Last Updated on February 12, 2026 by Ewen Finser

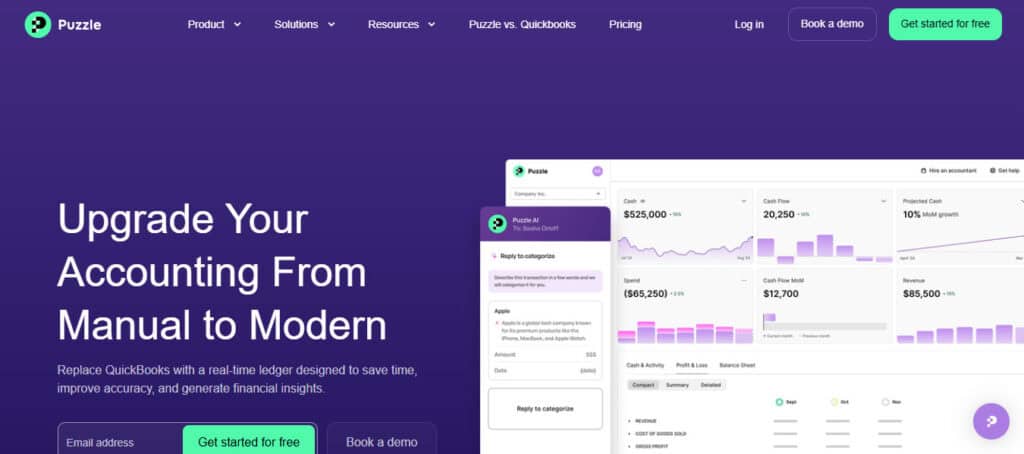

When most people think of accounting software, Quickbooks is often the first name that comes to mind. Well, there’s a new contender worth paying attention to, especially as AI continues to reshape how we work. What many folks don’t realize is that Puzzle.io has quietly and quickly become one of the most AI-integrated platforms in the industry — leveraging machine learning, predictive analytics, and automation to streamline financial workflows in a way that feels both intuitive and intelligent.

Whether you’re a solopreneur trying to categorize expenses or a CFO managing multi-entity consolidations, Puzzle.io’s AI-backed features are shaping a future where software doesn’t just track your books — it helps you run them.

The Bottom Line up Front

Puzzle.io is a mature, AI-enhanced accounting platform that brings serious intelligence to everyday financial tasks — but it works best when paired with a savvy human in the driver’s seat. It can do most of the heavy lifting that a bookkeeper does, but for a larger business it would be ideal to have a qualified accountant or CPA running it to ensure that errors are caught, transactions are coded appropriately, and that the software is operating smoothly and effectively.

AI-Powered Features That Stand Out

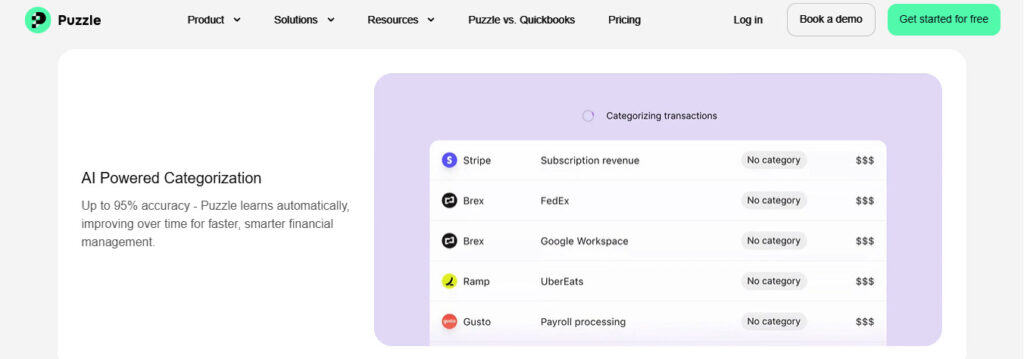

Smart Categorization

Puzzle.io’s AI uses machine learning models trained on millions of transactions to automatically classify bank and credit card transactions. Over time, the system “learns” your and your business’s habits — recognizing vendors, recurring charges, and how you categorize certain expenses — and adjusts its auto booking accordingly.

- Pro: Saves hours of manual entry, whether that be you or the business’s bookkeeper.

