- The Bottom Line, Up Front

- How To Pick Your Platform

- 1) Puzzle.io - Best for Modern, Automation First Record Keeping

- 2) Pilot – Best Done For You Option

- 3) QuickBooks Online – Best for Ecosystem and Its Ubiquity

- 4) Xero - Best for Clean UX and International Firms

- 5) FreshBooks – Best for Solo and Small Entrepreneurs

- My Thoughts On Each Platform

- My Migration Playbook

- What replaced Bench’s “software + team” combo?

- My bottom line

Last Updated on September 29, 2025 by Ewen Finser

Bench’s sudden shutdown left a lot of small businesses without access to their accounting and tax files right at year-end. If you were one of them, you’re not imagining it. Bench did close operations on December 27, 2024, and was acquired days later. As is typical after a buyout, many layoffs, cuts, and transitions immediately followed.

That disruption created two urgent jobs for owners and controllers:

- get your historical records secured, like, immediately

- stand up a stable, auditable system for 2025 and beyond.

Below are five viable platforms I’ve used or evaluated hands-on: Puzzle.io, Pilot, QuickBooks Online, Xero, and FreshBooks. Each can replace the core bookkeeping that many relied on Bench to do. They differ on automation, guidance, and how much “done-for-you” help you’ll get. I’ll explain where each one fits, what to watch for, and how I’d make the call.

The Bottom Line, Up Front

If you’re moving off Bench, pick a tool that keeps your books clean and your close fast. Puzzle.io is my first choice for most small teams because it automates the grunt work and keeps an audit-ready trail. If you want a provider to “do it for you,” choose Pilot. Need the safest, most supported general ledger? QuickBooks Online. Prefer a clean UI and better multi-currency? Xero. Running a solo service shop and just need invoicing and basics? FreshBooks. Secure your old Bench files, set a clean cutover date, and run one pilot month to confirm every reconciliation before you scale.

How To Pick Your Platform

Use this short list to narrow options fast:

- Complexity of revenue and COGS. Subscriptions, milestones, inventory, and job costing push you toward deeper GL control and workflows.

- Who’s doing the work. Do you want software you/your staff operate, or a service that handles the books for you?

- Close speed and audit trail. If you face investors, lenders, or audits, you need clean, reproducible journals and month-end discipline.

- Integrations. Banks, payroll, commerce, and billing systems should connect without brittle CSV shuffling.

- Budget and control. Decide what you’ll own in-house versus what you’ll pay a provider to do.

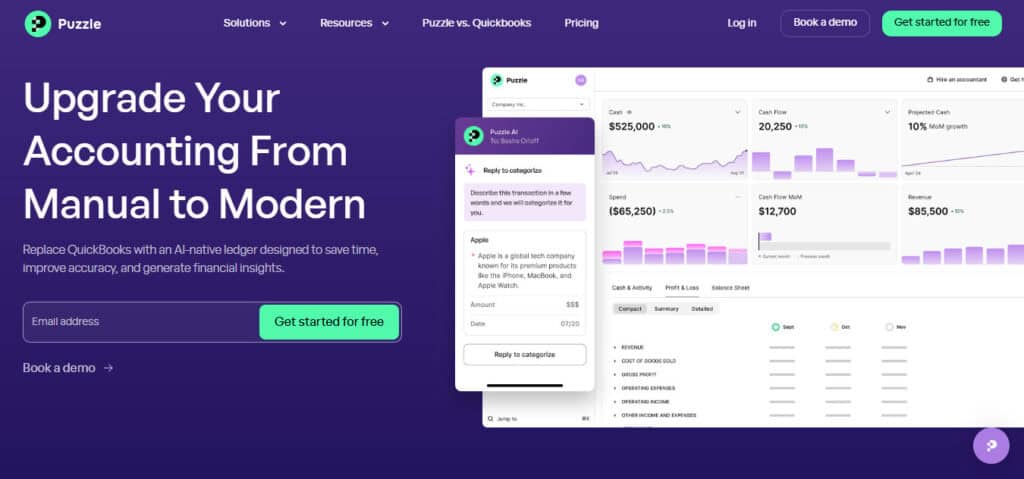

1) Puzzle.io – Best for Modern, Automation First Record Keeping

Puzzle.io is accounting software built for today’s data stack. The setup pulls data directly from your business systems and gives you real-time financials with an emphasis on automation and an audit-ready ledger. In practice, I see Puzzle reduce manual entry, surface mismatches early, and shorten the month-end close. If you have a lean team (or you are the team), that matters because it saves you time and headaches.

