Last Updated on July 21, 2025 by Ewen Finser

If you’ve ever tried to manage business payments without a dedicated finance team, you know that it’s more often than not a massive headache. Luckily, emerging tech solutions have made it much easier to manage financial inflows and outflows efficiently.

Airbase is one such solution. It’s primarily an expense management tool, and it’s especially well-known for its corporate card offering, but it caters to accounts receivable requirements as well.

I’ve run into Airbase a lot as a freelancer. I don’t hate it, but I’ve come to the conclusion that there are better options for a lot of teams. The right choice will depend heavily on your own payment flows; how frequent they are, how complex your expense management is, and whether there’s an international component to consider.

I’ve looked at the main Airbase competitors here and made some recommendations for you to consider.

Bottom Line Up Front

If you’re looking for a robust expense management solution over everything else, you could do a lot worse than Airbase. I’m especially keen on its corporate card system (for those teams that need it). However, there are other tools that offer a broader suite of functions or that offer different specializations that may be more suitable for your team.

Melio is my top recommendation for small businesses, particularly those in need of a robust solution for both accounts payable and accounts receivable. Ramp, Stampli, and Tipalti also have unique selling points that may appeal to you, depending on your circumstances.

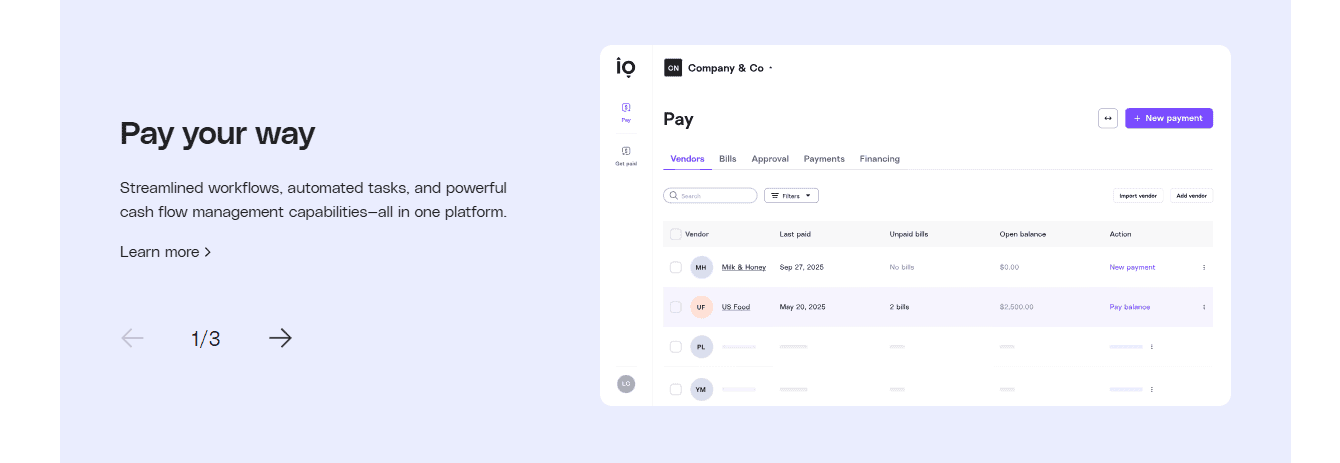

1. Melio (Pick of the Bunch for Small Businesses)

As a freelancer, I have a soft spot for any platform designed and marketed with small operations in mind. That’s not the only reason I recommend Melio, but it is an important one; many of the other platforms in this space are too feature-heavy (or too expensive) for smaller operations.

Melio does the basics impeccably and comes in at a reasonable price point. While its free plan is too lightweight for most businesses, its entry-level paid offering (Core, starting at $25 per month) offers many of its most useful features, including:

- Syncing with QuickBooks and Xero (hugely significant if you’re already using one of these).

- Batch payments.

- W-9 collection and 1099 automation.

- The option to pay any bill by card, regardless of vendor A/R systems (this actually comes with the free version as well). This is incredibly handy when you come across vendors who, for some mind-boggling reason, still prefer to take payment by check. Trust me, these companies exist.

I’m especially impressed by Melio’s zero‑cost ACH payment system. Unlike other providers, Melio does not charge monthly or per-transaction fees for standard ACH usage (although you will have to pay per-transaction fees if you go over certain limits on the lower subscription tiers).

