- The Bottom Line Up Front

- 1) Revenue Recognition Isn’t a Bank Balance

- 2) Cash Is Not a KPI; Gross Margin Is

- 3) Your Sales Tax Nexus Arrived Before Your First Employee (Compliance Isn’t Optional)

- 4) R&D, Section 174, and the “Surprise Taxable Income” Moment

- 5) Capitalizing Software and Implementation Costs

- 6) Cash Controls Without Killing Speed (Segregation of Duties)

- 7) The Close: From “We’ll Get to It” to a 5-Day Drumbeat

- 8) Billing Ops (Quote-to-Cash) Is a System, Not a Hero

- 9) Payroll and Independent Contractor vs. W-2, and the Tip/Jurisdiction Maze

- 10) Security, Controls, and Audit-Readiness (Because Diligence Is a Sprint)

- Now That We’ve Run Through Some Of The Paint Points…

- A Word on Tools (and How to Use Them Well)

- Final Take

Last Updated on November 1, 2025 by Ewen Finser

Let’s be honest: most start-ups don’t die from competition, they bleed out from spreadsheet paper cuts for things like mistimed revenue, mystery COGS, and data tables that live in a Dropbox labeled “final_final(3).xlsx.” These issues don’t stem from being bad at math, they’re from not keeping a leash on your accounting. And when the dollars don’t match what your board, bankers, and the IRS expect to hear, those ugly accounting issues can start to rear their head quickly. In this guide, the gloves are off and I’m putting my stern CFO hat on: we’ll talk revenue recognition (not “Stripe says so”), gross margin sanity checks, equity rails, and the close rituals that stop late night reclasses. Fun? No. But fewer “uh oh” moments on Friday when financials are due Monday? Absolutely.

The Bottom Line Up Front

Start-ups don’t “fail” accounting; they leak cash, miss covenants, and confuse boardrooms because their revenue, costs, and equity aren’t modeled the way their business actually moves. The fix isn’t flashy: nail revenue recognition, treat contracts as the source code, separate operating vs. growth spend, put equity on rails, and automate the ugly middle (billing, cash app, GL, financial reporting). Below is a playbook of common traps I see in early-stage companies (SaaS, e-comm, and service blends), and the precise workflows, controls, and tooling that stops the bleed quickly.

1) Revenue Recognition Isn’t a Bank Balance

The growing pain: Founders read MRR/ARR off Stripe and call it revenue. Then the first set of real due diligence asks for revenue by performance obligation with deferrals, breakage, and refunds reconciled to the GL. Cue the “we’ll get back to you” email.

How A CPA Would Handle It

- Explicitly map performance obligations in your contracts (e.g., “access to software,” “onboarding,” “implementation,” “premium support”). This is what will get you to recognize revenue.

- Price/discount discipline: Break out promos, coupons, and credits so you can showcase variability and have an explanation for any differences

- Build a waterfall: For each obligation in the contract, set a revenue schedule (straight-line over the service term, %-complete for projects, delivery-based for hardware, etc.).

- Deferred revenue control: Tie your billing system’s schedule to the GL with monthly journal entries that net invoice timing from recognition timing.

Tools That Help:

- Stripe Billing / Chargebee / Zuora for subscription logic, coupons, proration, add-ons.

- Avalara/TaxJar (if you sell taxable software or mixed goods) to keep tax separate from revenue.

- Close mechanics: If you’re on QuickBooks Online (QBO) or Xero, keep a recurring JE template for the revenue release, and store the waterfall backup per customer in the workpapers.

Things to Look Out For:

- Freemium to paid conversions – revenue starts at activation, not sign-up.

- Annual prepaids – A huge cash influx on day one, but revenue should be recognized over the 12 months.

- Implementation fees – often recognized over the life of the contract if they don’t transfer a distinct good/service.

2) Cash Is Not a KPI; Gross Margin Is

The pain: “We’re profitable!” But only on a cash basis of accounting, ignoring deferred revenue, inventory, and cloud spend that scales per unit.

