- The Features at a Glance

- The Platforms in a Nutshell

- Pricing

- The Core Engine: How the AI Actually Touches Your Books

- Reporting and Dashboards: Who Gives You Better Visibility?

- Tax, Compliance, and the “Who Files This?” Question

- Implementation and Technical Use

- The Tradeoffs: Where Each Platform Falls Short

- When to Choose Digits vs. Finta

- Which One Comes Out on Top?

Last Updated on November 25, 2025 by Ewen Finser

If you’ve raised a little money and your startup has graduated from a side project to a real company, you’ve probably had the late-night anxiety of “I really need to get my administrative work under my thumb.” After all, if you don’t have trued-up and accurate financials, you’re a rudderless ship that doesn’t know how your business is actually performing.

Luckily, there are several platforms out there that can lend a hand, and today, I’m giving a professional CPA’s opinion on two major players.

On one hand, you have Digits, an AI-native accounting platform that wants to be your always-on finance brain. On the other, there’s Finta, an AI-powered bookkeeping and tax crew that promises to keep your C corp out of trouble. Both say they’ll tame your Stripe, clean up your bank feeds, and tell you how fast you’re burning cash.

The real question is which one you want sitting in the middle of your general ledger when your board, your CPA, and the IRS all start asking the hard questions at the same time.

The Features at a Glance

Feature | Digits | Finta |

Core focus | AI-native accounting platform and GL | AI-powered bookkeeping and tax service |

Ideal customer | Startups/SMBs with a finance lead or firm | VC-backed Delaware C corp startups with lean teams |

What you own | Your ledger, workflows, and reporting stack | An outsourced back-office with a client portal |

Strengths | Autonomous GL, deep reporting, firm tools | Low-friction setup, bundled books + taxes |

Where it falls short | Still-growing ecosystem, no built-in tax prep | Narrow target, less depth for complex accounting |

The Platforms in a Nutshell

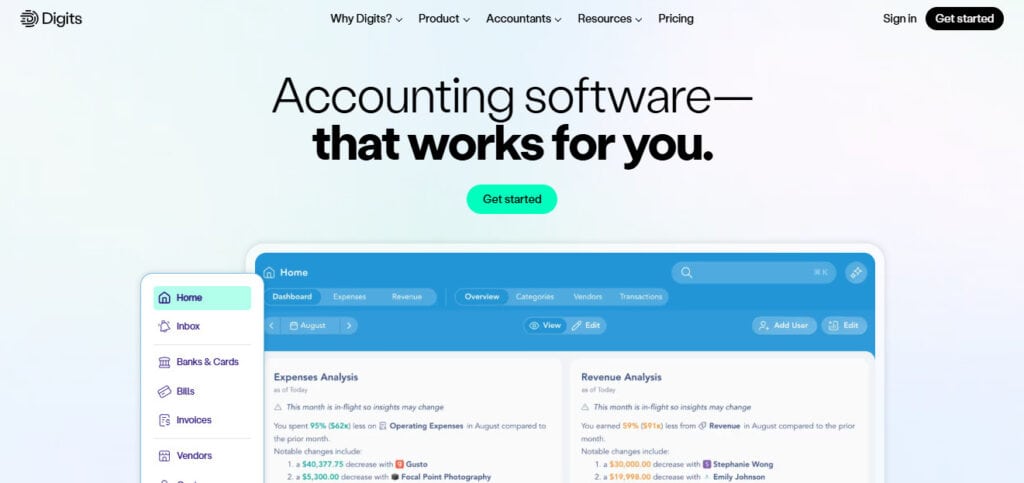

Digits

Digits is an AI-native, end-to-end accounting platform built around an Autonomous General Ledger. Its AI agents run bookkeeping, invoicing, bill pay, and financial reporting — stopping only when a human needs to review an oddball expense or unknown transaction.