I would say Melio’s feature set is more basic than what you’ll find on the likes of Airbase—it lacks in-depth invoice approval workflows and receipt capture, and its expense reporting is more basic than that of other tools. However, unless you actually need features like these, there’s no point shelling out for them.

Melio vs Airbase: Melio is the winner for most businesses, though it’s not as robust as Airbase.

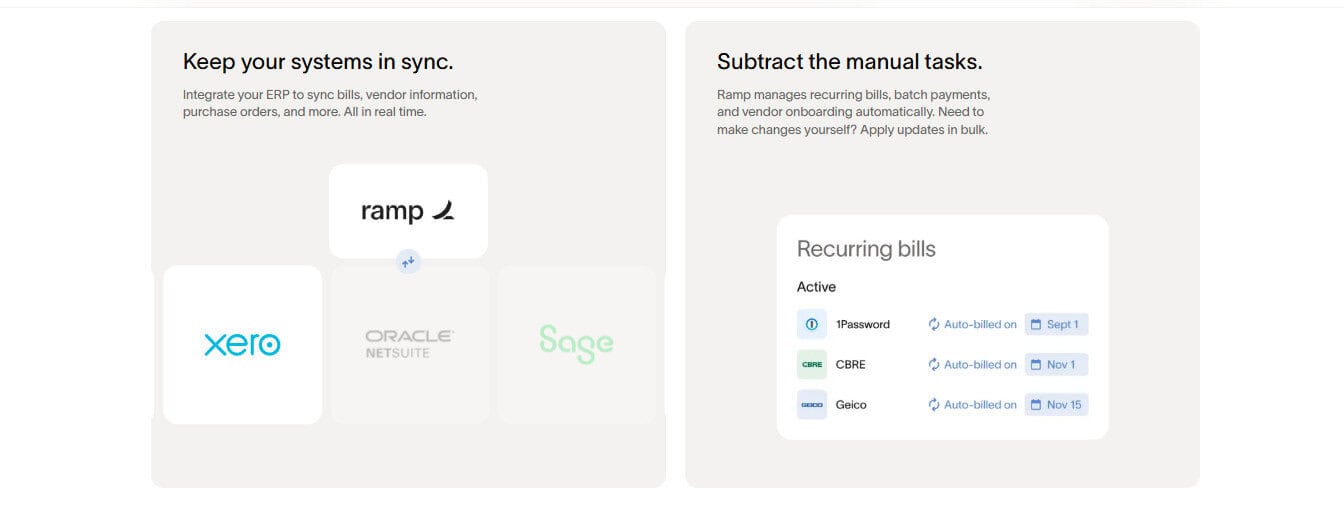

2. Ramp (Comprehensive Automation and Spend Insights)

If you don’t need an accounts receivable tool, there’s a lot to like about Ramp.

Like Airbase, Ramp is best known for its sophisticated corporate card offering. This encompasses both physical and virtual cards, and makes life a lot easier if you have team members that run up a lot of different expenses while out of the office. Setting up new cards is very straightforward, even if you’re not tech-savvy.

Ramp’s robust feature set is another big selling point. Its AI-driven savings suggestions and insights into recurring expenses are genuinely helpful (not something you can always say about AI features).

Ramp’s biggest drawback, as I mentioned at the start, is its failure to provide for accounts receivable requirements. Sure, you can always look elsewhere for an A/R tool, but the fact that so many competitors offer both A/R and A/P in an integrated platform means that this is a big incentive to look elsewhere. I’ll personally be keeping a close eye on Ramp over the coming years to see whether it branches into accounts receivable or doubles down on spend management.

Another major disadvantage of Ramp is its demanding onboarding process. The company has minimum revenue and funding requirements in place to manage credit risk; this might be a sensible practice, but it makes the overall experience a lot less accessible. Despite offering a similar service, Airbase doesn’t make life anywhere near as difficult in this respect.

Ramp vs. Airbase: Airbase’s lower barrier to entry hands it the win here in my book, but a lot of users might choose Ramp for its AI features.

