Last Updated on April 22, 2025 by Ewen Finser

Did your business have full-time employees during the COVID-19 pandemic?

If so, you might be entitled to the Employee Retention Credit (ERC). This tax credit comes as a refund of a portion of the wages you paid out in 2020 and 2021. It could provide you with a sizeable chunk of money, depending on the extent to which the pandemic affected your operations.

Sadly, the federal tax credit system was not devised with ease of use in mind. Finding out what you might be owed and claiming it can be a highly complex process.

If you want to make the most of your potential entitlements, you’ll probably need to enlist outside help.

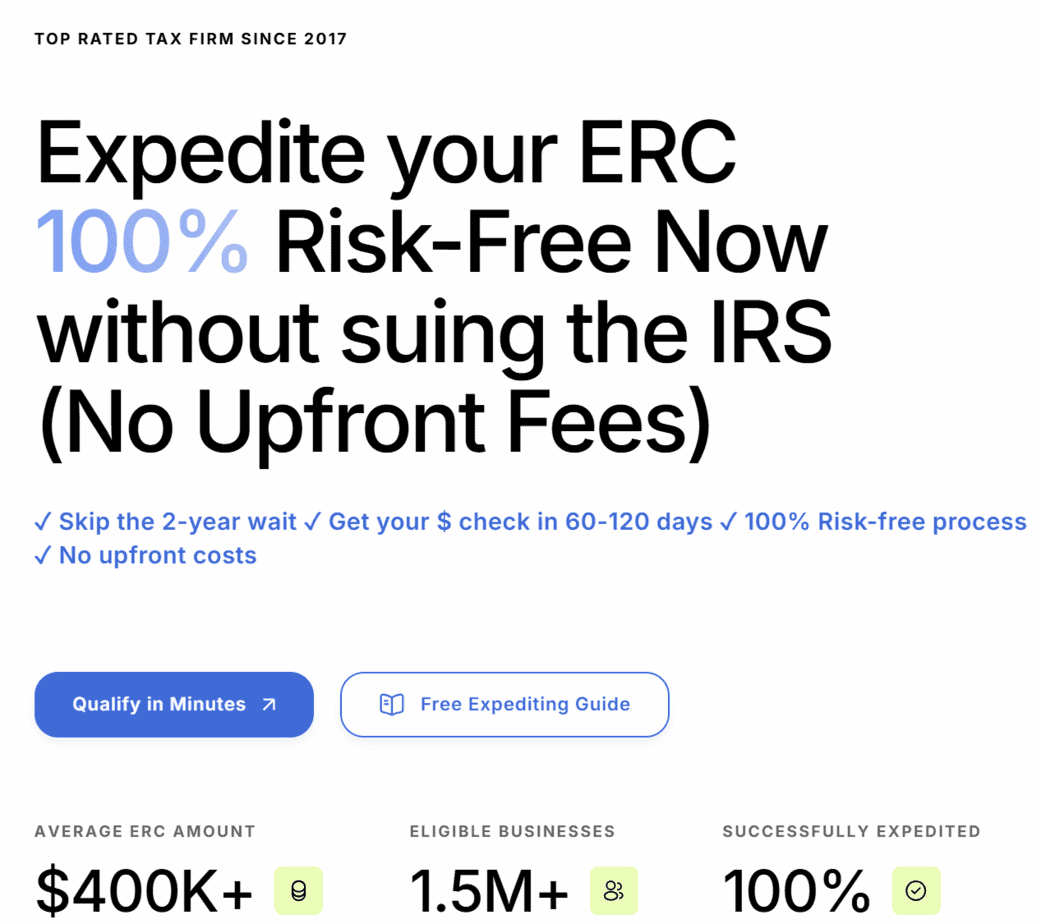

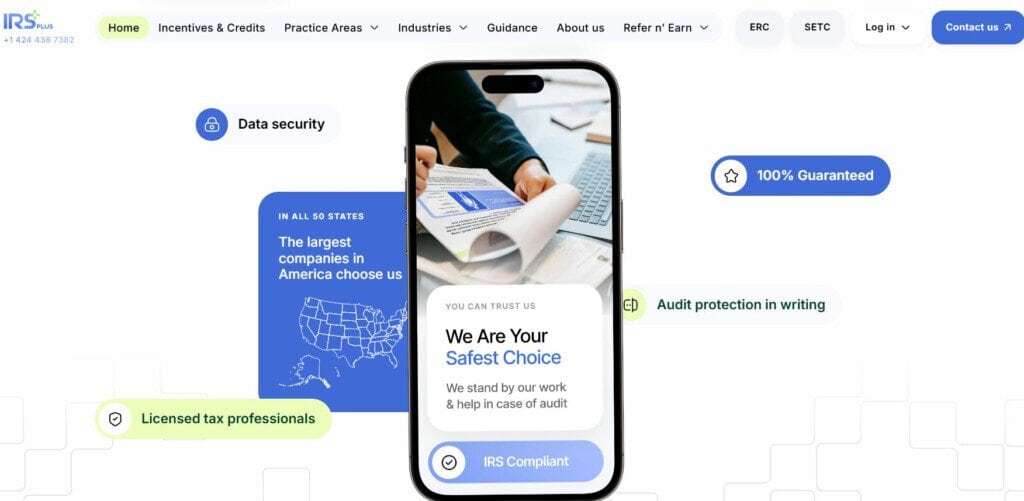

This is where IRSplus comes in. The company has been helping business owners maximize tax relief since 2017. More recently, it has specialized in ERC claims, but it still offers a broad range of compliance assistance services.

