- Things to Know Regarding Your Income Tax Liability and the ERC

- Does Claiming the ERC Require an Amended Income Tax Return?

- Impact of ERC Claims on Business Income Taxes and Deductions

- Professional Guidance and Recommendations

- Frequently Asked Questions on Tax Repercussions of the ERC

- The Key Takeaways

Last Updated on April 22, 2025 by Ewen Finser

As a licensed CPA, it seems to me that the Employee Retention Credit has been the only thing that business owners wanted to talk about for years.

But for good reason; if a business qualified, an entrepreneur could receive hundreds of thousands of dollars, if not millions, in refunds. In my experience, though, business owners loved the idea of the ERC for the financial windfall, but fewer CEOs, finance directors, and small business owners understood the intricacies of how to claim it and what its repercussions are on an income tax return basis.

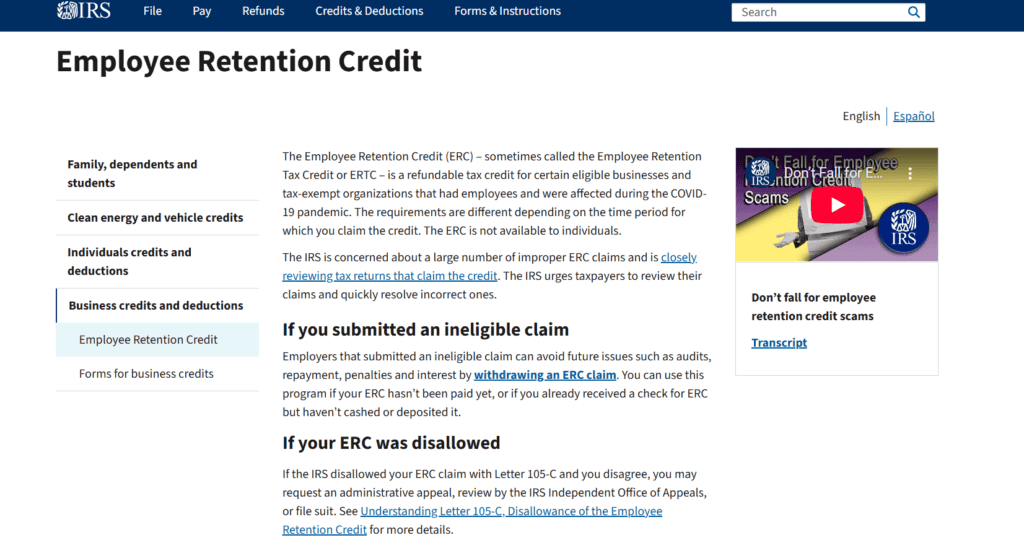

Initially enacted under the CARES Act and subsequently expanded, the ERC significantly benefited eligible employers. Businesses could substantially reduce payroll tax liabilities, directly giving their cash flow a boost and juicing up their balance sheets and P&Ls.

Due to evolving legislation and ongoing IRS guidance, many business owners are uncertain about the exact filing requirements for claiming ERC, particularly whether amending prior tax returns is necessary. Let’s take a look at how filing for the ERC can impact your personal tax liability.

The Short Answer:

Most employers filing for the ERC will not have to amend their income tax returns. However, there are a few exceptions. If the credit was claimed retroactively, prior year tax returns will need to be amended to adjust payroll deductions. If the credit was claimed in the correct accounting year, 2020 or 2021, typically you will not need to adjust your income tax returns.

Things to Know Regarding Your Income Tax Liability and the ERC

What is the ERC?

The ERC is a payroll tax credit. It acts as a refundable credit against the employer’s share of Social Security tax, effectively reducing payroll expenses.

How to Calculate and Value the ERC?

In 2020, the ERC provided a maximum credit of $5,000 per employee annually, calculated as 50% of up to $10,000 of qualified wages.

The 2021 ERC was expanded to 70% of qualified wages, up to $10,000 per employee per quarter, potentially totaling $7,000 per employee per quarter.

How to Claim the Credit – Original Filing of Form 941

Employers claimed the ERC by reporting eligible amounts on Form 941, the Employer’s Quarterly Federal Tax Return, during the appropriate quarter in 2020 and 2021.

