- The Bottom Line: Up Front

- First Things First: What Exactly is AI Bookkeeping?

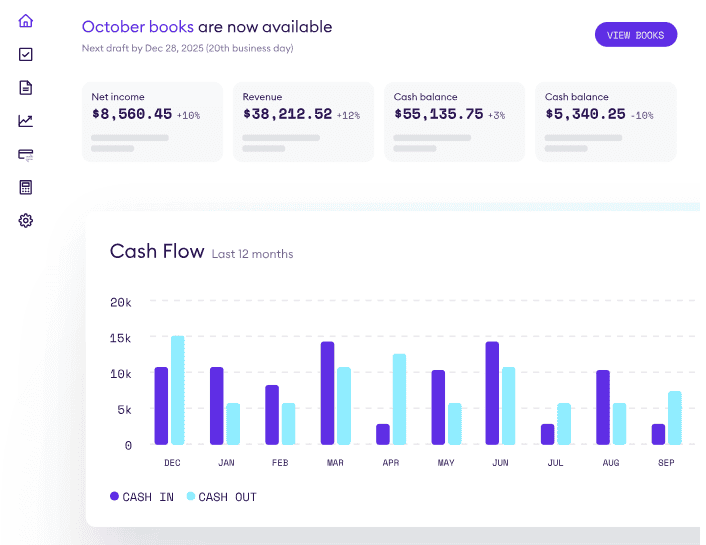

- 1. Pilot: Robust but Pricey

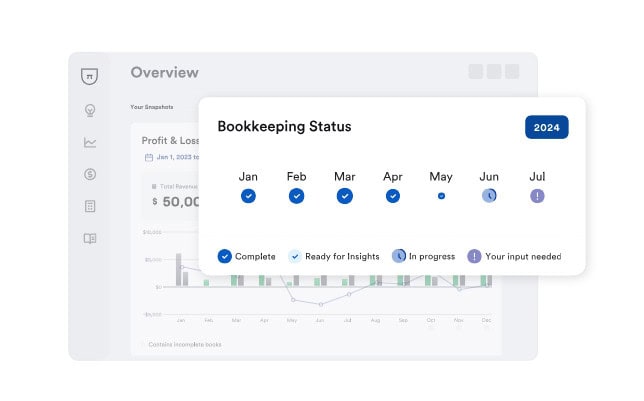

- 2. Bench: Simple, Reliable, but Less Flexible

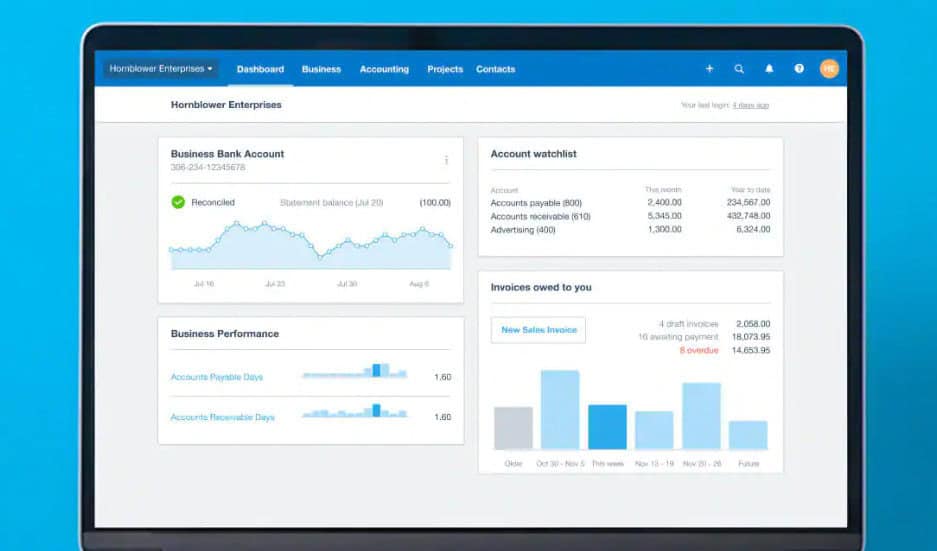

- 3. QuickBooks Live: Trusted Name, Familiar Feel, Lackluster AI

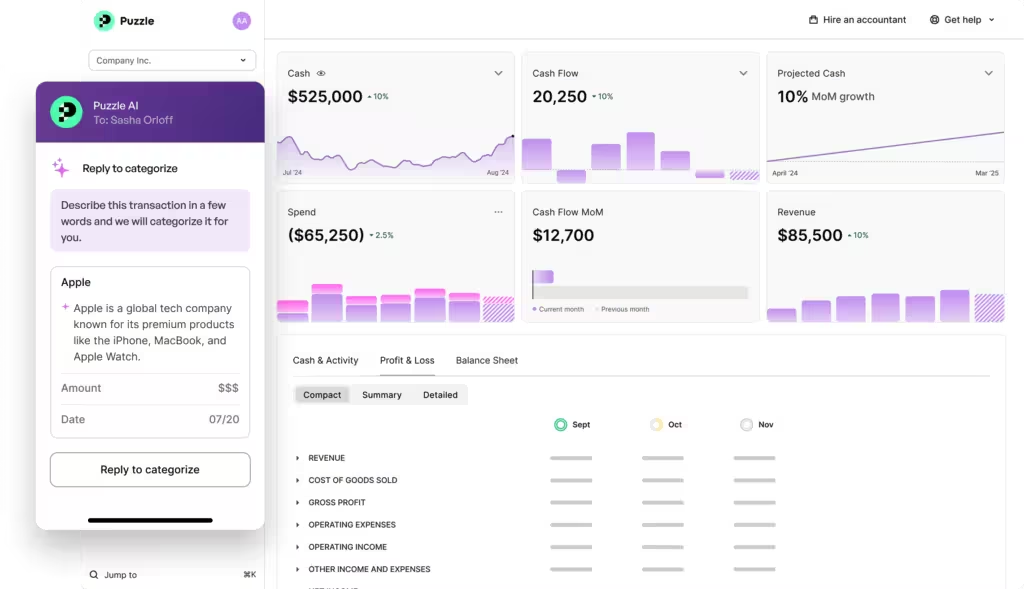

- 4. Xero (with AI capabilities): Powerful Integrations, Robust Ecosystem

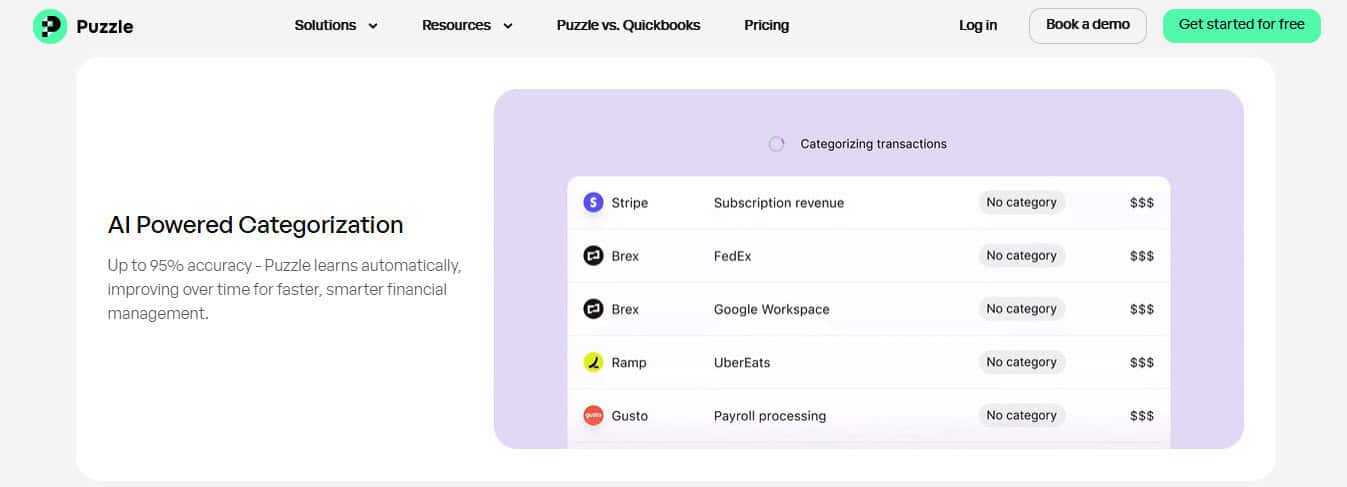

- 5. Puzzle.io: The New Guy that Nailed It

- Quick Comparison: Bullet Points to Guide Your Choice

- How AI Bookkeeping Saved One of My Clients’ Businesses

- Breaking Down AI Features: What Actually Matters?

- What About Security?

- Cost Considerations: Getting Value for Your Investment

- My Final Thoughts: Choosing the Right Tool for Your Business

Last Updated on July 30, 2025 by Ewen Finser

As a CPA who’s spent years DOWN IN THE WEEDS cleaning up financial records, I’ve seen firsthand how tech can make or break your business’s bookkeeping. Let me paint you a quick picture. It’s mid-2022 – Intuit is kicking tons of customers off their desktop version, so I am working to migrate about 6 clients over the course of a month to their online version. It’s a total nightmare. Lost data, broken connections, missing transactions – and this was from QBD to QBO, which is supposedly seamless and hassle-free! It took 6 of the worst months of my career to fix.

