- Melio vs Stampli Key Tradeoffs at a Glance

- User Experience and Interface

- Integrations and Compatibility

- Fee Structure and Cost Effectiveness

- Vendor Management and Collaboration Features

- Customer Support and Reliability

- Practical Insights from Real-World Experience

- Security and Compliance: A CPA's Perspective

- Scalability and Growth Potential

- Bottom-Line Recommendation from a CPA's Perspective

Last Updated on October 29, 2025 by Ewen Finser

Melio and Stampli are two payment processing platforms that have earned their stripes in the industry and offer compelling solutions. However, subtle distinctions might make one more suitable than the other, depending on the nature of your operations.

My career as a CPA has meant I’ve learned—often the hard way—that choosing the right payment processing solution isn’t just another administrative decision. It fundamentally changes the way you manage cash flow, vendor relationships, and even your strategic outlook as a business owner.

So, today I want to share my personal experience and professional insights on how these two payment platforms stack up in practical terms. I’ll compare them across several key areas so you can make the best decision for you and your business.

TL:DR: Melio stands out for me because of its seamless interface, clear and predictable fee structure, easy scalability, and simplicity of adoption. This makes it particularly well-suited for small-to-medium-sized businesses looking to efficiently manage cash flow and vendor payments. Stampli, while highly robust and feature-rich, aligns better with larger enterprises requiring complex approval workflows and detailed audit trails.

Melio vs Stampli Key Tradeoffs at a Glance

Here’s how I’d summarize the key distinctions between Stampli and Melio:

Key features | Melio | Stampli |

|---|---|---|

Integrations | Seamlessly integrates with QuickBooks Online, Xero, and other major accounting platforms. Plug-and-play nature reduces bookkeeping workload and eliminates manual data entry mistakes | Excels with ERP systems like Oracle NetSuite, Sage Intacct, and SAP. Smoothly layers into existing tech stack for businesses heavily invested in these ecosystems |

Fee Structure | Straightforward and transparent. Free ACH transfers (up to a certain limit per month). Credit card processing subject to standard fee but predictable. Helps smaller clients budget effectively | Tiered pricing based on invoice volume and features. Flexible but can be complex. Forecasting costs can be tricky for smaller businesses or those with unpredictable invoice volume |

Vendor Management | Intuitive vendor communications within payment process. Minimal learning curve. Straightforward messaging and notification systems improve vendor relations through transparency | Comprehensive workflows, advanced approvals, and collaborative comments on invoices. Highly detailed vendor collaboration for businesses with complex internal hierarchies |

Collaboration Features | Simple and easy to keep everyone on the same page | Advanced features valuable for complex hierarchies but can be distracting or overly complicated for smaller or leaner operations |

Customer Support | Responsive with consistently quicker resolutions. Emphasizes rapid-response support. Issues typically solved within a single interaction | Strong support, particularly in onboarding and training new users. Less immediate due to complexity of enterprise-oriented issues |

User Experience and Interface

Right off the bat, I always consider how intuitive a financial tool is—because, let’s face it, most business owners don’t want to spend time navigating confusing interfaces. Melio and Stampli both shine in different ways here.

