- Essential Features of Startup Accounting Software (The Big Ones)

- Other Considerations That Are Less Important

- 1. Ecosystem Considerations

- 3. Mobile Capabilities and Accessibility

- 4. Security, Compliance, and Data Privacy

- 5. Customer Support and Training Resources

- Top Accounting Software for Startups

- Puzzle.io

- QuickBooks Online

- Xero

- Wave Accounting

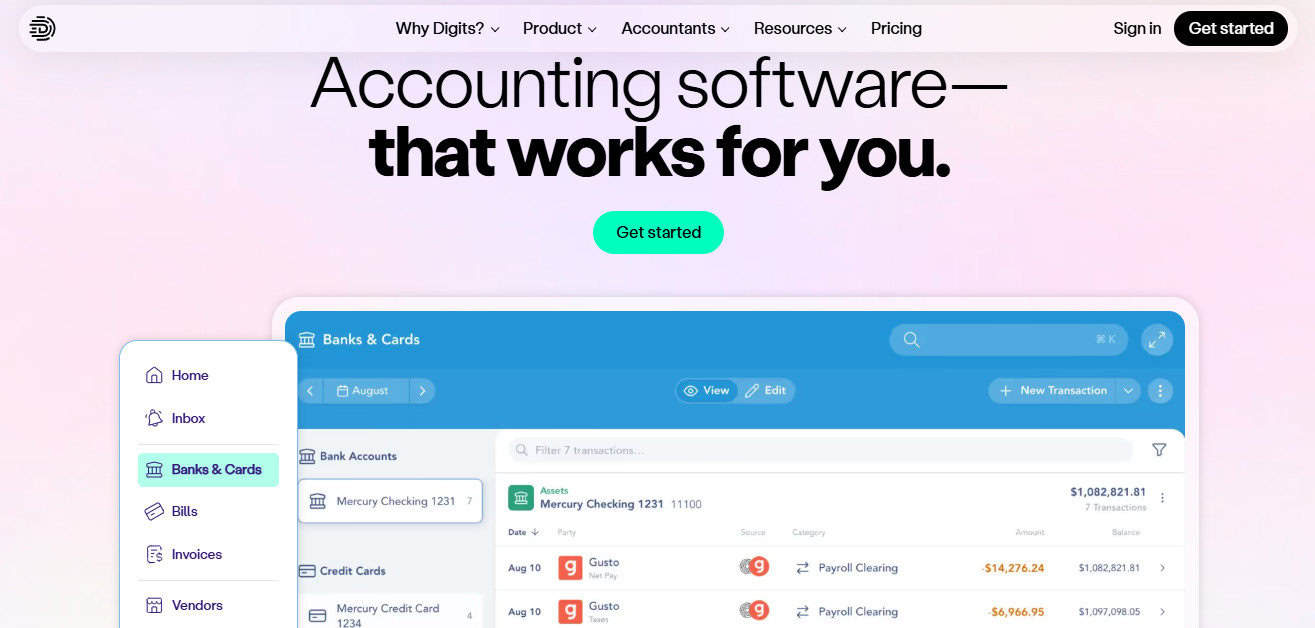

- Digits

- Best Practices for Implementing Accounting Software

- Setting Your Startup on the Path to Financial Clarity

Last Updated on February 12, 2026 by Ewen Finser

Launching a startup comes with countless responsibilities, and managing finances efficiently tops the list. As a CPA, I think good accounting software tailored specifically for startups can simplify complex tasks, enhance accuracy, and provide valuable insights for decision-making. After all, that’s really all accounting is; gathering information (typically finance-related) and organizing it in a way that’s easy to digest so that management can make decisions quickly and effectively.

Startups operate differently from established businesses, usually experiencing rapid growth, fluctuating cash flows, and ever-evolving business models. Standard accounting solutions may lack the flexibility startups require. Specialized accounting software can:

- Automate repetitive tasks (invoicing, payroll, tax calculations).

- Provide real-time financial insights and analytics.

- Integrate seamlessly with other startup tools and platforms.

- Scale alongside business growth without extensive migrations

When picking your software for your small business or startup, you should consider what it brings to the table, what it costs, and how it will fit your business today and five years from now.

