Last Updated on May 21, 2025 by Ewen Finser

Federal and state reporting requirements are among the most heartbreaking aspects of small business ownership. Getting them right doesn’t provide you or your customers with any additional benefits; getting them wrong can spell disaster.

The compliance consulting industry has entered the picture to help companies navigate these potentially troublesome waters. Of course, if you pick the wrong service provider, you could end up buying yourself additional headaches.

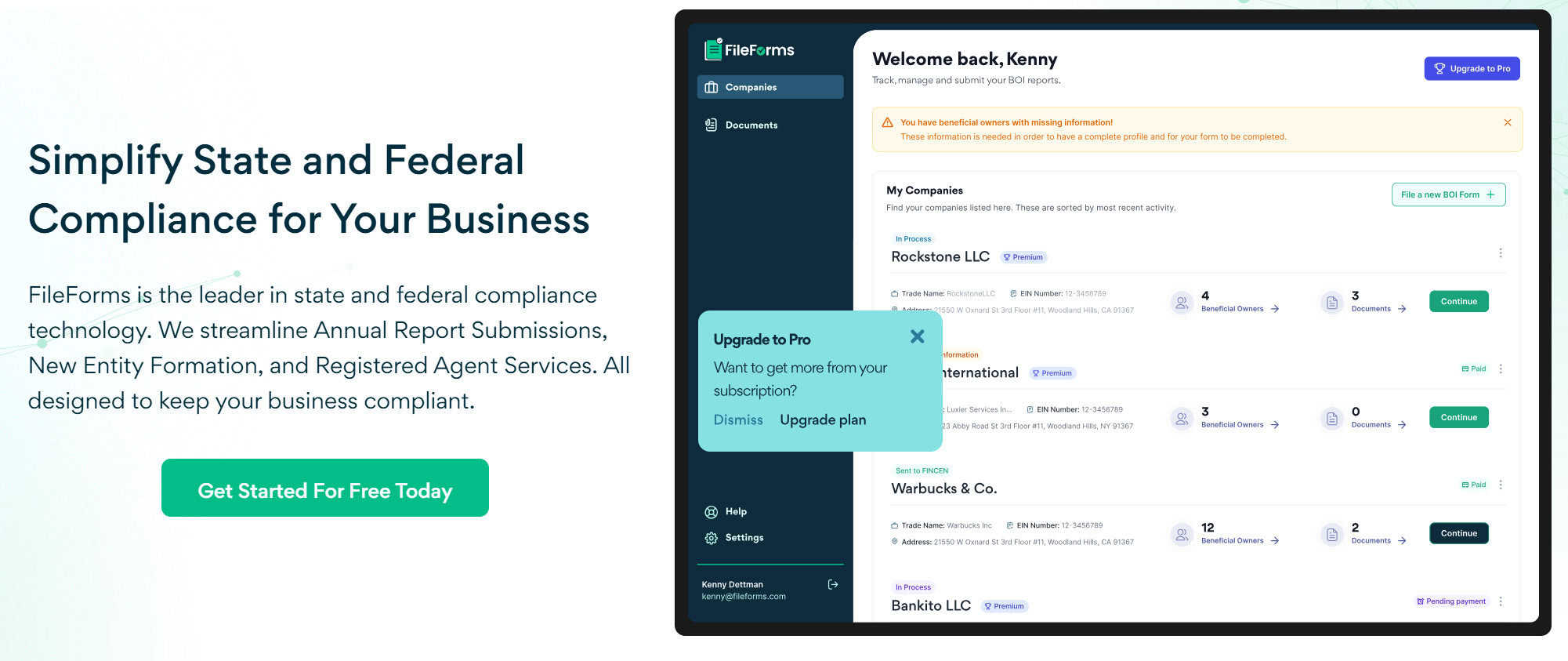

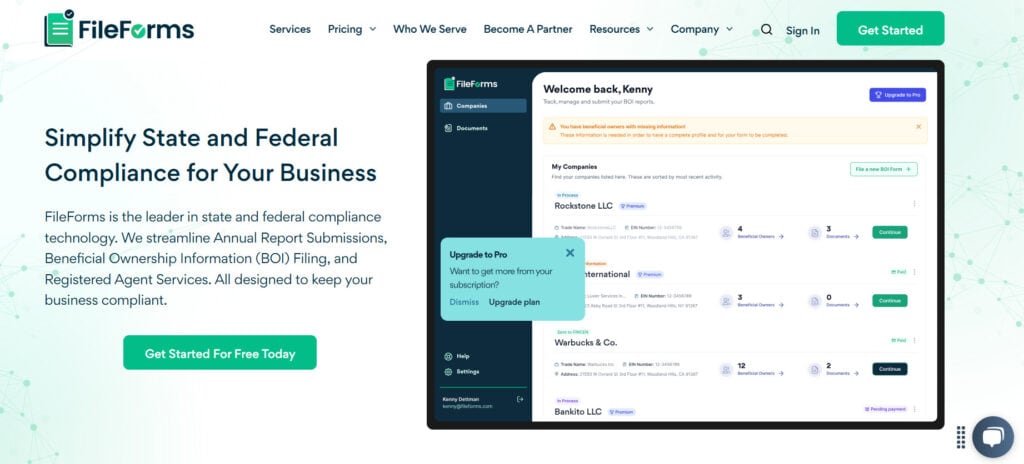

