Last Updated on June 11, 2025 by Ewen Finser

The accounting software market is crowded, and there is no shortage of platforms designed for modern businesses. As a CPA that is constantly being badgered by friends, family, and potential clients who want to know what they should use to run their new business idea, I usually recommend QuickBooks and end the short conversation there. But when I’m approached by serial business owners who ask thoughtful, meaningful questions on how to take their successful businesses to the next level, I usually give a different answer.

I usually mention Xero or Puzzle to the folks who are in it for the long haul. While both platforms serve growing businesses, they come from fundamentally different design philosophies. Xero represents the cloud-based evolution of traditional accounting software—a robust general ledger with an app ecosystem. Puzzle.io, on the other hand, was engineered from scratch for real-time finance, automated accruals, and AI-powered reconciliations. One is a tool; the other is a platform almost akin to an ERP.

The Bottom Line Up Front

If your business thrives on client invoices, payroll, and broad industry flexibility, Xero is a reliable, proven choice. It has a decade of development behind it and serves millions of users with a deep ecosystem of integrations.

But if your business is built on velocity, recurring revenue, investor scrutiny, and a lean finance team, Puzzle.io will feel like an unfair advantage. It removes manual bottlenecks, flags errors before they snowball, and delivers real-time clarity across your financial stack.

1. Underlying Design Philosophies

Xero: Modernized Traditional Accounting

Founded in New Zealand in 2006, Xero brought desktop-style accounting to the cloud. While that may sound unimpressive now because almost everything is on the internet, at the time, it was revolutionary. Xero’s interface is clean, its reporting modules are solid, and it supports a wide range of integrations through an expansive third-party app marketplace.

But Xero still adheres to traditional bookkeeping workflows:

- Manual bank reconciliations

- Cash or accrual toggle

- Chart of accounts management

- Rule-based transaction coding

It’s flexible and powerful, but largely dependent on how skilled the user or accountant is. Xero is great if you know what you’re doing—or you’ve hired someone who does. That’s why I, a CPA who crunches numbers every day and surfs spreadsheets like I’m on a beach in Hawaii, love it. It gets the job done, without fuss, consistently.

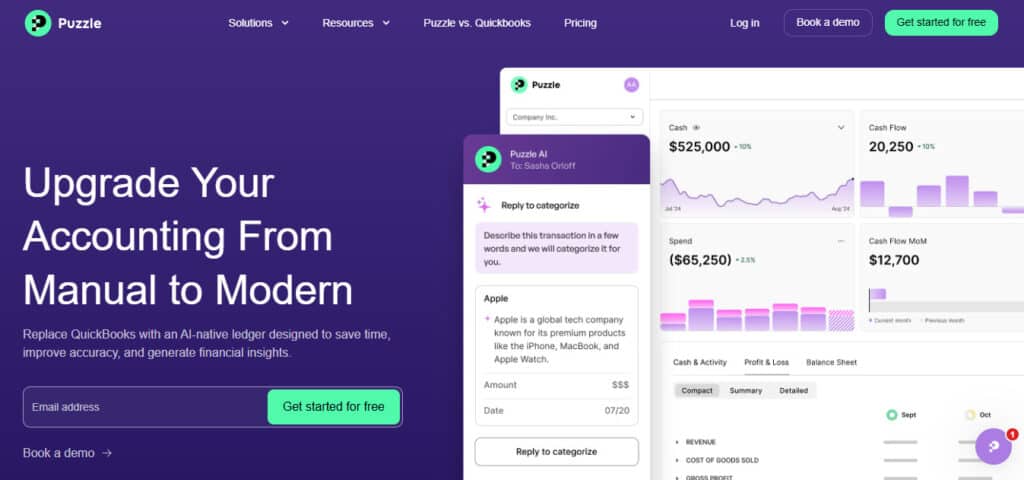

Puzzle.io: Automation from Day One

Puzzle wasn’t built as an online version of anything. It’s a purpose-built SaaS platform engineered for real-time, investor-grade financial data. Its goal isn’t to modernize bookkeeping—it’s to eliminate unnecessary manual bookkeeping altogether.

