- Key Takeaways: The Bottom Line Up Front

- Target Market and Design Philosophy

- Ease of Use

- Core Features of Each Platform

- Automation and Intelligence

- Reporting and Insights

- Integrations Within The Platforms and Their Ecosystems

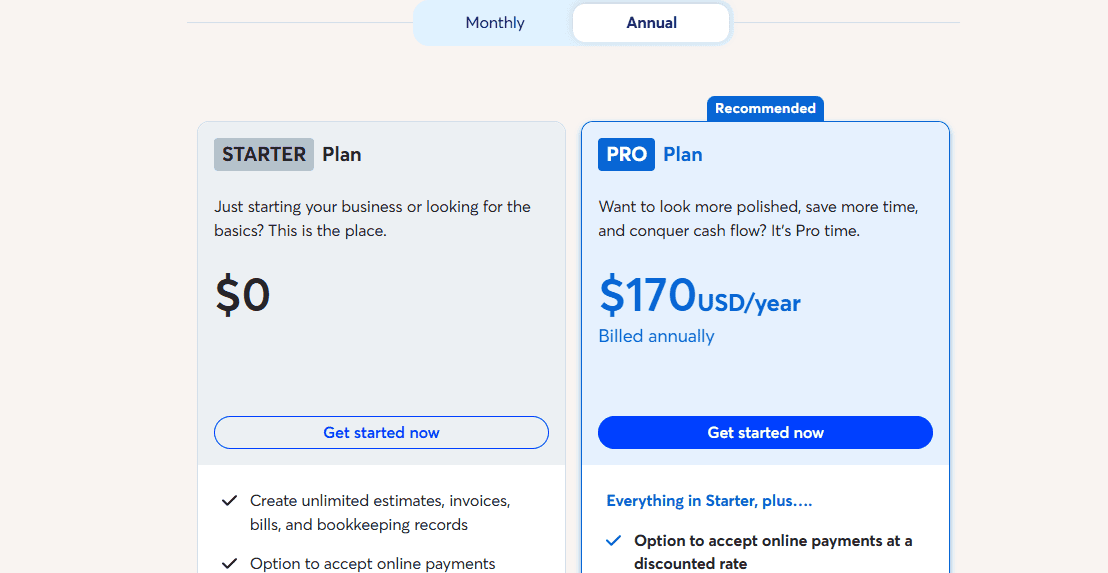

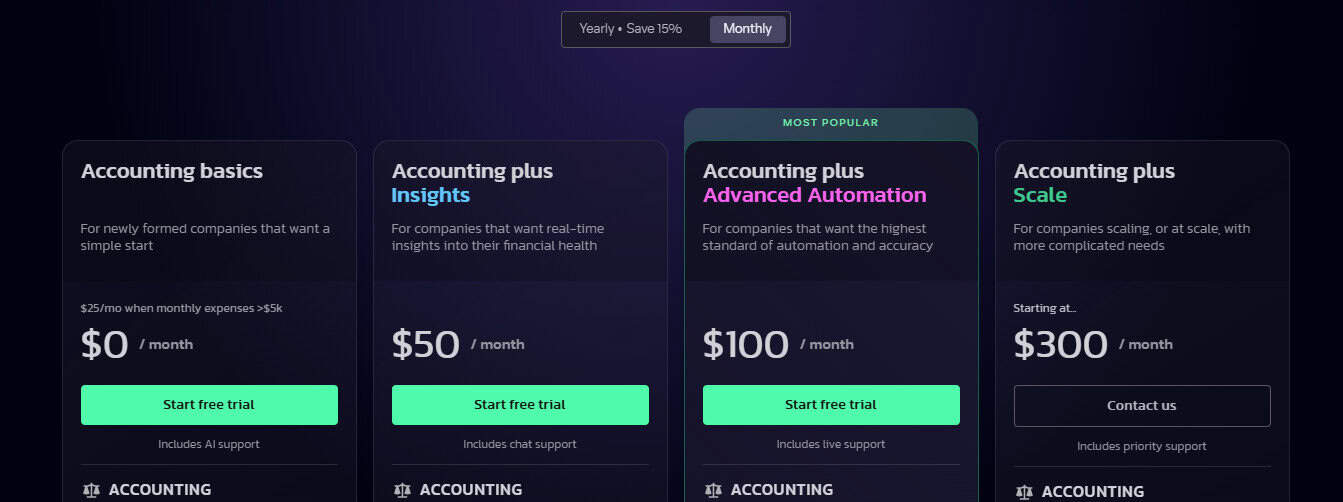

- Pricing Comparisons

- Customer Support and Onboarding

- Final Verdict: Which Should You Choose?

