- Bottom Line Up Front:

- Why Bill Pay Platforms Even Matter

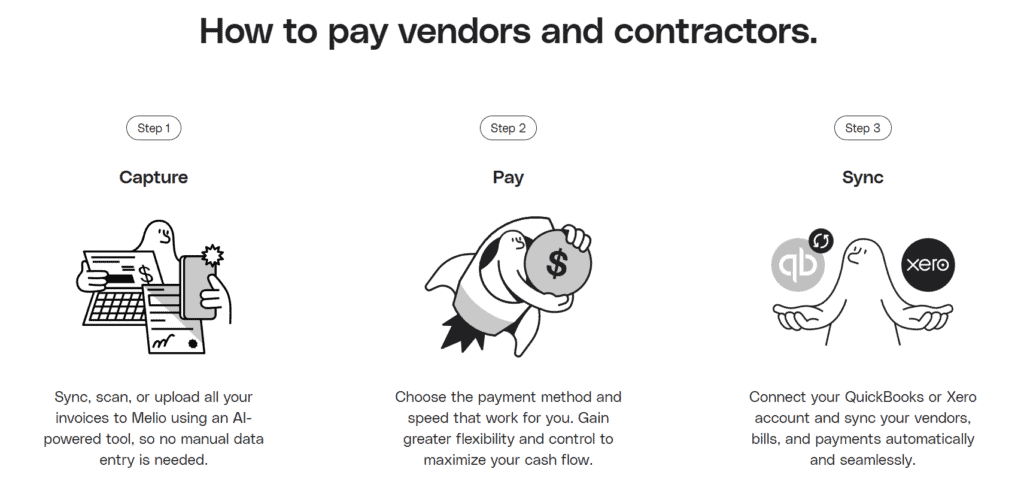

- My Experience with Melio

- My Experience with Airbase

- Direct Comparisons: Melio vs. Airbase

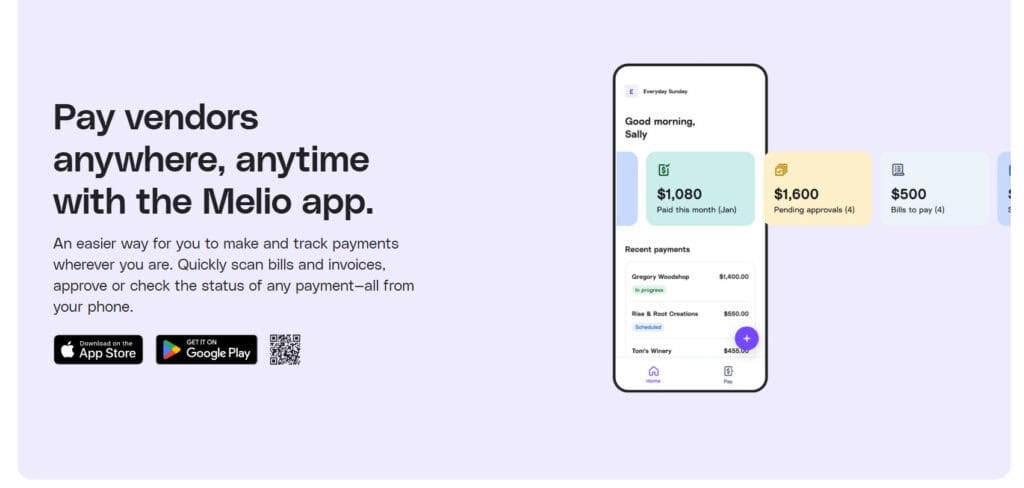

- Melio in the Real World: Story Time!

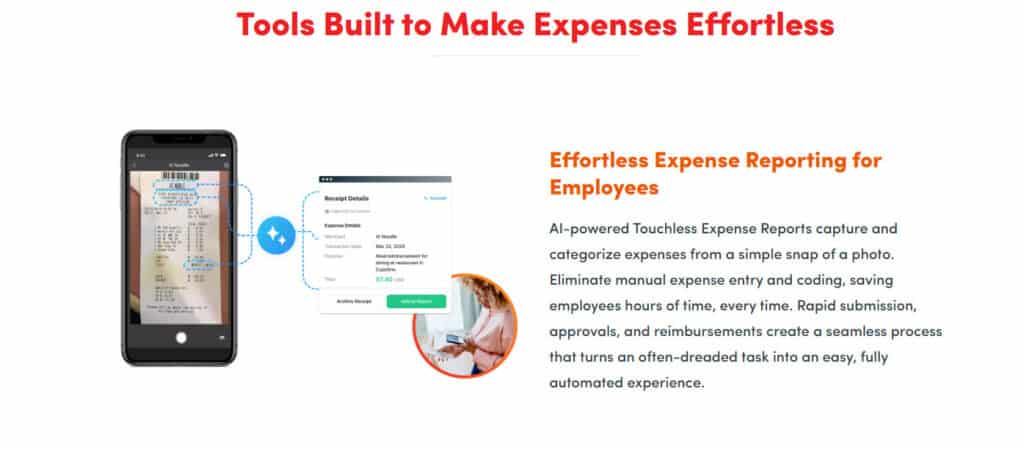

- Airbase in the Real World: Story Time

- Areas Where Melio Slightly Outshines Airbase

- Areas Where Airbase Holds Its Own

- When Melio Makes the Most Sense (And Why I Often Recommend It)

