- The Bottom Line, Up Front

- The Top Quickbooks Alternatives

- 2. Xero – Best for Integrations and Scalability

- 3. FreshBooks – Best for Freelancers and Service-Based Businesses

- 4. Wave – Best Free Accounting Software for Small Businesses

- 5. Zoho Books – Versatile and Budget-Friendly Solution

- 6. Digits

- Evaluating Your Business’s Needs

- Choosing the Right QuickBooks Online Alternative

- Closing Thoughts

Last Updated on January 17, 2026 by Ewen Finser

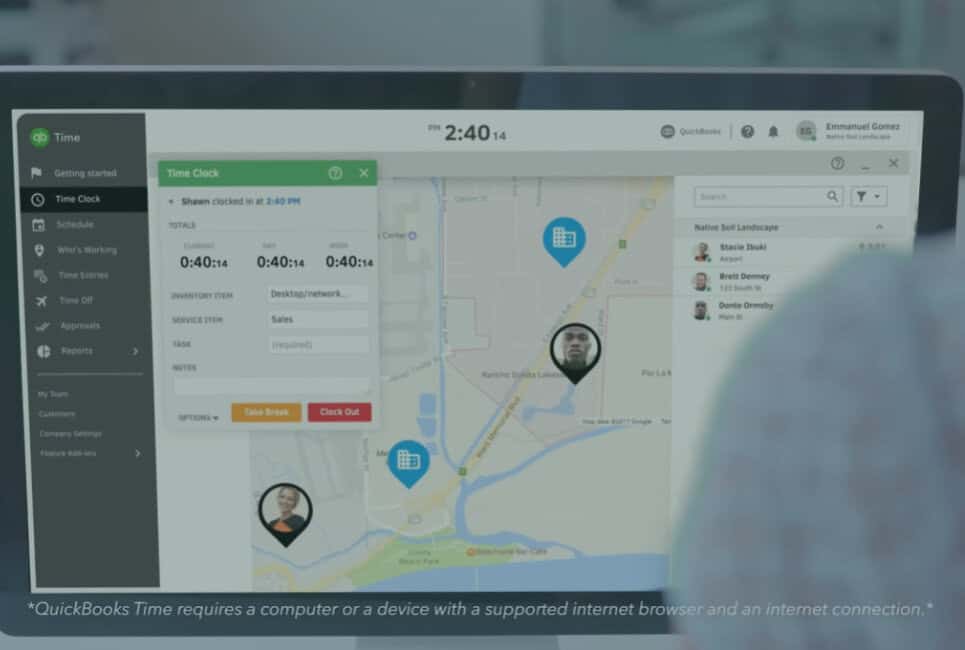

QuickBooks Online has established itself as a reliable and robust accounting platform for small businesses, freelancers, and even mid-sized enterprises, and for good reason. It has an intuitive interface, comprehensive feature set, and strong brand recognition, which have made it the go to choice for many business owners.

However, QuickBooks isn’t for everyone. Businesses seeking different price points, distinct functionalities, better automation, or simpler interfaces might find other accounting solutions more suitable.

As a CPA, I feel like I’ve tried them all. I’ve used everything from behemoths like SAP and Oracle to software like Wave. In that time, I’ve found plenty of great Quickbooks alternatives. If QBO isn’t working for you, you might need slightly different key features, pricing, usability, or unique strengths, all of which these alternatives provide.

Whether your priorities involve artificial intelligence-powered automation, user-friendliness, budget constraints, or scalability, the software discussed here can offer robust alternatives to QuickBooks Online.

The Bottom Line, Up Front

Here are my five noteworthy QuickBooks Online alternatives, and where they stand out:

- Puzzle.io: Geared for businesses that desire automation, fair price point, good for founders.

- Xero: Offers rich integrations, good for business with diverse inventory.

- FreshBooks: Best for service based businesses, excellent time tracking options.

- Wave: Freemium option, attractive for entrepreneurs on a budget.

- Zoho Books: Great for enterprises who desire scalability within an ERP.