Puzzle connects directly to banks, credit cards, and payroll providers and automates:

- Accrued journal entries

- Payroll journal mappings

- Receipt matching

- Close process visibility

Its ledger is immutable, auditable, and designed with AI-first logic that flags anomalies, uncategorized transactions, or potential compliance issues. If Xero is a generalist platform, Puzzle is a specialist—built for scale, finance discipline, and speed. But keep in mind, it still lets an experienced user take unprecedented control, which, as someone who likes to work without the training wheels, I absolutely consider a non-negotiable. I don’t feel hampered if I need to make some off-the-wall journal entry into the ledger, because Puzzle will still let an experienced accountant take the wheel.

2. Transaction Processing & Reconciliation

Xero: Bank Feeds + Manual Rules

Xero’s transaction engine is designed around bank feeds, which update daily. Users (or their accountants) build bank rules to auto-code transactions, which works well about 90% of the time in my experience. Reconciling a month involves a good bit of clicking: approve, match, recode, rinse, repeat. You can get hung up on bank rules, though, if you have two payments on the same day and amount to similar vendors, and Xero may not understand where to code each transaction.

This approach works well for:

- High-volume transaction businesses (e.g., retail, hospitality)

- Companies with an accounting staff running daily categorization

- Users who want to customize every aspect of their ledger

But it also results in higher maintenance, and if your rules aren’t set to be hyper-specific, you can make a gargantuan mess quickly (trust me, I’ve learned this the hard way so you don’t have to).

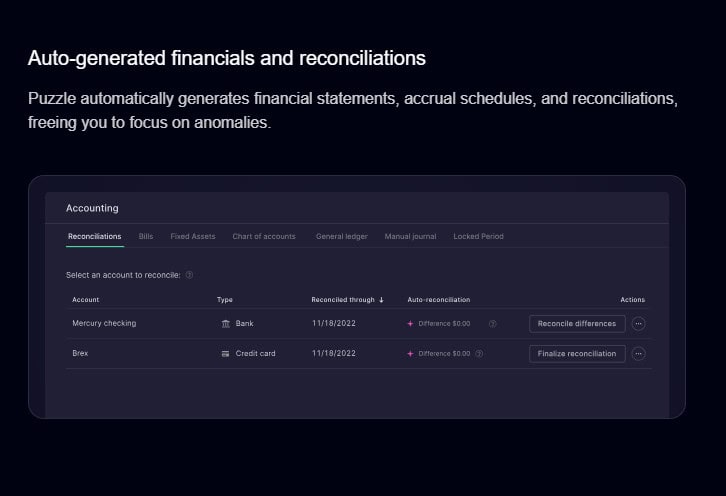

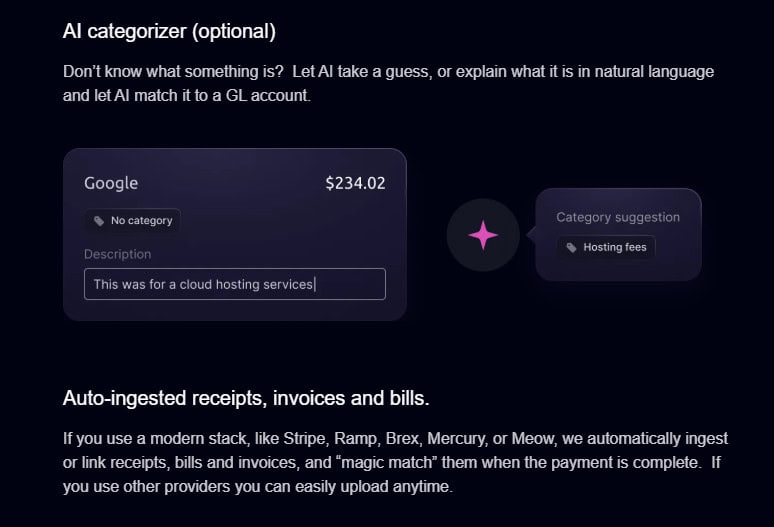

Puzzle.io: AI-Led, Ledger-First Automation

Puzzle operates more like a continuous closed platform. As soon as transactions hit your bank or corporate card, they’re ported over, analyzed, and mapped—complete with attachments, audit notes, and GL impact. This leads to Puzzle’s key strengths being:

- Reconciliations are continuous, not monthly

- Receipts auto-match to their transactions (via email or upload)

- AI flags outliers or unclassified items

- Accruals, payroll, and deferred revenue are automated

It’s not about controlling every step of the process—it’s about trusting the system to handle the rote work so you can focus on what matters. Now that’s not to say you should turn the AI loose into your ledger willy-nilly; it still needs a leash. But you can drastically cut back on labor hours by letting it do the heavy lifting.