- Pro: Reduces the chance of categorization errors

- Pro: Saves money on your labor and wage expenses since the software is performing the bulk of the work.

- Con: Occasionally mislabels new or unusual vendors

- Con: If left unchecked, can be burdensome to correct and fix

AI in action: As Puzzle.io begins to learn and recognize transactions, it’ll begin to push them over to the company’s financials, which are generated via the home dashboard. You can quickly identify what’s sitting in each expense, revenue, or balance sheet account by drilling into the account. A pop-up window will show you what transactions compose the balance of each account for the filtered time period.

Predictive Invoicing & Smart Suggestions

Puzzle.io uses predictive algorithms to suggest when and how to invoice clients, based on your historical billing cycles and customer payment behaviors. As a busy business owner who may be stretched a little thin, it’s super helpful to be reminded to invoice your clients for the services rendered. As a CPA, I’ve seen my clients let hundreds of thousands of dollars go overdue from their customers simply because they haven’t reached out to them or followed up. Puzzle.io takes the headache out of this if you’re billing consistently, as it’ll pick up on and learn these patterns.

- Pro: Helpful nudges when you forget to invoice customers and clients

- Pro: Suggests line items you might miss

- Con: It may suggest the wrong amount if you’re billing an amount that isn’t consistent with typical items

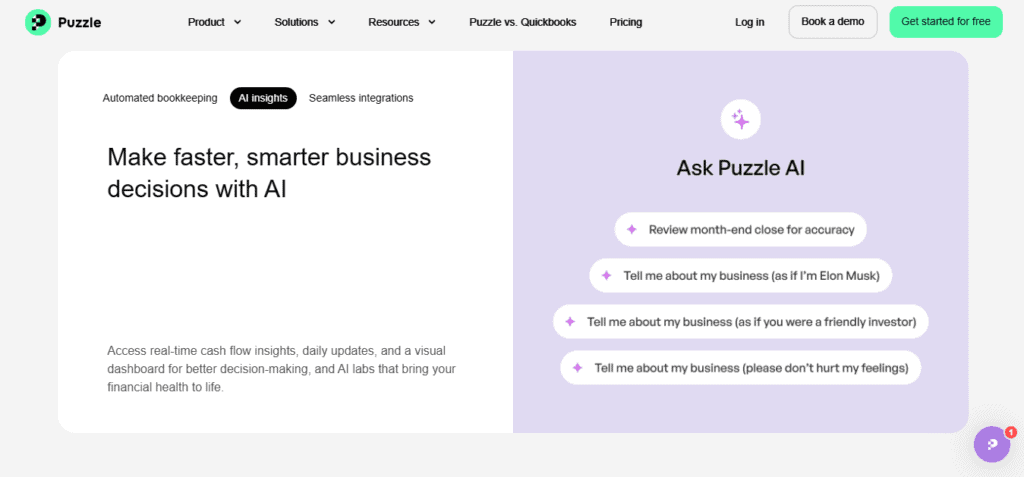

Real-Time Dashboards & Forecasting

In my opinion, as an accountant whose end goal is correct, accurate, and timely financial statements, the real-time dashboards and forecasting are the bread and butter of Puzzle.io (aside from the ability to link to Stripe, BNYM, and other payment processor vendors…more on that later). Its ability to prepare real-time financial statements and reconcile transactions as they come in and out of the bank can’t be overstated. It allows business owners to make decisions with real-time expense reporting, cash balances, and revenue generation.

In my opinion, Puzzle.io is specifically user-friendly to Start-Up businesses who may often find themselves in a state of cash burn as they spool up revenue generation. For example, if a start-up finds itself between funding rounds and is in a cash crunch, Puzzle.io can show real-time expenses and can help a Founder or CEO quickly decide where to cut costs until the next funding round comes in – no waiting for month-end close to getting a big picture as it’s ready in real-time.

While Puzzle.io isn’t a full-blown FP&A tool, its AI-powered cash flow planner uses transaction trends and scheduled expenses to forecast future cash positions. This feature has improved dramatically in my opinion compared to juggernauts like QBO and Xero and is especially helpful for short-term liquidity planning.