The Top Quickbooks Alternatives

1. Puzzle.io – AI-Driven Efficiency for the Modern Business

Overview

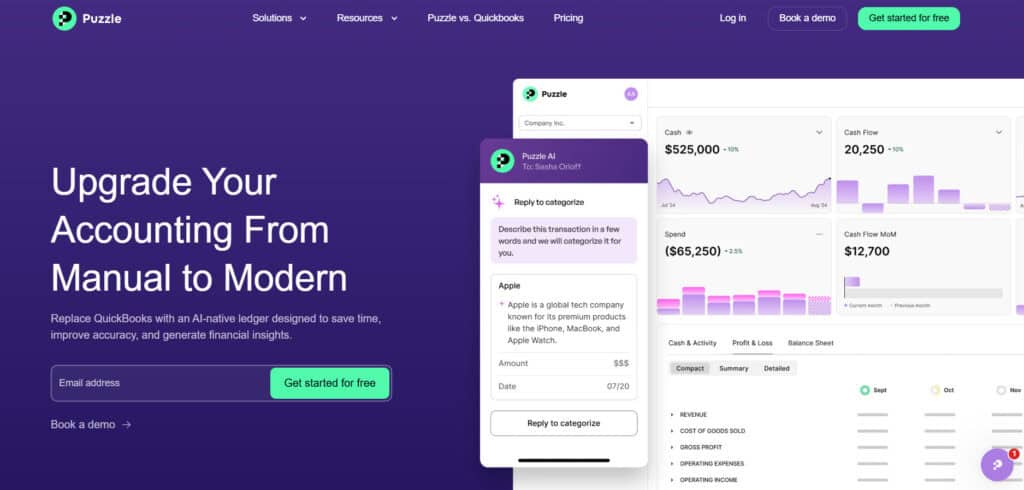

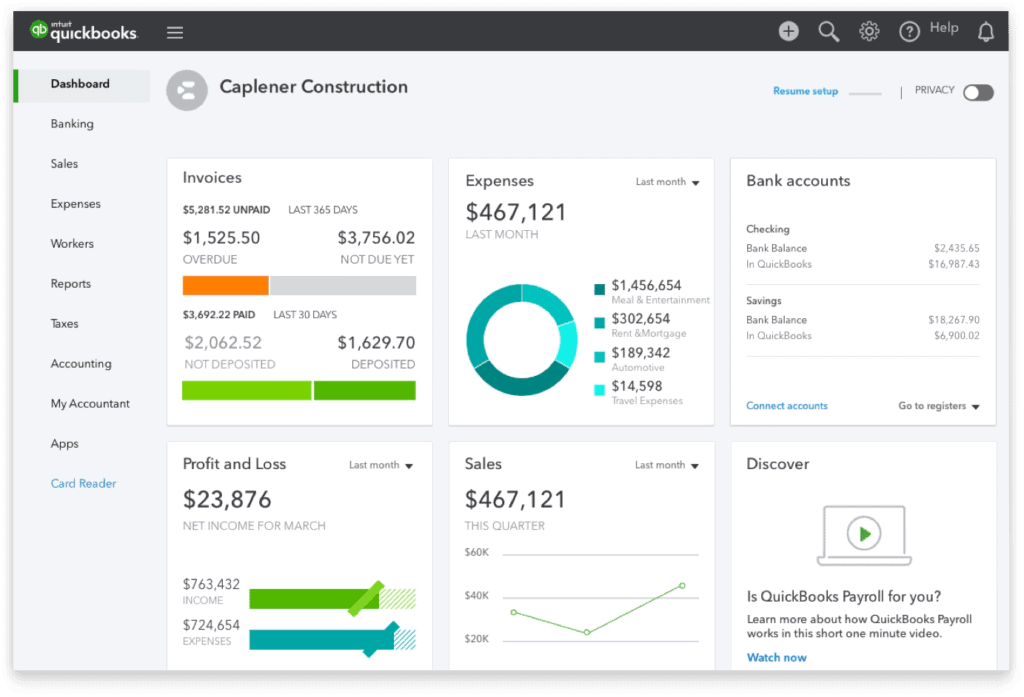

Puzzle.io is emerging as one of the strongest contenders among next-generation accounting software solutions, primarily due to its innovative integration of artificial intelligence. This cloud-based accounting platform differentiates itself from traditional solutions like QuickBooks Online by heavily focusing on automation.

Puzzle.io is engineered to minimize manual data entry, reduce errors, and significantly improve efficiency by leveraging advanced AI capabilities.

Key Features

- Automated Bookkeeping: Puzzle.io takes automation to the next level, using machine learning algorithms to handle repetitive tasks such as categorizing expenses, reconciling transactions, and generating insightful reports. This not only speeds up accounting processes but also greatly reduces human error.

