- The Bottom Line, Up Front:

- Why I Care About Platforms Like LegalZoom

- Why LegalZoom Shines Compared to Its Past Self

- Comparing LegalZoom to Alternatives

- Service Categories That Matter Most

- What Are Some Of The Most Practical Use Cases?

- Let’s Talk About Cost Analysis from An Accountant’s Point of View

- Where LegalZoom Still Has Limits

- Tying LegalZoom Into Tax Strategy

- The Balance of Cost vs. Value

- Pros and Cons: A CPA’s Breakdown

- Who Should Use LegalZoom

- Who Should Consider Other Options

- The Final Verdict on LegalZoom in 2025

Last Updated on September 8, 2025 by Ewen Finser

As a CPA who has spent years working with small businesses, startups, and independent contractors, I’ve seen just about every way people try to handle their legal and compliance needs. Some rely on full-service law firms, others on local attorneys, and more and more are leaning into online platforms like LegalZoom.

Over the last decade, LegalZoom has taken more than its fair share of criticism, in my opinion. A lot of this stems less from its performance and more from how LegalZoom’s competitors navigated the online attorney space. But after giving LegalZoom a whirl in 2025, I think it’s fair to say that it’s a platform that shouldn’t be overlooked. When you strip away the noise, and you look at what the service the platform delivers, I think that LegalZoom actually stands tall in areas that matter to business owners.

The Bottom Line, Up Front:

LegalZoom has taken plenty of criticism over the past decade, often fueled by how well competitors navigated the online attorney space. But in 2025, the platform has matured into a reliable, well-rounded choice for entrepreneurs and small business owners. While it isn’t the cheapest option on the market, its breadth of services, compliance support, and access to legal advice make it the most balanced solution for everyday business needs. From my perspective as a CPA, LegalZoom gives clients a stronger foundation for both legal protection and tax planning, which makes it the platform I feel comfortable recommending to my clients.

Why I Care About Platforms Like LegalZoom

As someone who reviews balance sheets and advises clients on structure, taxes, and compliance, I know that the legal foundation of a business is just as important as its books. It’s difficult to separate entity choice, tax elections, and liability planning from good accounting practice.

- A business formed correctly can save thousands in taxes.

- Poor paperwork around ownership can derail growth and cause confusion.

- Skipping compliance deadlines can mean penalties that eat away at hard-won profits.

LegalZoom steps into this intersection of law and accounting by giving entrepreneurs affordable access to tools that used to be locked behind traditional law firms. And that’s why I’ve kept a close eye on them for my clients.

Why LegalZoom Shines Compared to Its Past Self

In my opinion, years ago, LegalZoom was dismissed as “too basic” or “cookie cutter.” A walk through the online platform shows that it has matured greatly. In my experience, I’ve noticed three clear shifts:

- Depth of Services – It’s no longer just about forming an LLC. You can now handle registered agent services, trademark filings, and even contract reviews. For many of my clients, that covers 90% of their ongoing legal needs.

- Integration With Tax and Accounting – LegalZoom has put more focus on compliance reminders, EIN filings, and tools that connect directly to tax reporting. That’s an upgrade I can appreciate.

- Support Quality – The knock against LegalZoom used to be “you’re on your own.” That’s not true anymore. Access to licensed professionals, and even bundled attorney consultations, means you’re not left guessing.

Comparing LegalZoom to Alternatives

I don’t believe in hype. Every platform has pros and cons, and LegalZoom isn’t perfect. But in side-by-side comparisons, the balance has shifted. Here’s a brief look:

- Rocket Lawyer – Good for document templates and short-term needs, but in my experience, ongoing support isn’t as seamless.

- Incfile – Often cheaper upfront, but clients have told me upsells add up.

- LegalZoom – More expensive on paper, but better long-term value because of its broader service stack and support.

That’s why I’ve found myself recommending LegalZoom more and more often to the clients I help serve. It’s not about chasing the cheapest price tag, it’s about choosing the tool that prevents costly mistakes down the road.

