- The Bottom Line Up Front

- Pricing Snapshots

- What Each Platform Really Is

- Square Payroll vs Homebase: Feature by Feature, What Actually Matters Week to Week

- Ecosystem Fit: Where Each One Just Works

- Where Do They Fall Short?

- Technical Plumbing You’ll Care About (Trust Me!)

- What Platform is Best for What Business

- A CPA’s Decision Grid

- My Closing Thoughts

Last Updated on November 5, 2025 by Ewen Finser

Alright, guys, believe it or not, I wasn’t always a CPA. Before I spent my days surfing spreadsheets, I spent a period of my life doing something I think most people can relate to, which is waiting tables.

While I worked at a couple of different restaurants, one thing always kind of stuck with me, and that was how AWFUL the time management apps were. Trying to get shifts covered, shift differentials, and different pay for different roles, clocking in and out, I just absolutely despised how terrible all the different apps were.

That was a decade ago, and things have definitely changed. I now get to see these apps from an administrative standpoint, and I definitely carry the biases from my younger years into my work today. That’s why, as a CPA, I’m picky about the platforms I advise my clients to use.

Two of the platforms I find myself talking to my clients about are Homebase and Square Payroll, because they do a great job for Payroll and the surrounding peripherals. So buckle up, because I’m about to run through what makes an hourly teams platform great or what makes it garbage.

The Bottom Line Up Front

If you’re a small, hourly-heavy business (restaurants, retail, salons, field services) and you want scheduling, time tracking, tip pooling, messaging, hiring, and payroll living in one workflow, Homebase edges out Square Payroll. Not by being cheaper (Square’s base fee is slightly lower), but by being the more purpose-built operating system for hourly teams.

If you already run your register on Square and mostly need “good enough” full-service payroll with tight POS integration and budget pricing, Square Payroll is excellent. But if your real pain is people ops (schedules, timesheets, PTO rules, departments, compliance, tip distribution, garnishments) and you want that data to flow into payroll without duct tape, Homebase wins.

