- The Bottom Line Up Front

- Understanding the Problem First

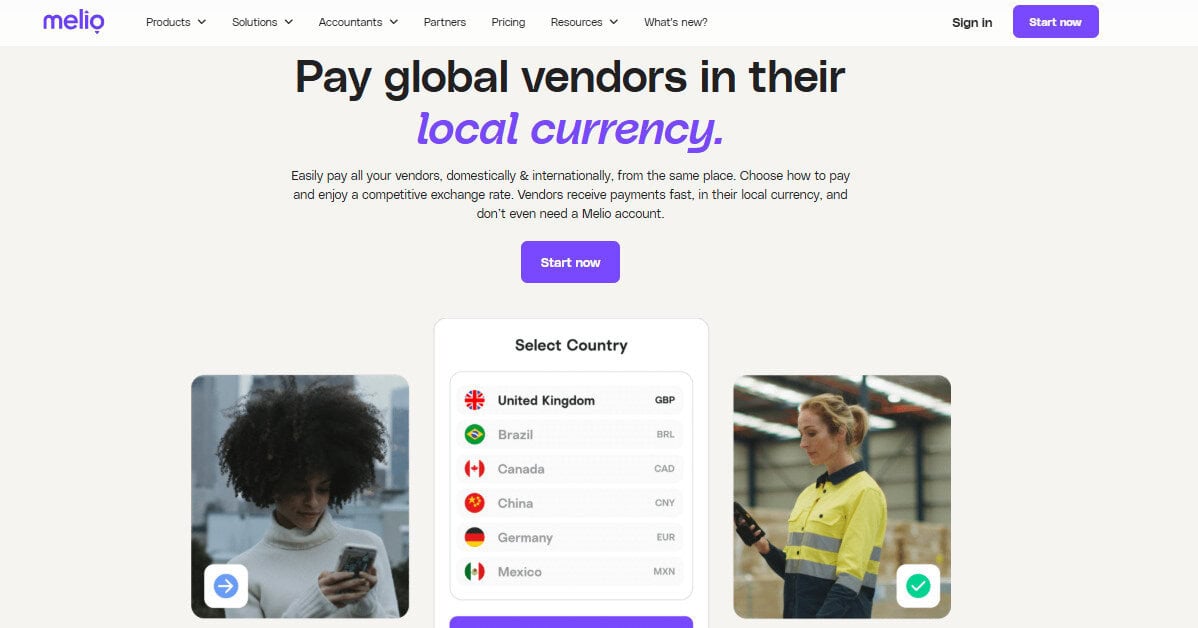

- Melio: The Simple and Efficient Choice

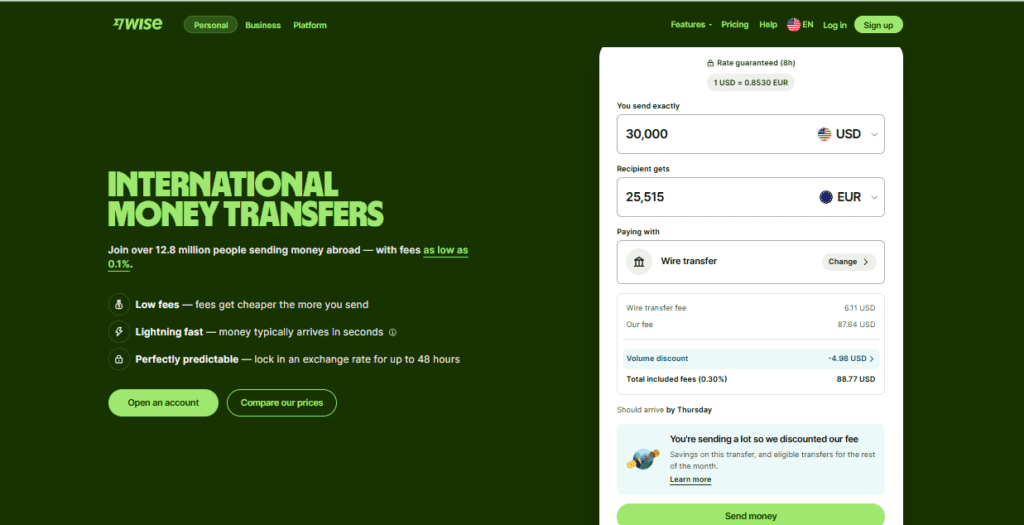

- Wise: The Cost-Saving Option

- PayPal for Business: The Familiar Choice

- Stripe: The Developer-Friendly Solution

- Comparing Your Options: What’s Best for Your Business?

