Last Updated on October 29, 2025 by Ewen Finser

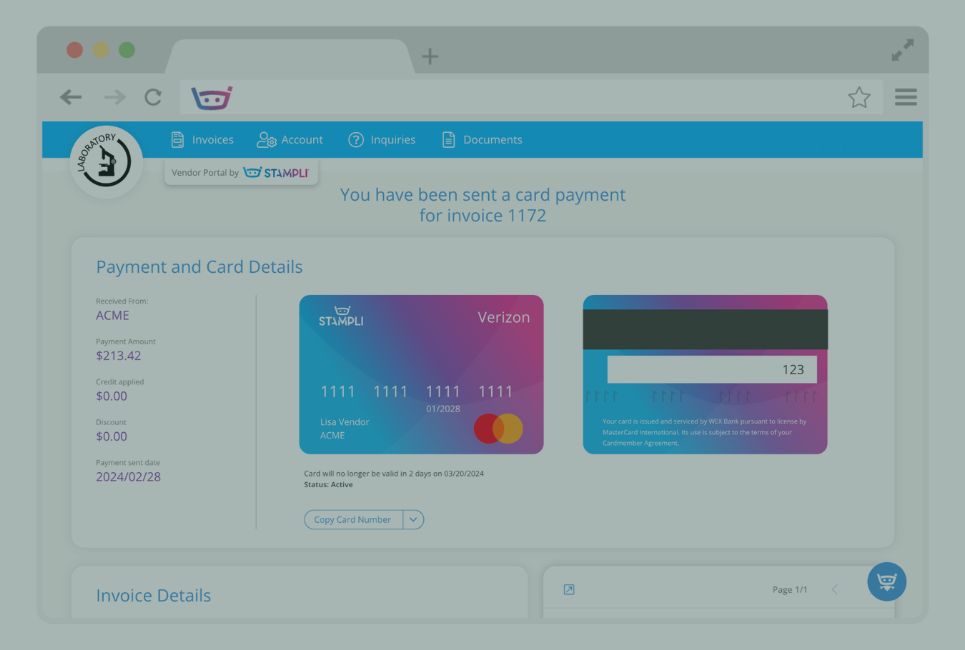

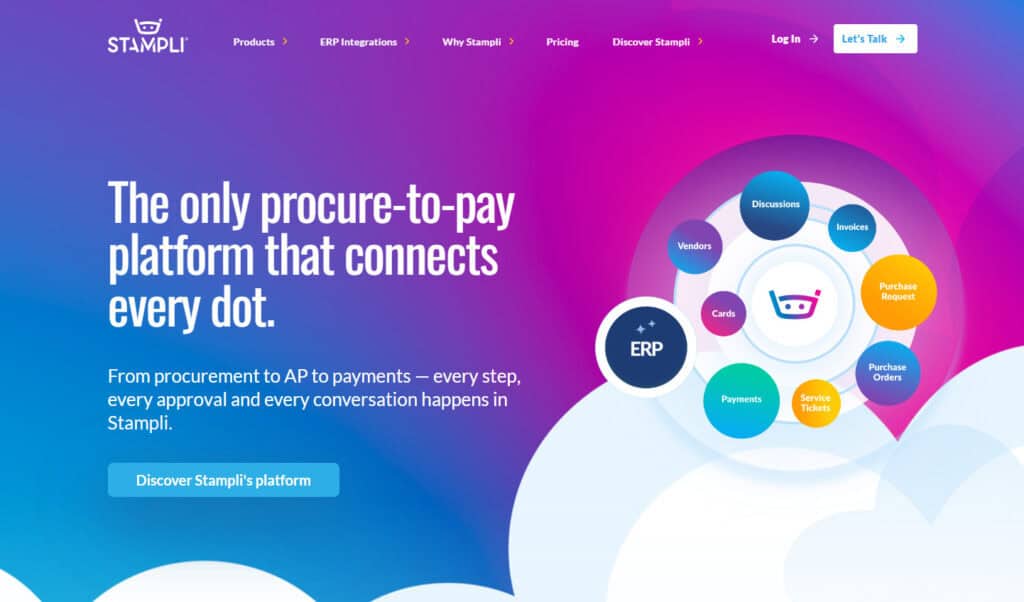

As a CPA, part of my job is guiding clients through choosing the best financial tools for their businesses. Stampli, a popular payment processor, frequently comes up as a favorite among my clients for its robustness, invoice management features, and feature rich platform. But every platform has strengths and weaknesses, and finding the best fit for your business means exploring alternatives that may suit specific needs better.