Essential Features of Startup Accounting Software (The Big Ones)

When selecting accounting software, startups should prioritize these features that directly address their unique challenges. I think some of the largest items to consider (in no particular order) are the following:

1. Cloud-Based Accessibility

Cloud solutions offer accessibility from any location, vital for remote and hybrid teams. Real-time collaboration ensures stakeholders stay informed, reducing miscommunication and errors. Long gone are the days of a bookkeeper using QuickBooks on their desktop, being siloed from the rest of the business’s IT infrastructure.

2. AI and Automation

Artificial Intelligence enhances accuracy and efficiency, automating away tasks such as invoicing, payment reminders, expense tracking, and financial forecasting, allowing teams to focus on growth rather than bookkeeping. I think AI is a really powerful tool, but it still needs to be leashed and monitored carefully.

3. Scalability

Startups evolve rapidly, and choosing software capable of scaling effortlessly prevents costly transitions. Features such as user expansions, increased data processing capabilities, and advanced reporting should be easily accessible. This is one of my largest gripes. Seeing a client outgrow QuickBooks because they became too successful, and then losing a ton of data during a migration, is something that just doesn’t sit well with me, as they will struggle to recover or reload the lost data.

4. Integration Capabilities

Effective integration with CRM systems, payment processors, and banking apps significantly reduces manual data entry, improving accuracy and productivity. It also makes it seamless to connect to companies like Square and Stripe, which is super important for B2B and B2C businesses.

5. User-Friendly Interface

Intuitive interfaces accelerate training and reduce errors, enabling startup teams without extensive accounting backgrounds to manage finances confidently.

Other Considerations That Are Less Important

We’ve talked about everything a new startup should consider essential features, and what it’d be wise to look at when selecting your accounting software. I would consider that to be the bare bones of what’s needed, but there are tons of other considerations that should go into selecting an accounting software.

1. Ecosystem Considerations

The effectiveness of your accounting software doesn’t end with built-in capabilities alone; integrations with third-party applications also impact your financial management experience. When selecting a software, we’ve already considered that it’s important for it to collect information from your payment processing vendors, but you’re going to want to consider how well the software plays with other important business hubs.

What to Evaluate:

- CRM and Marketing Tools: If you rely on customer relationship management (CRM) systems such as Salesforce or HubSpot, ensure your accounting solution integrates effortlessly. This connection streamlines billing, invoicing, and customer tracking.

- Inventory and POS Systems: Retail-oriented startups benefit greatly from integrations with inventory management software like Shopify or POS solutions. Proper integration automates inventory tracking and sales reporting, reducing manual input errors.

- Payroll and HR Platforms: Check for integration with payroll systems such as Gusto, ADP, or Rippling. Automated payroll and HR data syncing simplify complex tasks, including salary disbursements and payroll tax compliance.

- Bank and Credit Card Feeds: Direct bank integrations automatically import transaction data, dramatically reducing reconciliation effort and increasing accuracy.

2. Pricing Structures and Scalability

Pricing significantly impacts a startup’s decision-making due to typically limited budgets. It’s crucial to balance affordability with growth potential.

Common Pricing Models:

- Tiered Subscription: Most accounting software providers employ tiered subscription models based on the number of transactions, users, or features. QuickBooks Online, Xero, and Zoho Books fall into this category.

- Freemium Model: Platforms like Wave offer completely free usage with premium charges for services like payroll or payments. This model suits bootstrapped startups needing basic accounting functionality at minimal cost.

- Custom Enterprise Pricing: For rapidly growing startups, software providers like Sage Intacct offer custom pricing tailored to the startup’s scale and specific needs, typically negotiated with a sales representative.

Cost Considerations for Startups:

- Initial Costs: Assess the immediate affordability of the software, especially if funds are tight.

- Scaling Costs: Evaluate how quickly costs rise with additional users, transactions, or features. Ensure the software’s pricing structure aligns with your growth trajectory.

- Hidden Fees: Be aware of charges for customer support, training, or data migrations, as these can significantly increase the total cost of ownership.

3. Mobile Capabilities and Accessibility

I don’t consider this to be that important, as I work in a traditional office, but if you’re a startup that monitors information systems and are out in the field, for instance, this may apply to you. Small businesses today are highly mobile and require flexibility. Accounting software with mobile capabilities ensures business continuity is extremely convenient.

