- ADP vs Homebase The Bottom Line Up Front: Who Each Team Fits

- Pricing Each Platform

- Core Payroll Taxes

- Time Tracking and Scheduling (Where Most Managers Spend Their Time)

- Tips, Pools, and Hourly Nuance

- Integrations (POS and accounting)

- HR and Compliance

- Multi-Location and Multi-State

- Reporting and Job Costing

- Onboarding, Documents, and Year End Stuff

- Service Model and Buying Experience

- Compliance Details

- Let’s Talk About Real World Scenarios I’ve Ran Through

- Reporting To the Books (Pay Attention!)

- Where Each Falls Short

- Decision Checklist and What Makes Sense for Your Team

- My Verdict

- Related read

Last Updated on November 5, 2025 by Ewen Finser

Owners ask me this a lot: ADP or Homebase? I’m a CPA who sets up payroll and time for restaurants, shops, and field crews. Both pay people, file taxes, and issue W-2s and 1099s. The real difference is focus. ADP is payroll-first with HR and benefits you can add.

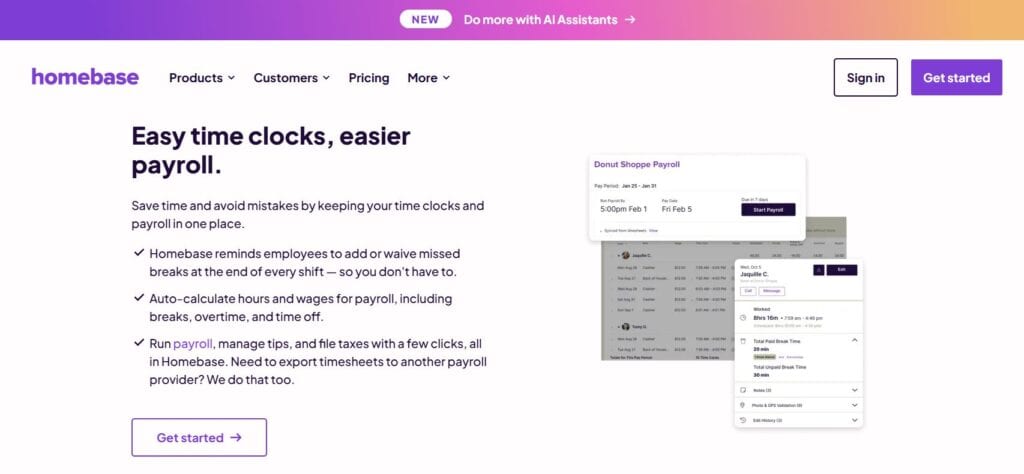

Homebase is schedule-first with time clocks, shift tools, and payroll you can turn on when ready. Both possess competitive pricing, easy setup, time tracking, tips, HR, reporting, and multi-state rules but each excel in their own respective areas. I often pick Homebase for schedule-heavy teams and ADP when a company wants deeper HR under one roof.

ADP vs Homebase The Bottom Line Up Front: Who Each Team Fits

ADP fits owners who want payroll as the hub, with optional timekeeping, scheduling, benefits, and HR add-ons. You can step up through packages as needs grow, and you’re not boxed in if you expand to multiple states or add benefits later. ADP’s RUN product for 1–49 employees includes new-hire reporting, W-2/1099s, tax filing, and multi-jurisdiction support, with higher tiers adding HR help desk, handbook tools, job costing, and more.

Homebase fits teams that live by the schedule: restaurants, retail, salons, job-site crews. It starts with scheduling and time clocks (including a free tier), then adds hiring tools, PTO controls, HR help, and a payroll add-on you can turn on when you need it. Pricing is per location with unlimited employees on paid tiers, and payroll is a clear base + per-employee fee.

Pricing Each Platform

As a CPA, I love talking about what things cost. Everything has a value proposition, and if you’re spending your hard earned cash, you better see tangible benefits in return.