How A CPA Would Handle It

- Define COGS with intent. For SaaS, COGS commonly includes hosting, third-party API fees used to deliver the product, support headcount, and implementation labor. For e-comm, it’s landed cost + freight-in + fulfillment + merchant fees allocable to sales.

- Chart of Accounts granularity: Break COGS into 4–6 lines you’ll actually monitor, e.g., Hosting, Support Labor, Merchant Fees, Fulfillment, etc.

- Unit economics grid: Track gross margin by product/tier/region. If you can’t, your pricing matrix is flying blind.

- Cloud cost tagging: Enforce product line tags by service/module so finance can attribute cost to their associated product lines.

Tools That Help:

- Ramp/Brex for vendor controls and categorization. These pair nicely with many accounting softwares.

- Bill (Bill.com) for AP approvals and cost center routing.

- Inventory (e-comm/hardware): Cin7/DEAR/Unleashed or a lightweight SKU ledger in Airtable while small.

Monthly ritual: Publish a COGS vs. ARR bridge: new logos, expansions, churn, add-on COGS, support hours, infra spikes all affect your business’s bottom line. Looking over these monthly will make your pricing measurably smarter.

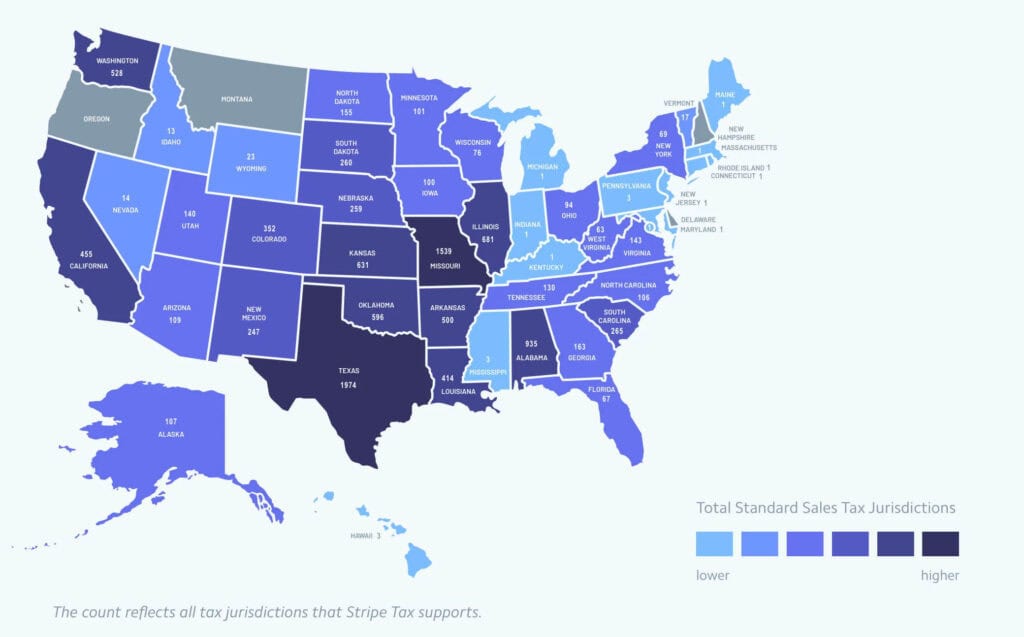

3) Your Sales Tax Nexus Arrived Before Your First Employee (Compliance Isn’t Optional)

The pain: You sell software and assume it’s nontaxable everywhere. Then a notice shows up from a state you barely remember demoing in.

How A CPA Would Handle It:

- Perform a Nexus review quarterly. Where am I doing business? Where am I physically selling goods? Where am I shipping goods to? Is my product or software subject to sales tax here but not there? This will help to keep your bases covered.

- SKU-level taxability: Classify each SKU: off the shelf software vs. custom dev, digital service vs. information service, support vs. training.

- Systematize exemptions: If you have B2B with exemption certificates, make sure they’re accessible and up to date; expired certs are audit magnets.

- File on rails: Once you register, calendar returns and automate remittance.