- Real-Time Financial Reporting: One of the standout features of Puzzle.io is its real-time reporting capability. The platform automatically updates financial statements as transactions occur, providing users with instant access to critical business metrics. Their dashboard is one of the best-looking that I’ve seen to date, and makes digesting complex information a breeze.

- Invoice Management: Puzzle.io allows users to generate, customize, and send professional invoices effortlessly. The software tracks payments, sends automatic reminders, and manages recurring billing cycles.

- Collaborative Environment: The platform promotes seamless collaboration between accountants, business owners, and team members. Its intuitive interface allows for easy access and efficient communication, facilitating better teamwork.

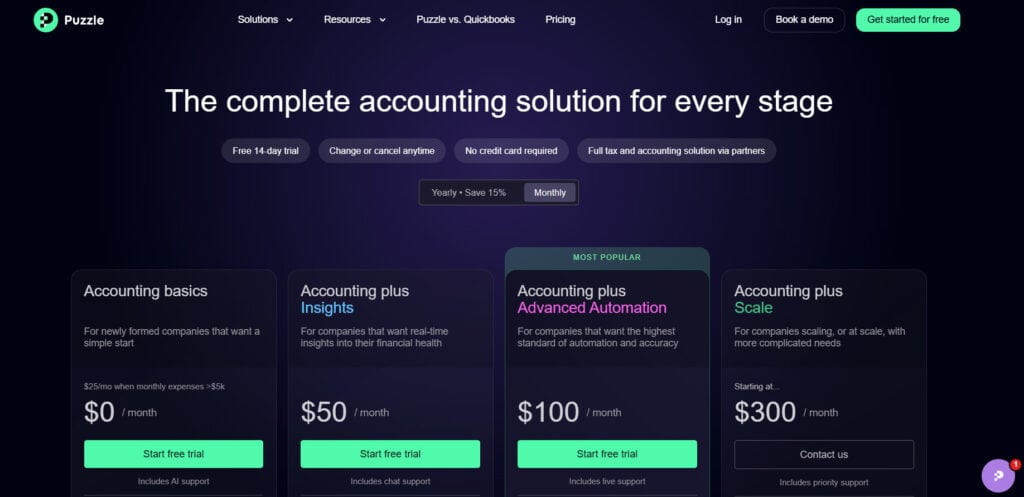

What’s the Price?

Puzzle offers competitive and scalable pricing. Plans typically start at around $25 per month for basic small-business functionality, with additional tiers unlocking advanced reporting, higher transaction limits, and multi-user access. Their enterprise solutions are around $300, with other tiers falling somewhere in between.

Strengths vs. QuickBooks Online

Compared to QuickBooks Online, Puzzle.io’s primary strength is its powerful automation capability. It can substantially streamline workflows and minimize manual intervention far beyond what QuickBooks can deliver. Businesses looking for a highly automated, AI-centric solution will find Puzzle.io compelling.

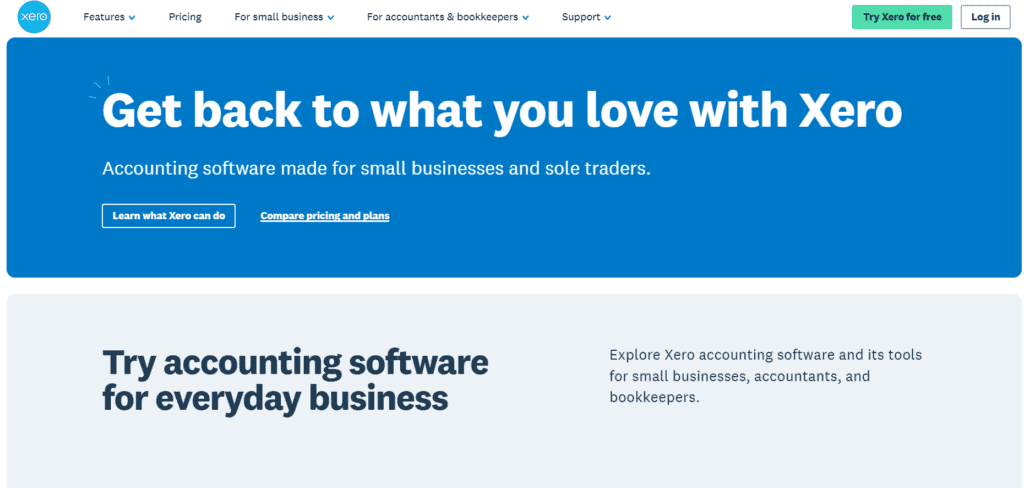

2. Xero – Best for Integrations and Scalability

Overview

Xero is one of QuickBooks Online’s closest competitors, having built a robust reputation as an easy-to-use, scalable accounting solution suitable for small to mid-sized businesses. Founded in New Zealand, Xero has grown into a global force, popular for its powerful integrations, user-friendly design, and strong community support.

