Last Updated on July 19, 2025 by Ewen Finser

I’ve spent more late nights than I’d like to admit wrestling with bad imports, manual adjustments, and missing audit trails, and, therefore, I’ve learned to look at accounting software with a skeptical eye. While I care about slick dashboards and ease of use, I’ve also come to appreciate the tools that make my job easier: solid GL controls, automation that works, and features that were clearly built by people who’ve closed a set of books before.

I’ve tested many platforms over the years—some legacy, some startup-built—and a few have stood out. Below is a breakdown of the ones I think actually cater to accountants and CPAs, not just business owners. I’ll walk through the key technical features that matter when you’re doing real accounting work, not just running P&L reports.

Let Me Save You Some Time: The Bottom Line, Up Front

Most accounting platforms can spit out a P&L, but very few are built for the way accountants work. After years in the field, I’ve found that what matters most are tools that support clean, controlled closes, solid audit trails, and workflows that don’t require constant manual fixes. Puzzle stands out by quietly delivering features like contra accounts, automated close checklists, and real-time syncing—things that actually move the needle for accountants. It’s not flashy, but it’s functional in all the right ways. The other platforms—QuickBooks, Xero, NetSuite, and Intacct—each have strengths, but Puzzle earns a spot at the top by focusing on what we actually need.