Tools that help:

- Avalara or TaxJar connected to Stripe/Shopify/Chargebee.

- Keep your GL tax liability account reconciled to the tax engine’s liabilities returns filed.

Pro tip: Publish a one-pager for Sales: “Where is our thing taxable and why?” It reduces accidental commitments during negotiation.

4) R&D, Section 174, and the “Surprise Taxable Income” Moment

The pain: After 2022, U.S. federal law shifted Research and Development costs from immediate expensing to capitalization/amortization. Many start-ups suddenly reported taxable income despite book losses.

How a CPA Would Handle It

- Track R&D costs in real time (engineering payroll by project, contractor dev, prototypes).

- Segregate R&D vs. maintenance: You’ll need the audit trail later.

- Model cash taxes in your forecast under current rules; assume capitalization unless your tax advisor shows you a change.

Tools that Help:

- Payroll with dimensions (Gusto/Rippling) to tag engineering time to projects.

- Project systems (Jira/Linear) produce time/issue logs that substantiate R&D allocation in your workpapers.

- An accounting system that syncs to your payroll provider that can carry those tags and maintain an associated cost code. Systems like Puzzle and QBO are robust enough to track the associated R&D Costs (capitalized), and when they turn into R&D Expenses.

5) Capitalizing Software and Implementation Costs

The pain: You expense everything to move quickly, or because you just don’t know better, then an auditor asks for your capitalization policy.

How A CPA Would Handle It

- Write a policy: Define things like product feasibility, which costs qualify (direct labor, certain third-party services), amortization periods, and impairment tests.

- Timesheets do not equate to bureaucracy: Even simple time allocations by feature gives you a defensible basis if ever questioned

- Customer implementations: If your product requires set-up that benefits the customer over the contract term, you may need to defer those costs, too.

6) Cash Controls Without Killing Speed (Segregation of Duties)

The pain: “We’re a team of six.” Translation: the same person creates vendors, approves bills, and pays them. That is, until a $22,000 typo or a friendly fraudster appears.

How a CPA Would Handle It:

- AP rules: The requester, approver, and payor all need to be different people. If headcount is tiny, the CEO can be Approver while a controller is Payer with dual-control banking.

- Card program with limits: Issue virtual cards per vendor/category with low ceilings, auto-lock on inactivity, and merchant category controls.

- ACH verification: Require callbacks for new banking instructions (vendor maintenance is how fraud enters).

- Bank rules: Positive pay, ACH filters, daily reconciliations during high cash-burn phases.

Tools that Help:

- Bill for approval routing & vendor onboarding.

- Ramp/Brex for granular spend controls.

- QBO/Puzzle.io bank rules or AI to auto-code low-risk transactions (but always reconcile).

7) The Close: From “We’ll Get to It” to a 5-Day Drumbeat

The pain: Financials arrive weeks late and don’t tie. The board meeting uses Franken-metrics copied from half a dozen sources. No one is happy. Everyone is uncomfortable. Accounting is in trouble. They’ve been asking for documentation for two and a half weeks.

How A CPA Would Handle It:

- I would live and die by the monthly close checklist: cash, AR, AP, payroll, fixed assets, revenue release, accruals, equity rollforward, flux analysis, all submitted and checked by the fifth business day of the month.

- Materiality thresholds (e.g., accrue anything >$2,500; everything else in period paid) to move faster without losing quality.

- Rolling 12-month variance analysis by account; if a number moves, explain why in one sentence.

- Source-of-truth KPI pack generated the same way every month (no slide-deck improvisation). Tie MRR/ARR logos, expansions, and churn back to the GL and CRM.

8) Billing Ops (Quote-to-Cash) Is a System, Not a Hero

The pain: One heroic person edits every invoice by hand. This is just asking for trouble if that person ever leaves the company, or forgets where they put that sticky note reminder.

How A CPA Would Handle It

- Standardize offers: A rate card, discount guardrails, and a term sheet checklist reduces custom billing edge cases.

- Integrate CRM into Billing: Opportunities feed the chance to push products cleanly and can help avoid mis-keys since everything is under one umbrella.

