- The Bottom Line, Up Front

- Flippa vs. Quiet Light: at a Glance

- Types of Businesses and Deal Sizes

- How The Sale Process Works

- Fees, Pricing, and Who Pays for What

- Diligence, Documentation, and Risk

- Buyer and Seller Experience

- Trust and Safety Measures

- Valuation Guidance and Education

- Fees in Practice

- Where Each Platform Really Shines

- Common Questions I Get Asked, and Their Common Answers

- Subtle But Important Differences Between the Two Platforms

- Risks And Trade Offs

- My Final Thoughts

Last Updated on October 23, 2025 by Ewen Finser

As a CPA, I find myself advising clients on things I would’ve never even thought of as a possibility. One of those things is, “What do I do with my business now that I’m ready to hang up the mantle? Sell it? Shut it down? Piece meal it out?” The business owners are often tired and ready to move on to the next thing or retire. Usually, SMB owners lean towards selling just because they can get more bang for their buck, and that’s where I often guide them.

But selling a business for top dollar is difficult, so it’s often necessary to have help. Two platforms I’ve used to help this process along are Flippa and Quiet Light. They both help people transfer their SMBs, whether it be SaaS, e-commerce, content sites, or apps, but they take very different paths to the same goal.

The Bottom Line, Up Front

If you need the short version: Flippa is a high-volume marketplace with auction and fixed-price listings plus light advisory options. Quiet Light is a curated brokerage with hands-on advisors and a full deal process. Either can work. The right choice depends on the size of your deal, how much help you want, your timeline, and your tolerance for doing your own diligence.

I’ll break down the differences in plain terms and then give you use cases at the end so you can pick a lane with confidence.

Flippa vs. Quiet Light: at a Glance

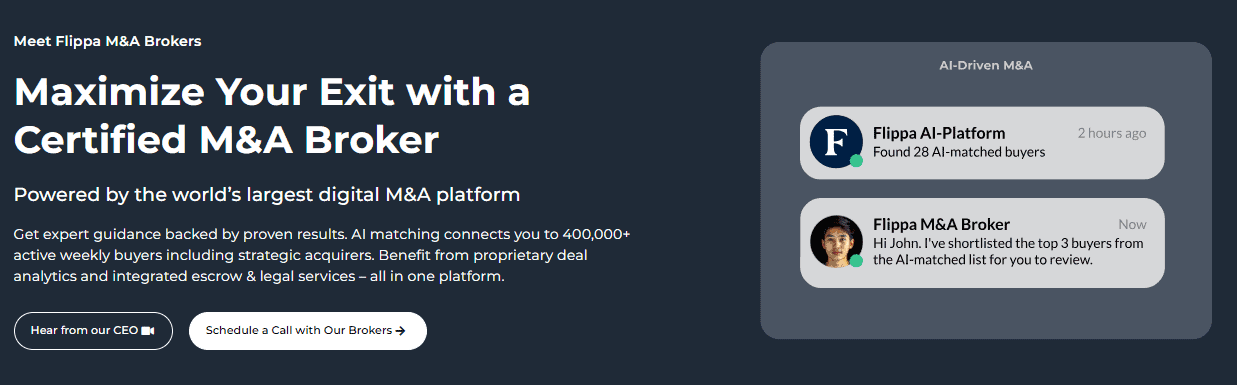

Flippa is a global marketplace for buying and selling online businesses and digital assets. Sellers can run auctions or classified (fixed-price) listings; buyers browse, ask questions, sign NDAs where required, and make bids or offers. Flippa integrates escrow and offers verification badges, migration help, and “advisory” layers if you want more support. It’s built for speed, volume, and range, from starter sites and domains up to 7 and some 8-figure assets.

On the other hand, Quiet Light is a boutique brokerage. You work with an advisor who’s knowledgeable and has experience navigating these types of transactions. They help you get valuation guidance, prepare materials, qualify buyers, run a managed process, negotiate, and close. You’ll see standard M&A steps: NDA, CIM (package), LOI, exclusivity, diligence, purchase agreement, escrow, and closing. It’s built for curation and white-glove guidance. From my experience, most deals are mid-market, but they also handle smaller transactions if they’re solid.

