Last Updated on October 29, 2025 by Ewen Finser

Handling payments manually felt like a necessary evil at some point. But platforms like Melio and QuickBooks Online changed that. They made payments easier. They transformed how businesses managed cash.

As a CPA who’s spent years drowning in invoices, ledgers, and every type of financial headache imaginable, I experienced these changes firsthand.

So, let’s break down what these two platforms offer, their strengths, weaknesses, and ultimately, how each one might fit different types of business.

TL;DR: If you’re a small business or solo operator looking for a simple, cost-effective way to pay vendors (even by check), Melio is the best option. It’s free, easy to use, and offers great payment flexibility. But if your business needs more complex accounting features, deeper reporting, internal controls, or payroll and inventory management all in one platform, QuickBooks Online is the better fit. But get ready for a steeper learning curve and a higher price tag.

Melio vs QuickBooks Online Key Tradeoffs at a Glance

Here’s how I’d summarize the key distinctions between QuickBooks Online and Melio:

Key features | Melio | QuickBooks Online |

|---|---|---|

Cost | Free ACH payments with tiered pricing for micro to large enterprises. Paid plans start at $25/user per month. 2.9% fee for credit card payments | Subscription-based ranging from $30/month for basic plans up to $600+/month for advanced functionality. Transaction fees apply for credit card payments |

Accounts Payable | Focused bill payment platform with straightforward payables management. Limited reporting options | Comprehensive accounts payable integrated with full accounting ERP. Advanced features include recurring transactions, batch payments, and customizable approval workflows |

Accounts Receivable | Basic receivables features focused on getting paid | Full-featured invoicing and receivables management integrated with complete accounting system |

Integration | Syncs with QuickBooks Online, Xero, and other platforms. Smooth integration that saves reconciliation time | Native accounting platform that integrates with payroll, expense tracking, and other financial management tools. Wide array of third-party integrations |

Platform | Web and mobile apps. Intuitive, easy-to-navigate interface designed for simplicity | Web and mobile apps. Powerful but complex interface that often requires training and ongoing support |

Payment Methods | ACH, debit cards, credit cards, checks (even if vendor only accepts checks—Melio issues check on your behalf), wires (for a fee) | Multiple payment methods including ACH, credit cards (with transaction fees), and traditional payment processing |

International Payments | Yes, international payments supported with wires available for a fee | Limited international capabilities compared to dedicated payment platforms |

User Experience | Highly intuitive and simple. Less tech-savvy users can manage bills within minutes. Minimal training required | Complex and powerful. Often overwhelming for new users, especially those less comfortable with technology. Significant training time required to fully leverage features |

Melio: Simplicity and User Experience

Melio is designed specifically with small businesses in mind, focusing heavily on simplicity. I find the user interface is intuitive and easy to navigate, something my clients have repeatedly praised. Even my less tech-savvy clients found themselves comfortably managing bills within minutes of logging in. As a CPA, I greatly appreciate platforms that don’t require me to spend hours training clients—Melio absolutely shines here. And my clients love it, because I don’t have to bill them hours for the trainings!

Payment Options and Flexibility

One area Melio really sets itself apart is payment flexibility. It allows businesses to pay vendors using ACH, debit cards, or credit cards—even if the vendor only accepts checks. Melio then issues a check on your behalf, essentially converting digital payments into physical checks when needed. Melio also allows wires (for a fee) and international payments, which is attractive if you’re operating with international vendors.