I took a look at FileForms, one of the market-leading providers of assistance with company formation, and FBAR compliance, as well as registered agent services.

Before You Keep Reading:

If you’re running a business and would prefer to offload your reporting work to someone who knows more about it than you (and who wouldn’t?), FileForms is worth looking into. Having test-driven all of its offerings, I’m confident it could help most small businesses save time and preserve peace of mind in several areas.

What I Like

Transparent pricing:

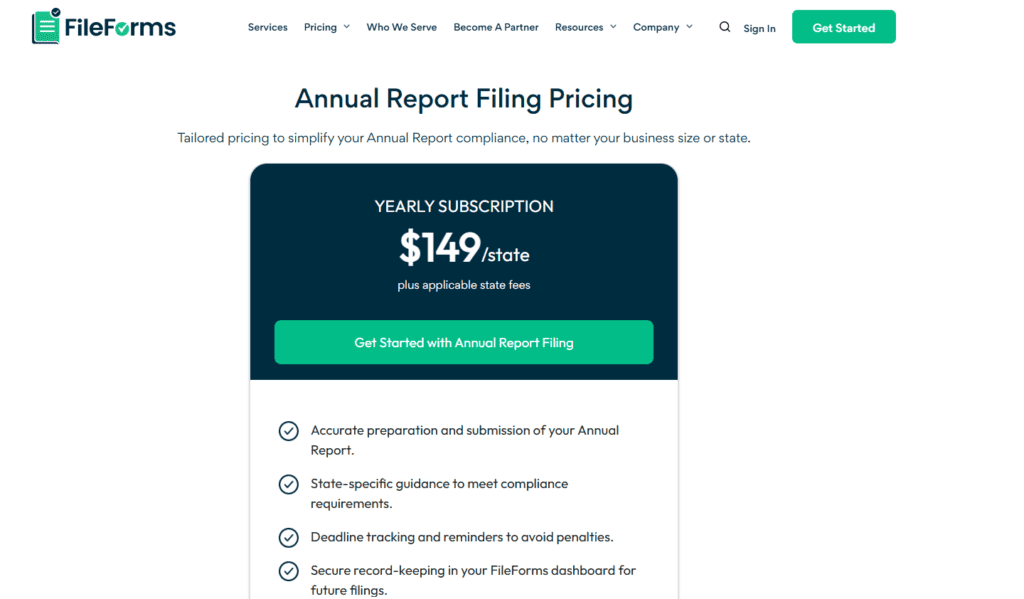

FileForms publishes a clear pricing structure for its services on its website (with the exception of its Enterprise Bulk Filing and FBAR compliance offerings).

