Last Updated on July 8, 2025 by Ewen Finser

Did you know that 80% of restaurant owners began their careers in entry-level positions? This means they completely understand what their employees experience and are committed to making their jobs easier, including helping them get paid faster.

Here’s some more facts – 30% of restaurant owners claim staffing as one of their main pain points. On top of that, 49% of employees will look for another job after just two payroll mistakes.

After hiring a new employee, it’s important that restaurant management makes sure they understand key details about their pay and workplace rules, as well as compliance requirements. New team members should know whether they’re hourly or salaried, full-time or part-time, and how tipped wages work. They should also be aware of how often they’ll be paid, their payment method, how taxes will be withheld, and what payroll deductions and employer contributions are involved.

Additionally, it’s essential to use an onboarding process to educate and communicate them about relevant labor laws such as minimum wage, overtime, breaks, paid time off, and public holidays. Clearly explaining these basics will help new employees feel confident and prepared as they join your restaurant team.

Restaurant payroll can be quite complex, as there are not just tips, but tips pooling and tip credits. As far as shifts go, servers work across multiple types of shifts with variable pay calculations and different shift-based pay. Then there is overtime pay, which is different between tipped employees and kitchen staff, and add on top of that break requirements, meal period rules and state-specific labor laws, and the restaurant owner could have a real headache on their hands.

And don’t forget, the restaurant business has a high-turnover rate, as high as 4.1% according to the U.S. Chamber of Commerce which translates into a constant hiring, onboarding and offboarding process.

When a restaurant operates across several locations or as part of a franchise, things can get more complicated. Each location might have its own pay structures, different tax rules to follow, and specific labor laws that apply locally. This means restaurant owners and managers need to keep track of varying regulations and requirements for each spot, which could be a challenge if you don’t have the right systems and technology in place.

To make all of this easier, there are plenty of payroll software options available, which can be a real lifesaver for restaurant owners. A payroll software can help handle everything from paying staff accurately, to onboarding and staying compliant with regulations. With the right software, managing payroll becomes far less stressful and much more efficient, allowing restaurant owners to focus more on running their restaurant smoothly.

Here are my choices for the best payroll software for restaurants.

Best payroll software for restaurants at a glance

Best Overall for restaurants with many hourly workers – Homebase

Best Overall for restaurants also wanting HR support – Gusto

Best Overall for restaurants who want advanced reporting – Paycor

Let’s go over these in detail to help learn which one is best for your restaurant.

Homebase

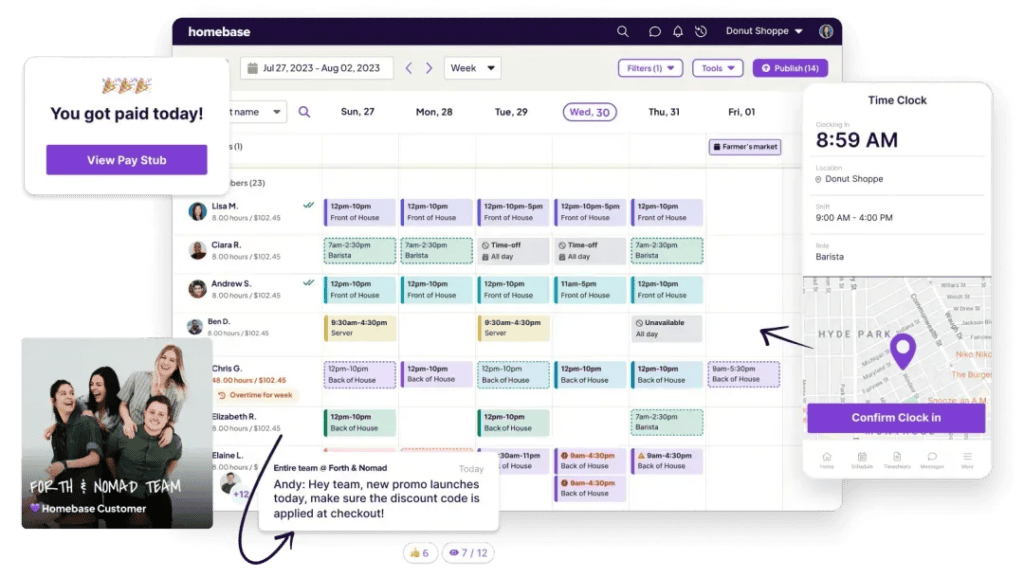

Homebase is a fantastic solution for restaurants looking to streamline how they manage their staff, thanks to its built-in payroll capabilities. Homebase acts as an all-in-one human resources platform. It combines everything you need for staff management, from scheduling and time tracking to team messaging, payroll processing, hiring tools, and onboarding features. Because it covers so much in one place, it’s become a go-to option for restaurant owners and their teams, especially those working hands-on in busy, real-world restaurant environments.

