- Artificial Intelligence in the Accounting Space

- Bottom Line Up Front (TL;DR):

- Why AI-Powered Accounting Software Matters

- The Best AI Accounting Software

- QuickBooks Online

- Xero

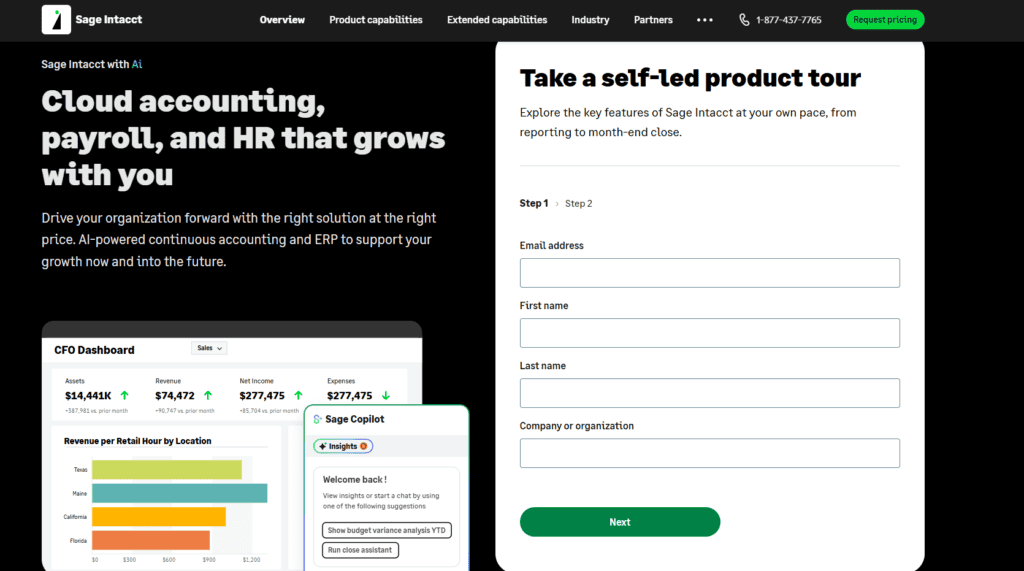

- Sage Intacct

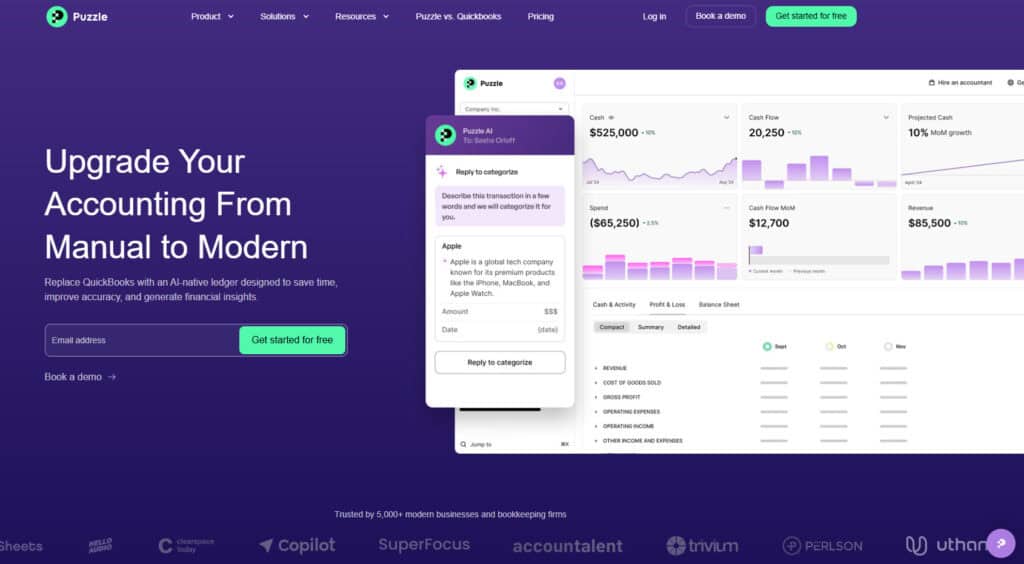

- Puzzle.io

- Zoho Books

- FreshBooks

- Wave Accounting

- OneUp

- ZipBooks

- Botkeeper

- BlackLine

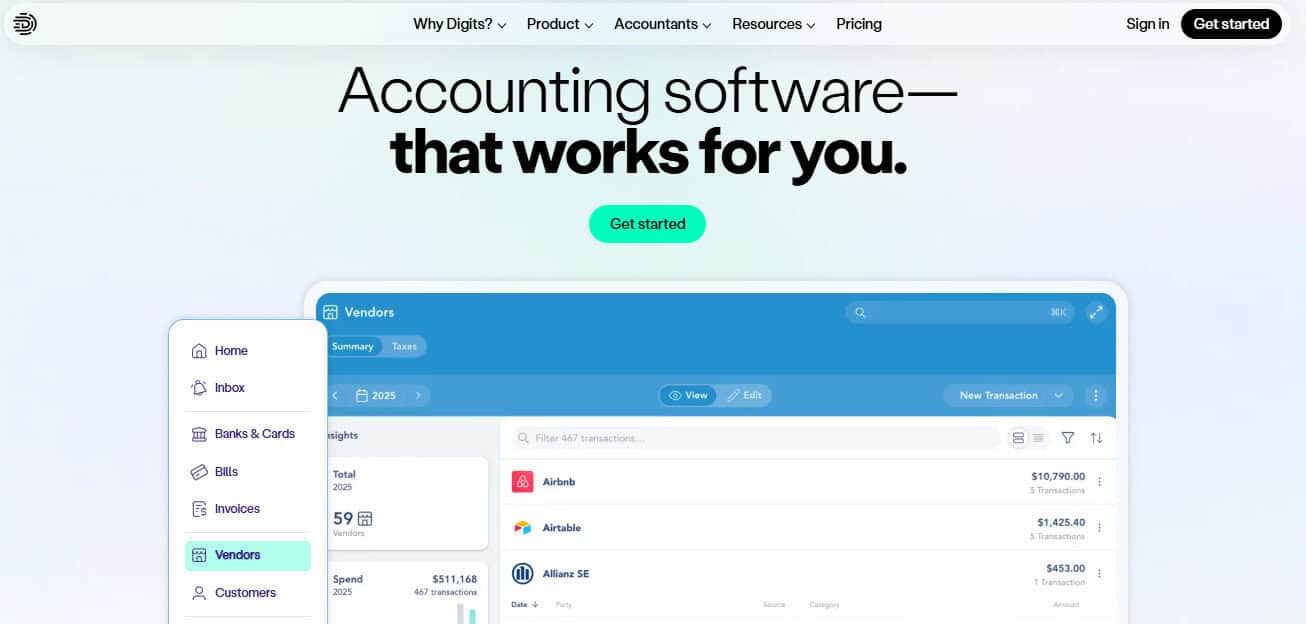

- Digits

- Balancing the Benefits and Risks of AI

- The Double-Edged Sword

- Final Thoughts

Last Updated on January 30, 2026 by Ewen Finser

Let’s face it…accounting has never been the flashiest, most cutting-edge profession. But as our world changes and Artificial Intelligence becomes more mainstream, even the most traditional industries are getting a digital upgrade—including accounting. AI is streamlining tedious tasks, catching errors before they snowball, and helping professionals make smarter decisions faster. The best AI accounting software doesn’t just save time, it gives accountants and business owners a serious edge

Artificial Intelligence in the Accounting Space

Before we jump in, let’s discuss something that many white collar workers have been thinking about lately: Will Artificial Intelligence be responsible for taking my job? Ouch, that’s a bit on the nose because more than likely, a white collar worker is reading this article. But I’m guessing at some point we’ve all asked ourselves, “Is my profession going to go the way of the switchboard operator or typewriter repairman because AI can do it faster, cheaper, and more accurately?”

As a CPA, I think certainly not, at least not for some time in my space. However, AI is a powerful tool in the toolbelt of many paper pushers, myself included, and we’re reaching a time when it needs to be leveraged to be competent and successful at your job. If everyone in your space is using it, and you’re not, you’ll ultimately get left behind. But what does AI look like in the world of accounting?

AI-powered accounting software streamlines tedious tasks, reduces errors, and provides powerful analytics. However, the rapid evolution of AI technology has brought about new considerations, highlighting both its strengths and its potential pitfalls. That’s why I think it’s important to choose your AI solutions wisely (and find responsible ways to leverage them.)

Bottom Line Up Front (TL;DR):

Today’s top accounting platforms like QuickBooks Online and Puzzle help accountants by using artificial intelligence to automate repetitive tasks, reduce errors, and deliver smarter insights. While the benefits are clear—like efficiency, cost savings, and improved forecasting—AI tools still require human oversight to avoid misclassifications and maintain accuracy.