Where It Shines:

- Data input and reconciliations. Bank feeds and system connections map into the GL with fewer manual edits.

- Close discipline. Built-in workflows keep the team moving so you don’t need a separate checklist tool (I feel like this is so uncommon and it’s such a no brainer – integrated close checklists are awesome!)

- Controller-friendly. Clear entries, drill-downs, and posting logic make reviews faster.

- Scaling from DIY to firm-supported. You can start self-serve and later loop in an external CPA or a team without changing tools.

Watch-outs: If you want a fully managed bookkeeping service (humans doing the monthly processing end-to-end), you’ll either run Puzzle in-house or pair it with a firm. The upside is you keep ownership and visibility while still getting automation.

Best fit: Founders and controllers who care about speed, control, and audit-ready books, and who prefer software that does more of the work for them.

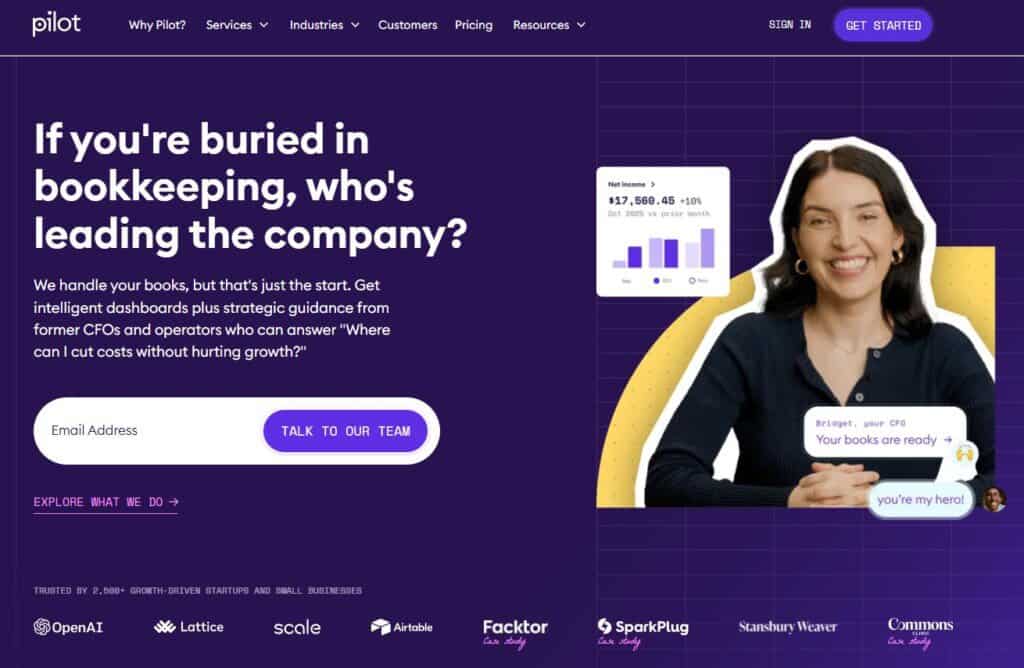

2) Pilot – Best Done For You Option

Pilot delivers bookkeeping, tax, and advisory as a service. In my experience, Pilot is a good match if you want a single vendor to handle the monthly grind and prep tax-ready financials. You’ll interact with software for status and reporting, but Pilot’s team is doing the entries and reconciliations. That division of labor is the draw to most businesses who are too busy or too young to worry about in house financials.

Where it works well:

- Time-strapped founders. You get clean basics such as cash, revenue, expenses without having to build an internal function.

- Tax bundling. Coordination between bookkeeping and tax prep can cut handoffs.

- Simple to moderately complex operations. If your chart isn’t exotic, Pilot keeps pace.

Watch-outs: Pricing scales with transaction volume/expenses. For fast-growing companies, that can add up; always model your next 12 months before committing.

Best fit: Owners who want a reliable, outsourced bookkeeping + tax combo and are fine living inside a provider’s process.