- Pro: Intuitive visualizations dashboard reporting, the UI is user-friendly and easy to navigate

- Pro: Forecasts that adjust as new data comes in

- Con: Limited to the short term and not customizable enough for complex models

- Con: If many items need to be filtered out, it can become cumbersome – and it might just be better to export to Excel and build out a model the traditional way

Automated Error Detection

Behind the scenes, Puzzle.io is constantly running integrity checks. If your balance sheet doesn’t balance, or if your bank balance differs from your register, Puzzle.io flags these inconsistencies, often offering solutions to fix them.

The fixes are usually pretty easy. Perhaps in your ledger, your bookkeeper booked two transactions, one for $40 and one for $60 to the same vendor, but on different days, and wrote a single $100 check to cover the expense. The system may struggle to realize those transactions on the two different days needs to match the single outgoing check. I have found that many accounting softwares often struggle with this, especially if their dates don’t match.

- Pro: Instant notification of data entry errors

- Pro: Recommends reconciliation strategies

- Con: Doesn’t always explain why a suggestion is being made

- Con: Can continue to struggle with complex situations, similar to ones described above

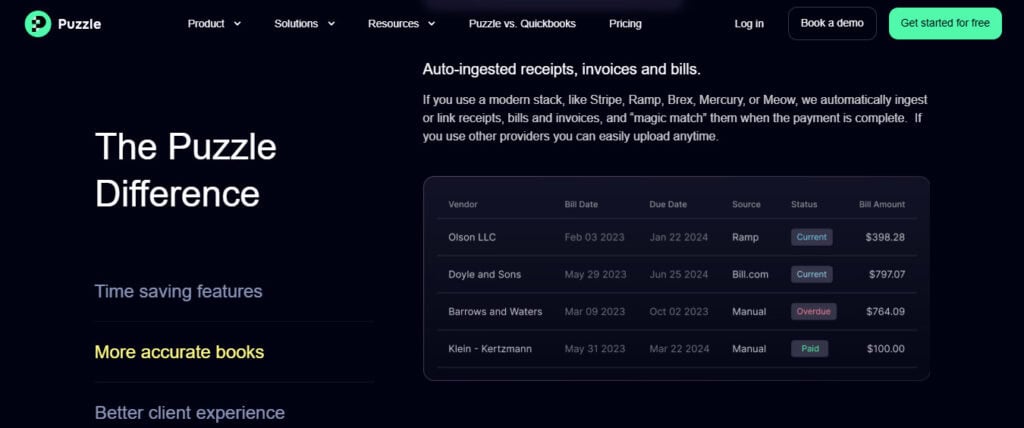

Integrations That Feed the AI

One of the unsung AI advantages of Puzzle is its ecosystem. Puzzle is readily available to integrate with payment processors like Stripe, Gusto, and Ramp — it gathers a massive amount of contextual data. This fuels its learning algorithms and enables cross-platform intelligence.

For example, Gusto payroll sync improves employee expense tracking and AI insights for labor cost forecasting. Shopify integration informs sales tax estimates and inventory restocking predictions. The more you integrate, the smarter Puzzle can become.

However, in my short time exploring the platform, I am not certain I saw a place for Square to interact with Puzzle. As many small businesses use Square for their point-of-sale system, this is something that I expect to be captured in an update in the near term. This was something that I consider to be a major con as Square has a superior reporting dashboard in my opinion, and the reports can be used to reference what’s on an accounting software’s books, as opposed to the granular data that’s available in their POS system.

Who Puzzle.io is Best For (AI-Wise)

Ideal Users | AI Impact |

Small business owners | Categorization, invoicing, and forecasting all become semi-autonomous |

Startup founders | Predictive cash flow planning and tax estimations are a massive plus |

Accountants & bookkeepers | Real-time dashboards and smart reconciliation tools manual grunt work |

Enterprises | May need to pair with third-party AI analytics platforms for deeper insights |

Limitations of Puzzle.io’s AI

No review would be complete without pointing out that there are limitations to any software. While software can make a business owner or accountant’s day easier, it still has to be reigned in and worked through consistently.

- In my opinion, it’s not explainable AI — meaning the system doesn’t always tell you why it made a categorization.

- The trouble that you get into with software outlining why it did something is if you’re trying to correct or replicate an entry consistently, it can get tricky pretty quickly.

- The trouble that you get into with software outlining why it did something is if you’re trying to correct or replicate an entry consistently, it can get tricky pretty quickly.

- It can learn bad habits if you incorrectly approve suggestions

- This item right here should raise a big red flag – but it’s true for all accounting platforms. A user can make their job ten times more difficult and time-consuming if they have to undo months of transactions because they didn’t catch a mistake. I like to call this a rogue AI running rampant.