Let me tell you, the arrival of AI-powered bookkeeping software has been game-changing, especially for startups, solopreneurs, and small businesses. Today, accounting software isn’t just about recording transactions. It’s about automating time-consuming processes, eliminating human errors, and simplifying complex monthly closes. But with so many options out there, it’s hard to decide which platform deserves your trust.

I’ve tested and worked with many of these platforms, and I’m going to share my insights on the top five AI bookkeeping tools in 2025: Pilot, Bench, QuickBooks Live, Xero, and Puzzle.io. Each has its strengths and suits different businesses uniquely. And to avoid a situation like the one I shared above, you’ll want one that’s future-proof, evolves with changes, and can grow with your company.

The Bottom Line: Up Front

If you’re a startup founder, solopreneur, or small business owner looking to simplify your books, AI bookkeeping tools in 2025 offer a clear path forward. The top platforms – Pilot, Bench, QuickBooks Live, Xero, and Puzzle.io – and found that while each has strengths, Puzzle offers the best balance of automation, accuracy, and ease of use. It’s the tool I recommend often to clients who want reliable books without the overhead.

First Things First: What Exactly is AI Bookkeeping?

Simply put, AI bookkeeping software leverages artificial intelligence and machine learning. Basically, it means the software learns your business’ habits, categorizes expenses automatically, predicts financial trends, and even spots errors humans might miss.

