Last Updated on June 1, 2023 by Ewen Finser

Direct deposit payroll services are an easy way to make your employees happy. Employees like to receive their paycheck electronically. It’s simpler, much easier to handle, and it also makes accounting for expenses easier for you as the employer.

There are many benefits of using a direct deposit service, but there are also some potential drawbacks that you should be aware of before making a decision.

If you are looking for a direct deposit payroll service, then this blog post is the perfect place to start! We will be discussing what a direct deposit payroll service is and what features to look for. We will dive into what you should look for in a good direct deposit payroll service provider as well as some high-quality options available to businesses today!

What is Payroll?

Payroll is the process of recording and paying an employee’s salary or wages. The payroll process begins with the calculation of gross pay, which is the total amount of money earned by an employee in a given period of time. Deductions for things like income taxes and Social Security contributions are then made, and the net pay is calculated. This is the amount actually paid to the employee.

Once an employer has calculated gross pay, they then must issue a paycheck or direct deposit payment for that amount to their employees. This is sometimes referred to as “remittance”. The final step in the payroll process is paying any applicable taxes and other deductions from the remitted check (or direct deposit).

Payroll is usually the most complicated task that a company’s admin team has to deal with. It’s the part of running a business that requires the most attention and expertise, but it can also be highly rewarding for both company and employees alike. This is why the best direct deposit payroll services can be so valuable to businesses of all sizes.

What is a Direct Deposit Payroll Service?

Replacing traditional payment methods such as issuing paper checks and cash envelopes, direct deposit is a new way to pay your employees. You reduce risk by electronically transferring money from your business’s bank account to their accounts and helping your payroll team do their job with less administrative hassle.

A direct deposit payroll service is usually a third-party company that supports this helps businesses process and pay their employees’ salaries. The service will take care of calculating gross pay, issuing payments, and paying any applicable taxes or deductions.

These types of services can be extremely valuable to businesses, as they take care of one of the most complicated and time-consuming tasks that companies face.

They also provide peace of mind, as businesses know that their employees will always get paid on time and in full. The virtual and non-paper version of payroll makes it easier to track, and this helps companies comply with labor laws.

How do Direct Deposit Payroll Services Work?

There are three main steps in the direct deposit payroll process:

- Calculation of gross pay: The first step is to calculate an employee’s gross pay. This is the total amount of money they have earned in a given period of time.

- Deductions: Next, deductions need to be made for things like income taxes and Social Security contributions. This will reduce an employee’s gross pay and determine their net pay, which is the amount actually paid to them by your company.

- Issuance of payment: Once all deductions have been made, a direct deposit payroll service can issue a paycheck or direct deposit payment for that amount to each individual employee.

Some companies choose to work with more than one direct deposit payroll service so they can find out who has the best product options available for different types of employees at their business (i.e., full-time vs part-time). Other businesses opt instead to use multiple online accounting software products rather than going through the indirect process of adding extra third party applications into the mix

The ultimate goal is getting as close as possible to completely eliminate the need for handling and managing paper paychecks on site.

How Important Is the Speed in the Direct Deposit Payroll Process?

Speed is incredibly important when it comes to payroll. It’s why so many businesses are ditching paper paychecks and moving to direct deposit for their employees’ salaries.

If your team has to distribute or issue hundreds of paper checks on-site, it can take hours just to get that done each time you need one new paycheck issued (and then there’s always at least a little bit of lag time between when an employee gets paid and when they see the money go into their accounts).

With direct-pay systems like Gusto, Wave Payroll, OnPay, Sure Payroll, or Zenefits—employees receive their payment almost immediately after payday rolls around because everything happens electronically.

