- Today’s Shortlist: The Accounting Platforms That Play Nice With Mercury

- Puzzle.io: Native Mercury Integrations

- QuickBooks Online: The default ledger with a strong Mercury pipe

- Xero: Clean UI and multi-currency support for global Mercury users

- NetSuite: ERP for when Mercury is only one part of the puzzle

- Pilot: Done-for-you books on top of Mercury

- FreshBooks: Simple accounting for service shops using Mercury

- How to Choose: A CPA’s Cheatsheet

- Why I Recommend Puzzle for Mercury Users

Last Updated on December 18, 2025 by Ewen Finser

Mercury is a fintech platform that provides modern business banking without the branch. It’s not a bank itself; it simply works with partner banks to offer FDIC-insured checking and savings, corporate cards, and a growing suite of tools for bill pay, invoicing, treasury, and spend management. Overall, it’s pretty versatile and not a bad way to set up your business while getting the admin side of things figured out.

If you already live in Mercury all day, your accounting stack either makes your life easier or it fights you every time you close the books. The good news is that Mercury now has proper accounting integrations, typically available via API.

The bad news is that some “integrations” are just glorified CSV exports with lipstick. A friendly setup, on the other hand, should:

- Pull all transaction data in a structured way (merchant, memos, tags, cards, accounts).

- Respect how Mercury works — a lot of SMBs have many checking accounts, virtual cards, treasury, spend controls… and all of it needs to be kept up with.

- Help you reconcile fast without endless manual rules.

- Keep your cash, burn, and runway current enough to use for actual decisions.

So, which platforms offer the best connections to Mercury?

Today’s Shortlist: The Accounting Platforms That Play Nice With Mercury

At a high level, here are your options:

- Puzzle.io: A newer accounting platform built natively on Mercury’s API, with real-time metrics and automated bank recs.

- QuickBooks Online: The default small-business ledger with a strong direct Mercury sync and a huge app store.

- Xero: Cleaner UX and multi-currency tools, with a Mercury integration for direct transaction sync.

- NetSuite: A full ERP that’s overkill for most startups but fits later-stage companies that already live in Oracle land.

- Pilot: Tech-enabled bookkeeping service that rides on top of tools like QBO and NetSuite and plugs into Mercury through those ledgers.

- FreshBooks: Lightweight accounting for service businesses that ties into Mercury using standard bank feeds and CSV exports.

Let’s jump in and start picking them apart one by one.

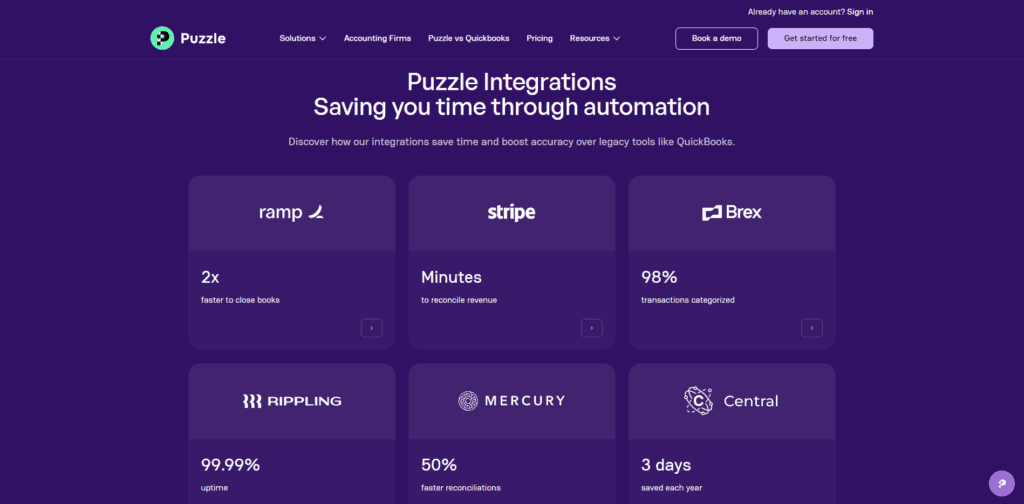

Puzzle.io: Native Mercury Integrations

This is the standout pick because it’s the only accounting platform built directly on the Mercury API — not just “connected” by a plug-in. While other platforms have more tenure in the space, Puzzle was built ground up with these kinds of integrations in mind.

How it integrates with Mercury

This is where Puzzle differentiates itself:

- Its direct, partner-grade Mercury integration pulls statement balances, runs checks, and ties out to Mercury each month, without you needing to touch anything.

- You can turn on accounting from your Mercury account in a single step, and it will code about 90% of transactions and flag the rest for review.

This seamless connection between Puzzle and Mercury is too beneficial to ignore, and as a CPA who spends a ton of time looking at transactions, it can be enough to make your decision for you.

Where Puzzle shines

- Mercury-first design: The product assumes your primary bank is Mercury and uses that to drive reconciliations, cash views, and spend analytics. It’s mostly automatic, and you look at exceptions.