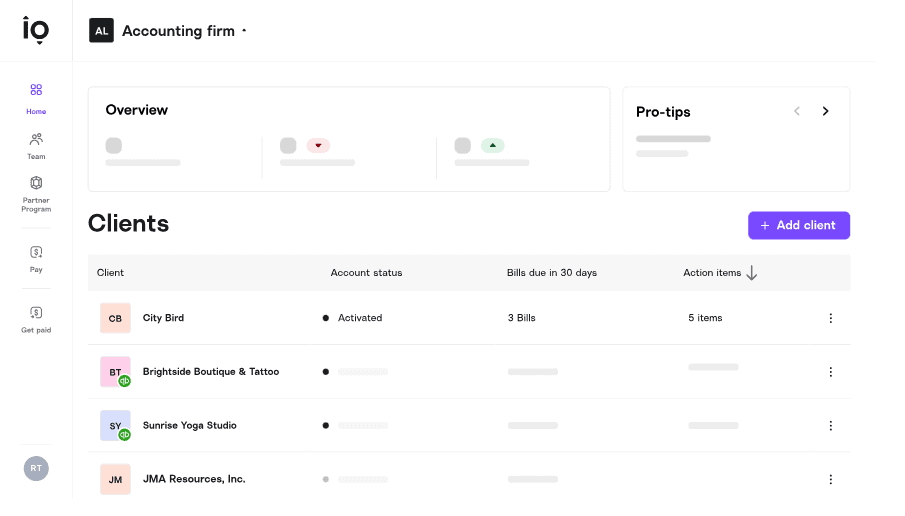

Melio‘s platform is clean and streamlined. Even clients who aren’t especially tech-savvy can pick it up quickly, thanks to its minimalist layout and clear directions. When I onboard new small business clients, they are genuinely surprised at how quickly they could schedule and manage payments without needing extensive tutorials or constant support calls.

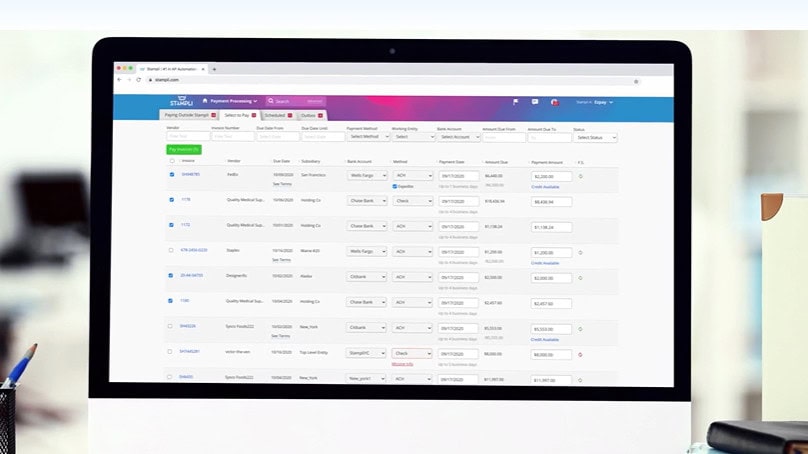

Stampli, meanwhile, offers a robust, feature-rich experience geared more towards medium to larger enterprises. The interface is also polished, though slightly busier, emphasizing granular invoice tracking, approval workflows, and a more structured approach to payment management. For a mid-sized business client with multiple departments, Stampli’s comprehensive approach to approvals and workflows is quite effective, albeit sometimes overwhelming for simpler tasks.

- Melio: Clean, intuitive, ideal for smaller or less complex workflows.

- Stampli: Robust, detailed, great for larger businesses requiring complex approval processes.

Integrations and Compatibility

I will say it until I am blue in the face because if I don’t, my job gets harder and harder; compatibility is huge—every tool must play nicely within a company’s existing ecosystem, especially accounting software. Both Melio and Stampli recognize this, though their strengths here differ slightly.

Melio seamlessly integrates with QuickBooks Online, Xero, and other major accounting platforms. For me, this integration simplicity is everything. I’ve seen clients reduce their bookkeeping workload dramatically, streamlining reconciliation processes and nearly eliminating manual data entry mistakes due to the plug-and-play nature of different platforms.

