Last Updated on June 10, 2025 by Ewen Finser

FreshBooks has established itself as a popular accounting platform for freelancers and small businesses, and for good reason! It’s renowned for its intuitive interface, simplified invoicing, and breezy project management, which is attractive for people who don’t want to get lost in the numbers. However, despite its strengths, FreshBooks isn’t a one-size-fits-all solution. Companies with more complex accounting needs, larger teams, or those seeking enhanced analytics will find FreshBooks inadequate. As a CPA, I’ve tried many alternatives to FreshBooks during my work with my clients, and because of that, I feel comfortable sharing what I think are a handful of contenders that may be appealing if you’re a business owner who’s looking to make the switch.

The Bottom Line Up Front

FreshBooks, while a strong solution for freelancers and small teams, often lacks the comprehensive features and scalability necessary for growing businesses or those with more complex accounting needs. Each alternative discussed here—Puzzle.io, QuickBooks Online, Xero, and Wave—brings unique strengths to the table.

- Puzzle.io is unmatched in AI-driven automation and analytics, significantly improving productivity for rapidly growing businesses or professional firms.

- QuickBooks Online remains the industry heavyweight, providing comprehensive capabilities essential for companies scaling rapidly or those needing robust integration and advanced features.

- Xero appeals broadly with global functionality, excellent integrations, and straightforward user experience, particularly beneficial for internationally oriented companies.

- Wave offers unbeatable simplicity and affordability, perfectly tailored for freelancers and small businesses with limited budgets.

My Picks for the Best FreshBooks Alternatives

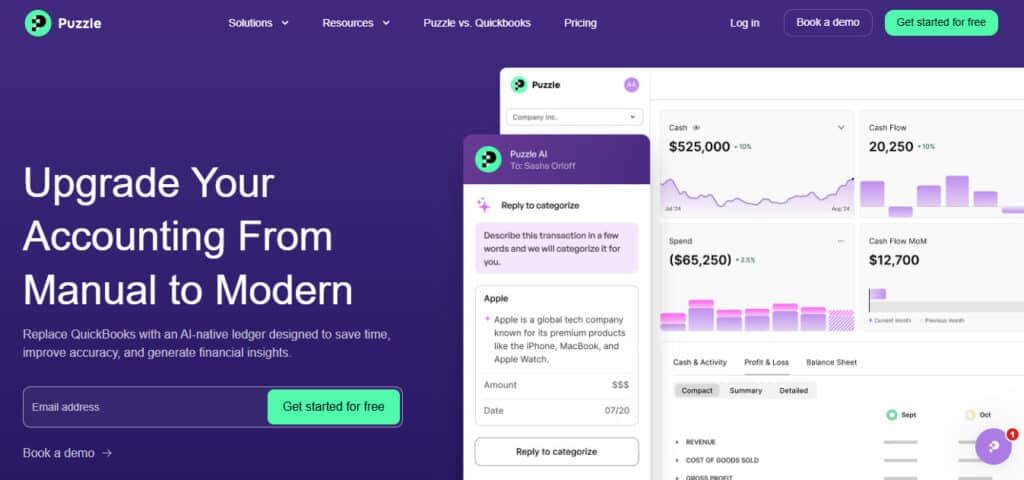

1. Puzzle.io: The AI-Enhanced Accounting Solution

Puzzle emerges as a fresh, AI-powered alternative to traditional accounting software like FreshBooks. Designed explicitly with automation in mind, Puzzle.io provides small-to-medium businesses and accounting professionals a robust toolkit for managing financial operations. I was recently introduced to this platform, and continue to be impressed with what it can deliver in terms of granularity, its sleek design, and user-friendly interface.

Core Features of Puzzle.io:

- AI-Powered Categorization: Puzzle.io automates transaction classification, reducing manual effort and improving accuracy.