Key Features

- Rich Integrations: Xero supports hundreds of integrations with popular business applications such as Shopify, Stripe, HubSpot, and more. This extensive connectivity makes it ideal for businesses that rely heavily on various third party tools.

- Bank Connections and Reconciliation: Xero simplifies bank reconciliations with its powerful rules-based matching. This feature significantly reduces the time spent on manual matching and categorization tasks.

- Inventory Management: Unlike some other competitors, Xero provides robust inventory management capabilities right within its software, making it ideal for small retailers or ecommerce businesses. This definitely sets it apart from QBO as many retail vendors must opt to use their POS system as a way to closely track inventory, instead of their accounting software. QBO just can’t handle that type of granular data, in my experience.

- Detailed Financial Reports: Users can generate comprehensive financial statements, cash flow forecasts, and other custom reports. Xero’s reporting tools are well-regarded for clarity and depth.

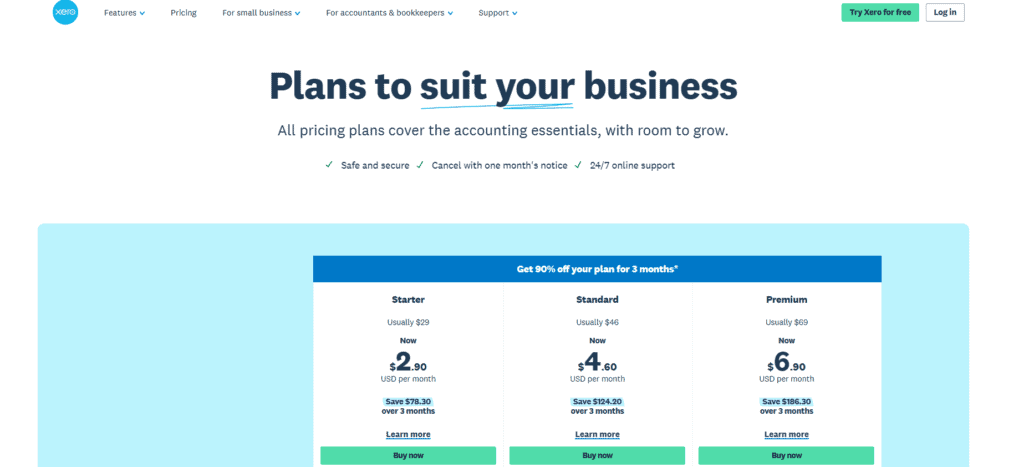

What’s the Price?

Xero’s pricing starts at around $20 per month for basic features, scaling upward to $80 and beyond for plans with more extensive capabilities like multi-currency support, payroll integration, and advanced analytics.

Strengths vs. QuickBooks Online

Compared to QuickBooks Online, Xero often receives praise for its superior integration capabilities and clean interface. Businesses heavily invested in third-party apps and services may prefer Xero’s seamless integration capabilities. Additionally, Xero’s pricing structure may offer better scalability for growing businesses.

3. FreshBooks – Best for Freelancers and Service-Based Businesses

Overview

FreshBooks positions itself primarily toward freelancers, consultants, and service-based small businesses rather than inventory-focused operations. It provides streamlined invoicing, easy expense management, and exceptional time-tracking capabilities.

Key Features

- Intuitive Invoicing: FreshBooks excels in invoice creation, with customizable templates, automated follow-ups, and online payment integration, making it highly suited for freelancers and service providers.

- Time Tracking and Project Management: To me, this one really stands out as many other software drop the ball when it comes to time tracking or project management. Business owners can effortlessly track time spent on projects and tasks, converting tracked hours directly into invoices. This integration significantly simplifies billing for hourly or project-based businesses.

- Client Collaboration Portal: FreshBooks offers a dedicated client portal where clients can view invoices, project statuses, and payment histories, enhancing transparency and client relationships.

- Ease of Use: FreshBooks stands out for its simplicity and ease of setup, making it ideal for users without deep accounting knowledge.

What’s the Price?

FreshBooks’ pricing begins around $11 per month for its Lite plan, suitable for freelancers. More advanced plans cost around $30–$55 per month, unlocking greater reporting, multi-user access, and additional automation tools. If you plan to use it for Payroll, expect it to be an additional $6 per employee per month.