This allows you to make a decision about the viability of a purchase without scheduling a consultation; other companies prefer to get you on the phone before talking turkey, which is often a waste of your valuable time.

FileForms is an excellent option for changing your registered agent (particularly after one of their competitors promo filings ends) AND it's a great option for managing multiple entities, bulk registering, and multi-state compliance.

Regularly updated features and customization options:

Like any good service provider, FileForms devotes a lot of resources to continually improving its client offerings. Things move fast nowadays, so it’s always good to develop relationships with providers that will change with the times.

Robust security features:

You don’t want to hand over sensitive business information if there’s a risk it will be compromised. FileForms will take good care of you here; it’s a market leader when it comes to data security.

Limited suite of services:

This might seem like a drawback; however, I always encourage readers to pick specialists over generalists when it comes to important business functions. It’s better to do a few things really well than a whole lot of things passably.

Resources:

If you visit the FileForms website, you’ll see a lot of helpful guides that walk you through the services it provides and the specific pain points it addresses (see, for example, its guide on filing annual reports here). This additional context is helpful if you’re not sure whether a particular offering represents good value for your business.

What I Don’t Like

Limited CRM integration:

FileForms doesn’t offer direct integration with popular CRM platforms. This means manual data transfer may be necessary in some cases, which isn’t ideal. However, as I noted above, FileForms is generally on the ball when it comes to adding features and updates, so this could change going forward.

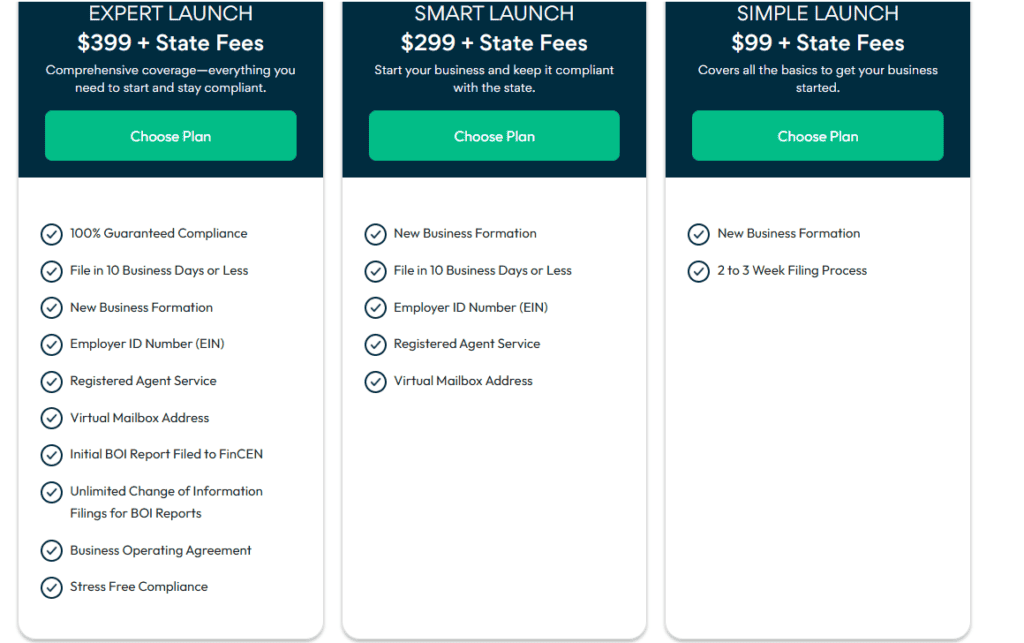

Limited features in lower-tier plans:

FileForms offers a number of options for every service offering; in many cases, though, the cheapest options won’t be comprehensive enough to meet your needs. For instance, the “Simple Launch” option for the new business formation costs just $99 (excluding state fees), but offers nothing other than the formation itself. You don’t get an employer ID number (EIN) or registered agent services; these come with the next package up, which is an extra $200. Realistically, these bottom-tier options will be impractical for a lot of companies.

