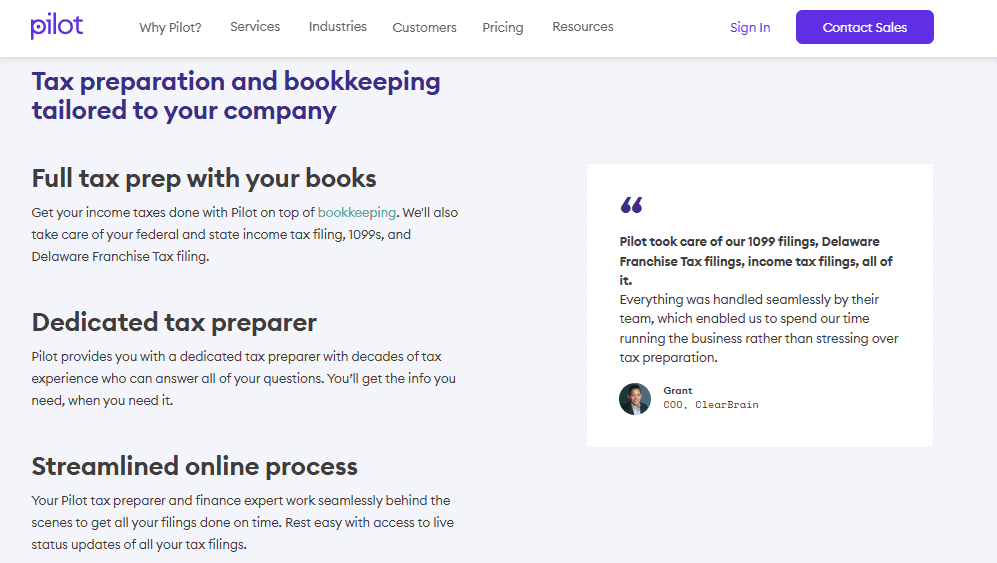

Pilot is a back-office service provider for startups and SMBs. The value prop is: hand your bookkeeping, tax compliance, and fractional CFO to Pilot’s team, with the firm’s software providing visibility and coordination. Pilot’s model is “50/50 people and software,” and the offering intentionally bundles services like monthly books, tax filings (often tied to bookkeeping plans), and optional CFO advisory. Pricing is tiered by service complexity and scale; think annual tax packages and monthly bookkeeping with add-ons.

Pricing (What Your Dollars Actually Get You)

- Digits: Clear SaaS tiers. There are three tiers being Essentials, Core, and Professional options; monthly fees start around $65 and $100 per month, depending on capabilities for Essential and Core (note that at this time Essential is not yet available). Professional pricing is custom.

- Pilot: Their pricing is a little bit more opaque, which, as mentioned in the past, I don’t love. Public pricing and third-party listings show bookkeeping packages (often monthly, sometimes with annual commitments), plus tax packages (commonly contingent on purchasing bookkeeping), and CFO advisory as scope/volume increase. Representative anchors include bookkeeping plans (varies by volume/complexity) and a published tax “Essentials” package from $2,450/year when bundled with bookkeeping. The spend profile is service-heavy by design.

CPA Take: If you want recurring software line items that scale predictably with automation, Digits is more favorable. If you’d rather pay for outcomes via a staffed finance function (closes, filings, advisory) and you don’t want to hire internally, Pilot is easier to budget as a single vendor.

Core Architecture: Autonomous GL vs. People-Plus-Software Approach

This isn’t marketing fluff; it drives how your firm keeps its books.

- Digits’ Autonomous General Ledger (AGL) is the organizing concept. Transactions land, are interpreted by proprietary, layout-aware language models, matched, and classified with high-context rules; agents orchestrate AP/AR, categorization, reconciliation, and reporting, only stopping for human review where confidence dips. The AGL also powers real-time dashboards and reports (not an afterthought BI layer). This leads to continuous close characteristics rather than monthly “big batch” close.

