Last Updated on December 18, 2025 by Ewen Finser

If you’ve read my content before, you know my philosophy on accounting: it’s the vegetable eating of the business world. No one’s passionate about categorizing Uber receipts or reconciling bank feeds. They do it because they have to — for taxes, for investors, and to keep the lights on.

These days, however, a lot of accounting has shifted toward something much more befitting the 21st century, especially as artificial intelligence has become increasingly mainstream.

For years, “automation” in accounting meant setting up a few bank rules in QuickBooks. But in 2025, we aren’t just talking about RPA or if/then rules anymore; we’re talking about AI that can contextually understand what a transaction is, draft your reports, and flag anomalies before you even open the dashboard.

There are several platforms that boast these modern capabilities, but they’re not all created equal. So I’ve devoted serious time and effort to stress-testing the industry’s best offerings so that I can give you my professional recommendations as a CPA.

TL;DR: While legacy giants like QuickBooks are playing catch-up, Digits edges out the competition by transforming static reports into a living conversation with your finances. Whether you need the human-hybrid safety of Botkeeper or the pure speed of Digits, the goal is the same: stop serving your ledger and let it start serving you.

How I Judge “Artificial Intelligence” in Accounting

Every SaaS platform today slaps an “AI” sticker on their homepage (it drives me crazy, to be honest). Of course, most of them are just glorified if/then statements. So when I evaluate these tools for my clients, I look for three specific things:

- Contextual Categorization: Does the tool know whether an Amazon purchase is office supplies or computer equipment, depending on the dollar amount and history?

- The “Black Box” Factor: Can I see why the AI made a decision? If the tool recategorizes a massive expense without telling me, that’s not automation; that’s a liability.

- Time to Insight: Does the AI speed up the time between a transaction happening and me seeing it in a report? The biggest killer in small business finance is lag.

With that in mind, here’s how the top players stack up.

1. Digits: The Living Financial Report

Digits attempts to attack bookkeeping from a different angle than the legacy players. While most platforms focus heavily on efficient data entry, Digits spends more time on generating usable insights. It uses proprietary AI to analyze your transactions in real time, attempting to kill the monthly close process (or at least dramatically cut it short) by keeping books continuous.

Unlike competitors that are just making an API call to ChatGPT, Digits’ AI feels purpose-built for finance, proactively monitoring your business finance data 24/7.

- Ask Digits: This is Digits’ AI assistant. With it, you don’t query your books with SQL; you ask, “How much did we spend on marketing in Q3 vs Q2?” and it instantly generates the chart and the breakdown.

- Living Reports: Instead of sending a static P&L PDF to stakeholders, Digits generates interactive reports. If a number looks off, you click it, and it drills down to the transaction level immediately.

My Takeaway: I’m usually skeptical of dashboards because they often hide the details unless you’re familiar with surfing them. However, Digits’ ability to maintain the integrity of the underlying data while making it readable for non-accountants has impressed me. The real wow factor, however, is the speed. In a traditional workflow, you wait until the 15th of the next month to see how you did. Digits aims to let you know your burn rate today. For my clients who are tech-forward, this visibility is addictive.

Tradeoffs to Note: Digits requires a shift in mindset. If you’re used to Excel and manually creating reports, this will annoy you since you’re basically asked to trust a digital-first workflow.

Best For: SaaS startups, e-commerce brands, accounting firms, and high-growth agencies that need real-time answers and find monthly PDFs too slow.

2. QuickBooks Online: The Elephant in the Room

You know QuickBooks. Your accountant knows QuickBooks. Your goldfish knows QuickBooks. It’s the standard operating system for small business finance in the U.S. And as of recently, Intuit has been pouring resources into Intuit Assist, their generative AI engine embedded across the platform.

The goal? To automate the tedious parts of the existing workflow.

- Invoicing: QuickBooks Online can draft invoice reminders or even generate invoices based on project activity.

- Anomaly Detection: QBO Advanced now scans your general ledger for transactions that look weird (like a duplicate bill or a vendor being paid double the usual amount) and flags them.

- Cash Flow Forecasting: QBO uses historical data to project your bank balance 30, 60, or 90 days out. For most of my SMB clients that are cyclical or seasonal, I have found these forecasts to have limited usefulness.

