Last Updated on January 31, 2026 by Ewen Finser

Let’s talk about something that is mind-numbingly boring but SUPER important: revenue recognition.

Recognizing revenue can be extremely tricky, having to follow specific accounting standards like ASC 606 if you want to ensure that financial statements reflect the true health of a business.

I believe that as much of it as possible should be automated. Without automation, you rely on spreadsheets, and manual entries lead to human error. If you record revenue too early or too late, you risk sending out inaccurate financials and losing trust. Automated software, on the other hand, removes the guesswork and aligns every transaction with current regulations.

So let’s talk about some of the big players in this space.

1. Puzzle

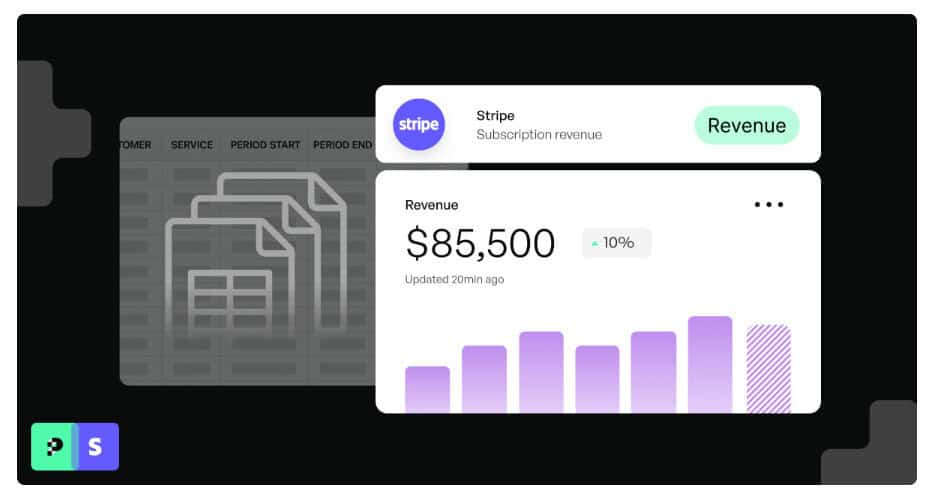

Puzzle is an accounting platform with an emphasis on automation and real-time data, targeting startups and modern businesses that need to move away from traditional, slow cycles. While many accounting platforms act as a storage bin for past data, Puzzle acts as a live engine.

Strengths

Puzzle uses an autonomous AI that’s trained specifically for accounting, connecting directly to your bank accounts, credit cards, and billing systems. While most legacy systems wait for the end of the month to close the books, Puzzle processes data as it happens.

- Real-Time Ledger: Transactions are categorized as they occur, providing a live view of deferred and recognized revenue.

- Direct Integrations: Puzzle pulls data from Stripe, Brex, Mercury, and Gusto without requiring manual CSV uploads.

- ASC 606 Compliance: The software can identify contracts and obligations, applying logic to every transaction to understand if money coming in is revenue or a liability.

- Automated Matching: Puzzle matches payments to invoices and contracts to ensure no revenue goes unrecorded.

The user interface is minimalist and clearly and cleanly presents data in a way that makes sense, letting you see your deferred revenue and recognized revenue on a single dashboard. And because it uses AI to categorize transactions, the need for manual tagging is low.

Weaknesses

Puzzle is a newer player in the market, and large, multi-national corporations with complex global tax needs might find it lacks some legacy features found in ERP suites. To me, it focuses on the needs of modern tech companies rather than heavy manufacturing or businesses with an immense amount of inventory.

Best For: Puzzle is a good fit for founders and finance teams at tech startups. It suits companies that want to see their financial position every day rather than every month.

Price: Pricing is transparent and scales with the volume of transactions. It starts with a free plan, then scales to $50, $100, then custom solution pricing per month.