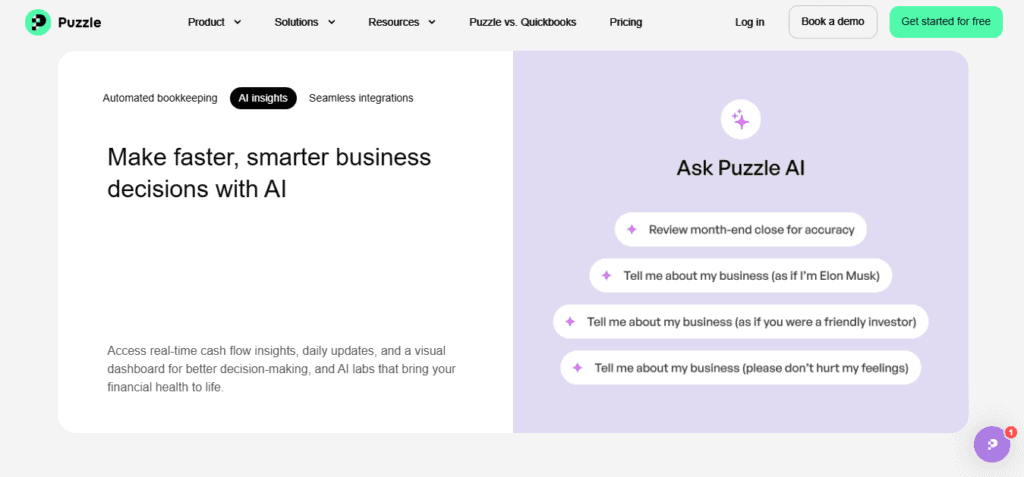

- Real-Time Financial Insights: Through the power of Artificial Intelligence, Puzzle offers predictive financial insights, budget analysis, and actionable cash flow forecasting.

- Seamless Integrations: Puzzle connects effortlessly with payment gateways, banks, payroll platforms, and CRM software, creating a unified financial management ecosystem.

- This is one of the big features, in my opinion, that makes Puzzle closer to an ERP / Financial Management system than “just another accounting software”. Its integrations allow so much control and data to be ported in, it’s almost overwhelming, in a good way.

- This is one of the big features, in my opinion, that makes Puzzle closer to an ERP / Financial Management system than “just another accounting software”. Its integrations allow so much control and data to be ported in, it’s almost overwhelming, in a good way.

- Comprehensive Reporting: Detailed, customizable financial reports that assist in decision-making processes and simplify end-of-period accounting.

Puzzle particularly shines in its ability to handle complex accounting scenarios effortlessly, making it ideal for businesses experiencing rapid growth or those dealing with frequent and diverse transactions. In my opinion, this basically separates it away from FreshBooks, as they’re made for such completely different markets that it’d be like comparing a tire to a basketball. Sure, they’re both rubbery and round, but that’s where the similarities stop!

Pricing Overview:

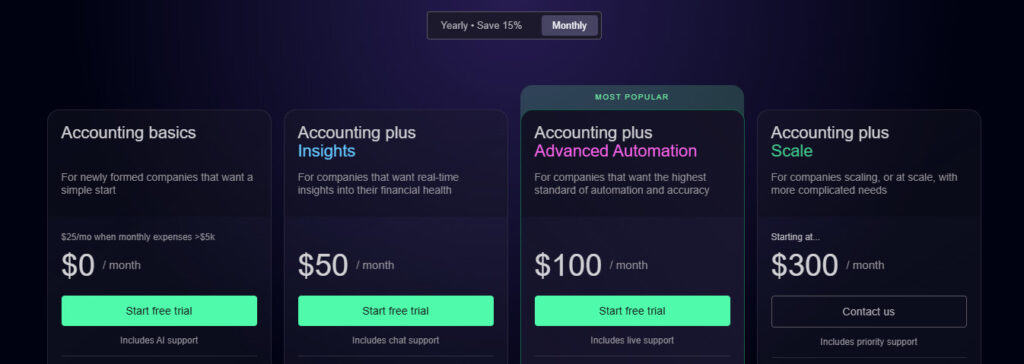

Puzzle.io’s pricing structure is flexible, adapting to different business scales:

- Basic Plan: Starts at $0/month and is super basic. It’s introductory and essentially lets you see if Puzzle is for you.

- Accounting Plus: $50/month, unlocks most automation options within Puzzle, and is for businesses who need something robust.