Pricing Snapshots

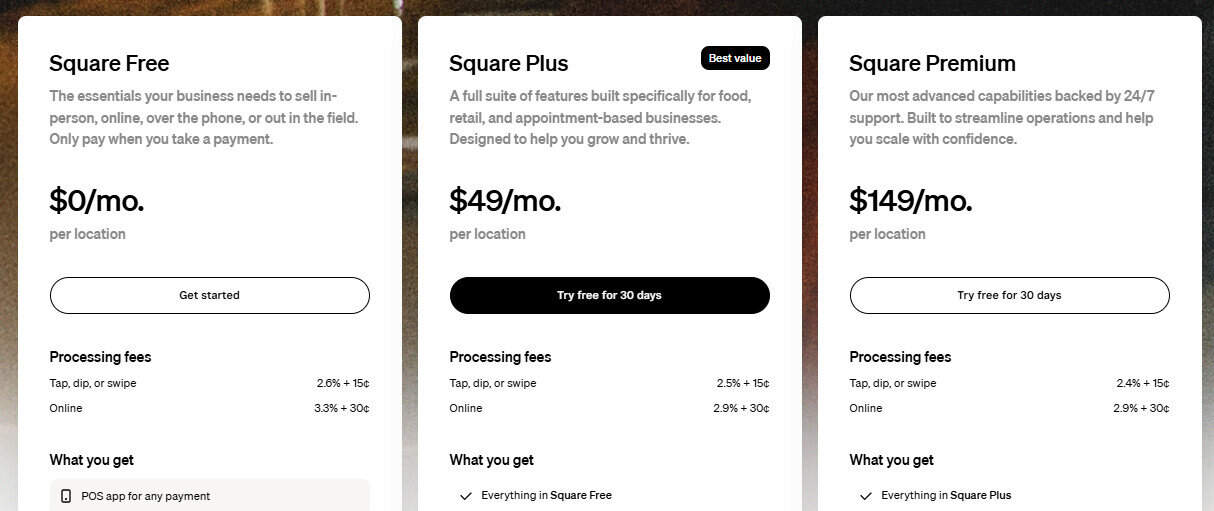

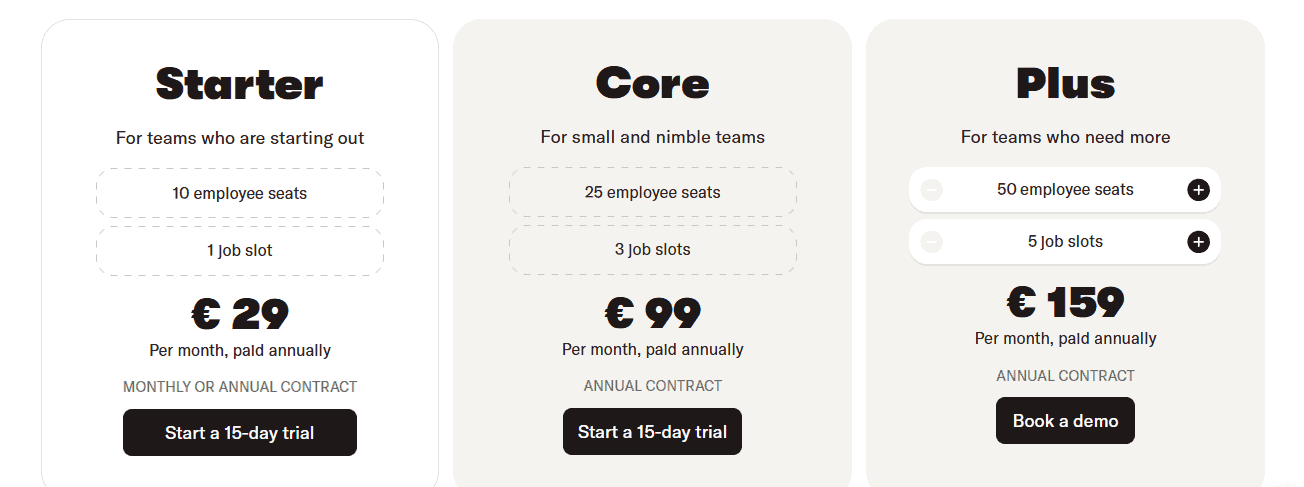

- Square Payroll (Full-service): $35/mo base $6/person paid; Contractor-only: $6/contractor paid with no base fee.

- Homebase Payroll (add-on to any Homebase plan): $39/mo base + $6/employee paid; optional Next-Day Pay plan $49 base + $9/employee; Tip Manager add-on $25/location.

Yes, Square’s base is $4 less. The delta is trivial if you’re also buying scheduling/time-tracking elsewhere (or you need the rest of the people-ops suite anyway). Where you save depends on your ecosystem: Square saves cash if you’re already all-in on Square (POS + Shifts).

Homebase often saves time by collapsing multiple tools into one workflow (scheduling, time clocks, messaging, hiring, PTO, labor controls, tip pooling) that feed payroll automatically. And let me share, if you’ve ever had to busy out the Excel spreadsheet to allocate tips, you know how invaluable everything being under one roof is!

What tips the scales in practice is how Homebase connects scheduling, time tracking, and payroll in real time — no exporting timesheets, no double entry, and no late-night reconciliation before payday. It’s built for hourly teams, automatically handling breaks, tips, and overtime while flagging tax/compliance issues before they become problems. That end-to-end sync is exactly where most “budget stacks” fall apart.