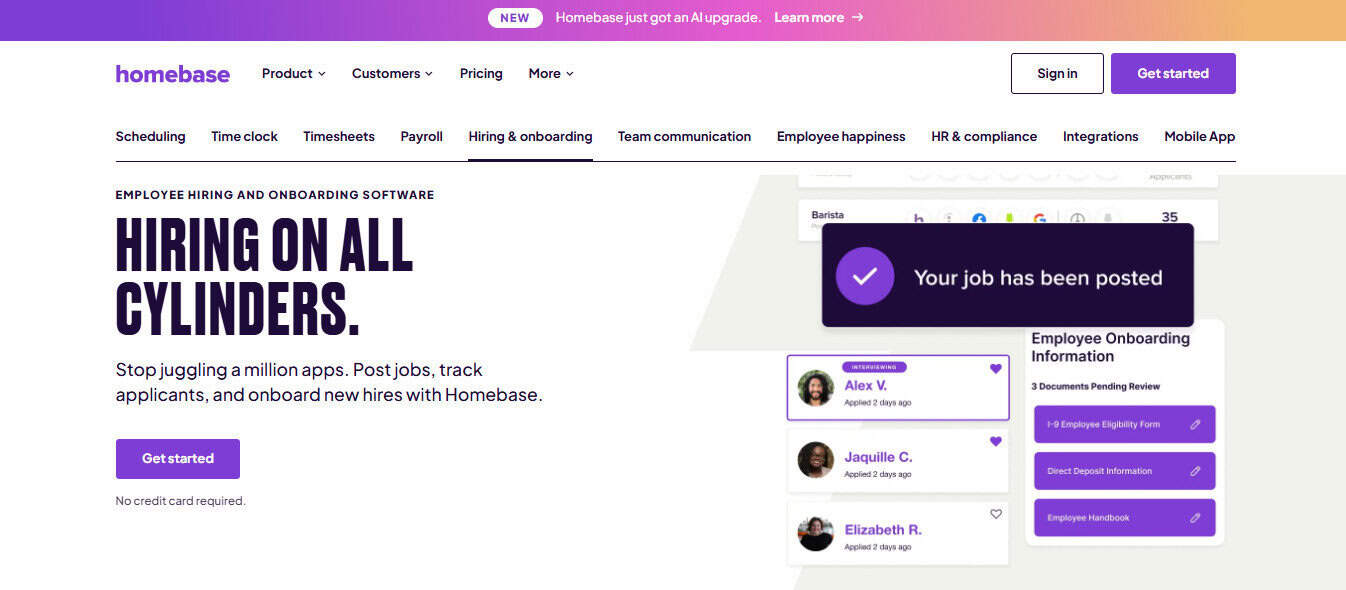

When it comes to onboarding employees, Homebase makes this process simple and efficient. You can quickly add new members to the roster and immediately send them their schedules and any other important documents such as regulation checklists that they need. This helps new employees get up to speed right away and ensures they have all the information needed from day one.