In practice, that means:

- Always-on categorization and reconciliation

- Native financials available directly in the platform

- Built-in invoicing and bill pay

- Dimensional accounting (departments, locations, projects)

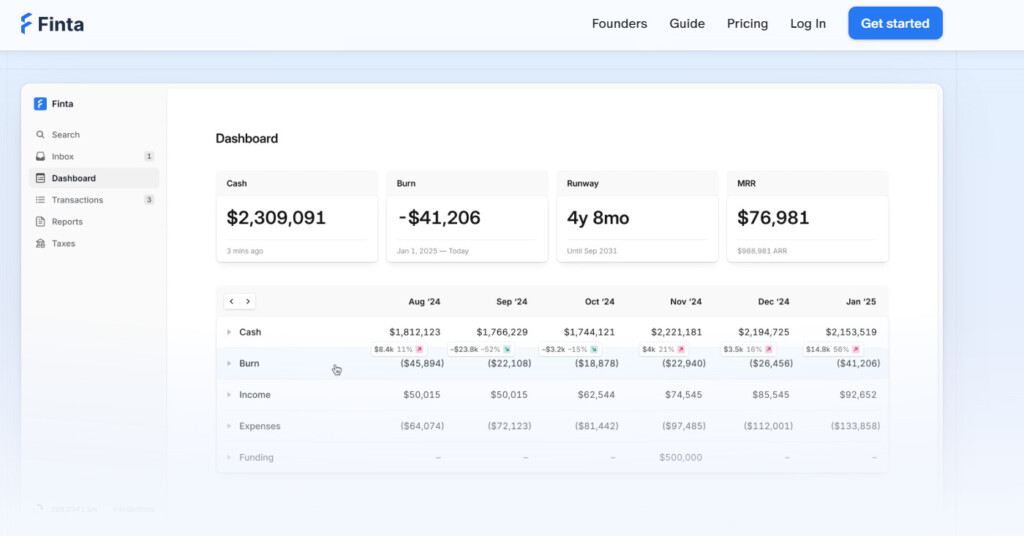

Finta

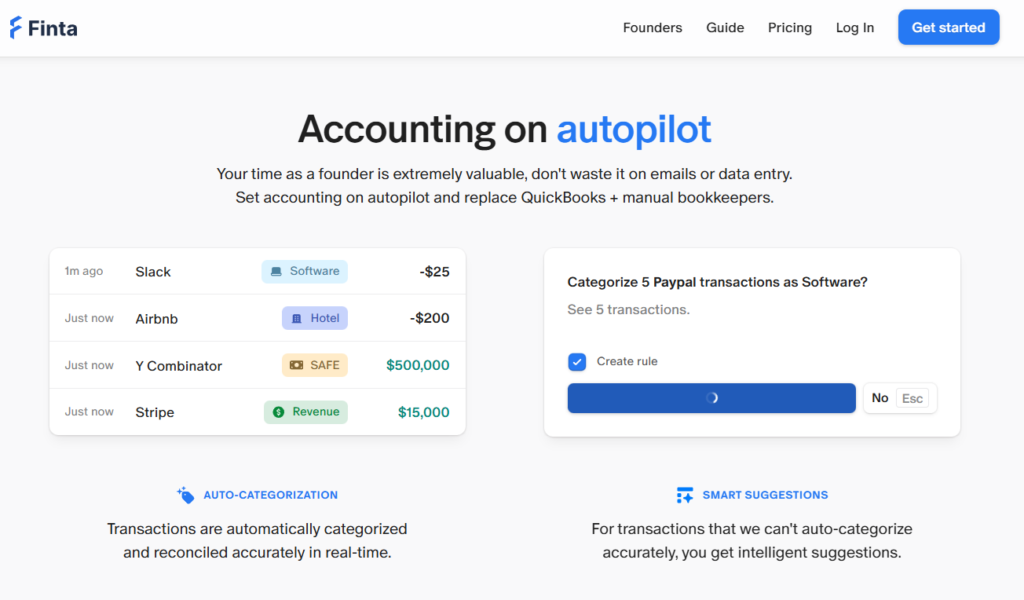

Finta is an AI-powered bookkeeping and tax platform tailored for venture-capital-backed Delaware C corp startups, bundling together automated transaction categorization, real-time dashboards, and done-for-you tax filing (including R&D credits) into one package. While they don’t require you to be a Delaware-registered C corp, they strongly recommend it since venture capital fundraising will ultimately require it.