The Best Accounting Software for Accountants

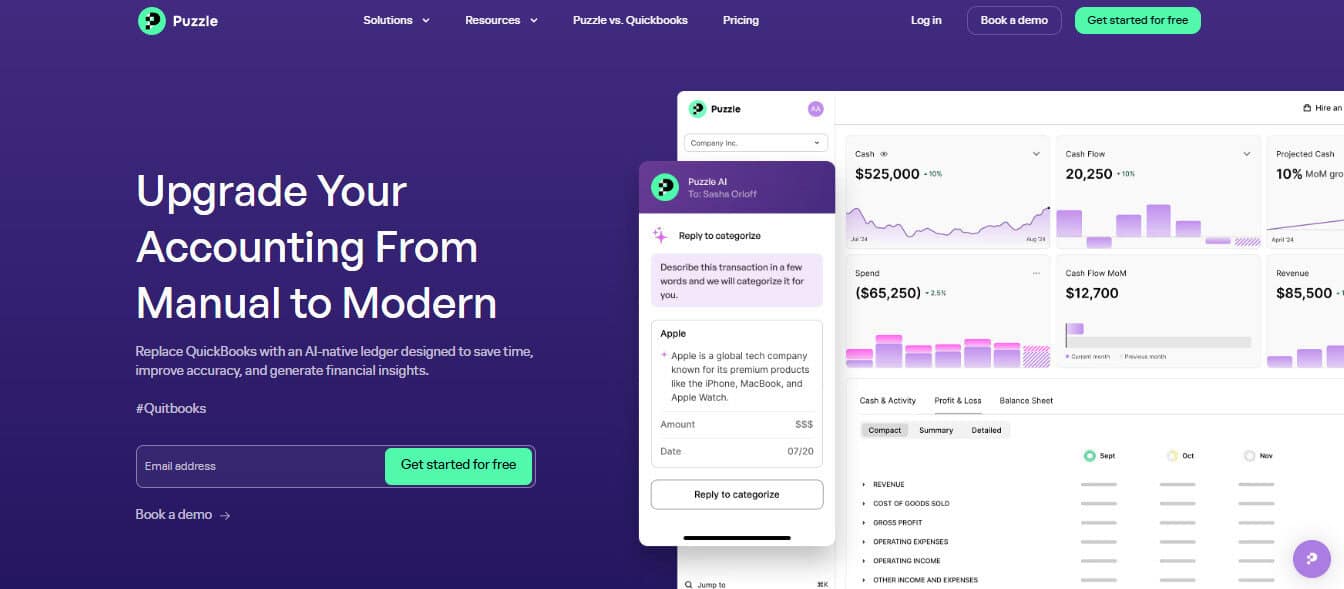

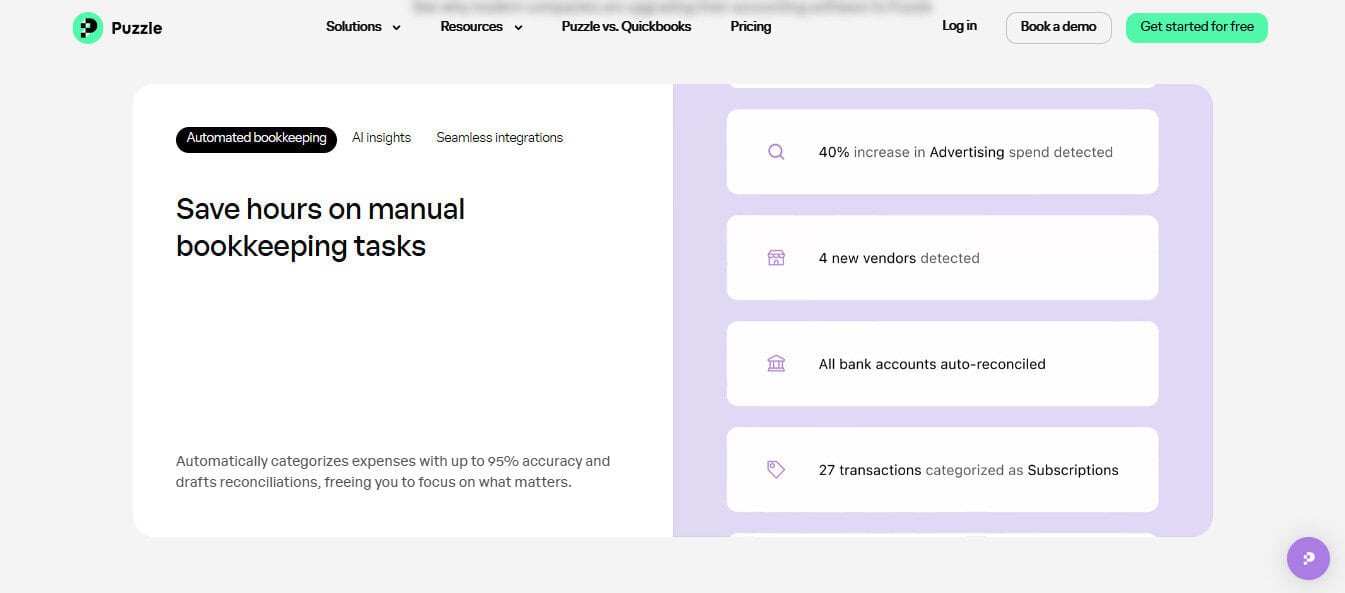

1. Puzzle.io

Puzzle’s relatively new, but it’s been built with a level of technical depth I don’t often see. You can tell it’s aimed at accountants who care about structure and accuracy, not just output.

Key features:

- Contra GL Accounts: You can configure contra accounts easily—something that’s a nightmare or outright impossible in most SMB tools. I don’t find myself needing to use CGL accounts, but when I do need to do something odd or awkward, it’s a life saver!

