Last Updated on April 3, 2025 by Ewen Finser

There could be any number of reasons why you’re now on the hunt for a suitable Plastiq alternative.

Maybe you’re an existing user who benefits from the way Plastiq allows you to use a credit card for paying vendors who don’t typically accept them, but finds the interface too confusing or the fees a little more than you’re happy to pay.

Perhaps you’re still on the fence about signing up and you’re curious if there’s a better option out there before you commit.

Whatever the case may be, this guide’s got you covered.

Recently, I tried and tested 10 different payment solutions and whittled them down to the following list of the five very best Plastiq alternatives on the market.

The Bottom Line: Melio is the Best Plastiq Alternative

Melio wins out thanks to its effortless simplicity. Although it lacks the automation features of other alternatives like Bill.com and its reporting features are nowhere near as detailed as Plastiq, it makes paying vendors and contractors just as easy as it does setting up invoices and getting paid by your customers.

If you’re a growing business with a rapidly increasing stack of invoices in your accounts payable folder, you may find Melio too basic for your more advanced needs. However, if you’re a small business or independent contractor looking for a simple way to keep on top of payments, it’s a clear winner.

Top 5 Best Plastiq Alternatives for Payment Processing

Name | Best For | Free Option? | ACH Fees | |

1. | Plastiq | Card-to-vendor payments | Yes | $0.99 |

2. | Melio | SMBs and Solo Entrepreneurs | Yes (limited) | Limited free transfers. Then $0.50 per transfer. |

3. | Bill.com | Mid to Large Businesses | No | $0.59 |

4. | Corpay Complete | Full vendor payment management | Unclear | Unclear |

5. | Veem | International Payments | Yes | Free |

6. | PayPal Business | Online Businesses | Yes | 0.75% |

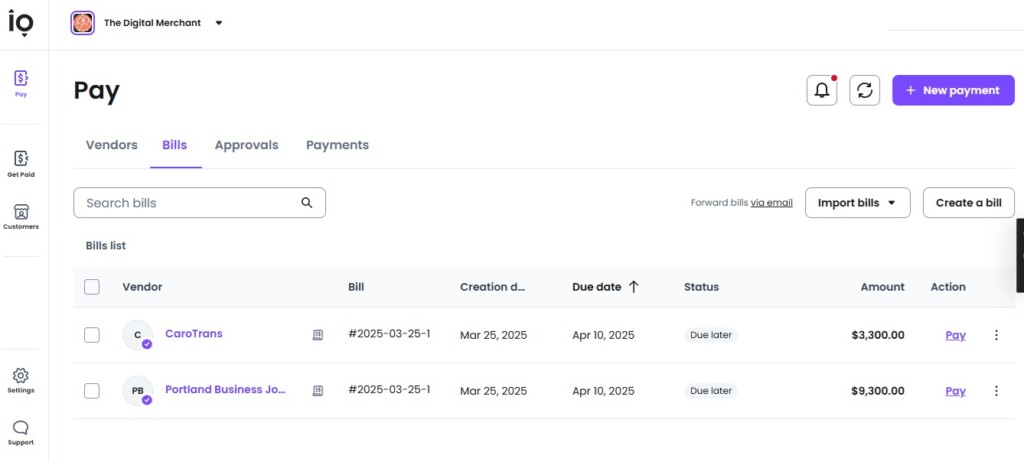

1. Melio

Best For: SMBs and Soloentrepeneurs

Pros:

- Incredibly user-friendly

- Fixed number of free bank transfers (ACH) per month

- Wide range of third-party integrations.

Cons:

- Fees for credit card payments.

- Limited reporting features.

