Last Updated on June 13, 2025 by Ewen Finser

Xero has long been a staple in the cloud-based accounting world. It’s sleek, easy to use, and loaded with features that cater to most businesses. But as with most things, it’s not one size fits all. If you’re here, you’re probably looking for alternatives, and let me help you with the headache – as a CPA, I’ve tried what seems like a gazillion options, so I know what works, and what doesn’t. Whether you’ve just outgrown Xero, are looking for deeper automation, or just want something that better aligns with your business’s specific workflows, it’s worth exploring the list of alternatives.

The Bottom Line, Up Front:

If Xero isn’t quite cutting it for your business, you’ve got strong alternatives. Puzzle.io is ideal for startups and finance teams that want real-time, automated books. QuickBooks Online remains the go-to for small businesses needing a familiar, feature-rich platform. FreshBooks is perfect for freelancers and service-based businesses that prioritize simplicity in invoicing and time tracking, while Zoho Books is a powerhouse for businesses already using Zoho’s suite or looking for affordable customization. And one of my personal favorites (because I love to save a dollar wherever I can), Wave offers solid core accounting features for free. Each platform has its strengths, so your best pick depends on what you value most in your day-to-day.

The Best Xero Alternatives

1. Puzzle.io – Real-Time Accounting for Fast-Paced Businesses

Puzzle.io isn’t just another general ledger in the cloud — it’s a full-blown rethink of how accounting software should work in a world where owners and CFOs want answers, not just entries. Built from the ground up with automation in mind, Puzzle connects directly to your bank accounts, payroll platforms, and billing systems to generate clean, GAAP-compliant books without you having to chase receipts and spreadsheets.

Why it stands out from Xero:

- It possesses real-time books with automated accruals and reconciliations.

- I want to note that Xero can assist with bank reconciliations using rules-based matchmaking, but Puzzle is so much more intuitive, and its AI is less likely to let a faulty rule cascade into a huge problem

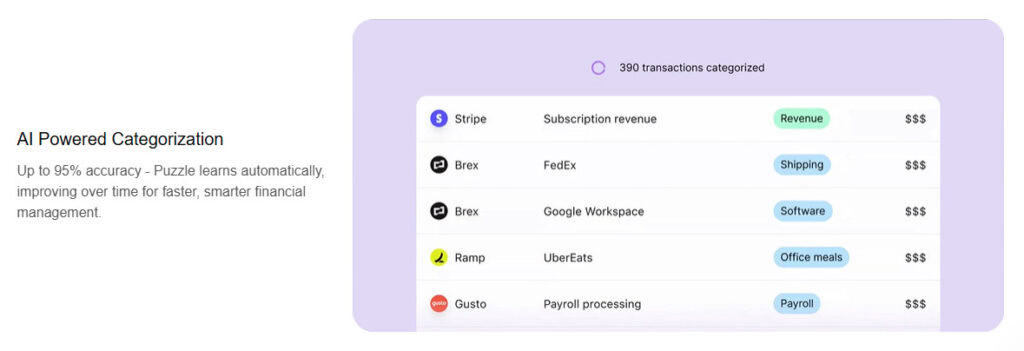

- The platform has AI-powered categorization that actually improves over time.

- I can’t overstate this enough – the UI is ultra sleek and doesn’t feel like it was designed in 2009.

- The system was engineered for scalability, meaning as your team and transactions grow, your software doesn’t break down or get messy.

While Xero does offer integrations and automation, it still leans heavily on rules and manual adjustments. Puzzle takes a different approach—let the machine do the bookkeeping, and let humans handle strategy (to an extent, I always recommend “the humans” to keep a close eye on any AI system). If you’re a founder, controller, or CFO spending hours trying to make sense of traditional accounting tools, Puzzle might be the sanity-saver you didn’t know you needed.