- Bottom Line: The Slight Edge to Melio

Last Updated on July 22, 2025 by Ewen Finser

I’ve been a CPA for years, running my own firm and helping businesses of various sizes manage their financial operations. In that time, I’ve seen bill pay platforms evolve from clunky bank portals and manual checks to sophisticated, user-friendly digital solutions.

Two platforms I regularly work with—and frequently recommend to my clients—are Melio and Airbase. Both offer robust features aimed at simplifying the bill payment process, but each platform has its strengths and weaknesses. By the time you’ve made it through this article, you’ll be able to discern which makes sense for you and your business!

Bottom Line Up Front:

As a CPA with years of experience, I’ve found that Melio typically works best for small and medium-sized businesses needing a straightforward, affordable, and reliable bill-pay solution. Airbase is great for larger companies with more complex expense management needs. But for most of my clients, Melio’s simplicity, clear pricing, quick payments, and easy accounting integration make it my preferred recommendation.

Why Bill Pay Platforms Even Matter

Accuracy, simplicity, and efficiency are essential to my everyday job. Every hour my clients spend struggling with payment processing is time away from running their business – or time that I have to bill them for when the problem is ultimately passed on to me. When bill pay is streamlined, it directly improves their bottom line, cash flow, and reduces stress.

I’m constantly on the lookout for solutions that reduce complexity, eliminate errors, and provide clear, auditable trails for payment history. Here’s how Melio and Airbase stack up.

My Experience with Melio

Melio grabbed my attention because it directly addressed one of my clients’ biggest pain points: paying vendors easily and affordably. It felt intuitive right away and I noticed clients, even those who I considered tech-averse, adopted it without much hassle.

Here’s what I’ve liked most about Melio:

- Simplicity and Ease of Use:

The interface feels natural. There’s no steep learning curve, which is a major plus. Clients have been able to jump in and start paying bills within minutes. - Cost Transparency:

Fees are clear and straightforward. Melio doesn’t bury extra costs in complicated fee structures or fine print, so clients immediately see what they’re paying. - Reliable and Fast Payments:

Payments processed through Melio typically clear quickly, often within a couple of business days. I have found this to be especially valuable for managing vendor relationships smoothly and avoiding late fees or cash flow disruptions.

However, no solution is perfect. Melio doesn’t offer the breadth of financial tools and features that some large-scale clients require, such as robust expense management or complex corporate card controls. For these businesses, I occasionally explore other solutions, which brings me to Airbase.

My Experience with Airbase

I think Airbase positions itself more broadly, serving mid-sized to large enterprise-esque companies that want to integrate corporate spending control, bill payments, and expense management under one platform.

Here’s what has impressed me about Airbase:

- Comprehensive Spend Management:

Airbase is powerful when it comes to controlling corporate spending. It offers features for expense categorization, approval workflows, and real-time spend tracking. Larger businesses needing tight controls on budgets find significant value here. - Corporate Cards and Expense Controls:

The platform seamlessly integrates corporate credit cards, helping larger companies simplify the complexity of employee spending and reimbursements. - Advanced Reporting:

Detailed financial reporting is easy with Airbase. My clients who love diving deep into data enjoy the insights available from its reporting tools.

Still, Airbase isn’t flawless. Its interface can feel a bit overwhelming at first. Clients who run smaller operations often find Airbase complicated. There’s definitely a learning curve compared to Melio’s straightforward experience. This sometimes slows adoption for small-business clients or teams that prefer simplicity, and I’ll be honest – I very rarely recommend it to my clients unless you’re running a very large business with at least 150 employees.

Direct Comparisons: Melio vs. Airbase

Here’s how the two platforms stack up based on my years of practical experience with clients across multiple industries:

Feature | Melio | Airbase |

User Interface Simplicity | · Simple and intuitive | · Robust but complex |

Expense Management | · Basic integration | · Advanced controls |

Payment Processing Speed | · Typically faster | · Reliable but can vary |

Corporate Card Integration | · Limited | · Comprehensive solution |

Cost Transparency | · Very clear upfront | · Clear but pricier overall |

Small Business Friendly | · Ideal for SMB | · Geared toward mid-large |

From my point of view, both platforms offer solid options, but their suitability greatly depends on the size and needs of your business.