If you’re looking for something that’s relatively “hands off” once it’s been trained, I’d check out Puzzle. If you’re into having tons of forums and support, I’d take a dive into QBO, and if you’re a boot strapping startup with budgetary constraints, check out a basic freemium software like Wave.

Why AI-Powered Accounting Software Matters

AI technology can significantly enhance accounting processes, providing automation for repetitive tasks like invoice processing, expense categorization, payroll management, and financial forecasting. This is key to its adoption, as it saves on wages by automating away many of these basic processes.

By leveraging machine learning algorithms, AI can help accountants and business owners make quicker and more informed decisions. However, improper management of AI tools can lead to inaccuracies, security vulnerabilities, and reliance on flawed models, but I’ll cover that in more detail later.

The Best AI Accounting Software

Some of the most notable accounting softwares that are implementing AI are:

QuickBooks Online

QuickBooks Online, by Intuit, is one of the most recognizable accounting platforms used worldwide. It’s also spearheading the charge in AI implementation. QuickBooks Online is a cloud-based accounting platform designed for small to mid-sized businesses, offering tools for bookkeeping, invoicing, payroll, and financial reporting. Its user-friendly interface and strong ecosystem of integrations make it a go-to solution for business owners and accountants alike.

Pros:

- Automated Categorization: AI-driven classification of expenses reduces manual data entry.

- Robust Integration: Compatible with hundreds of other business applications.

- Intuitive Analytics: AI-driven insights that help forecast cash flow and identify financial trends.

Cons:

- Costly for Smaller Businesses: Higher-tier AI features can become expensive.

- Occasional Misclassification: AI can incorrectly categorize transactions, requiring human oversight.

2026 Updates for QuickBooks Online

In 2026, QuickBooks has moved fully into “Agentic AI” with Intuit Assist.

- 1099 Automation: A new centralized dashboard uses AI to track 1099 status across all clients, automatically identifying missing W-9s and filing directly from the platform.

- Intuit Intelligence: This chat-based system allows users to ask complex questions like, “Which of my entities has the highest tax liability this quarter?” and receive immediate, plain-English answers with data visualizations.

- Multi-Entity Awareness: AI now handles intercompany eliminations and consolidated reporting automatically for growing businesses. However, I’d be weary of trusting this

Xero

Xero is renowned for its user-friendly interface and powerful AI capabilities that streamline daily accounting tasks. Designed with small businesses in mind, it automates functions like bank reconciliations, expense categorization, and invoice processing, all while offering real-time financial insights through intuitive dashboards. Its stand out feature is user friendliness, as it’s easy to pick up and learn.

Pros:

- Efficient Invoice Management: AI helps automate invoice capture and processing.

- Accurate Bank Reconciliation: Machine learning assists in matching bank transactions with invoices.

- Scalability: Ideal for growing businesses due to its scalable features.

Cons:

- Learning Curve: While intuitive, some advanced AI features require training.

- Limited Customer Support: Support responsiveness may decline as reliance on automated help increases.

Sage Intacct

Sage Intacct is an AI-driven accounting solution tailored specifically to medium and large businesses. It’s one of the most common softwares used by medium sized businesses, so its AI offerings are quickly being picked up.

Pros:

- Advanced Analytics: Powerful forecasting and budgeting tools enhanced by AI.

- Real-time Visibility: AI provides continuous monitoring of financial health.

- Comprehensive Reporting: AI-driven reporting automates complex financial documents.

Cons:

- Complex Interface: May overwhelm small business users.

- Cost Prohibitive: Premium pricing might restrict accessibility for smaller organizations.

Puzzle.io

Puzzle.io emerges as a compelling option specifically due to its AI-forward approach tailored to small and medium-sized businesses. This software uses machine learning algorithms designed explicitly to improve accuracy in bookkeeping and financial analysis. I think it’s one of the platforms to watch moving forward.

Pros:

- Intuitive Automation: Puzzle.io’s AI dramatically reduces manual entry errors.

- Customizable AI Models: Offers customizable AI training to match individual business needs.

- Enhanced Security Features: AI-driven security protocols detect and prevent financial fraud.

Cons:

- Newness: Being newer, it lacks an extensive user community or established best practices. Unlike QBO, which has dozens of forums available on every issue, Puzzle.io doesn’t have that option.