The Good

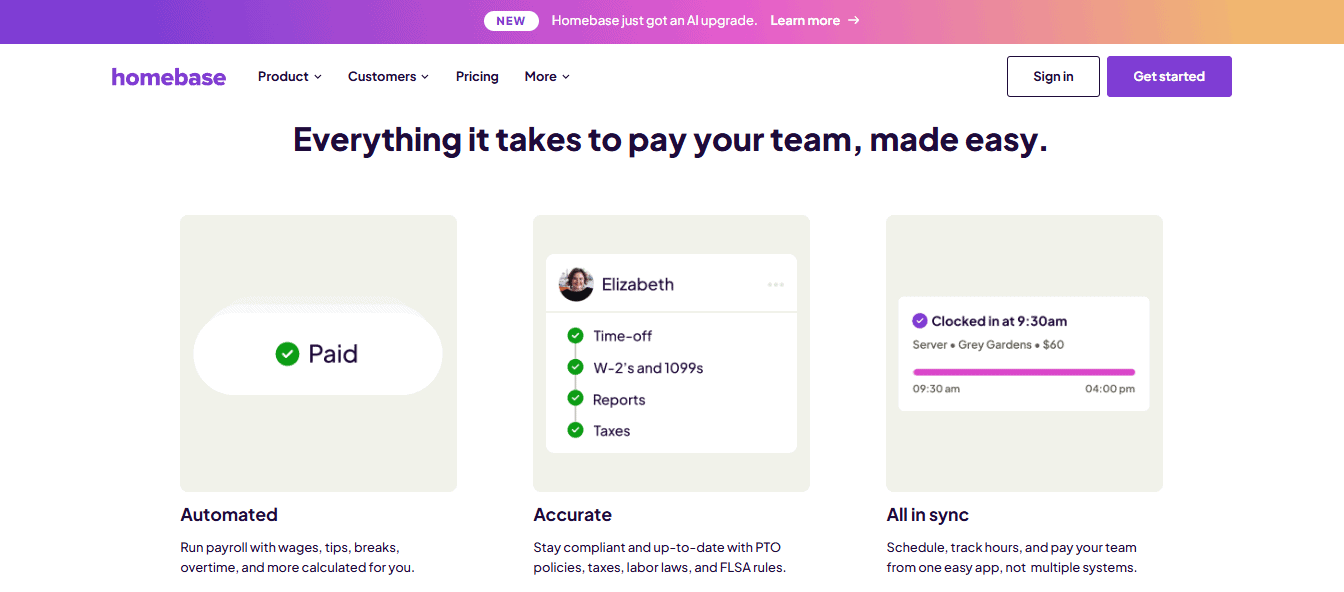

Homebase was designed with hourly employees in mind, so it caters to this specific type of staff and they understand restaurant operations. With this platform, managing your team is so much easier. You can build staff schedules and track everyone’s hours all in one spot, and everything automatically syncs with payroll, taking a lot of the stress out of payday.

Payroll itself is simple where wages, tips, breaks, and overtime all get calculated for you, so there’s no manual number crunching. Tip pooling and distribution are a breeze, thanks to user-friendly tools built right in. Taxes are no problem either, since the platform handles tax calculations, filings, and payments automatically to keep you on the right side of the law. Plus, if you use POS systems like Clover or Lightspeed, you can easily connect everything for an even smoother experience.

One thing I really appreciate about Homebase is how fast it is to add new employees to the system. It’s intuitive to set up, and easy for the employee to use. As soon as employee information is entered, Homebase automatically sends them an invitation to join the online portal. From there, we can easily upload and share all the essential documents they need for a smooth onboarding experience, like W-4 forms and payment method paperwork.

The Bad

Homebase takes a pretty standard approach to onboarding, mostly relying on forms and documents, and unfortunately, it doesn’t let you add videos or video links directly to the onboarding materials. So, if you want to share engaging training or welcome videos with new hires, you’ll need to do that separately, using another tool.

The onboarding process itself is the same for every employee, without much room for customization. This can be limiting if you have staff working in different parts of the restaurant and need a more personalized introduction for each role. The experience might not be ideal for employees who would benefit from restaurant-specific guidance and resources. Plus, it’s important to note that many of the more advanced features aren’t available on the free plan.

The Price

Homebase offers a free plan that works well for small teams of up to 10 employees, making it a great starting point for smaller businesses. If you want access to additional tools and features, you’ll need to switch to one of their paid plans. The interesting thing about Homebase’s pricing is that it’s based on the number of business locations you manage, not the total headcount, so you only pay more if you’re adding new restaurant locations rather than new employees. This setup can be especially cost-effective for restaurants or businesses with growing teams in the same spot.

Gusto

Gusto is an easy-to-use, all-in-one platform designed to make payroll, benefits, and HR tasks straightforward and stress-free. It brings everything together in one place, automating many of the time-consuming processes so restaurateurs can focus on other aspects of your business.