- Advanced Automation: $100/month, unlocks the full package, and gives additional insights, as well as using AI to help close month-end. This is for businesses that are cashing in all their chips to see what AI can deliver.

- Custom: A specialized package will be negotiated between Puzzle and the business owner for pricing. This is for larger companies with growing finance teams and offers custom solutions.

While Puzzle.io might initially seem pricier than FreshBooks, its automation capabilities and superior analytical tools justify the investment for growing businesses. After all, saved time is saved payroll costs, so I like to think of it as an investment.

Why Choose Puzzle over FreshBooks?

Puzzle.io is fundamentally different from FreshBooks because of its sophisticated AI-driven automation. Businesses that need more than basic invoicing and expense tracking, particularly those seeking growth, extensive reporting, and powerful automation, will find Puzzle a superior choice.

2. QuickBooks Online: The Juggernaut in the Room

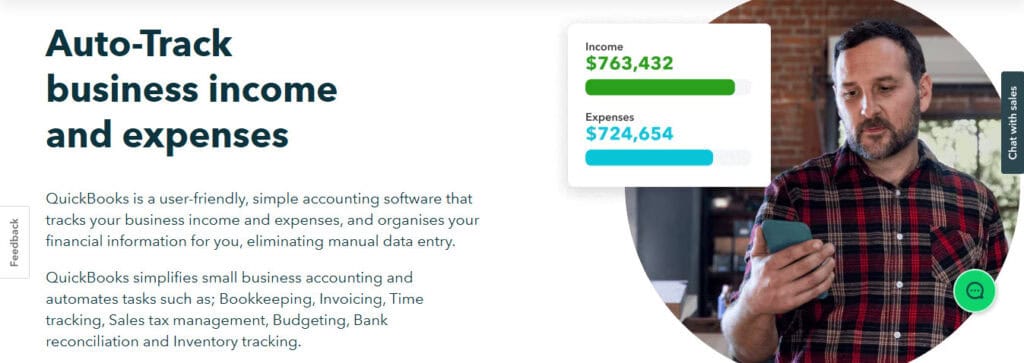

QuickBooks Online (QBO) stands as the industry standard in accounting software, widely recognized for its depth, reliability, and extensive feature set. It’s often the first alternative businesses consider when outgrowing simpler tools like FreshBooks. Everyone in the space has heard of it, knows how to use it, and can usually fine-tune it to match what their businesses need. There’s a reason it has stood the test of time – it just works.

Core Features of QuickBooks Online:

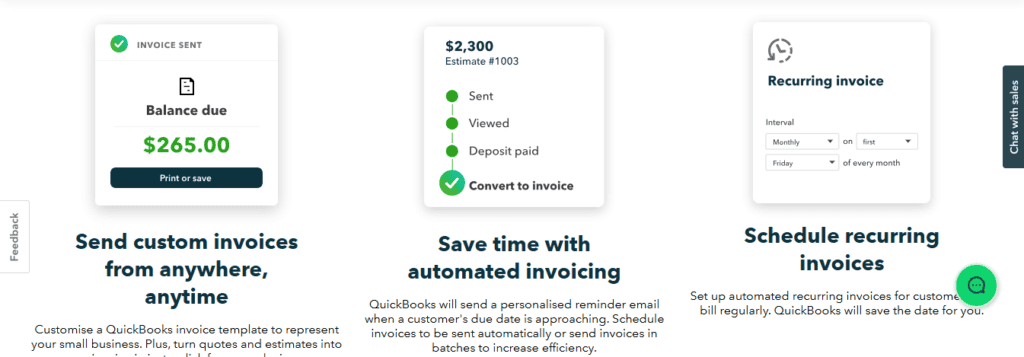

- Advanced Invoicing & Payment Integration: Offers comprehensive invoicing with payment options directly embedded in the invoice.

- Payroll Processing: Integrates payroll management seamlessly, including direct deposits, tax calculation, and reporting. This is something that I felt Puzzle fell short on, while QBO does an excellent job of managing Payroll.

- Tax Preparation & Filing: Extensive tax support, automated calculations, and direct filing capabilities integrated with multiple tax systems.