Over the years, I’ve helped my clients evaluate many payment processors. From my experience, there’s rarely a one-size-fits-all solution. What’s ideal for a small startup may not be perfect for an enterprise with hundreds of vendors. In this article, I’ll dive into seven solid alternatives to Stampli, sharing my perspective as a CPA on their strengths, weaknesses, and why they might be a good fit for your business.

TL:DR: My Preferred Stampli Alternative

I’ve worked extensively with businesses evaluating alternatives to Stampli for payment processing. While each solution has its strengths—such as Bill.com for complex workflows, QuickBooks Bill Pay for tight accounting integrations, and Tipalti for international payments—Melio consistently emerges as the best all-around choice for most small-to-medium-sized businesses. Its simplicity, cost-effectiveness, user-friendly interface, and vendor-friendly payment options offer an ideal balance of functionality and ease of use, making it my go-to recommendation for clients looking beyond Stampli.

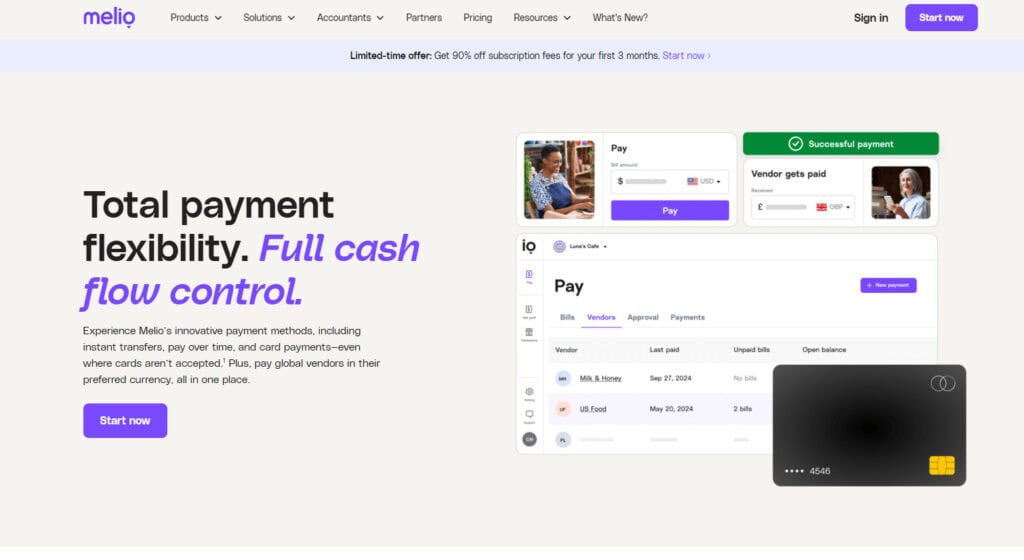

1. Melio

I recommend Melio frequently to my small-to-medium-sized clients due to its streamlined approach and ease of use. Melio cuts down the complexity found in many payment platforms and provides a smooth, intuitive experience.

Pros:

- Simple, user-friendly interface.

- Great for small businesses needing straightforward bill payment solutions.

- Fee-free ACH payments (depending on tiered plan choosing) and cost-effective credit card payments.

Cons:

- Not as feature-rich in terms of accounting automation for large enterprises.

- Customer support can be limited during peak hours.

From my experience, Melio hits the sweet spot for simplicity and cost-effectiveness, especially for businesses without an internal accounting team.