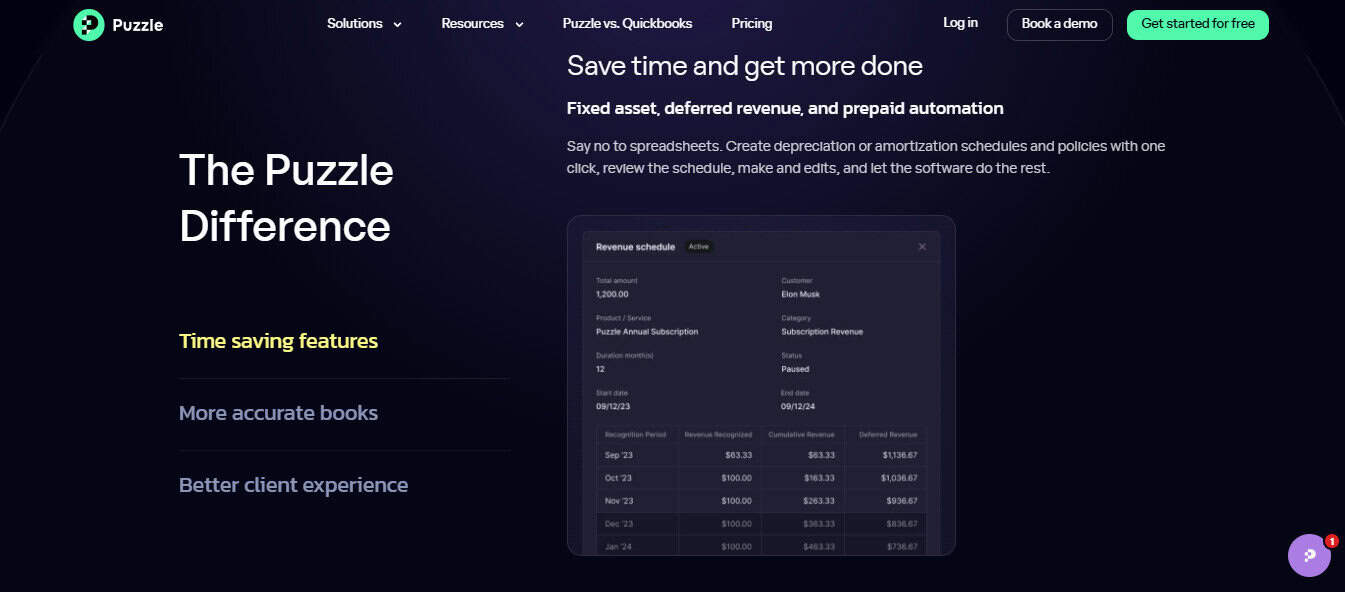

- Automated Close Checklist: The software generates a month-end close checklist tailored to your chart of accounts, helping ensure consistency every month.

- Asset Depreciation Module: Not only does it handle straight-line and declining balance methods, but it also integrates asset rollforward schedules—great for review or audit prep.

- Real-Time Syncing: Unlike the typical “sync once daily” routine in legacy platforms, Puzzle updates transactions in real-time.

- Audit Log Clarity: Every transaction edit is logged with user, timestamp, and affected GL accounts—makes audit trail reviews much smoother.

I’ve used Puzzle to manage mid-market clients with layered structures, and it holds up well. The interface is clean, but under the hood it has depth where it matters.

2. QuickBooks Online Advanced

QuickBooks at this point is a household name, and QBO Advanced does throw in a few features aimed at accountants. But at the end of the day, it’s still a generalist platform, and it costs a bit more than the typical QBO platforms.

Key features:

- Customizable GL: You can modify the chart of accounts and use sub-accounts, but it lacks true contra functionality, which absolutely frustrates me. It also lacks a fixed asset listing within the platform, and relies on 3rd party POS systems to track items similar to these.

- Classes and Locations: Good for basic departmental tracking.

- Recurring Journal Entries: A time-saver, though setup is clunky at first.

- Limited Close Tools: No built-in close checklist, which means you’ll need to use an excel sheet or 3rd party platform.

QBO works fine for cash-basis or modified accrual small businesses, but for accountants working in the weeds, it definitely does have its limitations.

3. Xero

Xero’s done a decent job blending usability with some accountant-friendly tools, but it’s still best suited to straightforward businesses. You can’t push it too far before hitting walls.

Key features:

- Fixed Asset Module: It does straight-line depreciation, but lacks flexibility for other methods like Double Declining Balance or MACRS (tax basis).

- Lock Periods: You can lock previous periods to avoid changes—essential when multiple users are in the books.

- Decent Reporting: Custom report layouts let you build by tracking categories, though no true consolidated reporting.

- No True Close Process: You can simulate one with manual steps, but there’s no checklist or progress tracker built in.

Xero gets points for usability, but from a technical standpoint, it requires workarounds for serious accounting workflows.