2. NetSuite (Oracle)

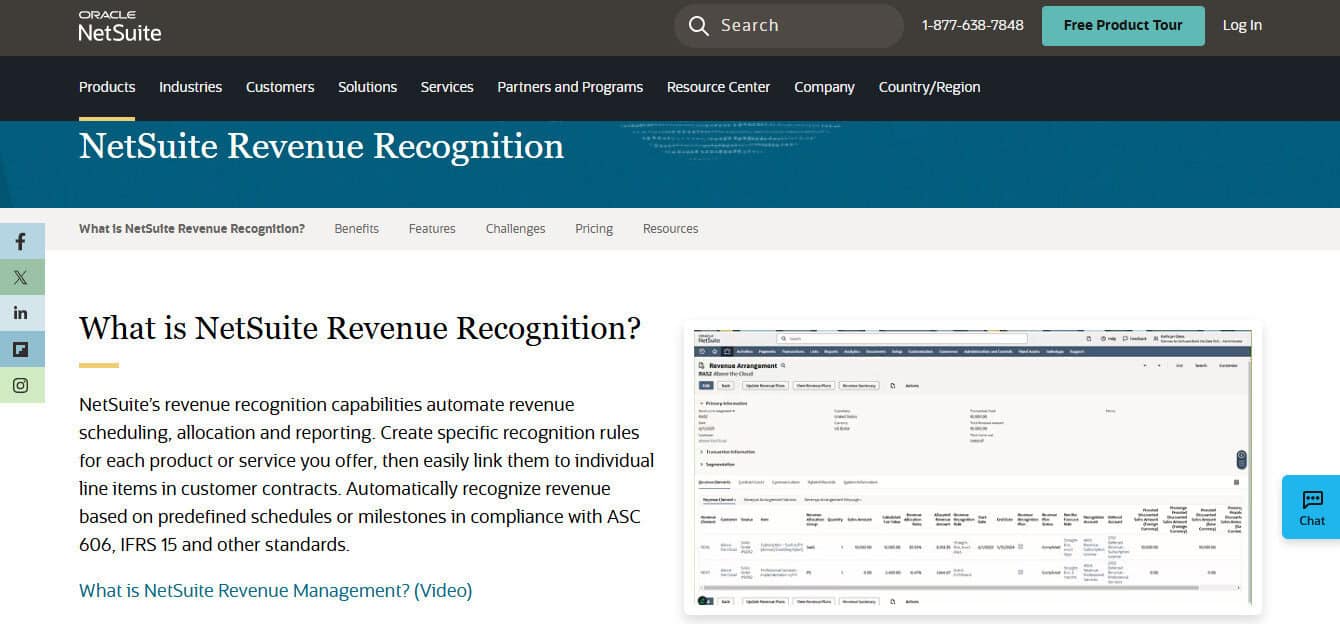

NetSuite is a comprehensive ERP cloud solution, handling everything from inventory to payroll. Its revenue recognition module, known as Advanced Revenue Management (ARM), is a standard in the enterprise world.

Strengths

NetSuite handles massive complexity; if your company operates in fifty countries and uses ten different currencies, it can manage the consolidation.

- Complex Rulesets: You can recognize revenue based on time, milestones, or specific events like product shipping.

- Multi-Currency Support: NetSuite automatically handles currency fluctuations and their impact on recognized revenue.

- Deep Audit Trails: Every change to a revenue schedule is logged, which satisfies the requirements of major auditing firms.

- Unified CRM and ERP: Since the sales data lives in the same system as the accounting data, the handoff from closed-won to revenue recognition is seamless.

The reporting tools are particularly deep here; you can create custom reports for any metric. And because it’s an all-in-one system, your sales data from the CRM flows directly into the accounting ledger.

Weaknesses

NetSuite is difficult to use. Most companies must hire a consultant to set it up, a process that can take months. The interface also feels dated compared to modern web apps; for example, navigation requires many clicks to find simple data points.

Best For: NetSuite is best for large, public companies or those planning an IPO. It provides the level of control that auditors from major firms expect.

Price: The price here is high and often hidden, requiring you to speak to a sales representative. But because the cost includes a base platform fee, user seats, and specific modules, you can expect to pay tens of thousands of dollars annually, if not more.