- Pilot’s stack is intentionally a services wrapper with software assist, commonly working over QuickBooks Online and related tooling. The advantage is familiarity and capacity. Pilot handles accrual books, tax, and CFO advisory for startups and SMBs that don’t want to run the machine themselves. The tradeoff is that “real-time” is gated by service cadence, handoffs, and the underlying ledger’s batchiness.

Impacts On The Daily Grind: On Digits, you design controls and review exceptions; on Pilot, you design scopes and SLAs. If you’re the kind of operator who likes to own your GL and keep tight latency on cash/burn/aging, an AI-first ledger with agents is a force to be reckoned with. If you want to delegate the back office so you can ship product, the people-plus-software approach wins.

Features Side-by-Side

Bookkeeping & Classification

- Digits: 24/7 categorization with agent-driven workflows; reconciliation tracking, vendor/customer curation, and exception review from one pane. Classification logic is model-based and improves with your data. That shortens review cycles and gives you earlier P&Ls.

- Pilot: Monthly bookkeeping by a dedicated team; you get P&L/BS packages, tax-ready year-end, and support via email or assigned staff. Excellent if you want “don’t make me think” service, but you’re working on the provider’s rhythm.

CPA Thoughts: If your chart of accounts is nuanced (capitalized R&D, contra-revenue for refunds, heavy prepaid amortization), Digits’ continuous rules and exception review appeals to the control freak in me. Pilot will do it, but it’s via instructions and review cycles with your bookkeeping team. And I don’t trust other people with complicated things that must be done correctly.

AP/AR & Documents

- Digits: I love the simplicity of Digit’s drag-and-drop bill capture, the approval flows are seamless, and payments get sent without a break in stride. Invoicing is also in-house, which accelerates cash collection. The Agents build aging reports as they go. The value here is fewer swivel-chair moments across different tools.

- Pilot: You can administer vendor payments and payroll under custom plans, but be ready to pay; remember, Pilot’s whole shebang is service-led rather than product-embedded. It’s good for teams who want a single throat to choke for payables and compliance, but not a native payments product.

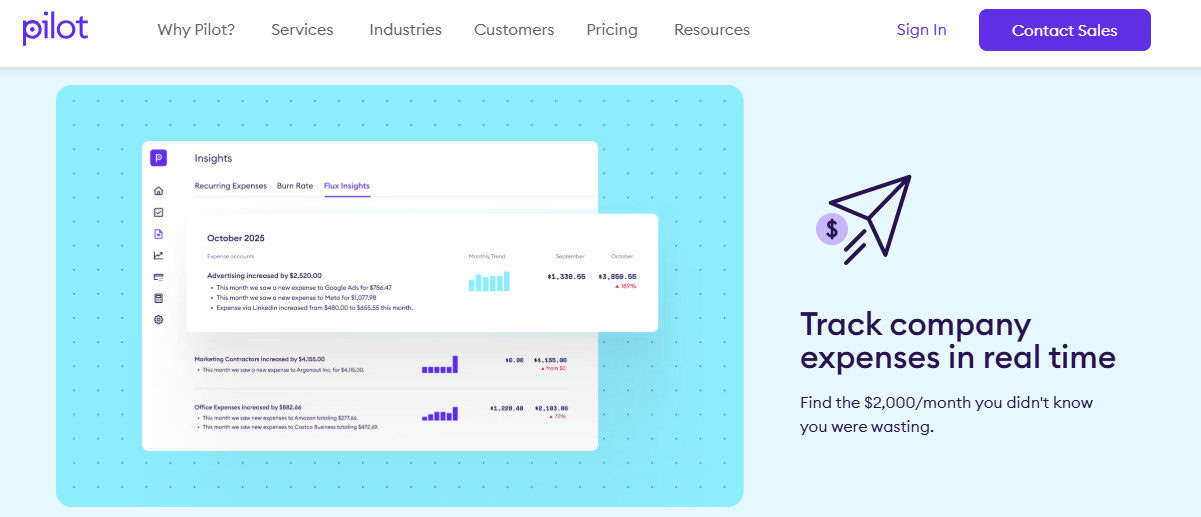

Financials, Dashboards, and Insights

- Digits: Real-time dashboards, trend analysis, and management reports are rendered from the AI-native data store. This is critical for cash-burn, runway, and cohort views mid-month, not just after the close.