- Always-on close: Real-time bank data plus automated recs and revenue rules keep the ledger nearly close-ready throughout the month.

- Startup metrics baked in: Cash, burn, runway, revenue, ARR/MRR, and investor-friendly charts ship inside the accounting platform.

- Strong fit with the rest of the startup stack: Puzzle also plays well with Stripe, Ramp, Brex, Gusto, and similar tools (which is where most Mercury users live anyway).

Where Puzzle can fall short

- Puzzle mainly focuses on VC-backed and tech-leaning startups. So something like a traditional construction shop or local retail business may want more industry-specific templates or features.

- The broader app marketplace is smaller than QBO’s, so if you want every niche add-on under the sun, Intuit’s ecosystem still wins.

Best fit

- Seed through Series C startups that bank with Mercury and want real-time financials for investors, not just tax filings.

- Accounting firms that support a portfolio of Mercury-powered startups and want faster closes and cleaner bank recs.

QuickBooks Online: The default ledger with a strong Mercury pipe

QuickBooks Online is still the default accounting platform for most small businesses. It covers the core: chart of accounts, invoicing, expense tracking, payroll add-ons, and basic reporting.

How it integrates with Mercury

Mercury ships a direct integration to QBO, allowing you to:

- Sync Mercury transactions into QuickBooks Online.

- Map transactions to QBO categories from Mercury and have that mapping pass into the ledger.

- Sync expenses and receipts from Mercury into QBO.

That is better than generic bank feeds because you get cleaner categorization based on Mercury’s controls, as well as less manual importing of CSV files if your bank feed is broken.

Where QBO shines

- Huge ecosystem: If you need a software vendor that integrates with your accounting, QBO likely has it.

- Familiar to bookkeepers and firms: Hiring outside help is simple because almost every bookkeeper knows QBO.

- Flexible for many industries: Retailers, agencies, contractors, simple SaaS startups, nonprofits… most major industries are supported here.

Where QBO can fall short

- QBO’s Mercury integration focuses on getting data in, not on full automation of the close. You still need to manage bank rules, adjust entries, and do reconciliations inside QBO.

- Multi-entity and consolidations start to strain, and many startups outgrow QBO once they add parent or child entities.

- Real-time metrics are not native, so you need third-party reporting or spreadsheets to get clean burn and runway dashboards.

Best fit

- Small businesses and early-stage startups that want the safest, most “standard” accounting tool.

- Teams with existing QBO-savvy bookkeepers who want a solid but conservative Mercury integration.

Xero: Clean UI and multi-currency support for global Mercury users

Xero is a cloud accounting platform designed for small and mid-size businesses that prioritize bank reconciliations, invoicing, and solid multi-currency handling. Mercury itself calls Xero a fit for similar companies as QBO, with a stronger pitch for global use.

How it integrates with Mercury

Mercury’s Xero integration lets you:

- Sync transaction details from Mercury into Xero.

- Assign general ledger codes to Mercury transactions right from your Mercury dashboard.

The integration flows one way: Mercury to Xero. Changes in Xero do not push back into Mercury, so if you need to update a GL code, make sure you do it in both Xero and Mercury.

Where Xero shines

- Multi-currency and global workflows: Xero handles foreign currency and international banking with fewer headaches than many U.S.-centric tools.

- Bank-feed-centric design: The product grew up around bank rules and reconciliation, which syncs well with a bank like Mercury. Just keep in mind that these rules aren’t very autonomous and could lead to later rebooking of entries if not monitored.

- Clean UI: Many founders feel Xero is less cluttered than QBO and easier to keep tidy.

Where Xero can fall short

- There’s a smaller U.S. tax and compliance ecosystem here.

- Heavy analytics still require add-ons or exports. You don’t get startup-style burn and runway dashboards out of the box.

- The Mercury integration is solid, but it is still a standard bank-to-ledger sync, not a native, API-driven experience.

Best fit

- Startups with global teams or revenue, where multi-currency and cross-border banking particularly matter.

- Founders who want a tidier interface than QBO but still like a general-purpose ledger.

NetSuite: ERP for when Mercury is only one part of the puzzle

NetSuite is not “just accounting.” It is a full ERP with modules for financials, inventory, projects, billing, etc. It’s a behemoth that really shows up at the growth stage: complex revenue recognition, multiple entities, and serious audit needs.

How it integrates with Mercury

Mercury includes NetSuite in its official accounting integration list alongside QBO and Xero, allowing you to:

- Sync Mercury bank transactions into NetSuite.

- Use those feeds to drive reconciliations and cash management inside a larger ERP footprint.

In practice, there’s often a consulting partner or in-house NetSuite admin that wires everything up and maintains it. Be prepared to pay to play.

Where NetSuite shines

- Complex entities and revenue: If you run multiple subsidiaries, currencies, or heavy contract accounting, NetSuite is built for that.

- Audit trail and controls: Role-based access, approval chains, and tight controls play well with later-stage governance.

- Deeper reporting: Management and board reporting can live inside NetSuite rather than in spreadsheets.