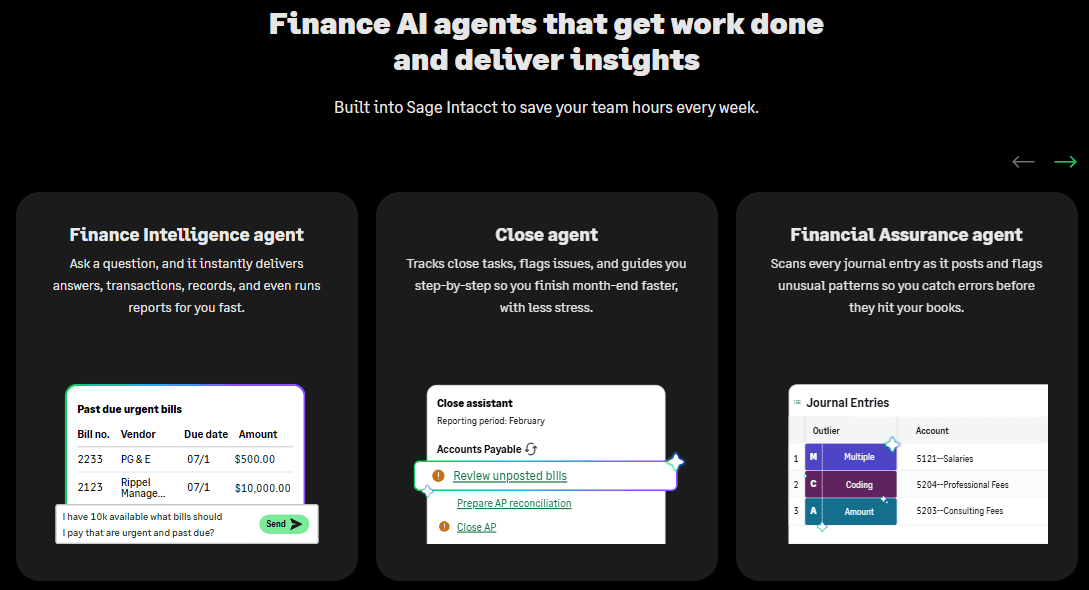

3. Sage Intacct

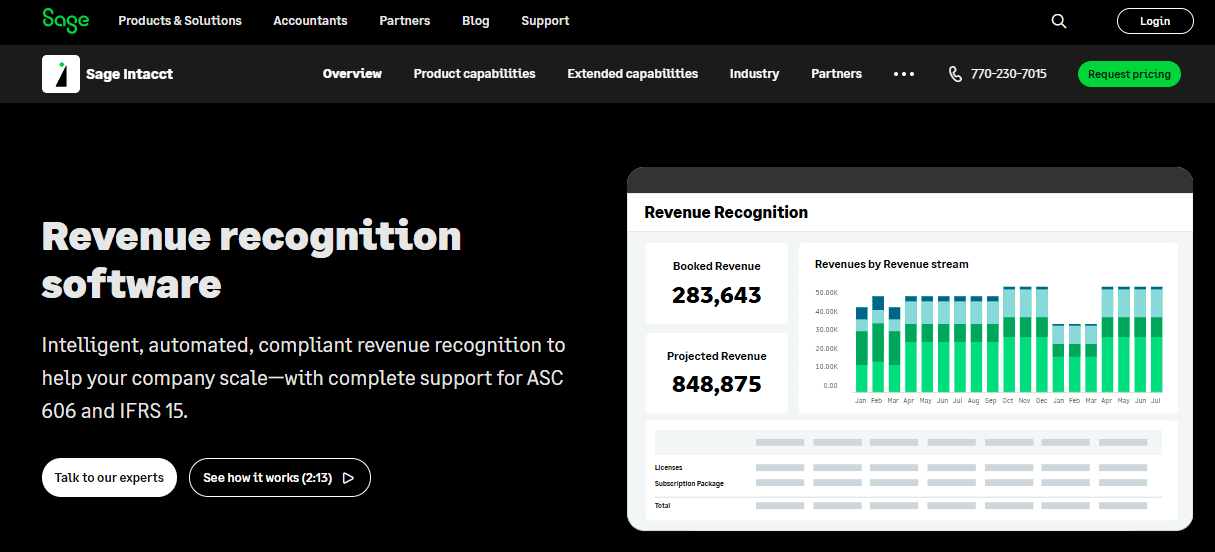

Sage Intacct is a popular mid-market accounting solution that focuses on financial management and leaves other functions like CRM to third-party integrations.