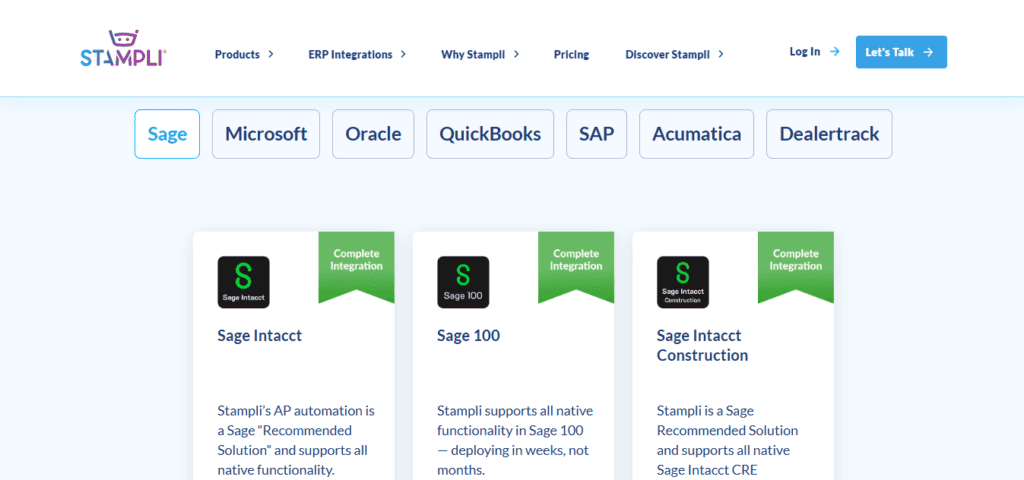

Stampli also does well on integrations, particularly excelling with ERP systems like Oracle Netsuite, Sage Intacct, and SAP. For businesses already heavily invested in these ecosystems, Stampli can smoothly layer into their existing tech stack. However, for small-to-medium-sized businesses typically using QuickBooks or Xero, Stampli’s ERP-centric integrations may offer less tangible benefit than Melio’s simpler, more user-friendly connections.

- Melio: Strong QuickBooks and Xero integration; highly accessible.

- Stampli: Exceptional ERP integration; better for complex enterprise environments.

Fee Structure and Cost Effectiveness

Speaking from experience, cost considerations drive a significant portion of my recommendations to clients. No business wants to see its margins eaten away by hidden fees or unclear pricing models.

Melio’s fee structure is straightforward. ACH transfers are free (up to a certain limit per month), and even their credit card payment processing, though subject to a standard fee, is transparent and predictable. I find that this clarity helps my smaller clients budget effectively without worrying about unexpected costs.

Stampli, on the other hand, offers tiered pricing based on invoice volume and features, which can be both beneficial and potentially confusing. In several scenarios, Stampli’s price flexibility has proved advantageous to my larger, more complex clients. But for smaller businesses or those with unpredictable invoice volume, forecasting costs can become tricky.

- Melio: Clear, transparent, predictable, ideal for budget-conscious businesses.

- Stampli: Flexible but complex; beneficial primarily for larger, predictable volumes.

Vendor Management and Collaboration Features

In my opinion, efficient collaboration and vendor relationship management aren’t optional. They’re essential. When evaluating platforms, I consider how easily my clients and their teams could communicate internally and externally about invoices and payments.

Melio shines with simplicity again, offering intuitive vendor communications within the payment process itself. It’s easy to keep everyone on the same page, with a minimal learning curve. I’ve overseen client teams improve vendor relations through Melio’s straightforward messaging and notification systems, as the vendors typically appreciate the transparency that comes with the platform.

Stampli, meanwhile, takes vendor collaboration to a highly detailed level, offering comprehensive workflows, advanced approvals, and collaborative comments on invoices. For businesses with complex internal hierarchies, this can provide immense value. For those without, it’s unnecessary, and the extra features can also be distracting or overly complicated for smaller or leaner operations.

Customer Support and Reliability

In my experience, customer support can make or break your satisfaction with any platform. Even the best-designed tools occasionally run into hiccups, so how quickly and effectively a platform resolves these issues is crucial.

Both Melio and Stampli offer responsive support, but I’ve noticed Melio consistently provides quicker resolutions. Melio seems to emphasize rapid-response support, which my clients have appreciated. One small business owner I worked with recently noted how relieved they were when Melio’s team solved a payment issue within a single interaction.

Stampli’s support is also strong, particularly in onboarding and training new users. Their specialists excel in helping businesses navigate the platform’s robust features. But, the support sometimes seems less immediate due to the complexity of issues typically addressed by Stampli’s larger, enterprise-oriented clientele.

Practical Insights from Real-World Experience

When assessing financial tools, I always stress that practicality trumps impressive features. Throughout my years as a CPA, I’ve seen countless businesses seduced by flashy dashboards and unnecessary complexities, only to revert to simpler solutions later. My goal has always been to recommend solutions that balance power with ease of adoption. Here’s how Melio and Stampli measure up based on my direct experience with clients in different industries.

A Florist’s Perspective

I advise a small floral retailer that was looking to simplify vendor payments. Previously, they managed invoices through a patchwork system involving emails, spreadsheets, and manual ACHs through their bank. This system worked for a while, but things kept slipping through the cracks, and it took more time than it needed to. After evaluating options, I recommended Melio. Within weeks, they transformed their payments from tedious multi-step processes into something quick and seamless.