The Good

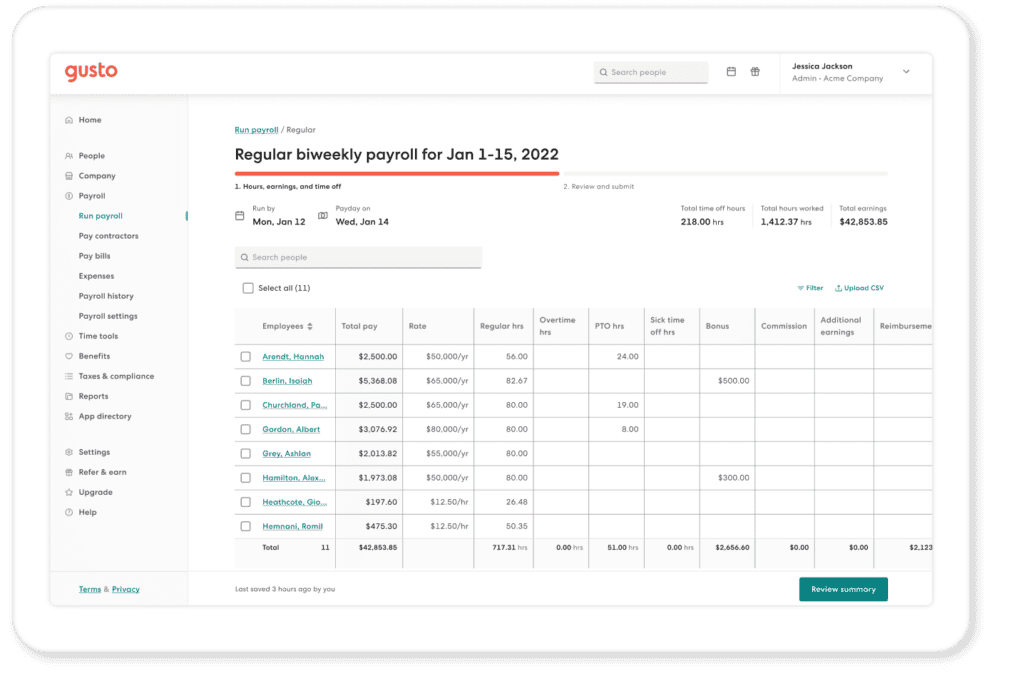

One of the best things about Gusto’s payroll services is how simple it is to use, so teams can manage payroll with very little training. The platform is packed with helpful features like time tracking, performance management, and hiring and onboarding tools, making it a great fit for small businesses looking to streamline their key HR responsibilities. Even their basic plan is quite powerful. It can easily handle things like wage garnishments, holiday pay, and tip credits, taking the guesswork out of more complicated payroll tasks.

And if you ever need help, Gusto’s customer support team is fantastic. They’re always ready to answer your questions or guide you through any challenges, which really takes the stress out of managing payroll and HR.

The Bad

Gusto doesn’t have a lot of workflow automations, which for busy owners means more time working manually in the platform. They also don’t provide direct deposit unlike some of the other payroll software platforms. One thing to keep in mind about Gusto is that its reporting features are pretty basic. Unlike some other payroll platforms, it doesn’t give you many advanced or customizable options if you need detailed reports or want to dig deeper into your payroll data.

Another limitation is the lack of a built-in time tracking tool. If your business needs to track employee hours, you’ll need to use a separate time tracking system or enter the hours manually, which can add a few extra steps to your process.

The Price

Gusto offers three main pricing plans to fit different business needs. The Simple plan is designed for small businesses that need single-state payroll, unlimited payroll runs, automated tax filings, and an employee self-service portal, which starts at $49 per month plus $6 per person.

The Plus plan, at $80 per month plus $12 per person, includes everything in Simple, with additional features like multi-state payroll, next-day direct deposit, time tracking, PTO management, hiring and onboarding tools, and health insurance admin.

For larger or growing businesses, the Premium plan starts at $180 per month plus $22 per person and adds benefits like a dedicated service advisor, access to certified HR experts, performance management, advanced analytics, custom reporting, and priority support.

