Last Updated on May 15, 2025 by Ewen Finser

Buying or selling a business is a big undertaking. Luckily for you, there are a number of brokers that can take a lot of the stress and uncertainty out of it.

Flippa is one such service provider. It’s one of the oldest and most widely used platforms in the space, so it has built up a solid reputation.

However, when you’re trusting a service provider with the purchase or sale of your business, there’s a lot you need to take into account. Different brokers specialize in different types of deals, so I always advocate doing careful research before diving into a relationship like this.

Let’s take a detailed look at Flippa’s service and check out some of its competitors as well.

Bottom Line Up Front Summary

Flippa is a self-serve marketplace that caters to a wide range of online business owners, from side projects and starter websites to full-scale SaaS and eCommerce operations. It works on both sides of deals, offering low barriers to entry and global reach.

However, its “open market” model comes with trade-offs. Scam buyers, inflated listings, low-ball offers, and minimal vetting can all lead to problems. While it can be a good place to offload small projects or test buyer interest, sellers looking to maximize the value of a mature, high-earning online business should look at other options.

What I Like

- Accessible entry point for small sellers: Flippa has no minimum revenue requirements. You can list anything from a domain name to a dropshipping business to a $5M SaaS platform. This openness makes it a great entry point for smaller entrepreneurs looking to test the waters. Equally, if you’re a first-time website buyer looking to invest no more than a few hundred bucks, you’ll find a lot of options on Flippa.

- Large and diverse buyer pool: Because it’s one of the oldest marketplaces in the space (founded in 2009), Flippa has a massive user base of global buyers. Again, this can suit small businesses looking for an exit, as there’s more visibility here than elsewhere. Many buyers are actively scouting for underpriced or under-optimized businesses they can flip or grow.

- Transparent pricing and auction tools: Flippa charges a recurring listing fee plus success fees, with pricing tiers based on your business type and size. While these costs can add up, they’re clearly laid out from the start, making it easier for you to price your potential exit. The auction functionality also gives you a lot of control as a seller — you can run timed auctions and accept private offers.

- Speed of execution: This is probably Flippa’s biggest selling point in my opinion. You’re potentially looking at days rather than months. If a quick exit is a priority for you, this is where you should start your search.

What I Don’t Like

- High scam risk and low buyer quality: One of the most common complaints about Flippa is the prevalence of scam buyers and tire-kickers. Buyers often submit inquiries just to get access to sensitive information like niche selection or traffic sources, with no intent to purchase. Others make low-ball offers, disappear after expressing interest, or attempt off-platform transactions. Proceed with caution.

- Inflated valuations and questionable listings: Flippa allows sellers to set their own asking prices and report their own revenues and traffic flows. As you might imagine, this often leads to wildly inflated valuations, so you need to be prepared to do a lot of your own homework.

- Minimal seller support: While Flippa has improved its customer support over the years, it’s still very much a DIY platform compared to its competitors. There’s no dedicated advisor helping you negotiate, manage due diligence, or structure the deal. For first-time sellers, this can lead to costly mistakes; there are a lot of sharks out there, and they can smell blood from a mile away. This is how Flippa manages to get deals made so quickly—it doesn’t spend the time vetting listings that other brokers do. This is indeed great for getting companies sold quickly, but it has its drawbacks.

- Poor fit for serious businesses: If your online business generates consistent profit, Flippa probably isn’t where you’ll get the best deal. Most high-quality buyers are skeptical of the platform due to its inconsistent vetting standards.

Competitor Comparison

Flippa may be the biggest name in online business brokerage, but it’s by no means the only one. A number of competitors have become active in this space as the flipping industry has grown, and some offer a more realistic path to success for serious businesses.

Quiet Light

I think Quiet Light is the best call for established online businesses eyeing up an exit.

Unlike Flippa, Quiet Light is a full-service M&A advisory firm. Founder Mark Daoust was already an entrepreneur by the time he launched the company, and he introduced a lot of the founder-focused principles you’d expect to the business as it grew. Quiet Light hires brokers who have bought or sold businesses themselves, so they understand the goals and pain points of people in the same position.