Our Direct Deposit Payroll Service Recommendations

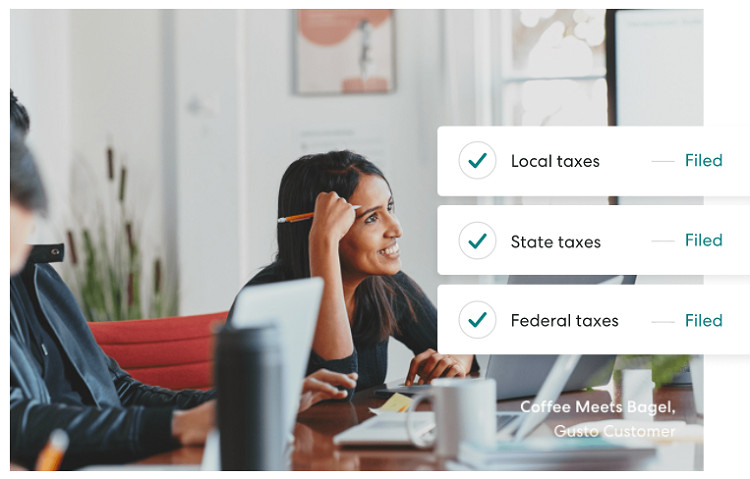

Gusto

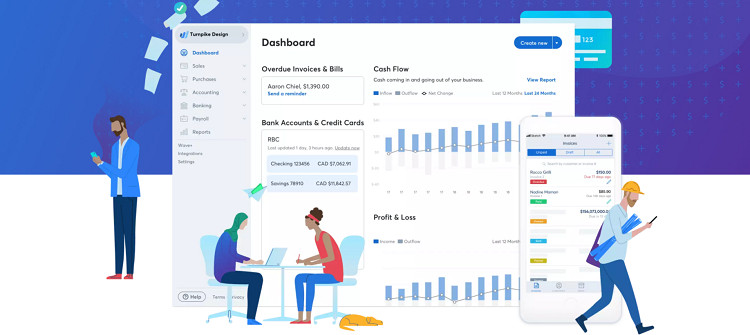

Gusto is a fantastic direct deposit payroll service since it is simple to use and provides an all-in-one solution that works for most companies. It’s very easy to use and integrates well with other business software products.

Gusto‘s pricing is reasonable, and its features are jam-packed with everything that firms without their own payroll staff will appreciate.

Gusto is a fantastic choice for any company, especially small businesses that need the most assistance. It’s a great alternative for any firm, but it especially excels when it comes to smaller businesses since it can automate your whole payroll and service firms in numerous states.

It also has a lot of helpful features, such as:

- Automatically calculating taxes and withholdings

- A penalty-free tax guarantee

- Employee benefits

- Integrations with Xero, Quickbooks, and other types of accounting software

- Hiring and onboarding tracking

- Insights and reporting

- Automatic payroll deductions

- Gusto Wallet

- Time tracking to monitor employee time off

Gusto is also particularly highly rated for customer service and offers phone, chat, and email support. The chat feature is available in Pacific time between 6 am and 4 pm Monday to Friday, but this does depend on which plan you’re on. If you’re on the most expensive plan, however, you get an entire customer success team dedicated to your account.

Gusto costs: $39 to $149 per month. You’ll then pay an additional $6 to $12 per employee per month

Wave Payroll

Another popular direct deposit payroll service is Wave Payroll. This company provides an easy-to-use platform for issuing payments electronically. They’re especially great compared to other products because of their flat pricing model, which only varies depending on what state you’re in (for tax reasons) as opposed to which features you need.

However, despite tax filings only being free in 14 states, Wave also provides free accounting and invoicing software that you can use with Payroll to make it more cost-effective. The simple-to-use payroll software is perfect for small or large businesses, and Wave also allows you to trail their software free for 30 days.

Here are some of the features that Wave offers:

- Free tax filings in 14 states (including NYC, Texas, and California)

- Easy integrations with their internal accounting tools

- Integration with Quickbooks

- Invoicing service

- Secure, PCI Level-1 certified software

- Support for recurring billing including automated receipts, drag and drop editing, and time zone control

- Accept payments online

They also offer customer support in addition to competitive pricing plans, although many people reported that the software wasn’t especially helpful. However, Customers can contact them by submitting a support ticket or via live chat, as well as by using their Help Center with articles and tutorials.