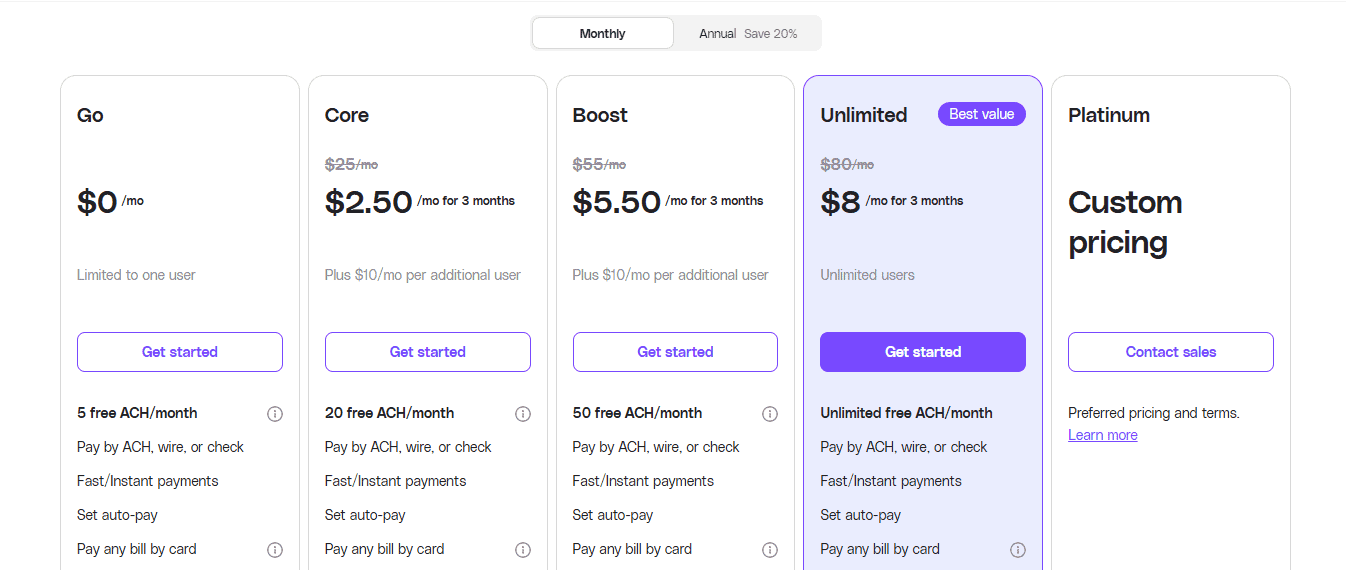

Cost Effectiveness

A huge reason why I recommend Melio to smaller businesses or startups is its affordability. It offers pricing tiers that make sense for micro businesses to large enterprises, and free ACH payments. This straightforward pricing model has been a game-changer for clients who are budget-conscious, especially during early growth stages. However, if you’re paying with a credit card, expect a 2.9% transaction fee—fairly standard but worth noting.

Integrations and Bookkeeping

Integration-wise, Melio syncs smoothly with QuickBooks Online (ironically enough), as well as with Xero, among other platforms. As a CPA who prioritizes accuracy and ease, this smooth integration has saved me and my clients countless hours reconciling accounts and ensures accuracy. However, Melio’s strength in simplicity sometimes comes at the expense of depth: the reporting options are a bit limited compared to larger, more established platforms.

QuickBooks Online: The Established Giant

Now, QuickBooks Online is hardly a newcomer. It’s been around for decades, becoming something of a gold standard in small business accounting. I’ve worked with QuickBooks products for virtually my entire career, and it remains a default choice for many clients due to its robust accounting features and widespread adoption.