Strengths

Intacct offers a robust revenue recognition engine that handles complex subscription models. It also allows for dual reporting, which is essential for companies navigating changing regulations.

- Dual-Book Accounting: You can view your books under both old (ASC 605) and new (ASC 606) standards simultaneously.

- Salesforce Integration: It features a pre-built connector that allows finance teams to see contracts before they’re even finalized.

- Fair Value Calculations: The software automates SSP calculations for different parts of a contract.

- Dimensional General Ledger: Instead of a traditional chart of accounts, Intacct uses dimensions to tag transactions, making revenue reporting more flexible.

Intacct is modular. You only buy the parts you need, and it integrates well with Salesforce. When a deal closes in Salesforce, Intacct creates the revenue schedule automatically.

Weaknesses

Like NetSuite, the setup is complex, and it requires a certified partner to implement. While the interface is cleaner than some older systems, it still has a steep learning curve. I personally find the reporting tool powerful but difficult to master without training.

Best For: Medium-sized businesses that outgrow QuickBooks but do not want the full complexity of a massive ERP. It works well for SaaS companies with recurring revenue.

Price: The cost is mid-range. It’s more expensive than entry-level tools but usually cheaper than NetSuite for similar functionality. You also must request a quote, but Intacct typically runs in the thousands of dollars per month.

4. Chargebee RevRec

Chargebee is primarily a subscription billing and revenue management platform — NOT an accounting platform. It’s merely another tool to help automate away the headaches that come with subscription billing revenue, sitting on top of your payment gateway to handle recurring invoices and complex billing cycles.

Strengths

Chargebee focuses specifically on the needs of subscription businesses, automating the entire lifecycle of a subscription.

- Contract Modification Handling: If a customer upgrades mid-month, the software automatically recalculates the revenue schedule.

- Unbilled Revenue Tracking: Chargebee tracks revenue that has been earned but not yet invoiced, which is common in professional services.

- Deferred Revenue Waterfall: The platform provides a visual waterfall-style report showing when future revenue will hit the books.

- Global Tax Automation: Chargebee integrates with tools like Avalara to handle sales tax alongside revenue recognition.

Chargebee RevRec is built for the ASC 606 era. It handles “unbilled” revenue well and provides clear visualizations of deferred revenue, so finance teams can forecast more accurately.

Weaknesses

Chargebee is not a full accounting system; you still need a general ledger like QuickBooks or Xero, and you’ll have to manage an integration between the two systems. If you have significant revenue from non-subscription sources, Chargebee might not be the right fit.

Best For: B2B SaaS companies that rely heavily on recurring subscriptions and need to automate their billing and revenue recognition in one place.

Price: Chargebee offers tiered pricing, including a free tier for very small companies. As you grow, you pay a monthly fee plus a percentage of your revenue.

5. Maxio

Formed from the merger of SaaSOptics and Chargify, Maxio focuses on financial operations for SaaS companies that need to professionalize their reporting. Once again, this is not a full-scale accounting solution; just another tool you may want to consider implementing into your arsenal.

Strengths

Maxio excels at SaaS metrics, tracking MRR and churn alongside your revenue recognition.

- SaaS Intelligence: Maxio provides a dashboard for metrics like LTV and CAC, derived from your revenue data.

- Audit-Ready Reports: Every transaction maps to a specific revenue rule, making it easy for auditors to verify the numbers.

- Collections Management: Maxio includes tools to chase failed payments, which directly impacts the accuracy of your revenue recognition.

- Multi-Element Arrangements: It handles contracts that include both software subscriptions and one-time implementation fees.

Maxio provides a strong audit trail, and you can drill down from a high-level report to a specific transaction. In my opinion, this makes the year-end audit much smoother.

Weaknesses

The platform can feel fragmented because it originated from two different companies. Some users find the transition between billing and financial reporting roles a bit clunky, and it’s very focused on SaaS, making it less useful for other business models.

Best For: Growth-stage SaaS companies that need to professionalize their financial reporting and track key performance indicators for investors.

Price: Pricing is based on your annual recurring revenue. It is, however, competitive for the mid-market and scales as the business grows.