In practice, that means:

- Automated bookkeeping from your bank and card data

- Real-time financial views for early-stage founders

- Finta’s team files your taxes and hunts credits like R&D

- Very startup-specific positioning

If Digits wants to be your operating system for accounting, Finta wants to be your outsourced back office for bookkeeping + tax, with a modern interface on top.

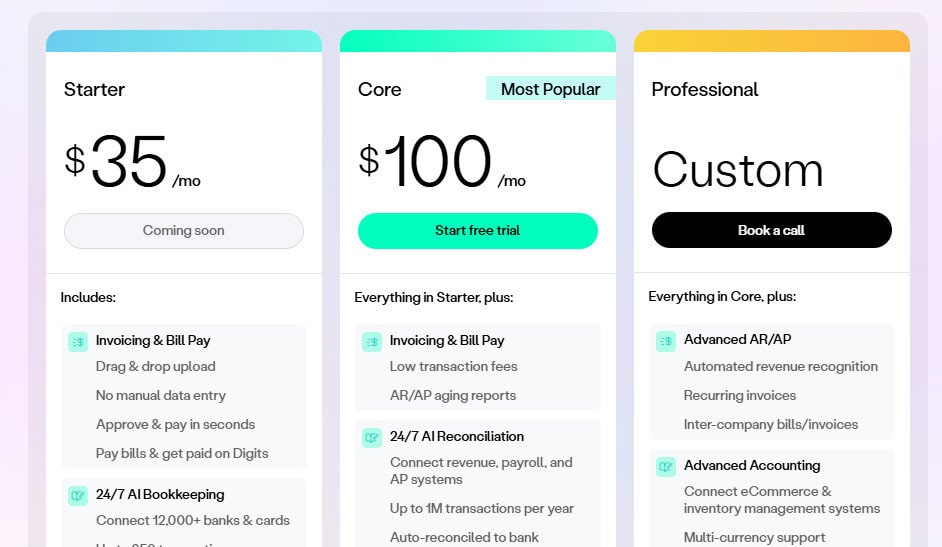

Pricing

Digit: Software-First, with Optional Services

- Starter: Not yet available, but will be around $35/month

- 24/7 AI bookkeeping up to 250 transactions/year

- Invoicing and bill pay

- Core financial statements and dashboards

- I foresee most firms outgrowing this quickly, so budget for the increased costs of Core.

- Core / AI Accounting: Around $100/month

- Up to ~1M transactions/year

- 24/7 AI reconciliation against bank data and statement PDFs

- Invoicing, bill pay, AR/AP aging

- Dimensional accounting (departments, locations, projects), vendor/customer directories, W-9/1099 tracking

- Professional: Custom Pricing

- Budgeting and forecasting are available within the application

- Automated fixed asset, prepaids, and liability schedules (you’d be surprised at how often these types of features are missed from the big players!)

In my opinion, most SMBs or accounting organizations should start at the $100/month Core plan and then move up to a custom solution if needed.