Types of Businesses and Deal Sizes

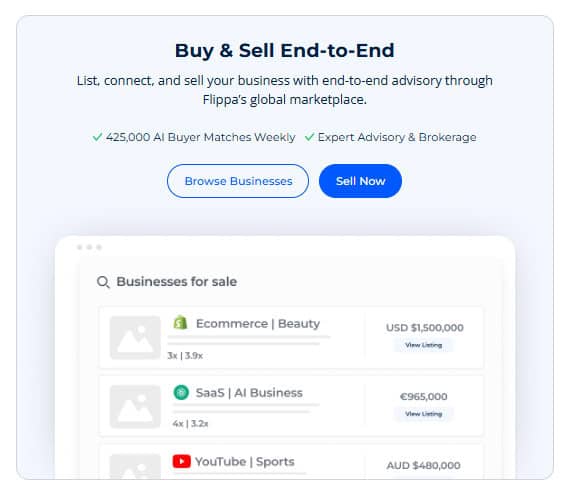

Flippa lists the full spectrum: SaaS, e-commerce, content/affiliate, apps, domains, communities, and more. Because of that, deal sizes vary from a few thousand dollars to multi-million. If you want choice and volume, you’ll find it here. The flip side: you’ll also do more filtering and diligence yourself.

Quiet Light focuses on established businesses like e-commerce, SaaS, content sites, and FBA brands with a curated roster and advisor guidance. Their public content, team bios, listings page, and podcast paint the picture: founder-operators turned advisors who run a process with qualified buyers.

How The Sale Process Works

On Flippa

- Listing format: Choose auction (bids, reserve price) or classified (fixed price, offers). Auctions can convert to negotiation if they end without a sale. Classified offers are private to the seller.

- Verification & trust: Flippa uses verification badges (e.g., ownership, traffic, revenue) and has a vetting team. You still need to verify source data during diligence.

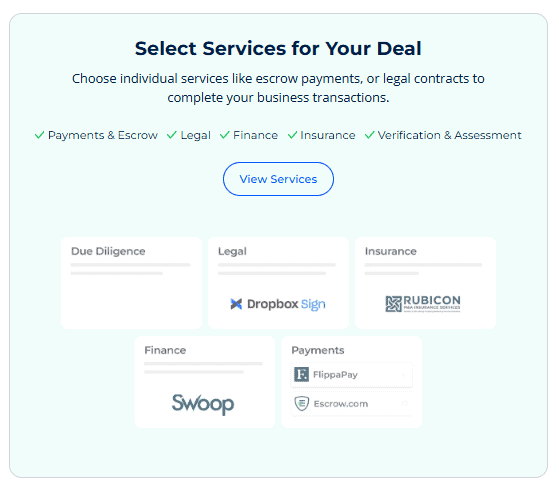

- Payments & closing: Flippa integrates Escrow.com for secure payments and outlines the escrow process in its help docs.

- Advisory add-ons: Beyond the open marketplace, Flippa markets “M&A services,” deal support, and access to in-house advisors for higher-touch needs. Think of this as a way to add some brokerage-style help on top of a marketplace backbone.

At Quiet Light

- Advisor-led prep: You get valuation guidance and readiness advice up front on things like documentation, adjustments, and risks the buyer will probe. They publish detailed materials on valuation and exit planning, which match the advisory approach they describe.

- Buyer qualification & process: Buyers sign NDAs, review a package (CIM), and submit offers. After an LOI, the deal enters exclusivity so diligence can proceed without competitive pressure, which is standard mid-market practice that reduces noise and protects both parties.

- Closing: You proceed to a purchase agreement, escrow, and migration. Quiet Light’s legal resources explain typical LOI terms and docs used.

My take as a CPA: Flippa gives you speed and access. Quiet Light gives you structure and guardrails. If you’ve never sold a business, those guardrails are often worth it.

Fees, Pricing, and Who Pays for What

Flippa: The marketplace charges a success fee when a listing sells. Public and third-party summaries show tiered percentages that step down as deal size rises. (Rates change, so be sure to always check the pricing page before you list.) Other Flippa costs: Buyers often pay escrow fees; Flippa documents buyer verification, holds, and fees in its help center.

Quiet Light: Like most brokerages, Quiet Light uses a success-based commission paid at closing; many brokers publish brackets that step down on larger deals. Third-party reviews describe a scale that starts near 10% and declines for bigger transactions. Quiet Light also discusses the ethics of contingency fees in its own content. (Again, confirm your engagement letter; commission tables can vary by deal.)

From a net-proceeds standpoint, sellers should model both options. A 1–3 point difference in fees can be trivial if the brokered process adds 5–10% to price or saves a busted deal. Conversely, if you have multiple eager buyers already, a marketplace route can be cheaper.