It’s for businesses that want:

- Less manual data entry

- Faster month-end closes

- Accurate and reliable financial insights

- Reduced overhead and accounting costs

Why does it matter? Well, accurate bookkeeping is the backbone of business. Messy books lead to lost tax deductions, compliance issues, and financial confusion. A good AI bookkeeping tool saves you from these headaches.

Let’s break down the best options, starting with the ones you’re likely familiar with:

1. Pilot: Robust but Pricey

Pilot has positioned itself strongly among startups and tech companies. I’ve worked with clients who swear by Pilot’s thoroughness and accuracy.

Strengths:

- Deeply specialized tax and bookkeeping services

- A real team of bookkeepers paired with AI-driven categorization

- Strong industry-specific insights, especially for SaaS companies

Drawbacks:

- Pricing is very high (in my opinion, I’m a cheapskate at heart)

- Smaller businesses sometimes feel overlooked compared to high-growth startups

Pilot is great if you’re scaling quickly, lack accounting expertise, need robust tax integration, and have the budget to match. However, it may not fit businesses watching their budget.

2. Bench: Simple, Reliable, but Less Flexible

Bench is the go-to for businesses seeking simplicity. Their combination of human bookkeepers and AI-driven automation means you spend less time doing the mind-numbing work that is accounting, and can focus more so on your business.