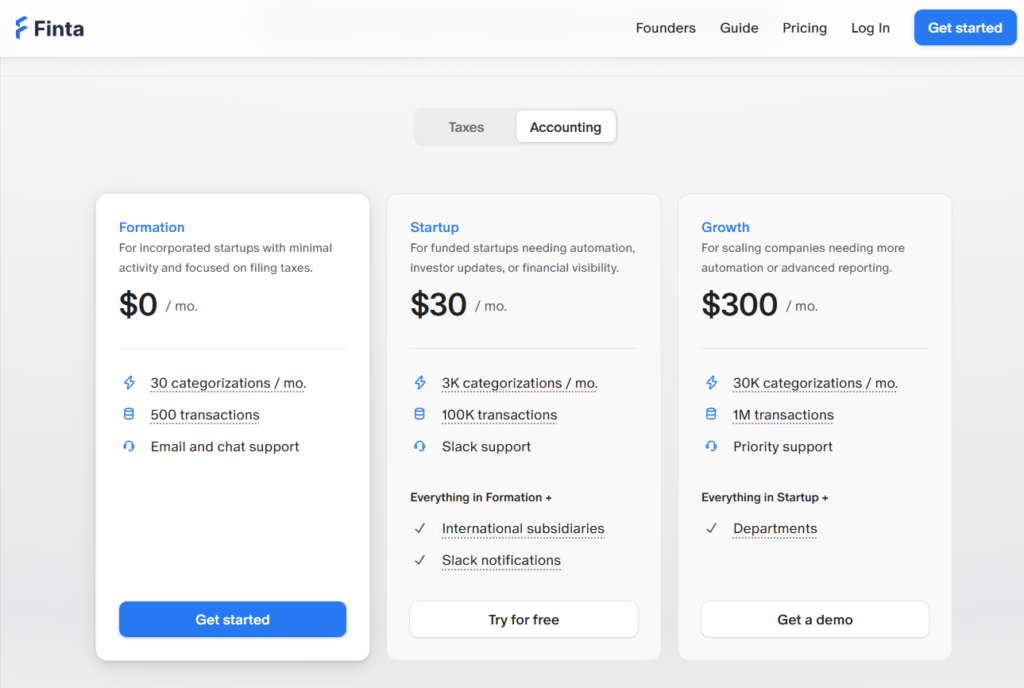

Finta: Bundled Bookkeeping + Tax

Finta advertises transparent pricing, but they like to funnel you into a sales or onboarding flow for exact numbers.

However, public listings paint a consistent picture:

- They do advertise a free version to take things for a whirl, and then there are tiers for $30/month, $300/month, and custom solutions for the bookkeeping side of things.

- Tax is $500/month, with additional add-ons for things like foreign subsidiaries, 1099s, state income tax, etc.

You’re not just paying for software; you’re paying for bookkeeping and tax services built on a modern stack. You’re also accepting Finta’s way of doing the books and tax work.

If Digits feels like an AI-turbocharged QuickBooks/Xero replacement, Finta feels closer to Pilot/Brex-style bookkeeping and tax, delivered through a simpler UI.

The Core Engine: How the AI Actually Touches Your Books

Digits: AI Agents and an Autonomous General Ledger

Digits’ Autonomous General Ledger (AGL) is an impressive AI model that runs across bank feeds, bills, invoices, and reports — not just a rules engine on top of QuickBooks. It’s also not bolted onto a legacy system.

It’s fresh, built from the ground up, and able to:

- Connect to 12,000+ banks and cards through its Connect API and banking integrations.

- Run 24/7 AI bookkeeping to categorize transactions immediately as they clear the bank feeds.

- Use Accounting Agents to handle end-to-end workflows such as bookkeeping, dashboards, KPIs, and management reporting — escalating only exceptions to humans.

The AI isn’t just categorizing; it’s owning the entire lifecycle from raw feed to final GL entry and statement reporting. If there’s something off, Digits will flag it and not waste your time with the rest.

Finta: Automated Bookkeeping with a Service Backbone

Finta’s pitch is a bit simpler. You connect your banks and cards, the system auto-categorizes transactions, and their team cleans it all up.

- Finta targets Delaware C corp startups (you don’t have to be registered in Delaware, but the platform does recommend it) and optimizes for things like R&D credits and early-stage tax positions.

- It’s less about giving you a GL to live in every day and more about giving you trustworthy reports and filings with minimal involvement.

- You still end up with financial statements, but you’re not necessarily building your internal finance stack on Finta long-term.