Strengths vs. QuickBooks Online

FreshBooks provides a more focused user experience specifically tailored to service-oriented businesses and freelancers. Compared to QuickBooks Online, it excels in invoicing, time tracking, and client communication features. Businesses or individuals needing straightforward invoicing and client management functionality will find FreshBooks an excellent alternative.

4. Wave – Best Free Accounting Software for Small Businesses

Overview

Wave Accounting stands out prominently as the most affordable alternative on our list, mainly because its core accounting functionality is completely free. Founded in 2009, Wave aims squarely at small business owners, freelancers, and startups that need reliable accounting tools without the added expense. The software has gained popularity among budget-conscious entrepreneurs and microbusinesses for its cost-effectiveness and simplicity.

Key Features

- Comprehensive Free Accounting: Wave offers completely free accounting features that cover essential financial needs, including bookkeeping, invoicing, expense tracking, and financial reporting. There are no hidden fees or usage limits, making it uniquely attractive to startups and solo entrepreneurs.

- Invoicing and Billing: Wave’s invoicing system enables users to create professional-looking invoices, send automatic payment reminders, and accept online payments. Although invoicing is free, Wave does charge a small fee for payment processing transactions.

- Bank Integration and Reconciliation: Wave supports direct connections with thousands of banks, automatically importing transaction data for easy reconciliation. Its straightforward reconciliation feature simplifies monthly accounting routines.

- User-Friendly Dashboard: Wave’s dashboard offers a clear snapshot of business performance, including profit and loss summaries, cash flow tracking, and quick access to financial statements. While not as robust as some of the others on this list, it’s hard to beat free!

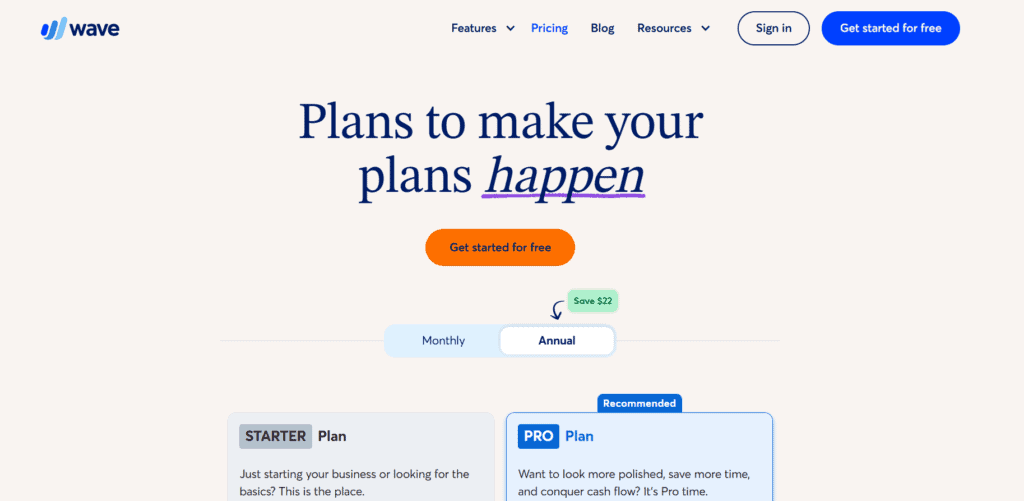

Pricing

Wave is entirely free for its basic accounting, invoicing, and expense tracking services. However, payment processing incurs standard credit card fees (around 2.9% + $0.60 per transaction). Payroll services are available for an additional monthly fee, typically around $20–$35, depending on state-specific features.

Strengths vs. QuickBooks Online

Wave’s greatest advantage over QuickBooks Online lies in its price—completely free for core accounting functionality. Small businesses or sole proprietors who do not require extensive customization or highly advanced reporting capabilities will find Wave’s free service more than adequate. QuickBooks may offer more sophisticated features, but Wave delivers unbeatable cost-effectiveness for budget-conscious entrepreneurs.