Strengths:

- Clean interface (this is a big, because if you don’t understand it, you won’t use it)

- Reliable, consistent monthly reporting thanks to their intuitive software that can automate the busywork

- Relatively affordable, flat-rate pricing structure (for what you get)

Drawbacks:

- Limited customization in reporting and features

- Lacks deeper integrations and forecasting tools compared to others

Bench suits small businesses that just want clean, accurate books without any bells and whistles. But if you require in-depth reporting, Bench can fall short unless you start shelling out some serious dough.

3. QuickBooks Live: Trusted Name, Familiar Feel, Lackluster AI

As a CPA, QuickBooks has been a staple throughout my career. Their move to AI and live bookkeeping feels like a natural evolution. In fact, as of this writing, about 4 or 5 weeks ago, QBO just updated to their new design that now thoroughly encompasses AI, and everyone I know despises it! Me included! But I’d be remiss to not include it here anyway.

Strengths:

- Familiar interface, seamless integration with QuickBooks ecosystem

- AI is starting to play a heavier role in booking transactions from bank feeds

- Solid reliability, backed by Intuit

Drawbacks:

- Intuit has increased its price by 25% in the last two and a half years – with no end in sight.

- Live support almost seems non-existent now – they want everything done through the chatbot, which typically doesn’t want to put you through to a human

- Their most premium options, which offer things like budget versus actuals, and fixed asset listings are PRICEY (like $275 a month, plus Payroll costs).

If you’re already using QuickBooks, their AI service is a logical next step. However, businesses craving good customer support and fair pricing should look elsewhere.

4. Xero (with AI capabilities): Powerful Integrations, Robust Ecosystem

Xero has earned a loyal user base by offering robust integrations and accessible financial analytics, amplified by AI capabilities in recent updates.

Strengths:

- Extensive third-party integrations, ideal for app-heavy businesses

- Powerful financial forecasting and AI-driven insights (only on their most expensive tier, though)

- Strong global focus, beneficial for businesses outside the U.S. who may be using different currencies (only on their most expensive tier)

Drawbacks:

- Slightly more complex than Benchmark and QBO, but not overwhelmingly so

- Higher-tier plans required for full AI functionalities, adding cost

Xero is perfect if your business thrives on integrations and data-driven decision-making, though smaller and more inexperienced teams may find it slightly overwhelming.

5. Puzzle.io: The New Guy that Nailed It

I discovered Puzzle.io relatively recently, and to be honest, I didn’t expect much. Another “AI-driven” bookkeeping app – been there, done that, right? Yet, Puzzle.io surprised me. It felt like it genuinely understood the pain points my clients face, and more importantly, what I, as a CPA, face. It’s technically deep, but also great for people who just want the big picture.

Strengths:

- Extremely intuitive, easy-to-navigate user experience

- Exceptional AI accuracy – best in categorizing that I’ve seen yet

- Flexible, real-time dashboards tailored for quick decisions

- Strong focus on automation, dramatically cutting down manual entries

Drawbacks:

- Still newer to market, which means if you run into a problem, you may not have others who have seen and solved that problem (think similar to online forums)

- Growing third-party integration ecosystem, but not yet as extensive as it could be. It does support integration to banks with Plaid, though

For startups, solopreneurs, and businesses seeking a balance of simplicity, affordability, and powerful AI, Puzzle.io hits a sweet spot.

Quick Comparison: Bullet Points to Guide Your Choice

- Best for Affordability: Bench and Puzzle

- Best for Startups with Complex Tax Needs: Pilot

- Best for Integration and Apps: Xero and QBO

- Best for Small Teams Who Focus On Simplicity: QuickBooks Online

- Best Overall Balance (cost, ease, AI accuracy): Puzzle

In practice, I’ve found Puzzle offers a balanced blend of the strengths the other platforms individually champion. While Pilot is thorough, it’s expensive. Bench is affordable but basic. QuickBooks is reliable but impersonal (and I increasingly grow tired of them, but that’s a soapbox for another day), and Xero excels at integrations but can be daunting. Puzzle.io seems to strike a natural balance, understanding the unique rhythm of small businesses.