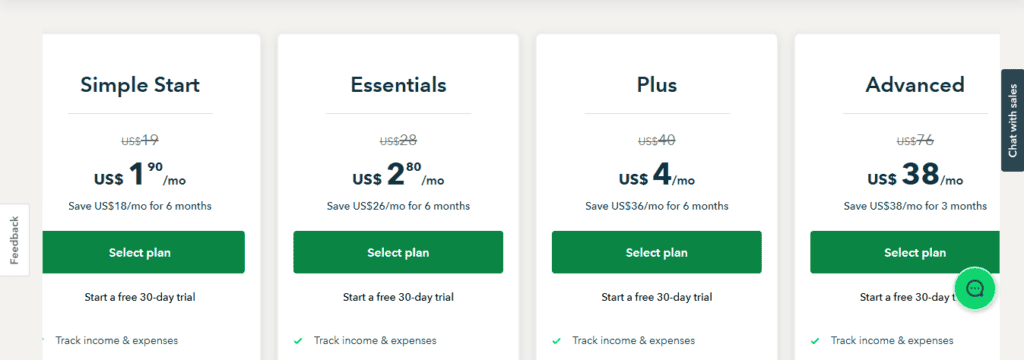

Pricing Overview:

QuickBooks Online offers several plans catering to various business sizes and complexity levels:

- Simple Start: $30/month, suitable for solo entrepreneurs.

- Essentials: $60/month, adds multi-user support and enhanced features.

- I find that most of my clients end up in this bucket, as they usually have one or two bookkeepers, and the business owner able to access the account.

- I find that most of my clients end up in this bucket, as they usually have one or two bookkeepers, and the business owner able to access the account.

- Plus: $90/month, ideal for inventory management and detailed reporting.

- Advanced: $200/month, designed for businesses requiring sophisticated features such as advanced analytics, workflow automation, and dedicated support.

Despite its slightly steeper learning curve compared to FreshBooks, QBO offers unmatched depth for businesses aiming to scale beyond small-scale financial tracking.

Why Choose QuickBooks Online over FreshBooks?

QuickBooks Online excels in environments where robust features, scalability, and detailed accounting functionality are priorities. Its capabilities in payroll, inventory, tax filing, and multi-user collaboration considerably surpass FreshBooks, making it an ideal choice for growing businesses needing extensive financial management.

3. Xero: The Cloud-Based Alternative

Xero is a globally recognized, cloud-based accounting solution that combines ease of use with powerful accounting functionality. It’s particularly appealing to international businesses or those looking for a more streamlined approach than QuickBooks Online.

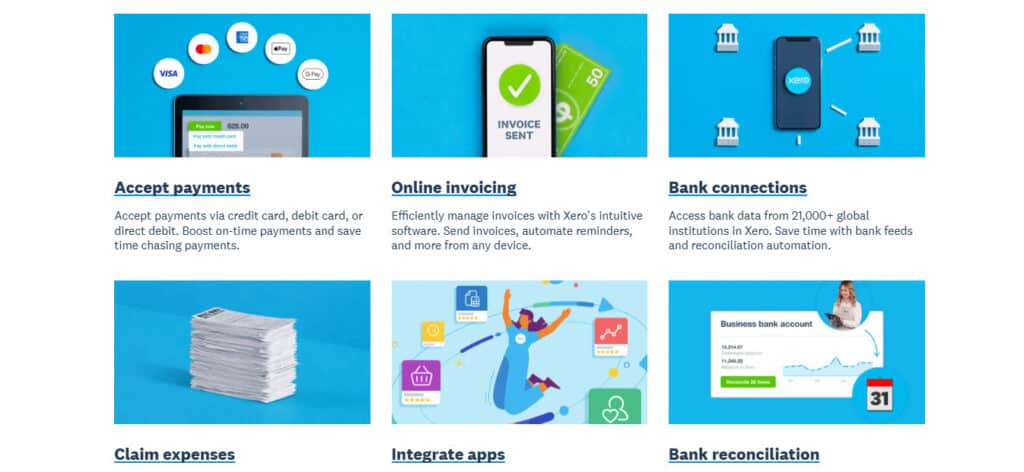

Core Features of Xero:

- Global Usability: Handles multiple currencies seamlessly, making it ideal for international businesses or companies dealing with overseas clients.