So if you want a long-term GL that finance and ops can build around, Digits has the edge. If you just want to make the accounting pain go away in the seed/Series A window, Finta is appealing.

Reporting and Dashboards: Who Gives You Better Visibility?

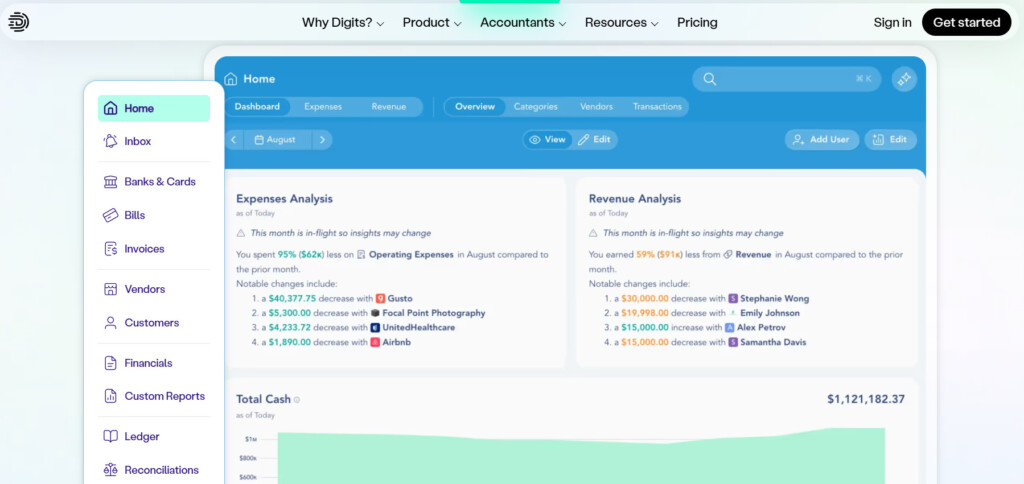

Digits: Operator-Level Control

Digits leans hard into real-time visibility and interactive financials:

- Native P&L, balance sheet, and cash flow statements

- Dashboards for burn, runway, KPIs, and trends

- Dimensional accounting by department, location, and project (opening up realms of possibilities for niche applications)

For a founder or controller, this matters:

- You can slice spend by channel, project, or team without exporting to a BI tool.

- You can tie invoicing, bill pay, and the ledger into one view.

- Accounting firms get a clear dashboard and roles through the Partner Program, so your external CPA or firm can run multiple clients in one place.

In my opinion, Digits is all about being that single pane of glass for the back office without feeling like legacy ERP.

Finta: Startup-Friendly Clarity

Finta’s value is more about clarity for founders who hate accounting:

- Real-time insight into cash, burn, and runway

- Simple dashboards tailored to VC-backed startup questions

- Less dimensional flexibility, more “tell me if I’m okay this month”

So if your questions are “What’s our runway?” and “How ugly is our burn?” then Finta is fine.

If your questions are “Which product line is dragging gross margin down?” or “Which locations are bleeding cash?” then Digits’ dimensional setup wins.

Tax, Compliance, and the “Who Files This?” Question

Digits: GL and Reporting First, Tax Via Your Existing Advisor

Digits leans towards running the accounting workflows: bookkeeping, reconciliation, reporting, invoices, and bills. Tax, in my opinion, should be managed by an existing firm or an in-house CPA.

From a control standpoint, I like this:

- You can swap firms without nuking your GL.

- You can keep your accounting policies and chart independent of any one service vendor.

Finta: Taxes Are Part of the Core Product

Finta explicitly includes:

- Done-for-you tax filing

- Help with R&D credits and startup-specific tax opportunities

- “The easiest bookkeeping and taxes have ever been”

If you’re a busy founder who just wants books clean enough that your investors don’t yell, or returns filed on time with credit optimization, then Finta’s value prop is strong. They’re not just shipping a ledger and walking away; they’re owning the busy work.