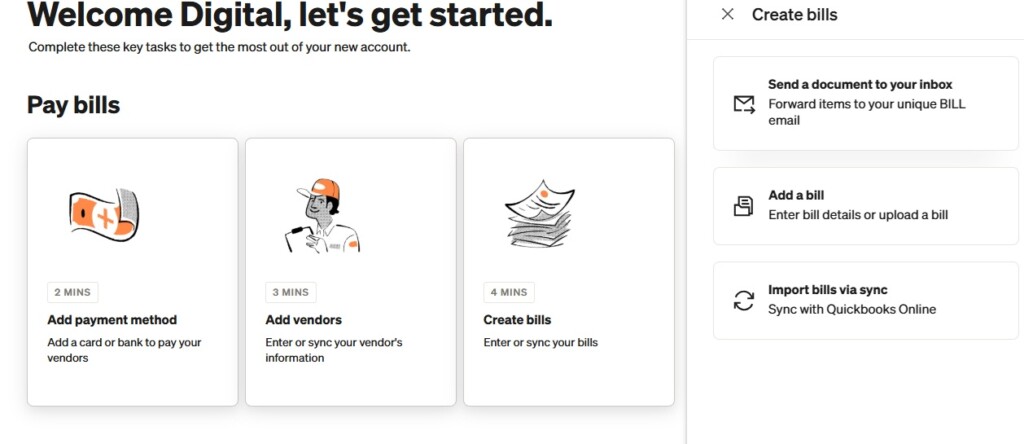

Melio isn’t just one of the most beginner-friendly payment apps I’ve ever used, it’s one of the easiest apps I’ve ever used, period.

Sure, it may not come with Plastiq’s financing options, and reporting features are limited to a basic CSV export of your payments. However, it’s overall a much easier platform that simplifies the whole payment process in such a way that paying your vendors and invoicing customers takes seconds, rather than minutes.

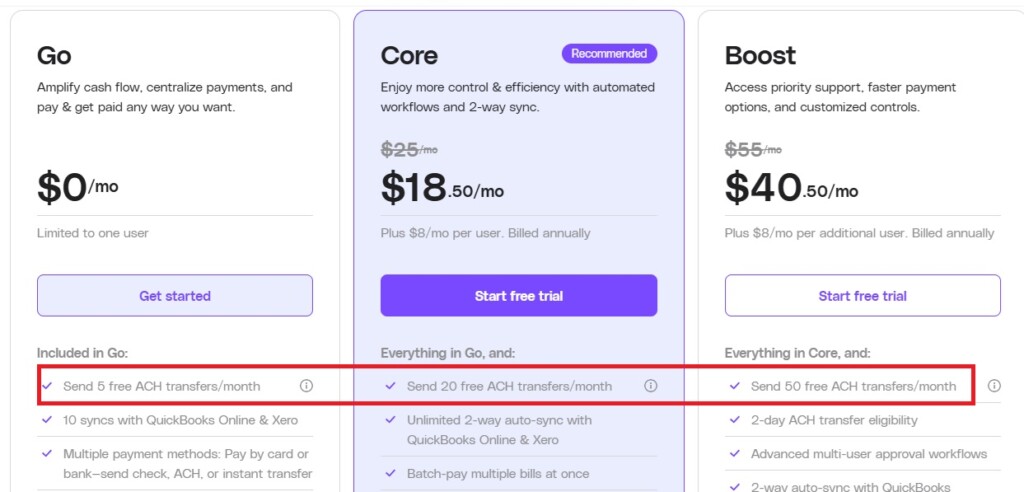

Costs and Fees

Melio triumphs over Plastiq by offering a fixed number of free bank transfers (ACH) on each of its plans.

- Free plan – 5 free transfers

- $19 p/m plan – 20 free transfers

- $41 p/m plan – 50 free transfers.

Should you run out of freebies, each additional payment comes with a single basic fee of $0.50. If you’re already using Plastiq, you’ll know this is practically twice as much as what you’re currently paying at Plastiq’s current rate of $0.99 per ACH transaction.

2. Bill.com

Best For: Mid to large businesses

Pros:

- Automated invoice processing and approval

- Robust reporting and audit trails.

- Strong integrations with accounting software.

Cons:

- Can be expensive for small businesses.

- May be overly complex for simple payment needs.

At a certain level, manually handling every outgoing payment takes up so much time that the process just simply isn’t sustainable.

So, if you’ve outgrown Plastiq and reached a level of success that tackling accounts payable by hand is just no longer feasible, switching to Bill.com might be the best alternative.

This full-scale automated solution for both accounts payable and accounts receivable can be used to put regular payments on auto-pilot so that you and your accounts team can regain some sense of control.

A powerhouse of a platform, Bill may be both too costly and too complex for smaller businesses with simpler payment needs, but for a growing company with more intricate financial workflows, it could mean all the difference in the world.