My Must-Have Mobile Features:

- Expense Tracking and Receipt Scanning: Apps like QuickBooks Online and Xero offer intuitive receipt scanning and expense categorization via smartphone cameras, streamlining expense management.

- Mobile Invoice Management: Issuing invoices directly from your mobile device ensures quicker billing and improved cash flow. This is very useful for mobile-based startups, such as mobile mechanic shops.

- Dashboard and Reporting: I don’t consider this as important unless you’re going to frequently be away from your laptop for extended periods of time, often. Mobile dashboards offering real-time financial insights support decision-making on the go, but typically, you should be able to access your information often enough to know where your business stands.

4. Security, Compliance, and Data Privacy

How much do you really trust the software you’re loading all of your sensitive data into? Would you be surprised if I told you Intuit (owner of QBO and TurboTax) had information such as names, addresses, birthdays, SSNS, drivers licenses, and financial details (bank accounts) stolen in February of 2024? If a large company such as Intuit can fall victim to this, you should be weary about who you trust with your company’s data.

Security Features to Prioritize:

- Data Encryption: Ensure the software employs end-to-end encryption to secure financial data in transit and at rest.

- Two-factor Authentication (2FA): Essential for protecting your accounts from unauthorized access. I can’t harp on this enough; it’s not useful unless it’s been set up. No one wants to remember another password, but it’s necessary for the safety of your business.

- Audit Trails and Access Controls: Software that provides detailed audit trails and customizable user permissions ensures data integrity and accountability.

Compliance Considerations:

- Tax Regulation Updates: Software should automatically update tax rules and rates to remain compliant with evolving legislation, significantly reducing compliance risk.

- GDPR and Data Privacy: Verify the software’s compliance with data privacy laws such as GDPR (for European customers) or CCPA (California).

5. Customer Support and Training Resources

Reliable customer support and accessible training resources are invaluable, especially for startups unfamiliar with accounting practices.

Support Considerations:

- Availability and Channels: Look for providers offering multi-channel support, including live chat, email, phone, and comprehensive knowledge bases.

- Quality of Resources:

Extensive tutorials, webinars, and guides facilitate a smooth onboarding process and ongoing training.

Outstanding Support Providers:

- QuickBooks Online: Known for extensive resources, tutorials, active community forums, and responsive customer support channels.

- Xero: Provides detailed documentation, training courses, webinars, and responsive customer support, helping users master the platform efficiently.

Top Accounting Software for Startups

So who checks all the boxes and falls in line with the above criteria? There’s hundreds of options to choose from, but only a dozen or so of them stand out. I’ve outlined the pros and cons of my top four based on what I think is important.