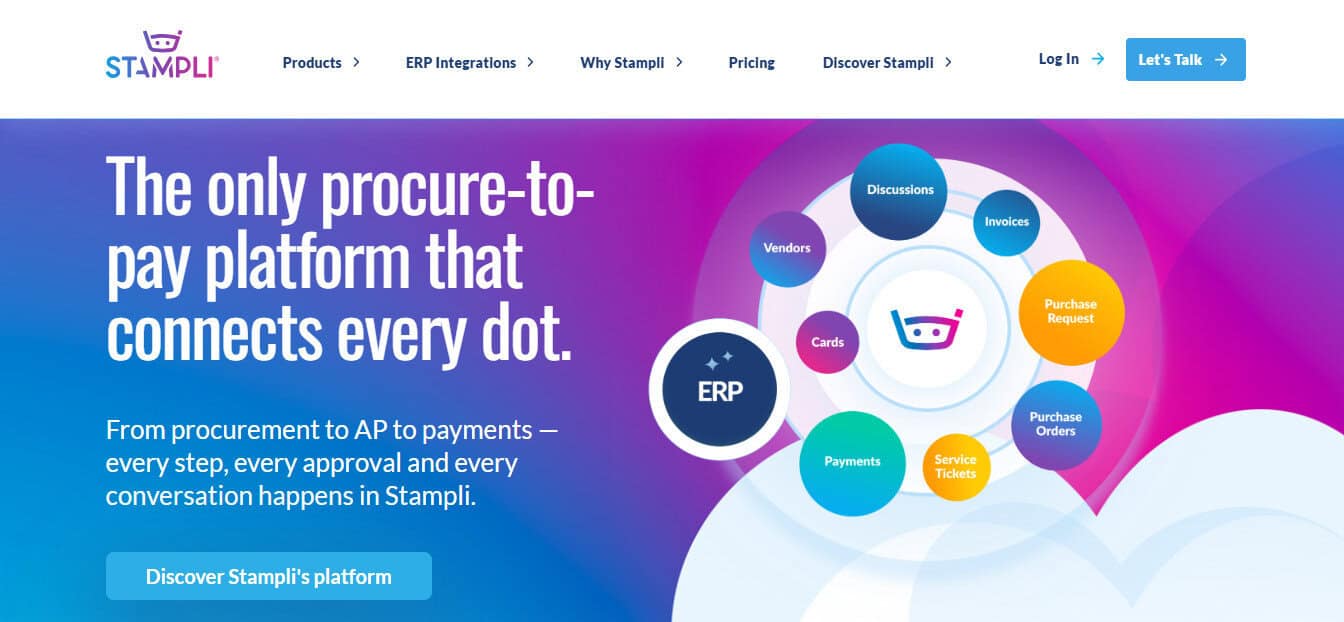

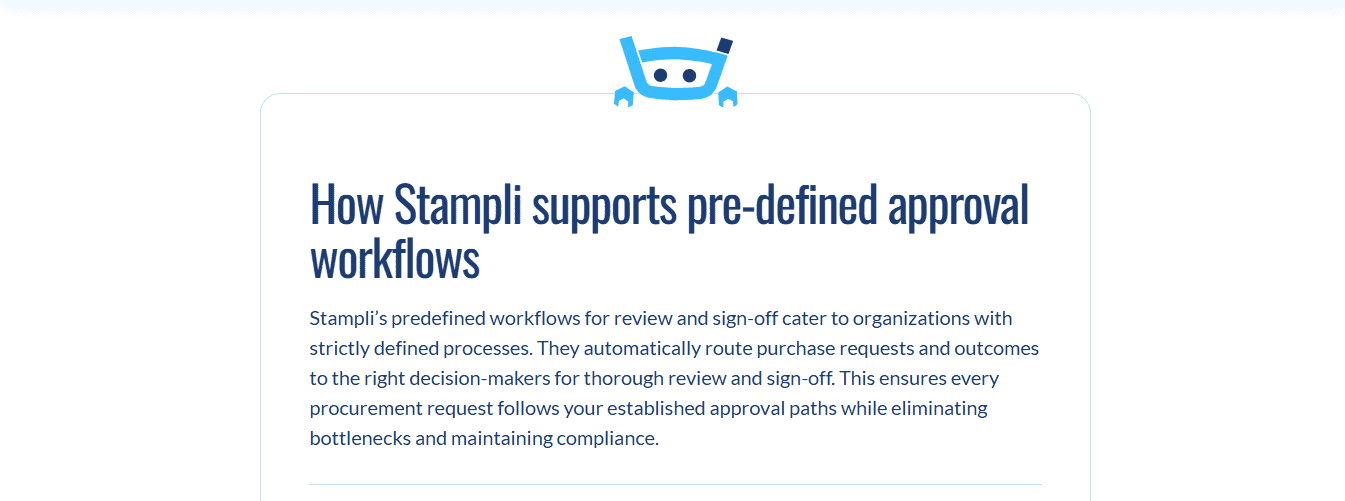

3. Stampli (Invoice Automation Specialist)

Manual invoice processing has made me want to frisbee my MacBook more than once, so I had to give Stampli a nod here. If your operation is invoice-heavy, it’s definitely worth looking at.