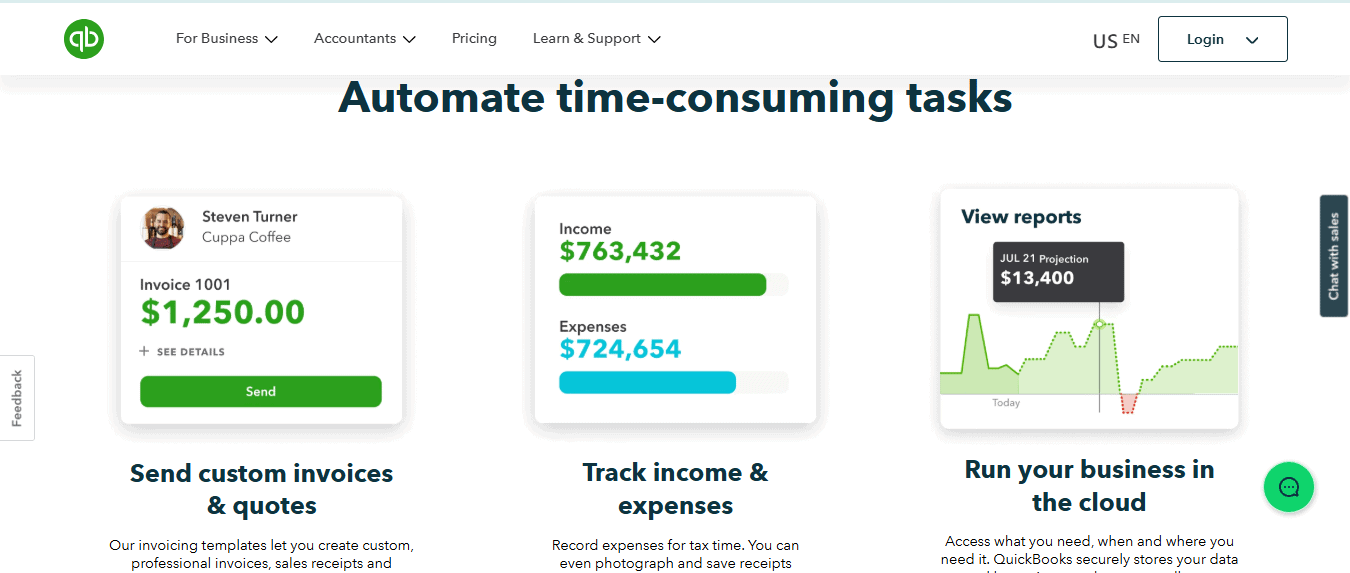

Depth and Comprehensive Accounting

QuickBooks Online offers far more than just bill payments; it’s a complete accounting ERP. Bills and expenses management is deeply integrated with a wide array of accounting tasks like payroll, invoicing, expense tracking, and advanced reporting. For many established businesses, especially those with more complex accounting needs, QuickBooks Online offers an all-in-one approach that can simplify financial management across multiple areas.

Automation and Advanced Features

The strength of QuickBooks Online lies in automation and advanced tools, such as recurring transactions, batch payments, and customizable approval workflows. These advanced features come in handy for businesses that regularly process large volumes of transactions or require multiple approval layers to maintain internal controls. This kind of robust functionality is something I deeply value for my mid-sized clients, especially those with internal accounting teams.

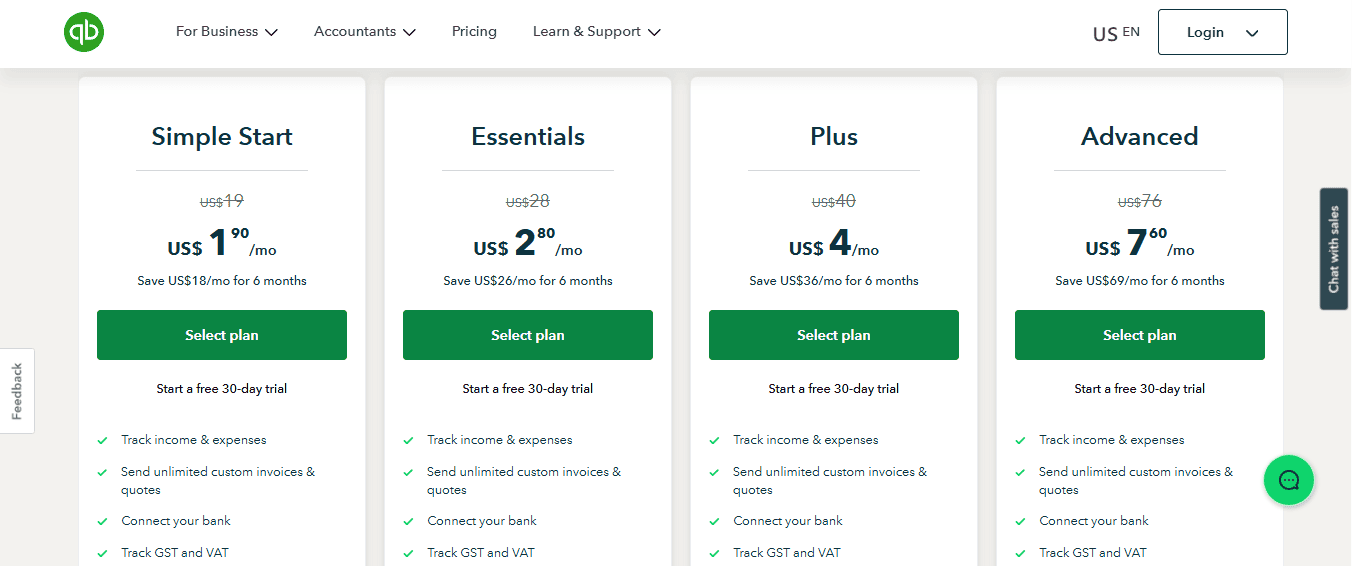

Pricing and Cost Structure

Like Melio, QuickBooks Online is a subscription-based platform, meaning you’ll incur monthly fees ranging from around $30/month for basic plans up to $600+/month for advanced functionality. Additionally, transaction fees apply when processing credit card payments. While costlier than Melio, the price can easily justify itself for businesses that require the more advanced accounting capabilities.