My Takeaway: I have a love-hate relationship with QuickBooks, but their AI is admittedly quite safe. Because they have data from millions of businesses, their categorization algorithms are very good at the basics. If you buy gas at Shell, QBO knows that it’s Fuel/Auto 99.9% of the time. However, the AI features often feel like they’re bolted onto a 20-year-old codebase. Sometimes, you have to click through five screens to find what you need. It’s powerful, but it’s not always elegant.

Tradeoffs to Note: To get the best AI automation features, you’re moving out of the cheap Simple Start pricing and into a significant monthly operating cost.

Best For: Traditional businesses (construction, retail, manufacturing) that need a robust, standard ledger that every accountant in the world knows how to use.

3. Botkeeper: Human-in-the-Loop AI Bookkeeping

Botkeeper was one of the first to market with the specific promise of AI bookkeeping. However, after AI continued to fail on its promise of reliability, they pivoted to a human-assisted AI model. You get the software, but there is a team of accountants (the “Bots”) verifying the machine’s work.

Botkeeper connects to your bank feeds and uses machine learning to categorize transactions. It learns your specific rules over time, so if you’re always coding Amazon purchases under $50 as office supplies, it remembers.

- Smart Categorization: Botkeeper handles the bulk of the volume here, like the recurrent, boring transactions.

- Exception Handling: When the AI gets confused, a human steps in to fix it before it hits your books.

My Takeaway: You aren’t just buying software here; you’re buying a quality service. The quality of the books is generally very high because of that human layer — you don’t get those AI hallucinations where a sales tax payment is categorized as an expense. However, as a result, the feedback loop is slower than a pure software solution. If you need to know a number right this second, you might be waiting for the human review cycle to clear. So for accounting firms, Botkeeper is a lifesaver. But for a direct business user, it can feel a bit heavy.

Tradeoffs to Note: Integration is the weak point here. Botkeeper usually sits in front of QuickBooks or Xero. It’s an extra layer in your stack. Also, pricing can be opaque and often depends on transaction volume.

Best For: Businesses with high transaction volumes (thousands of line items a month) that want to outsource the headache of categorization completely but still keep control of their main ledger.

4. Zeni: The Finance Team in a Box

Zeni is designed almost exclusively for the startup ecosystem and is a step above Botkeeper. They position themselves not just as a tool, but as a full-stack finance concierge. This means that when you sign up for Zeni, you’re essentially hiring a robo-CFO that handles bookkeeping, bill pay, and even yearly taxes.

Zeni claims to automate 80-90% of bookkeeping tasks, using AI to process receipts, reconcile bank accounts, and update a real-time dashboard.

- Vertical Integration: Because they handle the entire stack (including paying the bills), Zeni’s AI has more context. It knows you paid a vendor because it’s the one that processed the payment.

- The Dashboard: Zeni’s dashboard is famous for its burn rate focus. It tells founders exactly how many months of cash they have left based on current spending.

My Takeaway: Zeni is fantastic if you fit their box. If you’re a Series A startup, this is a no-brainer; it removes the need to hire a fractional CFO or an in-house finance team. However, if you have complex inventory, niche revenue recognition rules (like construction percent-of-completion), or a messy legacy file, Zeni’s automated model can struggle. They really force you into their way of doing things.

Tradeoffs to Note: You lose some control here since you’re relying on Zeni’s platform for everything. And if you ever decide to leave, migrating away from a full-service model is harder than just switching software.

Best For: Venture-backed startups who need investor-grade reporting without hiring an internal finance team.

5. Docyt: Granular Expense Management and Continuous Close

Docyt (pronounced “docket”) focuses heavily on the expense side of the equation. It’s an AI-powered automated bookkeeping platform that’s particularly strong for multi-location businesses. Its AI is trained to read receipts and invoices with high precision.

- Revenue Reconciliation: Docyt integrates with POS systems to match daily sales to bank deposits automatically. This is a nightmare task for humans, but Docyt’s AI eats it for breakfast.

- Expense Coding: Docyt doesn’t just look at the vendor; it looks at the line items on the receipt to code them to different GL accounts.

My Takeaway: If you run a business with high volumes of low-dollar transactions (like a coffee shop or a retail store), Docyt is incredible. The ability to verify that daily revenue actually hit the bank account is worth the subscription price alone. Note that the interface is very utility-focused. It’s not as shiny as Digits or Zeni, but it is a workhorse. It feels like a tool built by accountants who were tired of chasing paper receipts.