3. Financial Reporting & Visibility

Xero: Traditional Reports + Customization

In terms of financial statements, Xero provides the basic items you’d expect to find:

- Standard P&L, balance sheet, and cash flow

- Budgeting tools

- Tracking categories (similar to departments)

- Custom reports with Excel-like formatting

For many small to midsize businesses, these reports are sufficient. However, it becomes less efficient when:

- You need consolidated entity reporting

- You want investor dashboards

- You’re running GAAP-based adjustments regularly

Most accountants end up exporting to Excel or integrating with tools like Fathom or Spotlight to create more visual or stakeholder-friendly reporting.

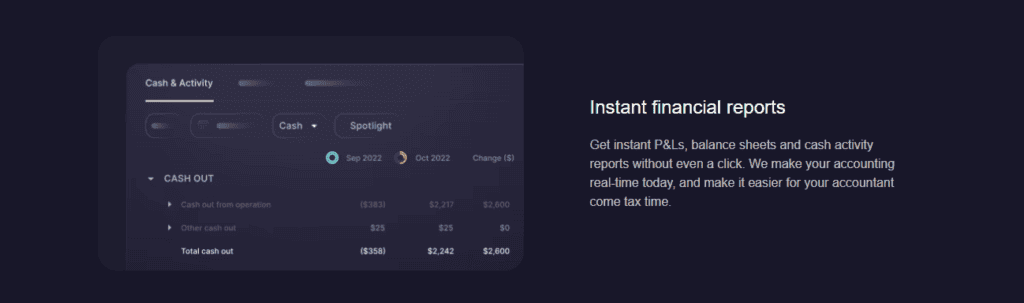

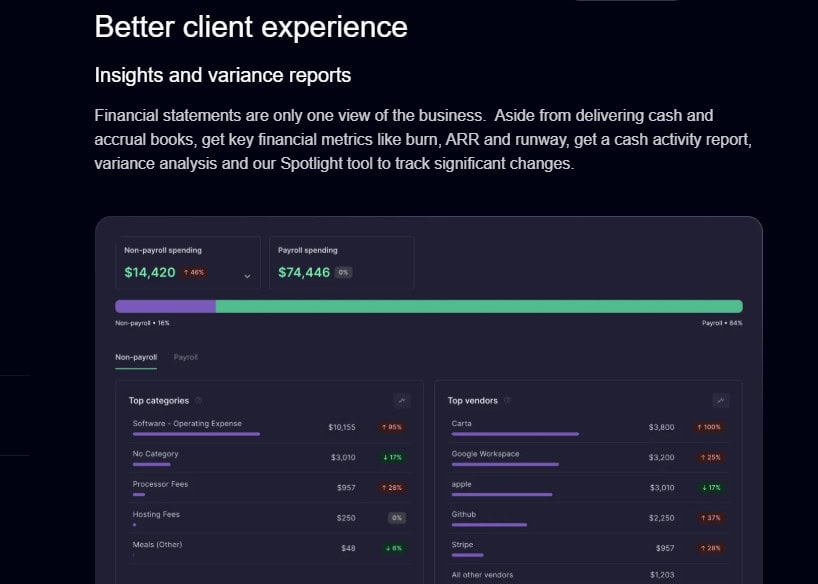

Puzzle.io: Real-Time, Audit-Grade Dashboards

Puzzle delivers live financials directly within its interface. And let me just tell you, the engineers weren’t playing around when they got with the graphic designers to bring this dashboard to life because it’s one of the most intuitive and sleek that I’ve ever worked with. You’ll see the following within Puzzle:

- Daily-updated P&L and balance sheet

- Variance analysis and visual trend reports

- Linked source documentation (i.e., see the invoice behind the number)

- Filters by department, account, or transaction type

Instead of exporting to Excel, Puzzle is built for internal collaboration and board reporting out of the box. Every number has a source, every entry has a note, and every stakeholder can see the same data with appropriate permissions.