- Integration Limitations: Fewer integrations compared to long-standing competitors like QuickBooks or Xero.

Zoho Books

Zoho Books is part of Zoho’s extensive suite of business tools, incorporating robust AI-driven features to assist businesses of all sizes. Its AI capabilities help automate invoice creation, categorize transactions, and provide predictive insights, making it a strong contender for companies seeking an all-in-one, scalable solution. This is important for businesses who could see exponential growth and want a software that can scale with their business, therefore avoiding costly and time consuming migrations.

Pros:

- Comprehensive Automation: AI automates expense tracking, invoice processing, and payment reminders.

- Affordability: Cost-effective for small businesses with competitive pricing.

- Smooth Integration: Integrates seamlessly within the Zoho ecosystem and third-party apps.

Cons:

- AI Accuracy Issues: Occasional inaccuracies with expense recognition can lead to manual correction. This is the case for most accounting softwares, though.

- Limited Advanced Features: Larger enterprises might find it lacks some sophisticated features provided by competitors like Sage Intacct.

FreshBooks

FreshBooks targets freelancers and small businesses with AI-driven features to simplify accounting and bookkeeping. Its intuitive interface makes it easy to track time, manage invoices, and monitor expenses, while automation handles recurring billing and payment reminders. With built-in reporting and client communication tools, FreshBooks is tailored for service-based professionals who need streamlined financial management without complexity.

Pros:

- Simplified Time Tracking: AI aids in accurately tracking billable hours.

- Client Communication: AI-driven reminders for timely payment collection.

- User-friendly: Ideal for those with minimal accounting experience.

Cons:

- Scalability Constraints: May struggle to support growing businesses due to simpler AI features.

- Limited Reporting: Basic AI-driven analytics and reporting capabilities compared to more robust solutions.

Wave Accounting

Wave Accounting stands out as a free AI-powered accounting solution specifically designed for freelancers and small businesses. It offers features like automated expense tracking, invoicing, and receipt scanning, all at no cost. While it lacks some of the advanced capabilities of paid platforms, its ease of use and built-in payment processing make it a strong option for budget-conscious users.

Pros:

- Cost-Effective: Completely free with optional paid services like payroll. I thought this was a unique way to engage with potential customers as you don’t have to pay for the services.

- Intuitive Automation: AI-powered categorization of income and expenses.

- User-Friendly Interface: Ideal for users with minimal accounting knowledge.

Cons:

- Limited Advanced Features: Basic AI tools may not meet the needs of larger businesses.

- Integration Constraints: Limited third-party integrations compared to competitors.

OneUp

OneUp focuses heavily on AI-driven financial management, tailored especially to small businesses and startups looking for powerful automation. It automates bookkeeping by syncing with bank accounts and using AI to suggest and validate entries in real time. Additionally, it includes inventory management, CRM, and invoicing tools, making it a comprehensive solution for entrepreneurs seeking an all-in-one platform.

Pros:

- Comprehensive Automation: AI automatically manages invoicing, payment reminders, and inventory tracking.

- Real-Time Financial Insights: Immediate insights into cash flow and business health.

- Inventory Management: Strong AI-driven inventory control system ideal for product-based businesses.

Cons:

- Complexity for Beginners: The extensive feature set might overwhelm new users.

- Integration Limitations: Fewer integrations available compared to other more established platforms.

ZipBooks

ZipBooks employs AI to streamline accounting processes, appealing particularly to small businesses and freelancers looking for affordability. It offers intelligent features like smart categorization, automated invoicing, and performance scoring to help users make better financial decisions. With a clean interface and essential tools for bookkeeping, time tracking, and reporting, ZipBooks balances simplicity with powerful insights.

Pros:

- Affordable Pricing: Offers competitive pricing tiers, including a robust free tier.

- Automatic Transaction Categorization: Efficient AI capabilities reduce bookkeeping efforts.

- User-Centric Interface: Designed for ease of use, reducing training time significantly.

Cons:

- Scalability Issues: Larger businesses might quickly outgrow the available features.

- Customer Support: Limited customer service availability could hinder quick problem resolution.

Botkeeper

Botkeeper represents a sophisticated AI accounting solution that combines machine learning and human oversight to optimize bookkeeping and financial reporting. It’s designed primarily for accounting firms and growing businesses, offering automated transaction processing, financial statement generation, and real-time dashboards. With its hybrid model, Botkeeper reduces manual workloads while maintaining the accuracy and compliance standards needed for complex financial environments.