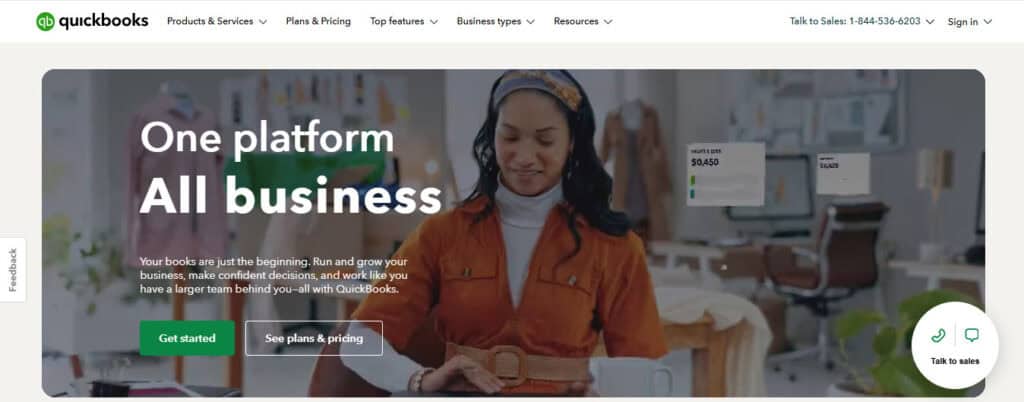

3) QuickBooks Online – Best for Ecosystem and Its Ubiquity

QuickBooks Online (QBO) is still the default small-business GL in the U.S. The advantage is the ecosystem: nearly every bank, app, and accountant supports it. Intuit has also been shipping AI-assisted features lately that speed up routine tasks and give better reporting context. If you need to hire staff or a local bookkeeper, QBO talent is everywhere (it’s me, I’m the QBO talent…begrudgingly).

Where it’s strong:

- Breadth of features. Invoicing, bills, inventory, projects, payroll add-ons, and most other things are covered by Intuit’s robust platform.

- Practice tools for firms. If you have an outside accountant, QBOA provides client and workflow management.

- Integrations. Payment processors, POS, commerce, and expense tools connect with minimal fuss.

Watch-outs: Feature sprawl can tempt teams to “toggle around” without building a consistent close process. You still need rules, cutoff discipline, and documented reconciliations. Also, QBO’s flexibility means two people can solve the same accounting problem in different ways. It’s a great power to have, but make sure to keep things consistent.

Best fit: Teams that value a familiar system, broad app support, and easy access to experienced bookkeepers.

4) Xero – Best for Clean UX and International Firms

Xero offers a clear, modern interface and solid bank feeds, with strong adoption in the U.K., Australia, and growing U.S. use. I like Xero for straightforward service businesses and multi-currency needs where simplicity and clean reporting are top priorities. If you’ve tried QuickBooks and felt boxed in by the UI, Xero’s approach may feel lighter. (And yes, it’s spelled Xero, not “Zero.”).

Where it’s strong:

- Bank reconciliation and daily hygiene. The matching flow is fast, and you can set tons of rules to help streamline recons.

- Multi-currency. Better than many SMB tools at handling FX basics.

- App marketplace. Solid options for AR, AP, and reporting.

Watch-outs: In the U.S., accountant availability skews toward QuickBooks. If you switch to Xero, confirm your CPA and bookkeeper are fluent before you commit.

Best fit: Owners who prize clarity, tidy bank recs, and global-friendly features…and who have a Xero-savvy accountant.

5) FreshBooks – Best for Solo and Small Entrepreneurs

FreshBooks is simple and serviceable for freelancers and very small teams. It handles invoicing, basic expense tracking, time capture, and light reporting with an approachable design and often-discounted pricing. For a contractor or creative shop with modest needs, it’s plenty. I find it unfairly overlooked in lieu of QBO, and that’s just not right in my opinion because it’s a great platform for reasonable cost!

Where it’s strong:

- Invoicing and time. Creating and sending invoices, tracking time, and getting paid are fast.

- Low lift. Minimal setup and a short learning curve.

- User Interface: The UX is extremely easy to follow without being overwhelming.

Watch-outs: When you grow into inventory, more complex revenue rules, or departmental reporting, you’ll hit the ceiling. Plan for a future migration if that’s on your roadmap. It’s great if you just want a sidehustle, though.

Best fit: Freelancers and small service businesses that want quick invoicing and simple books over deep GL control.

My Thoughts On Each Platform

We’ve talked about how each platform stacks up against one another, but what’s it actually like to sit in the driver seat?