Wave Payroll costs: $35 per month in the 14 states they file taxes in and $20 per month in all other states. You’ll also have to pay an additional $6 per employee or independent contractor per month. Their accounting and invoicing tools are free.

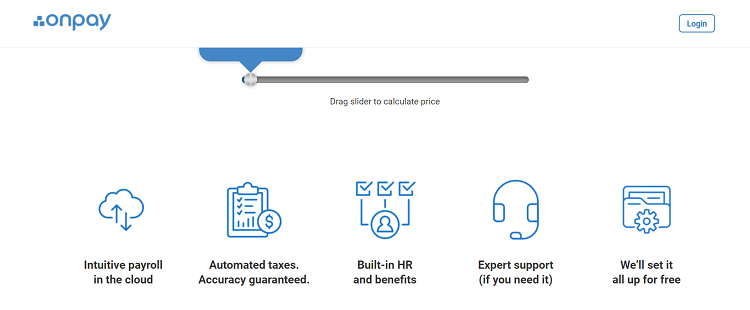

OnPay

OnPay’s services are great for companies looking for high levels of customization or support on-demand. This is particularly true when it comes to their product offering aimed at small business owners who need all the help they can get to stay afloat financially.

They integrate with a variety of accounting software systems as well as most time tracking software. Furthermore, their handy API means that it’s easy to integrate even with any tool you want if they don’t currently offer a direct integration.

OnPay’s quick processing time and ability to run the whole thing on your mobile phone make it ideal for small businesses.

Some of the top features that OnPay offers are:

- Annual employee tax filings

- Unlimited monthly pay runs

- Highly optimized for mobile use

- Integrations with popular accounting software such as QuickBooks, Xero, and Deputy

- New hire reporting tools

- Built-in document templates

- Compliance audits

- Self onboarding for employees

- Simple and affordable pricing structure.

When it comes to customer support, OnPay offers email and phone support Monday to Friday from 9 am to 8 pm Eastern time. It also has very high reviews from most of its customers.

OnPay costs: $36 per month, plus an additional $4 per employee per month

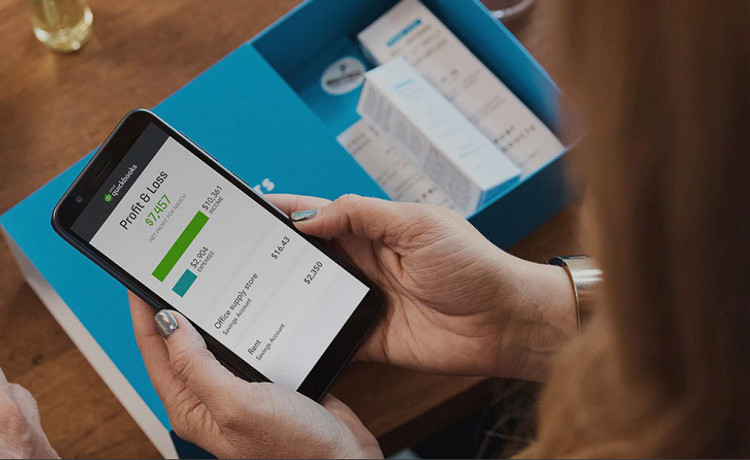

Intuit Quickbooks Payroll

Possibly the most popular name in direct deposit accounting software, Intuit Quickbooks Payroll is an ideal choice for accounting newbies and experienced professionals alike. The software can be used with any type of business, from restaurants to construction companies.

One of the finest overall programs on this list is Intuit QuickBooks Payroll, which is no surprise since it has everything most small businesses need. Combined with their ability to connect so seamlessly with QuickBooks – the most widely used accounting software for small businesses – and you have a payroll powerhouse.