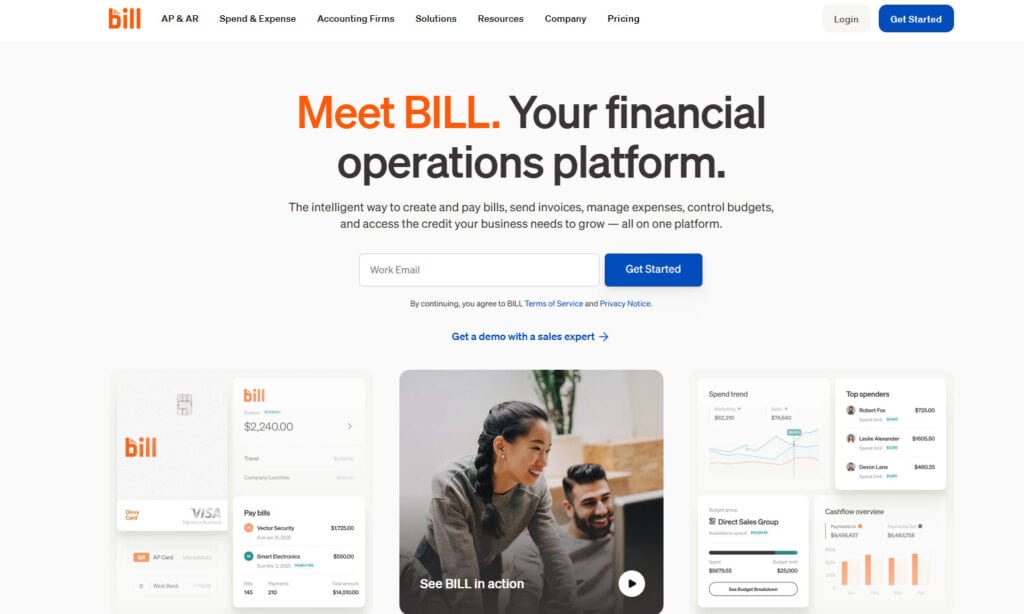

2. Bill.com

Bill.com is often considered the heavyweight in the payment processing space, ideal for larger businesses or those scaling quickly. It integrates smoothly with many accounting platforms.

Pros:

- Strong automation and approval workflows.

- Robust audit trails—important for compliance.

- Good integration with QuickBooks, Xero, and other popular platforms.

Cons:

- More expensive than alternatives like Melio, especially for smaller businesses.

- Interface can feel overwhelming to users unfamiliar with accounting software.

Bill.com works best when you need complex approval workflows and integration with multiple accounting systems. I typically recommend Bill.com to the clients who are pushing several hundred invoices out a month.