4. Ease of Use & Learning Curve

Xero: Designed for Accountants, Friendly for Founders

Xero walks the line between power and usability well. Management can run payroll, send invoices, and view high-level dashboards. Accountants can drill into the chart of accounts, journal entries, and reconciliations.

However, the steeper learning curve shows up when setting up reporting categories, managing accruals, or trying to run scenario planning. You’ll likely need some accounting knowledge or professional guidance to fully unlock its capabilities.

Puzzle.io: Designed for Accountants, Transparent for Founders

Puzzle, on the other hand, is unapologetically built for finance teams—but executives still benefit. Management doesn’t touch the journal entries—they just log in and can see key performance indicators such as:

- Current burn

- Real-time margins

- Recent anomalies

- Supporting docs for every transaction

If you’re a numbers-first founder or working with a fractional CFO, Puzzle feels like magic. If you’re a solo operator trying to DIY your books, Xero may be more approachable, at least initially.

5. Ecosystem & Integrations

Xero: App Marketplace Heavyweight

In my opinion, one of Xero’s greatest strengths is its extensive app ecosystem. It has so many more options than Puzzle, but I’d be surprised if Puzzle stays that way in the years to come. Xero offers the following impressive report card:

- 1,000+ integrations

- Payroll (Gusto, ADP)

- Inventory (DEAR, Unleashed)

- eCommerce (Shopify, Amazon)

- Time tracking (TSheets, Harvest)

- Reporting (Fathom, Spotlight)

This modularity means you can build a custom stack. But with that flexibility comes maintenance—apps don’t always sync perfectly, and reconciliation across tools requires oversight. And those third-party apps typically aren’t free, either.

Puzzle.io: Deep, Targeted Integrations

Puzzle takes the opposite approach: instead of connecting to everything, it connects deeply to the essentials:

- Banking: Chase, SVB, etc.

- Cards: Ramp, Brex, Amex

- Payroll: Gusto, Rippling

- Revenue: Stripe, Square

- HRIS: Puzzle claims to be onboarding these into its ERP, but time will tell

Because Puzzle controls the full ingestion and classification pipeline, its integrations are more robust. Instead of syncing balances, it understands transaction context and acts accordingly. This reduces errors, latency, and manual cleanup.

6. Pricing Breakdown

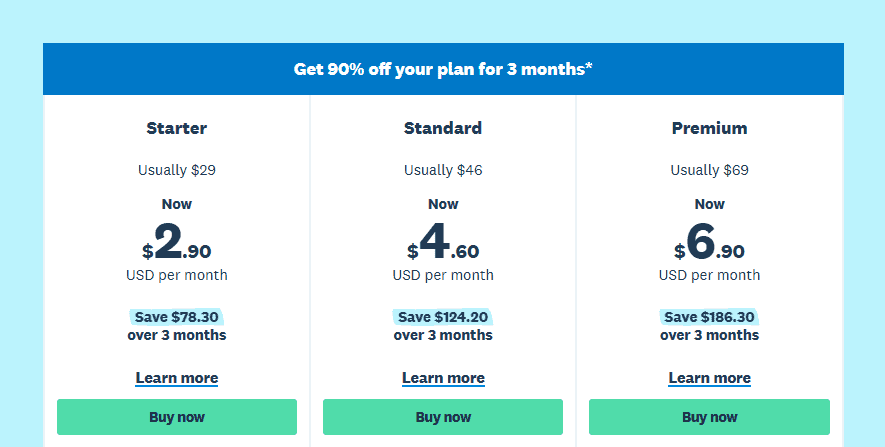

Xero uses a tiered pricing model, with the following plans:

- Early – $20/month, and you’re limited to 20 invoices and 5 bills

- Growing – $47/month, and you get unlimited invoicing, bills, and reconciliations

- Established – $78/month, and you’re entitled to multi-currency, project tracking, and expense management

- Add-ons: Payroll (via Gusto) is extra, as well as some third-party apps

Xero’s pricing is transparent, but can add up quickly as your stack grows and third-party tools become essential.