4. NetSuite

This is the beast of the bunch. It’s fully built for accountants—but it comes with a price tag, both in dollars and implementation time. It’s probably the most powerful tool you can implement, but it’s an immense amount of work to bring to life, and usually not needed for the majority of small businesses.

Key features:

- Segregated Duties and Roles: Strong role-based access controls for audit compliance. Excellent for accounting teams that may have 10+ accountants.

- Full Close Module: Built-in period close checklist with dependencies and sign-offs.

- Multi-Book Accounting: Handles GAAP and tax books in parallel, which exceeds most of the capabilities that most SMBs need.

- Journal Entry Workflows: You can set up approval chains, scheduled entries, and validations.

If your client or company can afford the implementation and ongoing maintenance, NetSuite is incredibly powerful. But it’s not nimble or easy to use. And when I say this, I mean it – I’ve trained people in NetSuite and I would assume at least 160 hours for someone to be able to surf it well, and the better part of 6 months for someone to become fluent. For many businesses, it’s absolute overkill. I would not recommend this platform unless it’s a business turning over $100M a year in gross revenue.

5. Sage Intacct

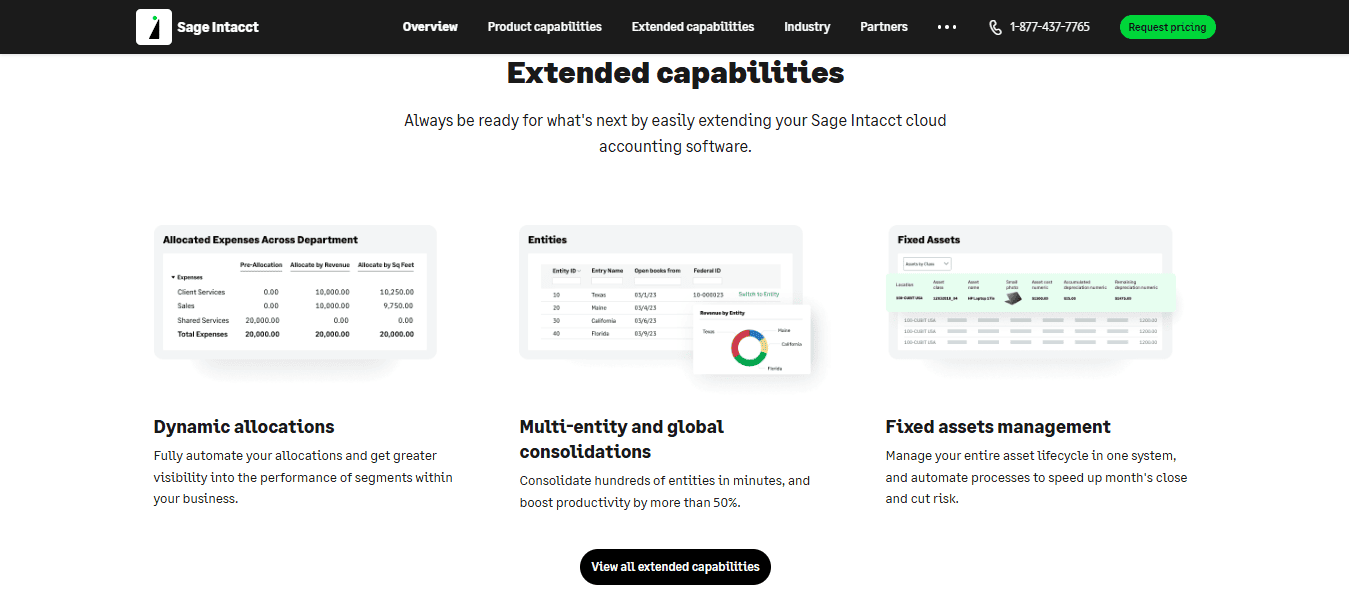

Sage Intacct hits a middle ground between Xero and NetSuite. It’s more robust than small business tools, but still manageable for a growing company or accounting team. Having used Sage Intacct for many years, it’s one of my favorite tools for growing small businesses and mid sized businesses.