How AI Bookkeeping Saved One of My Clients’ Businesses

I’ve advised dozens of small businesses on their bookkeeping. Time and again, I’ve seen good companies stumble because of sloppy financials. Missing transactions, accounts that don’t reconcile, inaccurate expense tracking, overlooked deductions – it all adds up, pushing net income into the red and slowing growth.

Recently, a small client of mine – a bustling organic café that turned over $2.2MM per year and still couldn’t net a profit – transitioned from traditional accounting with one bookkeeper to a more AI-centric platform. Management drug their heels at first, but after just a few weeks, the impact was clear. The bookkeeper who was always horribly stressed, who once spent evenings buried in receipts and would email me at 1 AM, suddenly had extra hours each week to dedicate to cleaning up the books with the help of AI. Their month-end close shrank from weeks to just a few days. This is atypical, but paints a clear picture – I also feel like I gave that poor bookkeeper her sanity back that month.

Breaking Down AI Features: What Actually Matters?

Not every AI accounting platform is created equal. In practice, here are the features I always tell clients to prioritize:

- Automated Expense Categorization:

This one to me is almost non-negotiable. AI must learn how your business operates, categorizing expenses automatically. Puzzle.io stands out here, consistently learning patterns faster than others I’ve tried. - Real-Time Financial Dashboards:

Instant insights matter. You shouldn’t need to wait for monthly reports to know your financial standing (looking at you, QBO). Bench and Puzzle both excel here, offering live financial snapshots. - Forecasting and Insights:

Good AI anticipates issues before they become problems. Xero and Puzzle.io offer strong forecasting abilities, but Puzzle’s uber-simple dashboard and simplicity edge it ahead, especially for newer business owners. - Integration Capabilities:

If you rely on several business apps (CRM, payment processing, inventory), easy integration matters. Xero takes the lead here, followed closely by QBO, which I will begrudgingly admit has one of the most extensive app ecosystems. - Human Touchpoint:

Even with AI, occasionally, you’ll need real human advice. Pilot and Bench provide dedicated bookkeepers, while QuickBooks offers more forum-style access.

What About Security?

I often get questions about data security. As someone who deals with names, Social Security Numbers, phone numbers, banking details, etc. I take infosec extremely seriously. When you’re entrusting your financial data to cloud software, security can’t be an afterthought. From my experience:

- All five platforms utilize robust encryption and follow industry-standard security practices.

- Pilot and QuickBooks leverage additional layers of security due to their size and corporate backing.

Cost Considerations: Getting Value for Your Investment

As a penny pincher, I caution clients to consider the total value, not just price. Here’s my quick take on pricing:

- Pilot: High cost, but worth it if you value deep financial support and tax services.

- Bench: Most affordable and straightforward, perfect for tight budgets who want to be as hands-off as possible

- QuickBooks Live: Mid to high range pricing, best if you’re already invested in QuickBooks software.

- Xero: Good value if your business utilizes multiple integrations.

- Puzzle.io: Offers value, balancing strong AI features, support, and affordability. It gives you a premium experience without the premium price.

My Final Thoughts: Choosing the Right Tool for Your Business

At the end of the day, bookkeeping software should simplify your business, not complicate it further. Each of these platforms serves certain business types better than others. If you’re a solopreneur or small team needing accurate books without complexity, Bench is solid. High-growth startups needing extensive support might lean towards Pilot. Those tied into QuickBooks will find QuickBooks Live natural, and integration-focused businesses should explore Xero.

But Puzzle.io has genuinely impressed me, striking an effective balance between simplicity and power. It’s not perfect, but it adapts incredibly well to diverse needs. It feels like the future of bookkeeping – streamlined, intuitive, and remarkably intelligent.

In my experience, businesses that choose wisely benefit greatly. Efficient bookkeeping isn’t just convenience; it’s freedom – freedom from errors, stress, and wasted hours, letting you focus more clearly on growing your business.

And isn’t that what we all want from technology?