Stampli excels at PO matching, automated data extraction, and resolving invoice discrepancies directly within the platform. The user interface is well-structured and designed specifically to streamline approval processes and improve collaboration across teams.

Stampli vs. Airbase: If invoice handling is your biggest pain point, go with Stampli. If you’d benefit more from a rounded payment platform, pick Airbase.

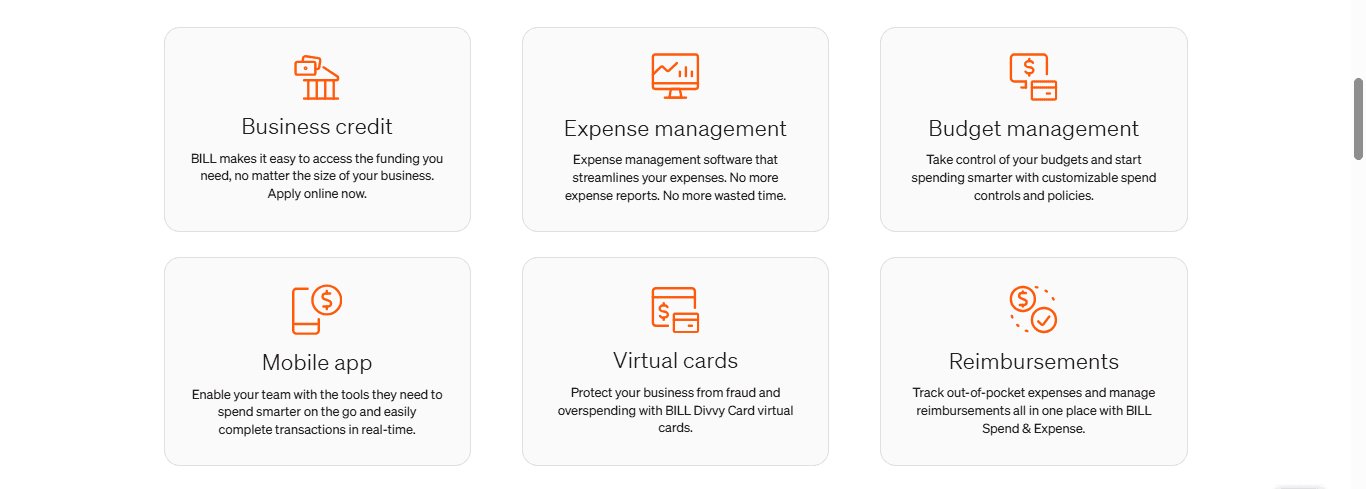

4. BILL Spend & Expense (Scalable Solution)

I’ll be honest—I only included this because I felt the article wouldn’t be complete otherwise. BILL is a hugely popular AP/AR tool, but I personally find it frustrating to use and would hesitate to recommend it for this reason alone.

The learning curve here is unnecessarily steep; other platforms make onboarding much easier, which may be enough for you to discount BILL right away. I’ve also found it particularly inhospitable when it comes to international payments

That aside, there is something to be said for the scalability of BILL. Unlike some other popular platforms (like Ramp), BILL doesn’t impose revenue or funding requirements on prospective users. This makes the onboarding experience much quicker, and means there’s no risk that you’ll waste time vetting a platform that’s not going to accept you. So, even though it caters to bigger companies, it’s accessible to smaller outfits too.

BILL also does a better job of striking the balance between accounts receivable and accounts payable than the likes of Airbase, which is more heavily focused on the A/P side of things.

BILL vs. Airbase: BILL wins if you want an all-in-one solution, but Airbase is the more intuitive platform.