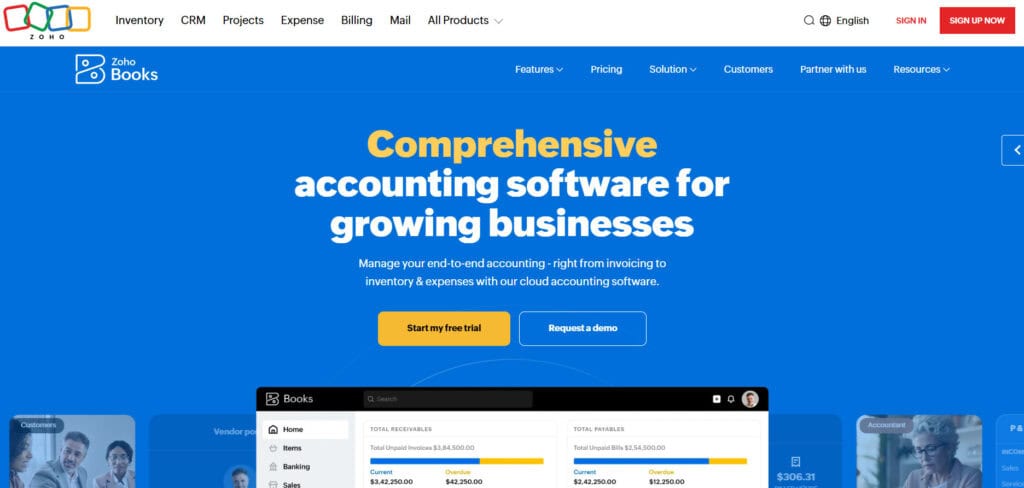

5. Zoho Books – Versatile and Budget-Friendly Solution

Overview

Zoho Books, part of Zoho’s comprehensive suite of cloud-based software, provides an excellent accounting solution that effectively competes with QuickBooks Online. Known for its affordability, robust customization capabilities, and seamless integration within the broader Zoho ecosystem, Zoho Books caters primarily to small and mid-sized businesses seeking both simplicity and versatility.

Key Features

- Robust Customization: Zoho Books allows extensive customization of invoices, estimates, financial reports, and dashboards. Businesses can tailor features to match their specific workflows and branding.

- Comprehensive Inventory Management: Zoho Books includes robust inventory management capabilities, ideal for retail and e-commerce businesses. It tracks stock levels, manages purchase orders, and updates real-time inventory valuations. In my mind, Zoho is playing chess while QBO is playing checkers when it comes to inventory management; you can’t even compare the two.

- Strong Integration with Zoho Ecosystem: Users invested in the Zoho ecosystem will benefit significantly from seamless integration with other Zoho products like Zoho CRM, Zoho Inventory, Zoho Expense, and Zoho Projects, streamlining overall

- Project and Time Tracking: Like FreshBooks, Zoho Books includes project management and time-tracking functionalities, allowing users to invoice clients accurately based on hours logged.

- Detailed Reporting: Users have access to over 50 customizable financial reports, including cash flow statements, income statements, and balance sheets. Zoho’s reporting suite is robust yet easy to interpret.

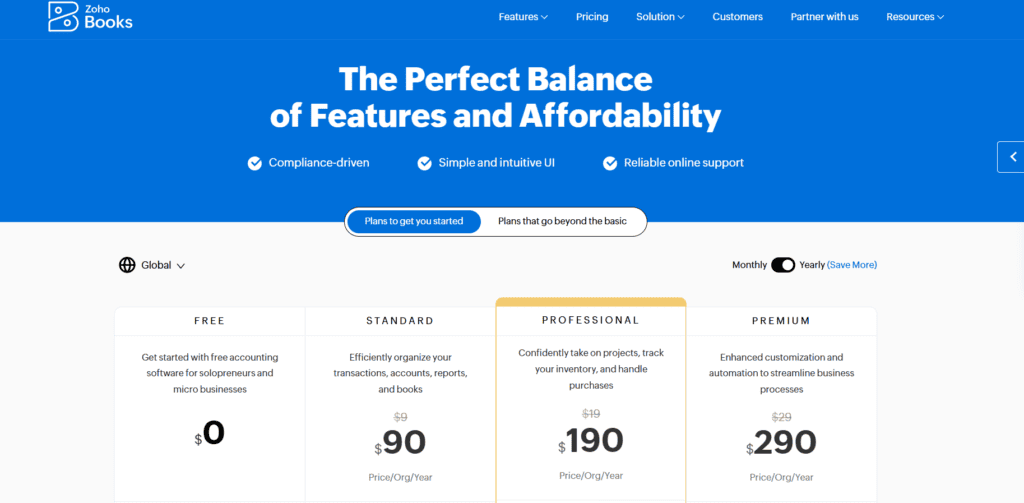

Pricing

Zoho Books provides exceptional value, starting around $15 per month for basic features with limited invoicing and transactions. Higher-tier plans range from $40–$60 per month, providing increased transaction volumes, multi-user access, advanced reporting, and comprehensive inventory management. Zoho often offers attractive discounts for annual subscriptions.