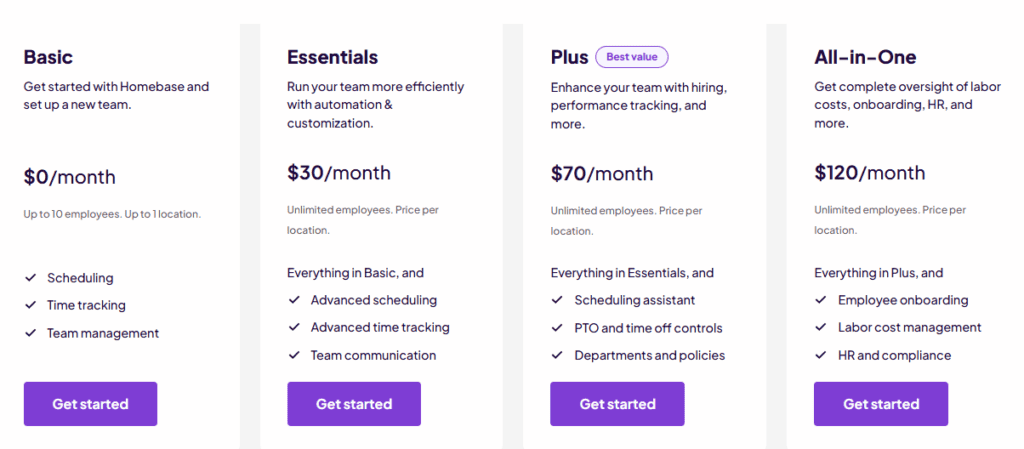

- Homebase: Clear, posted pricing. They have different tiers: Basic ($0 for one location, up to 10 employees), Essentials ($30/location), Plus ($70/location), and All-in-One ($120/location). Payroll is an add-on at $39/month base + $6 per employee paid. Tip Manager is $25/location if you pool tips. This transparency makes budgeting simple and lets you start with scheduling and time, then layer in payroll when ready.

- ADP: Uses a consultative, quote-based model, which I don’t appreciate. I like to know exactly what things cost, and they should scale based on services delivered, not arbitrary statistics made up by a salesperson. Packages (Essential, Enhanced, Complete Payroll & HR Plus, HR Pro) are published with feature lists, but you request pricing. That can match your exact footprint and get you promos, but it also makes apples-to-apples budgeting harder before you talk to sales.

My accountant’s take: if you need a quick, predictable number to plug into a cash flow, Homebase is easier. If you want a tailored bundle that can include benefits, workers’ comp, and more under one umbrella, ADP’s quote process can pay off, but will typically be higher in terms of costs.

Core Payroll Taxes

Both run payroll, pay people by direct deposit, and handle filings. The differences are in scope and framing.

- ADP RUN (1–49 employees): Includes new-hire reporting, W-2s and 1099s, tax filing, a general ledger interface, multi-company and multi-jurisdiction payroll, and employee self-service. For many small firms, that covers the essentials without extra tools.

- Homebase Payroll: Homebase acts as a reporting agent and files federal, state, and local payroll tax forms for you, and it issues W-2s/1099s to employees and contractors in the app. Homebase can even mail paper copies for a small per-form fee. For multi-location setups, Homebase supports separate locations and local rates, and it explains when extra state or local registrations are required.

In practical use, Homebase Payroll stands out because scheduling, time tracking, and payroll are all synced automatically. This eliminates the need for manual data transfers or double entry, while overtime, breaks, and tip calculations are handled natively. The system also flags potential tax or compliance issues before they escalate, providing a reliable, low-maintenance payroll workflow that fits naturally into how hourly teams operate.

In practice: ADP’s multi-jurisdiction depth is battle-tested in edge cases; Homebase covers the standard state/local filings most hourly firms hit in one or a few states.

Time Tracking and Scheduling (Where Most Managers Spend Their Time)

- Homebase: Scheduling, time clocks, mobile geofencing, shift swaps, approvals, late alerts, and strong break-and-overtime controls are core to the product. It’s built around hourly work, so managers spend less time chasing corrections. Break waivers and compliance workflows are built in, which matters in break-rule states.

- ADP (Time & Attendance / Timekeeping Plus Scheduling): ADP offers a full time-and-attendance suite that integrates into RUN (and other ADP platforms). You can build schedules, post open shifts, allow swaps, set work-rule limits, and flow hours straight to payroll with kiosks or mobile clocking. It’s robust, but it’s an add-on to payroll for RUN clients, which will further inflate costs.