What Each Platform Really Is

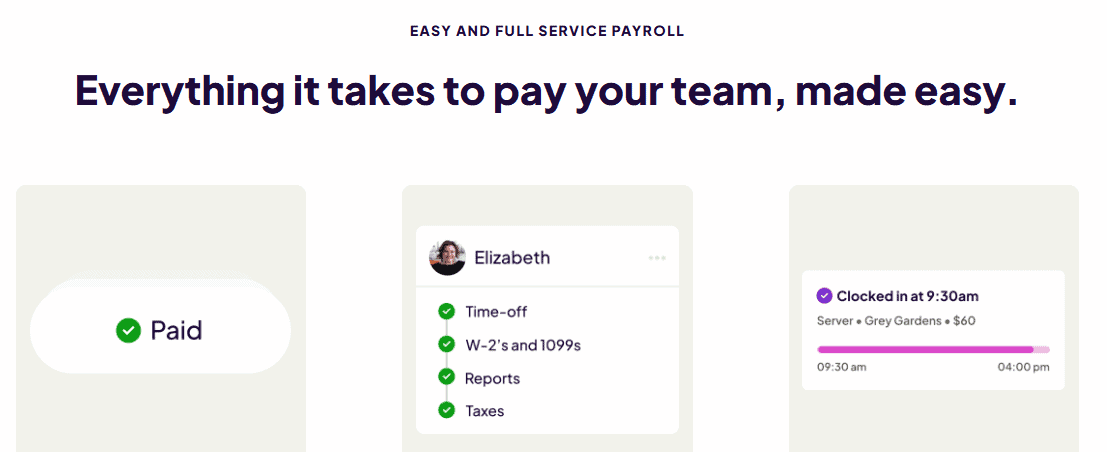

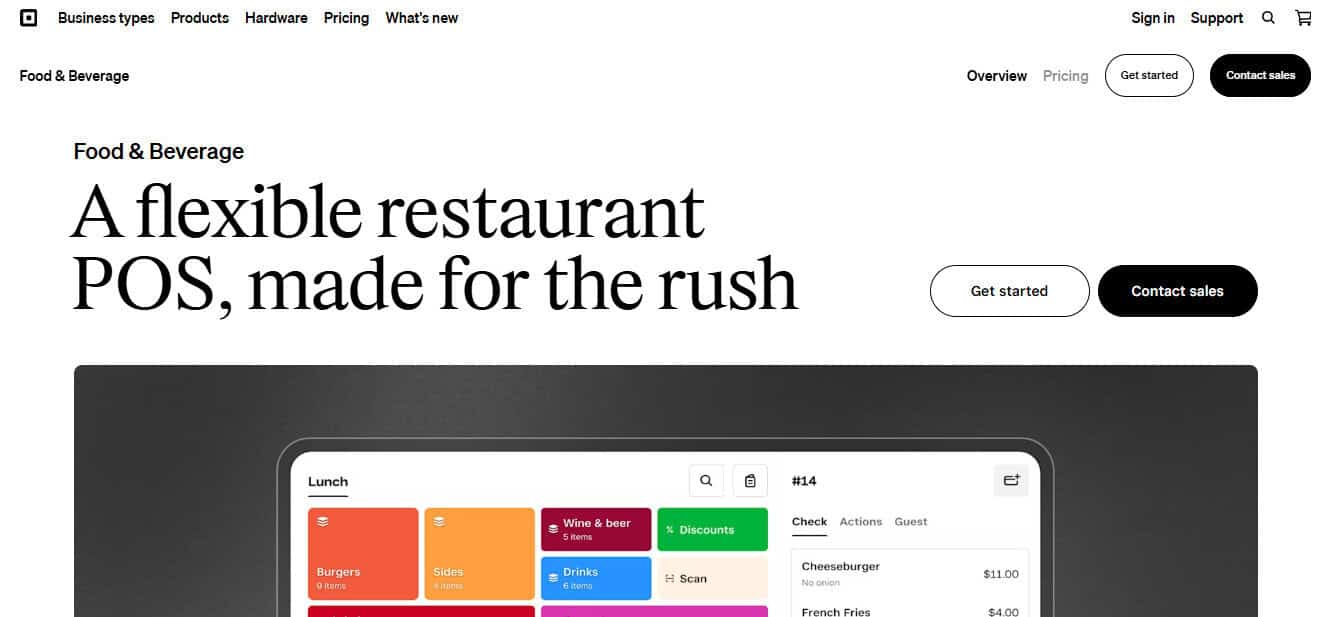

Square Payroll is a full-service payroll that’s tightly integrated with Square’s POS and Square Shifts timecards. It handles W-2 and 1099s, files and remits federal/state taxes, and offers add-on benefits via partners (health through SimplyInsured, 401(k) via Guideline, workers’ comp, etc). If your cash register is Square, you get a clean pipe from clock-in to timecard to payroll.

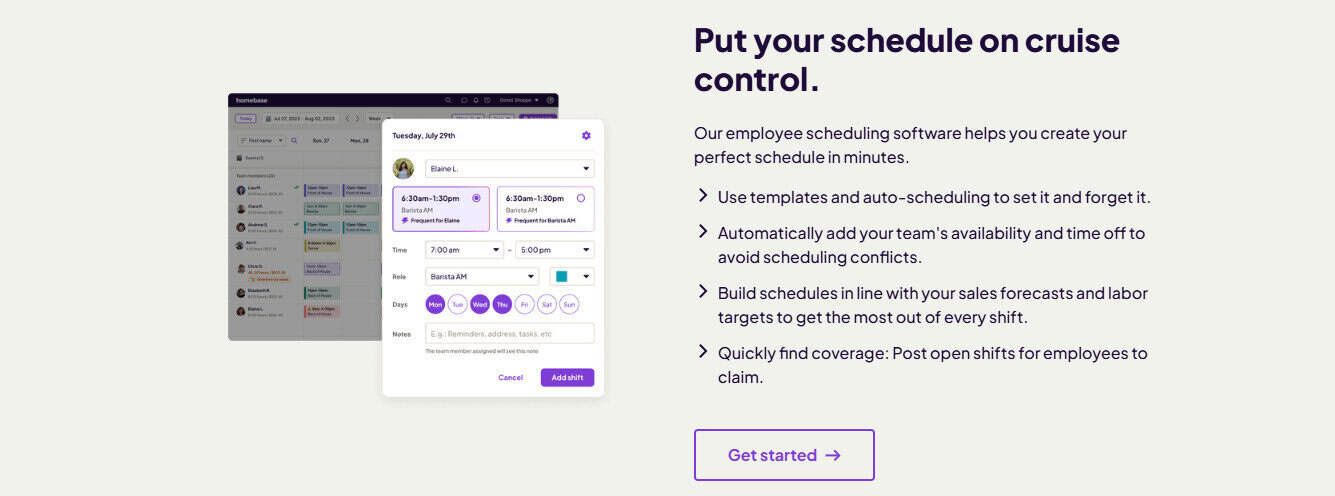

On the other hand, Homebase is an all-in-one hourly team stack: free plan for basic scheduling/time clocks (up to 10 employees at one location), paid tiers for advanced scheduling, PTO controls, departments/permissions, hiring/onboarding, HR/compliance, plus an integrated Homebase Payroll add-on. The center of gravity is scheduling and time tracking; payroll is the downstream “one-click” output.

Square Payroll vs Homebase: Feature by Feature, What Actually Matters Week to Week

1) Time Capture, Overtime, Breaks & Compliance Controls

- Square (with Shifts) gives you timecards, break/overtime rules, clock-in from POS/Team App, and overtime calculations; Shifts Plus unlocks advanced items that I think are very important, such as labor vs. sales reporting, clock-in prevention, tip management, and commissions.

- Homebase supports tablet/phone/web clocks; GPS/geo-fencing on mobile; photo capture at clock-in on tablets/POS; custom OT/break policies; store timesheets for years (not just the pay period); and auto-convert timesheets to payroll inside Homebase Payroll. Advanced scheduling/time-off and message confirmations come with paid tiers.