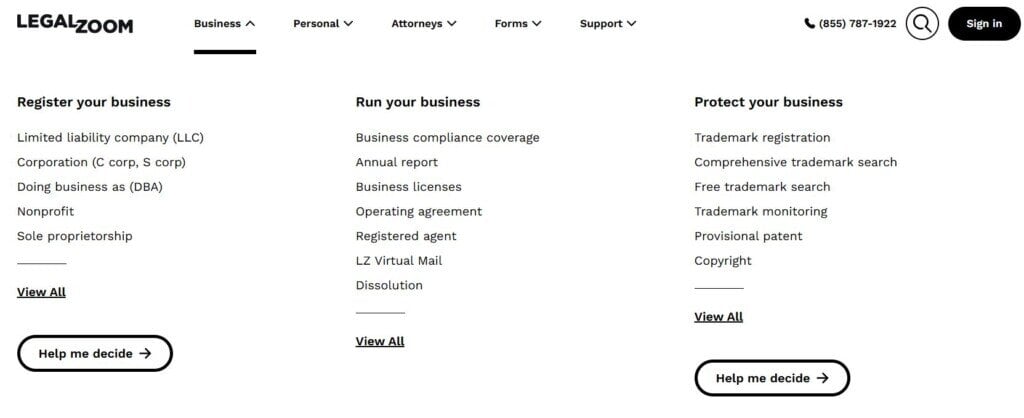

Service Categories That Matter Most

When I evaluate platforms like LegalZoom, I do it through the lens of my clients’ real-world needs. Here are the areas where I’ve seen LegalZoom step up:

1. Business Formation

This remains their bread and butter, in my opinion. Whether it’s an LLC, S-Corp, or C-Corp, LegalZoom covers entity selection, state filings, and EIN registration. For many entrepreneurs, the choice of entity can make or break their tax liabilities. I’ve walked into engagements where the wrong election cost a client hundreds of thousands each year. LegalZoom’s guided process helps people avoid those missteps.

2. Compliance and Annual Reports

One of the most common headaches I see is missed compliance deadlines. I own multiple LLCs, and even I am guilty of these missteps. Each state has different rules for annual filings and franchise taxes. LegalZoom’s compliance reminders and filing services take this off the plate for business owners. For someone juggling payroll, sales, cash flow, and every other headache that comes with running a business, that’s a big deal.

3. Intellectual Property

In 2025, more and more businesses are digital-first. Trademarks and copyrights aren’t luxuries, they’re necessities. LegalZoom’s services give clients an affordable way to secure their brand before competitors swoop in.

4. Contracts and Legal Advice

LegalZoom now offers attorney consultations and contract review bundles. While it won’t replace a long-standing relationship with a dedicated attorney, it gives small business owners a professional safety net. I think that’s often all they need.

What Are Some Of The Most Practical Use Cases?

To give this more context, here are a few situations where I’ve seen LegalZoom become the go-to solution:

- First-Time Entrepreneurs: Many of my clients don’t know the difference between an LLC and an S-Corp. Heck, my first few years as an accountant, I didn’t either! LegalZoom’s questionnaires help them navigate the decision before they even sit down with me.

- Growing Small Businesses: Once a business starts hiring employees, compliance becomes an even larger headache, and ever more critical. LegalZoom’s registered agent and annual report services keep the company in good standing.

- Freelancers and Contractors: I’ve had contractors who needed a quick LLC to separate business income from personal. LegalZoom makes that process accessible in days, not weeks.

- E-Commerce Sellers: With online stores, IP protection becomes the weak point. LegalZoom’s trademark services give these sellers the first line of defense against copycats.

Let’s Talk About Cost Analysis from An Accountant’s Point of View

One of the biggest points of contention about LegalZoom is price. Critics say it’s higher than competitors. That’s true if you only look at the sticker. But when you dig deeper, the value equation changes:

- Cheaper Isn’t Always Cheaper: I’ve seen clients choose a cut-rate service, only to rack up fees when they realize add-ons weren’t included. By the end, they often spend more than if they’d gone with LegalZoom.

- Avoiding Penalties: A missed state filing fee can easily exceed LegalZoom’s annual compliance cost. I’ve had clients pay $400–$600 in penalties because they missed a deadline that LegalZoom would have caught for pennies on the dollar.

- Attorney Access: Even one hour with a local attorney can cost $300–$500 (at those rates, I should’ve been a lawyer, not a CPA!). LegalZoom’s bundled legal services stretch that dollar further for basic needs.

From a CPA’s perspective, the math makes sense. A little more up front often means fewer financial leaks down the road.

Where LegalZoom Still Has Limits

I’m not here to paint LegalZoom as perfect. No platform can replace a strong accountant-lawyer team for complex businesses. A few limits worth noting:

- Complex Structures: If you’re doing multi-member partnerships or raising outside capital, you’ll need more customization than LegalZoom can offer. I often think of multi entity consolidations where one parent company owns many subsidiaries.