Diligence, Documentation, and Risk

On Flippa, it’s my opinion that you must drive diligence. Verification badges and assessments are a start, but they are not a substitute for reviewing bank statements, payment processor reports, tax returns, channel dashboards, and key person dependencies. Plan to request raw exports (not screenshots), re-create revenue and margin bridges, and reconcile traffic claims. Build your own quality of earnings (QOE-lite) if the deal is sub-$1M. Flippa’s trust & safety docs and “verification & assessment” pages are helpful, but you still own the verification burden.

At Quiet Light, the advisor’s prep typically improves what you receive: a clean P&L, add-backs explained, drivers of value, risks called out, and a sequence of buying that makes sense. As a buyer, you should still verify everything; you just start from a more organized base. Their legal articles around LOIs and exclusivity align with that managed flow.

My CPA checklist is the same in both cases: verify revenue, verify traffic, test customer concentration, confirm supplier terms, map churn if SaaS, model normalized working capital, and detail transition services. The difference is how much is pre-assembled for you.

Buyer and Seller Experience

Flippa:

- Huge inventory and tons of filters to sift through whatever you want.

- Fast access; you can move from browsing to NDA to questions in days.

- You need to screen hard. Expect a range: gems, okay businesses, and some you’ll pass on.

- Escrow and migration support are available, which is especially helpful for first-time buyers.

Quiet Light:

- Fewer listings, more curation.

- Deeper packages and responsive advisors who know the numbers and the operators behind them.

- A paced process: intro call, package review, LOI, exclusivity, diligence.

- Strong fit if you value time and want context, not just raw data.

Seller’s Experience on Flippa:

- Control your listing type and pace.

- You’ll handle a lot of Q&A yourself unless you bolt on advisory services.

- Great if you’re comfortable marketing your asset and fielding many buyers.

Seller’s experience with Quiet Light:

- Advisor handles prep, buyer screening, and negotiations.

- You invest more up front in materials and calls, but you save time later.

- Useful if you want fewer, better buyer conversations and a higher probability of close.

Trust and Safety Measures

Flippa uses identity checks, credit-card authorization holds for bidders, verification badges, and an escrow-first posture. Those steps reduce obvious fraud and align incentives during closing. Still, it’s a marketplace: your guard should stay up until you’ve reconciled the data.

Quiet Light leans on advisor curation, NDA gating, and a formal LOI with exclusivity before deep data sharing. It’s closer to traditional lower-middle-market M&A, which can improve signal-to-noise and reduce tire-kicking.

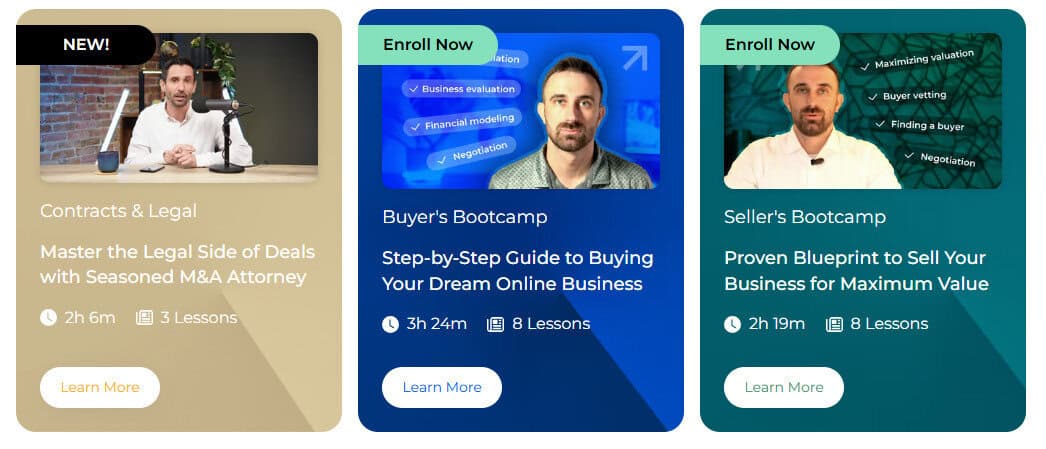

Valuation Guidance and Education

Both platforms invest in education, but the styles differ.

- Flippa publishes seller onboarding guides and market data snapshots. That’s helpful context if you’re trying to decide auction vs fixed-price and want a feel for category trends.

- Quiet Light publishes valuation content, checklists, and a long-running podcast. The tone is exit-planning and operator-to-operator advice, which lines up with their advisor bench.

As a CPA, I like anything that pushes owners to think in terms of normalized earnings, add-backs, risk, and transferability. On balance, Quiet Light’s material reads like mid-market M&A 101 for internet businesses, which many first-time sellers need.