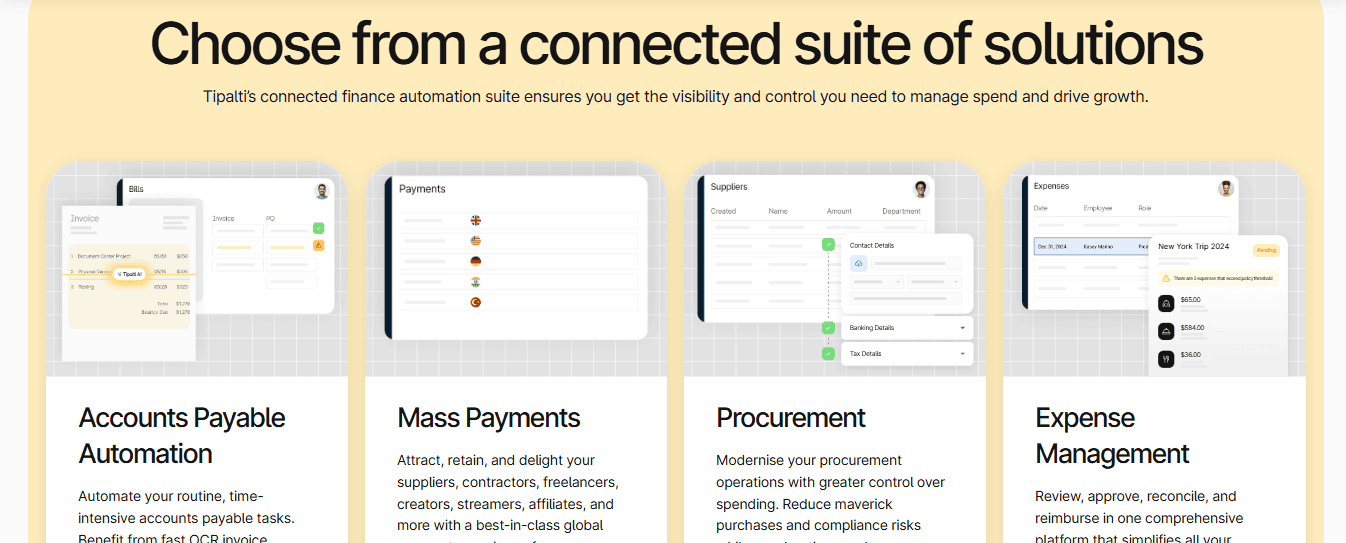

5. Tipalti (Global and Multientity Payment Powerhouse)

If you’re running a large business and you need to pay bills in multiple currencies, this is the tool for you.

Tipalti’s support for multi-currency payments, automated tax and compliance workflows, OCR invoice capture, and vendor portal functionalities are all extremely useful for teams that need them.

It integrates cleanly with ERPs and can handle payments across international jurisdictions, automation of compliance updates, and management of multi-entity structures.

Of course, enterprise-grade tools like these don’t come cheap. Tipalti doesn’t offer a free version, and its entry-level subscription is $99 per month. Higher tiers (on which you’ll find many of the most useful features) are priced on a custom basis.

Additionally, Tipalti isn’t the most user-friendly tool on the market for new users; there’s a significant learning curve to navigate.

Tipalti vs. Airbase: This really depends on your use case. If you need Tipalti, go with Tipalti. If you don’t, don’t.

Honorable Mentions

There are plenty of capable payment tools I didn’t have the space to cover in detail here, including:

- Navan (formerly TripActions): Originally a travel management platform, Navan has evolved into an all-in-one corporate travel and expense solution. It streamlines travel booking, card issuance, and automated expense reconciliation, ideal for teams with heavy T&E spend.

- Mesh Payments: Mesh offers centralized spend controls with real-time virtual card issuance and budget tracking. It is especially popular among fast-growing tech startups looking to streamline SaaS subscriptions and department-level spend.

- PayEm: PayEm combines procurement, AP, and global payments into one platform, with native ERP integration and customizable approval workflows. Its international payment support and vendor management tools suit globally distributed teams.

- Spenmo: Based in Southeast Asia, Spenmo provides a localized solution for AP automation, bill pay, and card issuance. It’s a solid option for startups and SMEs in emerging markets needing multi-currency payment support.

- Yokoy: A Swiss-based platform that integrates expense management, invoice processing, and corporate cards with AI-driven automation. Yokoy is ideal for European enterprises seeking compliance-heavy spend controls and cross-border capabilities.

What’s the Verdict?

I think Melio offers unrivaled bang-for-buck for the average team seeking an all-in-one payment solution, and I especially like that you can use a card to pay anyone (even those pesky check-only vendors). If you have more specialized requirements, though, you may well find a more suitable provider in one of the other options I’ve mentioned.