6. Zuora Revenue

Zuora is a leader in the subscription economy. It’s a massive platform designed to handle the most complex recurring billing scenarios for the world’s largest companies.

Strengths

Zuora Revenue (formerly RevPro) is arguably the most powerful revenue recognition engine on the market, able to process millions of transactions.

- Massive Scalability: It handles high-volume transaction data that would crash smaller systems.

- Advanced Rule Configuration: You can build almost any revenue rule into the system to account for unique contract terms.

- Global Compliance: It supports various accounting standards across different international jurisdictions.

- Revenue Forecasting: The system uses historical data to predict future revenue recognition schedules across the entire customer base.

It also handles complex multi-element arrangements with ease; if your company has thousands of different price points and contract terms, Zuora can manage them.

Weaknesses

The complexity is a double-edged sword. Zuora is notorious for being hard to implement and maintain, and you need a dedicated team or a consultant to manage it. The user interface is dense, and it’s overkill for companies that are not at the enterprise level.

Best For: Large, global enterprises with massive volumes of subscription data and highly complex contract terms.

Price: Zuora is expensive and aimed at the higher end of the market. Pricing is tailored to the enterprise and involves significant upfront costs and recurring fees.

How They Handle by Use Case

Identifying the Contract

You’ve got funds coming through the door… now what? You need to figure out if you’ve actually earned these funds, or if they’re a liability on the balance sheet. You do that by understanding what’s in your contract with your customer and setting up your systems accordingly.

NetSuite and Zuora require manual setup of contract rules. Once set, they’re rigid. Puzzle uses its AI engine to identify contracts based on the flow of funds and documentation from platforms like Stripe.

Performance Obligations

Performance obligations are the promises you make to a customer. For a SaaS company, this might be access to software and a one-time setup fee.

- Sage Intacct and NetSuite handle these well, but require you to define every item in a product catalog first. This is part of the reason it can take months to onboard a new client into these large and robust systems.

- Puzzle looks at the nature of the transaction to suggest obligations based on what it’s seen in the past.

- Your third-party tools that aren’t accounting platforms themselves will land somewhere in between.

Transaction Price and Allocation

Allocating the price across different obligations is where many companies fail to recognize revenue appropriately. If you sell a bundle, you must assign a portion of the price to each part.

Zuora has the most advanced math for this. However, Chargebee and Maxio are no slouches either. That data would then get pushed over to your accounting suite of choice and appropriately be coded.

Technical Hurdles and Integration

Integration is the most common point of failure for revenue recognition projects. If your billing system does not talk to your accounting system, you have to move data manually, which is what we’re ultimately trying to get away from.

NetSuite and Zuora are ecosystems. They want you to do everything inside their platform. This reduces integration issues but creates vendor lock-in, and it’s very hard to leave once you are in. Puzzle, Chargebee, and Maxio take a best-of-breed approach, connecting to the tools you already use.

- API-First Design: These platforms use modern APIs to sync data instantly.

- Banking Data Access: Puzzle’s ability to pull data from banking APIs is a major technical advantage.

- Data Integrity: Automated flows ensure that the numbers in your billing system match the numbers in your ledger.

Making the Decision

Choosing the right platform will often come down to your company’s stage and complexity.

If you’re a global enterprise with a massive budget and a large finance team, Zuora or NetSuite are the standard choices; they can handle the incredible amount of transactional volume required, providing the control and depth needed for extreme complexity. However, you must accept the high cost and slow pace of these systems.

If you’re a mid-market SaaS company, Sage Intacct, Maxio, and Chargebee provide a balance of power and usability, offering better metrics than a traditional ERP but requiring more maintenance than a modern platform. They also have a higher cost.

For the modern startup or growth-stage company, Puzzle offers the most compelling package. It removes the friction of traditional accounting, providing the accuracy of an enterprise system without the complexity. The real-time nature of the platform allows founders to make decisions based on today’s data, not last month’s data.

The shift toward AI-centric platforms is clear. Companies need more than just a digital ledger; they need software that processes data in real-time. In my opinion, Puzzle best represents this shift — it offers a way to handle the complexities of ASC 606 while keeping the finance function lean and fast.

Whichever you go with, choose a platform that grows with you and minimizes the manual work of your finance team.