User Experience and Complexity

QuickBooks Online is powerful, but with that power comes complexity. I’ve had multiple experiences where new clients, especially those less comfortable with tech, were initially overwhelmed, and I had to spend months working with them to get them up to speed. Training and ongoing support are often required to fully leverage the software. This complexity can become a significant factor, especially for smaller businesses where simplicity might outweigh advanced features.

Side-by-Side Breakdown: Melio vs QuickBooks Online

Here’s a quick snapshot based on what I think of each platform:

Melio

- Ideal for small businesses/startups needing simplicity.

- Different cost structures, cost-effective.

- Easy, intuitive interface.

- Excellent payment flexibility.

- Integration-friendly but basic reporting.

QuickBooks Online

- Ideal for larger businesses or those with complex accounting needs.

- Somewhat pricey monthly subscription fees required.

- Powerful, robust accounting and automation.

- Steeper learning curve and complexity.

- Advanced reporting and deeper integration across financial tasks.

Cash Flow Management

Cash flow is king, and anyone who runs or advises small businesses knows it. Efficient cash flow management can be the difference between growth and stagnation, or worse, survival and shuttering your business.

Melio’s Impact on Cash Flow Management

One of my clients struggled initially with cash flow management, largely because their clients paid inconsistently. They needed flexibility in payments to vendors and contractors without draining their operating cash. Melio’s ability to leverage credit cards, turning vendor payments into cash-flow-friendly credit transactions, was a game-changer. This provided breathing room during lean months and allowed them to manage cash flow strategically, preserving liquid cash for essential expenses. Although I don’t typically recommend clients use a credit card to get by, for the slow season, that 2.9% charge is absolutely worth it to keep the doors open.

QuickBooks Online’s Impact on Cash Flow Management

On the other end of the spectrum, QuickBooks Online shines in scenarios where complexity demands deeper visibility and reporting. A retail client with extensive inventory initially struggled to manage supplier payments across locations. QuickBooks’ dashboard and cash flow projections allowed us to pinpoint exactly when and how much money needed to be available for vendor payments. The platform’s detailed reports significantly reduced uncertainty and improved financial forecasting accuracy, helping us maintain strong relationships with suppliers through timely payments.

Melio’s Strength

Melio’s straightforward payment approach proved invaluable to a client in the event-planning industry. This client often worked with freelancers and small vendors who preferred traditional payment methods like checks. Melio’s unique feature—allowing digital payments that converted into physical checks sent directly to vendors made them happy and kept us from having to do the paperwork. The simplicity of this process reduced disputes, eliminated late payment fees, and improved the amount of vendors who would love to work with us.

QuickBooks Online’s Strength

For larger, more intricate supply chains, QuickBooks’ extensive payment tracking and reporting features became indispensable. A construction client benefited immensely from QuickBooks’ advanced features, such as vendor-specific reporting and customizable approval workflows. The added transparency and control were particularly beneficial in negotiating terms with suppliers. This visibility meant better relationships, fewer disputes, and even occasional discounts for prompt payments, directly impacting profitability.

Final Verdict: Which Platform is Right for You?

In my experience, there’s no one-size-fits-all answer to bill payment platforms. But let me summarize this clearly, drawing on my years in the industry.

- Choose Melio if:

- You’re a small or growing business seeking simplicity.

- Budget constraints demand a cost-effective, subscription-free solution.

- You need maximum flexibility in how vendors get paid (e.g., credit cards, ACH, or checks).

- You don’t require complex reporting or integrations beyond basic accounting.

- Choose QuickBooks Online if:

- Your business has complex accounting and operational demands.

- You require detailed financial reporting, integrated payroll, inventory, or project accounting.

- You operate a larger team or organization needing robust internal controls and approval workflows.

- Subscription costs are justified by comprehensive functionality and advanced integrations.

As someone who’s navigated countless bill payment platforms, let me reassure you that investing time upfront in the right solution dramatically simplifies financial management in the long run. Both Melio and QuickBooks Online can significantly enhance your bill payment processes—but understanding your unique needs is key.

Ultimately, my advice is always this: analyze your specific scenario carefully, assess your business’s complexity and financial capabilities, and choose accordingly. Your time, cash flow, vendor relationships, and peace of mind depend on it.