Employers who were able to timely claim the ERC using their original quarterly filings streamlined the credit process significantly. However this process is no longer available, and now employers must use Form 941-X.

Using Form 941-X (Adjusted Employer’s Quarterly Federal Tax Return)

If an employer failed to claim ERC during the original quarterly filing, they must use Form 941-X to retroactively claim the credit. Form 941-X allows employers to adjust previously reported payroll taxes and request refunds from earlier periods.

Filing Form 941-X for ERC purposes involves detailed explanations of payroll corrections, credit calculations, and substantiation of qualified wages.

Does Claiming the ERC Require an Amended Income Tax Return?

General Rule: No Amendment Required

Generally, claiming the ERC does not require amending the employer’s annual income tax return (e.g., Form 1120, Form 1065, or Form 1040 Schedule C), if the credit was claimed in 2020 or 2021 and the tax return was prepared correctly. The ERC directly impacts payroll tax reporting rather than business income tax reporting, meaning no automatic amendment of annual income tax returns occurs.

The IRS clarifies that adjustments for ERC purposes occur on payroll tax returns (Form 941 or Form 941-X) rather than income tax returns. In most straightforward scenarios, businesses can claim the ERC without needing to amend annual income tax returns, so long as the credit and original income tax return were filed in the same year (2020 and 2021).

Exceptions and Special Situations

There are specific scenarios where ERC indirectly affects annual income tax returns, potentially necessitating amendments.

For example, IRS guidance explicitly states that employers must reduce wage expense deductions on their income tax returns by the amount of ERC received, preventing a “double benefit.” Employers who claimed wage deductions without reflecting ERC reductions on originally filed returns will need to amend their income tax filings.

Specific cases such as partnerships, corporations, or sole proprietors may face adjustments requiring amended returns. Identifying whether these scenarios are simple; if the credit was received after the 2020 and 2021 income tax returns were filed, the business owner will more than likely need to amend their payroll tax expense to prevent double dipping.

Impact of ERC Claims on Business Income Taxes and Deductions

ERC and Wage Deduction Adjustments

Because ERC payments offset employer payroll expenses, the IRS requires businesses to adjust their payroll-related deductions accordingly. Essentially, the IRS prevents employers from deducting payroll costs funded by tax credits, thus avoiding a double tax benefit. Employers receiving the ERC must decrease their deductible payroll expenses by the amount of ERC claimed.

Clearly identifying these adjustments and accurately reflecting them in income tax filings ensures business owners stay in good graces with the IRS.

When Amending Income Tax Returns Become Necessary

If a business previously filed its annual tax return and later claims ERC retroactively via Form 941-X, amendments to the annual return become necessary. Situations particularly involving partnerships (Form 1065), corporations (Form 1120), or sole proprietorships (Form 1040 Schedule C) will more than likely require adjustment. Amendments typically arise when wage deductions originally claimed are inconsistent with ERC claims made retroactively.

Recommended Process for Determining If an Amendment Is Needed

Businesses should thoroughly review prior-year income tax filings once ERC is claimed or retroactively adjusted. Start by determining whether wages deducted on original returns now differ substantially due to ERC adjustments. Then, evaluate the impact on business income and deductions line by line, usually on schedule C for small business owners. Consult IRS Notices 2021-20 and 2021-49 to understand deduction and amendment requirements clearly.

IRS Processing Timeline and Refunds

Form 941-X typically takes significantly longer for IRS processing compared to original Form 941 filings. The IRS usually takes several months to review amended payroll returns and issue ERC refunds. Employers filing Form 941-X should anticipate delays and plan cash flow accordingly – i.e., don’t hold out hope for a quick turn around time as retroactive credits are taking months to process. Monitoring refund status through IRS channels can provide helpful transparency, but will not speed up the process of receiving your funds.

Common Pitfalls and Misconceptions: Confusion Between Payroll and Income Taxes

A common confusion arises from misunderstanding the difference between payroll tax adjustments (reported on Form 941 or 941-X) and income tax amendments (Form 1120, 1065, Schedule C).

Employers unfamiliar with these distinctions sometimes erroneously amend their annual income tax returns unnecessarily after filing ERC claims. This misunderstanding creates additional administrative burdens, causes IRS scrutiny, and wastes valuable time.