Key features:

- Dimensional Chart of Accounts: Powerful tagging for departments, projects, or locations. It can be overwhelming if you don’t know what they’re for though and how to use.

- Fixed Asset Tracking: Handles book and tax depreciation schedules, and integrates with GL.

- Close Management: Has built-in close functionality and supports audit-ready documentation.

- Intercompany Accounting: Makes multi-entity consolidations much easier than most tools.

It’s got depth, but you still need to configure a lot of it yourself. And the learning curve is steeper than Puzzle or Xero.

Pricing and Cost Transparency

Accounting software pricing can be slippery. Some platforms publish rates; others make you sit through a demo to get a number, which is super annoying. Here’s how the major players compare:

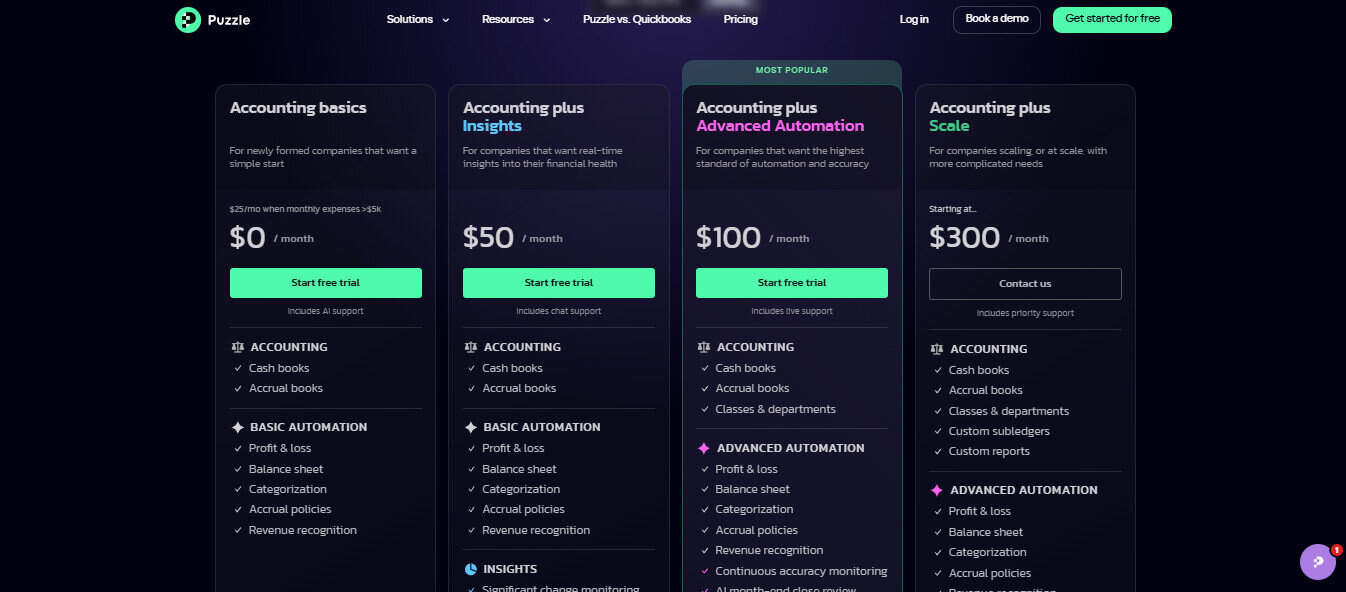

Puzzle.io

- Transparent Pricing: Puzzle is one of few platforms that’s upfront about costs.

- Flat Monthly Rate: No per-user pricing, which makes it easier to budget for growing teams.

- Includes Everything: Core modules like asset management and close checklists are included—no nickel-and-diming for technical “add-ons.”