- This item right here should raise a big red flag – but it’s true for all accounting platforms. A user can make their job ten times more difficult and time-consuming if they have to undo months of transactions because they didn’t catch a mistake. I like to call this a rogue AI running rampant.

- Puzzle, in my opinion, is still bound to the round peg to a round hole dilemma — custom rules and nuanced exceptions aren’t always supported.

- This makes it ideal for small to mid-size businesses. Custom solutions just don’t seem to be something it’s ready to offer, which is often the needs of large enterprises.

- This makes it ideal for small to mid-size businesses. Custom solutions just don’t seem to be something it’s ready to offer, which is often the needs of large enterprises.

- Performance drops off for multi-entity or industry-specific workflows like real estate, government contracting, or construction WIP accounting.

- A prime example of this would be something I’d struggle to use Puzzle for – I frequently work with construction clients who are often opening and closing dozens of projects quarterly. I just don’t see Puzzle being able to keep up with drilling each expense into each project – which is necessary for GAAP-compliant financials within the construction industry.

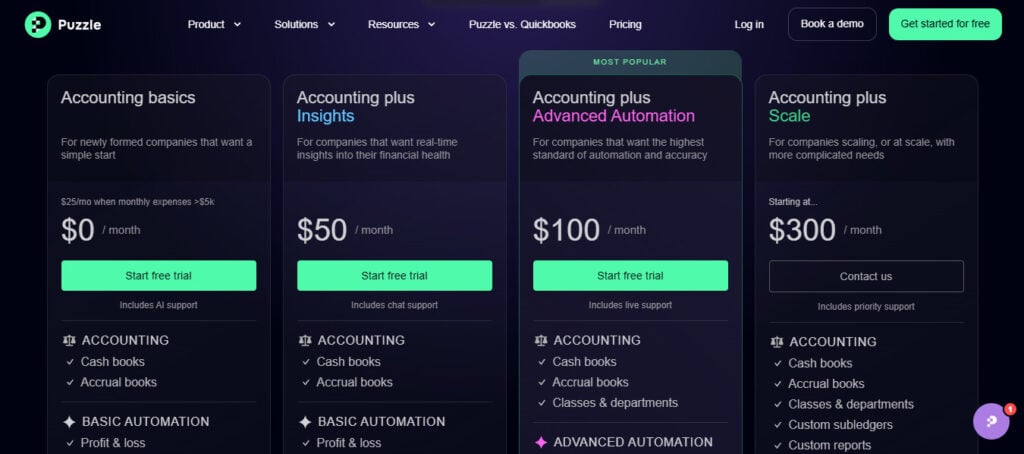

Pricing & Plans

I think Puzzle offers a unique and dynamic pricing plan for every business, even though some of their higher-tiered plans can be a little bit more expensive. Their business model includes a free plan that I think is perfect for giving Puzzle a test drive before any contracts are signed.

Plan | Price (Monthly) | Highlights |

Basics | $0 | Basic categorization & invoicing |

Accounting Plus | $50 | Adds insights, spend explorer, and significant change details |

Advanced Automation | $100 | Adds advanced automation, P&Ls, Balance Sheets, business insights, flux analysis |

Advanced | $300+ | The end all, be all, for custom solutions. Custom automations are available, custom prompts, continuous monitoring, etc. |

In my opinion, if you’re only using Puzzle for basic bookkeeping, you may not fully benefit from the AI features. But if you’re integrated across sales, payroll, and payments — it starts to shine. If that’s the case, a mid-tier to higher-priced tier plan would probably be more beneficial.

The Verdict: AI Forward, But Not Fully Autonomous

Puzzle.io may not be the most in-depth and granular (we’ll leave that trophy to SAP or Oracle) accounting software on scene, but its deep roots in financial data — and millions of categorized transactions — give its AI tools a serious edge. It’s not trying to reinvent accounting. Instead, it’s augmenting your workflows in subtle but powerful and seamless ways.

For users who embrace automation and want a smart co-pilot for their business finances, Puzzle is more than capable of checking all the boxes. Just remember, it’s still your responsibility to review, approve, and verify. Even the smartest machine-learning engine won’t protect you from bad data entry, poor judgment, or a missed deadline.