Tradeoffs to Note: Docyt can be overkill for a simple service business. If you just send five invoices a month and have recurring software subscriptions, its power is wasted on you.

Best For: Hospitality, retail, and multi-entity businesses where reconciling revenue and expenses is a daily volume struggle.

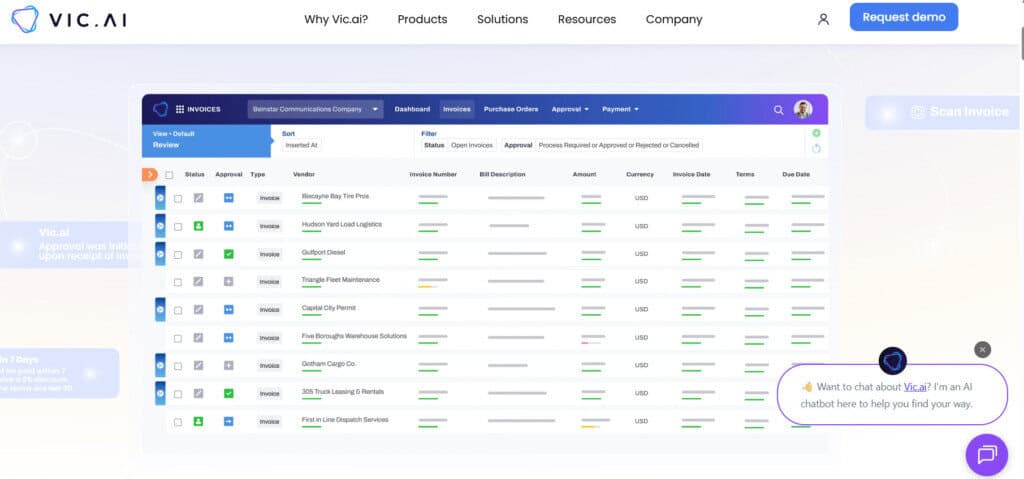

6. Vic.ai: The “Autonomous” Accounts Payable Department

While many tools claim to do AP automation, Vic.ai is one of the few that is aggressively trying to remove humans from the loop entirely. It targets the most tedious parts of bookkeeping: receiving an invoice, coding it, getting it approved, and paying it.

Most AP tools use OCR to just read the text. Vic.ai, on the other hand, uses a massive dataset of historical transactions to understand intent.

- Autonomy: Vic.ai doesn’t just read “Apple Store”; it predicts the general ledger account, the department, and even the dimension/location based on patterns from millions of other invoices it’s seen.

- Approval Flows: The AI learns who usually approves what. If marketing invoices usually go to Sarah but IT invoices go to Mike, Vic.ai can route them automatically without you having to build complex rule trees.

My Takeaway: For larger clients or businesses with heavy procurement volume, this is a game-changer. The error rate in manual AP entry is shockingly high, with fat fingers leading to double payments constantly. Vic.ai catches duplicates and errors that a tired human bookkeeper misses. It shifts the role of the bookkeeper from “data entry clerk” to “exception manager.”

Tradeoffs to Note: Vic.ai is overkill for the small guys. If you only have 10 bills a month, you don’t need this. This is for businesses where AP volume is becoming a bottleneck.

Best For: Mid-sized companies and growing agencies that process hundreds of vendor invoices a month and are drowning in approval emails.

The Final Verdict: Which One Wins?

If you are looking for the “best” tool, the annoying CPA answer is “it depends on your business model.”

- The “Set it and Forget it” Crowd: Botkeeper offers the safety net of human review that lets you sleep at night.

- The Tech Founder: Zeni provides that all-in-one dashboard that investors love. Just be prepared to pay for the convenience.

- The High-Volume Retailer: Docyt handles the daily grind of POS reconciliation better than anyone.

But if I had to pick the platform that feels most like the future of accounting, I have to give the nod to Digits.

Why? Because we’ve already solved the data entry problem… the next frontier is understanding that data.

Digits stands out because it doesn’t just dump a P&L in your lap; it lets you interact with your finances. The conversational AI, the living reports, and the sheer speed of insight here make it feel like a modern tool rather than a digitized version of a paper ledger. It’s the platform that most feels like the AI is a core architect of the software, rather than a half-baked feature they added in an update.