- Some Things to Watch Out For

- Final Thoughts

Last Updated on February 25, 2026 by Ewen Finser

As a CPA, I’ve spent the better part of my career untangling the complex web of payments, financial records, and international transactions for small to mid-sized businesses. If there’s one topic that consistently trips up business owners—regardless of industry—it’s the challenge of paying international vendors efficiently, securely, and affordably. Trust me, I’ve seen it all: late payments, lost wires, exorbitant fees, and those tedious hours wasted chasing down bank records.

Given my experience with clients across industries—from construction and hospitality to retail and digital marketing—I’ve navigated my fair share of payment systems. So, today, I’m sharing my insights into the best ways to pay your international vendors, featuring some of my personal favorites.

The Bottom Line Up Front

From my years of experience helping businesses manage international payments, I’ve found that traditional methods like wire transfers are dated, expensive, and inefficient. Fintech platforms like Melio are changing the game by offering low fees, fast processing, great vendor flexibility, and seamless integrations.

While other options like Wise, Stripe, and PayPal have their place, Melio stands out as the best all-around solution in my mind for small to mid-sized businesses that need to pay international vendors without the headaches. If you want to save money, streamline operations, and keep your books clean, it’s worth making the switch.

Understanding the Problem First

Before we dive into solutions, let’s quickly clarify the issue at hand. When dealing with international vendors, businesses usually encounter a few common headaches:

- High Transaction Fees: Banks often charge a markup on international wire transfers, plus hidden fees. These can add up fast, eating into your margins.

- Slow Processing Times: Traditional banks typically take several days for international payments to clear.

- Exchange Rate Pitfalls: Exchange rates fluctuate daily, and banks don’t typically provide competitive rates. You might be losing money without realizing it.

- Limited Payment Methods: Many small businesses struggle with restrictive payment methods, creating barriers in relationships with international partners who prefer alternative payment methods.

If any of these sound familiar, the tools below are built to address them. Here are the best ways to pay international vendors, along with the situations where each option works best.

Melio: The Simple and Efficient Choice

If you’re not yet familiar with Melio, let me introduce you. Melio is a relatively new player, having emerged in the fintech landscape around 2018. But despite being the new kid on the block, it’s quickly become a favorite of mine and many of my clients. Because it hits the sweet spot for international vendor payments with simplicity, cost-efficiency, and flexibility.

I recommend Melio because it’s cost-effective, transparent, and easy to use. Even my least tech-savvy clients can handle it. It offers lower fees than banks and shows clear exchange rates, which can add up to meaningful savings for businesses that send frequent or international payments.

The interface is clean and intuitive, payments process quickly, and it supports multiple funding and payout methods. Melio also integrates smoothly with tools like QuickBooks and Xero, cutting down on manual data entry and improving accuracy. It’s a solid option for businesses that want to streamline their payables without the usual headaches.

Let me illustrate with a quick anecdote. I recently worked with a client, a growing digital marketing agency. They’d been using traditional bank transfers to pay graphic designers who weren’t in the United States. Payments were delayed, fees were high, and both teams were frustrated. After I advised them to switch to Melio, their international payments became streamlined and cheaper, which made both parties significantly happier.

Wise: The Cost-Saving Option

Wise has gained considerable attention as a low-cost and efficient way to handle international transactions. It offers real-time exchange rates with minimal markups and provides a transparent breakdown of fees upfront. Wise’s standout feature is its ability to store and transfer funds in multiple currencies, which can be advantageous for businesses dealing regularly with international vendors.

I’ve used Wise with clients who pay in CAD and pay vendors located in Mexico. The multi-currency account feature particularly benefits businesses aiming to hedge against currency fluctuations.

PayPal for Business: The Familiar Choice

I’m guilty of this as well, but PayPal is often the first platform business owners consider for international payments, primarily due to brand familiarity and convenience. It’s also accepted globally, which makes it ideal for businesses working with freelancers and vendors who prefer digital wallets.

However, from an accountant’s point of view, PayPal can get pricey quickly, especially with large or frequent transactions. While easy to use, the fee structure, particularly currency conversion charges, is higher than solutions like Melio and Wise. Still, its ubiquity and ease of use often outweigh these drawbacks for certain businesses.

Stripe: The Developer-Friendly Solution

I have found that Stripe isn’t just for domestic bill payments; it’s also capable of handling vendor payments internationally. Its advantage is the powerful suite of APIs that integrates seamlessly with virtually every existing business infrastructure, which makes it ideal for tech-savvy teams. Stripe offers competitive rates and bullet-proof infrastructure, making it excellent for large businesses that handle a high volume of payments regularly.