My experience: if scheduling and time are the pain, Homebase feels more “native.” With ADP, you can reach the same outcome, but you’ll enable the time add-on and configure it.

Tips, Pools, and Hourly Nuance

- Homebase: For tipped teams, Tip Manager auto-pulls tips from your POS, runs the pool by rules you choose (by hours, by role, or all-hands), and sends allocations to timesheets. That reduces spreadsheet work and mismatches between the drawer and payroll. The add-on is priced per location.

- ADP: Timekeeping and scheduling are strong, but tip pooling is usually handled upstream in the POS or another workflow, then fed into payroll. That’s fine for many teams, but it’s not “one screen” by default, which is a tough pill to swallow as many SMBs already struggle with Payroll.

For restaurants, bars, and cafés, Homebase’s native tip flow is a real advantage.

Integrations (POS and accounting)

- Homebase: Deep POS integrations (Square, Lightspeed X-Series and others). Hours and sales sync so you can compare labor against revenue. It also integrates with QuickBooks Online for labor sync and GL work which is a massive plus.

- ADP: Broad marketplace with integrations for accounting (including QuickBooks), recruiting, benefits, and more. If you need a large ecosystem, ADP’s marketplace is wide.

Pick based on the systems you use most today. For POS-heavy ops, Homebase is plug-and-play gold. For general HR and finance stacks, ADP’s marketplace is deep.

HR and Compliance

- ADP: Tiers add HR help desk options, handbook tools, training, poster compliance, SUI management, and more, which is useful if you want a predictable place to call for HR questions and a formal handbook workflow.

- Homebase: The All-in-One plan includes HR & compliance features, live HR advisors, handbook support, labor-law change alerts, and onboarding (W-4, I-9, direct deposit, e-sign). When I think of a couple restaurants that I help out, this is more than enough.

In my experience, most <50-employee hourly firms don’t need an enterprise HRIS. They need policies buttoned up, forms signed, and a place to ask “can I do this?” Both tools cover that; ADP goes further if you’ll grow into heavier HR.

Multi-Location and Multi-State

- ADP: “Multi-jurisdiction payroll” is included even at the Essential level. If you operate across states or localities, ADP is set up for it.

- Homebase: Supports multi-location setups, lets you assign managers per site, and keeps local rates current. If you expand to a new state, it flags when you need new tax registrations.

For a single metro with a few locations, both are fine. For complex, multi-state footprints with changing rules, ADP has the edge.

Reporting and Job Costing

- ADP: Job costing is listed in the Enhanced tier, and reporting is a core strength. If you need labor to roll up by job, department, or project for your GL, ADP has long had those features.

- Homebase: All-in-One adds labor cost management, overtime alerts, forecasted sales scheduling, and “Business Insights” reports that tie schedule and actual hours to sales and targets. That’s enough for most hourly operators who monitor labor on a daily basis to ensure that the dollars going out the door match what’s coming in.

For construction with detailed job-phase costing, ADP’s native job-costing can be useful. For restaurants and retail measuring labor vs. sales, Homebase’s dashboards do the job eloquently without drifting into a “more complex than you need” territory.

Onboarding, Documents, and Year End Stuff

- Homebase: All-in-One includes onboarding with W-4, W-9, I-9, e-sign, and secure storage. Payroll issues W-2s/1099s in the app and can mail paper copies for a small fee if you want that service. In my experience, this is all that most SMBs need.

- ADP: The RUN module includes new-hire reporting and onboarding, with W-2/1099 generation as standard.

From a year-end standpoint, both meet the mark for small employers, but I’ve been a bit happier with Homebase’s options as opposed to ADPs.

Service Model and Buying Experience

- ADP: You’ll often talk to sales, discuss headcount, states, timekeeping needs, and benefits, and get a tailored quote (boo to “custom” quotes!). This can secure bundles and promotions, but it adds steps. ADP highlights ease of switching and speed to run payroll once set up.

- Homebase: You can self-serve, which I adore. Pricing is posted, and you can add payroll with a flat base + per-employee price. For owners who want to get the ball rolling immediately, this is gold.