- Pilot: You’ll get reporting packs and CFO modeling via services. Strong for FP&A storytelling, fundraise readiness, and board decks, especially for startups who want seasoned finance pros on call.

Integrations & Connectors

- Digits: “Connect” platform advertises 12,000+ real-time integrations (banks, cards, apps). Practically, this reduces CSV purgatory and speeds up first-mile data ingestion.

- Pilot: Integrates the systems your startup already uses, but the connective tissue is managed by the service team. You’ll still end up within a QuickBooks-centered ecosystem for ledger.

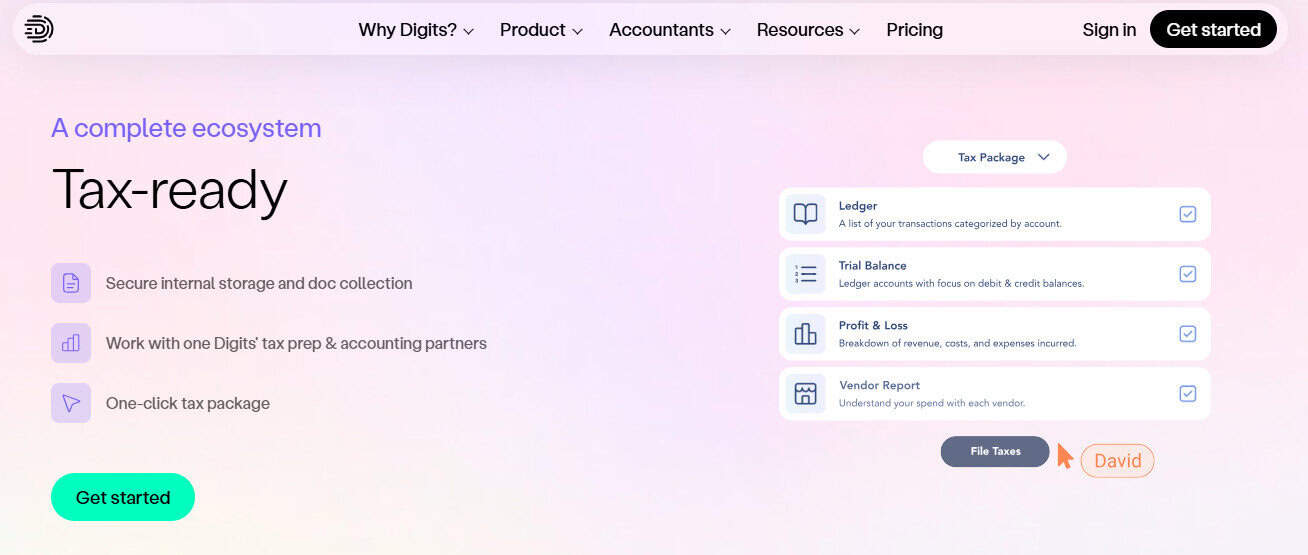

Tax & Compliance

- Digits: Software-first; you can layer on Full-Service Accounting or CFO services if you want a human-delivered compliance wrapper. This keeps the core product modular if you already have a tax CPA.

- Pilot: Tax filing packages are a core offering, often bundled with bookkeeping. It’s a big draw if you want a one-and-done vendor for 1099s, federal/state/city filings, Delaware Franchise, etc.

Speed, Close Cadence, and Review Burden

- With Digits, the cadence is “continuous bookkeeping.” Agents categorize and reconcile as data lands, and you review exceptions. The upshot is a faster close and earlier visibility into variances, which is useful for runway-sensitive teams and operators managing covenants. Recent releases explicitly position agents as running workflows “end-to-end” and pausing for human judgment when needed.