That said, I tend to recommend Stripe primarily to businesses with a high degree of technical capability, as the customization and integration can be complex for smaller businesses.

Comparing Your Options: What’s Best for Your Business?

Determining the best international payment solution ultimately comes down to understanding your business’s unique needs. Here are a few guiding questions to help you decide:

- Volume and frequency: Are your international payments frequent and high-volume, or sporadic and smaller-scale?

- Technical capability: Is your team comfortable with more complex integrations, or do you need simplicity above all else?

- Budget sensitivity: How crucial is minimizing fees and exchange rate markups to your profit margins?

- Accounting integration: Do you need seamless reconciliation with existing accounting software?

Consider these key points before jumping into what you may consider as your next international payment platform.

Some other things you may consider before jumping into an expensive and costly transition:

1. Evaluate and Test the Platform

Before making any permanent changes, test-drive the platform you’ve chosen. Melio, Wise, PayPal, and Stripe each offer ways to open a demo account or perform small initial transactions. With Melio specifically, you can create a free account within minutes and perform test payments to verify the ease and speed of the platform.

This hands-on approach gives you immediate insight into how the platform integrates with your workflow and helps eliminate potential surprises down the line. Yes, it may take some additional time up front, but can prevent absolute disasters later down the line.

2. Consider Discussing Changes With Your Vendors

Communication with vendors is critical, especially international vendors. Ensure your partners understand you’re changing platforms and what they can expect moving forward, whether than means shorter payment turnaround times, fewer transaction costs, or greater payment flexibility.

In my experience, most vendors are receptive, especially when they see clear benefits such as faster and more reliable payments. It’s a great opportunity to strengthen vendor relationships, even if hiccups arise. Just be transparent, and they will be thankful.

3. Update Internal Accounting Processes

When introducing a new payment platform, your internal accounting processes and controls should reflect the change. For instance, when my clients switch to Melio, I work with their accounting staff or bookkeepers to make sure they understand how the data is fed into reconciliations, how they can track vendor payments (in case someone hasn’t got paid, they can check where the funds are), and how to use the new system.

4. Integrate With Your Accounting Software

The strength of a good international payment solution is amplified significantly by its ability to integrate seamlessly with your existing accounting software. Most bill payment platforms should be able to integrate with your accounting platform, such as Sage, Xero, or QBO.

As an experienced accountant, I can’t stress enough how critical this integration is. It not only saves you time but dramatically reduces errors, making financial reporting more reliable and timely.

5. Monitor and Optimize Over Time

Even after successfully transitioning, regularly revisit and assess the performance of your payment solution. You should continue monitoring transaction costs, payment processing speeds, and vendor satisfaction to ensure the platform continues to serve your business effectively. Clients who make a habit of periodic reviews often discover opportunities to further optimize their payments, either by negotiating better terms or leveraging new features as platforms evolve.

Some Things to Watch Out For

Throughout my career, I’ve witnessed a few mistakes that come up again and again make businesses pay international vendors. Here’s my advice to you so you can avoid the most common pitfalls:

Pitfall #1: Ignoring Exchange Rate Fluctuations

Exchange rate variations can significantly impact your bottom line. Always clarify who shoulders the risk of exchange rate fluctuations, your business or your vendor. Platforms like Melio and Wise clearly present real-time exchange rates, which help you avoid unpleasant surprises and protects your margins.

Pitfall #2: Relying Solely on Wire Transfers

Banks often push traditional wire transfers as the default international payment method, even though they can be slow, costly, and less flexible. Embrace digital solutions instead, whether Melio, Wise, or similar fintech platforms, which typically offer more streamlined and affordable transactions, while also being transparent.

Pitfall #3: Poor Record-Keeping

From an accounting standpoint, keeping detailed transaction records is paramount. Thankfully, modern solutions automatically store comprehensive payment histories, simplifying audit trails and reducing compliance risks. Just make sure you know how to find the data you’re looking for within your new accounting ERP.

Final Thoughts

International payments are about managing relationships as much as managing cash flow. The right payment solution empowers businesses and builds great vendor relationships.

Each business is unique. While Melio is a strong fit for many small and mid-sized companies, your specific situation might call for alternative options like Wise, Stripe, or PayPal depending on your priorities. When choosing, focus on what matters most for your workflow, such as total fees, speed, vendor flexibility, ease of use, and accounting integration.

Ultimately, choosing the right international payment platform positions your business for better growth, improved relationships, and greater overall financial health. With a thoughtful choice, international transactions can move from being a recurring frustration to a dependable workflow.