Some of the top features that QuickBooks offers are:

- Run payroll anywhere from complete cloud-based software

- Easily connect with other QuickBooks products

- Process paychecks and print pay stubs

- Manage employee timesheets, rotas, leave, and expenses

- Automatic tax deductions and employer contributions

- Self-serve employee portal reduces admin work

- Automatically generated payslips

- Tax penalty protection

Fo customer service, Intuit QuickBooks Payroll offers email and phone support Monday to Friday between 6 am and 6 pm from their California offices. They also have a very helpful knowledge base with FAQs and useful resources, which answers the most common questions.

Intuit QuickBooks Payroll costs: $45 to $125 initially, and then $4 to $10 per employee per month

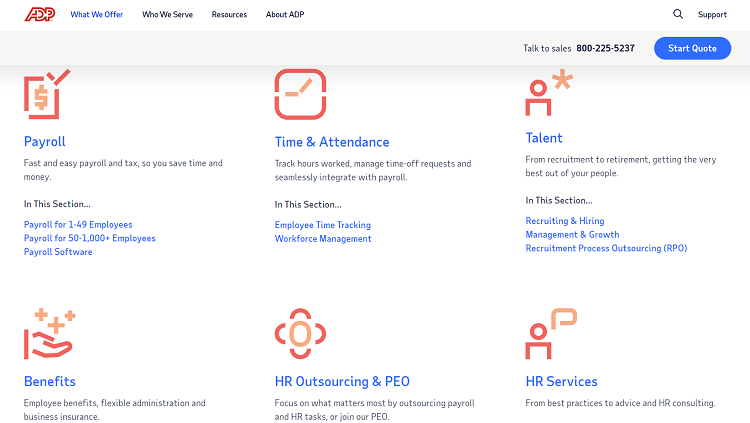

ADP Run Payroll

ADP is a name that small business owners likely know all too well. The payroll giant offers a wide range of services, with something to fit businesses of all sizes and industries. As you would expect from such an established company, ADP has extremely comprehensive features as well as decent customer service.

They take care of corporations of all sizes, so they can handle a small firm or hundreds of people without difficulty. When it comes to businesses greater than 100 employees, they employ the best technology and tools to keep things running smoothly.

Some of the top features that ADP offers are:

- Highly customizable payroll services for businesses both big and small

- Integrates seamlessly with popular accounting software such as QuickBooks, Xero, Zoho Books, Sage Intacct, or Microsoft Dynamics GP

- Handles all W2 and 1099 filings, as well as employment taxes

- Built-in tax and compliance features

- A personalized dashboard so you can easily pay employees

- Easily automate recurring payments

- Access employee health records from within the app

- Award-winning mobile app

Although they’re not known specifically for having amazing customer service, they’re not known for being awful either! ADP offers 24/7 assistance for all of its customers.

ADP Run Payroll costs: an undisclosed amount, specific to each individual customer

Zenefits

Zenefits is the newcomer to the payroll scene, but it’s made a big impact in a short time. The company provides an all-in-one HR and benefits platform for small businesses, making it easy to manage employee files, health insurance, 401ks, and more.

The platform bundles together a lot of clever HR tools into a single easy-to-manage platform. It allows businesses to both streamline their payroll processes and save time.

Some of the top features that Zenefits offers are:

- Streamlined onboarding features

- Fully integrates with popular accounting software

- HR, benefits, scheduling, and payroll in one place

- Self onboarding for employees

- Automated compliance tasks and tax filings

- Exceptional employee mobile app

- Reporting tools allow you to see timelines and data

Zenefits customer support includes a helpful training center full of videos and step-by-step guides. They also offer email and live chat support from 7 am to 4 pm Pacific time.

Zenefits costs: they have 3 different tiers. The Essentials tier costs $8 per employee per month; the Growth plan costs $14 per employee per month, and the Zen plan costs $21 per employee per month.

SurePayroll

SurePayroll is one of the most popular direct deposit payroll services for smaller less common businesses. In fact, it is ideal for extremely specific industries and can be utilized by every type of company, from retail to churches.

One of the top benefits of using SurePayroll is that it’s very affordable, especially for businesses with smaller staff sizes. The company is known for its user-friendly platform, which makes it easy to process payroll, manage employee files, and more. SurePayroll also offers great customer service with quick response times.