Takeaway: Both can keep you out of DOL trouble if you configure rules. Square is “good enough” if you’re a Square POS shop. Homebase gives more control knobs (departments, permissions, retention/performance notes, PTO accrual policies) that make multi-manager, multi-department operations cleaner.

2) Tip Management (I Can Attest This Is Where Most Restaurant PR Gets Hinky)

- Square: Shifts + Payroll sync tip data, so tips and commissions flow into payroll; Square also documents tip-credit overtime nuance in its restaurant content. But automated pooling logic and distribution rules may require Shifts Plus and/or manual policies depending on configuration, which adds costs or hours.

- Homebase: Has a dedicated Tip Manager add-on ($25/location) that pulls tips from your POS, calculates the pool by rules, and writes back to timesheets. Real-time visibility means staff can see projected tips before they clock out; managers avoid end-of-shift math fights.

Takeaway: If tip pooling, splits by role/hours, and auditability matter, Homebase’s add-on is the tidier, “no-spreadsheet” workflow. It’s the difference between “tips make it to payroll” and “tips are calculated, documented, and defensible.”

3) Multi-State / Multi-Location Reality

- Square Payroll supports multi-state taxes and filings, plus W-2 employees in multiple jurisdictions; contractors are supported in all 50 states. It will remit appropriate filings per jurisdiction and can add home-work locations for remote staff.

- Homebase Payroll handles multi-location under the same EIN on one pay schedule/frequency; everything funnels through one dashboard (and the mobile app) for admins. (Key nuance: locations must share EIN and pay cadence.)

Key Takeaway: For franchisees with separate EINs or distinct cadences, confirm your business’s structure; Square’s documentation is explicit on multi-state setup, while Homebase is clean for “same EIN, multi-location” operations.

4) Speed to Money & Pay Flexibility

- Square: standard ACH timing; (contractor-only runs are cheap), but Square doesn’t position earned wage access (EWA) as a native payroll feature.

- Homebase: Next-Day Pay plan (priced higher) and Pay Any Day / Cash Out style earned wage access for employees (with limits that can be set by management and program usage documented). That’s a real lever for hourly retention, as most tipped employees expect to be paid same day.

5) Benefits, Garnishments, and Year-End

- Square: partners for health (SimplyInsured) and 401(k) (Guideline), with deductions syncing to payroll. Workers’ comp is add-on available. It’s a classic, proven partner model with predictable pricing for 401(k) plans.

- Homebase: full-service payroll with automatic tax calculation/filing, W-2/1099 creation, and wage garnishment services (child support, tax levies, other post-tax deductions) handled with built-in caps/end dates and remittances.

Takeaway: Square’s benefits are robust via partners; Homebase shines when you’re wrangling garnishments alongside hourly payroll complexity.

6) Reporting

- Square: payroll reports include paycheck details & employee totals; you can pull state tax resources and filings views from Dashboard.

- Homebase: payroll reports plus labor vs. sales views (via POS imports), department/role cost breakdowns, and long-term timesheet retention on higher tiers, which in my experience as a CPA, is super useful for audits.

Ecosystem Fit: Where Each One Just Works

If You’re Already on Square POS

Square Payroll + Shifts is a straight line: team clocks in on the register or Team App, tips/commissions sync, and you run payroll at one price point that’s hard to beat. For owner-operators with simple schedules, this is the lowest-friction path.

If Your Bottleneck Is Scheduling/Coverage and Compliance (Not “Just Payroll”)

Homebase starts at the schedule and time clock, not the register. The product’s center of gravity is keeping the schedule staffed, enforcing your break/OT rules, capturing timesheets with proof, messaging the team, and then pushing clean data into payroll. You can add hiring, onboarding (W-4/I-9/W-9 capture), HR/compliance, PTO accrual policies, permissions, departments, and tip pooling without relying on multiple vendors. This keeps you from having to use multiple apps to get the job done, which I always count as a big advantage.