- Cash application discipline: Auto-match via bank rules; anything that doesn’t match by day 3 gets investigated.

9) Payroll and Independent Contractor vs. W-2, and the Tip/Jurisdiction Maze

The pain: “They’re a contractor, I swear!” Then the state says otherwise. Or you’re a restaurant with tip credits, service charges, and multiple jurisdictions.

How A CPA Would Handle It:

- Worker classification checklist per role and state. When in doubt, W-2 it out.

- Tip handling (I’m looking at you, restaurants): Distinguish true tips vs. service charges (which are wages). Track tip credits, allocate, and report using an upstream database like Homebase.

- Multi-state payroll: Register where employees work (physical presence and sometimes remote nexus). I’ll be honest sometimes this one can still trip me up, and I often find myself looking things up, so don’t be afraid to investigate where necessary!

Tools that Help:

- Gusto/ADP/Rippling for filings; be disciplined with locations and local taxes.

- Restaurant: Look for POS-payroll integrations that preserve tip detail (Toast, Square, etc.).

10) Security, Controls, and Audit-Readiness (Because Diligence Is a Sprint)

The pain: A buyer or lender sends a 60-item list: SOC 2, bank recs, revenue tie-outs, cap table, tax filings. Your business has about half of it.

How A CPA Would Handle It:

- Document the close (checklist + timestamps).

- Data retention: Contracts, waterfalls, tax returns, payroll registers, board minutes should be on a shared drive

- Access controls: SSO, MFA, least-privilege in finance tools; rotating vendor master changes require dual review.

Tools that Help:

- Any accounting software worth its chops will be able to handle these items. I recommend Puzzle for its in house close checklist, its exception style bank reconciliations, and the ability for teams to work intuitively and natively interact.

- Tools like Dropbox, OneDrive, or any shared drive are excellent for sharing needed workpapers, so that the appropriate people can access what is needed. Just make sure to lock files as needed. Not everyone needs access to the Master Payroll Sheet.

Now That We’ve Run Through Some Of The Paint Points…

No startup, new business, or newly formed partnership is going to get its accounting correct out of the gate. Sometimes, you have to figure out what works by falling on your face, and that’s okay. With that in mind, there are some things that you can do to shorten the “trial by fire” stage of your business.

Use Templates Where You Can (Tons of Free Ones Are Out There!)

- Use Revenue memo template (per product): Obligations, pricing, discount types, variable consideration, recognition pattern, and examples will help reduce edge cases. If everyone is the same, you don’t have to remember who received special treatment.

- Capitalization policy (software): Criteria, included costs, amortization period, impairment test cadence, sample journal entries are all things that will be repeated month over month. Template, template, template. Use them where you can!

- Close checklist: 30–40 line items, owner, due date, and “evidence” link. This should also change very little MoM, and is begging to be standardized.

- Board KPI dictionary: One page. Definitions that never change without board approval. Change the numbers, change the explanations, and use standardized verbiage. This should also be templated.

A Word on Tools (and How to Use Them Well)

Pick tools that (a) integrate, (b) enforce structure, and (c) produce audit-ready financials without requiring a headcount you don’t have the budget for. For subscription logic, Chargebee or Stripe Billing handles proration, add-ons, and couponing. Bill plus Ramp/Brex nails down AP and expense spending. And for revenue schedules and monthly tie-outs, a modern finance workspace like Puzzle.io can help you keep the GL, supporting schedules, and performance metrics in one place without needing to flip between different applications.

When your data starts to sprawl across CRM, billing, and the GL, consolidate your KPI pack from the same governed dataset every month. If you don’t have a data team yet, a finance-first system like Sage Intacct or Puzzle can provide a single app that reduces copy-paste and keeps your close commentary attached to the numbers.

Final Take

Start-ups don’t need perfect accounting; they need predictable and reproducible accounting that matches how the business earns money and spends it. Set policies you can follow, automate the obvious, and make your board materials tie back to the ledgers every single month. Do that, and fundraising, banking, and exits become conversations about the business, and not debates about the math.