Fees in Practice

- On Flippa, budget for the platform’s success fee plus escrow and your own diligence costs (accounting, legal, and any technical audit add up quickly). Then run a seller’s net sheet at 90%, 95%, and 100% of your target price to see how small price changes fee deltas.

- On Quiet Light, assume a success-based commission. The key is whether the advisor can lift price and reduce the risk of a failed process. If I can get even a 5% better outcome or avoid one busted closing, commission pays for itself.

Where Each Platform Really Shines

Use Flippa when:

- You value speed and volume. You want to see a lot of deals fast, and you’re comfortable screening.

- You’re selling a smaller asset or a unique digital property (e.g., certain apps, domains, communities) that might perform well at auction.

- You plan to DIY diligence or have your CPA/attorney run a lean review.

- You like having escrow and migration tooling built into the marketplace experience.

Use Quiet Light when:

- You want an advisor-led process with proper packaging, qualified buyers, and deal sequencing.

- You’re a first-time seller or buyer and want fewer surprises from LOI to close, with clean data and organized calls.

- Your business is established with meaningful earnings, and you want to present it the way strategic and financial buyers expect.

- You want to run a competitive, but confidential process with LOI exclusivity baked in.

Common Questions I Get Asked, and Their Common Answers

“Which one gets me the highest price?”

Price comes from competition, credibility, and fit. Flippa’s reach can surface more bidders, but the quality of their bidders varies. On the other hand, Quiet Light’s packaging and buyer base often produce cleaner offers with fewer retrades. I’ve seen both paths work. If your numbers are strong and transferable, a brokered process tends to compress variance and reduce fall-through risk.

“Which one closes faster?”

Marketplace deals can close fast, but you might spend more time upfront sorting through noise. Brokered deals often take a bit longer per step, but you waste less time on unqualified buyers. Either way, missing financials or messy add-backs will slow you down (so hire a good CPA!).

“I’m buying. Where do I start?”

If you’re new, browse Flippa to learn categories and pricing. When you find something serious, do a real diligence pass and use escrow. If you value a structured process with a curated slate, work with Quiet Light and ask for context on the operator, risks, and levers to grow post-close.

“How much diligence is ‘enough’?”

For sub-$1M deals, build a simple QOE-lite: month-by-month revenue, COGS, OPEX, add-backs with proof, channel dashboards, and a quick working-capital check. For $1M+ deals, consider a formal QOE and a technical audit (tracking, SEO, code, or supply chain). On either platform, insist on raw exports and bank/processor ties to confirm cash in/cash out.

Subtle But Important Differences Between the Two Platforms

- Listing format (bids vs fixed price): Flippa’s auction model can create urgency for certain assets. Classifieds support negotiation without public bidding. That choice changes buyer behavior, so in my opinion, you should carefully consider how you want to list your business.

- Buyer gating: Flippa relies on platform verification and holds; Quiet Light relies on advisor screening, NDAs, and LOI exclusivity. Different tools, same goal: reduce risk.

- Education & resources: Flippa’s guides and data snapshots help with DIY decisions. Quiet Light’s checklists, valuation pieces, and podcast guide sellers through a full exit cycle.

- Team composition: Quiet Light highlights advisors with founder/operator and finance backgrounds; that lived experience shows up in how packages are built and calls are run.

Risks And Trade Offs

- Marketplace noise vs. curated flow: With Flippa, you gain volume but accept wider variance in quality. With Quiet Light, you gain curation but see fewer options at once.

- Fees vs. net outcome: Don’t chase the lowest fee; chase the best net after fees and the highest probability of close. From my experience, I can’t stress this enough – a bird in the hand is worth two in the bush. A 2% fee difference is meaningless if your final price swings 10% or worse yet, the deal fails to close.

- Diligence burden: Marketplace = you drive the bus. Brokerage = you still verify, but you start closer to the finish line.

My Final Thoughts

If you’re comfortable running your own process, Flippa offers reach, flexibility, escrow, and the choice between auction and fixed-price sale. It’s a strong fit for smaller assets, quick sales, and buyers who enjoy the hunt.

If you want a guided process with an experienced operator-advisor, Quiet Light fits well. The LOI-to-close structure, packaging, and buyer screening can reduce retrades, keep diligence on track, and preserve seller sanity. In my experience, those things matter more as deal size and complexity rise.

If I had to choose for most owner-operators with solid, established businesses, I’d slightly favor the advisor-led route because process quality and buyer fit tend to drive net proceeds and reduce headaches. But I still recommend you look at both, confirm current fees, and decide based on your specific asset and goals.