- Final Thoughts

Last Updated on July 4, 2025 by Ewen Finser

In the ever-evolving world of accounting software, business owners, accountants, and financial controllers are constantly on the lookout for tools that not only meet compliance needs but also simplify workflows and save time while offering deeper insights. Two platforms that serve very different user bases but are increasingly part of the same conversation are Wave and Puzzle.io.

As many in the accounting space know, Wave is a long-established favorite among freelancers, small business owners, and service-based companies. As fewer folks may know, Puzzle.io, on the other hand, is a newer, AI-centric accounting platform built with venture-backed startups and modern finance teams in mind. Each platform offers a unique philosophy on accounting—Wave focuses on usability and client-facing tools, while Puzzle.io emphasizes automation, integration, and real-time visibility.

Key Takeaways: The Bottom Line Up Front

In my time as a CPA, using many different softwares, I’ve come to the conclusion that Wave and Puzzle.io serve very different audiences. They both excel as accounting platforms, but you’ll experience more success if you tailor the platform you use to what your business needs are. Wave is ideal for freelancers and small service-based businesses seeking simplicity, intuitive invoicing, and client management, while Puzzle.io is built for fast-growth startups needing real-time, GAAP-compliant financials, automation, and audit-ready reporting. If you’re a solo professional or small team, Wave is quite literally made just for you. But if you’re scaling fast and need serious financial visibility and controls, Puzzle.io is the smarter long-term play.

Target Market and Design Philosophy

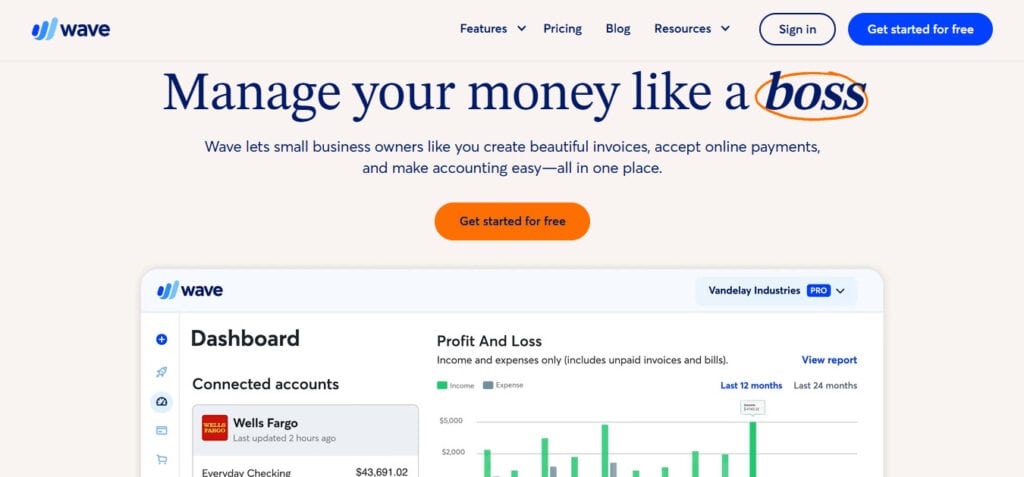

Wave:

Wave has always been targeted at freelancers, solopreneurs, and small service-based businesses. It caters especially well to professionals like designers, consultants, photographers, and coaches who don’t necessarily have an accounting background but need an intuitive tool to send invoices, track time, and get paid. I always liken it to people who just want to get their toes wet, and not people who want to dive in head first into a potentially expensive commitment.

The interface is clean, approachable, and user-centric. It avoids accounting jargon in favor of plain language, which is part of why it’s long been a favorite for users who just want to “get the books done” without diving into debits and credits.