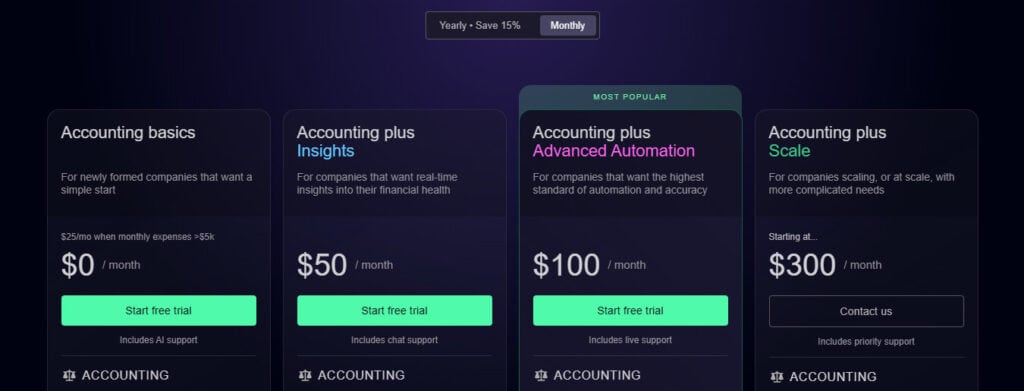

Pricing: Custom pricing based on company size and needs; entry level plans are free, and then it scales up to $50 a month for basic, $100 for mid-tier, and $100 for premium. Their enterprise system offers custom solutions for custom pricing.

Best for: Startups and high-growth companies that need real-time, automated accrual accounting and intelligent insights.

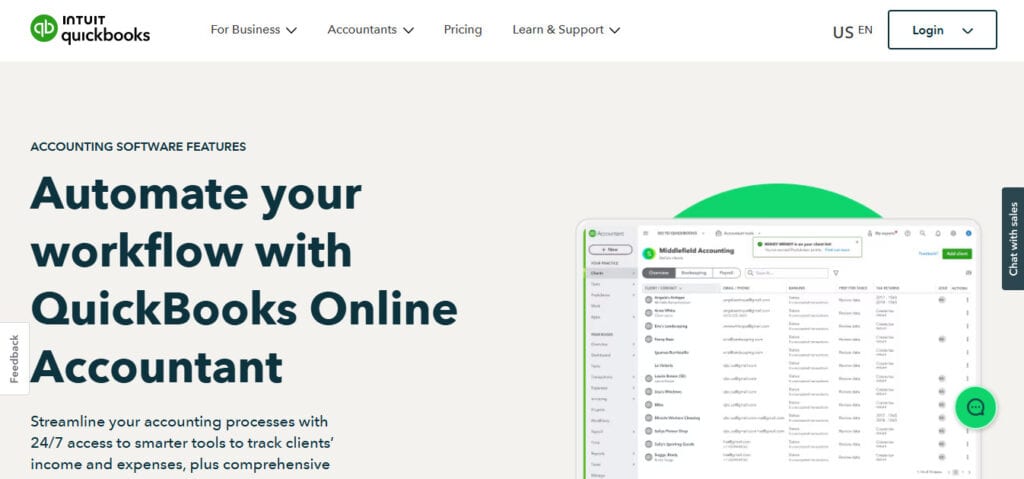

2. QuickBooks Online – The 800 lb Gorilla In The Room

I’m absolutely guilty of this, but if you’ve asked any accountant for software advice in the last decade, chances are you’ve heard, “Just use QuickBooks.” And for good reason—Intuit’s QuickBooks Online (QBO) is the most recognized accounting software in the U.S. It offers deep functionality for payroll, invoicing, inventory, and tax prep, which is pretty much the extent of what any small business would need.

Why it’s a solid alternative to Xero:

- QBO has the widest accountant adoption in the U.S., meaning it’s easier to find help.

- It hosts a robust ecosystem of third-party apps and integrations.

- Built-in payroll and tax tools, including automatic 1099s.

- This is part of the reason I believe QBO is as ubiquitous as it is; it can be tailored to run just about any small business, from shoe sales to construction companies to professional firms. It just works, period.