Strengths vs. QuickBooks Online

Compared to QuickBooks Online, Zoho Books offers superior integration capabilities within its own ecosystem, powerful customization options, and generally more affordable pricing tiers. Small businesses already using other Zoho products will find it particularly appealing due to streamlined integration.

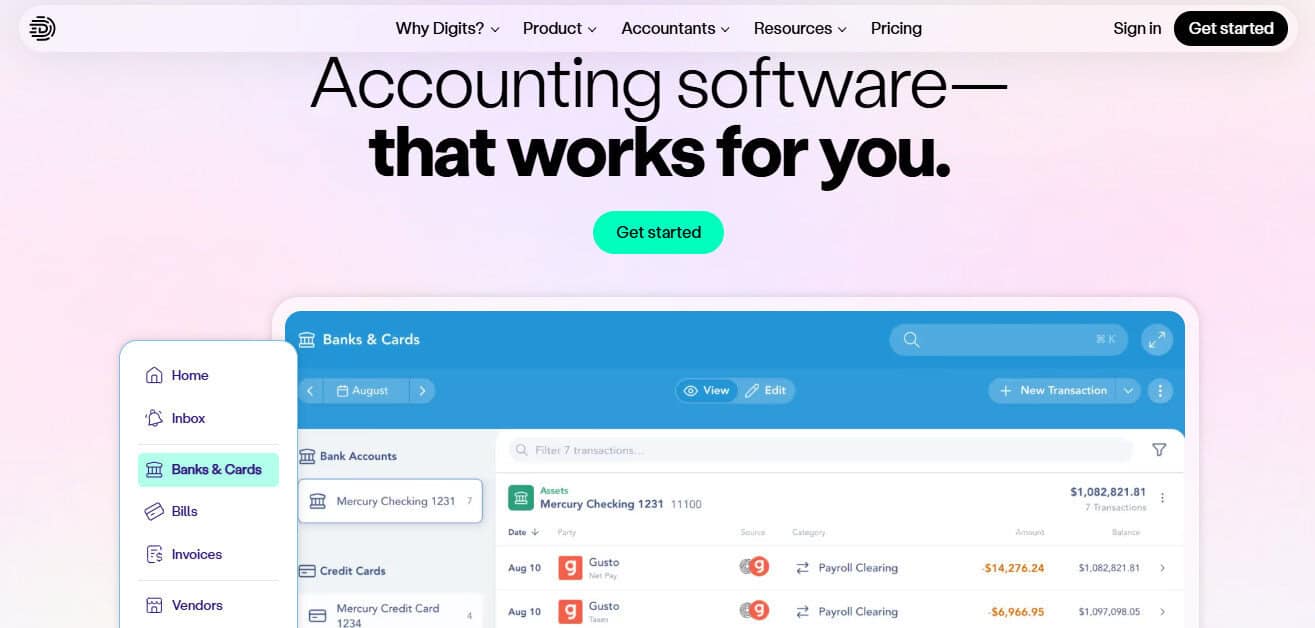

6. Digits

Overview

Digits is a cutting-edge accounting platform that moves away from the traditional “static” ledger and focuses on a “living” data model. Built from the ground up with a focus on artificial intelligence, Digits aims to eliminate the delay between transactions occurring and them appearing in your financial reports. It is designed specifically for modern founders and tech-forward businesses who want to spend zero time on manual categorization and instead focus on real-time financial health.

Key Features

- Digits AI (Financial Assistant): This is the crown jewel of the platform. It allows you to ask natural language questions like “How much did we spend on travel this month compared to last?” and get an instant, visualized answer without digging through reports.

- Living Dashboards: Unlike QBO’s static snapshots, Digits provides interactive, real-time dashboards that update as transactions occur, giving you a constant view of your burn rate, runway, and top expense categories.

- Automated Smart-Categorization: Digits uses advanced machine learning to predict and categorize transactions with high accuracy, learning your business’s specific patterns to reduce the human oversight required for bookkeeping.

- Collaborative Reporting: Reports are transformed into secure, web-based briefings. You can leave comments directly on specific transactions or data points for your team or accountant, turning financial review into a collaborative conversation.