When you sign up with Quiet Light, you get a dedicated advisor who helps with everything from business valuation to buyer outreach, as well as due diligence, negotiation, and closing. Unlike Flippa, Quiet Light has a highly vetted buyer pool, which maintains a high level of quality and trust and avoids a lot of the issues that Flippa has come to be known for.

I’m particularly keen on Quiet Light’s robust pricing system. Brokers consider your proposed asking price in the context of your business numbers, conditions in the market more broadly, and their own ability to find what you’re looking for. This is a world away from the slapdash valuations you’ll see on Flippa.

For all that, though, Quiet Light still gets things done quickly. Smaller transactions reportedly take just 30-60 days to reach a conclusion.

Empire Flippers

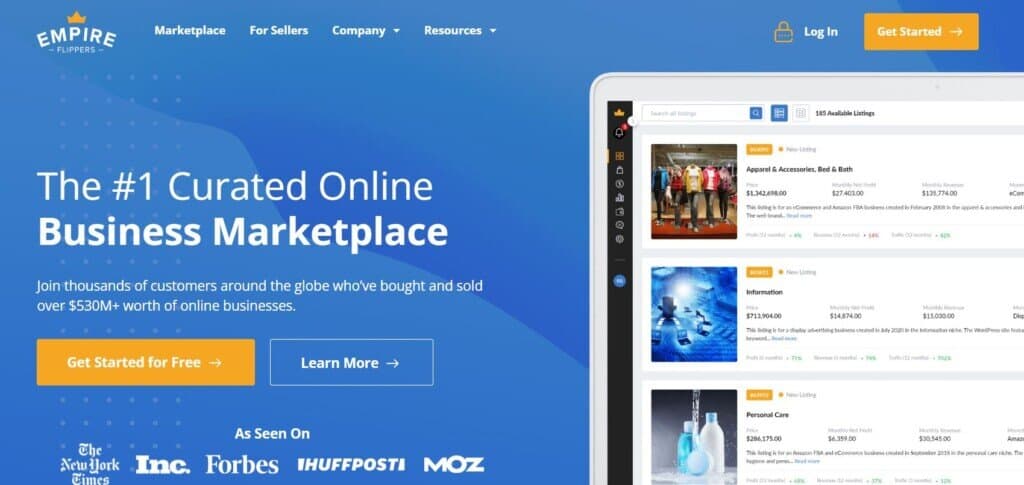

Empire Flippers focuses on curation as a chief selling point, billing itself as the “#1 Curated Marketplace for Buying and Selling Online Businesses.”

I’m a big fan of curation in this space. The volume on Flippa can quickly become overwhelming for both buyers and sellers; you’re much better off with a small number of good options than an avalanche of middling offers with the viable ones buried somewhere in the snow.

Empire charges a commission fee based on the value of your business; the higher the value, the lower the percentage. Commission fees start at 15% of sale price.

I also really like Empire’s two-month exclusivity period—if you’re not happy with your progress at that point, you’re free to de-list your company and try to sell it elsewhere. In a space like this, with high stakes and low certainty, this offers valuable peace of mind.

While it has its benefits, though, there are reasons to be cautious about Empire Flippers. The company is often criticized for being slow to respond and overly rigid in its vetting process. Some users have also reported that the dashboard is clunky and difficult to use.

Acquire (formerly MicroAcquire)

Like Flippa, Acquire.com is a self-serve marketplace. It’s very tech-centric, with lots of pre-revenue SaaS startups and micro-SaaS tools listed for sale.

Acquire has better UX than Flippa and attracts a more tech-savvy buyer pool, and has SaaS experts on hand to figure out the details of more technical sales. However, it still lacks the personalized support high-value sellers need. It’s a viable option for small startup exits or acqui-hires, but not for mature businesses.

What’s the Verdict?

Flippa is fast, affordable, and accessible to almost anyone. If you’re selling a side hustle, a starter blog, or a domain portfolio, Flippa might serve you well.

But for sellers looking to maximize the value of a larger online business, Flippa’s hands-off model, inconsistent buyer quality, and reputation issues can be major drawbacks. For more serious sales, I’d recommend looking elsewhere.