- It allows management, supervisors, PMs, etc, granular user permissions, which is perfect for growing businesses.

QuickBooks’ main edge over Xero is its broader familiarity among bookkeepers and accountants in North America. If you want to make onboarding easy or outsource your books to a local CPA, odds are they already use QBO.

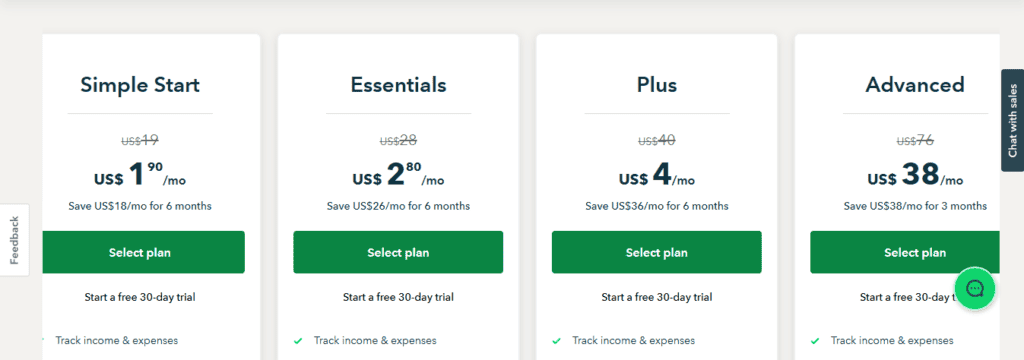

Pricing: Starts at $30/month for the basic plan, scaling up to $200/month for advanced plans with deeper reporting and workflow tools. If you want the payroll option and have employees, the price goes parabolic from there. I have some clients that pay over $500 a month for the software.

Best for: Freelancers, solo entrepreneurs, and small service firms who want dead-simple invoicing and time tracking.