If you prefer a separation of your general ledger and tax services, Digits feels better.

Implementation and Technical Use

Digits:

- Setup takes minutes: just connect your banks, cards, revenue tools, payroll, and AP.

- The system backfills years of transactions and bulk-codes them with its AI engine.

- True exceptions surface in a review queue; humans only touch edge cases.

- The ledger stays close-ready, with books continuously updated in the background.

- Invoicing, bill pay, and bank data share one data model, so reports pull from a single place. Users will primarily work in workflows: reviewing exceptions, approving bills, sending invoices, and letting the platform handle posting and matching.

Finta:

- Onboarding is light: just connect financial accounts, and answer a short entity and tax questionnaire.

- Transactions flow through an AI layer, then to Finta’s bookkeeping and tax team for final review.

- The main interface for founders is a simple dashboard for cash, spend, and runway.

- Most of the heavy accounting and compliance work sits with Finta’s internal team, not in your own close process.

- Day to day, users glance at high-level numbers and respond to occasional info or document requests.

The Tradeoffs: Where Each Platform Falls Short

Digits

- Young ecosystem: You’re not getting the decade-plus integration library of QBO/Xero yet. You do get 12,000+ bank connections and strong core tooling, but its app store is still in its early days. Make sure your stack is plug-and-play.

- Tax gap: Digits is not pretending to be a tax firm — you still need someone to handle elections, returns, and specialty credits. For some founders, that’s a feature (separation of roles). For others, it’s one more vendor to manage.

- AI trust curve: Digits’ Autonomous GL and Accounting Agents are powerful, but not everyone is emotionally ready to let AI run large pieces of the close (I agree with those people, to an extent). This means having someone with accounting literacy to keep an eye on things.

Finta

- Narrow target: Finta is deliberately built around venture-backed C corp startups. That’s great if that’s you; it’s much less compelling if you’re a multi-entity group, services business, or non-U.S. operator.

- Service dependency: With Finta, you’re tying your books and taxes to one provider’s workflow. If you want to switch firms later, you may discover that the system isn’t meant to be your long-term, internal ledger of record.

- Limited dimensional depth: Finta’s sweet spot is founder clarity, not nuanced management accounting. If your ops questions sound like, “Which SKU has the worst per unit economics?” you’ll feel the ceiling in a hurry.

When to Choose Digits vs. Finta

Where Digits is the Better Fit:

- You want a durable, AI-native GL your finance team can own.

- You care about dimensional accounting: departments, locations, projects, and vendor/customer analytics.

- You have or plan to have a controller, fractional CFO, or firm involved who needs serious tools.

- You want AI to automate drudgery like categorization, matching, reconciliation, and document extraction while still keeping humans in the loop for judgment calls.

Where Finta is the Better Fit:

- You’re a Delaware C corp startup still in the “just don’t let the IRS or my board kill me” stage.

- You want bookkeeping and taxes bundled in one relationship.

- You want to avoid hiring an in-house accounting team for as long as possible.

- You’re fine with a simpler set of reports as long as they are correct and timely.

Which One Comes Out on Top?

If you were to force me to pick a winner across most modern startup and SMB scenarios, Digits edges out Finta for one reason: Digits can grow into your long-term finance stack, while Finta is more of a phase-of-life solution.

Digits gives you an AI-first ledger instead of just AI-assisted services, with deep dimensional reporting, real-time dashboards, a partner-friendly environment for your controllers and firms, and a roadmap that allows it to grow alongside your firm. Finta, on the other hand, gives you fast, low-friction bookkeeping and tax support for C corps, clear pricing and startup-friendly onboarding, and a strong bridge from having no real accounting in place to having your basic compliance handled.

Both platforms are indeed miles ahead of sending CSVs to a random bookkeeper in April. But if you’re thinking beyond the next funding round and you want your finance stack to be something that your operators, board, and future acquirer can live inside, Digits is the one that runs more like an actual platform than a service with a nice UI.