Compliance Details

- Breaks and waivers: Homebase lets teams acknowledge or waive required breaks at clock-out and helps you track missed breaks which is useful in states with strict rules.

- FLSA/overtime setup: Both systems support overtime rules; ADP’s time suite calls out compliance tools and work-rule limits; Homebase lets you set overtime and break preferences and automates alerts.

- Tax registrations: Homebase guides you when new state or local IDs are needed as you add locations.

Let’s Talk About Real World Scenarios I’ve Ran Through

1) Single-location growing to two stores

Imagine this: You’re a manager that lives in the schedule. Tips are pooled. You want fewer tools because you’re expanding. Homebase with All-in-One, plus Payroll and Tip Manager, keeps everything in one place. The POS integration pulls in sales and tips, and your schedules forecast to targets. The payroll add-on handles W-2s/1099s and filings. You get hours back every week. It’s almost too easy! This was a situation I’ve walked through with a SMB owner in the past, and it went relatively seamlessly.

2) Trade contractor with techs in two states

We needed payroll first with clean GL mapping, job costing, and room to add benefits. ADP RUN with timekeeping add-ons gave multi-jurisdiction coverage, job costing, and a path to more HR if hiring accelerates. This one was a bit more complicated than the prior situation, and therefore ADP made sense and was the easy choice. After some onboarding hiccups, everything flowed smoothly.

3) Retail boutique with weekend staff and one salaried manager

The client wanted a simple schedule, an easy time clock, and payroll that won’t break the budget. Homebase Essentials with the Payroll add on is what we gave a whirl, and it worked flawlessly. You can start on the free Basic tier to test scheduling, then switch on payroll after two pay cycles.

Reporting To the Books (Pay Attention!)

If your payroll system doesn’t talk to whatever accounting system you’re using, break contract immediately. You’re wasting HOURS every week doing anything manual related to payroll.

For today’s comparison, both connect to QuickBooks. ADP offers a general ledger interface; Homebase syncs labor hours and supports API access on higher tiers. If your accountant closes the month on labor allocations, either works; ADP’s GL mapping is mature, and Homebase’s labor reports plus POS data make margin review fast.

Where Each Falls Short

No system is perfect, and it wouldn’t be a just comparison unless we discussed where the platforms fall short.

- Homebase limits: If you want one vendor for payroll, benefits, workers’ comp, retirement, and layered HR with advanced training and legal add-ons, Homebase won’t be that single pane of glass. You’ll need to assemble a stack (which is fine for many hourly operators).

- ADP limits: If your day starts in the schedule, ADP can feel like payroll with a time module added, not a schedule-first tool. For tipped businesses that want one place for tip pooling, ADP usually relies on POS workflows rather than a native tip-manager.

Decision Checklist and What Makes Sense for Your Team

- Where do managers spend time?

If it’s scheduling and shift changes, I would definitely lean Homebase. If it’s payroll, HR, and benefits setup, lean ADP. - How many locations and states?

One metro or a couple of stores: either works. Multi-state now or soon: ADP has the edge. - Tips, pools, and POS?

If pooled tips are something you use in your business, Homebase’s Tip Manager saves an immense amount of time. - Budgeting style?

Want clear posted pricing you can start with today? Homebase. Want a bundle tailored to include HR and benefits? ADP.

My Verdict

Both are strong. Both do payroll and filings right. The better fit depends on where your operational pain lives.

- If you run an hourly, schedule-driven business and want to keep time, scheduling, tips, HR basics, and payroll in one clean flow with transparent pricing, Homebase is the smoother choice. It reduces handoffs and rekeying, and managers stay in one system.

- If you prefer a payroll-centric platform that can bundle time, HR, benefits, and multi-state compliance with room to grow, ADP is the safer long-term anchor, especially if you expect headcount or footprint to expand.

If I had to choose for the “typical” café, retail shop, or field crew under 50 heads, I’d start on Homebase with the paid tier that matches your needs and add payroll when you’re ready. If we’re talking about a firm that will hire across states, add benefits, and wants a single vendor over the long haul, I’d spec ADP with timekeeping and HR layered in. Both answers are defensible. The right one matches where you work every day.