3. FreshBooks – Designed for Service-Based Businesses and Freelancers

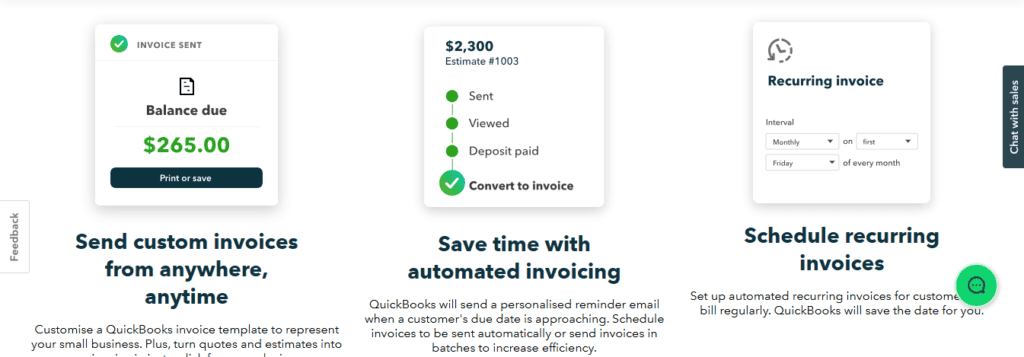

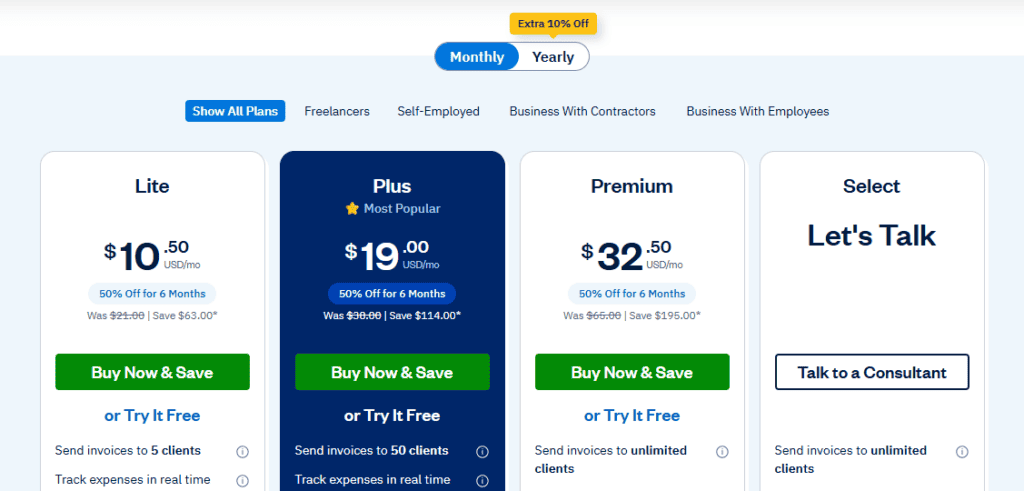

FreshBooks began life as a lightweight invoicing tool, but it’s grown into a full-featured accounting solution that remains super focused on simplicity. If you run a service business and don’t need complex accruals or heavy-duty inventory tracking, FreshBooks makes your life easy.

What sets it apart from Xero:

- Ridiculously easy invoicing with automated reminders and payment links.

- Time tracking and project-based billing baked in.

- To me, this is a big distinguisher as I have found that many accounting platforms are often lackluster when it comes to project-based record keeping

- Client portals that make your business look polished and professional.

- Clean and simple interface designed for non-accountants.

Xero may be more powerful under the hood, but FreshBooks wins on user experience, which is a big thing to consider if you’re not into the numbers side of things. Its reports are basic compared to something like Puzzle or QuickBooks, but they’re more than enough for freelancers or consultants who care more about getting paid than running layered budget forecasts.

Pricing: Starts at $21/month (Lite) and goes up to $65/month for the Premium plan. Custom pricing for larger teams and businesses is available.

Best for: Small businesses that are focused on project based work looking for a feature-rich, widely adopted platform with strong support and integrations.

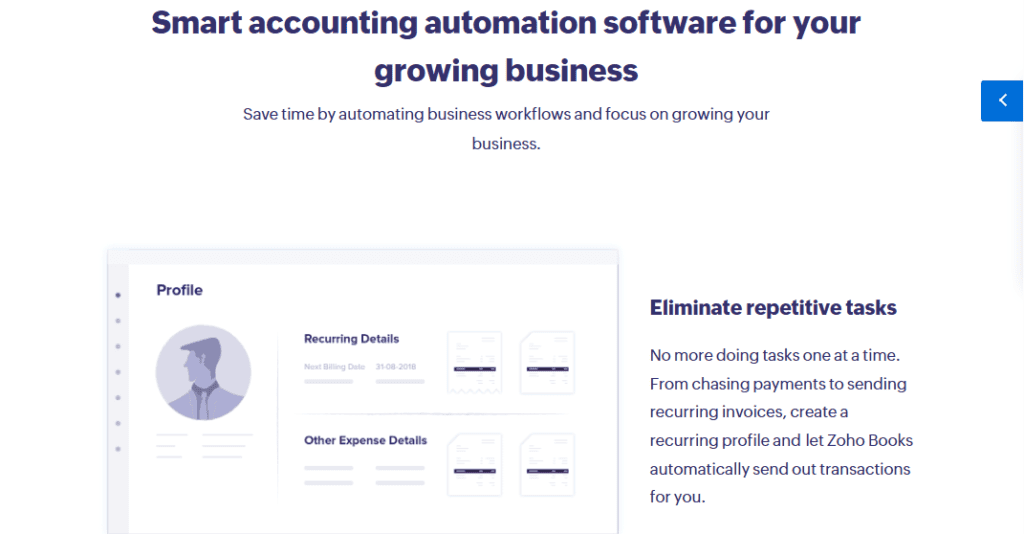

4. Zoho Books – Ideal for Tech-Savvy Businesses Already Using Zoho Suite

Zoho Books is the sleeper of the accounting world (wow, that sounded nerdy to type out). It’s incredibly affordable, packs a surprising amount of features, and integrates seamlessly with Zoho’s massive suite of business apps, including CRM, inventory, and HR.