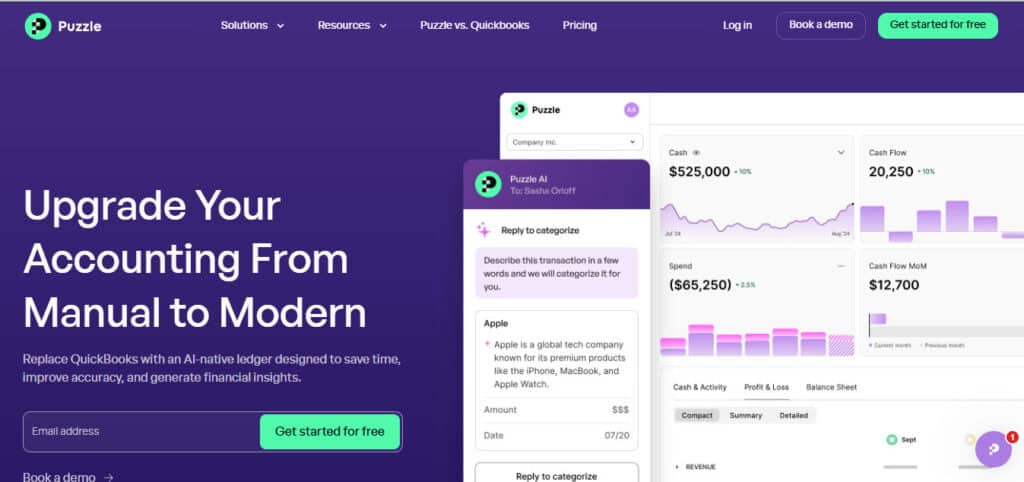

Puzzle.io:

Puzzle.io, on the other hand, is squarely aimed at early-stage to mid-sized tech startups and high-growth companies that expect to scale. It’s built for controllers, CFOs, and founders who want real-time financial data, audit-readiness, and automatic accrual-based accounting out of the box.

Puzzle is cloud-native, API-driven, and engineered for businesses that want to plug into their financial stack (banks, payroll, Stripe, HRIS, etc.) and see clean, GAAP-compliant books almost instantly.

Ease of Use

Wave:

Wave is known for being one of the most user-friendly accounting platforms on the market. Its dashboard is intuitive, navigation is smooth, and its core features—like invoicing, expense tracking, and time tracking—are accessible even to complete novices.

It’s optimized for mobile use as well, with an easy-to-navigate mobile app that lets you invoice or track expenses on the go.

Puzzle.io:

Puzzle is also user-friendly—but in a different way. Its ease of use comes from automation and intelligent suggestions rather than drag-and-drop simplicity. Once integrations are set up, transactions flow in automatically, are categorized using AI, and reconciled in real time. It’s seamless, and almost too smooth to believe until you see it in action.

However, because it uses more advanced concepts like auto-accruals, deep inventory management, audit trails, contra account creations, etc., new users without an accounting background might face a steeper learning curve.