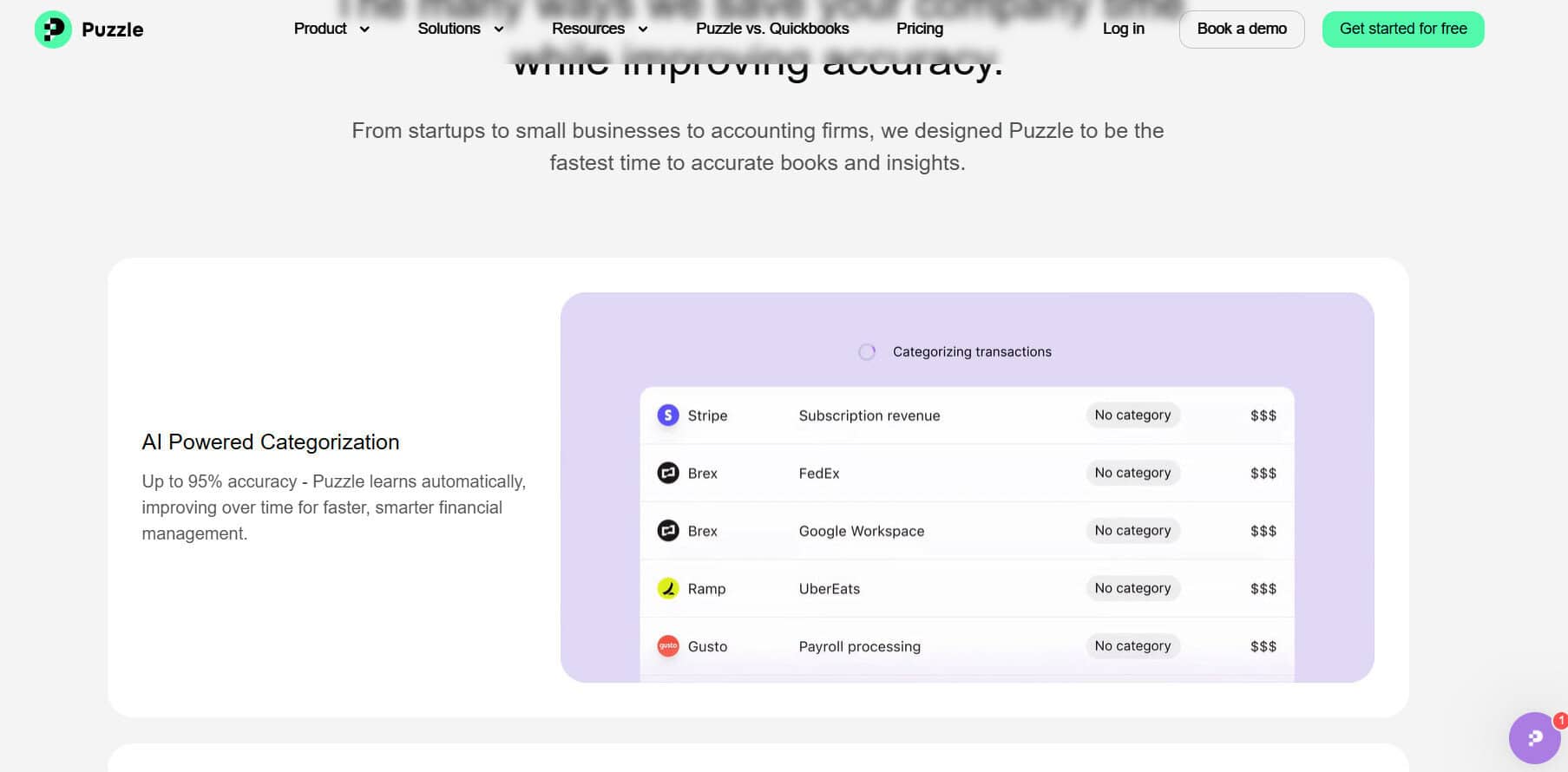

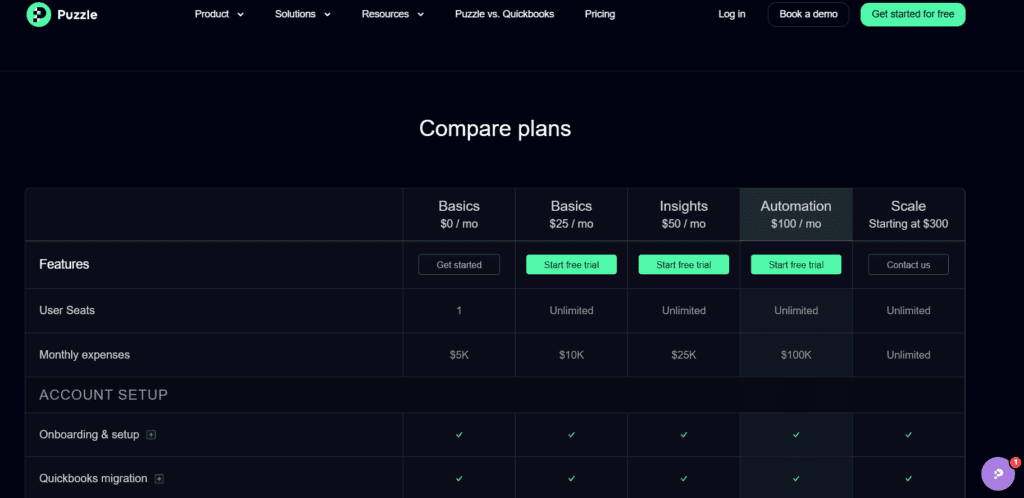

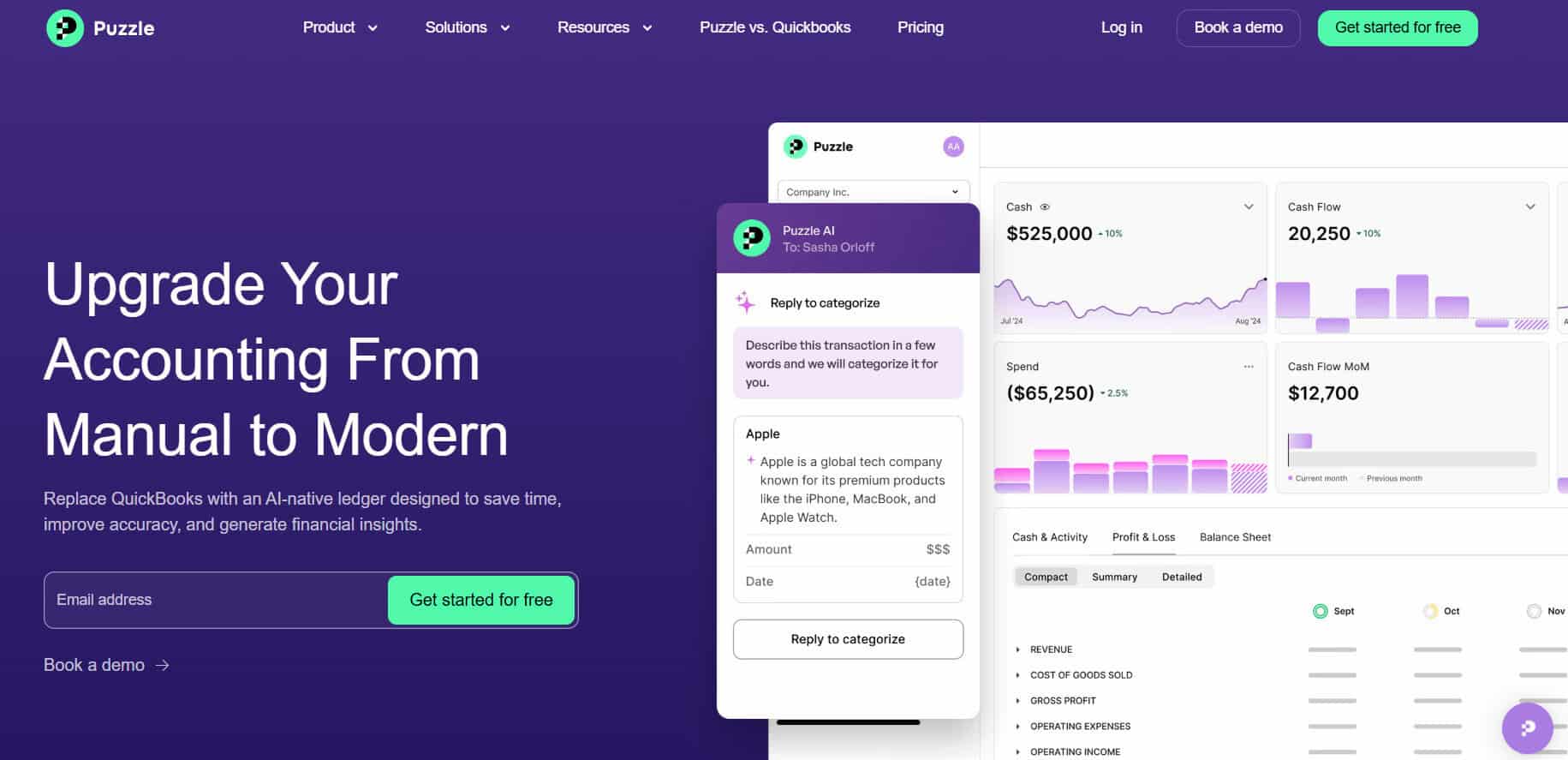

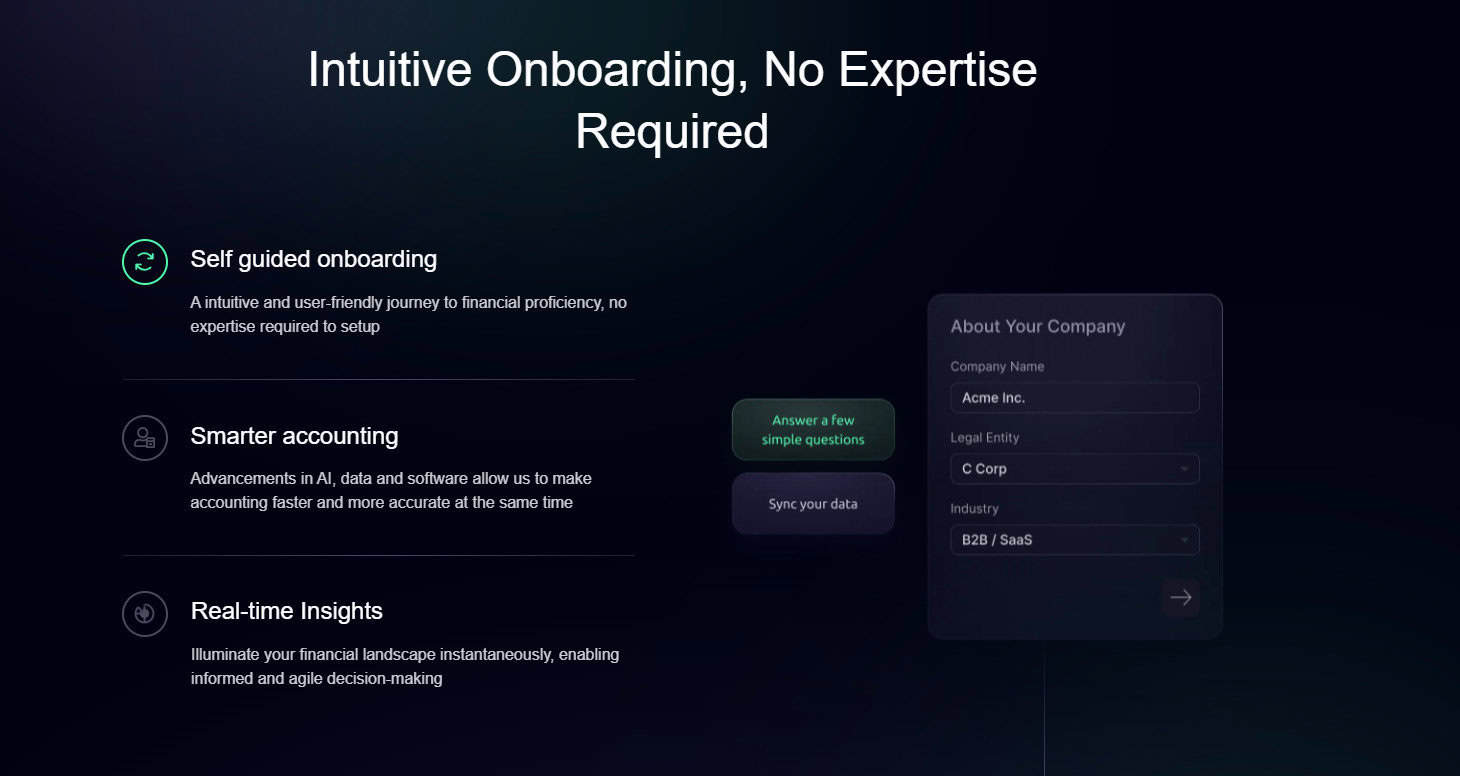

Puzzle.io

Puzzle.io stands out due to its robust AI-driven automation specifically designed for startups. The software emphasizes cash flow management, financial forecasting, and strategic insights, empowering startups to make informed financial decisions rapidly. It also has a very intuitive and user-friendly dashboard, which is extremely attractive for non-finance personnel who need information easily and quickly.

Pros:

- Exceptional cash flow forecasting

- AI-driven insights and recommendations

- User-friendly interface with minimal learning curve

- Strong integrations with startup tools (e.g., Stripe, HubSpot)

Cons:

- Slightly higher pricing compared to basic accounting tools

- Limited traditional accounting functionalities for very advanced financial operations

Check out our full Puzzle.io review here: Puzzle.io: An AI-Forward Powerhouse in Modern Accounting