- User-Friendly Interface: Intuitive, easy-to-navigate dashboard that simplifies complex accounting tasks.

- As a caveat, Xero’s dashboard still isn’t as sleek as Puzzle’s.

- As a caveat, Xero’s dashboard still isn’t as sleek as Puzzle’s.

- Integration and Flexibility: Robust third-party integrations with over 800 business applications, ranging from CRM to ecommerce and payroll.

- Detailed Expense Tracking: Advanced expense management tools, including receipt capture, expense classification, and robust reimbursement functionality.

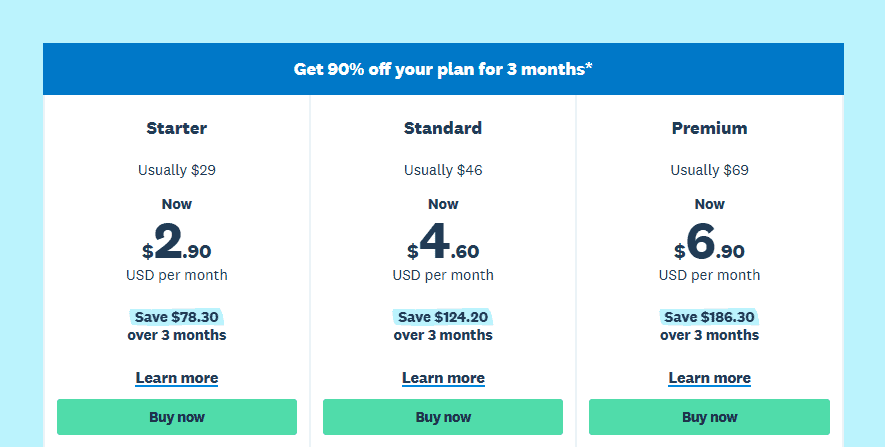

Pricing Overview:

Xero maintains a competitive pricing model, attractive especially for businesses scaling at an early stage.

- Early: Approximately $20/month, limited invoicing and bill processing, ideal for freelancers or new startups.

- Growing: Around $50/month, supporting unlimited invoicing and expense management.

- Established: Approximately $80/month, offering advanced reporting, multiple currency transactions, and sophisticated project tracking.

Xero’s approachable pricing and robust functionality position it as a practical solution for small to medium-sized businesses seeking comprehensive accounting without the complexity associated with QuickBooks.

Why Choose Xero over FreshBooks?

Businesses operating internationally or requiring serious integration options often prefer Xero to FreshBooks. Its international currency handling, extensive integrations, and advanced features at a reasonable cost make it an excellent FreshBooks alternative, especially for global enterprises.