Clearly distinguishing between payroll-related ERC reporting and annual income tax filings significantly simplifies compliance. As a reminder, oftentimes if the credit was filed for in 2020 or 2021, no amendment to the income tax return is needed. However, if you retroactively claimed in 2022 and onward, you will most likely need your tax return amended.

Professional Guidance and Recommendations

Consulting with Tax Professionals

Given ERC’s complexity, businesses often benefit from consulting experienced tax professionals like CPAs, tax attorneys, or payroll specialists. Professional assistance can ensure accurate interpretation of eligibility rules, correct ERC calculations, and timely, compliant filings.

This guidance is particularly crucial when navigating nuanced situations, retroactive claims, or when considering potential income tax amendments. Tax professionals also support businesses during potential IRS audits or inquiries related to ERC claims.

It’s my opinion as a state licensed CPA that professional advice reduces risk, optimizes available tax credits, and enhances financial outcomes for businesses. Professional advice and consulting can also help paint a more realistic picture of what outcomes are realistic before engaging in a complicated undertaking such as the ERC.

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.

Recordkeeping Best Practices

Maintaining thorough, organized records is critical for substantiating ERC claims. Employers should document eligibility criteria, financial statements showing gross receipts, payroll records detailing qualified wages, and supporting government orders relating to business disruptions. Proper recordkeeping simplifies filing and helps defend against potential IRS inquiries or audits. Consistent documentation also aids businesses in accurately calculating credits, particularly when filing retroactively using Form 941-X. Investing in robust payroll and accounting systems ensures ongoing compliance and streamlines future tax reporting processes.

Frequently Asked Questions on Tax Repercussions of the ERC

Question: What if I already filed my business income taxes without adjusting wages for ERC?”

Answer: Employers who filed annual tax returns without adjusting payroll deductions for ERC should review their filings promptly. If the ERC adjustment materially impacts taxable income, businesses will need to amend their income tax returns to accurately reflect reduced wage deductions. I recommended consulting a tax CPA for guidance on necessary amendments, and oftentimes find myself consulting with two or even three tax CPAs to ensure that my clients are considering all options. By consulting with multiple professionals who do this everyday for a living, a business owner will receive a host of feedback and have a better picture of what action to pursue.

Not all businesses may require amendments, but most will if they received the ERC credit retroactively, so careful analysis of prior returns is necessary. Quick action prevents potential complications with IRS compliance.

This is something that I often ask my clients when I notice they have retroactively received credits, say in the year 2023 or 2024. They often don’t or didn’t file amendments for their previous year tax returns for 2020 or 2021, which can lead to a significant tax liability if they received 100s of thousands of dollars in credits. Usually, it’s a matter of simply not knowing, so we try to amend those previous income tax returns as soon as it’s noticed.

Question: Can I still claim ERC for prior quarters?

Answer: Yes, businesses can retroactively claim ERC for eligible prior quarters using Form 941-X. Generally, employers have three years from the original Form 941 filing deadline to amend payroll returns and claim refunds. Timely filing is crucial to ensure businesses do not miss refund opportunities due to statutory deadlines. Detailed payroll records must support these retroactive claims clearly and accurately. Businesses should proactively review past payroll quarters to maximize potential ERC refunds.

Question: How long do I have to amend Form 941 for ERC?

Answer: Employers have a period of three years from the original due date of each Form 941 filing to file amendments (Form 941-X) and claim ERC. Missing this deadline prevents businesses from receiving credits due for past eligible periods. Companies should maintain organized schedules, tracking their original payroll filing dates to avoid missing amendment windows. Businesses considering ERC claims should review deadlines proactively to secure eligible refunds.

The Key Takeaways

Claiming the Employee Retention Credit does not inherently require businesses to amend their annual income tax returns, as ERC primarily affects payroll tax reporting. This generally applies if you successfully claimed the credit during 2020 or 2021.

However, special circumstances such as retroactive claims or wage deduction adjustments can necessitate amendments to income tax returns if the credits were claimed after those two years. The reason for this is because payroll expense must be reduced by the amount of credit claimed for those two years, which will increase net profit for the business and prevent tax payers from “double dipping”.

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.