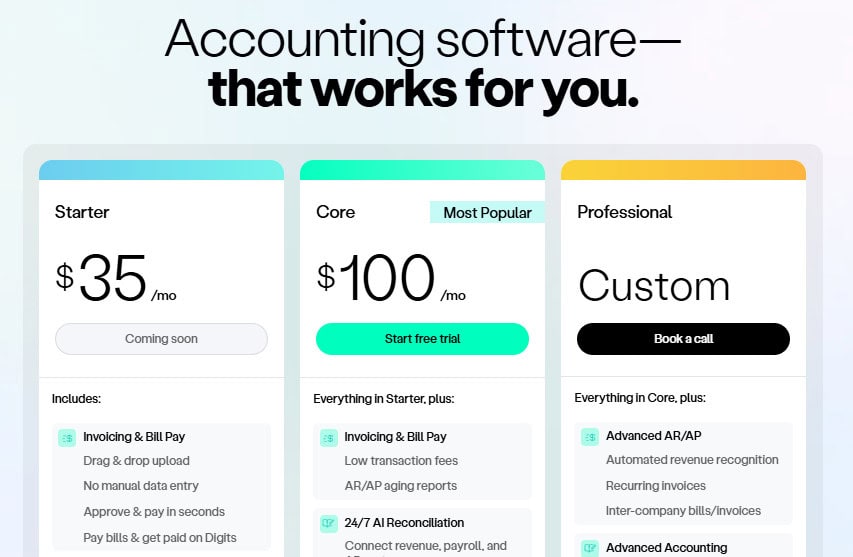

What’s the Price?

Digits offers a tiered approach that is very competitive for the tech space. They offer a lite version that’s around $35 per month, while their full accounting suite, Core, typically starts at $100. Custom solutions are available at custom price points in their Professional plan. This makes it a mid-range option, more expensive than Wave, but often more affordable than the mid-to-high tiers of QuickBooks Online.

Strengths vs. QuickBooks Online

The fundamental difference is proactivity. QuickBooks is built on a “check the box” philosophy, where you look back at what happened. Digits is built to tell you what is happening now. Its AI assistant is far more advanced than QBO’s search function, and its ability to handle automated reconciliations in real-time makes it much faster for founders who don’t have a dedicated full-time bookkeeper.

Evaluating Your Business’s Needs

So how do you know which of these platforms is best for you? When choosing your accounting software, start by assessing your business’s size and growth expectations, as scalability matters. Consider how important automation is to your workflow and whether integration with other tools—like payroll, CRM, or ecommerce—is essential. Evaluate your budget and whether you prefer predictable subscription-based pricing as opposed to annual contracts. Think about whether you need robust inventory management or if a service-focused solution is sufficient. Lastly, factor in your team’s accounting experience—some platforms cater to beginners, while others are built for seasoned professionals. Answering these questions will help you identify the software that best fits your business needs.

Choosing the Right QuickBooks Online Alternative

Now that we’ve explored the five QuickBooks alternatives—Puzzle.io, Xero, FreshBooks, Wave, and Zoho Books—consider what your business needs are and think what type of user you’d be when interacting with your accounting software. I have found the best fits for each accounting platform to be the following:

- Puzzle.io: Best for businesses emphasizing advanced automation, AI-driven bookkeeping, and real-time insights. Ideal for growing businesses aiming to significantly reduce manual accounting tasks.

- Xero: Excellent for companies needing robust integrations, scalability, and inventory management. Suitable for growing businesses or e-commerce operations needing extensive third-party connectivity.

- FreshBooks: Perfect for freelancers, consultants, and service-based businesses requiring simple, robust invoicing, project management, and time-tracking functionality.

- Wave: Ideal for startups, freelancers, and very small businesses needing reliable accounting functionality without incurring additional costs. The perfect entry-level accounting solution.

- Zoho Books: Recommended for small to medium-sized businesses already integrated into the Zoho ecosystem, requiring customization and robust inventory and expense management features.

Closing Thoughts

While QuickBooks Online remains the dominant player in accounting software, it’s far from the only solution that delivers value. Each alternative covered here offers unique strengths—be it Puzzle’s AI-powered automation, Xero’s extensive integrations, FreshBooks’ exceptional usability, Wave’s budget-friendly appeal, or Zoho Books’ comprehensive flexibility.

Ultimately, evaluating your unique business requirements against the features, pricing, and capabilities outlined above will lead you to the right alternative—empowering you to streamline your accounting operations and focus on achieving long-term business success.