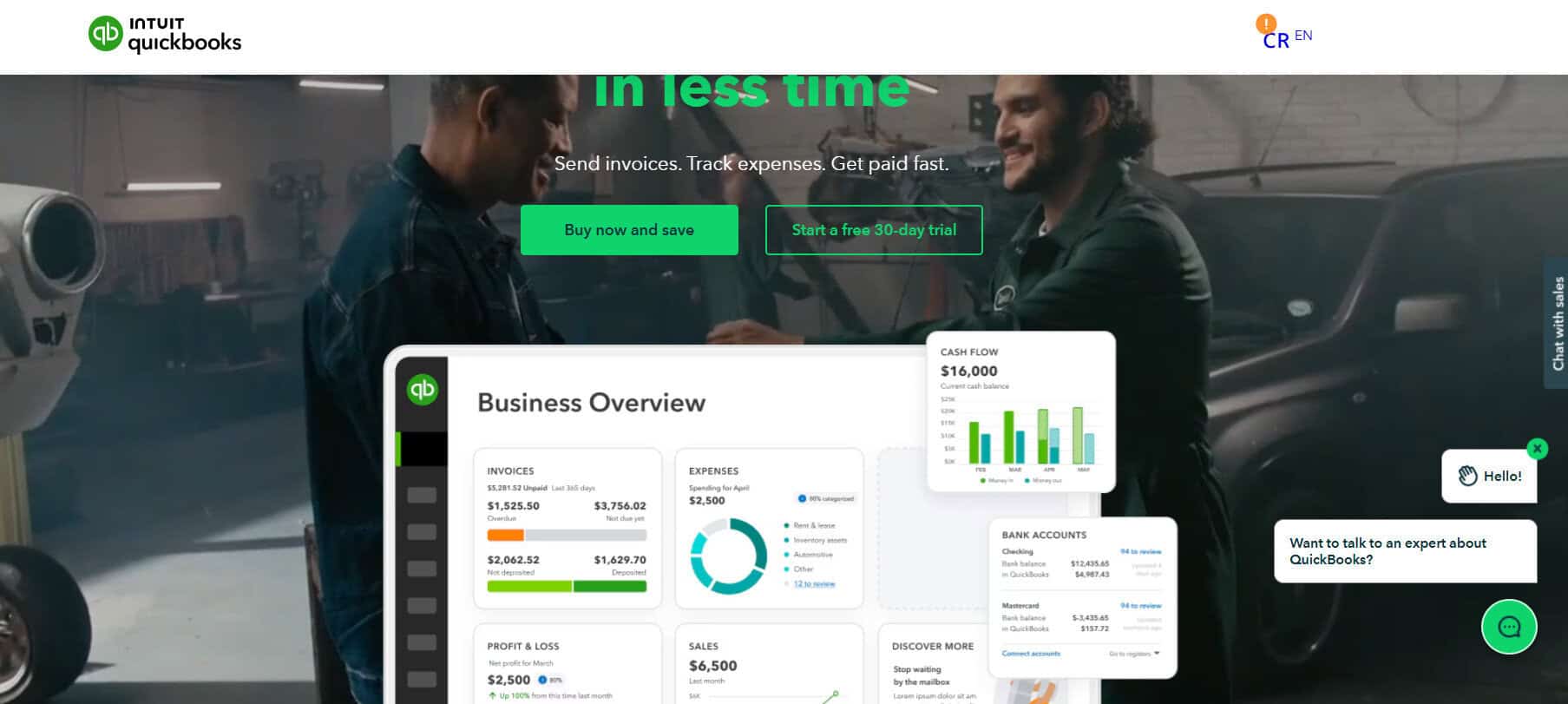

QuickBooks Online

QuickBooks Online remains the juggernaut in small business accounting, thanks to extensive features, reliability, and tons of integrations. The AI-driven features like expense categorization and predictive cash flow management provide significant value. There’s nothing necessarily wrong with using QBO as your software for a startup, and I actually quite like it, but if you’re in a niche field or plan on turning over more than $200M, you should probably look at other software.

Pros:

- Comprehensive reporting and analytics

- Powerful integrations (PayPal, Shopify, Square, Stripe)

- Easy to scale (up to a point) with diverse plan options

- Tons and tons of forums, and most people are familiar with it

Cons:

- Can become costly with added features or users

- Some learning curve for complex accounting tasks

- Running Payroll can be cumbersome if you have many employees

Xero

Xero is recognized for its simplicity, affordability, and effective cloud collaboration capabilities. It suits startups requiring accessible, reliable accounting software that scales smoothly with growth.

