Last Updated on January 30, 2026 by Ewen Finser

Payroll is rarely just about paying employees. For a founder, payroll can be the single largest data export in the business — a dense collection of liabilities, tax obligations, and cash outflows.

Most teams start with Gusto because it handles the complexity of local tax filings and direct deposits with ease. However, this can later create a gap between paying the team and actually closing the books.

That’s because, when you connect Gusto to a traditional accounting platform, you expect a bridge. But in reality, what you really get is more like a mirror. The software reflects the cash movement but ignores the context, creating a monthly cycle of manual adjustments that drain time and introduce compliance risk.

What’s often lost in the weeds is the fact that the goal of a strong payroll-accounting integration is not just to “have the numbers”; the goal is to have confidence in the numbers. You need to know that your P&L reflects reality, not just bank transactions. You need to know that your tax liabilities are accounted for and that your departmental costs are accurate.

To fix this, we must look at the specific friction points that occur when payroll data meets the general ledger.

The Granularity Gap: Why Totals Tell Lies

The main challenge with payroll integration is the level of detail.

Gusto knows exactly how much you paid in employer-side Social Security, state unemployment insurance, and health insurance premiums. Traditional accounting software, however, often sees these as a single, massive lump sum hitting your bank feed.

To get an accurate picture of your burn rate, you need to break those numbers down. You need to know how much of that payroll line item belongs to research and development vs. sales and marketing. Without this split, your P&L is a blunt instrument. And you can’t make informed hiring decisions if you do not know the true cost of each department.

Consider a startup with twenty employees. If the accounting software simply records a $150,000 “payroll” expense every two weeks, the CEO can’t see that the cost of the sales team is scaling faster than revenue. By the time the bookkeeper manually splits these costs at the end of the month, the data is already old and a liability.

The Accrual Dilemma: Tracking Time, Not Just Cash

Most startups operate on an accrual basis (required by GAAP) to satisfy investors or prepare for audits, recording expenses when they are incurred and not when the money leaves their account.

Payroll is the most common offender in accrual accounting.

If a pay period ends on the 30th but the cash leaves your account on the 2nd of the next month, your books are technically wrong if you rely on simple bank feeds. You must record a payroll accrual to show that you owed that money in the previous month.

This is where I see standard integrations usually fail. They wait for the transaction to clear the bank, so by the time the data arrives in your accounting software, your “real-time” dashboard is now out of date. This creates a “lag-and-fix” culture, where the finance team spends the first 10 days of every month correcting the previous 30.

Without an automated way to handle these timing differences, your monthly financial reports will always fluctuate. One month will look cheap because the cash didn’t leave the bank until the 1st, while the next month looks expensive because it shows three pay runs. This noise makes it difficult to track your actual monthly burn rate accurately.

The Siloing Effect of Benefits and Taxes

Gusto is a great platform. It’s excellent at managing benefits like 401(k) contributions and health insurance.

The problem is that when Gusto pulls $5,000 for employee health insurance, that money often sits in a clearing account until it’s pushed to an entity that needs it. And if your accounting software is not configured to recognize these specific sub-categories, these amounts get lost, making it impossible to track your benefit spend over time.

When it comes time to renew your insurance policies, you lack the data needed to negotiate better rates or switch providers. You’re flying blind because your payroll data is siloed away from your general ledger.

Furthermore, payroll taxes are a mix of employee-paid and employer-paid amounts — a basic sync often fails to distinguish between the two. This matters for tax compliance and for understanding the fully burdened cost of an employee. If you don’t know your true burden rate, you can’t price your products or services effectively. I see this most often in the construction industry when GC’s are still a little green and don’t know the true cost of an employee.

Why Simple Syncing Isn’t Enough

Most founders think “sync” means “done.” In reality, a standard sync is just a data transfer. It moves the names and the totals, but it doesn’t move the logic.

- Mapping Errors: If you add a new department in Gusto, you must remember to create a matching class or category in your accounting software. If you forget, the sync breaks or dumps the data into an uncategorized bucket. This leads to hours of cleanup during the month-end close.

- Reconciliation Nightmares: Gusto often pulls funds in multiple waves: one for net pay, one for taxes, and one for reimbursements. If your accounting software expects one clean line item, you will spend hours clicking “Match” in your reconciliation screen. This manual matching is prone to human error.

- The R&D Tax Credit: This is a major source of capital for startups. To claim it, you need precise records of which employees worked on which technical projects. But a standard sync rarely carries over the metadata required to satisfy an IRS audit for R&D credits. Without this data living directly in your accounting software, your CPA will have to recreate the records from scratch at year-end.