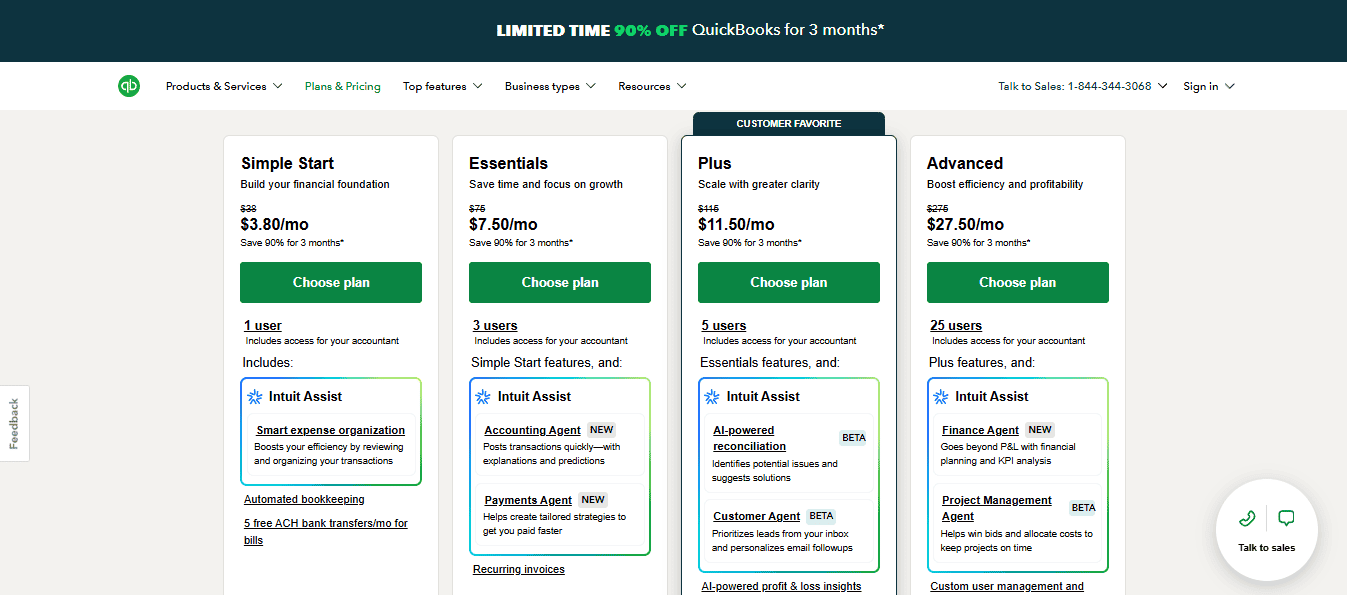

QuickBooks Online Advanced

- Tiered Pricing: You pay more as your feature needs grow. Advanced plan includes automation and custom reporting, but it adds up fast.

- User Limits: Under certain plans, you pay per user, which gets expensive if you’re building out a team or working with external accountants.