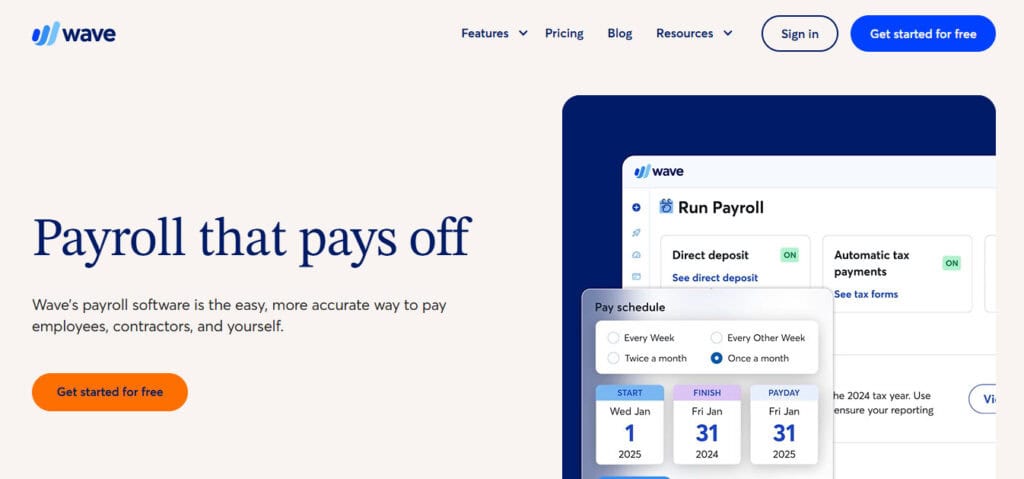

4. Wave: The Free Accounting Option

Look, I don’t know if it’s a stereotype that just so happens to be true, but most accountants can pinch a penny hard enough that it’ll squeal. I’m no different, and that’s why I always love to mention Wave – because I’m a cheapskate. Wave stands apart as a free accounting software, making it an attractive choice for freelancers, startups, and micro businesses. Wave combines the essentials of bookkeeping and invoicing without monthly fees, creating a budget-friendly alternative to FreshBooks.

Core Features of Wave:

- Free Unlimited Accounting: Includes invoicing, income and expense tracking, and basic reporting at no cost. Of course, you can always upgrade tiers and unlock additional options.

- Invoice Customization: Personalized invoices, including branding, payment reminders, and recurring billing.

- Payment Integration: Accepts online payments with integrated credit card processing (fees apply only per transaction, not monthly).

- Payroll and Taxes: Optional payroll and tax services available for additional fees, providing flexibility for growing businesses.

Wave’s strength lies in its simplicity, affordability, and straightforward functionality, making it ideal for budget-conscious businesses needing essential financial management without the overhead of monthly subscription fees.

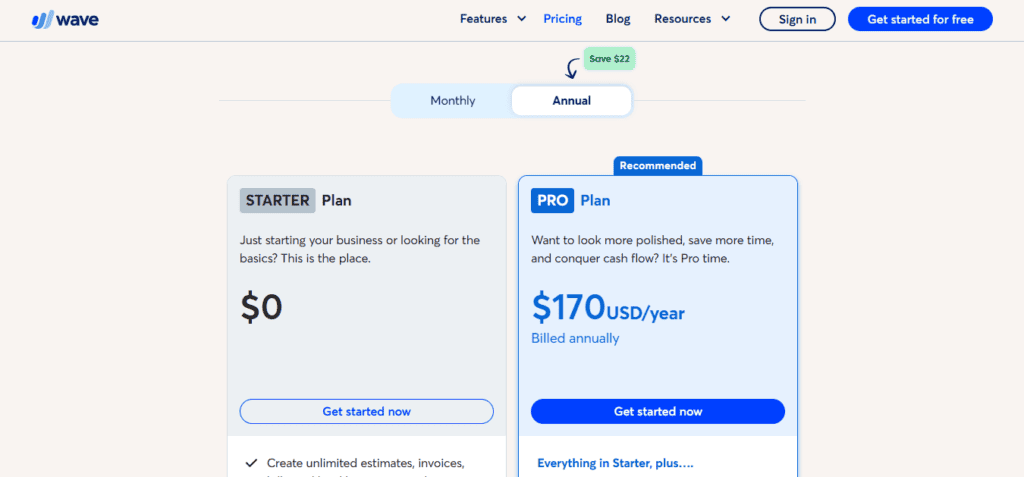

Pricing Overview:

Wave offers a unique pricing model:

- Core Accounting and Invoicing: Completely free.

- Payment Processing: Standard payment transaction fees apply (around 2.9% + $0.30 per transaction).

- Payroll Services: Available starting from $20/month plus additional per-employee costs.

Wave’s free model is particularly beneficial for small-scale entrepreneurs and freelancers who manage relatively simple financial tasks and need cost-effective solutions. I always recommend it to folks who aren’t sure if they want to be business owners, just so they can get their feet wet on the admin side.

Why Choose Wave over FreshBooks?

Wave provides an unbeatable value proposition for startups and solo entrepreneurs needing basic accounting capabilities without recurring expenses. Businesses prioritizing budget considerations and essential financial tasks will find Wave highly advantageous compared to FreshBooks, especially when minimizing overhead is critical.