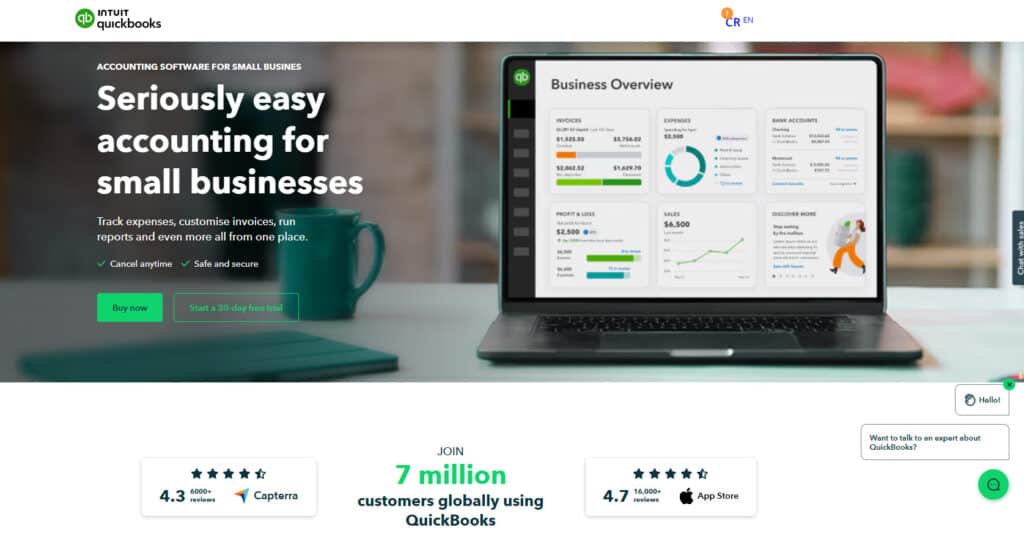

3. QuickBooks Bill Pay

QuickBooks Bill Pay naturally fits clients already invested in the QuickBooks ecosystem. Many of my clients prefer this due to seamless accounting integration.

Pros:

- Tight integration with QuickBooks Online.

- Automated accounting entries and easy reconciliation.

- Familiar interface for QuickBooks users.

Cons:

- Limited if you’re not already within the QuickBooks ecosystem.

- Pricing seems a little steep for what you receive

QuickBooks Bill Pay simplifies workflows dramatically for businesses heavily reliant on QuickBooks but feels limiting outside that environment.

4. AvidXchange

I’ve worked with a fair number of mid-sized enterprises and construction companies over the years, and many have found AvidXchange particularly useful if those clients are in specific niches. It shines when handling high invoice volumes and complex payment workflows.

Pros:

- Excellent handling of large payment volumes.

- Robust automation capabilities reduces manual entry errors.

- Tailored for industries like real estate, construction, and healthcare.

Cons:

- Steeper learning curve for smaller teams.

- Implementation can be time-consuming and costly upfront.

AvidXchange makes sense if you’re scaling quickly and need a system that can grow with your operations. It might be overkill, though, if your invoice volume is modest.

5. Tipalti

Tipalti is another popular choice, especially among my clients who regularly deal with international vendors. It’s a robust solution if your payment complexity involves currencies, cross-border compliance, and international tax reporting.

Pros:

- Handles global payments efficiently.

- Great compliance tools for international tax and regulations.

- Strong automation for large-scale operations.

Cons:

- Pricing can become prohibitive for smaller or domestic-only businesses.

- The platform can be overwhelming for those who need simple invoice processing.

For businesses regularly paying vendors abroad, Tipalti is a top contender, but for domestic-focused small businesses, it might offer more features than necessary.

6. Dwolla

Dwolla has often caught my attention because of its emphasis on ACH payments and API integrations. It suits tech-savvy businesses that prefer customizing their payment solutions. I’d be wary to recommend this platform to my clients though unless they’re very tech forward.

Pros:

- Exceptional ACH payment handling with rapid transaction speeds.

- Developer-friendly with easy-to-integrate APIs.

- Low-cost ACH solutions compared to competitors.

Cons:

- Limited payment methods—primarily focused on ACH.

- Less intuitive for businesses without technical teams.

Dwolla is ideal for tech-oriented businesses that handle frequent ACH transactions. However, if you need broader payment options or have limited tech resources, other platforms might be simpler.

7. Airbase

Airbase combines corporate expense management with robust payment processing capabilities. It appeals to companies seeking unified solutions for spending and payments.

Pros:

- Combines payments, expense management, and accounting automation.

- Good visibility and control over spending policies.

- Simplifies reconciliation with detailed reporting.

Cons:

- Potentially expensive for startups or small businesses.

- Complexity can be overwhelming for users looking for simple invoice payments.

I recommend Airbase to clients who need advanced control over corporate expenses along with payments but find it excessive for straightforward AP workflows.

How The Platforms Stack Up

Here’s a quick bullet-point comparison highlighting each platform’s best fit based on my professional experience:

- Melio: Small-to-medium-sized businesses looking for simplicity, cost-effectiveness, and easy-to-manage ACH payments.

- Bill.com: Larger businesses requiring complex approval workflows and comprehensive integration with accounting software.