Pros:

- Hybrid Approach: Combines AI-driven automation with human oversight for enhanced accuracy.

- Advanced Reporting: Generates comprehensive financial reports and forecasts efficiently.

- High Scalability: Easily adaptable to the needs of growing and medium-sized businesses.

Cons:

- Cost Factor: The hybrid model may incur higher costs compared to purely AI-driven solutions.

- Learning Curve: Users might require time to fully leverage the sophisticated feature set.

BlackLine

BlackLine offers an AI-focused accounting automation platform primarily targeting medium-to-large enterprises that require advanced financial solutions. It specializes in streamlining complex processes such as account reconciliations, journal entries, and financial close management. With AI and machine learning at its core, BlackLine enhances accuracy, ensures compliance, and improves transparency across enterprise-level financial operations.

Pros:

- Enhanced Automation: Exceptional AI capabilities automate complex reconciliation tasks.

- Compliance and Audit Management: Strong AI-driven compliance features that aid regulatory adherence.

- Detailed Analytics: Robust analytical tools provide deep financial insights.

- Scalability: Best for large businesses and enterprises

Cons:

- Enterprise Pricing: High cost makes it less accessible for small businesses.

- Complex Implementation: Significant setup and implementation efforts are necessary.

Digits

Digits stands out as an AI-native platform built around an Autonomous General Ledger (AGL). Unlike traditional software that adds AI features to an old framework, Digits uses specialized AI agents to manage the entire accounting lifecycle and was built from scratch.

Pros:

- Real-time Ledger: The Autonomous General Ledger updates constantly. This removes the need to wait for a month-end close to see accurate financial data.

- Specialized AI Agents: Three distinct agents focus on bookkeeping, finance, and reporting. The agentic AI performs task autonomously and surfaces exceptions for people to view.

- Instant Visibility: Founders can access live dashboards that show burn rates and cash flow metrics immediately.

- Automated Bill Pay: The drag-and-drop system extracts invoice data and schedules payments without manual data entry. This may be one of my favorite features because typically, you’d need a third-party add-on, which stacks costs.

Cons:

- Modern Tech Focus: The system works best for companies with digital workflows. Businesses that rely on legacy paper systems may face hurdles.

- Learning Curve: Users accustomed to traditional manual bookkeeping might find the autonomous nature of the software a significant shift in workflow.

- Data Dependency: The accuracy of the AI agents relies on the quality of the digital data inputs from linked bank accounts and tools.

Balancing the Benefits and Risks of AI

AI accounting software boosts efficiency, reduces errors, and provides strategic insights—but only when properly managed. Without human oversight, even the best AI tools (like inexperienced bookkeepers) can produce inaccurate outputs, leading to flawed financials and poor decision-making. If no one can trace a transaction or explain why it was booked a certain way, how can the AI be trusted to do it right?

Ongoing training, human review, and periodic audits are critical to ensuring AI works with your team, not against it. If left unchecked, AI can create more problems than it solves—especially when financials need to be accurate at month-end. Businesses must remain hands-on, adjusting their processes to keep AI outputs reliable and audit-ready.

The Double-Edged Sword

AI delivers speed and automation, but it also introduces risk. Errors can multiply fast, and overreliance on AI may dull human judgment, especially in unpredictable or high-stakes situations.

Case in point: In early 2024, I worked for a healthcare company when a major clearing house was hacked. Revenue dropped 70% overnight. No AI model could’ve seen it coming, and it took months of manual re-forecasting to keep the company afloat. AI couldn’t solve that—but people could.

AI platforms like Puzzle.io, QuickBooks Online, and Xero offer powerful tools, but they’re not infallible. Regular audits, staff training, and human checks are essential to keeping these systems accurate and secure. Done right, AI in accounting is transformative. Mismanaged, it’s a ticking time bomb.

Final Thoughts

AI is the hottest topic across nearly every industry, and the momentum shows no signs of slowing down. It’s an invaluable tool—one that can and arguably should be integrated into most software platforms, accounting included. As a business owner or accountant, failing to leverage the AI features built into the tools you already use means falling behind.

Why spend hours on repetitive journal entries when a platform like Puzzle can handle them in minutes? Why stay up late reconciling accounts when FreshBooks could do it automatically before you even open your laptop? While you’re stuck entering invoices by hand, your competitors are using AI to reclaim their time and focus on growing their business.