- Overview of the Case

- The Parties Involved are As Follows:

- Background and General Allegations

- Alleged Misrepresentation and Conflict of Interest

- Violations of Legal and Ethical Standards

- Allegations of Legal Malpractice and Professional Negligence

- Breach of Fiduciary Duty

- Deceptive Trade Practices Claims

- Damages and Remedies Sought

- Broader Implications

- What the Future Holds and What It Might Mean for You

- What You Should Do Next

Last Updated on April 22, 2025 by Ewen Finser

So what happens when a firm claims to be an expert in the field of something niche, charges what some may argue to be an exorbitant fee, and then gets sued by the client they were tasked with helping? Well, keep on reading to find out.

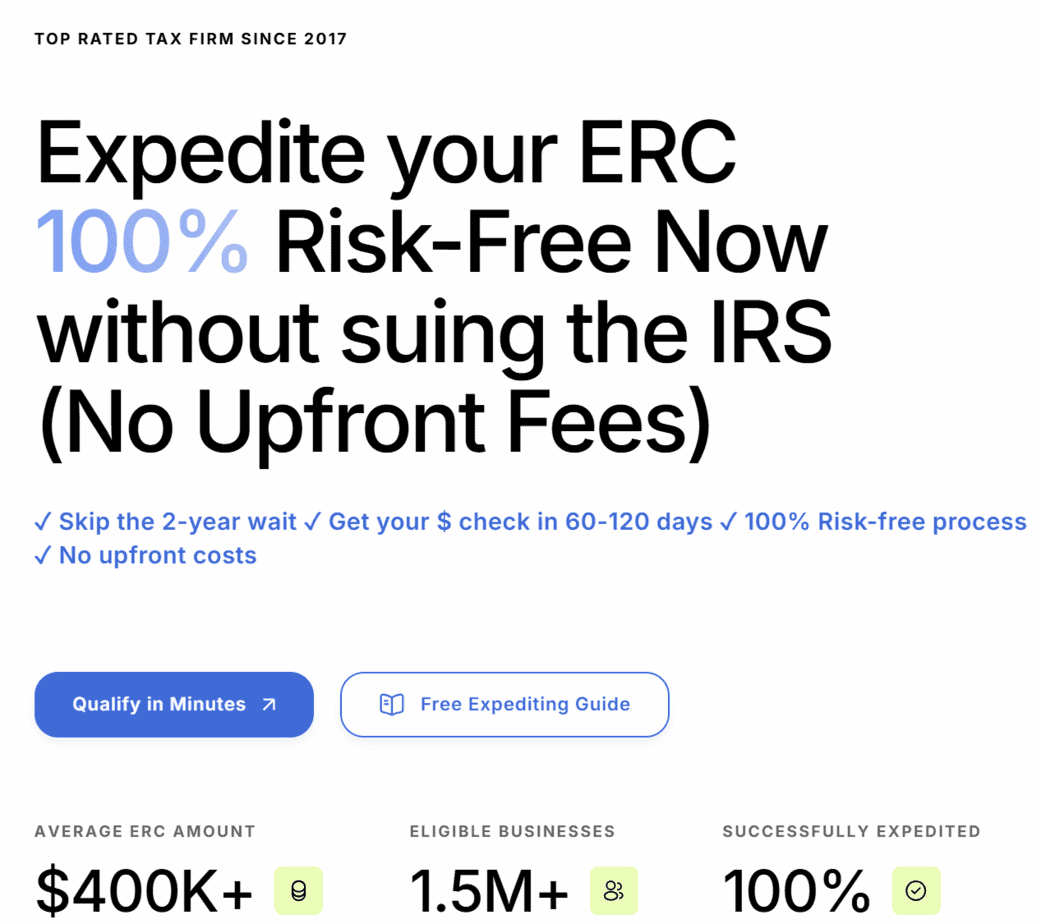

ERC Specialists was and still is a firm that specialized in helping companies claim the ERC credit during the pandemic. They claimed to be experts in their field, helping to expedite refunds and ensure accuracy to help reduce risk of audits and delays.

As a licensed expert in the field of accounting, I can assure you that this company was not alone, and this will be one of the first of many lawsuits to what many refer to as an ERC Mill.