Total Cost of Ownership in the Real World

- Square: $35 base + $6/person paid + (optionally) Shifts Plus ~$4 per team member if you need advanced scheduling/time features beyond the free 5-person allowance. If you’re already paying for Square POS and don’t need complex scheduling, your monthly burn is fairly lean.

- Homebase: $39 base + $6/employee paid for payroll, plus your Homebase plan (Basic is free for up to 10 employees at one location; Essentials/Plus/All-in-One carry per-location fees), and Tip Manager $25/location if you need pooling. That sounds like “more,” but you’re also consolidating 3–4 tools you might otherwise buy separately.

When I model this for a 20-employee, two-location restaurant with tip pooling and real PTO controls, Homebase’s higher subscription can pencil out when you back out the cost of separate scheduling/time apps and the labor hours saved by not reconciling tips manually every payroll (something I detest doing).

Implementation and Administrative

- Square onboarding is straightforward if you’re already a Square seller: connect payroll, authorize as reporting agent/POA, add state accounts (they partner with CorpNet for registrations), and you’re off. Timecards from Shifts flow automatically.

- Homebase setup is similarly streamlined: stand up time clocks, bring in your POS for sales/tips if desired, configure OT/breaks/departments, and enable Payroll. For multi-location under one EIN and unified pay cadence, it’s designed to be admin-light.

From there, the day-to-day is pretty hands-off: once Homebase is configured, scheduling, time tracking, and payroll stay in sync without manual exports or imports. The onboarding help is human (not just docs), setup is quick, and pay runs become a background task — accurate, reliable, and aligned with how hourly teams actually work.

Where Do They Fall Short?

- Square Payroll

- Base price is great, but if your scheduling needs push you into Shifts Plus for a larger team, the cost gap shrinks.

- Benefits are via partners (good), but it’s still a multi-party experience; if you prefer a single vendor for everything beyond payroll, this feels more “assembled.”

- Tip pooling logic and restaurant-grade distribution transparency rely on Shifts configuration more than a purpose-built pooling engine.

- Homebase

- Payroll base fee is $4 higher than Square; Next-Day Pay costs more if you want faster ACH.

- Tip Manager is an extra $25/location (I consider it worth it for restaurants, but it’s still a line item).

- Multi-location nuances: all locations need the same EIN and pay schedule/frequency for the unified workflow. I haven’t run into this as a problem in the real world, but it’s something to consider.

Technical Plumbing You’ll Care About (Trust Me!)

- Data provenance & audit trail

- Square: timecards and tips originate in the Square ecosystem (register + Team App), minimizing export/import friction if you’re already there. Reports for payroll and tax forms live in the Dashboard, which is still under one umbrella.

- Homebase: longer retention on timesheets at higher tiers, labor-vs-sales analysis by department/role, and photo/GPS clock-ins to defend time entries. The direct write-back of pooled tips to timesheets eliminates the most common reconciliation failure.