Products and Services

New Business Formations

Starting a business is exciting; telling the government about it is not.

You’ll need to:

- Pick the right structure for tax and liability purposes (there are a number of these, and figuring out which one will best suit your business could be a headache).

- Get your employer identification number (EIN). Every business with at least one employee needs an EIN.

- File correctly and on time.

State laws on the establishment of companies vary widely. In some cases, the right move for you might be to set up your company in a different state (many business owners choose to set up LLCs in Delaware because of the business-friendly rules and tax benefits available there).

One of the key selling points of FileForms is that it offers business formation assistance to companies in all 50 states. If you live in a state with Kafkaesque filing requirements (*cough* California *cough*), letting someone else do the legwork for you could be especially worthwhile.

Packages here range from $99 to $399 (excluding state fees). It’s worth taking a good look at what’s on offer in each case, as you don’t want to do without important features.

Annual Reports

Most businesses are required to file an annual report to stay in good standing with the state. Fail to do so on time and you’ll face fines, or worse.

Depending on where you live, you may face administrative dissolution or loss of liability protection if you delay long enough in returning your annual report to the authorities. I don’t have the space to explain these outcomes in detail here; suffice to say, you’d prefer to avoid them.

State-specific considerations are also highly relevant here. Deadlines, filing requirements, and penalties for failing to file on time vary widely from one state to the next. Again, this is where FileForms shines; it submits annual reports for companies in all 50 states. It can also submit multiple individual reports on your behalf if you do business in more than one state.

Overall, it makes the annual reporting process fairly stress-free, reminding you before deadlines and handling the paperwork on your behalf. For $149 per submission (excluding state fees), this is a smart investment for a lot of small businesses.

Registered Agent Services

A registered agent is a person or entity designated to receive legal and government documents on behalf of your business. It’s legally required in most states if you’re running an LLC or corporation. Additionally, most states do not permit businesses to serve as their own registered agents.

Many businesses use their attorneys or CPAs as registered agents; if you’re already doing this and it’s not costing the earth, there’s probably no reason to make a change. Frankly, it’s not the most pivotal business function there is; you don’t need to spend too much time dwelling on who should do it for you.

However, if you don’t have a registered agent service set up, FileForms will do the job perfectly well.

Foreign Bank Account Reports (FBARs)

The Foreign Bank Account Report (FBAR) is a requirement for businesses (and individuals) with foreign bank or brokerage accounts holding $10,000 or more at any time during the year.

The penalties for non-compliance with FBAR rules are draconian, to say the least—you could be hit with a $10,000 fine for an accidental violation. If you break the rules on purpose (or the IRS thinks you’re breaking them on purpose), you could be looking at a fine of over $100,000, or 50% of the balance of the relevant account.

You obviously don’t want to expose yourself to this kind of risk. FileForms’ FBAR compliance service provides great peace of mind here; the company’s agents will ensure you stick to the rules and meet all relevant deadlines, and ultimately make sure you don’t get slapped with any jaw-dropping fines.

Industries FileForms Serves

I’ve stressed the need for specific expertise many times on this blog; if you’re paying someone to do something for your company, you want them to have done the same thing for businesses like yours before.

FileForms’ track record across a range of industries is one reason why I’m so keen to recommend it here. It has a history of client satisfaction across professional services, retail, trades, education, and more. Also, while small businesses make up the core of FileForms’ client base, it has also had success with bigger clients.

Overall, there’s a lot to like about FileForms. While there may be some quibbles about its price points, the value it provides is undeniable. It has the potential to save you a lot of time, and time is money; it can also protect you from penalties and fines, and those are money too.

FileForms is an excellent option for changing your registered agent (particularly after one of their competitors promo filings ends) AND it's a great option for managing multiple entities, bulk registering, and multi-state compliance.