Core Features of Each Platform

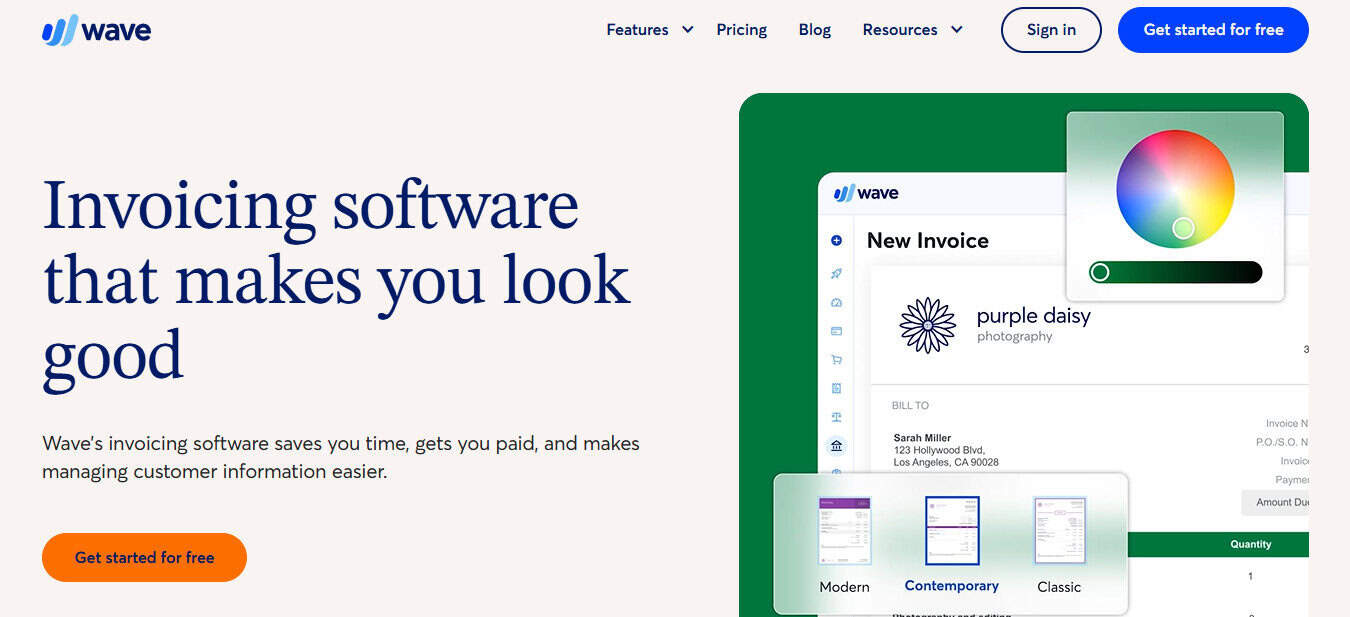

Wave’s Core Features:

Wave offers a host of features, but at its core, it offers what a standard accounting platform would offer, so none of these should come as a surprise:

- Invoicing (customizable and recurring)

- Time tracking

- Expense tracking (manual and via bank feeds)

- Estimates and proposals

- Payment integration (Stripe, PayPal)

- Double-entry accounting

- Basic reporting (P&L, balance sheet)

Wave also includes client portals and project-based billing features, making it excellent for client-facing work, but these options are going to require a higher tier plan (costs more).