Why it can outshine Xero:

- It has tight integration with other Zoho tools for CRM, HR, and inventory, meaning its more than just an accounting platform – it can almost function as an ERP.

- Zoho is highly customizable with automations and advanced workflows.

- The platform does an excellent job supporting multi-currency and multi-language support, which is great for global teams.

- I think Zoho is an excellent value for the price, even at the top tier.

The downside? It’s not quite as intuitive out of the box as FreshBooks or QuickBooks. And if your team doesn’t already use Zoho’s ecosystem, it may not offer as much added value. But for international companies or tech-savvy founders who love a unified suite, Zoho Books punches well above its weight class.

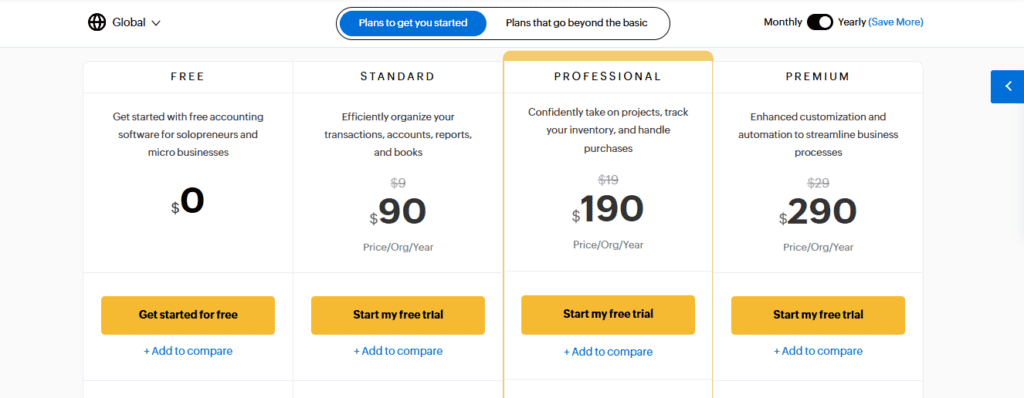

Pricing: Free for businesses under $50K in revenue; paid plans start at $20/month and cap at $275/month for high-volume businesses.

Best for: Businesses using Zoho CRM or other Zoho apps, or anyone looking for deep customization at a low price.

5. Wave – Best Free Option for Small Teams and Solopreneurs

I mention all the time that I’d pick a penny up from the sidewalk, and it’s probably for that reason that I always mention Wave. Wave is one of the few free accounting platforms worth using. It’s clean, user-friendly, and surprisingly powerful given the price tag (which is… zero). While it doesn’t have the bells and whistles of Puzzle or the scalability of QuickBooks, it covers the core needs of many micro-businesses and individuals who just want to get their feet wet.

Why you might pick Wave over Xero:

- Wave has completely free core features, including invoicing, accounting, and receipt scanning.

- While Wave is based on the freemium idea, it also has built-in payments and payroll available if you want to pay a bit extra.

- No hidden fees—what you see is what you get.

- It has a simple interface with just enough reporting to get by.

Wave is perfect for people who don’t need a ton of complexity. If your business is small and your finances are straightforward, there’s no reason to overpay for bloated features. That said, support is limited, and it’s not ideal if you have inventory, complex tax needs, or fast-scaling operations.