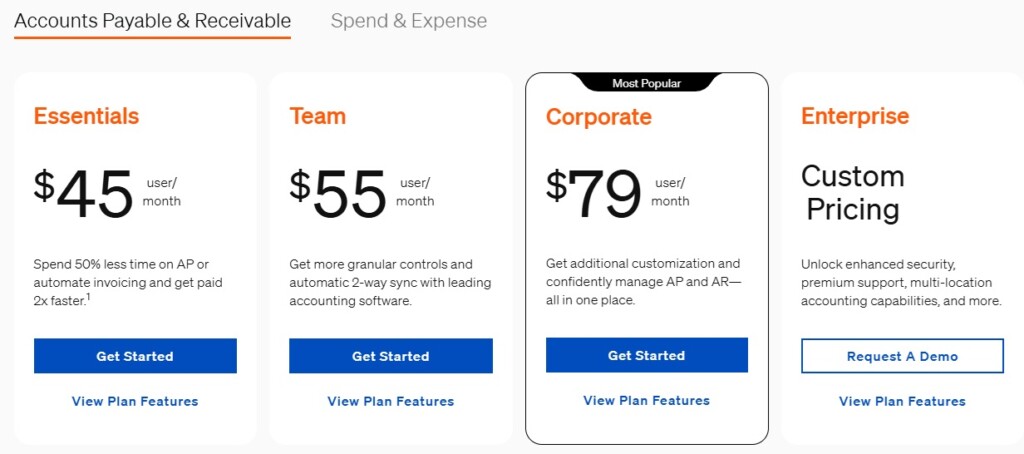

Costs and Fees

While Bill’s transaction fees are either similar to or cheaper than Plastiq’s (for example, ACH fees are only $0.59 per transaction), it’s also a monthly subscription service with recurring charges that are comparatively expensive against Plastiq’s free-with-fees pricing.

Plans run from $45 – $79 per user/per month with no free plan available. While that could be a solid investment for brands who need Bill’s automation features, there are certainly more affordable options for budget-restricted small businesses.

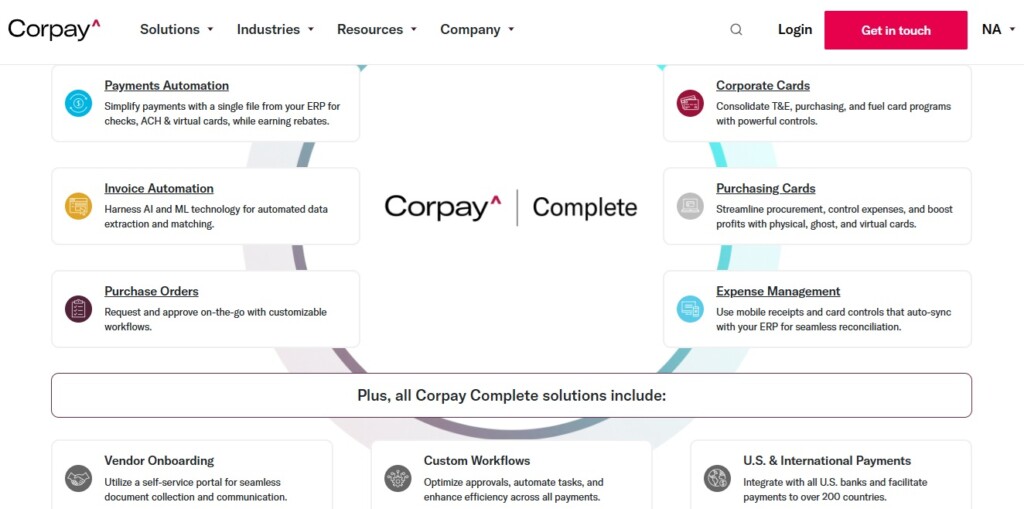

3. Corpay Complete

Best for: Managing Vendor Payments

Pros:

- Automated accounts payable

- Employee expense tracking

- Corporate cards and card control options.

Cons:

- Comes with a steeper learning curve than Plastiq

- Lacks transparency regarding costs and fees.

Combining the convenience of Plastiq’s credit-card-to-vendor payments with Bill.com’s automation features and extensive payment options (including credit cards, ACH, and checks), Corpay is a strong contender for one of the best vendor payment platforms around.

Along with all of the above, the platform offers automatic vendor payment reminders, customizable approval workflows, and robust reporting features, making it ideal for businesses that need to efficiently manage and track vendor payments at scale.

While that’s great, it’s worth mentioning that Corpay is definitely better suited for medium-to-large businesses. If you’re running a small business or working solo, it comes with a level of complexity that could feel like overkill.

Costs and Fees

Corpay keeps its prices and transaction fees close to its chest. You need to book a demo with the company to discuss costs.