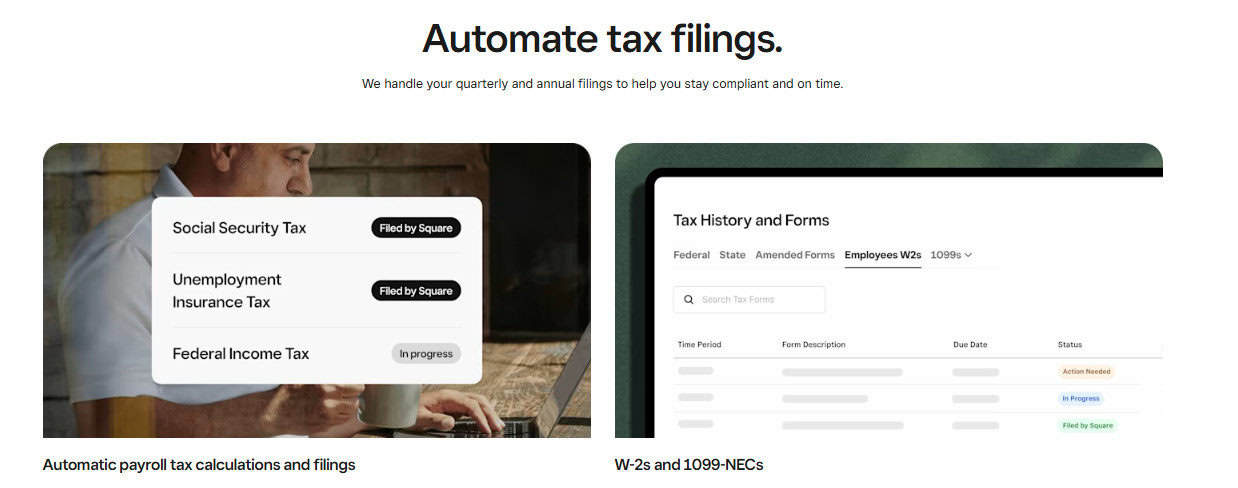

- Taxes & filings

- Both are full-service: they calculate, file, and remit federal/state (and local, where applicable), and issue W-2s/1099s at year-end. Square’s docs are explicit about multistate. Homebase’s payroll pages and tax-form guides outline what they file and deliver to employees.

- Garnishments & deductions

- Homebase can automate handling of child support and other court-ordered deductions with caps and remittance; Square supports benefits/garnishments entry per employee, but emphasizes benefits via partners.

- Pay flexibility / EWA

- Homebase’s Pay Any Day / Cash Out gives employees access to earned wages, which is useful for retention when $50 before Friday determines whether a shift is covered. Be aware of program terms/limits.

What Platform is Best for What Business

Choose Square Payroll If:

- You run Square POS and want the cheapest credible full-service payroll tightly coupled to that POS.

- Your team is ≤5 for scheduling (or you only need basic Shifts), and tip pooling isn’t complex.

- You’re comfortable with benefits via partners and don’t need a consolidated HR/people-ops suite.

Choose Homebase If:

- Your headaches are schedules, coverage, OT/break rules, PTO accruals, departments & permissions, and tip pooling, and you want that data to automatically become payroll.

- You operate multiple locations under one EIN and want managers to run the day-to-day inside one app (schedules, time off, messaging, hiring), with payroll as a push-button artifact.

- You need EWA/Next-Day Pay options, garnishment automation, and restaurant-grade tip distribution with a clean audit trail.

A CPA’s Decision Grid

- Cash cost: If you’re pure POS-centric and super price-sensitive, Square wins by ~$4/mo on base plus the contractor-only bargain tier. If you’d otherwise be buying scheduling/time/tip-pooling separately, Homebase often nets out.

- Admin hours: Homebase makes people ops (not just payroll) simpler. That saves you hours every week when swaps, PTO, and tips surge.

- Risk: Both file taxes and issue year-end forms. Homebase’s guardrails (break waivers, OT rules, timesheet retention, garnishments) reduce gotchas I see in Dept of Labor audits. Square’s multistate documentation is strong if you’re distributed.

- Restaurant realities: If you pool tips or blend FOH/BOH distributions, Homebase’s Tip Manager is purpose-built and worth the $25/location. If you’re a counter-service café with light tipping and Square POS, Square is perfectly fine.

My Closing Thoughts

Both platforms are credible. Square Payroll is the budget-friendly, POS-native workhorse that is especially compelling for Square sellers who want a single vendor for checkout + payroll. Homebase inches ahead for hourly teams that live and die by scheduling discipline, compliant time capture, and clean tip math, and want payroll to be a downstream button, not a weekly project.

If you’re in the messy middle, i.e., multi-manager scheduling, frequent shift swaps, PTO accruals, pooled tips, wage garnishments, and a need for EWA Homebase is the stack I’d deploy, and I wouldn’t even think about looking back. If you’re Square-first and your scheduling needs are modest, Square Payroll is the pragmatic choice and will save you a few dollars a month.