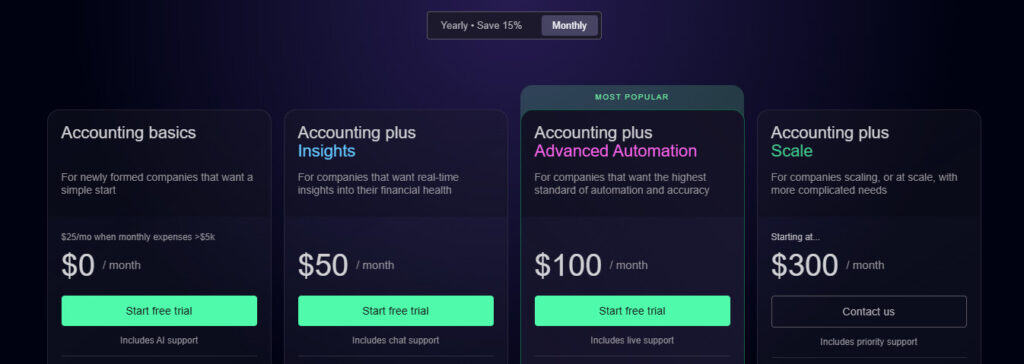

Puzzle’s model is usage-based and stage-aligned:

- Basics – Free – For early-stage startups (expenses under $5K/month) and includes basic accrual accounting, real-time reports, and audit logs

- Accounting Plus – $50/month – Includes financial insights, vendor analysis, and smart anomaly detection

- Accounting Plus Advanced Automations – $100/month – unlocks full accrual automation, revenue recognition, AI categorization, and team collaboration tools

- Accounting Plus Scale – $300/month – custom solutions for large established firms, typically, you’ll have a sales representative to help guide your team to what it needs.

Puzzle is more cost-effective early on, with far more automation baked into the mid-tier.

7. Scalability & Multi-Entity Support

Xero: Scales with Complexity—To a Point

Xero handles a surprising amount of complexity, and most small businesses should feel comfortable scaling with Xero for quite some time. Things that I have found that it has a decent grasp on are:

- Multi-currency support

- Project tracking

- Departmental tracking via “tracking categories”

- Consolidation possible—but only with third-party tools

- API access for custom integrations

I want to note that complex things such as multi-entity accounting (e.g., consolidating multiple subsidiaries) is not native, and you’ll need an external app and workarounds—fine for small operations, painful for large groups.

Puzzle.io: Built for Scalable, Venture-Backed Businesses

Puzzle isn’t just scalable—it was built with the ability to scale in mind.

- Daily financial updates—no batch reports

- Audit-grade accounting with supporting docs

- Collaboration-friendly for CFOs, founders, bookkeepers, and auditors

- This is a big one, because small businesses that grow can often find themselves hampered if they can’t onboard enough team members into their systems.

If you’re running a SaaS company with foreign subsidiaries, intercompany revenue, or investor obligations, Puzzle is closer to a lightweight ERP than an accounting platform.

8. Who Is It Really For?

Xero Is Best For:

- Established small businesses with in-house bookkeepers

- Companies needing invoicing, payroll, and time tracking in one tool

- Accounting firms serving a wide variety of industries

- Businesses that can afford to customize their tech stack via integrations

- Brick-and-mortar businesses, trades, and agencies

Puzzle.io Is Best For:

- Startups backed by VC or preparing to raise capital

- SaaS or subscription-based businesses

- Teams with finance professionals who want to close faster, with better audit trails

- Founders who want to reduce spreadsheet reliance

- Controllers seeking automated reconciliations

The Final Verdict

If you’re operating a traditional small business—think retail shops, professional services, or trades—with regular invoicing, payroll, and moderate growth ambitions, Xero is your tried-and-true option. Its robust app ecosystem, familiar workflows, and flexible reporting mean it can comfortably scale with you for quite some time, especially if you have internal or external accounting support. While its reliance on manual input and traditional reconciliations requires more oversight, businesses accustomed to or comfortable with these methods will find Xero efficient, reliable, and user-friendly.

For modern startups, particularly SaaS companies, subscription services, or businesses backed by venture capital, Puzzle.io clearly pulls ahead. It excels in real-time reporting, automated accrual accounting, and AI-driven reconciliations—perfect for businesses that prioritize rapid growth, financial transparency, and investor accountability. Puzzle’s design specifically caters to lean finance teams or fractional CFO arrangements, significantly reducing manual work and ensuring investor-grade clarity and accuracy from day one. If you’re aiming to scale rapidly, minimize spreadsheet chaos, and maintain pristine financial hygiene, Puzzle.io is the smarter strategic bet.