Where it falls short for typical Mercury users

- Licenses, consulting, and ongoing admin time add up. For most seed and Series A startups, this is serious overkill.

- Changing your chart, workflows, or integrations usually means tickets and consultants, not an afternoon tweak.

- No founder wants to live in NetSuite every morning just to check basic metrics.

Best fit

- Later-stage companies that already have a finance team, a NetSuite plan, and a reason to centralize everything in one ERP.

- Businesses where Mercury is simply one of many banks, not the center of the world.

Pilot: Done-for-you books on top of Mercury

Pilot is a tech-enabled bookkeeping and tax firm that targets startups, e-commerce, and nonprofits, using software plus an internal accounting team to deliver monthly books and tax support. Under the hood, it usually runs on top of tools like QuickBooks Online or NetSuite, depending on company size.

Mercury calls out Pilot as an option for startups that want an outsourced finance function rather than in-house bookkeeping.

How it integrates with Mercury

Pilot does not bolt directly into Mercury. Instead, it:

- Connects Mercury to QBO or NetSuite using Mercury’s standard accounting integrations.

- Builds workflows and checklists around those feeds.

- Has human bookkeepers review and categorize transactions, then produce monthly financials.

From your perspective, you hook Mercury to the ledger once, grant Pilot access, and they handle the daily grunt work. It’s basically a platform for people who don’t want to think about or manage anything in regards to accounting.

Where Pilot shines

- Hands-off bookkeeping: You get a team watching your transactions and handling coding, reconciling, and adjustments.

- Tax and advisory in one place: Many founders prefer one vendor for books, tax, and some level of CFO-lite guidance.

- Predictable cost: Pricing is packaged by size and complexity, not a random billable-hours mess.

Where Pilot can fall short

- Less real-time visibility that forces you to depend on Pilot’s cadence. If you want live dashboards keyed off Mercury activity, you’ll still end up paying for and using another tool.

- Less control means that if your internal finance lead wants to design the chart, run scenarios, or tweak automations… good luck.

Best fit

- Startups that want to outsource the back office and focus on product and fundraising.

- Founders who care more about compliant books and tax filings than about owning the accounting stack.

FreshBooks: Simple accounting for service shops using Mercury

FreshBooks is a lighter accounting platform that shines for freelancers and small service businesses. Mercury’s own content calls it a good fit for service-based companies that need straightforward invoicing and expense tracking.

How it integrates with Mercury

FreshBooks doesn’t sit in Mercury’s “official” direct integration trio with QBO, Xero, and NetSuite, but you still have two workable options here:

- Use Mercury’s CSV exports to pull transactions into FreshBooks on a schedule.

- Use a middleware tool (Zapier, Pipedream, etc.) to watch Mercury transactions and push them to FreshBooks.

It’s definitely more DIY than the direct connections you get with other tools. However, this platform is cheap and easy to use, so it still gets a mention.

Where FreshBooks shines

- Simple, client-facing invoicing: Great if your world is proposals, recurring invoices, and getting paid by clients.

- Low learning curve: Non-finance founders can pick it up fast.

- Good fit for solo and very small teams: You do not need a controller to run FreshBooks.

Where it falls short with Mercury

- No native Mercury integration means you’re managing CSV files or middleware instead of a direct link.

- There’s limited depth for investors here. It’s fine for Schedule C life, but not so much for venture-backed board decks.

- Less startup-specific tooling means no burn/runway dashboards tied to Mercury balances without extra work.

Best fit

- Small agencies, freelancers, and service shops that use Mercury but do not need full startup-grade reporting.

- Founders who value simple invoicing and a clean UI over deep automation.

How to Choose: A CPA’s Cheatsheet

If you already bank with Mercury, here’s how I would approach the question of integration:

- If Mercury is your financial nerve center and you want real-time metrics plus automated reconciliations built on Mercury’s API, Puzzle is the strongest match.

- If you want the default, safe ledger with a solid Mercury integration and tons of third-party apps, use QuickBooks Online.

- If you’re more global than local and care about clean multi-currency support, Xero deserves a good look.

- If your company is already at the ERP stage and your auditors keep mentioning NetSuite, then Mercury’s NetSuite integration makes that path workable.

- If you don’t want to own accounting at all and prefer to hand it to a firm, pair Mercury with Pilot sitting on top of QBO or NetSuite.

- If you’re a smaller service business using Mercury mostly as a bank, and you care about easy invoicing more than board-level reporting, FreshBooks is enough.

Why I Recommend Puzzle for Mercury Users

Mercury treats QBO, Xero, and NetSuite as first-class accounting integrations, which make them strong choices indeed. Pilot and FreshBooks round out the field depending on whether you want done-for-you bookkeeping or a lighter service-business stack.

But only Puzzle actually builds on the Mercury API as a core design choice, with one-click onboarding, automated reconciliation, high auto-categorization, real-time startup metrics, and real case studies where month-end close time drops by half.

That’s why I nudge Puzzle to the front of the line while still respecting that the other tools have long track records and deep ecosystems.