4. Veem

Best for: International Payments

Pros:

- Lower fees on international transfers compared to banks and Plastiq

- Good QuickBooks & Xero integration

- Multi-currency support with real-time exchange rates.

Cons:

- 3.5% credit card fees – higher than Plastiq and others.

While Veem is pretty good for domestic payments, it’s in the international realm where it really shines.

With lower fees than traditional banks or Plastiq and more affordable, real-time exchange rates, Veem provides a cost-effective solution for businesses with global vendor relationships.

Like Plastiq, Veem lets you use a credit card to pay vendors who don’t normally accept them. However, it does so at a higher rate than Plastiq. What’s more, If your business primarily handles local payments, Veem’s international payment capabilities may feel unnecessary.

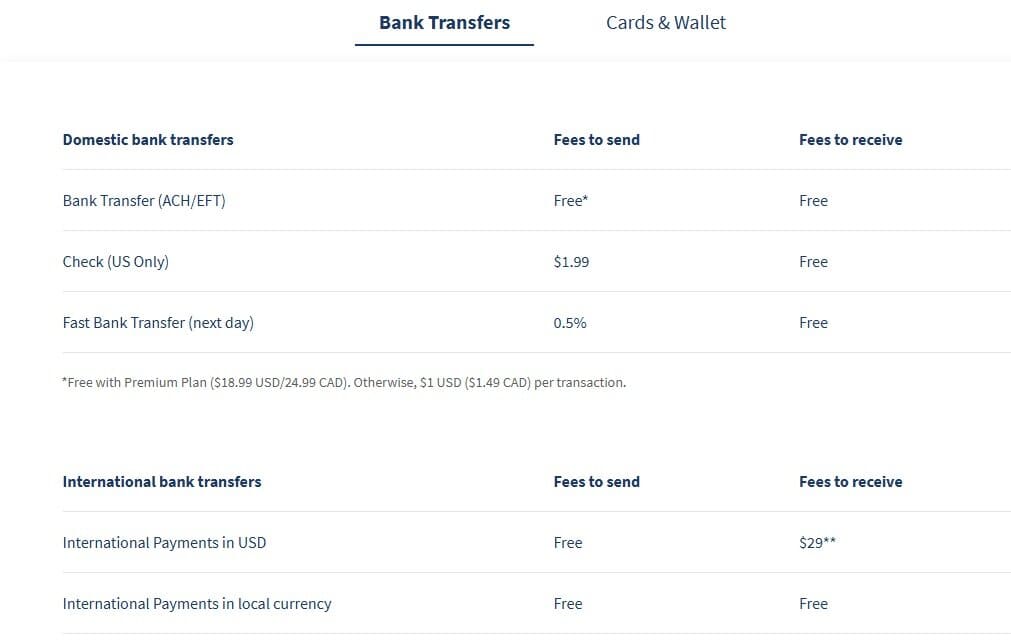

Costs and Fees

One of Veem’s biggest drawbacks is that it comes with a 3.5% transaction fee for credit cards. Given that Plastiq only charges a 2.9% fee, that’s a pretty big difference.

For bank transfers, especially international ones, it’s almost unbeatable, with only receiving money in US dollars coming with any kind of fee. Granted, it’s a substantial one, but if you only send money in USD or you send and receive money in your vendor or client’s local currency, you can enjoy zero percent fees.

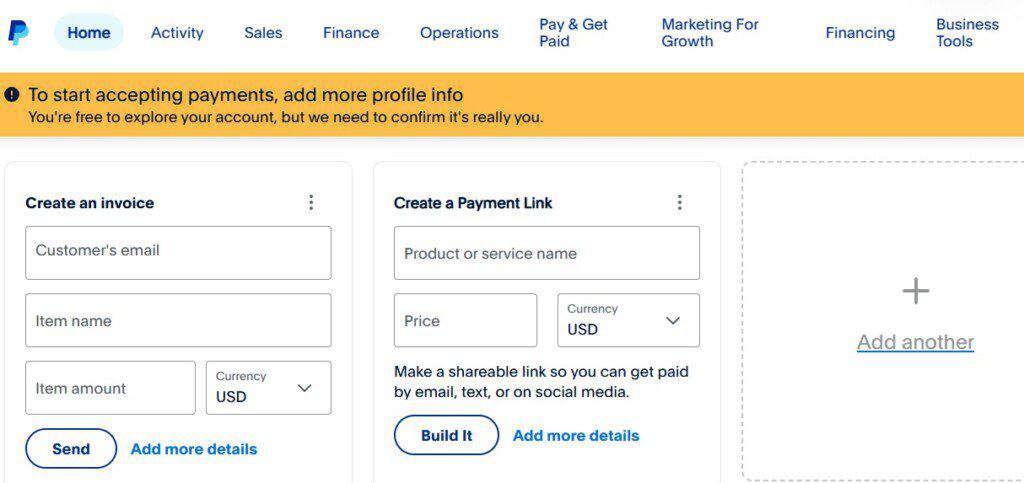

5. PayPal Business

Best For: Online businesses

Pros:

- Widely accepted payment platform

- Mobile app for on-the-go payments

- Integrates well with major eCommerce solutions

Cons:

- Transaction fees can be high.

- Account holds can be disruptive

- Customer service can be hard to contact.

If you’re running an online store or any kind of business that involves accepting payments directly via your website, PayPal Business should at the very least be on your radar.

The platform’s global recognition means its a brand people are likely to trust. It also integrates effortlessly with practically all major eCommerce platforms (such as WooCommerce, Shopify, and Squarespace Commerce).

Together, this combination of recognizable branding and ease-of-use creates a great user experience for your customers.

For you as a business owner, however, the experience can be frustrating.

The interface could be better laid out, though the biggest problem with PayPal Business are the payment holds.

Should you have the audacity to earn noticeably more than usual in a given month, then there’s a viable chance PayPal will withhold a percentage of your earnings for a set time.

PayPal calls this a security measure. I call it a pain. On more than one occasion I had a sudden spike in sales which PayPal decided was so unexpected they should keep a noticeable chunk of my income from me.

Here’s a little tip:

If you do decide to use PayPal and this happens to you, I found that instead of waiting for the hold period to expire, you can get your money faster just by talking to customer service.

I’ve certainly never had that kind of issue with Plastiq, though I can’t deny that PayPal Business is the better of the two for payments via websites.

Costs and Fees

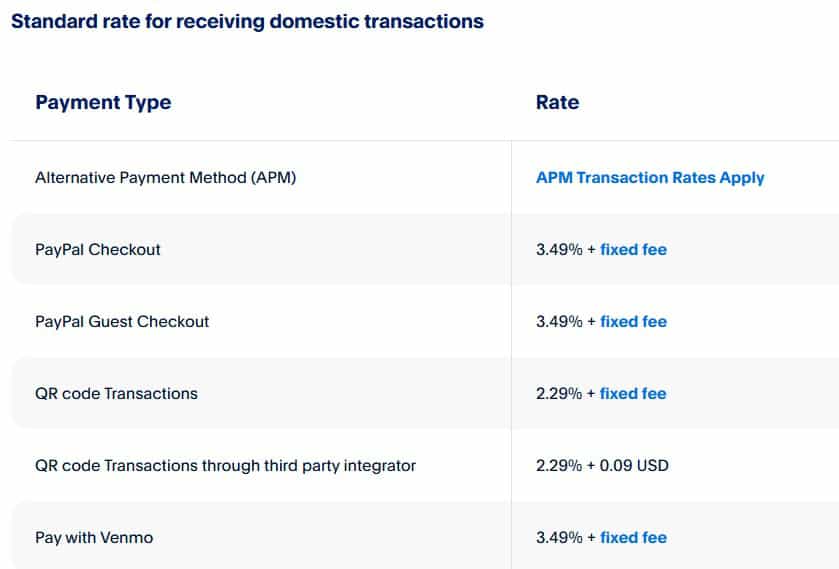

Although PayPal Business itself is free to use, 3.49% fees on online checkout payments are higher than average.

Elsewhere, PayPal and Plastiq’s fees for card payments and ACH services are relatively similar and unlikely to be a major dealbreaker if you’re thinking of switching to PayPal.

What Are The Best Plastiq Alternatives for Payments? My Final Verdict

Whether you’re leaving Plastiq or just weighing up your options, the best alternative for you will be the one that best aligns with your priorities.

If your business has grown to a level that Plastiq now seems too small or basic a solution, the automated payments and advanced features or Bill.com or the straight forward card-to-vendor payment options offered by Corpay may be your best alternative.

If you’re in eCommerce, PayPal is still tough to beat despite payment holds and other frustrations.

However, if you’re looking for the complete package of beginner-friendliness, low-cost fees and just the right amount of features for a small business, Melio is hands-down the one to beat. Learn more about this easy-to-use payment solution, see our complete Melio review.