I looked into its full suite of services, and was generally impressed with what I learned; IRSplus takes its commitment to clients seriously, provides better value for money than its competitors, and guarantees coverage of any liabilities that might arise if things go wrong.

Bottom Line Up Front Summary:

If you might qualify for ERC OR have a pending application that has not processed, it’s worth contacting IRSplus for a consultation.

There are no up-front fees, so there’s no risk for you. Plus, if you decide to go it alone and try to claim a credit you’re not entitled to, you may face serious penalties. The deadline for claims is fast approaching, so there’s no time to waste. IRSplus also offers capable help when it comes to claiming other tax credits, and provides a full suite of accounting, assurance, business advisory, outsourcing, and wealth management services.

How Does the IRSplus ERC Tax Compliance Service Work?

The Employee Retention Credit (ERC) is a refundable payroll tax credit introduced under the CARES Act in 2020 to reward businesses for retaining employees during the COVID-19 pandemic.

While the ERC provides a big windfall for many businesses, filing for it can be risky. The IRS has received so many exaggerated ERC applications that it has warned companies to be careful if they’re considering applying for it. In practice, this means you could be at risk of audit if you seek it (and no company needs that).

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.

Determining ERC Eligibility

We’ll cover the ins and outs of ERC eligibility in another post, so I won’t go into great detail on them here. Suffice to say they’re detailed, and often headache-inducing.

Essentially, in order to be eligible, your business must have suffered a significant impact because of COVID-19, and you must have had employees in 2020 or 2021.

Of course, this TL;DR option won’t work if you want to actually claim the credit, so you’ll either need to devote a lot of time and energy figuring out the eligibility requirements yourself, or let a company like IRSPlus do it on your behalf.

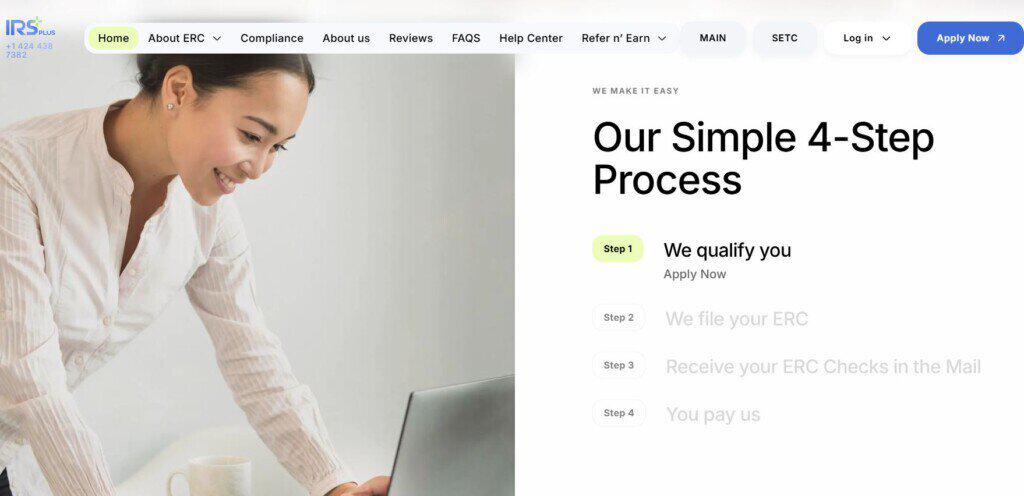

The company provides a 60-second eligibility test, so it’ll only take a minute to figure out whether the service might be right for you.

Filing the Claim

According to a publication by the agency late last year, the IRS was then dealing with around 400,000 ERC claims worth a collective $10 billion. This is a significant amount of work; agents will have little patience for those who submit erroneous claims, and if you accidentally get something wrong, you’ll quickly find yourself at the back of the queue (or, even worse, you’ll get a letter about an impending audit).

Significantly, IRSPlus offers audit protection and full financial coverage for mistakes made on your filing. So, if there is an error, you won’t be the one paying for it. At a time when the IRS is cracking down on ERC filers left and right, this is a huge consideration.

As far as you’re concerned, the process is simple; IRSPlus takes the considerable complications involved off your hands. It also does this for a reasonable fee; you can expect to spend ~25-30% less on IRSPlus than its competitors. This, I think, sums up the key selling point of IRSPlus; it’s cost-effective, and it makes your life easier (not harder).

IMPORTANT: The chance to benefit from ERC will soon be gone for good. The deadline to claim for relief based on payments made in 2021 is April 15, 2025; if you want to file a new claim, you need to do it before then.