For instance, if you run a small to medium-sized business and prioritize straightforward bill pay with minimal overhead, Melio is hard to beat. If your business is larger and requires sophisticated spend management, Airbase may better align with your needs.

In my experience, because I tend to work with smaller clients, Melio has typically been more popular due to ease of adoption, affordability, and quick payment processes. Yet Airbase maintains an important role, especially with clients who require stronger internal financial controls and corporate spend management.

Melio in the Real World: Story Time!

I have a long-term client who runs a busy retail store. This client is fantastic at sales and marketing but loathes the bookkeeping and accounting side of her business. Initially, her payment process was chaotic: checks lost in the mail, late fees adding up, and vendor relationships were becoming tense because she just dreaded doing the work.

After spending a couple of days working with her bookkeeper on onboarding Melio, the change was pretty much night and day for a few reasons:

- Ease of adoption: She and her bookkeeper were comfortable using Melio right away—no lengthy training sessions or troubleshooting required.

- Improved cash flow: Payments began clearing faster, giving her better visibility into her cash position.

In her case, Melio was clearly the better option. It simplified her life without adding complexity or unnecessary features.

Airbase in the Real World: Story Time

Another client I worked with was a rapidly growing tech startup, and they faced very different challenges. With multiple teams across different offices, they needed precise spending controls and detailed financial reporting. In this scenario, Airbase was a strong match:

- Expense controls: Managers easily set spending limits, tracked expenses, and approved payments in real-time.

- Corporate card integration: Simplified employee spending and expense reimbursement processes.

- Detailed reporting: Provided crucial insights for informed financial decisions.

For this larger, more complex organization, Airbase’s extensive tools proved beneficial.

Areas Where Melio Slightly Outshines Airbase

When choosing between these platforms, I’ve observed a few subtle areas where Melio tends to outperform Airbase, particularly from the perspective of small and mid-sized businesses.

1. Simplicity and User-friendliness

Melio’s intuitive interface is welcoming even for those who struggle with technology. For smaller clients who don’t have dedicated financial teams, this ease-of-use is often the deciding factor.

2. Cost Efficiency for SMBs

Melio’s transparent fee structure is appealing, especially to cost-sensitive business owners. It feels straightforward and honest—qualities that matter greatly to my clients and help establish trust.

3. Quick Payment Turnaround

Clients often remark how quickly their payments clear through Melio. This efficiency strengthens vendor relationships and improves cash flow visibility.

Areas Where Airbase Holds Its Own

While Melio is my go-to recommendation for smaller clients, Airbase deserves credit where it’s due:

- Advanced Spend Management: Few solutions match Airbase’s breadth when managing larger-scale financial operations.

- Robust Approval Workflows: For clients with complex organizational structures, Airbase’s granular spending controls are beneficial.

- Corporate Card Integration: This remains a major draw for mid-sized and large companies needing a seamless integration between cards, payments, and expenses.

When Melio Makes the Most Sense (And Why I Often Recommend It)

In my CPA practice, most of my clients operate businesses that benefit most from simplicity, cost efficiency, and speed. That’s just the nature of the beast, they’re small business clients, as that’s what I typically focus on. Here’s why Melio frequently ends up as my recommendation:

- Easy adoption: Saves my clients time and frustration.

- Cost-effective: Helps my clients avoid hidden fees.

- Reliable: Delivers payments quickly and predictably.

- Smooth integrations: Makes bookkeeping and reconciliation effortless for me as their CPA.

When bill pay becomes frictionless, my clients can focus on their core business operations. For most businesses I serve—especially SMBs—Melio consistently fits the bill.

While not a dealbreaker, this distinction underscores why Melio subtly edges out Airbase in terms of simplicity and practicality for most clients.

Bottom Line: The Slight Edge to Melio

Both Melio and Airbase have considerable strengths, and I’ve confidently recommended each to different clients based on their unique needs. However, when looking through the lens of a typical small-to-medium-sized business client, Melio usually emerges as the better all-around option due to simplicity, cost transparency, rapid payments, and ease of integration.

As a CPA, my goal is always to help my clients simplify their financial operations without sacrificing accuracy or efficiency. While Airbase undeniably excels in certain scenarios, Melio consistently delivers a straightforward solution that aligns closely with the practical needs of most of my clients. If you run a large or complex business with extensive expense management requirements, Airbase is an excellent option. But, based on years of practical, hands-on experience, if you’re looking for a no-nonsense, reliable, user-friendly platform that makes paying bills painless and affordable—Melio is typically my first choice.