- Industry-Specific Needs: Highly regulated industries (healthcare, financial services, construction with union compliance) often need local legal guidance.

- High-Growth Companies: If you’re seeking venture capital, you’ll still want a law firm that specializes in startup equity.

For the majority of small businesses, though, these aren’t barriers. And that’s where LegalZoom shines, because they can serve the 80% of entrepreneurs who need reliable, accessible legal support.

Tying LegalZoom Into Tax Strategy

Alright folks, let’s talk about where I step into the role of the expert. Entity choice is one of the most important tax decisions an entrepreneur makes. As a CPA, I see LegalZoom’s process as more than paperwork; it’s about creating a framework for smarter tax planning.

- LLCs and Pass-Throughs

Most small businesses start as LLCs. LegalZoom makes it easy, and once the LLC is active, I can work with clients on whether an S-Corp election makes sense. That election alone often saves clients thousands each year in self-employment taxes. - S-Corps and Payroll

When LegalZoom handles the formation, I step in to set up payroll systems and determine reasonable compensation for owners. That’s where accounting and legal services complement each other. - Compliance Costs vs. Tax Penalties

When a business misses an annual filing, the IRS or state doesn’t just forgive it. Penalties stack up, and deductions may be questioned. LegalZoom’s compliance services help ensure clean books and no tax-time surprises. - Multi-State Operations

For businesses expanding into multiple states, LegalZoom’s registered agent network saves owners from chasing down legal mail in each jurisdiction. That kind of consistency keeps tax filings smoother on my end.

In other words, LegalZoom creates a foundation that I, as an accountant, can build on. It doesn’t replace professional advice, but it makes the process more efficient and less error-prone.

The Balance of Cost vs. Value

The longer I’ve worked with entrepreneurs, the more I’ve realized that cheap solutions often cost the most in the long run. The old saying rings true, penny wise, pound foolish.

A missed filing, a contract dispute, or a failed trademark can undo years of effort. I have found that LegalZoom positions itself in the middle ground: not as cheap as the barebones services, but far more affordable than hiring a law firm for every step. For my clients, that middle ground makes sense.

- Reliability: Clients don’t come back to me with surprise compliance issues when they’re using the platform.

- Time Savings: Owners spend less time chasing forms and more time running their businesses.

- Peace of Mind: Even if they never use the attorney consultations, knowing that option exists is valuable.

That mix of affordability and support is why I’ve shifted from being skeptical to recommending LegalZoom in many situations.

Pros and Cons: A CPA’s Breakdown

To simplify things, here’s a quick look at where LegalZoom fits in the broader landscape:

Pros

- Wide range of services beyond business formation (IP, contracts, wills and estates, compliance)

- Integrated support with attorney consultations

- Strong registered agent and compliance reminders

- More reliable than cut-rate competitors

- Affordable compared to traditional law firms

Cons

- Not ideal for complex business structures or venture-backed startups

- Pricing is higher than some alternatives if you only want basic filings

- Industry-specific compliance issues often require local attorneys

Who Should Use LegalZoom

- First-Time Entrepreneurs: If you’re forming your first LLC or S-Corp, LegalZoom’s guided process makes it simple.

- Growing Small Businesses: Compliance reminders and registered agent services reduce risk as you scale.

- Freelancers/Contractors: Quick, affordable entity formation helps separate personal and business finances.

- Online Sellers: Trademark protection and IP services are accessible without high legal fees.

Who Should Consider Other Options

- High-Growth Startups: If you’re chasing venture funding, you’ll need specialized legal structures.

- Heavily Regulated Industries: Local attorneys still offer the expertise needed for healthcare, finance, and construction compliance.

- Complex Partnerships: Multi-layered ownership structures require custom agreements beyond LegalZoom’s templates.

The Final Verdict on LegalZoom in 2025

After years of working with entrepreneurs, contractors, and small business owners, I’ve seen just about every way people approach their legal setup. Some pay top-dollar to law firms, others cut corners with bargain-basement online services, and many end up stuck in the middle when mistakes catch up with them.

LegalZoom’s evolution over time has convinced me that it’s no longer fair to dismiss the platform as “too generic” or “only for beginners.” While it’s not perfect for every scenario, it has matured into a reliable, balanced option that delivers consistent value.

From where I sit as a CPA, the benefit isn’t just in getting forms filed, it’s in creating a smoother, more reliable foundation for the accounting and tax work that follows. When clients come to me with clean documents, active compliance reminders, and registered agent coverage, it makes my job easier, their costs lower, and their risks smaller.