Pros:

- Excellent dashboard and intuitive design – often said to be more user-friendly than QuickBooks Online

- Strong integrations with over 800 third-party applications

- Automated bank feeds and reconciliations

- Cost-effective pricing suitable for startups

Cons:

- Limited built-in payroll functionality (requires third-party solutions in some regions)

- Some advanced reporting features are restricted to premium plans

- More restrictive for accountants in terms of workarounds (i.e., it can be harder to clean up messes in the system without extensive workarounds)

Wave Accounting

Wave is particularly attractive for very early-stage startups and solopreneurs due to its free base offering. It provides basic accounting tools necessary for managing simple finances efficiently.

Pros:

- Free software suitable for budget-conscious startups

- Easy setup and straightforward usability

- Reliable invoicing and expense tracking

- Integrated payment processing (at competitive fees)

Cons:

- Limited advanced accounting features

- Less scalable for rapidly growing businesses (This is one of the big ones that I like to harp on for my clients. What’s cheap now can be expensive later.)

Digits

Digits is a newer entrant that has quickly become a favorite for tech-forward startups. It brands itself as “AI-native” accounting, meaning it wasn’t a traditional software that had AI “bolted on” later—it was built from the ground up to use machine learning. What I find most impressive about Digits is its Ask Digits feature, which acts like a financial assistant you can query in plain English (e.g., “How much did we spend on AWS last month compared to January?”). It’s designed for the founder who wants a real-time pulse on their burn rate and runway without waiting for a month-end report.

Pros:

- Real-Time Visibility: Unlike traditional software that requires manual reconciliation, Digits uses “Living Analysis” to show you where your money is going as it happens.

- Superior Dashboard & UX: The interface is sleek and feels more like a modern fintech app than a dusty accounting ledger.

- Ask Digits AI: The ability to ask natural language questions about your finances is a massive time-saver for non-finance founders.

- Deep Integrations: It plays very well with the “modern startup stack,” including Stripe, Mercury, Gusto, and Ramp.

Cons:

- Newer Platform: While it’s evolving fast, it may lack some of the deep-tier “legacy” reporting features found in QuickBooks for very complex corporate structures.

- Pricing Tiers: The “Core” plan is a jump up from basic tools, which might be a hurdle for bootstrapped solopreneurs (though its “Starter” plan is competitive).

- Accountant Familiarity: While gaining traction, you may find fewer “old school” CPAs who are already experts in the platform compared to the ubiquity of QBO.

Best Practices for Implementing Accounting Software

So now that we’ve covered what a startup needs to look for in an accounting system, and who some of the top contenders may be, we need to discuss how to implement it so that your startup can enjoy success and take full advantage of everything your system has to offer.

1. Clearly Define Financial Processes

Before integrating new software, startups should map out existing financial processes and consider what they want those processes to look like after the migration. What does that mean in non-accountant speak? Essentially, clarifying invoicing workflows (who’s paying for what, what is the approval method?), expense reporting processes, and budgeting practices ensures that software configuration aligns perfectly with operational needs and available personnel.

2. Utilize Training Resources

This is a no-brainer. An accounting software gets its best ROI if everyone knows how to use it. Many providers offer comprehensive onboarding programs, tutorials, and webinars to ensure startup teams quickly become proficient.

3. Integrate with Existing Tools

Immediately set up integrations with your CRM, payment platforms, banking services, and other core business tools if your software of choice allows it. Most third-party platforms now can be connected via Plaid or API relatively seamlessly. Proper integration minimizes manual entry, significantly reduces errors, and enhances data accuracy. This should be done as soon as feasible.

4. Regularly Update and Audit

Startups should schedule routine audits and updates. While expensive, burdensome, and frankly annoying, a thorough annual audit will help ensure that funds aren’t being misappropriated and that the system is being implemented correctly. Regularly reviewing your software ensures it meets evolving business requirements, maintains compliance, and maximizes efficiency.

Setting Your Startup on the Path to Financial Clarity

Choosing the right accounting software is not just about simplifying bookkeeping; it’s quite literally one of the core pillars that your business will need to stand on its own. The right software can empower strategic decision-making and pave the way for scalable growth that startups are always desperately chasing.

Leveraging modern features like AI-driven automation, robust integrations, and mobile capabilities transforms financial management into a growth engine for startups. By systematically evaluating your options against the considerations outlined above, your startup can confidently adopt an accounting solution designed to support its long-term success.

With the proper foundation in place, accounting ceases to be a mundane administrative task and instead becomes a strategic cornerstone, enabling entrepreneurs to focus on innovation and growth—the very lifeblood of every successful startup.