Overview of the Case

In a complex and highly charged legal dispute filed in the in the US court systems, Yaya’s Kitchen, LLC (The Plaintiff), a Nevada-based LLC, has accused ERC Specialists, LLC, The Law Office of Rocky D. Crofts, LLC, and attorney Rocky D. Crofts (The Defendants) of professional malpractice, breach of fiduciary duty, and deceptive trade practices. This dispute arises primarily from the Defendants’ handling of the Employee Retention Credit (ERC), a COVID-19 relief measure provided by the U.S. government.

Additionally, Yaya’s claimed that ERC Specialists didn’t disclose the intertwined relationship between the three defendants (the law office, the lawyer, and the company), which would’ve influenced their decision to use the firm to help them claim their credit.

The Parties Involved are As Follows:

The Plaintiff:

- Yaya’s Kitchen, LLC: A Nevada LLC specializing in manufacturing wholesale food products, significantly impacted by the COVID-19 pandemic due to disruptions in its food production operations.

Defendants:

- ERC Specialists, LLC: A Utah-based company representing itself as a specialized consultancy in securing government Employee Retention Credits.

- The Law Office of Rocky D. Crofts, LLC: A Utah-based legal firm.

- Rocky D. Crofts: A Utah attorney affiliated both with the Law Office and ERC Specialists, identified as general counsel for ERC Specialists.

Background and General Allegations

Yaya’s Kitchen suffered substantial economic hardship during the COVID-19 pandemic. In 2021, amidst continuing disruptions, Yaya’s Kitchen was approached by ERC Specialists, which claimed special expertise in obtaining the ERC. The ERC is a refundable tax credit established by the U.S. government as part of pandemic relief, specifically targeted at businesses adversely impacted by COVID-19.

ERC Specialists presented itself as uniquely positioned to streamline and expedite the ERC application process. According to court filings, ERC Specialists represented itself as having superior knowledge and capability compared to standard tax preparers or CPAs, claims later alleged by Yaya’s Kitchen to be misleading and false.

Alleged Misrepresentation and Conflict of Interest

Central to Yaya’s Kitchen’s claims is the Client Agreement signed with ERC Specialists, under which ERC Specialists agreed to provide specialized tax services and legal advice concerning ERC claims. The defendants allegedly charged a 15% contingency fee on the entire ERC obtained, amounting to $169,311.96.

Yaya’s Kitchen contends this fee was unreasonable, illegal, and in violation of regulations governing practice before the IRS. (As an interjection, based on the historical data I’ve seen as a CPA, this is not an uncommon rate for the services provided, although it is on the higher end.)

Further complicating matters, Yaya’s Kitchen accuses Crofts of failing to disclose his simultaneous affiliation with ERC Specialists and the Law Office, including a financial interest in ERC Specialists. Additionally, it alleges Crofts provided legal services without clarifying his conflicting roles and interests.

But what exactly does this mean? Essentially, Yaya’s gave Power of Attorney to the Law Office, without realizing that the lawyer who was representing Yaya’s (R. Croft) had a financial interest in ERC Specialists. It was alleged that the law office put its interests ahead of Yaya’s, which ultimately harmed Yaya’s business in a material way.

ERC Specialists, Crofts, and the Law Office are accused of employing a referral agent who was paid a substantial percentage of the contingency fees collected. This agent allegedly made additional misleading claims to convince Yaya’s Kitchen to utilize their services, including falsely claiming no costs would be incurred by the Plaintiff in filing for the ERC.

Violations of Legal and Ethical Standards

The lawsuit highlights significant alleged breaches of professional standards:

- Charging an excessive contingency fee contrary to IRS rules (31 U.S.C. § 10.27). (Further interjection—this, in my opinion, is difficult to quantify, as what is deemed “excessive” has its goal posts moved based on the complexity of the work, the skill and time involved, and industry norms.)

- Failing to disclose conflicts of interest and financial incentives.

- Misrepresentation regarding expertise, timeframe, and cost associated with ERC applications.

- Breach of fiduciary duty by prioritizing their financial interests over client welfare.

The plaintiff alleges this constituted both professional negligence (legal malpractice) and violations of Nevada’s Deceptive Trade Practices statutes (NRS 598 et seq.), demanding substantial financial damages, rescission of the Client Agreement, and punitive damages for malicious and oppressive behavior.

Allegations of Legal Malpractice and Professional Negligence

Yaya’s Kitchen specifically alleges that ERC Specialists, along with Rocky D. Crofts and the Law Office, engaged in legal malpractice by failing to provide adequate counsel, misrepresenting their expertise and capabilities, and neglecting to disclose conflicts of interest.