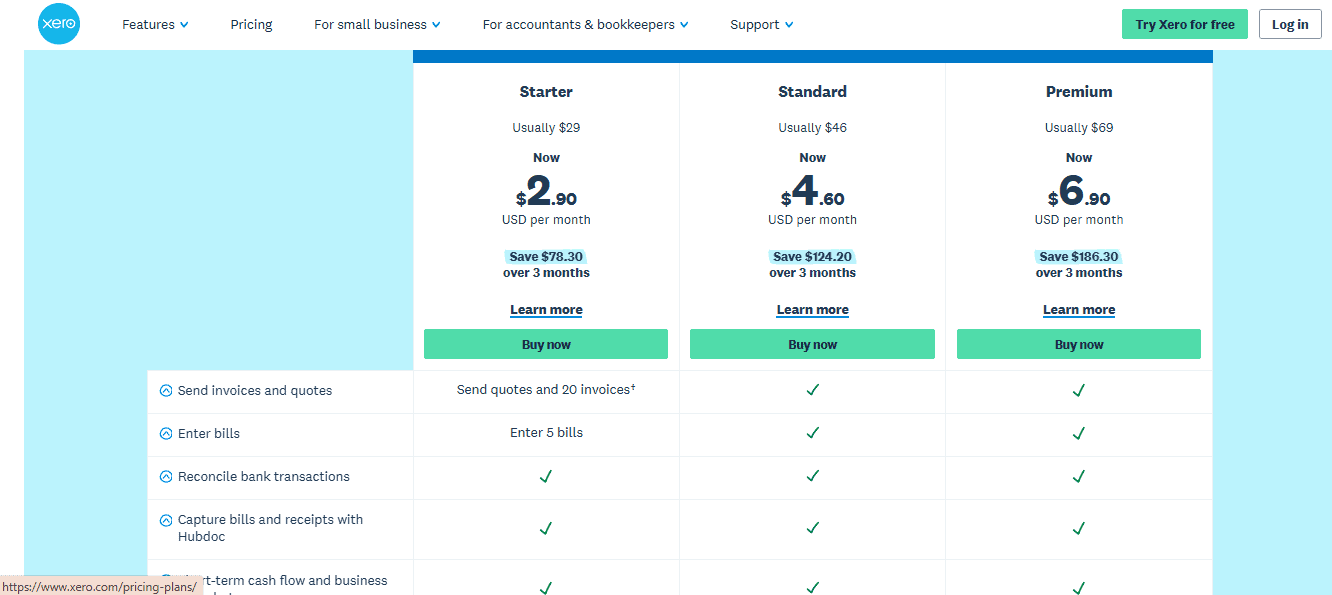

Xero

- Simple Tiers: Plans are clear, but if you need more than the basics (like fixed assets or multi-currency), you’ll have to go up a level. And with the highest tier being $80, it can get expensive quick!

- Add-On Fees: Payroll, project tracking, and expense management cost extra.

NetSuite

- Opaque Pricing: You won’t find prices online. Expect a high monthly minimum plus setup fees in the thousands.

- Everything Is Custom: That includes the price tag. Negotiation is expected, and discounts are common—but unpredictable.

Sage Intacct

- Modular Pricing: You only pay for what you use, but that means features like consolidation or multi-entity cost extra.

- Implementation Costs: Budget for an implementation partner—most setups aren’t plug-and-play.

Scalability

Software that works for a five-person startup might fall apart at fifty employees—or fifty entities. Here’s how each tool scales with complexity.

Puzzle.io

- Built for Growth: Supports multiple entities, intercompany eliminations, and multi-user collaboration without slowing down.

- Close Checklist Grows With You: You can create templates for different subsidiaries or client types, which is a huge time-saver.

QuickBooks Online Advanced

- Hits a Wall at Complexity: Good for single-entity businesses, but can’t natively handle consolidated reporting or complex structures.

Xero

- Fine for Small Teams: Once you add multiple entities, custom reporting needs, or nuanced approval flows, it starts to buckle.

NetSuite

- Enterprise-Ready: Built for complex, multi-entity orgs. Handles global consolidations, currency translations, and layered approval hierarchies with ease.

Sage Intacct

- Solid Mid-Market Fit: Can handle multiple entities, dimensions, and growth—if you set it up right. Not quite as flexible as NetSuite, but much easier to manage.

Integration with Other Tools

Accounting doesn’t happen in a vacuum. Each platform connects with AP tools, payroll, forecasting, and banks at some point in its life, and if you really are clever with your accounting platform, it can also connect to point of sales, customer management platforms, marketing, all kinds of business tools. Integration is key to make sure your platform is plug and play.