The Problem With Shadow Books

When the integration between Gusto and accounting software is weak, finance teams often resort to shadow books: complex spreadsheets that track what accounting software misses.

One spreadsheet tracks the departmental splits. Another tracks the accruals. A third tracks the R&D eligibility. Soon, the spreadsheet becomes the source of truth, and the accounting software is just a place where you dump data to satisfy the bank. This redundancy is expensive and dangerous; if a formula in a spreadsheet breaks, you make decisions based on false information.

The Evolution of the Integration: From Passive to Active

The industry is moving away from passive wrappers that sit on top of old software. The new wave of accounting focuses on AI-centric automation. These systems don’t just wait for a CSV upload; they actively communicate with the Gusto API to interpret what every penny represents.

Instead of asking the user to map every transaction, they look at the metadata inside the Gusto API, seeing department tags, tax types, and pay period timing. They then pre-emptively categorize the data, turning accounting from a retrospective chore into a real-time data stream.

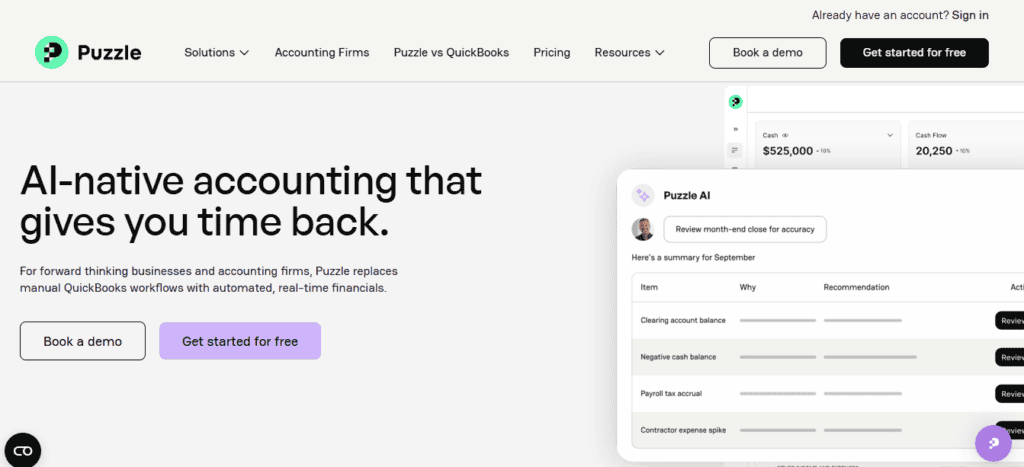

Platforms like Puzzle build this bridge as you work. It doesn’t just pull the data; it understands the intent behind every payroll run.

- Automated Categorization: Puzzle recognizes that a payment to a specific engineer should automatically be categorized under R&D, including the associated employer taxes. This happens instantly, without manual tagging.

- Real-Time Accruals: Puzzle can see the pay period dates in Gusto and automatically suggest the correct accrual entries. This ensures your P&L is accurate the moment the work is done, not just when the check clears, which means you can see your true burn rate in the middle of the month.

- Clean Reconciliation: By matching the various Gusto withdrawals to the specific payroll run, Puzzle eliminates the hunting and gathering phase of the month-end close. It already knows which bank withdrawal belongs to which tax liability.

- Audit-Ready Documentation: Because Puzzle pulls the full context from Gusto, the “why” behind every number is baked into the ledger. This is a feature that I really like; if an auditor or an investor asks about a specific payroll expense, the answer is one click away, not buried in a separate payroll report.

This level of automation shifts the role of the founder or the finance lead. You stop being a data entry clerk and start being an analyst. You spend your time looking at the “why” behind the numbers rather than the “where” of the transactions.

Redefining the Month-End Close

The month-end close is a relic of the paper-ledger era. In a modern startup, you shouldn’t have to wait until the 15th of the following month to know how much you spent on payroll.

When your Gusto integration is AI-centric, the close happens continuously. Every time a payroll run is finalized, the accounting software updates the ledger, calculates the accruals, and adjusts the burn rate. This allows founders to make real-time adjustments to their hiring plans or marketing spend — a level of agility that traditional accounting simply cannot match.

When your systems talk to each other without friction, you gain a clearer view of your runway, your margins, and your future. Choose a platform that treats payroll data as the vital intelligence it is, rather than just another line item to be reconciled. By moving beyond simple “syncing” and toward intelligent automation, you turn your back office from a bottleneck into a competitive advantage.