The lawsuit emphasizes that Crofts, in particular, provided legal advice and services while simultaneously serving as general counsel for ERC Specialists and holding an undisclosed financial interest in the company.

Crofts is accused of acting below the standard of care expected from an attorney by failing to advise Yaya’s Kitchen that accepting a contingent fee from the ERC was prohibited under federal law, specifically 31 U.S.C. § 10.27.

Yaya’s Kitchen asserts that if properly informed, they would not have entered the Client Agreement and would instead have engaged their CPA to handle the ERC application at a significantly lower cost (estimated under $3,000).

Breach of Fiduciary Duty

The lawsuit also alleges that ERC Specialists, Crofts, and the Law Office breached fiduciary duties owed to Yaya’s Kitchen through their roles as legal representatives and advisers. The defendants are accused of prioritizing their own financial interests—specifically the lucrative 15% contingency fee—above the plaintiff’s best interests, constituting a significant ethical violation.

According to the filing, these fiduciary breaches directly led to Yaya’s Kitchen incurring unnecessary and substantial financial obligations. The company argues this caused tangible economic harm, evidenced by the demanded contingency fee amount of $169,311.96.

Deceptive Trade Practices Claims

Yaya’s Kitchen further accuses ERC Specialists and its affiliates of violating Nevada’s Deceptive Trade Practices Act. These claims include allegations that ERC Specialists intentionally misrepresented the scope and complexity of the ERC process, falsely advertised nonexistent filing costs, and overstated their capability to expedite claims processing.

ERC Specialists allegedly promised a sixteen-week turnaround for ERC refunds, a timeline the defendants knew was unrealistic or impossible to guarantee.

These deceptive practices are portrayed as part of a systematic effort to secure lucrative contracts under false pretenses, exploiting the plaintiff’s lack of specialized tax knowledge related to the CARES Act and associated tax credits.

Damages and Remedies Sought

In response to the alleged malpractice, breaches, and deceptive practices, Yaya’s Kitchen seeks comprehensive relief, including:

- Compensatory damages to recover the contingency fee and related financial losses.

- Punitive damages intended to penalize defendants for malicious and fraudulent actions.

- Rescission of the Client Agreement, thus nullifying any contractual obligations to pay the disputed contingency fee.

- Pre and post-judgment interest, attorney fees, and associated legal costs.

- Declaratory judgments clarifying the rights and responsibilities of the parties involved.

Broader Implications

The lawsuit highlights potential systemic concerns in the handling of government relief programs like the ERC. It underscores the vulnerabilities of small businesses during periods of economic pain, emphasizing the necessity for greater oversight and regulation of entities claiming specialized expertise in navigating complex government assistance programs.

This is evident due to the IRS’s ongoing moratorium on ERC processing, as well as the dozens of publications regarding the danger of falling prey to an ERC Mills.

What the Future Holds and What It Might Mean for You

The outcome of Yaya’s Kitchen, LLC v. ERC Specialists, LLC will likely set important standards for consultants and advisors who assist businesses in obtaining government tax credits and similar relief programs.

While I’m an accountant, not an attorney, I do believe business owners who feel misled by so-called “ERC Mills,” particularly regarding what services were promised versus what was actually delivered, may indeed have legal recourse.

Business owners should carefully weigh the amount of the ERC refund they received against the fees charged to obtain it.

Although claiming the ERC can be time-consuming, it typically isn’t overly complicated—provided all payroll data is readily accessible. Given this, charging a business $169,000 simply for preparing a few amended payroll tax returns appears excessive and questionable. I believe Yaya’s Kitchen was justified in challenging the appropriateness of this substantial fee.

If the court ultimately rules in favor of Yaya’s Kitchen, it could significantly raise accountability standards and reinforce ethical practices across the industry. Such a precedent could offer meaningful protection to businesses by discouraging similar practices in the future. The case remains ongoing and is being closely monitored by legal experts, business owners, and regulators, as its outcome may shape how similar disputes are resolved moving forward.

What You Should Do Next

If you’ve already claimed the ERC through a third party (whether ERC Specialists or someone else) it’s worth double-checking your refund against the fees you’ve paid. If you’re still planning to file ahead of the (swiftly approaching) deadline, I can’t recommend going with ERC Specialists (and even if I could, they’re no longer accepting applications). Get in touch with a different ERC company like IRS Plus, but do so quickly.

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.