Here are some of the other top features that SurePayroll offers:

- Easily integrates with QuickBooks, Xero, and other popular accounting software

- Paid time off tracking

- 2 months free for small businesses

- Automatically run payroll

- Suitable for tiny niche businesses, or even nannies

- Employee onboarding and termination processes

- Easily handles 401(k) deductions

- Handy mobile app to use on the go

- Integrates with Xero, Zoho Books, and other accounting software

In addition, their customer service is known to be some of the best in the business – they’re always happy to help and are quick to resolve any issues. You can speak to their operatives 6 days a week via phone, email, or live chat – Monday to Friday between 7 am and 8 pm Central Time, and Saturday between 9 am and 1pm Central.

SurePayroll costs: $19.99 to $49.99 as a base, and then an additional $4 to $10 per month per employee or independent contractor

What Should You Look for in a Direct Deposit Payroll Service?

When it comes time to choose a direct deposit payroll service for your company, there are a few things you’ll want to keep in mind. The first is what type of business you have: are you a small mom-and-pop shop or do you have hundreds of employees? The size of your company will help determine which type of direct deposit payroll service is best for you.

Next, take a look at the features each service offers and what might be important to your business. Services like Gusto and Quickbooks offer employee onboarding, tracking of hours worked, and tax filing services while Zenefits and Wave Payroll have low monthly fees.

Finally, make sure to ask the potential providers about their customer service policies. You’ll want to know how quickly they can respond to any questions or problems you may encounter with the direct deposit payroll process.

Here are some of the most important factors to look for in a direct deposit payroll service:

Precision

The precision of a direct deposit payroll service is incredibly important. Any mistakes could lead to frustration on the part of your employees and additional work for your team.

Capacity

Softwares like this are usually based on team size and chargeable per employee. This means you’ll need to consider how many employees you have when choosing the best direct deposit payroll service for your company. This will also most likely affect the price.

Integrations

The right platform should integrate with all of your other business software so that it can be easily set up and managed within a small number of clicks or taps on any device, including tablets and smartphones.

That will save managers time in terms of dealing with setup workflows while also improving accuracy by making sure information is always current across every system used to manage payments at your company.

Security

Direct deposit payroll services are often cloud-based platforms which means they’re susceptible to security breaches just like most online tools are these days (and even more so than desktop apps since their data might be stored on servers around the world).

The better providers should have top-notch security features in place to protect your data as well as the privacy of your employees.

Ease of use

A direct deposit payroll service should be easy for everyone involved to use. From managers who need to set up new employees and payments to the accountants who need detailed reports on pay rates and deductions, to the employees themselves who will simply receive their wages deposited into their bank accounts without having to go through any extra steps.

The best options should also be simple enough so that people who are perhaps not particularly tech-savvy, will still be able to use this type of payroll.

Efficiency

Depending on the business your company runs, efficiency can be a make-or-break factor for any direct deposit payroll service.

If you work in retail and need to issue paychecks weekly or even per shift or if you’re an independent contractor who needs instant access to funds after submission of hours worked (and without delays), look for providers that offer features like next-day payouts and same-day payments.

Flexibility

The direct deposit payroll service should be flexible enough to meet the needs of your business. It should offer a variety of payment options, such as checks, ACH transfers, and wire transfers so that you can choose the one that best

Ease of Setting Up

The platform should be easy to set up and manage, which will save your employees time. It should also have a low learning curve so that managers can become accustomed to working with it quickly without having to take extensive training courses or read through manuals.

Customer Service

Because this type of service is usually associated with sensitive information about your business, you’ll want the potential providers to have solid customer support in place so that any problems are resolved as soon as possible rather than being ignored for days or weeks on end. r company, there are a few things you’ll want to keep in mind.

How Often Do You Need to Use it?

Another factor is how often payroll needs to occur: daily, weekly, monthly? The regularity of paychecks could influence which provider would be best suited for your company.