Paycor

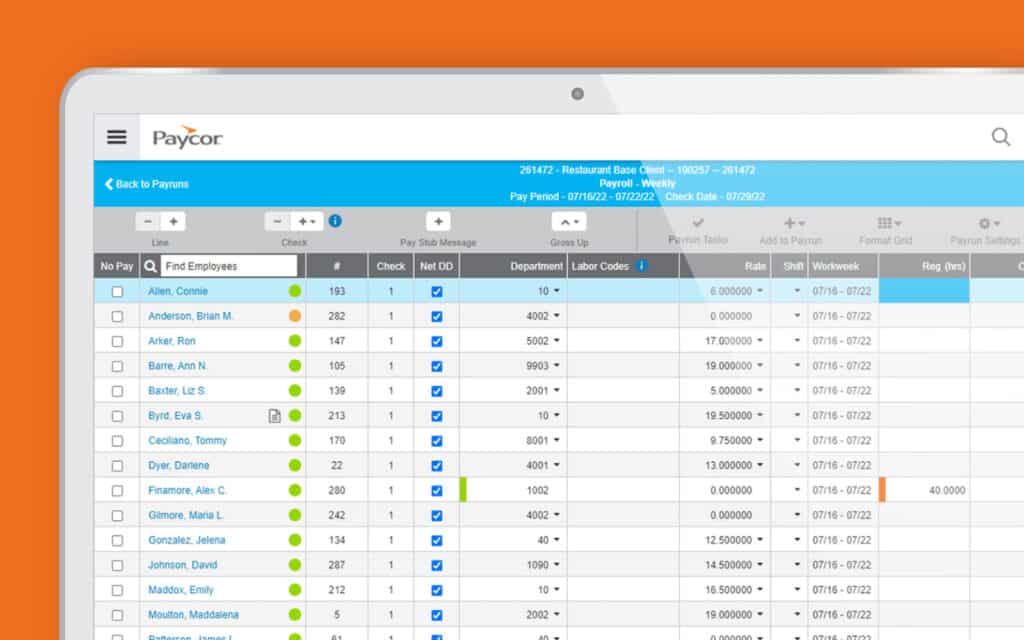

Paycor is an all-in-one platform created to help restaurants navigate their many HR complicated responsibilities. It brings together essential functions like running payroll, hiring and onboarding new staff, managing day-to-day workforce scheduling, and organizing employee information.

The Good

One of their added perks is the mobile app, which lets you access important features from anywhere and is perfect for managers or staff who are busy being on the move. Plus, employees have several ways to clock in, making it even more convenient for teams with varying work routines.

The Bad

Paycor does offer time tracking and scheduling features, but these are only available as add-ons. For restaurant businesses, where managing schedules and tracking hours is a crucial part of daily operations, having to pay extra for these essential tools doesn’t feel too practical.

Another thing to keep in mind is that their customer support isn’t known for being the most helpful, which can be frustrating if you’re a busy restaurant owner with little time to troubleshoot tech problems. On top of that, the platform’s integration options are pretty limited, which might become a challenge as your restaurant expands and you need it to connect seamlessly with other systems you use.

The Price

Paycor offers several pricing tiers to suit different business needs. The Basic plan is designed to help you process payroll accurately and stay compliant with tax regulations. The Essential plan streamlines payroll processing, helps manage compliance, and makes it easier to onboard new hires. The Core plan provides deeper business insights to drive growth, while the Complete plan delivers an all-in-one solution to attract, retain, and develop your team.

Each plan comes with different features and benefits, giving you the flexibility to choose the best fit for your restaurant or business. For detailed pricing, you’ll need to contact Paycor directly, although most plans run from $19–$27 per employee per month with a one-time implementation fee.

How does a restaurant owner know which payroll system to choose?

As you can see, running a restaurant isn’t just about great food. It’s also about keeping your team happy, engaged, and paid on time. In fact, with 80% of restaurant owners starting in entry-level roles themselves, it’s clear that they truly understand the everyday challenges their employees face. The reality is, staffing is one of the biggest headaches for restaurant owners, and even a couple of payroll mistakes can send employees looking for new jobs.

That’s why it’s so important to have a solid onboarding process and clear payroll communication with every new hire. Giving staff all the details about their pay, hours, tips, and workplace rules helps them feel comfortable from day one. Add in that the landscape of labor laws, tip pooling, shift variability, and complex wage calculations is constantly changing, and so a restaurant owner needs reliable support to keep running smoothly.

Luckily, modern payroll software can take a huge burden off the shoulders of a restaurateur. These powerful platforms handle everything from scheduling and recording hours, to processing payroll, distributing tips, and ensuring compliance with tax laws. Having the right platform in place helps you avoid mistakes, reduces stress for everyone, and gives you more time to focus on growing your business.

After comparing the options, here are my top choices for restaurant payroll software:

Homebase shines if you have lots of hourly team members, offering all-in-one scheduling, payroll, and staff management tools perfectly suited for busy kitchens and dining rooms. Gusto is great if you want extra HR support, with an easy-to-use platform and excellent customer service. Paycor is great for those searching for powerful reporting and flexible payroll options.

No matter your restaurant’s size or setup, investing in the right payroll software can save you time, boost team morale, and help you avoid costly payroll errors. Take a close look at these top picks to find the perfect fit for your needs, and set your restaurant up for long-term success with happy employees!