Puzzle.io

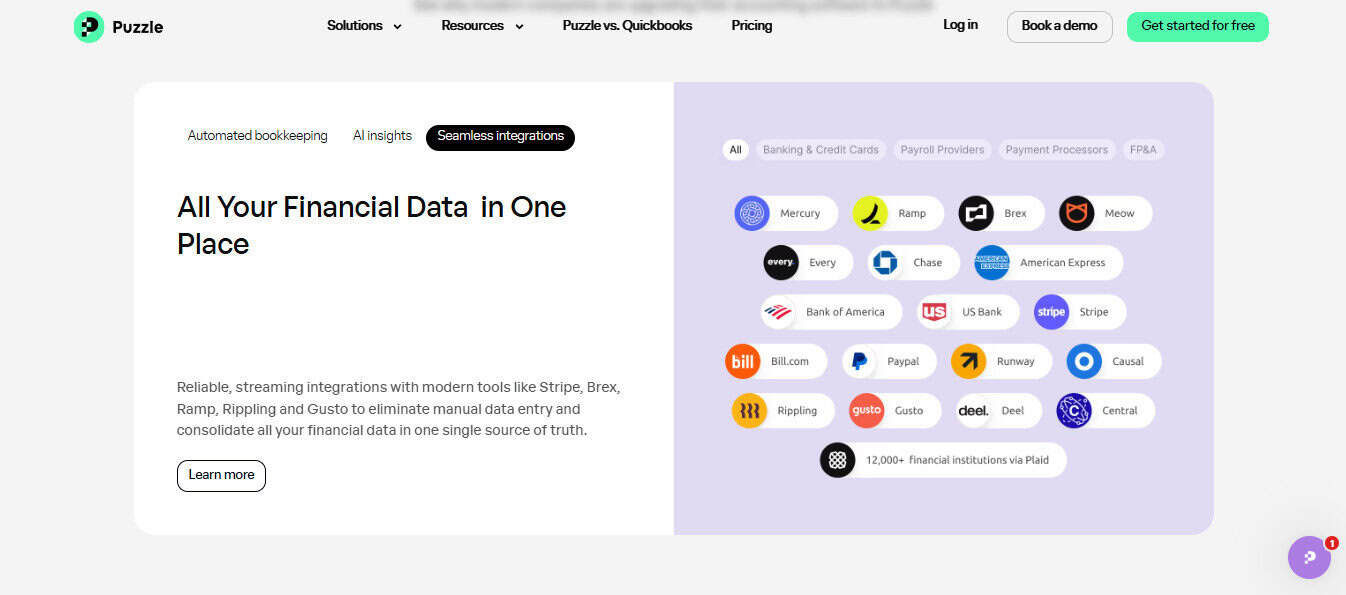

- Strong API Focus: Easy to connect with payroll systems, AP tools, or your data warehouse.

- Bank Feeds with Controls: Daily syncing with built-in matching to help reconcile at month end

- Prebuilt Integrations: Works well with platforms like Gusto, Ramp, and Stripe without data mapping headaches.

QuickBooks Online

- Lots of Integrations: Because of its popularity, nearly every tool connects with QuickBooks—but data quality varies.

- Bank Feeds Are Fragile: Breaks often, especially with smaller banks or credit unions. I can’t even begin to describe how frustrating it is when a client banks with a small credit union and their bank is not available to integrate. I usually ask the client to switch to a preferred banking partner.

Xero

- Good App Ecosystem: Their marketplace is broad, with solid integrations for e-commerce, inventory, and payroll.

- Bank Feed Strength: More reliable than QBO in my experience.

NetSuite

- Powerful but Complex: You’ll likely need a developer to connect third-party tools, which means you better have an IT Staff and its budget in your forecast.

- Native Modules Available: Payroll, inventory, forecasting—if you’re willing to pay for it.

Sage Intacct

- Strong Accounting Integrations: Good fit with bill pay tools, FP&A systems, and payroll providers.

- Custom Integrations Often Needed: Many tools require API setups or middleware to work well, but work well they often do.

Final Thoughts

Over the years, I’ve learned that most accounting software can generate a P&L. But very few platforms actually make closing the books easier for us accountants. They also seldom help you maintain a clean, auditable set of records month over month.

Puzzle, to me, stands out for one simple reason: it’s clearly built with accountants in mind. The features aren’t just checkboxes—they’re tools I actually use. And while the other platforms each have their place depending on budget, team size, and industry, Puzzle manages to deliver the depth of a legacy system without the bloat. That said, no platform is perfect. The best software is the one that meets your specific workflow without forcing you into clunky workarounds. But if you’re an accountant who’s spent time in the trenches and you’re looking for a tool that “just makes sense,” Puzzle is worth a serious look.