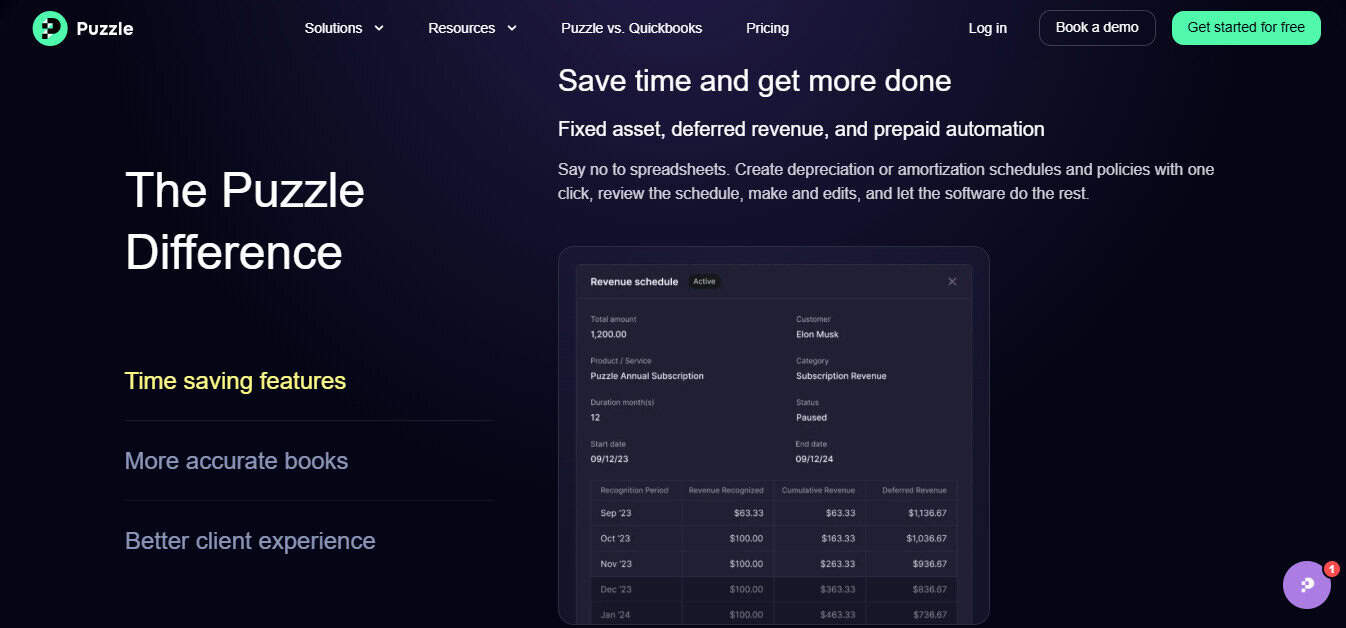

Puzzle’s Core Features:

On the other hand, Puzzle is going to offer many more advanced features, because in my opinion, it’s a much more technical and advanced platform. Out of the box, you can expect the following:

- Real-time accrual accounting (auto-accruals)

- Continuous close and real-time GL

- Bank, payroll, and Stripe integrations

- AI-driven transaction categorization

- GAAP-compliant financials

- Investor-ready reporting (SaaS metrics, burn rate, runway)

- Full audit trails

- SOC 2-compliant data handling

Puzzle is engineered to be your source of financial facts, giving controllers and CFOs visibility into cash and accrual views without needing to plug manual things into Excel or doing recalculations.

Automation and Intelligence

Wave:

Wave does not excel in terms of automation, but does offer some light automation, such as:

- Recurring invoices

- Late payment reminders

- Expense categorization rules

- Basic reporting automation

While helpful, these automations are more about convenience than intelligence. You still have to manually close books, categorize many transactions, and handle bank reconciliations at month-end. In my experience, the simplicity of this system can cost time, which in the long run can cost money and cause frustration if you’re a more experienced accountant looking to move quickly without training wheels.

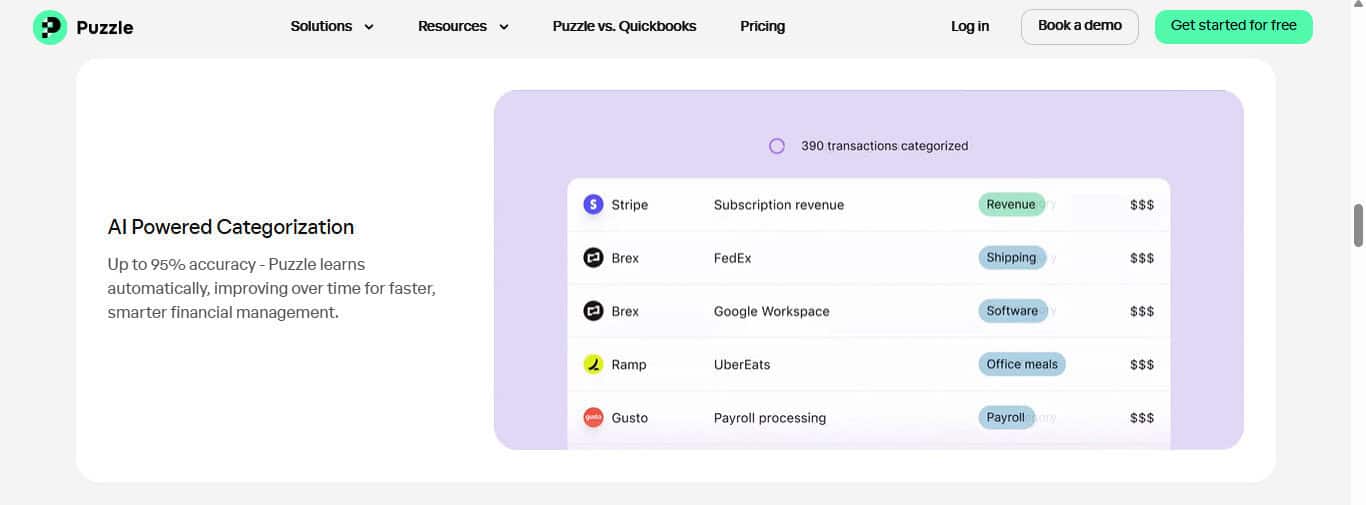

Puzzle.io:

Puzzle’s automation is its main selling point. It’s built on an AI-first architecture that allows for:

- Continuous close (automated month-end to an extent)

- Automatic revenue recognition

- Multi-entity consolidation

- Real-time sync from external systems

- Advanced transaction rules powered by AI

I always advise my clients to keep their AI and integrations “on a leash”, so to speak. Many of the above-mentioned features are wonderful, but if you’re not actively monitoring and watching, the AI and rule automations can cause a massive headache to clean up if something is being booked incorrectly for months at a time. I preach to my clients and practice this myself, but it’s imperative to closely monitor monthly reports to ensure all transactions ultimately end up booked where you’d expect.

However, it effectively eliminates many of the repetitive manual tasks controllers typically face, and it’s built to scale with volume, handling thousands of transactions with minimal friction.

Reporting and Insights

Wave:

The reporting suite in Wave is basic but useful. You’ll find:

- Profit and Loss

- Balance Sheet

- Sales Tax Summary Reports

- Invoice Details

- Time Tracking Reports

These are easy to generate but not customizable beyond the basics. There’s limited drill-down capability or dimension-based reporting.

Puzzle.io:

Puzzle, on the other hand, was designed for real-time multidimensional financial reporting and includes:

- Custom P&L by department, location, or product

- Burn rate and runway tracking

- SaaS metrics (MRR, ARR, churn)

- Audit-ready financials

- Accrual vs. cash toggles

- Consolidation across entities or subsidiaries

Puzzle gives finance leaders the tools to drive strategy, not just compliance. Additionally, if you’re a professional finance or accountant, you can download any report you need, and relatively quickly combine reports, which unlocks unlimited possibilities.

Integrations Within The Platforms and Their Ecosystems

Wave:

Wave connects to a wide range of third-party apps, including:

- Stripe

- PayPal

- Gusto (for payroll)

- Shopify

- Square

- HubSpot

- Trello, Asana, Slack

The integrations are focused on streamlining client work, payments, and project management.

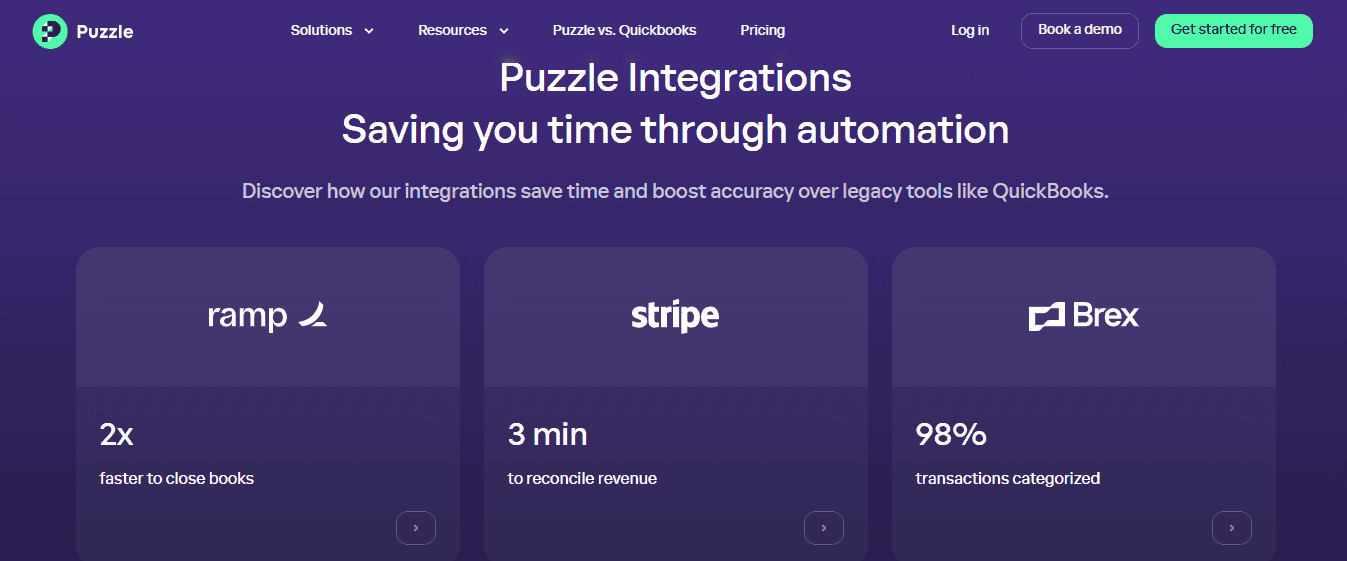

Puzzle:

In my opinion, Puzzle does not integrate with nearly as many platforms, just because it’s still new and updates are being pushed out. However, one thing that Puzzle has going for it is that it integrates with Plaid, which does allow many banks to be linked, so you can take advantage of Puzzle’s AI platforms. Puzzle also integrates tightly with:

- Banks and credit cards (via Plaid, as previously noted)

- Payroll systems (Gusto, Rippling, Justworks)

- Stripe and other revenue processors

- HRIS systems

- Carta (cap table management)

- ERP tools (for scaling companies)

Puzzle’s integrations are designed for finance stack consolidation and data integrity that interacts closely with the systems AI.

Pricing Comparisons

Wave:

Part of the reason I love talking about Wave is that it offers a freemium version of its platform. There just aren’t many useful things you can get for free nowadays, but Wave is the exception. If you need more options, you can opt into their Pro Plan, which is $16.00 and allows you to accept online payments, auto-import bank transactions, and categorize transactions automatically, among other things.

Puzzle.io:

Puzzle is free to get started — that’s a core part of their strategy. Their “Free Forever” plan includes core features, integrations, and accrual-based accounting for startups that want robust GAAP-compliant books without upfront cost.

Once you scale or want deeper functionality (like multi-entity consolidation, enterprise-level audit support, or advanced analytics), Puzzle moves to their Accounting Insights or Advanced Automation plans, which are $50 and $100 per month, respectively. If your business needs custom solutions, Puzzle also offers Scalable pricing, which isn’t publicly listed, but anecdotal data suggests it’s aligned with other finance tools which start at $300 per month.

Customer Support and Onboarding

Wave:

Wave offers:

- Phone and email support (with high customer satisfaction ratings)

- A detailed help center

- In-app guides and tooltips

- Live chat on higher tiers

In my experience, good customer service is the gift that keeps on giving. Wave’s support team is known for being approachable, fast, and clear, which reflects its user-friendly branding. It’s not accounting advice per se, but for basic issues, it’s more than adequate.

Puzzle.io:

Puzzle.io’s support is tailored to finance professionals. Support options include:

- Guided onboarding for new companies

- Dedicated account reps for scaling companies

- A growing knowledge base (as the platform becomes more mature, problems and questions will ultimately be posted online via forums)

Because Puzzle is often used by CFOs and controllers who need GAAP-level accuracy, the support team is more technical in nature, often staffed by folks who have more of a finance or accounting background.

Final Verdict: Which Should You Choose?

The decision between Wave and Puzzle.io depends heavily on what kind of business you run and who’s managing the books.

Use Wave If You Are… | Use Puzzle.io If You Are… |

A freelancer or solo professional | A startup founder, CFO, or controller |

Running a small service business | Running a venture-backed or tech startup |

Focused on client billing and time tracking | Focused on investor reporting, runway, or burn |

Need an easy, non-technical solution | Want an AI-powered, audit-ready accounting platform |

Not interested in deep accrual accounting | Need accruals, revenue recognition, or real-time GAAP |

Wave is tried, tested, and well-loved for good reason—it just works for the typical freelancer or micro-business. But for those scaling into high-growth territory, juggling tough reporting requirements, or closing books monthly with precision, Puzzle.io provides unparalleled automation, intelligence, and visibility.

Final Thoughts

Wave and Puzzle.io represent two sides of the same coin: one focuses on simplicity and billing; the other on automation and scale. They don’t so much compete as complement different stages of business evolution.

A solo consultant might live in Wave for years, while a fast-growing SaaS startup might use Puzzle.io from Seed stage through going public. Choosing the right tool is about finding the one that makes your finances not just manageable, but valuable to your business decisions.