- With Pilot, the cadence aligns to your statement cycles and the team’s processing window. For many businesses, this is perfectly fine. The books are clean, tax-ready, and CFO-interpreted, but the operator waiting on same-day insights or pre-close decisions will feel the lag.

Data Ownership, Auditability, and Controls

- Digits keeps everything inside a purpose-built ledger with audit trails, reconciliation status, and attachments linked to transactions. Because the models do the grunt work, reviewers spend time on exceptions and policy rather than rekeying. This maps well to a control environment where you want evidence of review and a clean path from source doc to ledger to report.

- Pilot will maintain audit-worthy books and workpapers as part of the service, and you get a year-end package for your tax preparer. For companies with external auditors, the service model can be helpful. Pilot’s team handles PBC requests and schedules. The tradeoff is less day-to-day configurability unless you request it.

Scalability (From a Solo Operator to Multi-Entity Behemoth)

- Digits scales like software. You can add entities/clients, apply templates, rules, and let agents carry the weight. For accounting firms, the “agent and exception review” pattern is compelling. You standardize review, not entry. For multi-entity startups, real-time rollups and standardized charts are achievable without multiplying staff.

- Pilot scales like a service. You buy more scope for more complex revenue recognition, more entities, tighter close SLAs, and Pilot staffs it accordingly. This is good if you never want to build an internal finance team. It’s less ideal if your long-term plan includes insourcing or running a very lean internal ops model.

Security & Risk Posture

- Digits positions “bank-grade security” and first-party ML (not a patchwork of third-party automations) as part of the value proposition. In my opinion, it really toots its own horn when it comes to security, and I’m all about it. I think security is not often enough discussed when discussing sensitive data like addresses, bank accounts, SSNs, etc.

- Pilot benefits from centralization of duties; one vendor handles sensitive operations like payroll administration, vendor payments, and tax filings under a controlled process. If you struggle with segregation of duties internally, this can be a governance win.

Who Should Pick Which

Choose Digits if you:

- Want real-time visibility and faster closes without growing headcount.

- Prefer to own the ledger, automate the boring parts, and keep tax/advisory modular.

- Are a firm (or a founder-CPA) standardizing exception-based review across many clients.

- Value a modern UI with dashboards that aren’t bolted on after the fact.

Choose Pilot if you:

- Want to outsource the finance back office, like books, tax, and advisory, to a single vendor.

- Are a funded startup that needs CFO storytelling, board prep, and fundraising support more than you need to tinker with charts and rules.

- Prefer service SLAs over running your own accounting operations.

Edge Cases & Caveats (The Part That Most Reviews Skip)

- Revenue recognition & industry nuance: Pilot’s CFO/tax bench is useful when you need more technical accounting items (e.g., SaaS revenue deferrals, multi-element arrangements, or inventory costing quirks). The only thing is you must ensure that your Pilots team understands what you need and ensure that it’s correct. Digits can model policies and automate the mechanics, but if you need white-glove accounting position papers, a services-led model has an advantage.

- Hybrid operating model: Some teams run Digits for day-to-day ops and keep an external CPA for tax. Others hire Pilot for tax and advisory, but still maintain internal tools (cash dashboards, billing ops). Both work; just avoid double-paying for the same deliverables.

- Change management: Moving to Digits means committing to an automation-first posture, which is great once established, but do plan time for chart cleanup, bank/app connections, and policy codification. Moving to Pilot means committing to a vendor relationship great for capacity, but you’ll want a clear chain of command so decisions aren’t bottlenecked.

Final Thoughts

Both products solve a real problem. The question is whether you want software leverage or service leverage. In 2025, with AI agents now credibly running accounting workflows end-to-end and only escalating exceptions, the leverage curve on the software side has steepened. That’s why I give my edge to Digits, specifically for teams (and firms) that want continuous accounting, faster closes, and modular control over tax/advisory rather than a bundled service dependency. It’s not a slam dunk for every business, but the architecture points to where the industry is headed.