You’ll also want to consider whether you have non-employees who require payment as well and if so, how many there are and what types of payments they should receive.

Features

Next, think about the specific features that will help streamline things like attendance tracking and timekeeping while saving managers’ time overall by automating routine tasks. These factors all contribute towards finding a direct deposit payroll service that fits into your company like a glove.

HR support

Though not as important as some of the above factors, you may also want to consider whether or not your potential provider offers HR support.

This can include everything from customer service to payroll-related questions and concerns, especially if your employees are paid weekly or daily instead of monthly which means their paychecks will be smaller but come at a higher frequency (which makes tracking easier).

It’s crucial for businesses to stay up-to-date with all federal law compliance requirements like withholding taxes, and direct deposit payroll providers cab greatly help with this.

Whether you’re starting out fresh without an existing system in place or looking for ways to streamline current processes that aren’t working well enough, take into account these tips when choosing a platform that is right for your business needs.

Price

Last but not least, price is always a factor to consider. No business wants to spend more than necessary, so be sure to compare the rates of different providers and find one that fits your budget without sacrificing any of the above-mentioned factors.

FAQs

Question: What is the Best Direct Deposit Payroll Provider?

Answer: This is a difficult question to answer as it depends on the specific needs of your business. However, some of the top providers for larger businesses include ADP and QuickBooks, and for smaller organizations SurePayroll is ideal.

Question: What is a Direct Deposit Payroll Service?

Answer: A direct deposit payroll service is a platform that allows businesses to pay their employees electronically without having to print and distribute physical checks. To facilitate this, employees provide the company with their banking information, and then each pay period funds are transferred to those accounts.

Question: Why Should I Use a Direct Deposit Payroll Service?

Answer: There are several reasons why companies that employ remote workers or hourly/part-time staff should consider using a direct deposit payroll service. Some of these include:

• Convenience: Sending and receiving payments can be done electronically without the hassle of printing and distributing checks.

• Security: If an employee has their bank account information on file, they no longer have to worry about losing or forgetting a check at home because it will never be sent in the first place!

• Accuracy: Allowing employees to enter their own hours makes it easier for them and saves time on the manager’s end.

• Verification: Direct deposit payroll services can help ensure that all required federal withholding taxes are being paid, as well as prevent workers from claiming too many allowances which could result in a smaller tax return.

Question: What is the Best Payroll Provider?

Answer: Again, this depends on the specific needs of your business. However, many providers offer a variety of services that cater to different types of businesses – so it’s important to do your research and find one that fits both your budget and company size. ADP is a great option for larger businesses, while SurePayroll is perfect for small organizations.

Question: Can You Use QuickBooks for Payroll?

Answer: Yes, QuickBooks has a specific payroll tool that can be used as a direct deposit payroll service. Different versions are available to accommodate the specific needs of different types of businesses and the tool integrates seamlessly into other Quickbooks services.

Question: How Much do Direct Deposit Payroll Services Cost?

Answer: The cost of direct deposit payroll services varies greatly depending on the specific needs of your business. However, many providers offer a variety of different packages to accommodate small-to-large organizations, and prices typically start at around $30/mo for up to five employees.

The cheapest provider on this list is $8 per month per user, while the most expensive will easily be over $200 per month.

Conclusion

Different payroll services offer different benefits for businesses, but it is important to find the one that fits your budget and company type.

Overall, we feel that ADP or Gusto are great options for larger organizations while SurePayroll works well with smaller ones. Some of the top providers like QuickBooks can be used as direct deposit payroll service platforms too.

Whichever tool you use, direct deposit payroll services offer a great way for businesses to save time and money while ensuring accuracy and security with employee payments. The best direct deposit payroll service will fit the specific needs of your business.

This is why, when it comes to finding the best direct deposit payroll service for your company, comparison shopping is key.

By taking into account all of the above factors, you can make an informed decision about which provider will work best for your specific needs. And rest assured that with so many great options available, there’s definitely one out there that’s perfect for you!