Detailed Comparative Analysis of FreshBooks Alternatives

After understanding the fundamental characteristics and pricing of Puzzle.io, QuickBooks Online, Xero, and Wave, it’s crucial to compare these alternatives in key areas relevant to most businesses—usability, scalability, integrations, customer support, and value for money. I feel these are the things that everyone forgets about because they get lost in the design of the platform, or worried about how difficult it may be to learn a platform. That comes with time, but failing to consider the following can hamper the effectiveness of an accounting platform long term.

Usability and User Experience

Puzzle.io:

Puzzle’s user experience is optimized around automation and intelligence. Its dashboards are designed with user-friendly navigation, making complex financial management accessible even to less tech-savvy users. The automation significantly reduces the time spent on repetitive tasks, increasing overall productivity.

QuickBooks Online:

QuickBooks has historically had a steeper learning curve. While improvements have made its interface more intuitive, it still requires some accounting knowledge or dedicated training. However, once mastered, it provides unmatched control and depth.

Xero:

Xero excels in usability with its clean, straightforward design. The dashboard layout simplifies complex accounting processes into manageable tasks, benefiting users who prefer visual clarity and ease of navigation. Its simplicity and accessibility often surpass FreshBooks.

Wave:

Wave’s simplicity is its greatest asset. Designed specifically for freelancers and micro-businesses, its no-frills approach provides basic functionalities clearly and concisely. Users needing advanced features might find Wave limiting, but those who value simplicity will greatly appreciate its intuitive interface.

Scalability and Flexibility – The Often Forgotten Consideration

Puzzle.io:

Puzzle scales excellently alongside businesses. The AI-driven platform is adept at handling increased complexity in transactions and accounting needs, making it an excellent fit for growing companies or professionals managing multiple clients. It also allows additional users and teams to access it, and work aside one another.

QuickBooks Online:

QuickBooks is arguably the most scalable platform on this list. It comfortably accommodates businesses transitioning from small startups to medium and large enterprises, thanks to advanced features like inventory tracking, payroll integration, and extensive reporting capabilities.

Xero:

Xero provides moderate scalability, making it ideal for small to medium-sized businesses. Its global-oriented features—multi-currency support and numerous integrations—support growth, particularly for businesses expanding internationally.

Wave:

Wave is less scalable compared to others. It’s optimal for micro-businesses, freelancers, or very small teams. As a business grows and requires more advanced functionalities, companies typically migrate from Wave to more feature-rich platforms.

Integrations and Ecosystem – Are they Plug and Play?

Puzzle.io:

Puzzle’s integration ecosystem is robust and designed explicitly for seamless integration with numerous financial, payroll, payment, and CRM tools. This seamlessness reduces friction and increases productivity across various aspects of financial management.

QuickBooks Online:

QuickBooks boasts the largest integration marketplace among accounting software, supporting over 750 applications. Its integrations span payroll, ecommerce, POS systems, inventory management, and numerous industry-specific solutions, providing unmatched flexibility.

Xero:

Xero follows closely behind QuickBooks, offering integration with more than 800 business apps. Its expansive ecosystem is particularly beneficial for businesses seeking robust connections with e-commerce platforms, CRM systems, and payment processors.

Wave:

Wave offers fewer integrations, focusing on the essentials like PayPal, Shopify, and basic payment gateways. Its limited integrations reflect its target market—small businesses and freelancers needing minimal third-party support.

Who Are The Ideal Users for Each Platform?

Puzzle.io:

Best suited for tech-savvy small-to-medium businesses or accounting professionals who desire automation, advanced analytics, and streamlined operations through AI.

QuickBooks Online:

Ideal for growing businesses that require comprehensive financial management, robust inventory, payroll processing, and extensive integrations.

Xero:

Perfect for businesses expanding internationally or companies that prefer straightforward usability combined with strong integration capabilities.

Wave:

Excellent choice for freelancers, micro-businesses, or startups prioritizing cost-effectiveness and basic accounting functionality without ongoing subscription costs.

How Do I Pick the Right One For My Business?

When considering a FreshBooks alternative, businesses should prioritize their specific needs—automation, scalability, international operations, integrations, or cost efficiency—to select the platform most suited to their objectives. Each option discussed here serves as an excellent FreshBooks replacement, provided businesses align their choice with their specific operational needs and strategic growth goals.