Puzzle: How it Feels Day to Day

My first test with Puzzle is always the bank and system connections. The platform pulls data quickly, classifies with rules, and keeps a clear trail of what is posted and why. That audit trail is what lets me sign off on monthly statements quickly. I also like that I can keep the process in-house or pair Puzzle with an external firm later, and that I’m not locked into a vendor. For teams that care about a fast, documented close, Puzzle aligns with how controllers think.

Pilot: The Managed Route

Pilot is for leaders who don’t want to hire and train an internal bookkeeping team. You’ll get a consistent month-end package, and if you bundle tax work, handoffs are smooth. The key is to size pricing honestly against your expected transaction volume for the year; the cost curve can steepen as you scale. If that trade-off saves you a hire (or your nights/weekends), it still pencils out.

QuickBooks Online: The Default

QBO gives you almost everything you need for standard SMB accounting plus a crowded marketplace of add-ons. Intuit’s recent AI work is meaningful, even though I hate to admit it. It reduces clicks and makes searches and corrections faster. If you ever need to add staff or swap firms, there’s no shortage of QBO pros. Use role-based permissions, lock closed periods, and document posting rules to avoid the “anything goes” problem.

Xero: Clarity For International Folks

Xero’s bank rec experience is clean, and multi-currency support is strong for a tool at this tier. U.S. talent is improving but still trails QBO. If your CPA is Xero-fluent (many are), the day-to-day is smooth. Try a month of parallel books if you’re switching from QBO to validate reports match.

FreshBooks: Keep It Simple

For solo operators and small agencies, FreshBooks gets you paid and keeps basic records without overhead. You’ll outgrow it if you add inventory, complex revenue, or departments, but that’s an okay trade-off to start. Price promos are common, and the UI is friendly.

My Migration Playbook

Alright, let’s break the flow of the article for a minute. I want to preempt this paragraph by saying I advise to avoid migrations if at all possible. The reason for this is that migrations are risky, expensive, and time consuming. The risk of data loss is real, the costs are astronomical, and learning a new system is a drag. When Bench went dark, I helped onboard a few clients so we could stabilize them fast. This is the checklist I follow so the new system starts strong:

- Secure your legacy data. Grab bank statements, tax workpapers, and any exports of the general ledger, AR/AP, and trial balance. If you still have a data-download window from the legacy software provider, make sure to download anything you can.

- Rebuild bank connections and payroll feeds. Don’t re-key if you can avoid it, connect your banks and processors directly in your new platform. QBO/Xero do this natively; Puzzle auto-connects during setup; Pilot will set up connections for you.

- Define your chart of accounts (COA). Keep it simple: revenue lines that match how you sell, COGS lines that match how you deliver, and operating expenses grouped for decision-making.

- Write the close checklist. List every reconciliation (banks, credit cards, loans, deferred revenue, sales tax, inventory), who owns it, and due dates. Lock it every month.

- Document revenue recognition. Spell out when you book revenue, how you handle refunds/credits, and how you amortize prepayments or subscriptions.

- Open balances and cutover date. Choose a clean cutover (e.g., January 1) and bring in reconciled opening balances.

- Pilot month. Run the first month end to end. Inspect every reconciliation and journal entry. Fix now, not in Q4.

Do these steps and any of the five options above will carry you to victory in the arena that is small business accounting.

What replaced Bench’s “software + team” combo?

Many chose Bench because it felt like software that took work off your plate. If you liked that model:

- Closest match on service: Pilot.

- Closest match on software automation with firm-friendly design: Puzzle.io.

- Most flexible for in-house + local bookkeeper: QuickBooks Online or Xero.

That’s the fork in the road: do you want to own the books with strong software support, or do you want a provider to handle them? There’s no wrong answer, only a bad fit for your stage.

My bottom line

If I had to pick one platform for most small businesses and lean finance teams today, I’d choose Puzzle for its automation, audit trail, and controller-friendly workflows. It lets you keep control without drowning in manual tasks. Pilot is my go-to when a founder wants to outsource monthly bookkeeping and tax prep to a single accountable provider. QuickBooks Online is the safe generalist with the largest bench of talent and integrations. Xero is a clean, global-friendly alternative with a strong reconciliation flow. FreshBooks is a fine starting point for solos who need simple invoicing and basic accounting.

And if you were impacted by Bench’s shutdown, stabilize first: secure your data, pick your cutover date, and run a clean pilot month. With the right setup, you’ll be in better shape than you were before the disruption.