Other IRSplus Services

While IRSplus has worked mainly on ERC claims over the last while, I also have a lot of good things to say about its other offerings. The company helps businesses of all sizes secure credits in niche areas, and provides a large suite of other services as well.

If you’re interested in clawing back other juicy refunds from the federal government without wading through its oppressive filing systems, IRSplus offers more services you should check out:

- SETC (Self-Employed Tax Credit): The SETC benefits self-employed folks who missed work due to COVID-19 (whether directly because of the illness or because they spent time providing care). The biggest possible payout here is $32,220; like the ERC, however, the SETC has been heavily targeted by fraudsters, so the IRS is scrutinizing all claims. If you want the money, but not the hassle and uncertainty of claiming it yourself, I’d recommend contacting IRSPlus to learn more. As a small business owner myself, I know just how intimidating processes like this can be, so competent third-party help is something I’d recommend.

- Provider Relief Fund (PRF): Another COVID-era scheme, this benefits healthcare companies affected by the pandemic. The key requirement is that claimants suffered financial hardship because of the pandemic; of course, if you’ve been paying attention, you’ll now understand that it’s never that simple. IRSPlus does a great job of letting potential claimants know whether they might be eligible, indicating how much a claim might be worth, and taking care of all the tricky bits.

- R&D Tax Credits: Research and development isn’t always as involved a process as it sounds; it can be as simple as developing a piece of software. If your company qualifies for a credit in this area—and, in my experience, many do—it could become an annual payout (rather than a once-off like ERC).

- Work Opportunity Tax Credit (WOTC): Hiring new employees from certain target groups (such as veterans, people on long-term unemployment, or individuals from certain disadvantaged groups) can earn a business a tax credit. This is another credit that many businesses seem not to know they’re eligible for.

- General Services: While incentives are the company’s chief focus, IRSPlus also provides more traditional services such as tax planning, compliance, wealth management, risk management, assurance, and outsourcing. The company could do a better job of outlining its selling points in these areas; it’s not clear to me why you’d be better off with IRSPlus than a more specialized service provider. At the same time, though, I’ve heard nothing but good things about the company’s wider portfolio of services. In any case, because IRSPlus offers free consultations, there’s no risk for you in at least scheduling a consultation if you’re in the market.

Competitor Comparison

IRSPlus isn’t the only company that has entered the ERC consulting space; a number of others are offering similar services, but there are notable differences when it comes to their approaches. The best option for you will depend on your individual needs.

The service providers I’ve looked at here run the gamut of specialized ERC companies, large all-purpose accounting firms, and payroll providers.

Omega Accounting Solutions

Omega Accounting Solutions has been lauded for its quick service—because it offers bridge loans, you might get an advance on your ERC refund in as little as 45 days (or 10 days if you’re an existing client). If you need funding urgently, this is something to consider.

However, bridge loans come with interest. Also, even without borrowing anything, you’re probably going to spend more on Omega’s consulting services than those of IRSPlus (you need to do a consultation to get a full breakdown of what Omega will charge for completing your claim).

IRSPlus vs Omega: Unless time is of the essence, go with IRSPlus.

Innovation Refunds

Innovation Refunds is another respected player in the ERC consulting space (and the tax advisory industry in general). It has a 4.5 star rating on Trustpilot with over 500 reviews, and it’s had success with clients from a wide range of industries.

However, Innovation Refunds is not currently accepting new ERC clients due to the IRS moratorium on new claims. Until this changes, you’ll need to look elsewhere for ERC services.

IRSPlus vs. Innovation Refunds: If you want help with an ERC claim in the near future, IRSplus is likely a better call.

Bottom Line Concepts (BottomLine Savings)

Bottom Line is a consulting firm that’s reportedly worked with 20,000 clients since its inception in 2009. Like other firms in this space, it has focused a lot of its efforts on the ERC business since the emergence of the scheme.

Although I’m a big fan of IRSplus generally, I do wonder whether it’s the best fit for large, established companies. Most of its experience is in the small-to-medium business sector, and larger companies have different requirements.

If this is a concern for you, Bottom Line’s long history in the industry and impressive list of past Fortune 500 clients may be attractive.

IRSPlus vs. Bottom Line Concepts: If yours is a bigger organization, Bottom Line may be the way to go. However, IRSPlus probably offers better value for money, considering there’s a full guarantee in place for any mistakes the company makes on your claim.

Traditional CPAs and Payroll Providers

Some businesses use their regular CPA or payroll service (ADP, Paychex, etc.) to handle ERC. As I’ve outlined, though, ERC is a specialized practice area requiring specialist experience.

IRSplus vs Generalists: Unless you trust that your regular provider knows what they’re doing when it comes to ERC, I’d recommend letting a team of specialists handle it.

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.

Is IRSPlus Right for You?

With the costs of doing business skyrocketing across the board, it can be difficult to justify investing in anything that doesn’t pay for itself right away.

IRSplus is a service that can do just that. If you’re considering squeezing an ERC application in before the deadline in a few weeks’ time (or if you need help in another of the company’s areas of specialization), it’s likely worth scheduling a consultation.