- QuickBooks Bill Pay: Businesses already invested in QuickBooks looking for tight, simple integration.

- AvidXchange: Companies in specific industries with large invoice volumes and complex AP processes.

- Tipalti: Businesses frequently managing international payments and compliance concerns.

- Dwolla: Tech-savvy organizations with high volumes of ACH payments and integration needs.

- Airbase: Companies combining expense management and payment processing into a single platform.

Why Melio Stands Out

Throughout my career as a CPA, I’ve learned that bigger, more complex, or more expensive isn’t always better. The right tool should balance ease of use, cost-effectiveness, and functionality tailored to your specific needs.

Melio edges out as my recommended alternative to Stampli, particularly for businesses that want clarity and simplicity without sacrificing important features. It covers essential functions well—ACH transfers, vendor payments, and bill scheduling—with minimal fuss. Unlike more complex platforms, Melio won’t overwhelm your team or budget.

However, I never recommend a platform based solely on popularity or my personal preferences. Each business is unique, and ultimately, your choice should reflect your workflow, vendor relationships, and growth stage.

Let’s break down a few common scenarios from my CPA experience:

- Small, domestic business:

Melio often hits the sweet spot due to ease and affordability. Dwolla could be a good alternative if ACH payments dominate your workflows. - Medium-sized, growing enterprise:

Melio remains effective, though Bill.com and AvidXchange might also suit higher volumes or industry-specific requirements. - Tech-focused businesses:

Dwolla shines here due to its API capabilities, though Melio’s simplicity can still be appealing for smaller tech startups. - Businesses with international payments:

Tipalti is unmatched internationally, but if global transactions are occasional, Melio might still suffice without complexity.

Matching the Platform to Your Needs

As a CPA, part of my role is to help businesses avoid pitfalls in selecting financial tools. Payment platforms aren’t always easy to switch once you’ve invested time integrating them into your workflow. For this reason, I always encourage clients to consider more than just the surface-level features.

When choosing among alternatives like Melio, Bill.com, QuickBooks Bill Pay, AvidXchange, Tipalti, Dwolla, and Airbase, I typically advise clients to consider the following questions:

Volume of Transactions:

- Do you process hundreds of invoices monthly, or are doing just a couple dozen?

- High volume: Bill.com, AvidXchange, Tipalti

- Lower volume: Melio, Dwolla, QuickBooks Bill Pay

Complexity of Workflows:

- Do you have multi-level approvals or strict compliance needs?

- Complex approval workflows: Bill.com, AvidXchange, Airbase

- Simple workflows: Melio, QuickBooks Bill Pay, Dwolla

International Payments:

- Are cross-border payments frequent or occasional?

- Frequent: Tipalti, Bill.com

- Occasional: Melio

Final Thoughts: The CPA Bottom Line

In the end, my recommendation always comes down to balancing complexity, functionality, cost, and scalability. Stampli remains a solid choice for many businesses, but exploring alternatives is crucial to confirm you have the optimal fit for your operations.

For clients requiring robust international capabilities, Tipalti shines. For tech-savvy enterprises needing ACH API solutions, Dwolla is often ideal. If your business heavily depends on QuickBooks, their native Bill Pay offering integrates smoothly. Bill.com and AvidXchange provide scalable options for larger companies or those with complex accounts payable processes. Airbase combines expense management and payments in a comprehensive suite.

Yet, for the majority of my clients—especially small-to-medium-sized businesses who prioritize simplicity, cost-efficiency, and intuitive usability—Melio consistently edges out the competition.

My professional advice? Evaluate based on your immediate and foreseeable needs, and remember: more features don’t always translate into better solutions.

Having worked with numerous platforms firsthand, I continue recommending Melio for most scenarios where businesses seek simplicity, reliability, and ease of management without unnecessary complexity. It’s not the perfect tool for everyone, but it comes remarkably close for many.

And that, in my CPA opinion, is how you confidently choose the right Stampli alternative.Bottom of Form