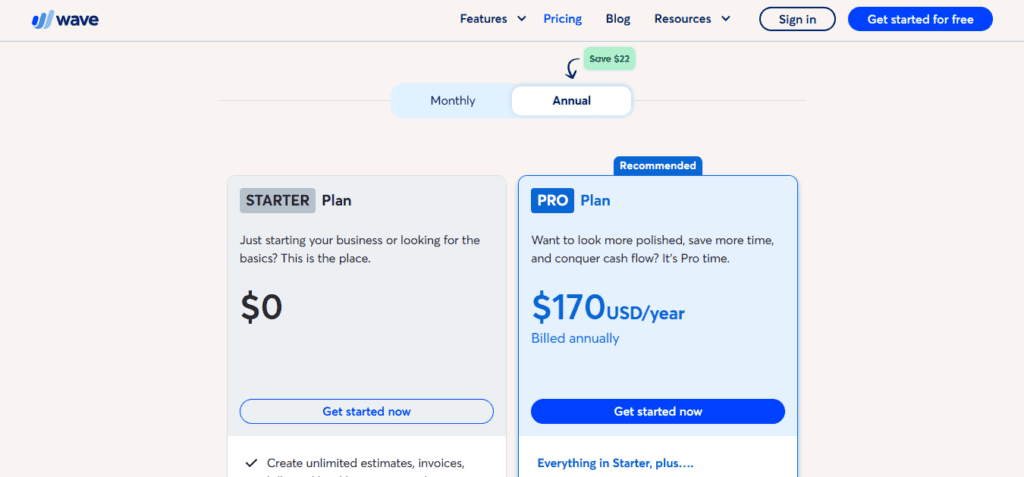

Pricing: Free for accounting, invoicing, and basic features; paid add-ons available for payroll and payment processing.

Best for: Budget-conscious freelancers, very small businesses, or side hustlers who want solid basics without the cost.

Why Some Businesses Outgrow Xero

So you’re here with me, reading this article. But why? Either you’re using Xero and are looking for advice on the leap of faith you’re about to take to switch platforms, or you’re getting started and your research led you to Xero, and you’re doing your due diligence. Good for you!

Let’s be clear—Xero is still a great product. It has a loyal user base, a clean UI, and solid functionality. But it’s not for everyone. Here are a few of the most common reasons businesses start looking for something else:

- Lack of real-time automation: Xero still relies heavily on rule-based bookkeeping, which means if your business has lots of transactions or accruals, you’re stuck with manual intervention or third-party tools.

- Scaling challenges: As you grow and bring on new revenue streams, subsidiaries, or investors, Xero can start to feel limiting—especially in areas project accounting, entity consolidation, or the need for advanced financial analytics.

- Industry limitations: Service-based businesses love Xero, but it can be awkward for SaaS startups, manufacturing companies, or others that rely on more nuanced financial processes.

- Reporting needs: While Xero’s reports are clean, they can lack the depth and flexibility needed by finance teams running strategic, data-driven operations.

This is where platforms like Puzzle.io and Zoho Books start to shine, especially when automation, customization, or real-time financials are non-negotiable.

Key Takeaways: Don’t Settle for One-Size-Fits-All

When it comes to accounting software, there’s no universal “best” option. The right tool depends entirely on what kind of business you run, what stage you’re in, and how hands-on you want to be with your books.

If you’re a modern startup or VC-backed company that needs GAAP-compliant books without hiring a full finance team, Puzzle.io is probably your best bet. If you just want a trusted, tried-and-true system that every CPA in town already knows, QuickBooks Online is the path of least resistance. Running a solo service business? FreshBooks or Wave will do the job beautifully. Already using Zoho CRM? Zoho Books might save you time and money.

What matters most is picking software that makes your life easier, not more complicated. Automation, scalability, and ease of use should be non-negotiable in 2025.

Choosing the Right Fit for Your Financial Future

Xero is still a powerhouse, but the accounting world has evolved. Today, you have more specialized, automated, and intelligently designed platforms than ever before. Whether you’re managing five invoices a month or handling complex month-end close across multiple departments, there’s a tool out there that can do more than just “keep the books”—it can power your next stage of your business.

Don’t be afraid to experiment with free trials, talk to your accountant, or book demos. You’re not just buying software—you’re buying back your time, reducing human error, and giving your business a stronger financial foundation. And if the old guard tools aren’t cutting it anymore, it might be time to welcome a new era of accounting platforms—starting with one that actually feels like it was made in this decade.