Melio allowed them to schedule payments easily, and with its transparent fees (or lack thereof for ACH), they instantly saw improvements in working capital. The book keeper I was working with also noted how simple it was to reconcile transactions due to Melio’s integration with QuickBooks. The ease of use dramatically cut down on administrative hours, allowing their team to shift focus from mundane tasks to strategic budgeting.

A Manufacturer’s Perspective

On the other end, I’ve also worked with mid-sized businesses that required multiple layers of approval before any one vendor payment could proceed. One such business—a manufacturer with multiple departments and approval hierarchies—needed detailed workflows to accommodate their complexity. Stampli was appealing here due to its advanced approval-routing capabilities, customizable permissions, and detailed audit trails.

For them, Stampli did its job admirably, ensuring every payment was thoroughly reviewed, documented, and traceable. However, implementing Stampli required significant upfront training and adjustments within their existing systems. It was effective but required patience, dedicated training time, and ongoing support. Which I of course charged for by the hour.

From these experiences, here’s my distilled practical insight:

- Melio: Ideal for businesses that prioritize simplicity, efficiency, and easy implementation without sacrificing essential features.

- Stampli: Better suited for larger businesses with sophisticated internal approval processes and sufficient resources for training and implementation.

Security and Compliance: A CPA’s Perspective

As a CPA, I’m naturally inclined to scrutinize the security and compliance standards of any financial tool my clients adopt. After all, these platforms handle sensitive financial data, vendor banking details, and payment schedules. Security isn’t optional; it’s foundational.

I closely evaluate the security and compliance of any financial tool my clients use, especially since these tools handle sensitive financial information. Both Melio and Stampli offer strong security with data encryption and PCI DSS compliance, but there are subtle differences. Melio emphasizes data minimization, collecting only essential information to limit risk exposure. Stampli, on the other hand, keeps detailed logs and audit trails, beneficial for larger businesses but requiring stricter data management and potentially expanding the data footprint.

- Melio:

- Minimal data collection approach reduces risk.

- Robust encryption (PCI DSS compliance).

- Simpler data management suits smaller businesses perfectly.

- Stampli:

- Detailed audit trails and extensive logging.

- Strong encryption (PCI DSS compliance).

- More comprehensive data management suited for enterprise-level compliance.

Scalability and Growth Potential

One question clients frequently ask me: “Will this solution scale with our growth?” It’s crucial to choose solutions that can accommodate future growth without forcing a costly or disruptive migration later.

Both Melio and Stampli offer strong scalability, albeit targeted at different business trajectories:

- Melio provides seamless scalability for small-to-medium businesses experiencing rapid growth, particularly beneficial when expanding vendor networks or increasing transaction volumes. I’ve observed that Melio handles higher volumes gracefully, maintaining its simplicity and ease-of-use, enabling businesses to scale effortlessly without the hassle of extensive retraining or system overhauls.

- Stampli, conversely, scales impressively well within enterprises already structured for complexity. If growth means more departments, more approvals, and more structured processes, Stampli can comfortably accommodate this without compromising performance. However, smaller companies might find that Stampli’s strengths become burdensome complexities if their growth trajectory involves streamlining rather than adding complexity.

Bottom-Line Recommendation from a CPA’s Perspective

Drawing from years of experience advising businesses across multiple industries and sizes, I believe both Melio and Stampli are exceptional solutions in their respective niches. But in scenarios most frequently encountered in my own practice—small to medium-sized businesses seeking a blend of simplicity, ease of adoption, straightforward integrations, and predictable pricing—Melio has consistently demonstrated an edge.

Melio’s approach is refreshingly clear, accessible, and adaptable. Businesses I work with appreciate the absence of surprise fees, the user-friendly interface, and the uncomplicated integration with mainstream accounting software. While Stampli excels in structured, highly regulated environments, it requires investment in training, implementation, and ongoing support—an investment that smaller businesses might find burdensome.

So, while both platforms stand tall in their categories, if your organization aligns more closely with the profile of most businesses—prioritizing operational simplicity, predictable costs, and ease of use—I would gently nudge you toward Melio as the slightly superior choice.

But rest assured, either path offers strong capabilities that will undoubtedly enhance your payment processes.